IRS Letter Templates and Samples

What Is an IRS Letter?

An IRS Letter is a formal document issued by the Internal Revenue Service (IRS) to notify the taxpayer about issues or concerns regarding the latest tax documentation submitted, approve the retirement plan, or provide the taxpayer with the information requested by third parties before the contract is signed or the benefits are granted. If you receive a letter from the IRS, it does not necessarily mean negative consequences for you, your family, or your business - the tax authorities may need to verify your identity if you submitted a different address, notify you about the delay in processing your tax return, or tell you that you are eligible for a tax refund. Once a letter was delivered to you via certified mail, do not ignore it - carefully read the document and, if needed, respond to the IRS by a specific date stated in the letter.

If you are looking for samples and Letters from the IRS, you can check out our library below. Keep all correspondence you get with your tax records for several years - these files may come in handy during the audit.

IRS Letter Types

The IRS Letters below are among the most common IRS statements - the IRS can send them to you after you request documentation online or by mail or initiate the contact to learn more about your taxes. You may learn more about these documents and prepare to communicate with tax authorities.

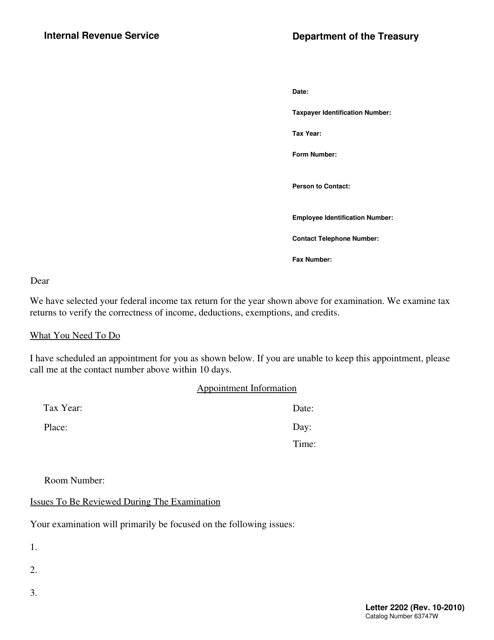

- IRS Audit Letter. This document serves as notification of the upcoming audit - any taxpayer may receive a letter with the requirement to share additional information about their income, credit eligibility, and deductions either by mail or via a personal interview with the IRS representative.

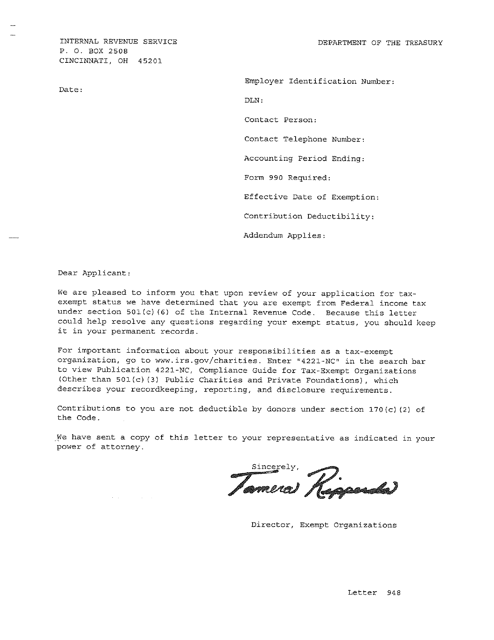

- IRS Determination Letter. Used to confirm the qualification of the employee benefit plan for special tax conditions, this letter will be available to any organization that requests it from the IRS. While the decision might be reversed, the tax authorities still warn the employer and employee about their views on the proposed pension plan or savings plan before it comes into force.

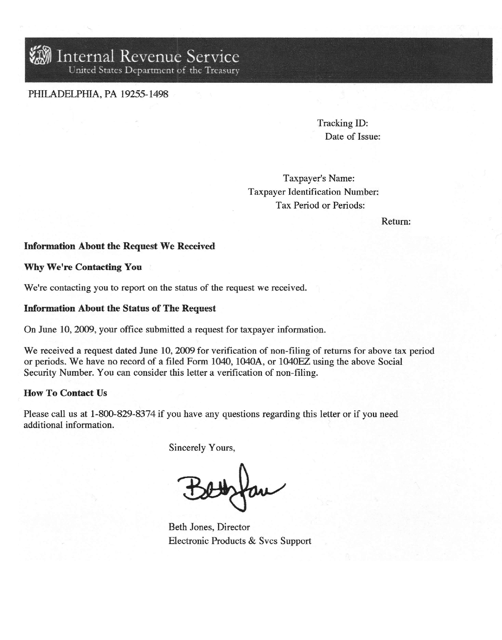

- IRS Non-Filing Letter. You might need to furnish verification of non-filing to receive educational assistance benefits or some other financial help - ask the IRS to send you tax records that demonstrate you did not file any tax returns for a specific year.

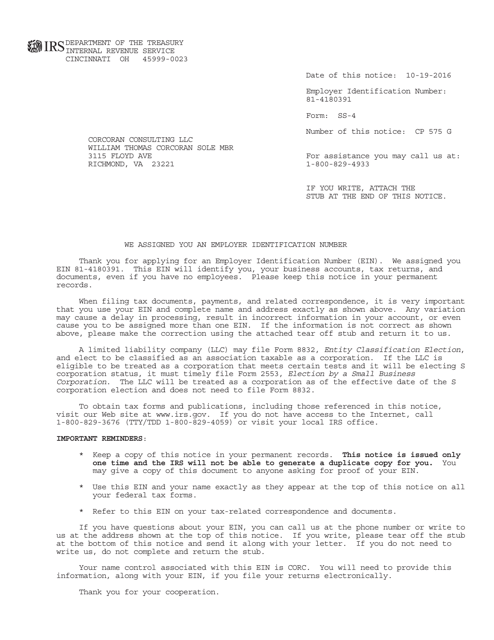

- IRS EIN Confirmation Letter. Any company may be asked by their existing and potential business partners or financial institutions to provide an official document that contains the employer identification number assigned to the organization - this number is typically required to enter into deals safely and with assurance.

Not what you need? Check out these related letter topics:

Documents:

4

This letter contains and verifies information about a company's Employer Identification Number (EIN).

Obtain this letter from the IRS in order to be recognized as a nonprofit organization that offers employees company-sponsored retirement, medical, vacation, or other benefit plans.

The IRS can initiate a review of the information you submit via your tax return by sending you an IRS Audit Letter in the mail.

This document confirms that the taxpayer did not any of the IRS 1040 forms for the specific year.