Small Business Documents Templates

Related Articles

Documents:

640

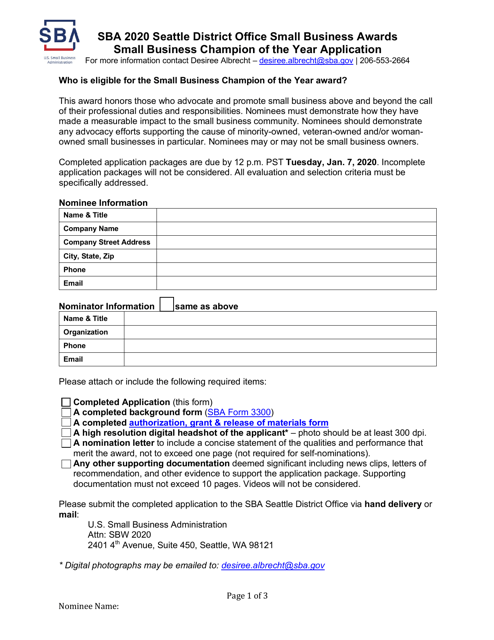

This document is an application for the Small Business Champion of the Year award given by the Seattle District Office.

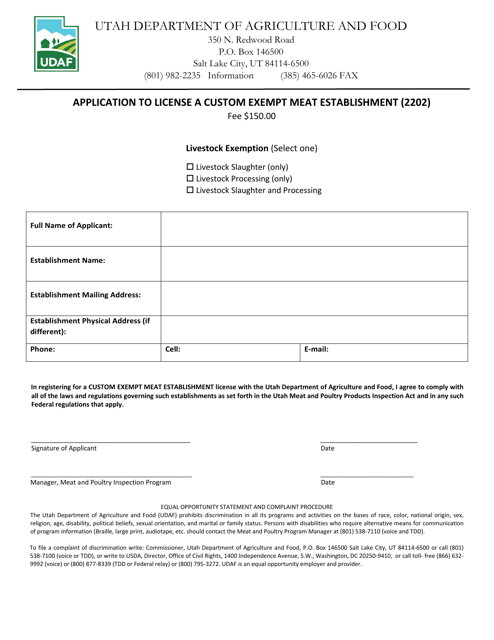

This document is for applying to license a custom exempt meat establishment in the state of Utah. It outlines the required steps and information needed to obtain a license for this type of establishment.

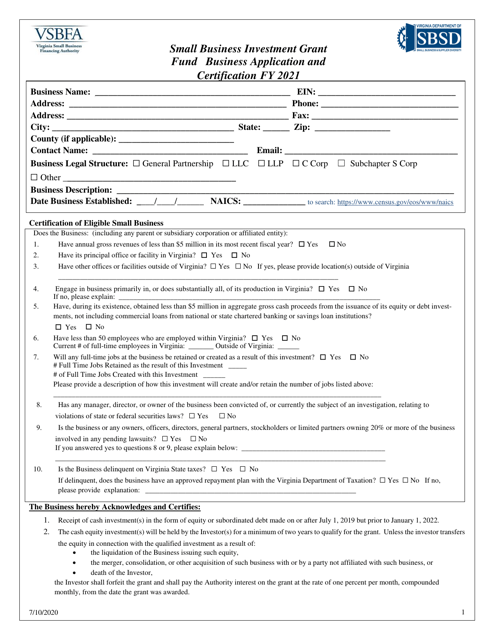

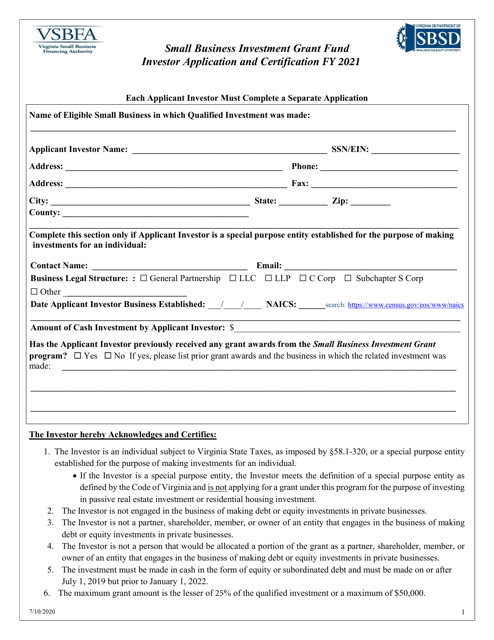

This document is for individuals or businesses applying for funding in the state of Virginia. It includes a certification process to ensure compliance with state regulations.

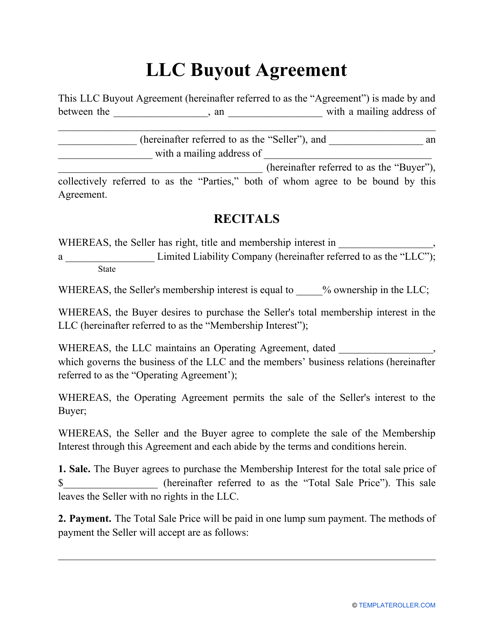

Use this form to record the decision of a Limited Liability Company (LLC) member to permanently leave the company.

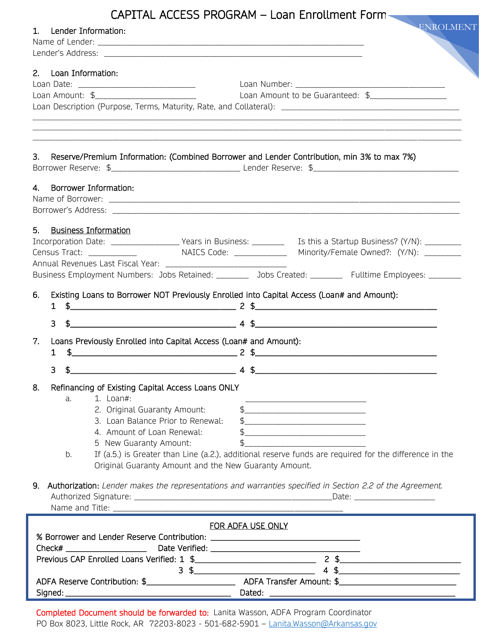

This form is used for enrolling in the Capital Access Program, which is a loan program in Arkansas.

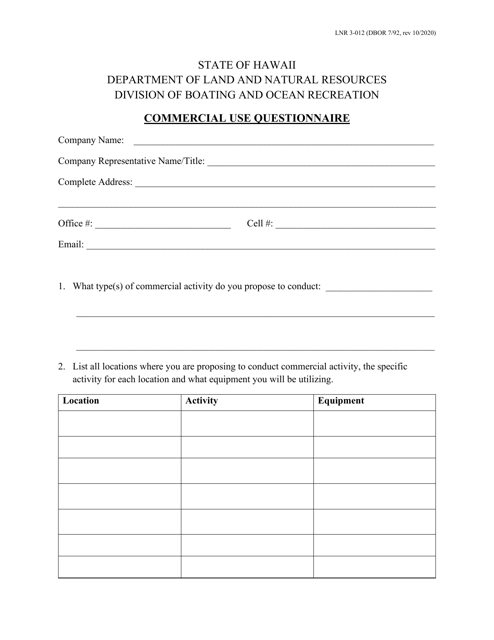

This form is used for completing a commercial use questionnaire in Hawaii. It gathers information about businesses and their potential impact on the environment and community.

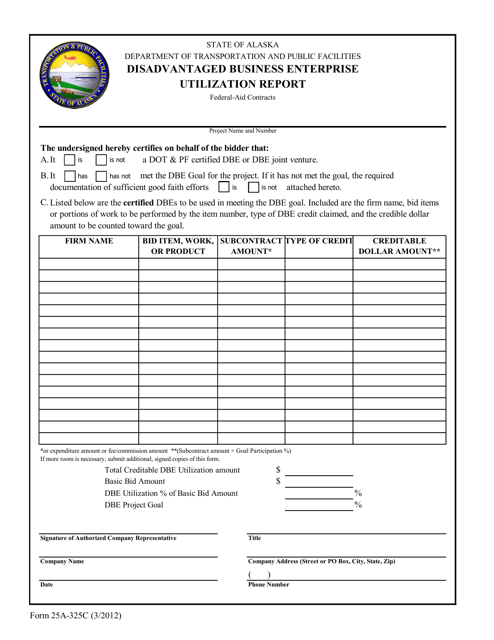

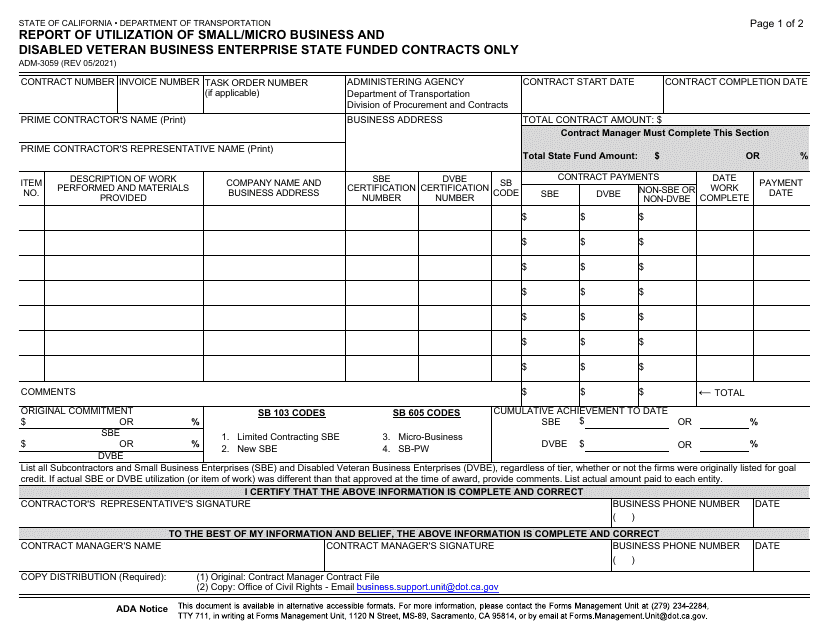

This form is used for reporting the utilization of disadvantaged business enterprises in Alaska.

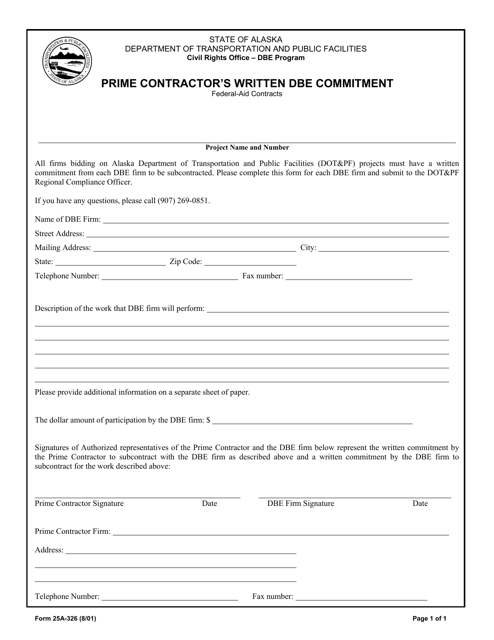

This form is used for prime contractors in Alaska to provide a written commitment to the Disadvantaged Business Enterprise (DBE) program.

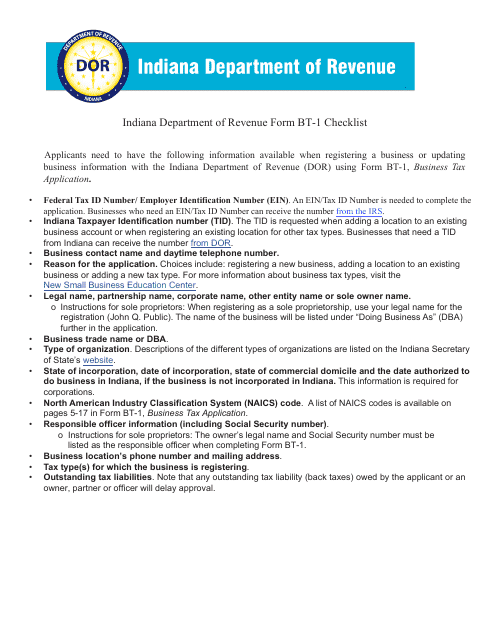

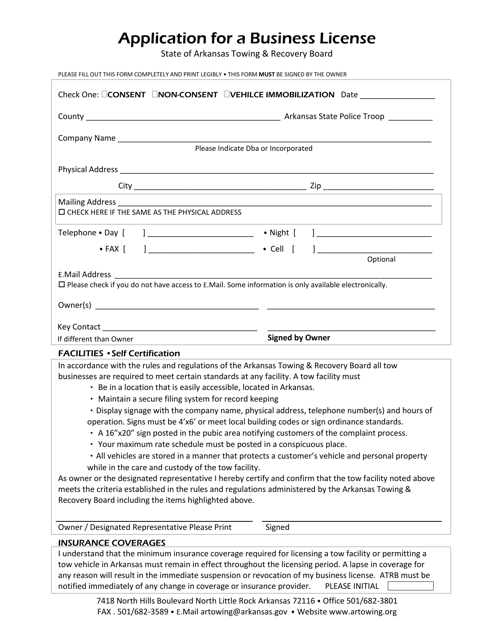

This document is used for applying for a business license in the state of Arkansas.

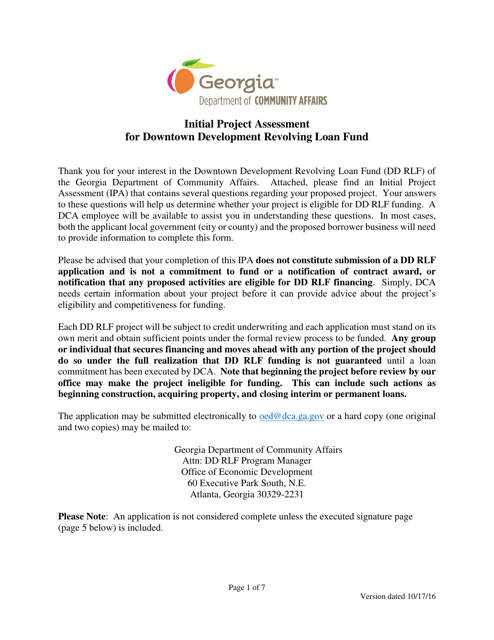

This document is an initial project assessment for the Downtown Development Revolving Loan Fund in Georgia. It provides an evaluation of a potential development project in downtown areas and determines its eligibility for a loan from the fund.

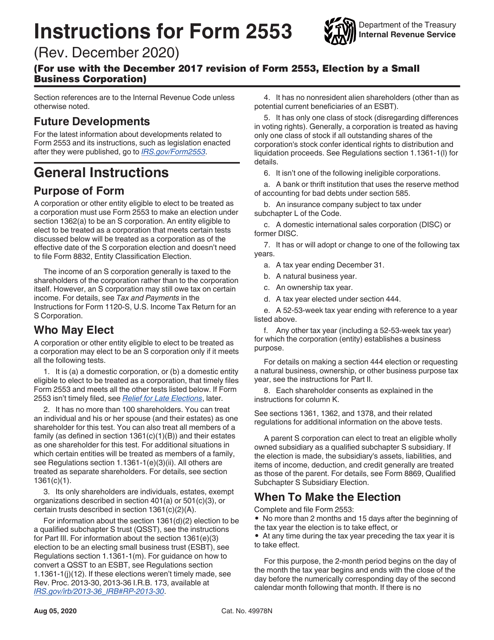

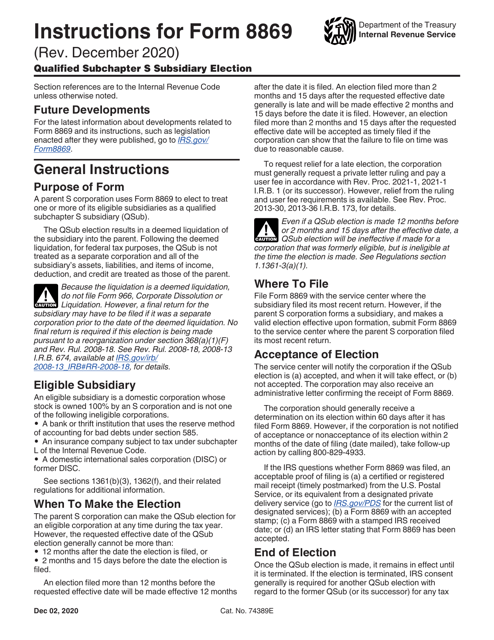

This Form is used for electing to treat a domestic corporation as a Qualified Subchapter S Subsidiary (QSub).

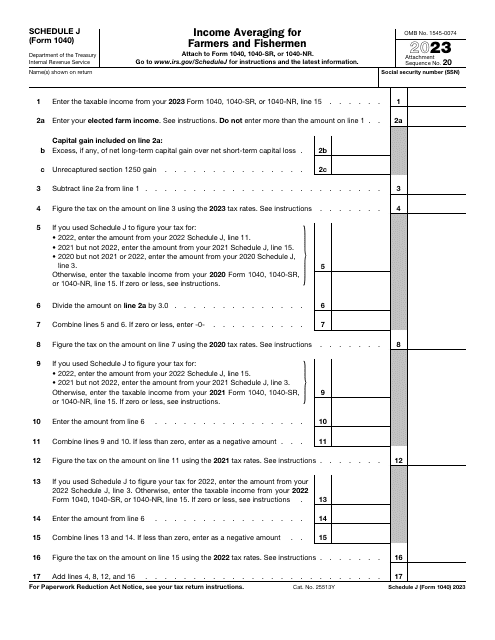

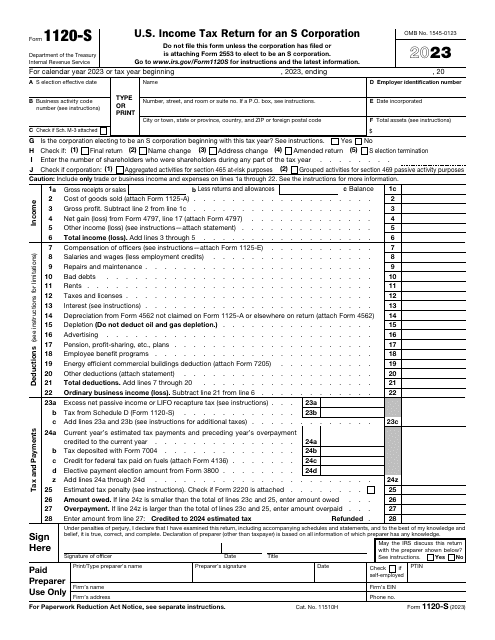

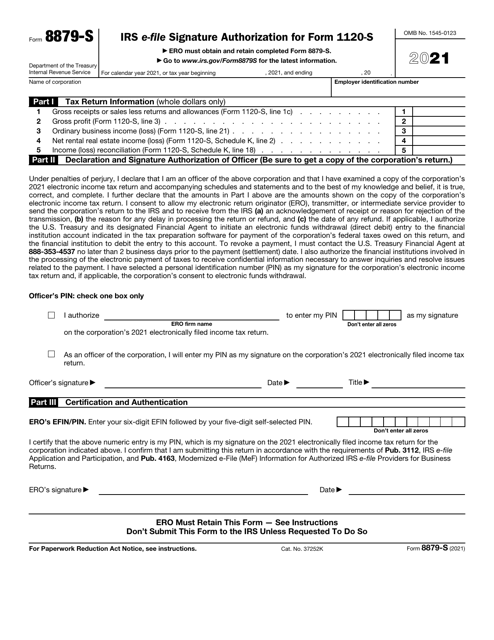

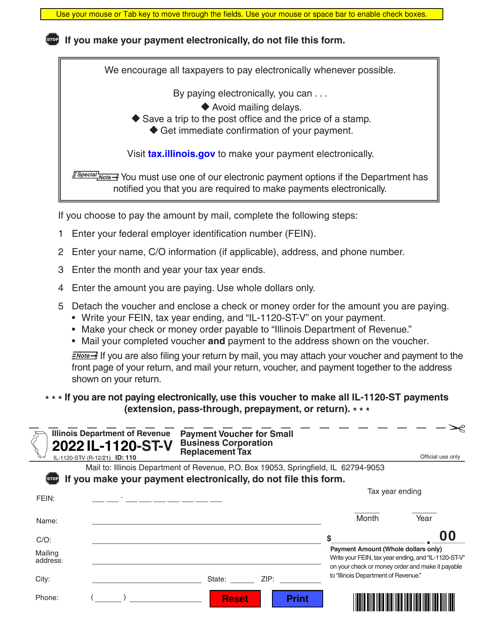

This form is used for reporting income, deductions, and credits of a domestic corporation or any other entity for any tax year covered by an election to be an S corporation. The information is sent to the Internal Revenue Service (IRS).

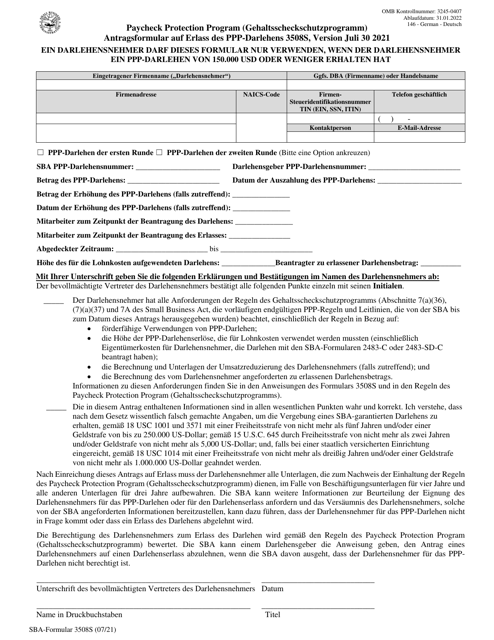

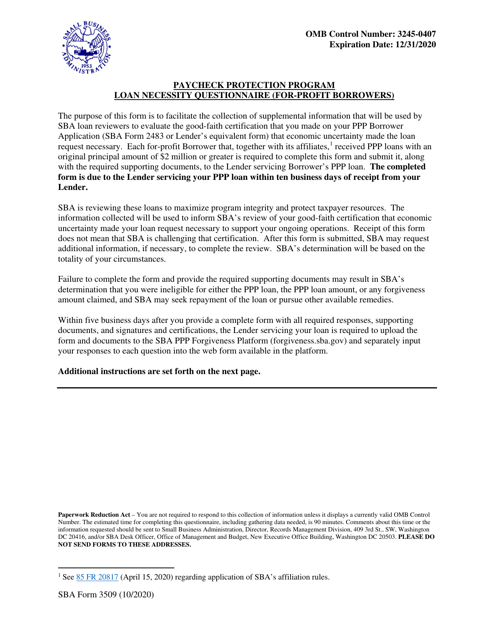

This form is used for for-profit borrowers applying for the Paycheck Protection Program loan to answer a questionnaire about the necessity of the loan.

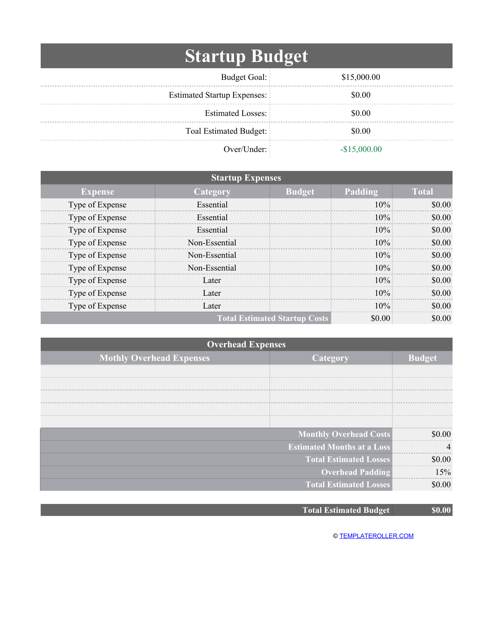

This document is a way for a startup business to assess all of the costs necessary to open their business based on income and expenses.

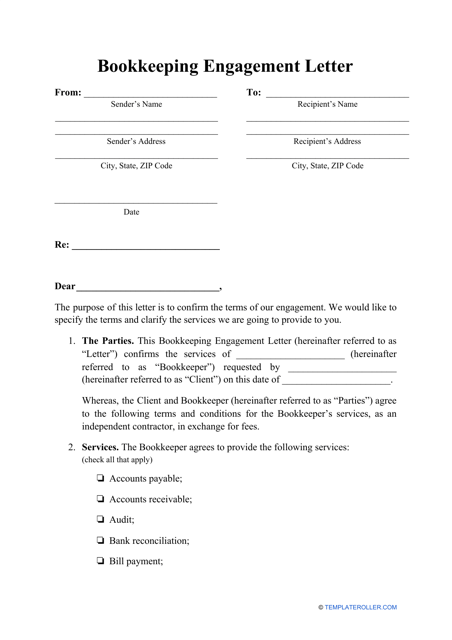

The purpose of this letter is to outline the terms and conditions of the bookkeeping services that can be provided by a specific company to their client.

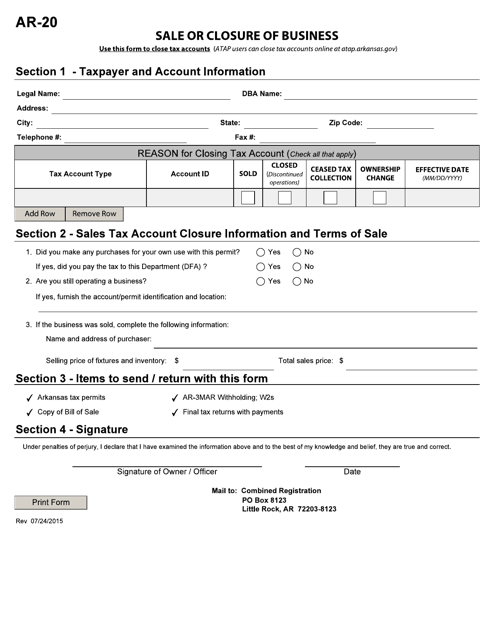

This form is used for reporting the sale or closure of a business in Arkansas. It is required by the state for tax and record-keeping purposes.

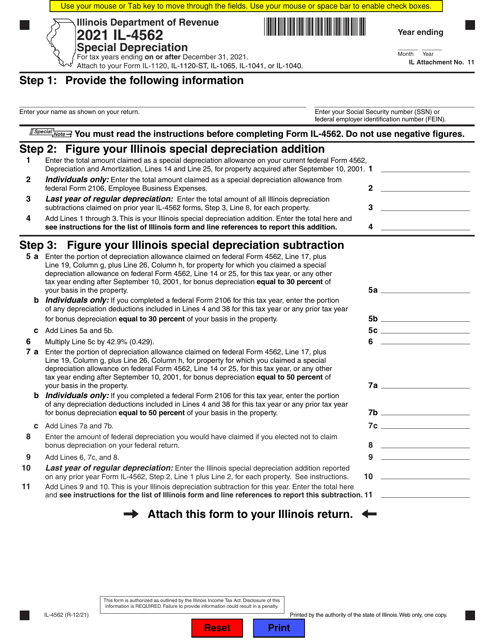

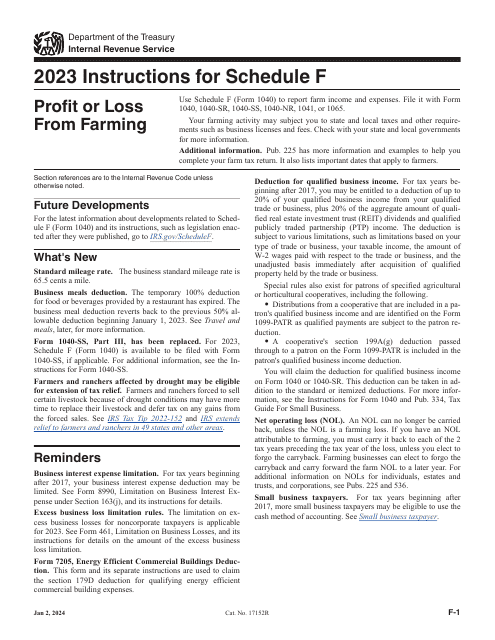

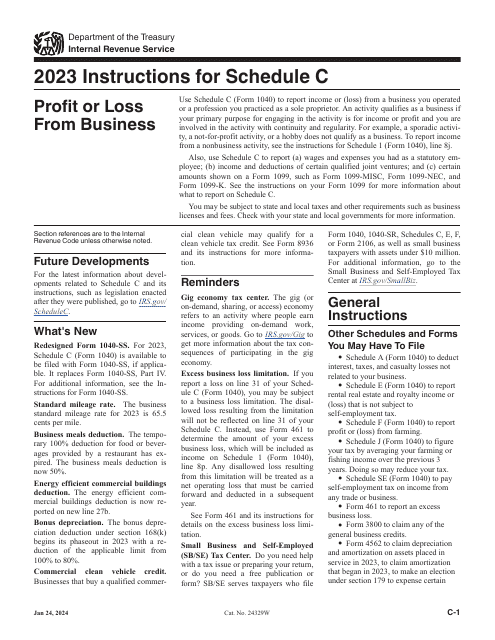

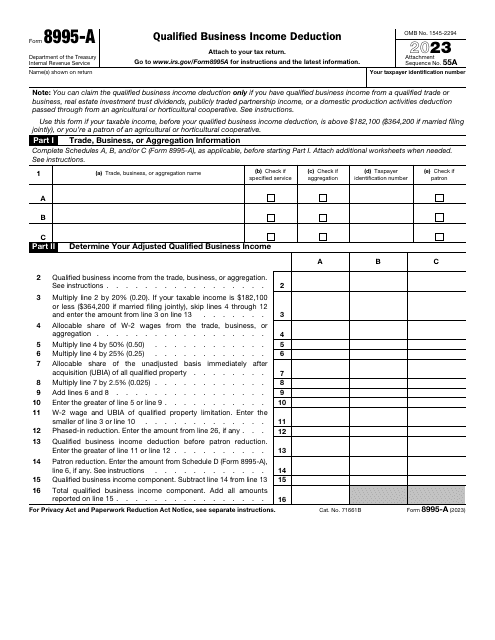

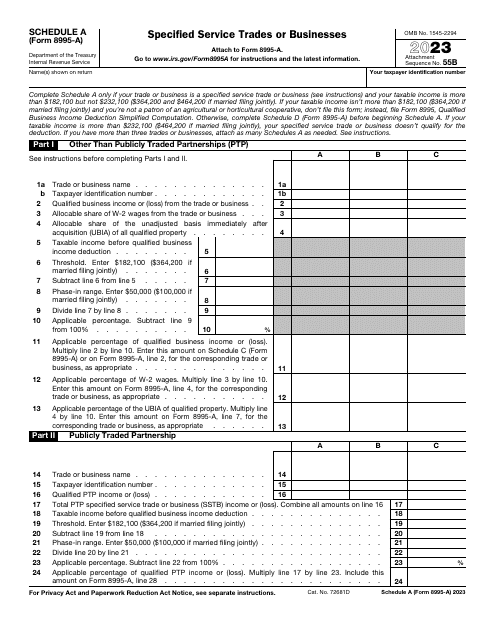

This is a supplementary IRS form used by taxpayers in order to claim a business deduction after reporting your business income.