SBA Loan Documents Templates

Documents:

42

This type of document is a security agreement used in the Premier Certified Lenders Program of the Small Business Administration (SBA).

Use this document if you are a lender and the guarantor is liable for the repayment of the entire amount of the borrower's loan.

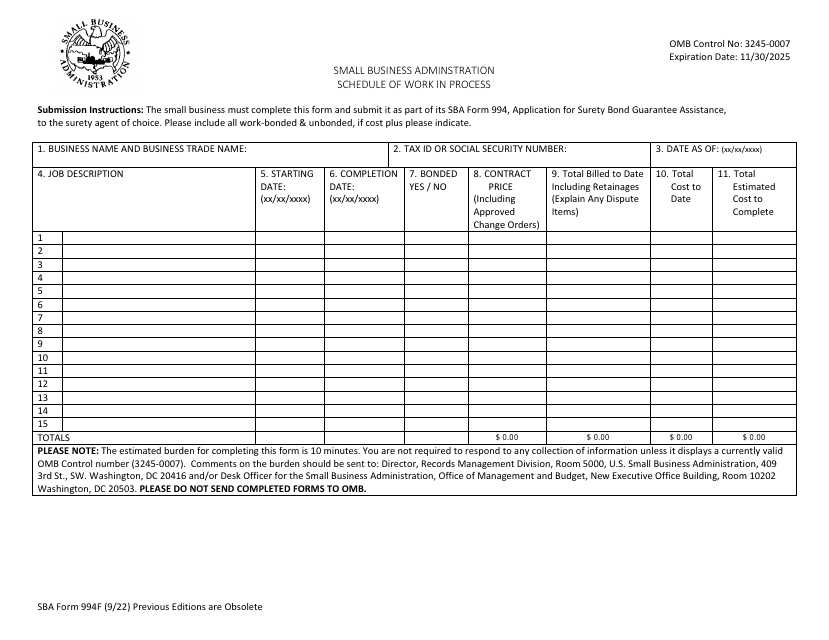

This Form is used for businesses to agree to comply with certain regulations or requirements set by the Small Business Administration (SBA).

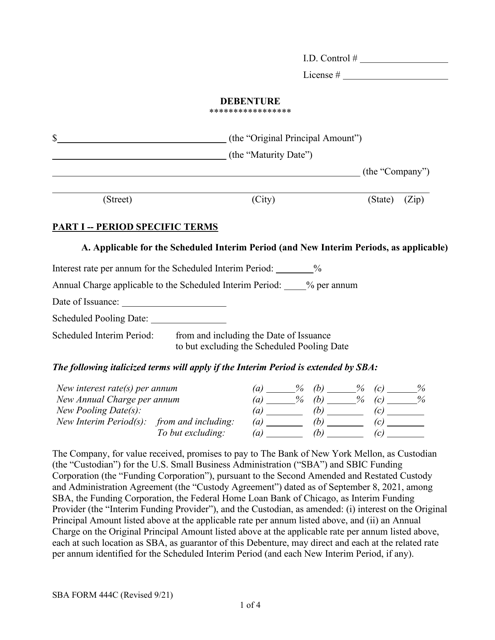

This form is required to be filled out by the Certified Development Company (CDC) to report the debenture payment schedule of development companies.

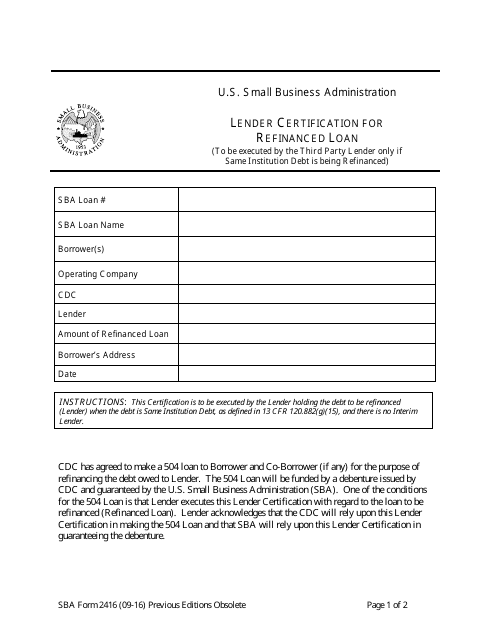

This certification is to be executed by the Third Party lender holding the debt to be refinanced. The debt is from the same institution and there is no interim lender.

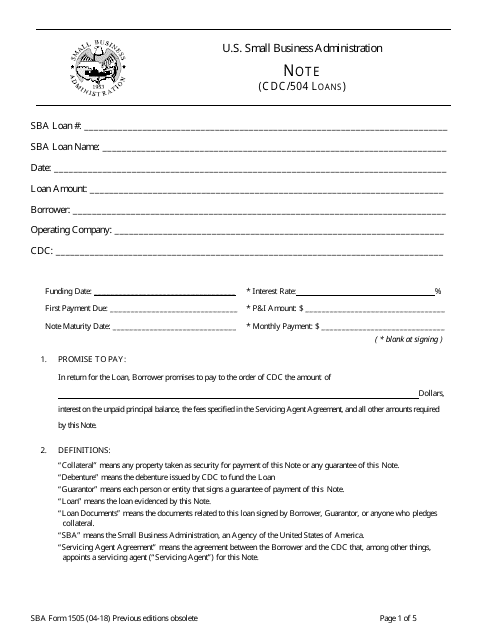

This form serves as evidence of a 504 Loan from the proceeds of a 504 Debenture. The Certified Development Company (CDC) signs this Note to assign it to the Small Business Administration (SBA).

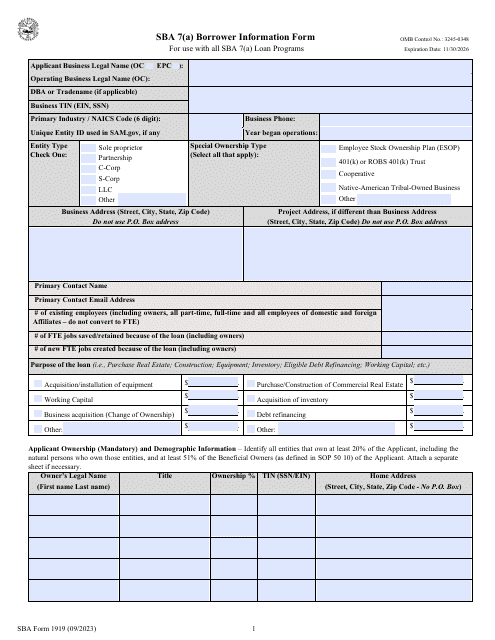

This form is issued by the Small Business Administration (SBA) and used by small businesses applying for a 7(a) loan and submitted to the SBA participating lender.

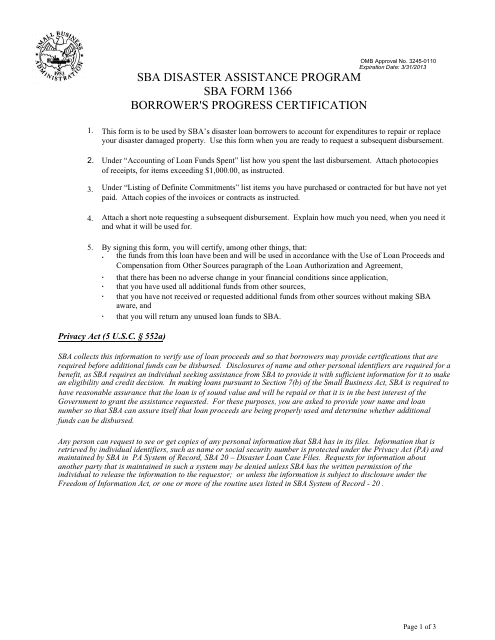

This form is used for borrowers to certify their progress in the SBA Disaster Assistance Program. It helps track and verify the borrower's use of funds and the progress made towards recovery.

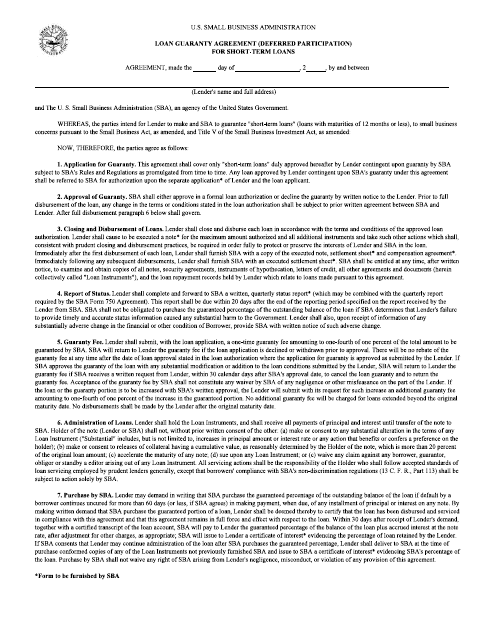

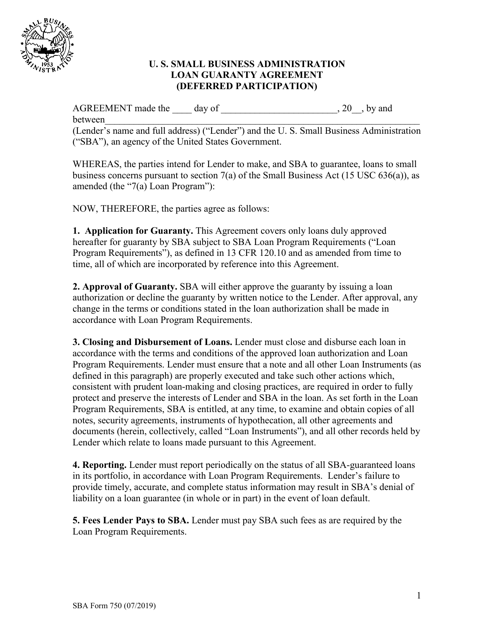

This document is used for the Loan Guaranty Agreement (Deferred Participation) for Short-Term Loans under the Small Business Administration (SBA) program.

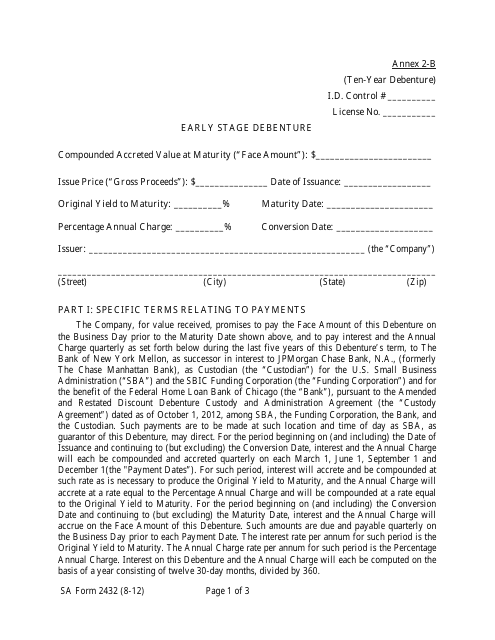

This form is used for applying for an Early Stage Debenture with a ten-year term through the Small Business Administration (SBA).

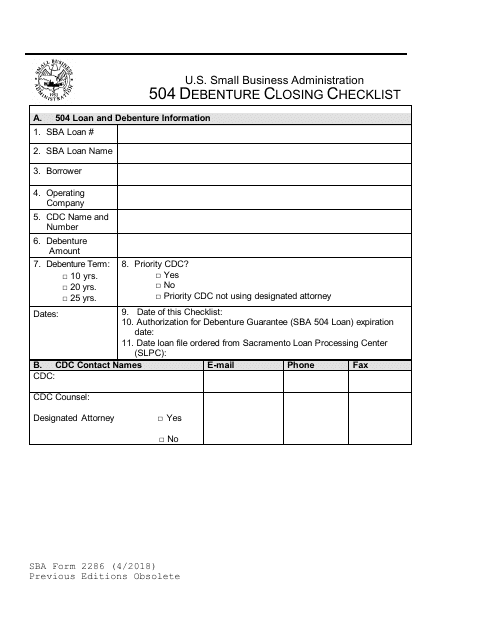

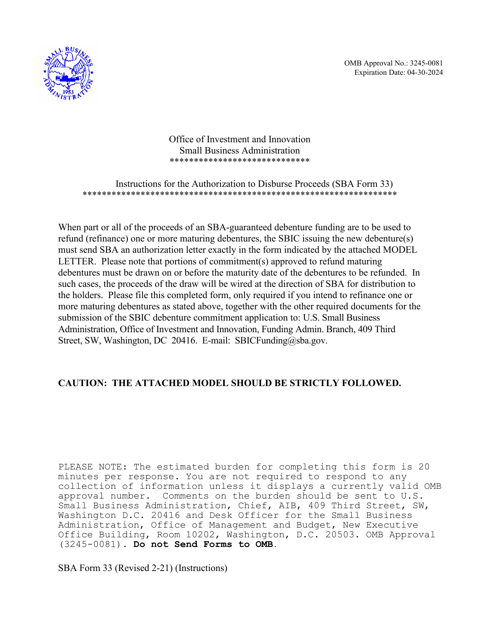

This form is used by Certified Development Companies (CDCs) and the Small Business Administration (SBA) for 504 loan and guarantee debenture closings.

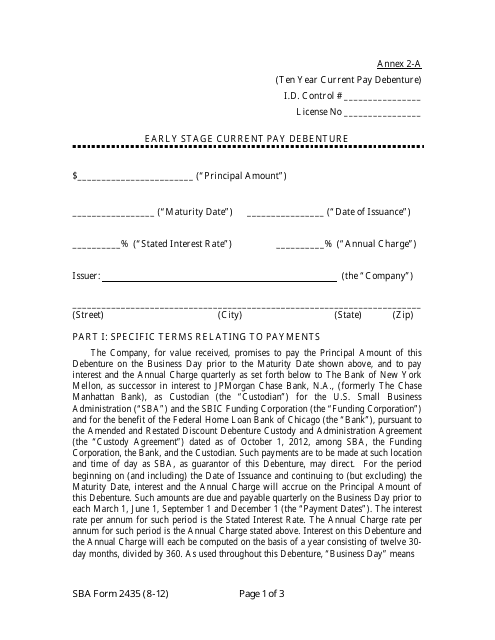

This document is used for applying for an early stage current pay debenture with the Small Business Administration (SBA).

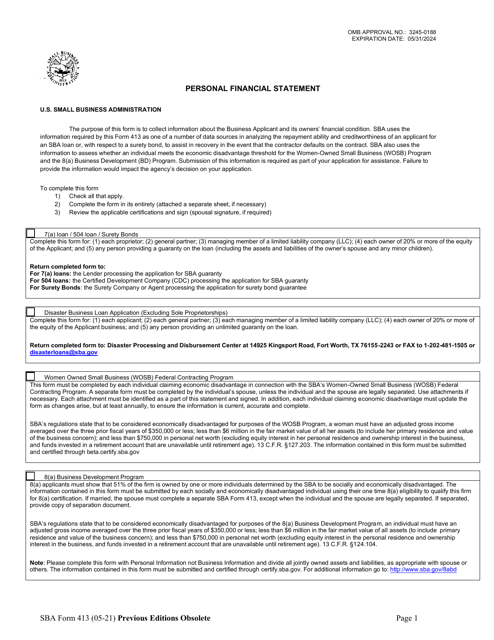

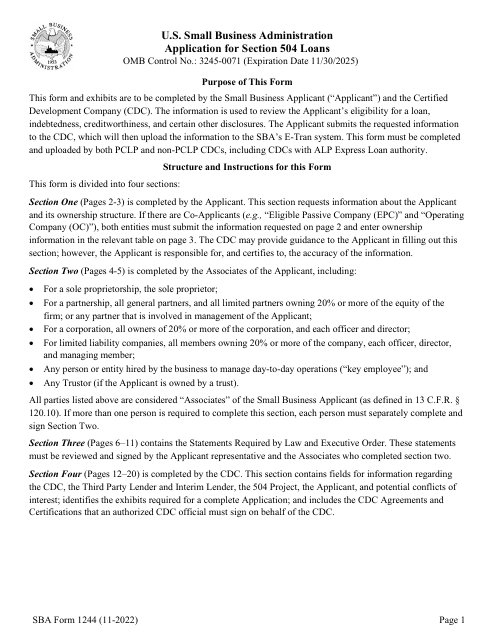

This form is used by the Small Business Administration (SBA) to determine a loan applicant's creditworthiness, indebtedness, and overall eligibility for the SBA Section 504 loan.

This form is used for notifying new borrowers about the Small Business Administration (SBA) requirements and terms for their loan.

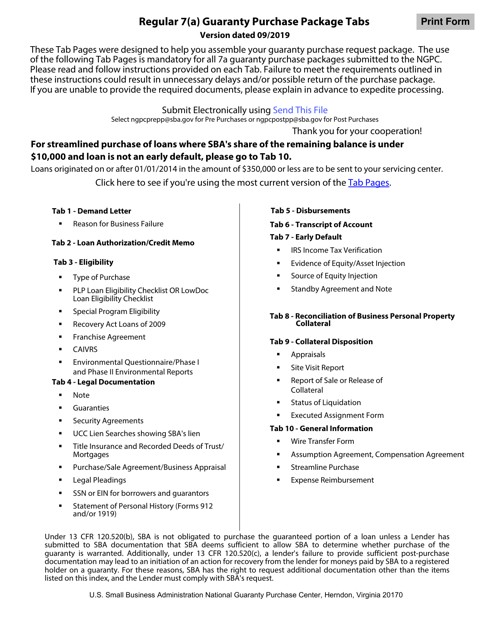

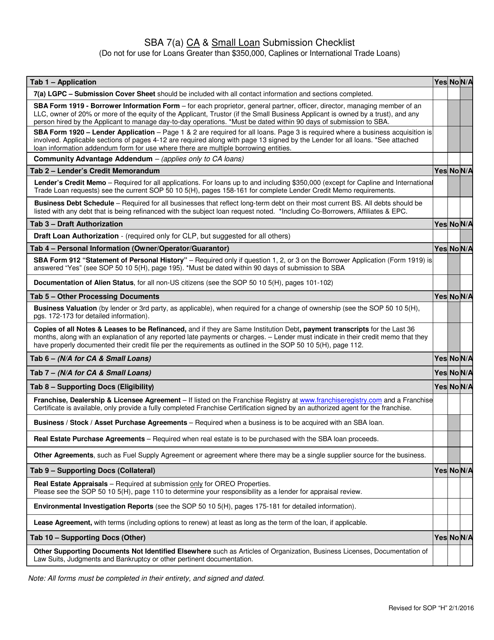

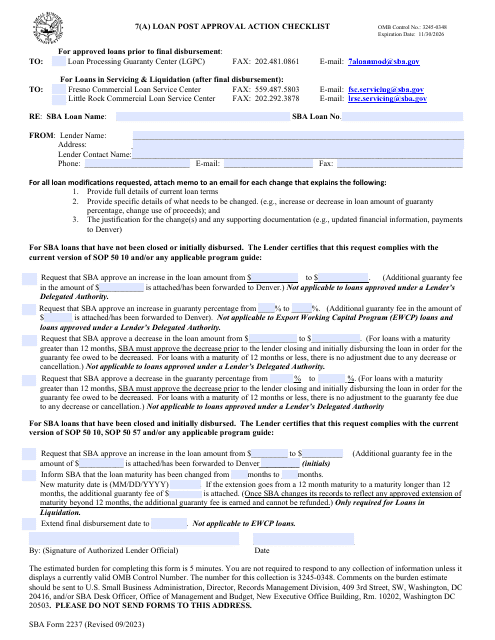

This document provides a checklist for submitting a CA and small loan application under the Small Business Administration's 7(A) loan program.

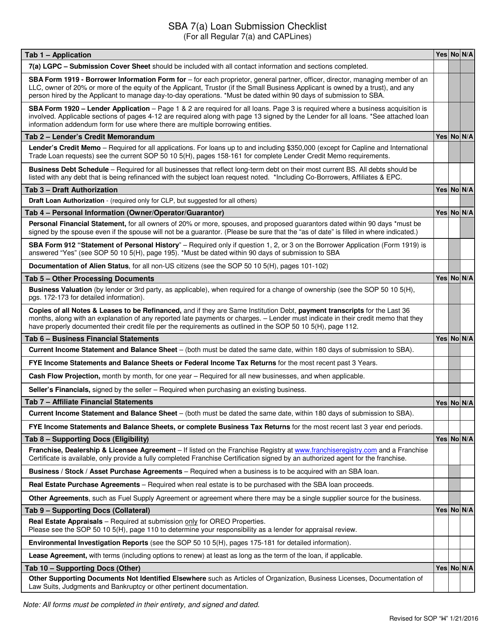

This document provides a checklist for submitting SBA 7(A) loan applications, including regular 7(A) loans and Caplines loans. It helps ensure that all necessary documents and information are included in the loan submission process.

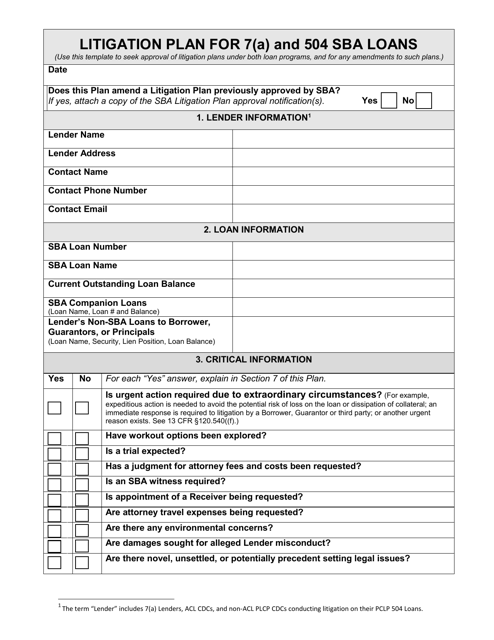

This document outlines the plan for handling legal disputes related to 7(A) and 504 SBA loans. It covers strategies and steps to take in litigation proceedings.

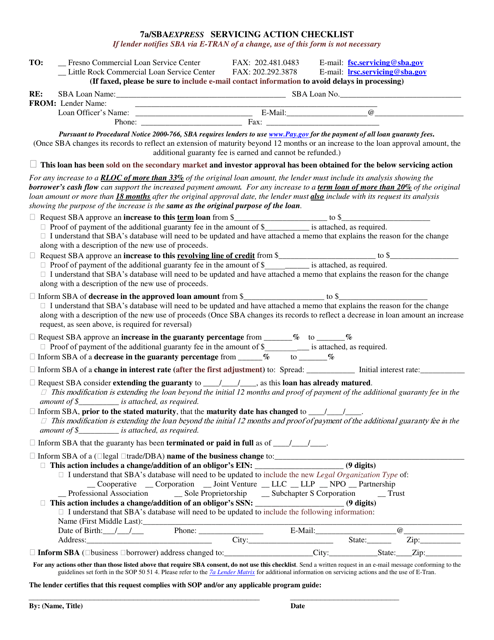

This document is a checklist for the Small Business Administration (SBA) Express Servicing Action. It provides a step-by-step guide for completing various tasks related to SBA Express loans. Use this checklist to ensure all necessary actions are taken to service SBA Express loans effectively.

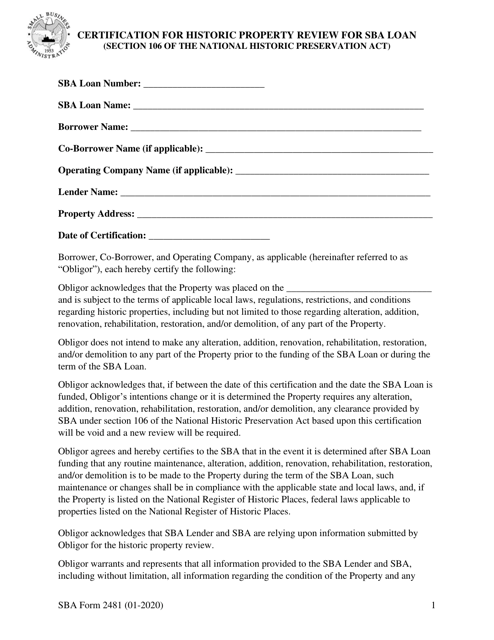

This form is used for confirming the review of historic properties for an SBA loan, specifically in accordance with Section 106 of the National Historic Preservation Act.

Use this form if you are a lender to notify the SBA of the following actions conducted after the loan was approved: closing the loan, changes in the borrower's legal or business name, and the like.

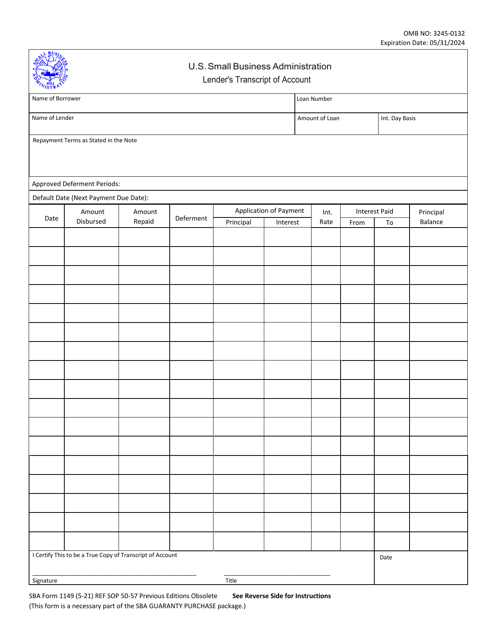

This document keeps track of the disbursement of 7(a) Loan proceeds and the applications of payments. It allows to determine the date the loan went into default and to assess how much interest the lender is receiving.

This Form is used for non-profit borrowers to answer questions about the necessity of their Paycheck Protection Program loan.

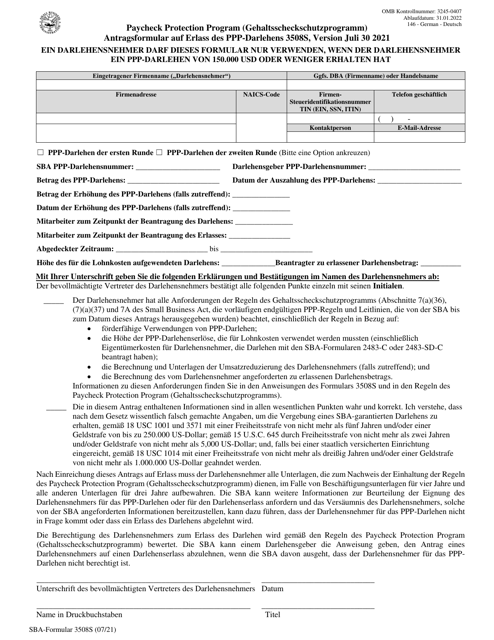

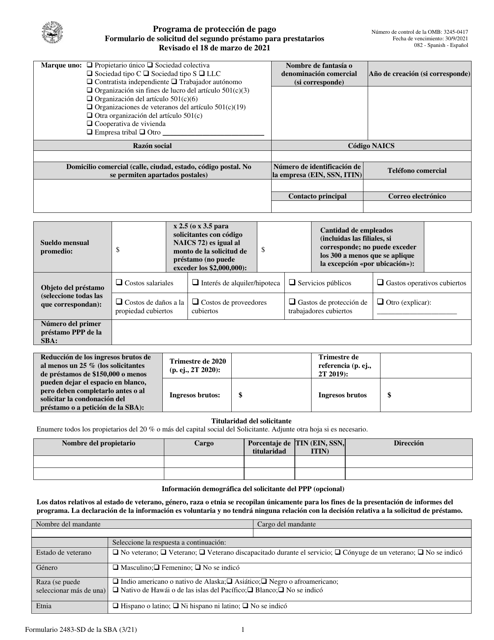

This document is a Spanish version of the SBA Form 2483-SD used for applying for the second loan under the Paycheck Protection Program.

This form is used for submitting an application for an early-stage current pay debenture through the Small Business Administration (SBA). It is a type of document for requesting funding for small businesses.

This form is used for applying for an Early Stage Debenture through the Small Business Administration (SBA). It is a type of document that helps entrepreneurs secure long-term funding for their business ventures.

Download this form in order to identify a third party agent hired by a small business owner for assistance in a Small Business Administration (SBA) loan application.

This document outlines the insurance requirements that must be met when applying for Small Business Administration (SBA) loans. It details the types of insurance coverage that businesses must have in order to qualify for an SBA loan and protect their assets.