Trust Tax Form Templates

Documents:

73

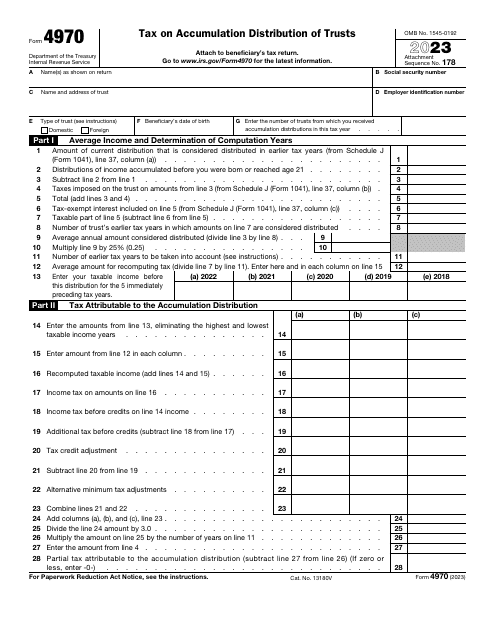

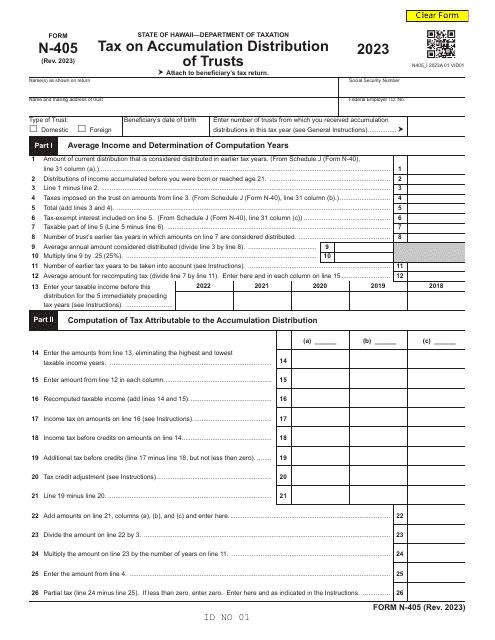

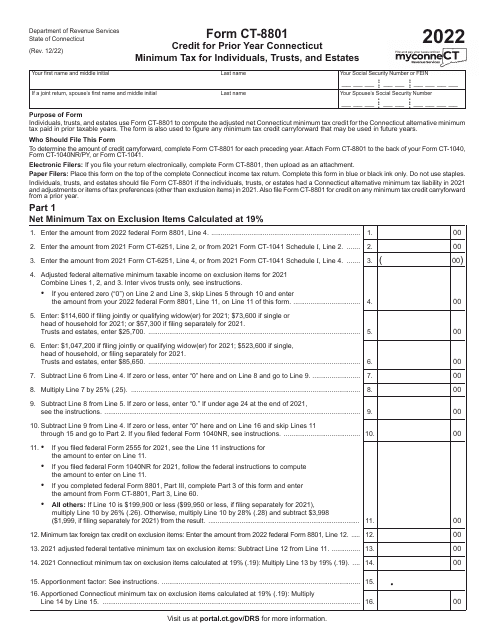

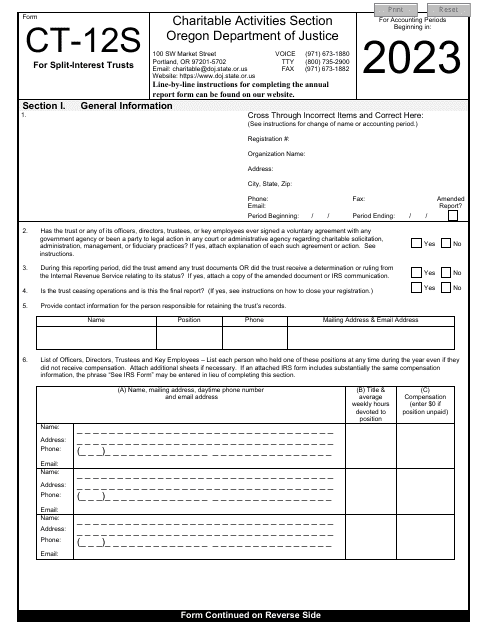

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.

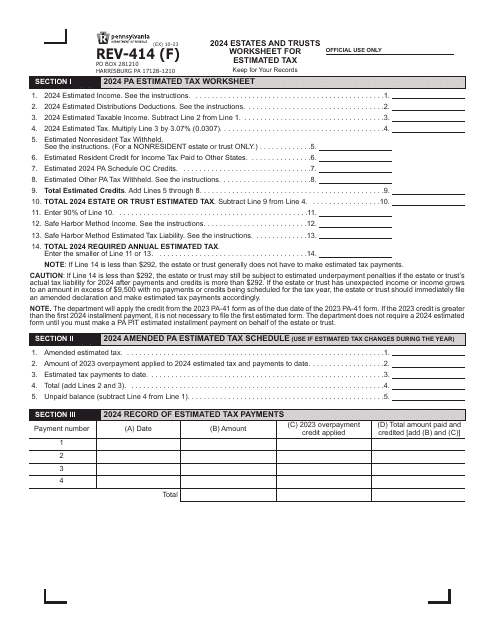

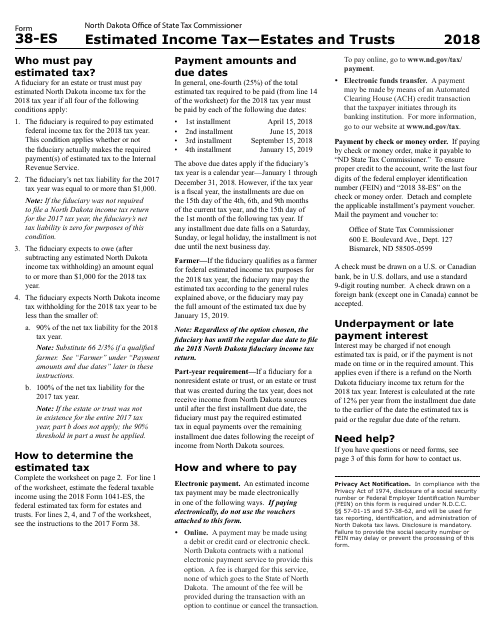

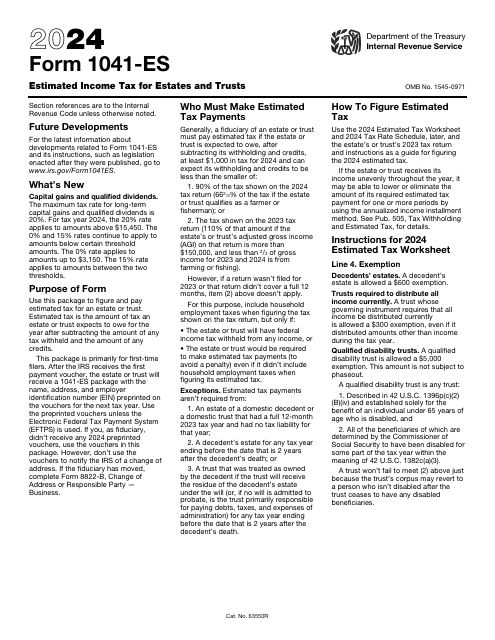

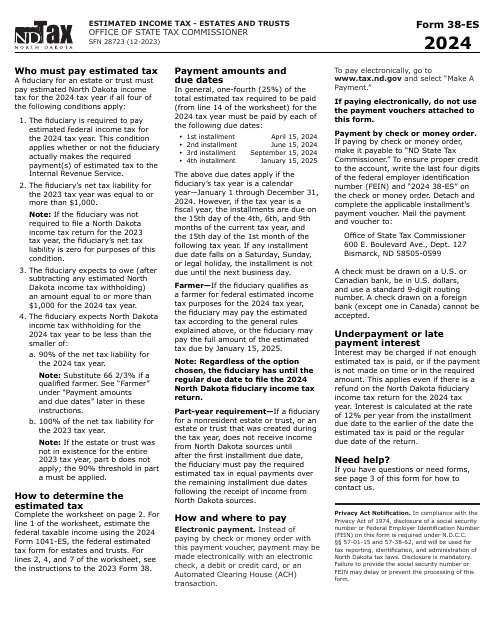

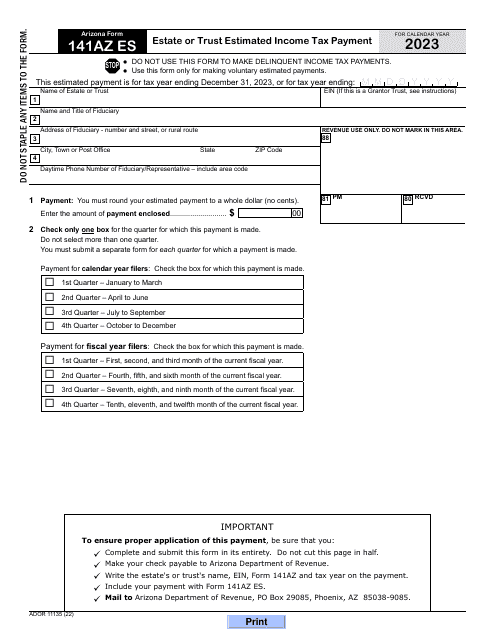

This Form is used for estimating income tax for estates and trusts in North Dakota.

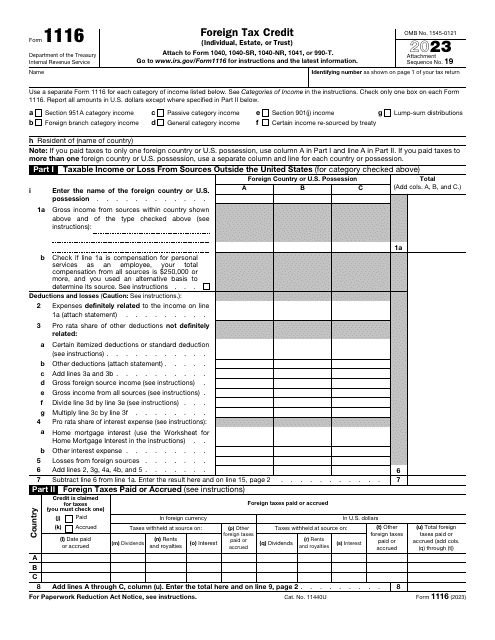

This is a formal document that allows American taxpayers that reside, work, and manage businesses overseas to lower the amount of tax they owe to the U.S. government.

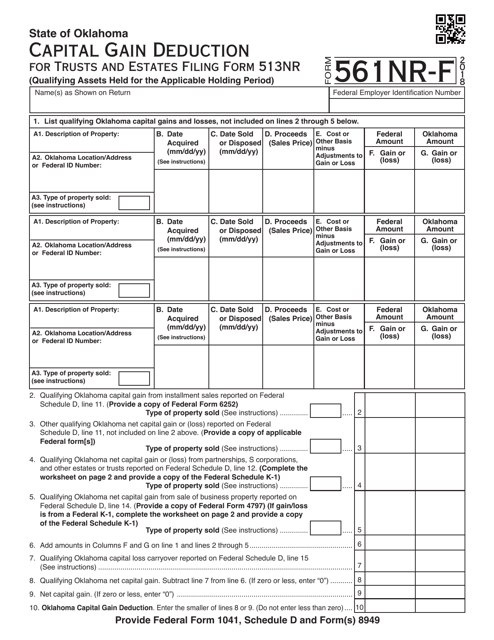

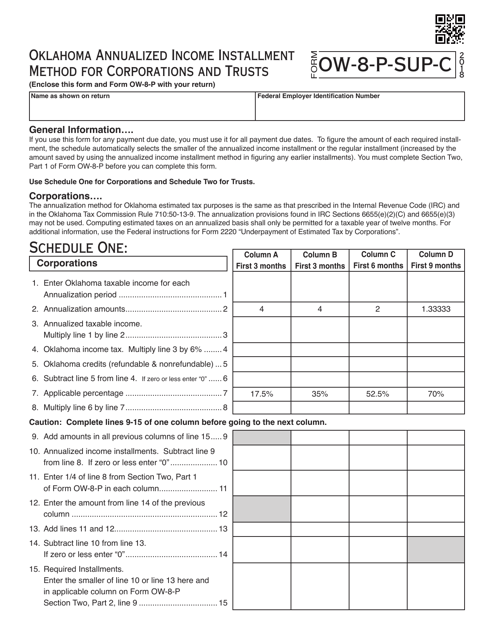

This Form is used for calculating annualized income installment method for corporations and trusts in Oklahoma.

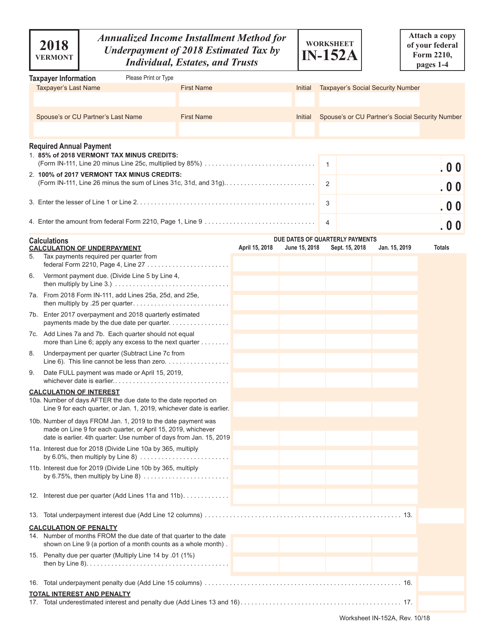

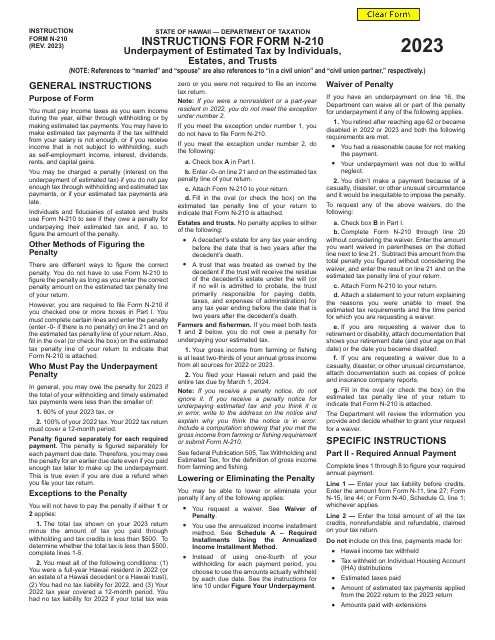

This document is a worksheet that individuals, estates, and trusts in Vermont can use to calculate their annualized income installment for the underpayment of estimated tax for the year 2018. It helps determine if any additional tax needs to be paid to avoid penalties.

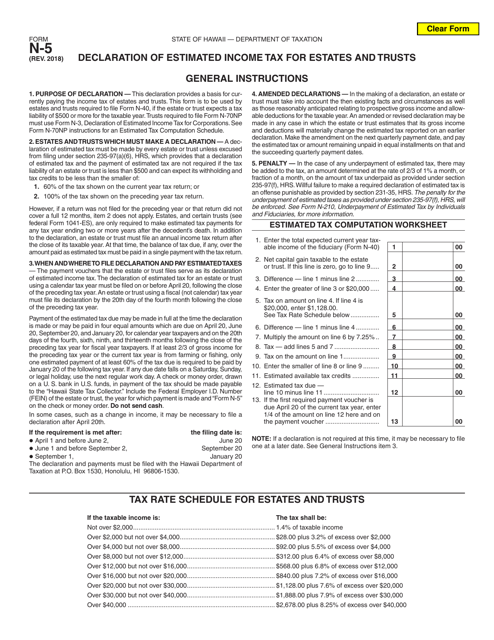

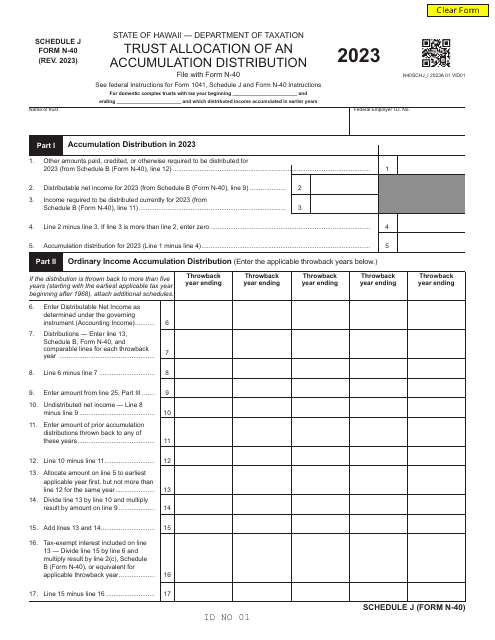

This form is used for estates and trusts in Hawaii to declare their estimated income tax.

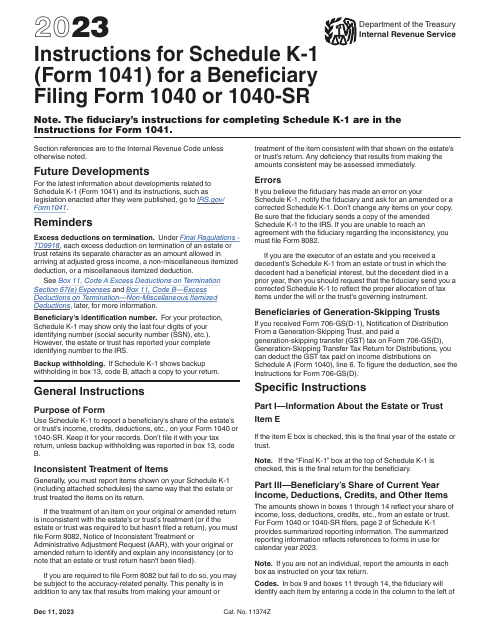

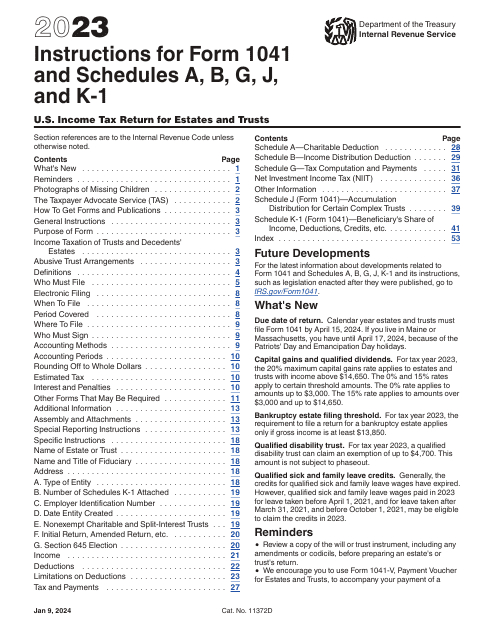

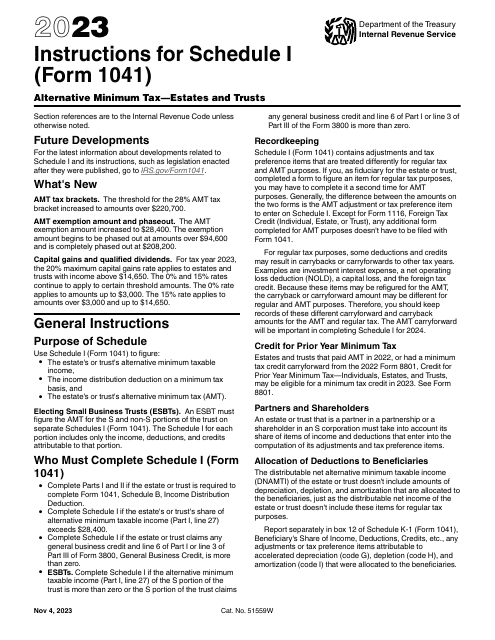

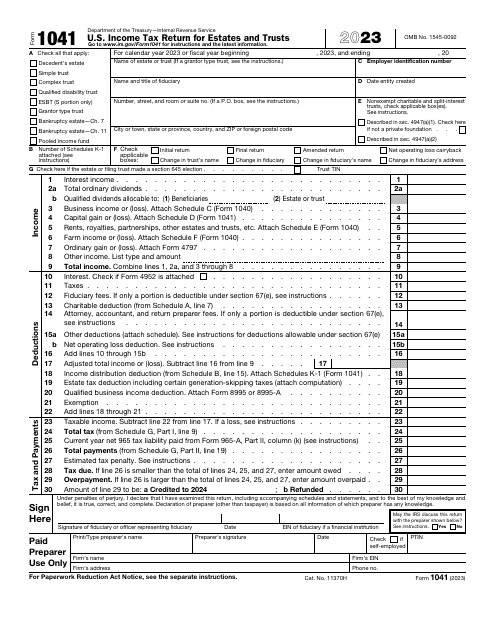

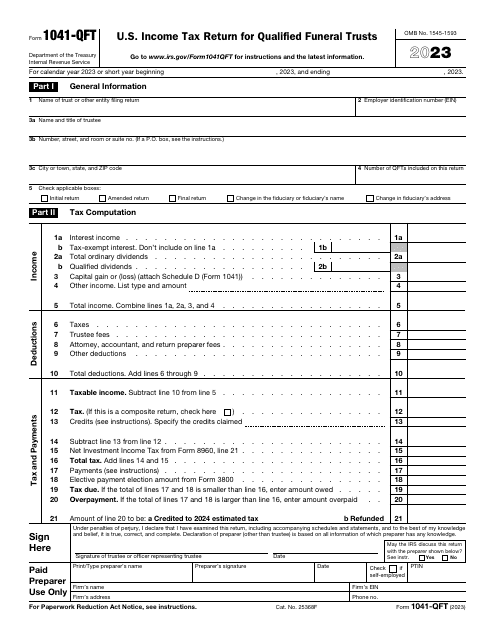

File this document, also known as the Estates and Trusts Tax Return, as an income tax return to the Internal Revenue Service (IRS) if you are a fiduciary of a bankruptcy estate, domestic decedent's estate, or a trust.

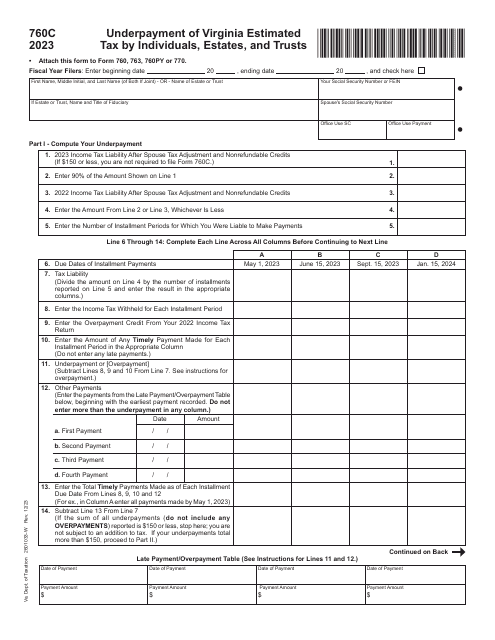

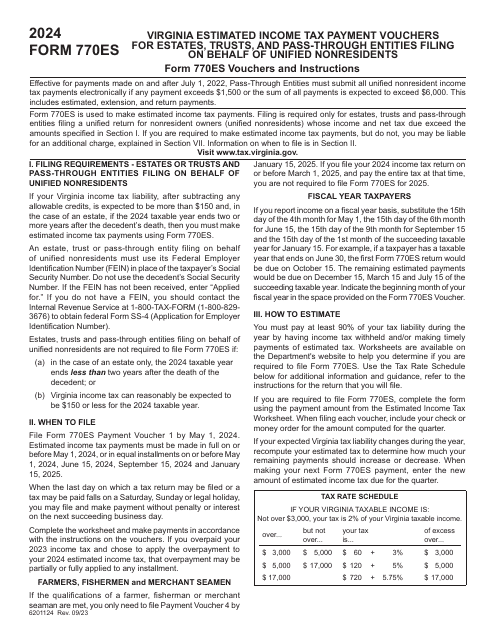

Form 760C Underpayment of Virginia Estimated Tax by Individuals, Estates and Trusts - Virginia, 2023

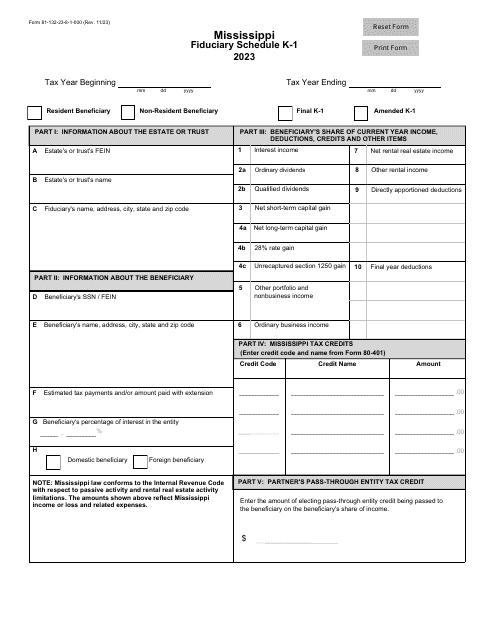

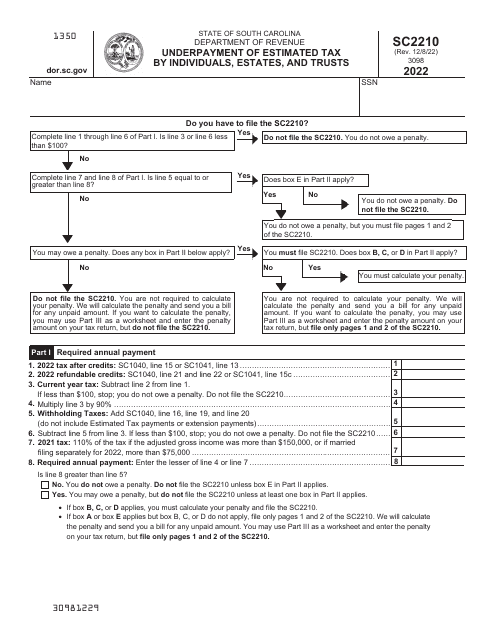

Form SC2210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts - South Carolina, 2022

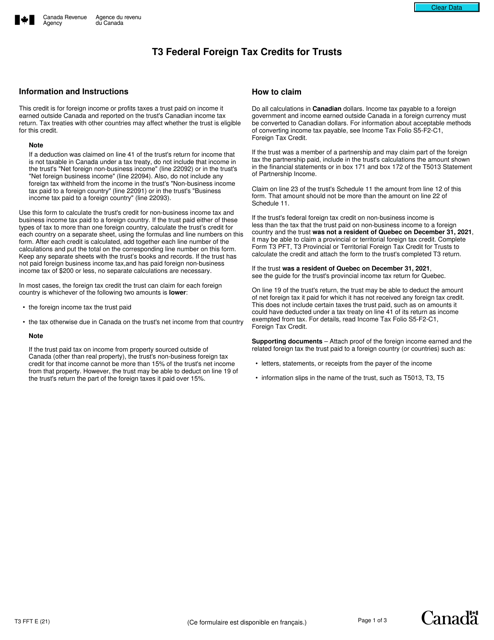

This form is used for reporting foreign tax credits for trusts in Canada. It helps trustees claim credits for taxes paid to foreign countries.

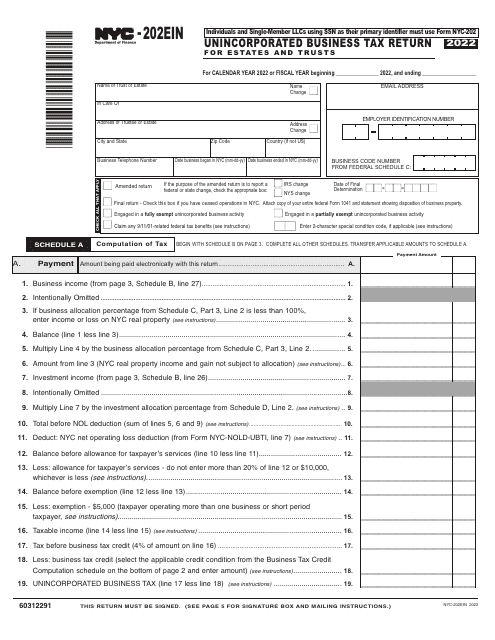

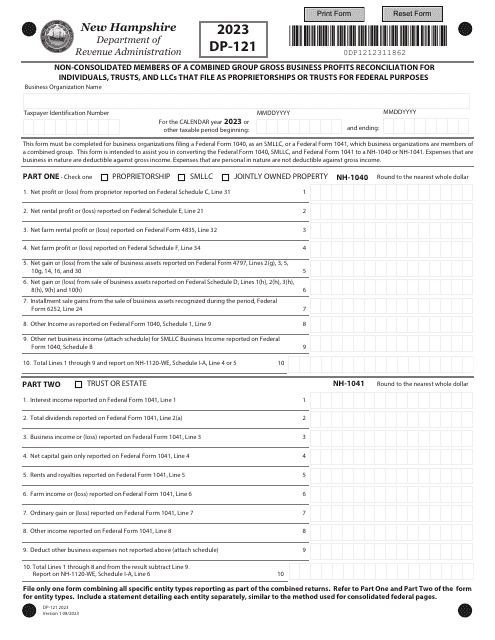

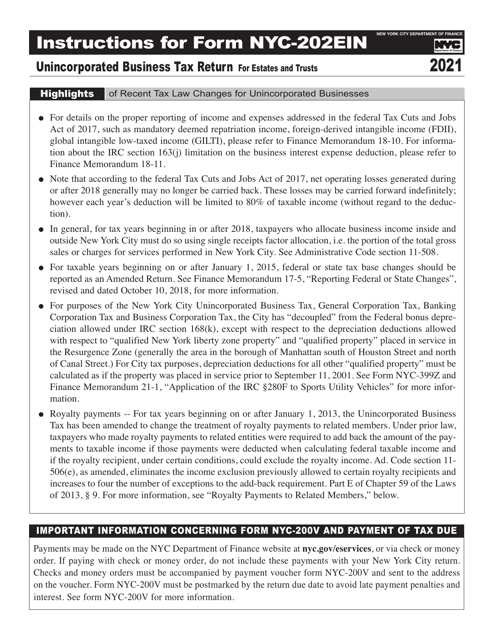

This Form is used for filing the Unincorporated Business Tax Return for Estates and Trusts in New York City. It provides instructions and guidelines for completing the form accurately.

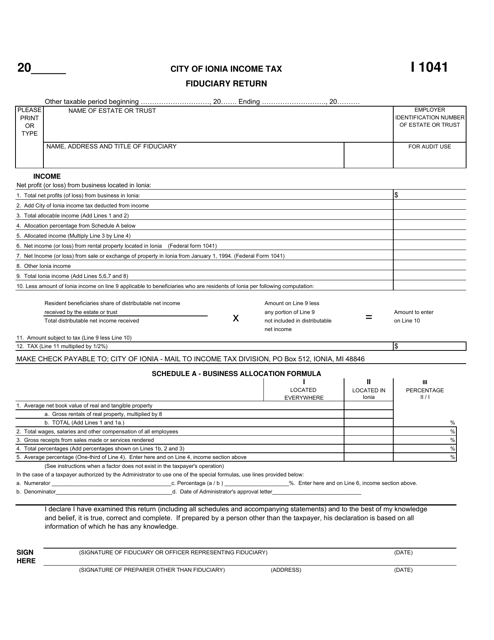

This form is used for filing the Fiduciary Return for the City of Ionia, Michigan. It is specifically for individuals who are acting as fiduciaries for an estate or trust in the city of Ionia, Michigan.