Small Business Documents Templates

Related Articles

Documents:

640

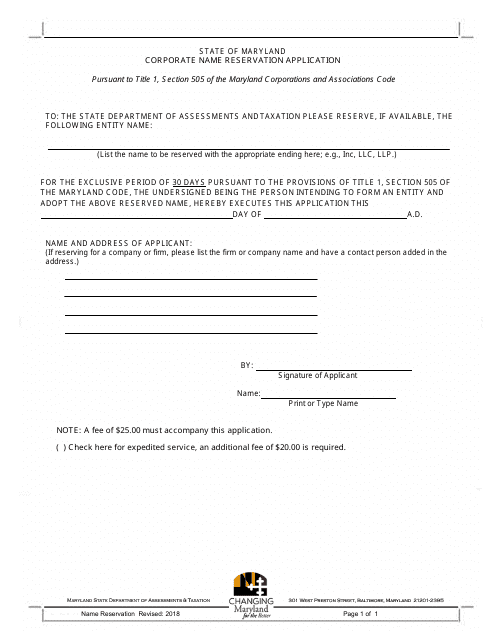

This Form is used for reserving a corporate name in the state of Maryland.

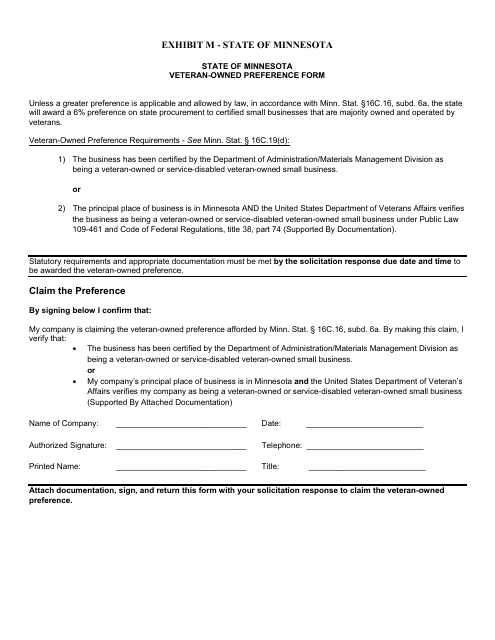

This document is used for applying veteran-owned preference in Minnesota. It is important for veterans who own a business and want to participate in government procurement opportunities in Minnesota.

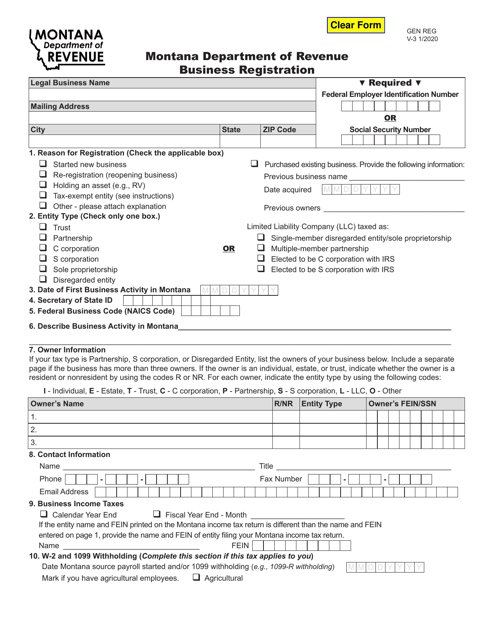

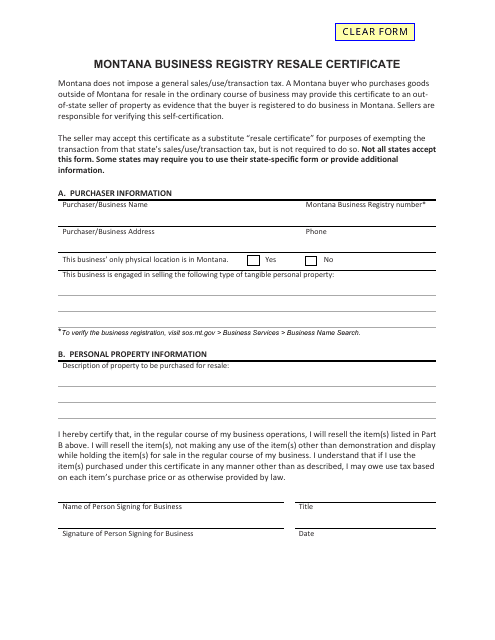

This Form is used for obtaining a Resale Certificate in Montana to conduct business activities and make purchases without paying sales tax on items that will be resold.

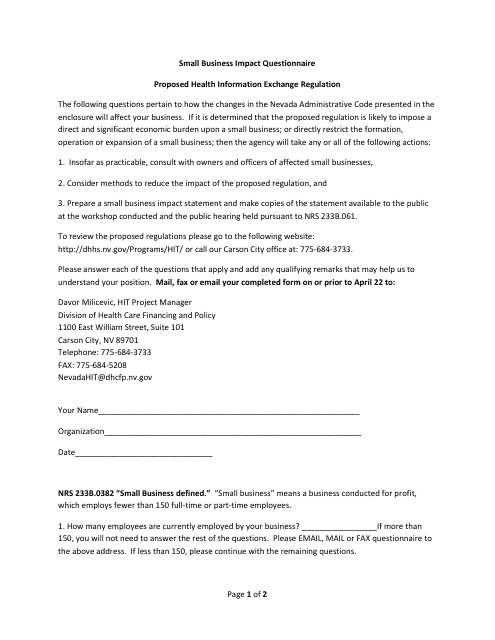

This Form is used for collecting information on the impact of proposed Health Information Exchange Regulation on small businesses in Nevada.

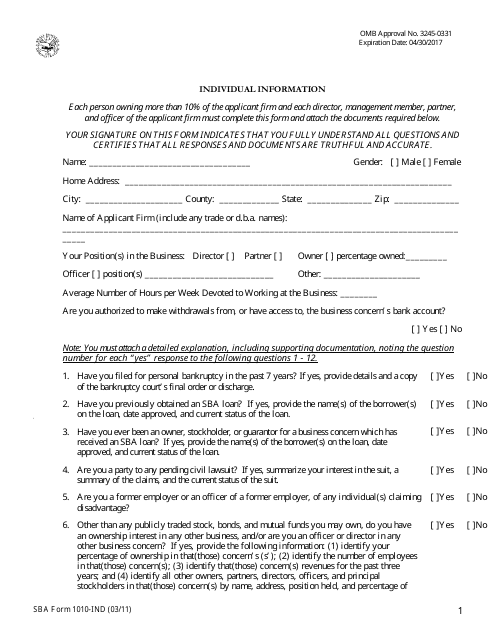

This form is completed by each individual who owes more than 10% of a business when applying for 8(a) Business Development Program.

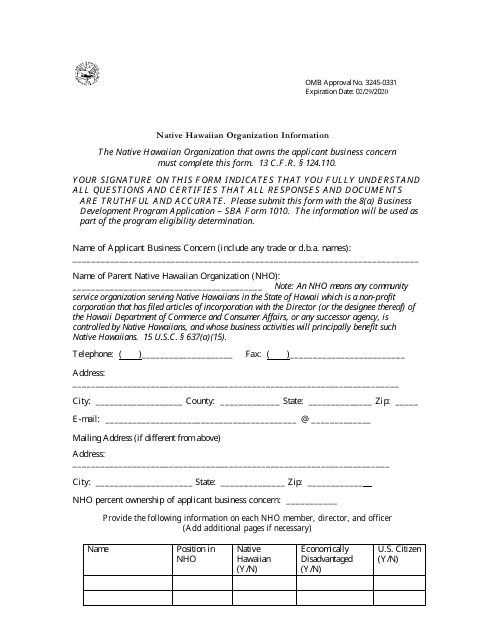

This form is completed by representatives of Native Hawaiian Organizations that own the applicant businesses concern.

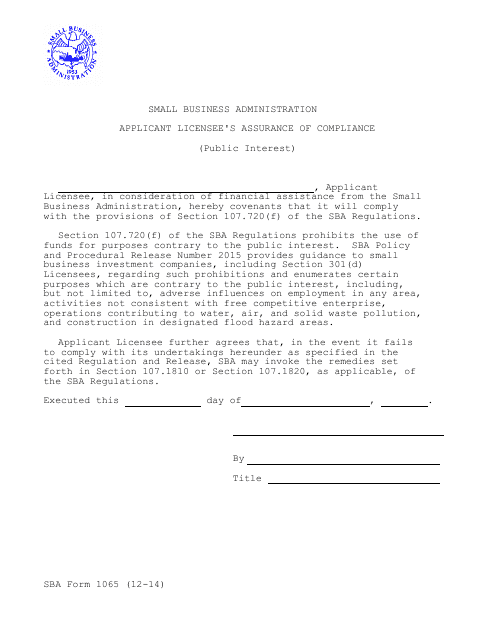

This Form is used for applicants of SBA Form 1065 to provide assurance of compliance with licensing requirements.

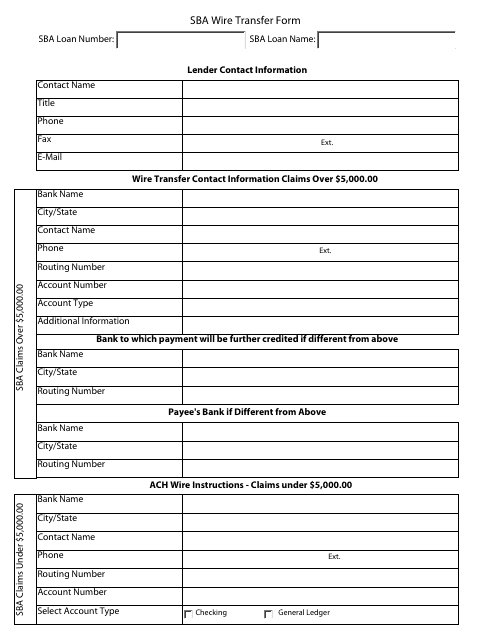

This document is used for initiating a wire transfer through the Small Business Administration (SBA). It provides the necessary information to securely transfer funds from one account to another.

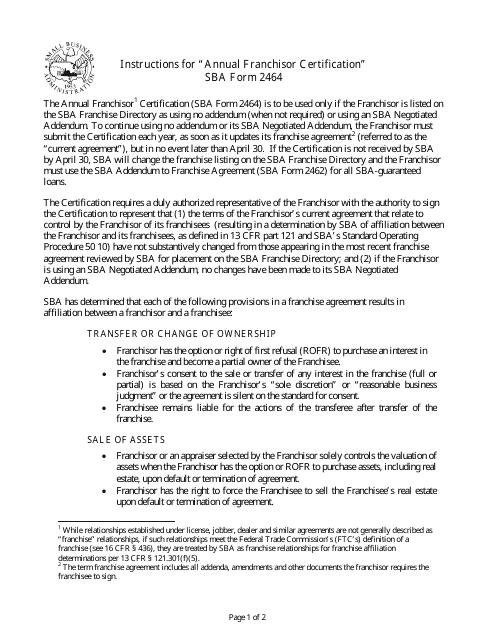

This form is used for annual franchisor certification for Small Business Administration (SBA) purposes.

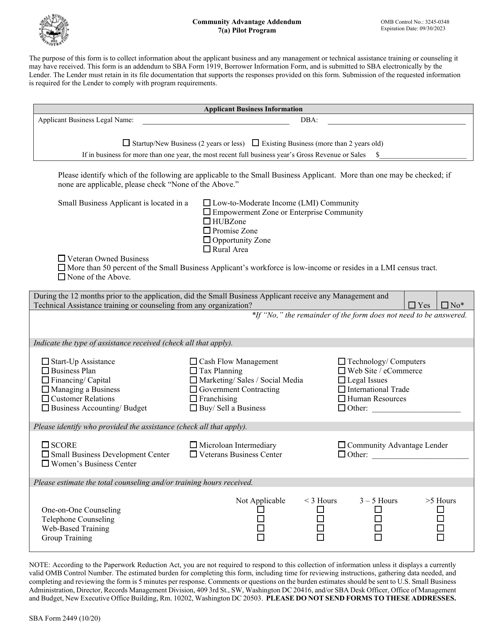

Submit this form to the Small Business Administration (SBA) if you wish to apply for a Community Advantage Loan Program.

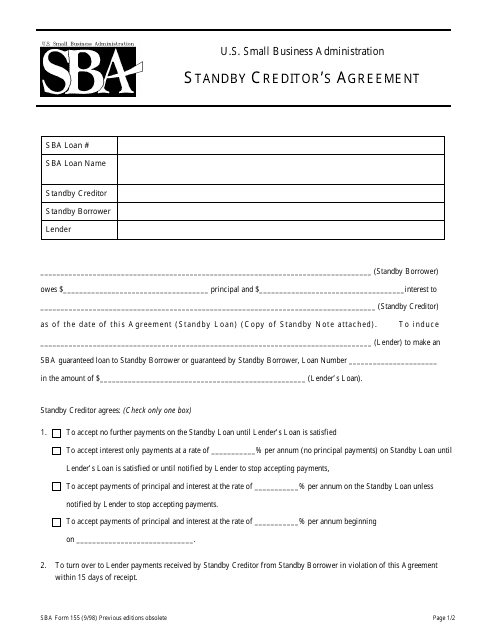

Use this document to formalize a subordination of lien rights of the Standby Creditor to the Small Business Administration (SBA) Lender's rights in the collateral.

This Form is used for giving consent to the Small Business Administration (SBA) to disclose information during Small Business Week.

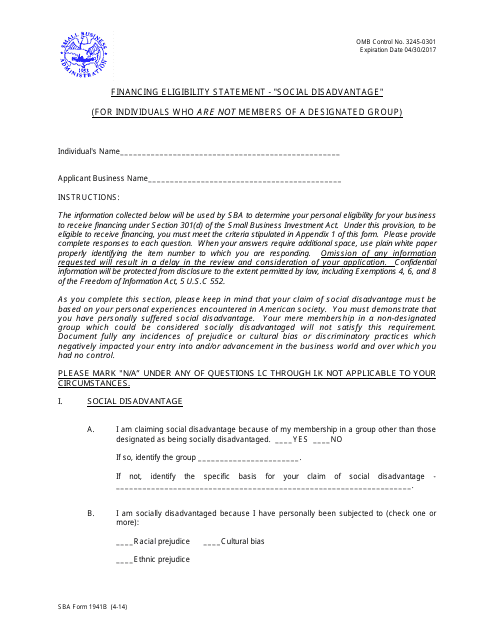

This document is for individuals who are not part of a designated group and are seeking financing eligibility. It relates specifically to the assessment of "social disadvantage."

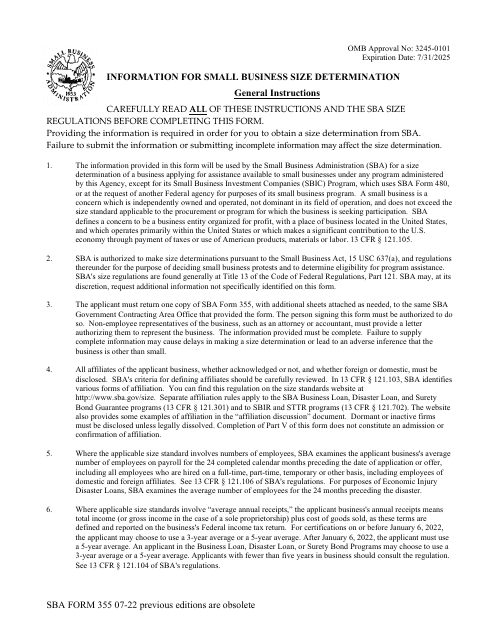

This form is used by small business owners to request an assessment of the size of their business done by the Small Business Administration (SBA) in order to qualify for a loan.

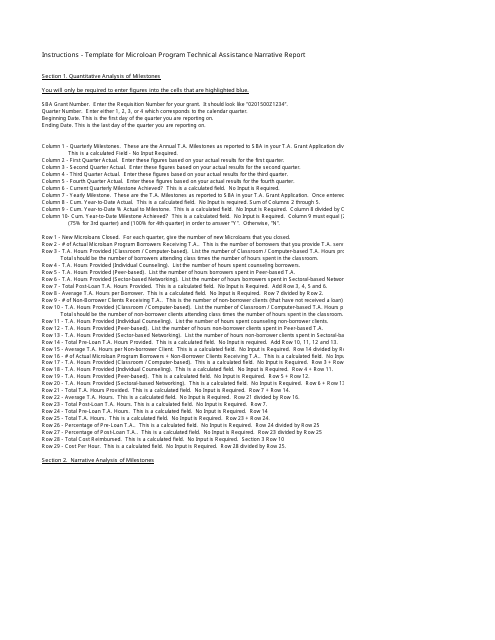

This document is a template for creating a narrative report for a technical assistance program associated with a microloan program. It helps in documenting the progress and outcomes of the technical assistance provided to support microloan programs.

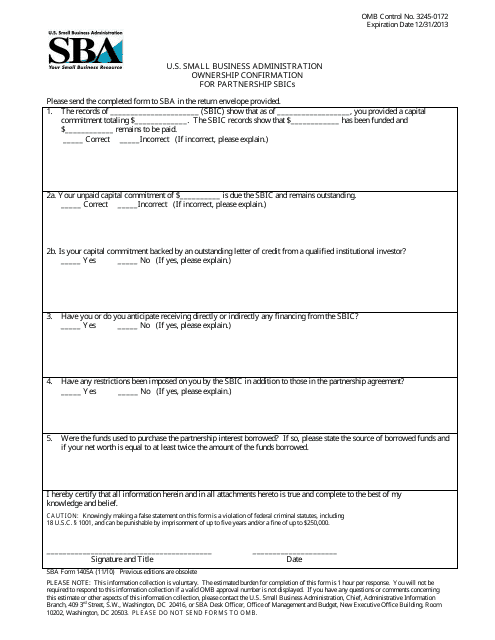

This document is used for confirming ownership in a partnership Small Business Investment Company (SBIC).

This document is for small agricultural cooperatives who want to apply for certification under the HUBZone Program. The HUBZone Program is a government initiative that helps small businesses in historically underutilized areas gain access to federal contracting opportunities.

This document is completed by a Certified Development Company (CDC) to help the Small Business Administration (SBA) to apply for a Section 504 Loan.

This document provides the application form and requirements for U.S. citizens, ANCs, NHOs, or Cdcs to apply for HUBZone Program certification. The HUBZone Program aims to encourage economic development in historically underutilized business zones.

This form is used for nominating Jody Raskind for the Lender of the Year Award during National Small Business Week.

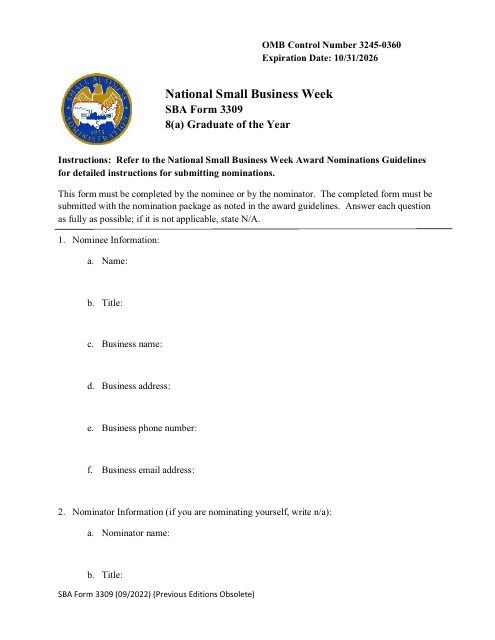

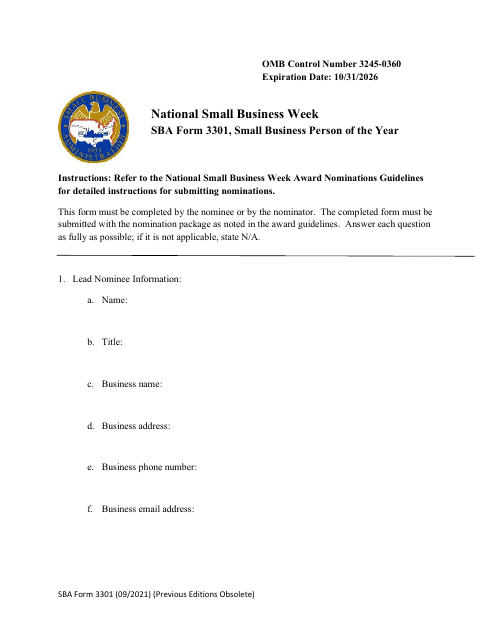

Use this form for self-nomination or if you wish to nominate a candidate for the Small Business Administration (SBA) Award.

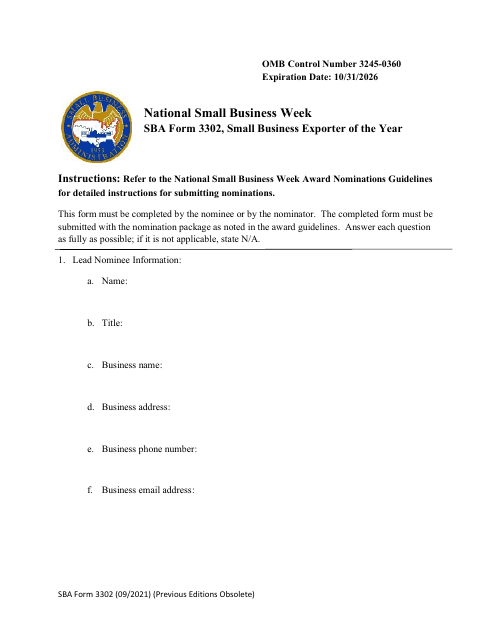

SBA Form 3302 Nomination Form for Small Business Exporter of the Year - National Small Business Week

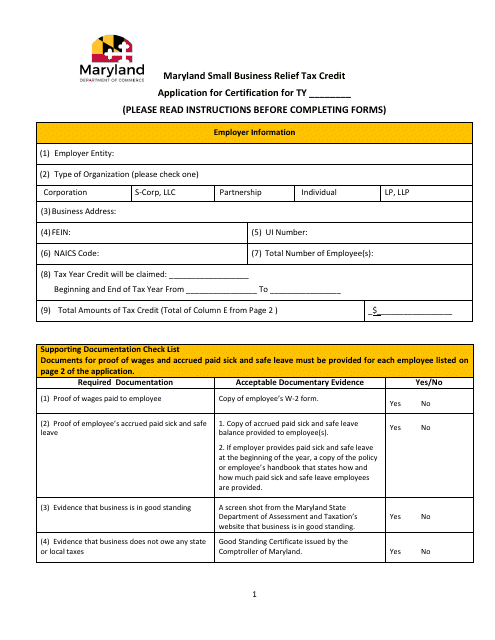

This document is an application for the Maryland Small Business Relief Tax Credit in the state of Maryland. It is used by small businesses to apply for certification and eligibility for the tax credit.

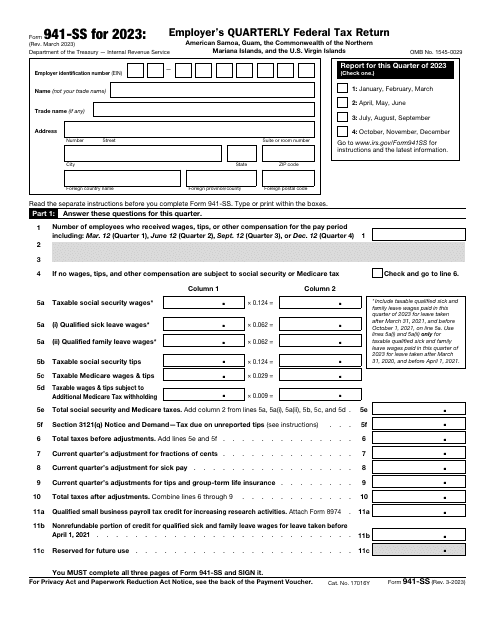

This document, otherwise known as the Employer's Quarterly Federal Tax Return, is a form downloaded to report about your social security and Medicare taxes. This form is used only if the official place of business is located within the specified territories.

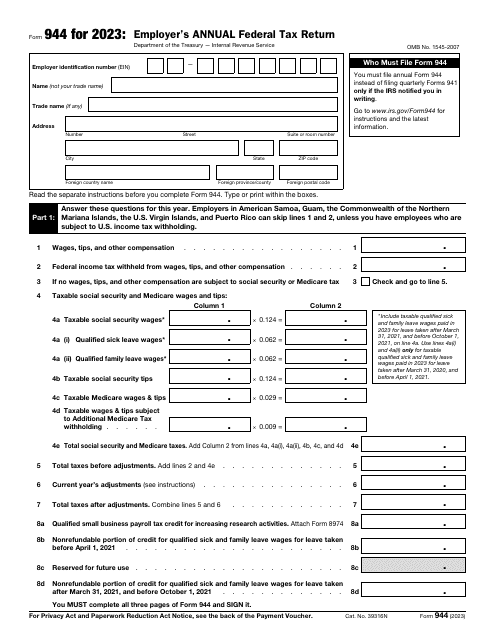

This is a fiscal document filled out by employers with a low annual tax liability to report their payroll activities to tax organizations.

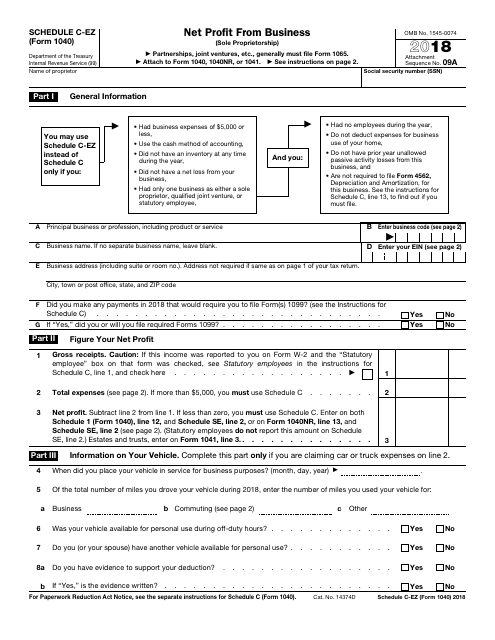

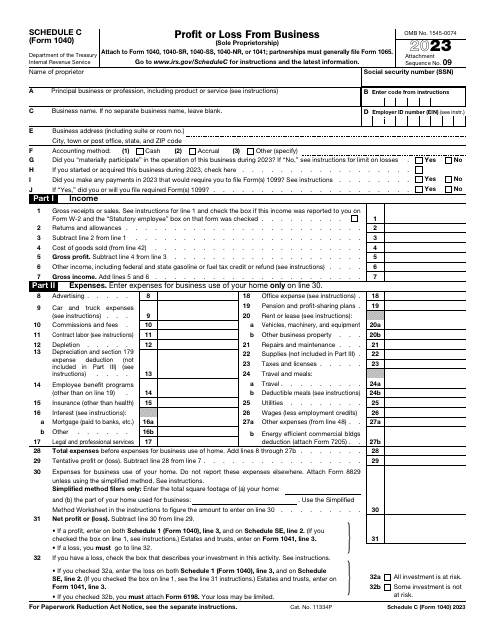

Complete this form in order to report income and loss from a business, qualified joint venture, or profession where you were the sole proprietor. This form is a simplified version of Schedule C. The document relates to the series of IRS 140 form series that is used for reporting and deducting of various types of income and losses.

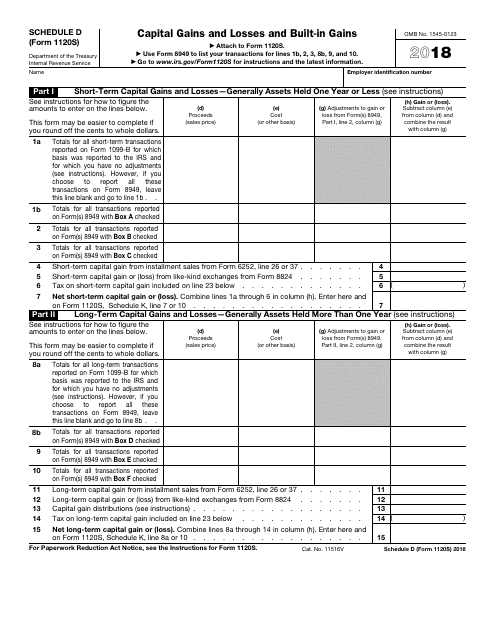

This document provides a schedule for reporting capital gains and losses, as well as built-in gains, on IRS Form 1120S. It is used by S corporations to report these financial transactions to the IRS.

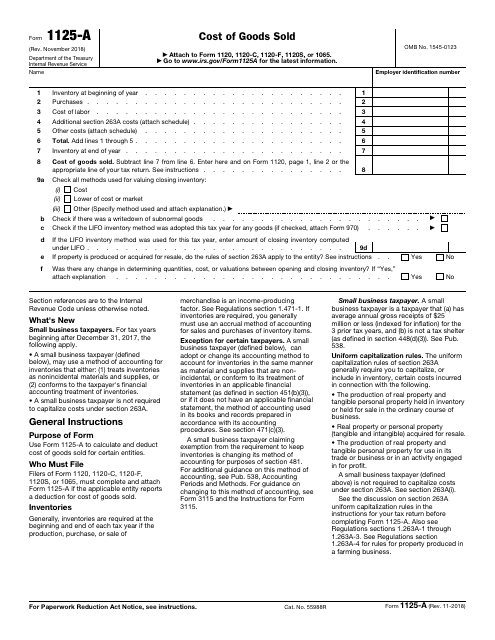

This document is used to calculate and deduct the cost of goods sold for certain entities.

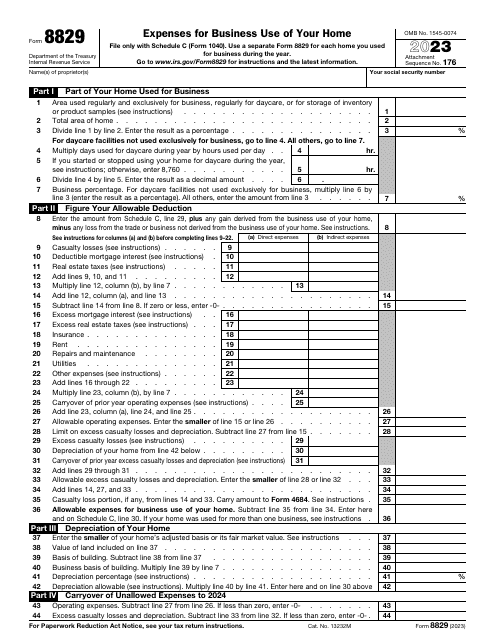

This is an IRS form used by taxpayers who work from home and want to inform tax organizations about the business expenses they wish to deduct from their taxes.