Fixed Asset Templates

Documents:

24

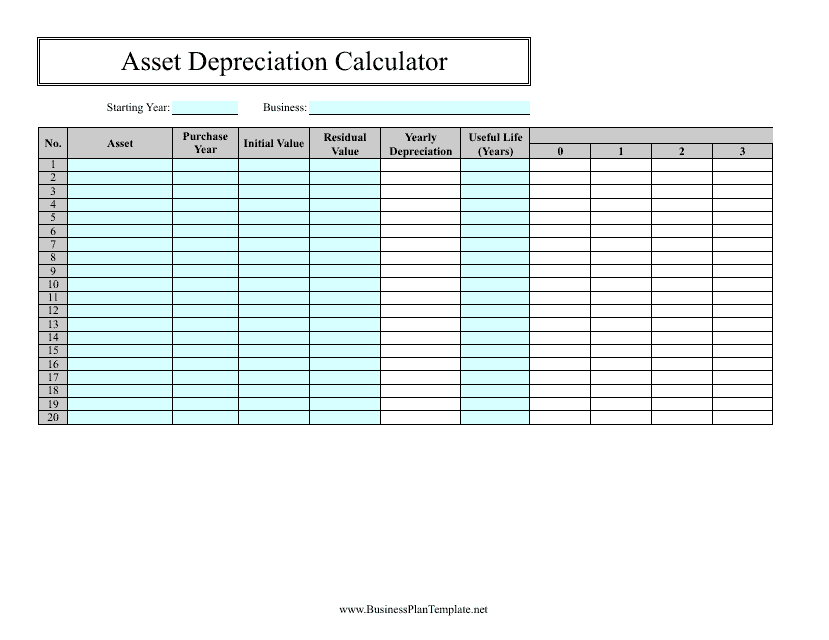

This document is a spreadsheet template that helps calculate asset depreciation. It assists in determining the decrease in value of assets over time.

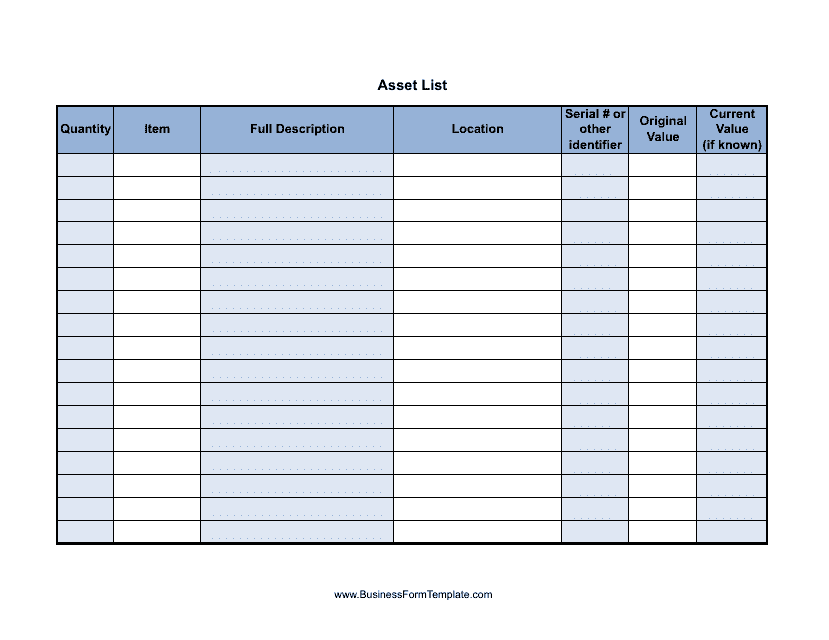

This document is an asset list template. It is used to create a comprehensive list of assets owned by an individual or a business.

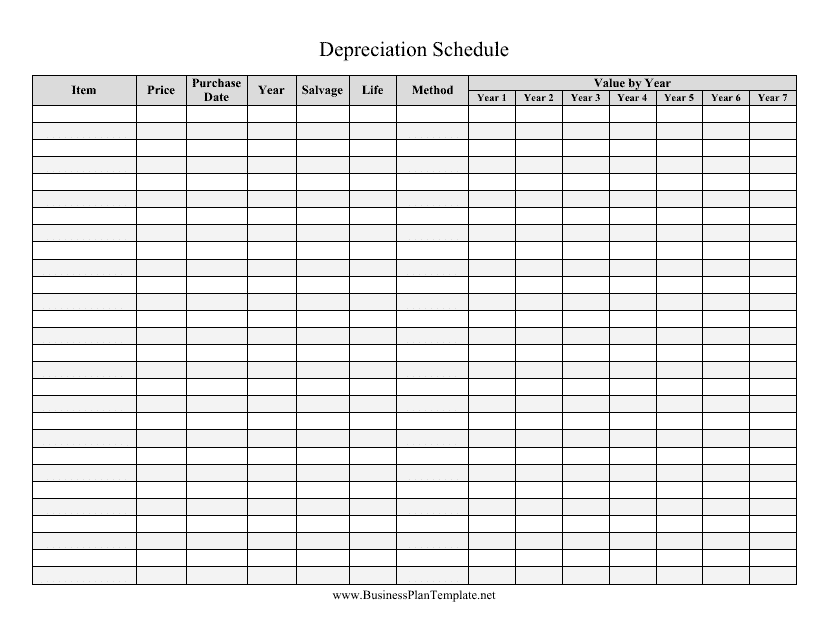

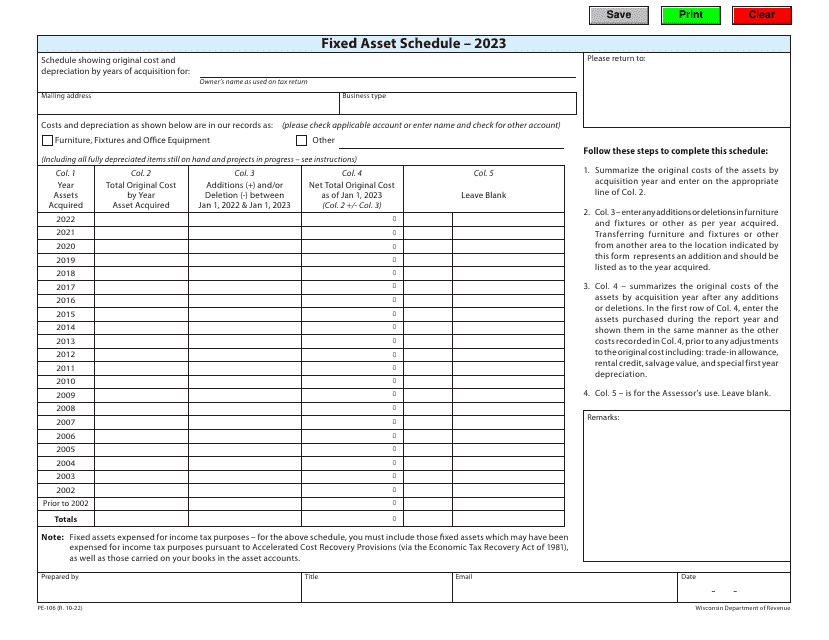

This document provides a template for creating a schedule that determines the depreciation of assets over time. It is useful for businesses to track the decrease in value of their assets for accounting and tax purposes.

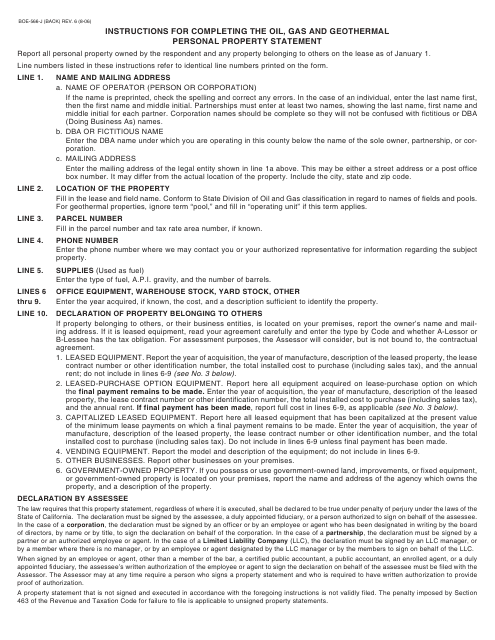

This Form is used for reporting oil, gas, and geothermal personal property in California. It provides instructions on how to fill out and submit the Form BOE-566-J.

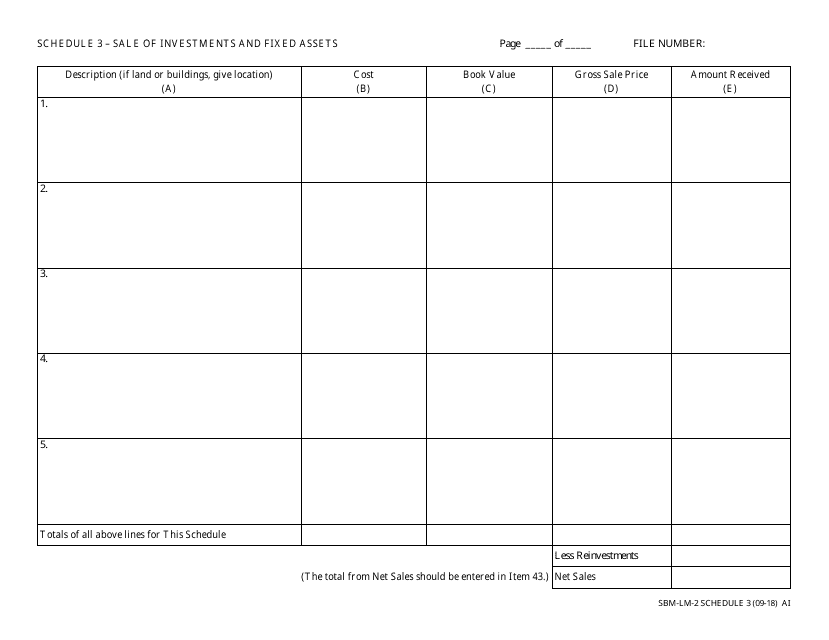

This Form is used for reporting the sale of investments and fixed assets in the state of Missouri.

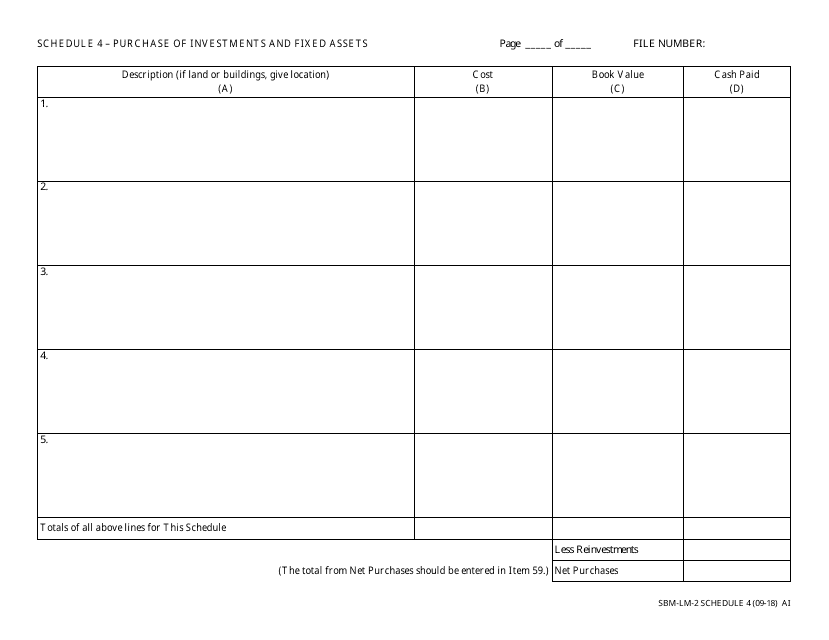

This form is used for reporting the purchase of investments and fixed assets in the state of Minnesota.

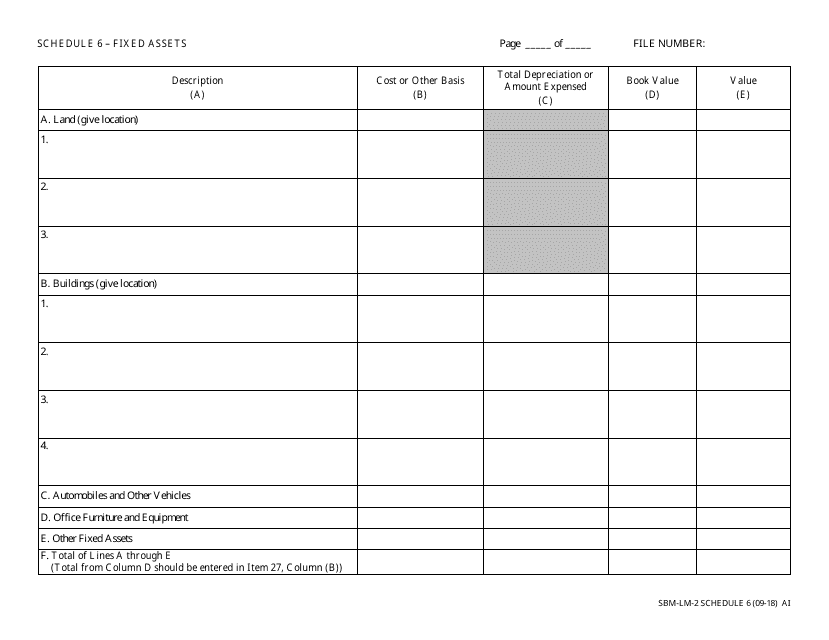

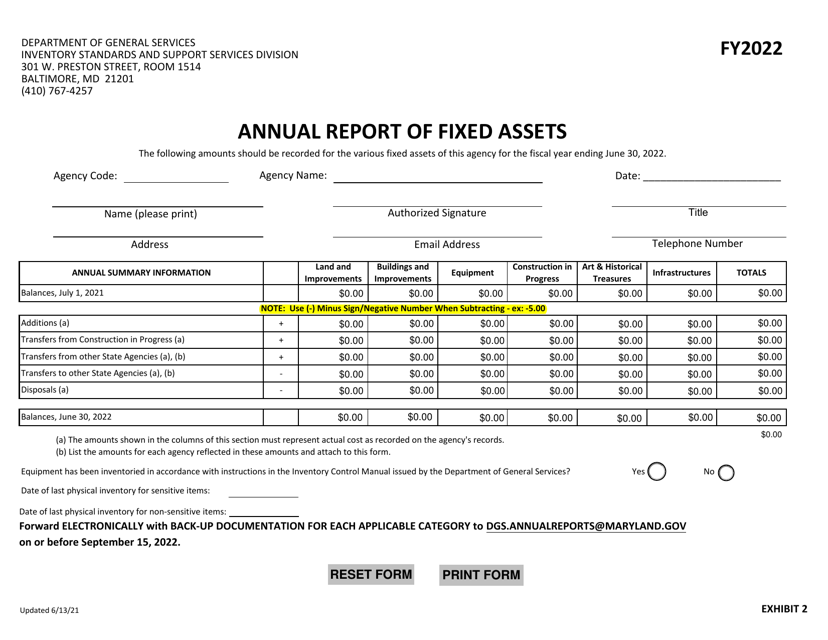

This document is used for reporting fixed assets in the state of Missouri.

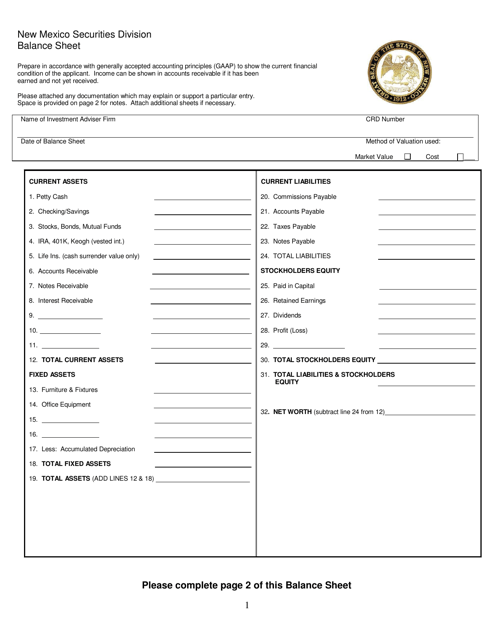

This document provides a snapshot of the financial position of a company or organization in the state of New Mexico. It includes information about their assets, liabilities, and equity.

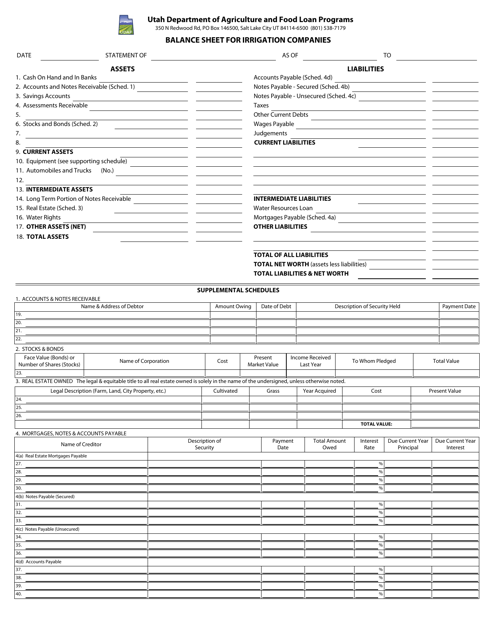

This document provides a detailed overview of the financial position and performance of irrigation companies in Utah. It showcases assets, liabilities, and shareholders' equity, giving valuable insights into the company's financial health.

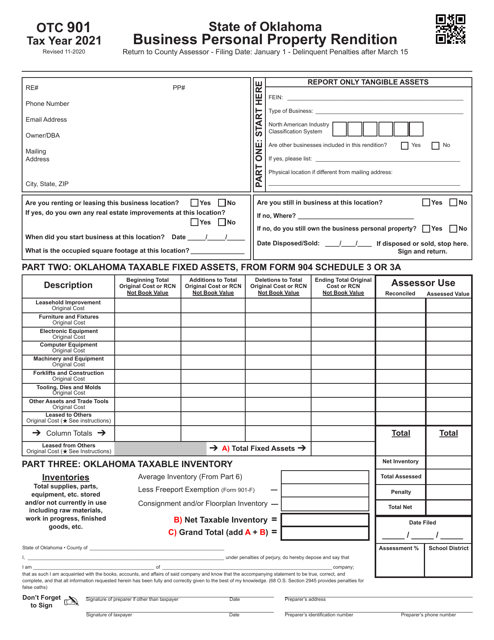

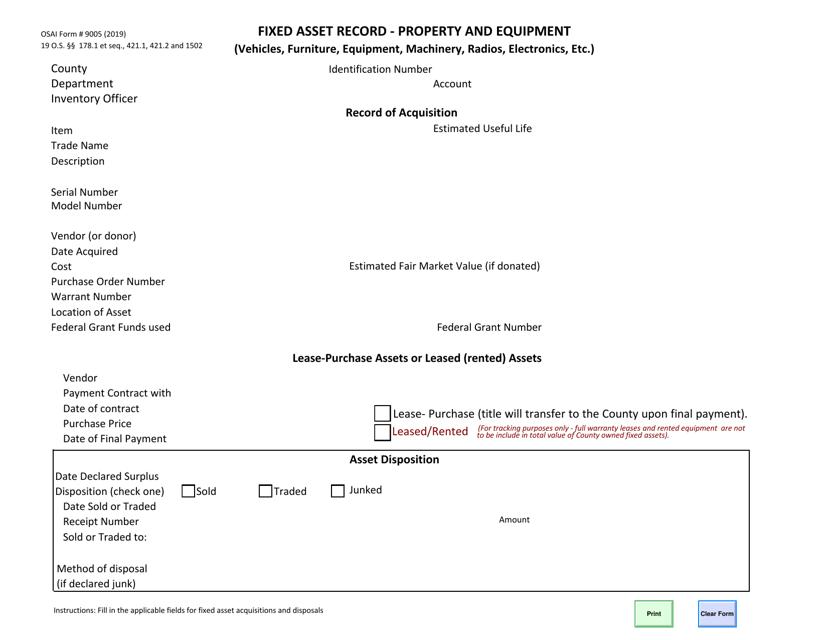

This Form is used for keeping records of fixed assets such as property and equipment in the state of Oklahoma.

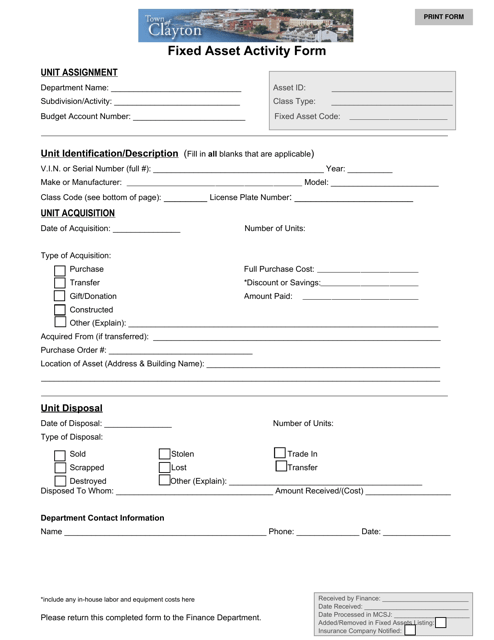

This document is used to record and track the activity related to fixed assets in the Town of Clayton, New York. It helps the town keep a record of the movement, maintenance, and disposal of their fixed assets.

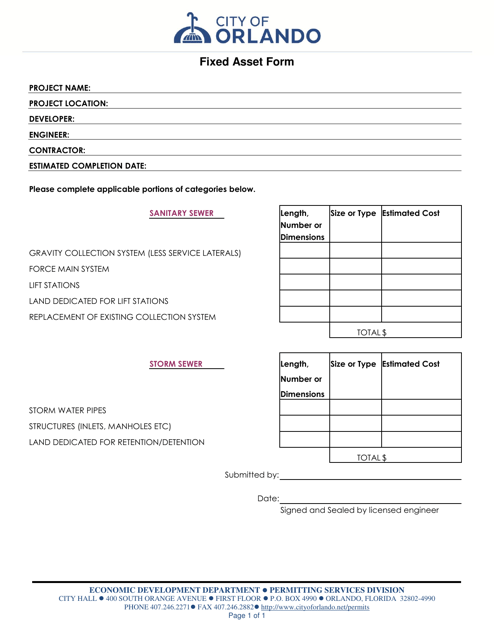

This Form is used to track and manage fixed assets owned by the City of Orlando, Florida.

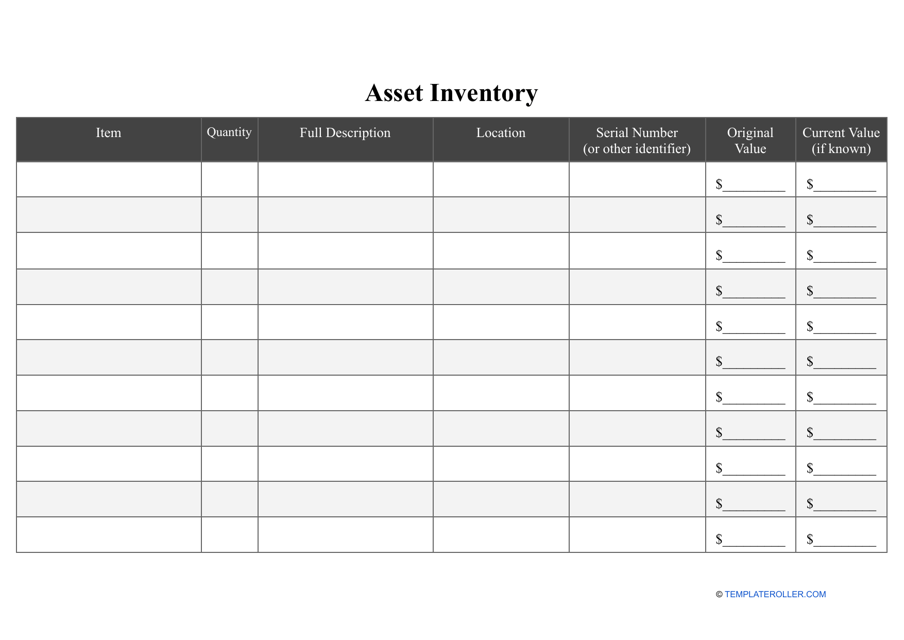

This type of template can be used by a company to name and describe the assets it has.

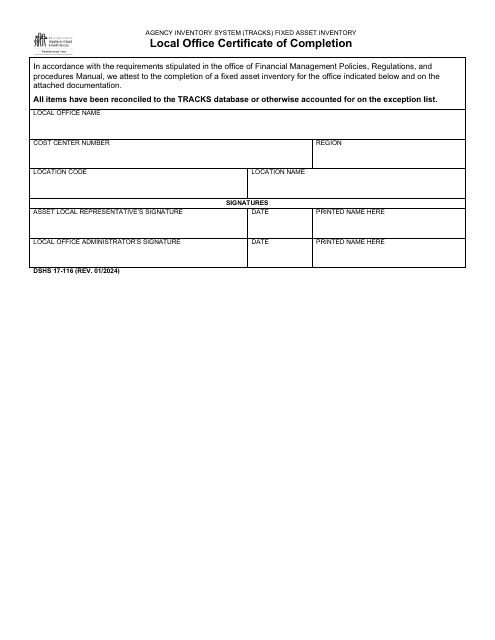

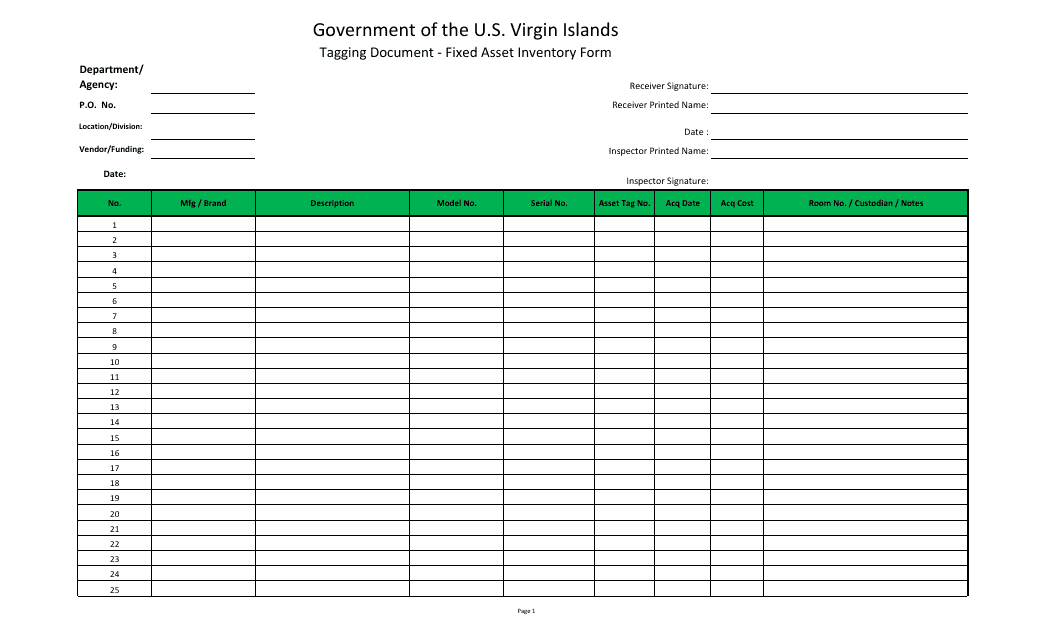

This Form is used for keeping track of fixed assets in the Virgin Islands. It helps organizations effectively manage their inventory of assets and ensure accurate financial reporting.

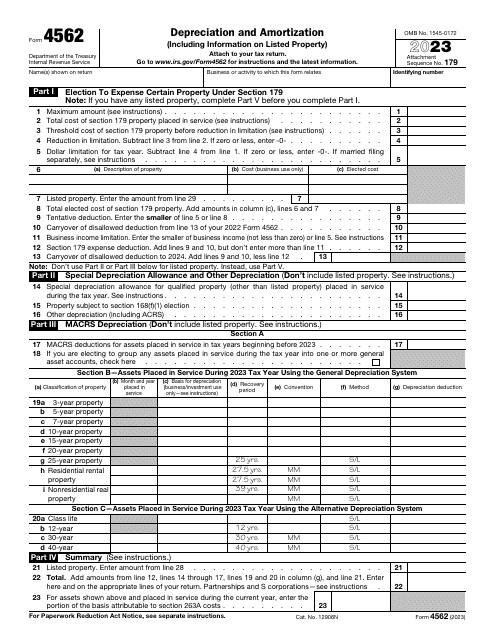

This is a formal document prepared by business owners whose intention is to ask for tax deductions due to depreciation of assets they used to carry out business operations and amortization of this property.