Fuel Tax Form Templates

Documents:

319

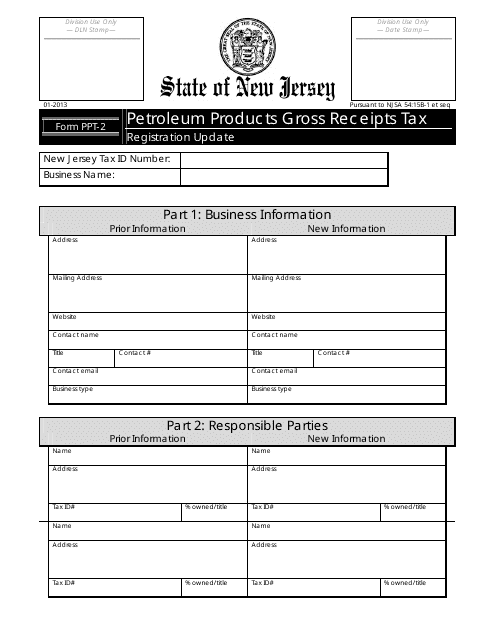

This form is used for updating the registration information for the Petroleum Products Gross Receipts Tax in New Jersey.

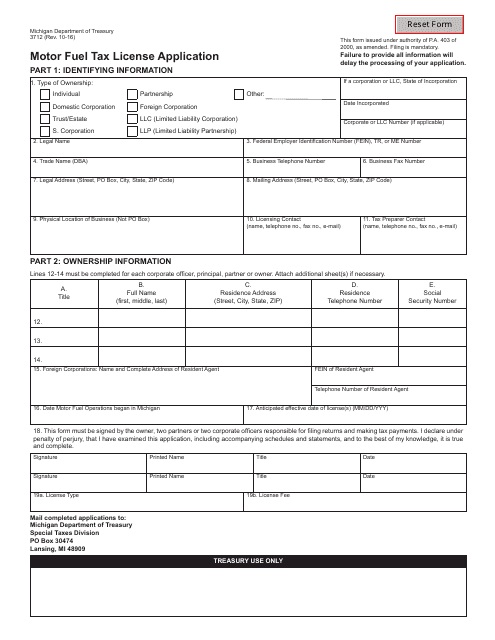

This form is used for applying for a Motor Fuel Tax License in the state of Michigan.

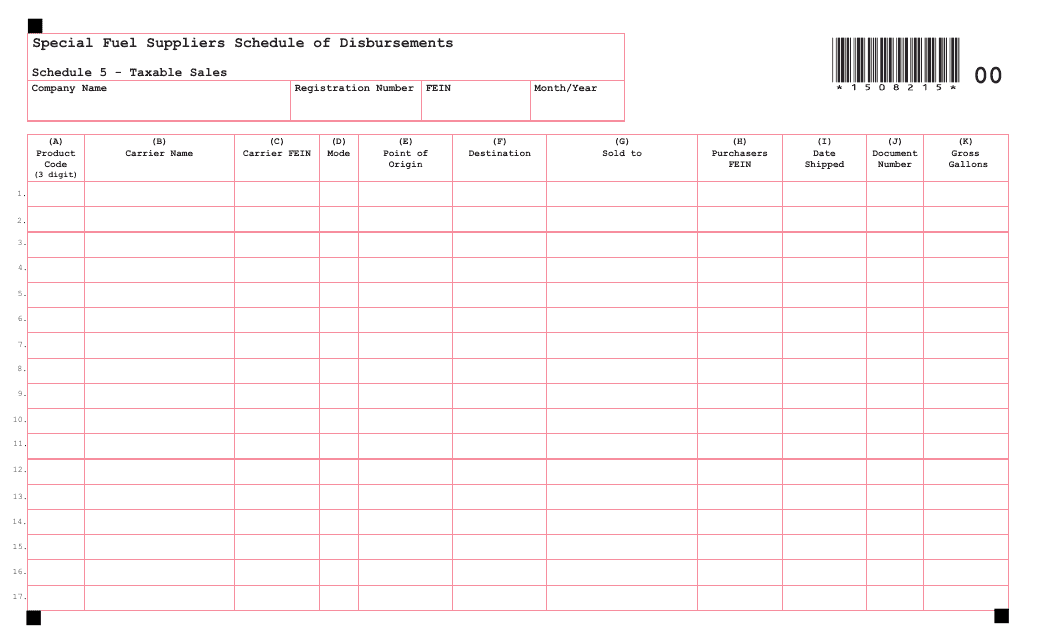

This document provides a schedule of disbursements for taxable sales of special fuel suppliers in the state of Maine.

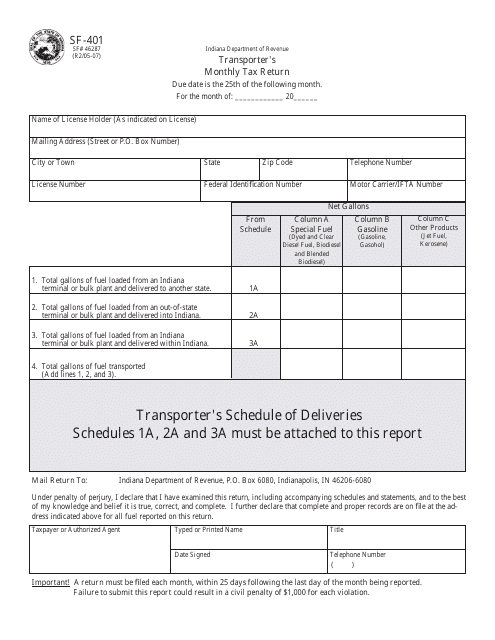

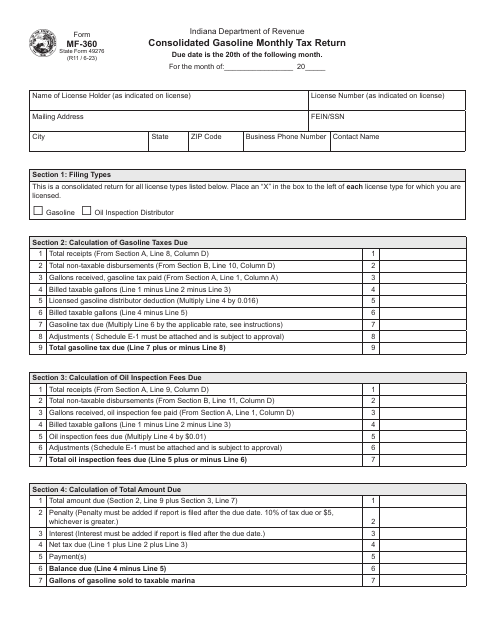

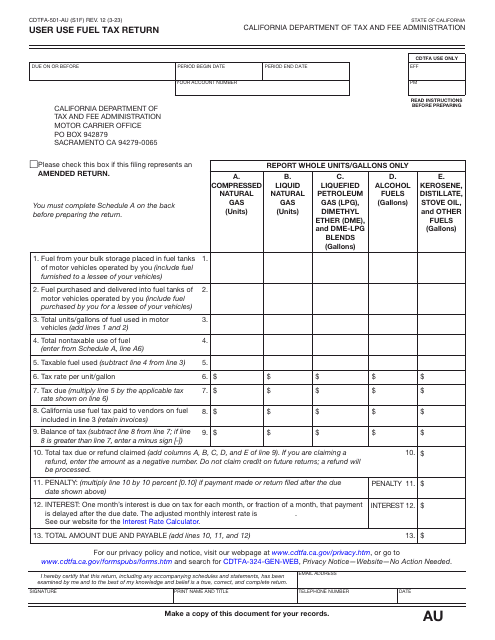

This document is used for reporting and submitting monthly taxes for transporters in the state of Indiana.

This document is used for monthly tax calculation for motor fuel tankwagon importers in Oklahoma

This document is used for calculating the fuel blender tax in Oklahoma.

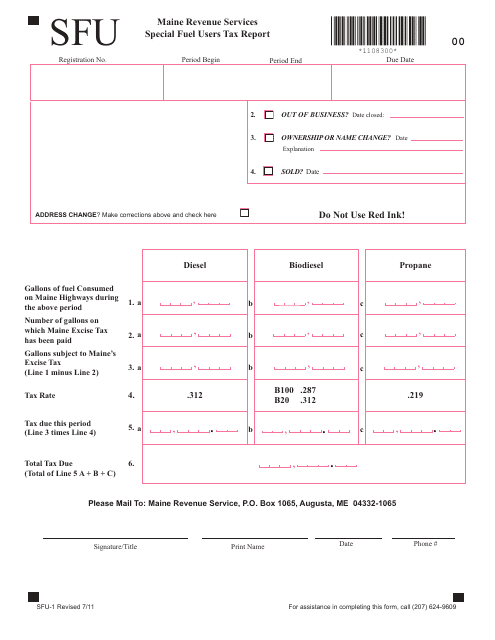

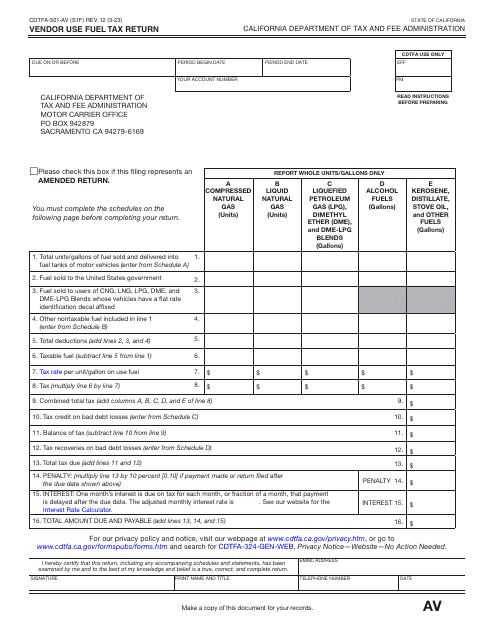

This form is used for reporting taxes on special fuel usage in the state of Maine. It is mandatory for businesses and individuals who use special fuel for their operations to file this report.

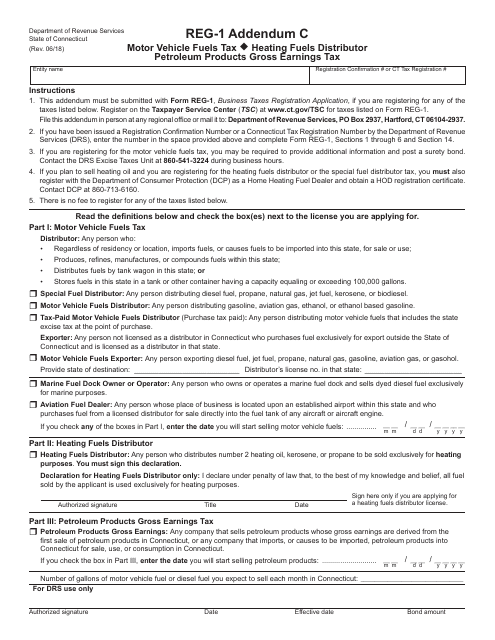

This type of document is an addendum form for reporting motor vehicle fuels tax, heating fuels distributor tax, and petroleum products gross earnings tax in Connecticut.

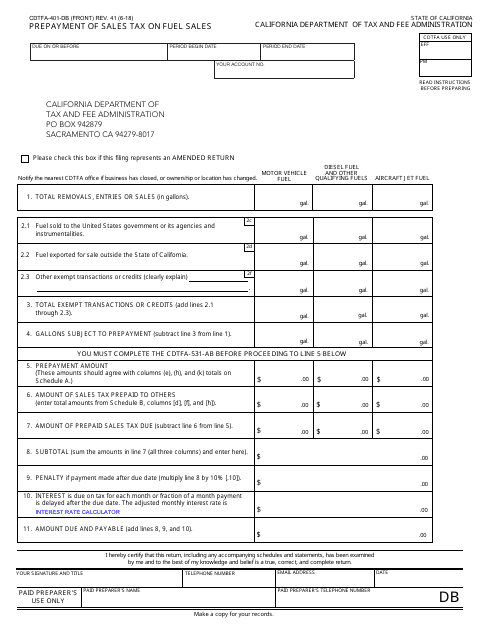

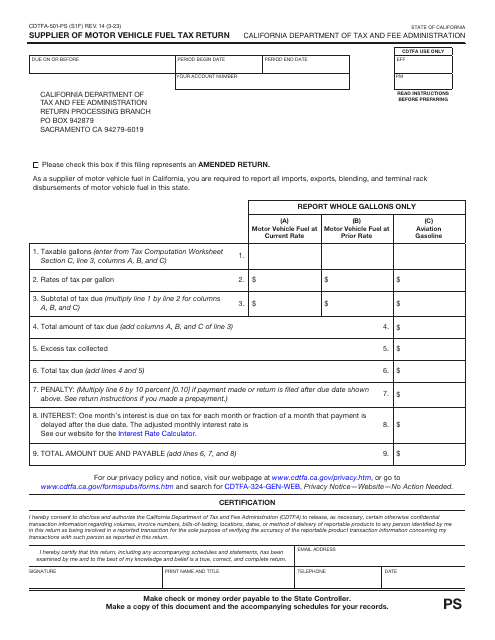

This document is for prepaying sales tax on fuel sales in California. It is used by businesses to submit their prepayment to the California Department of Tax and Fee Administration (CDTFA).

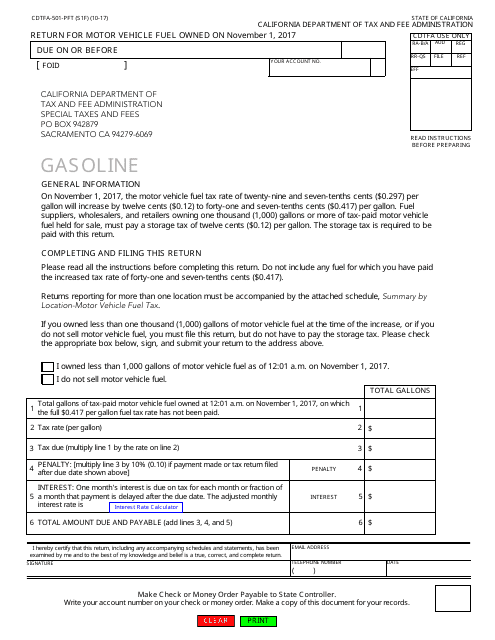

This Form is used for reporting and paying taxes on motor vehicle fuel owned in California on November 1, 2017. It is necessary for compliance with state tax laws.

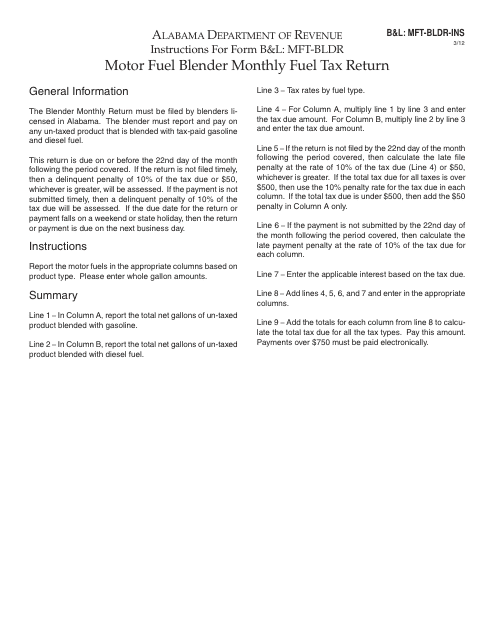

This form is used for submitting the Motor Fuel Blender Monthly Fuel Tax Return in Alabama.

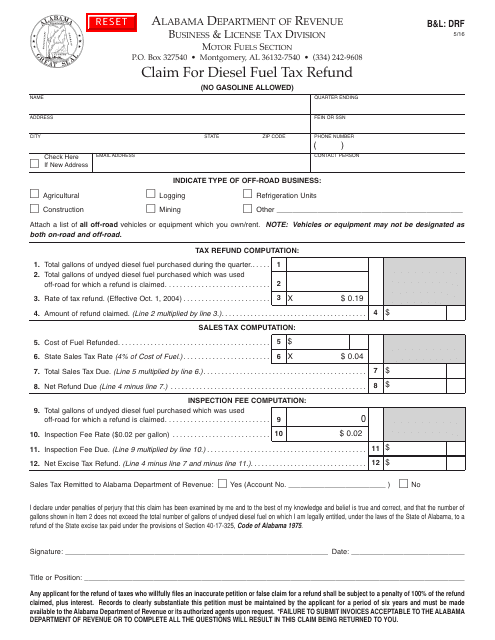

This Form is used for claiming a refund on diesel fuel tax paid in Alabama.

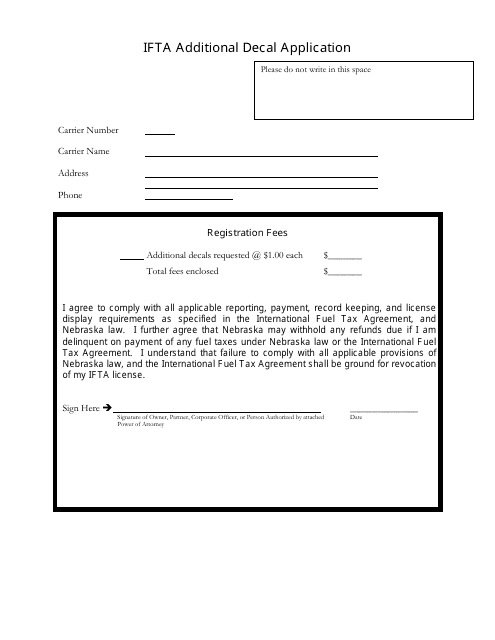

This document is used for applying for an additional IFTA decal in the state of Nebraska.

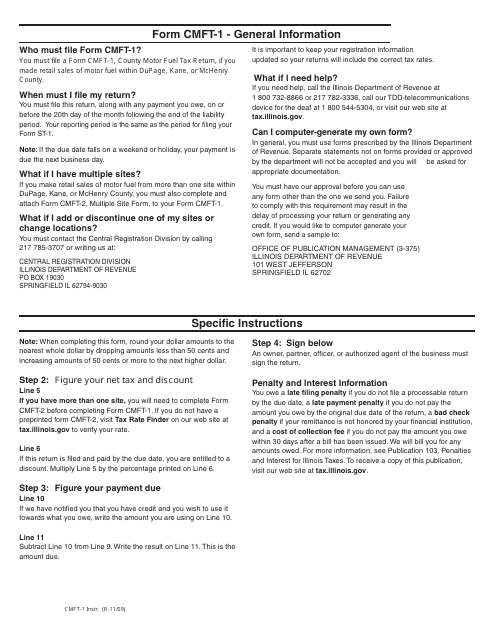

This document provides instructions for completing the CMFT-1 County Motor Fuel Tax Return in Illinois. It guides taxpayers on how to accurately report their motor fuel taxes and provides step-by-step instructions on filling out the form.

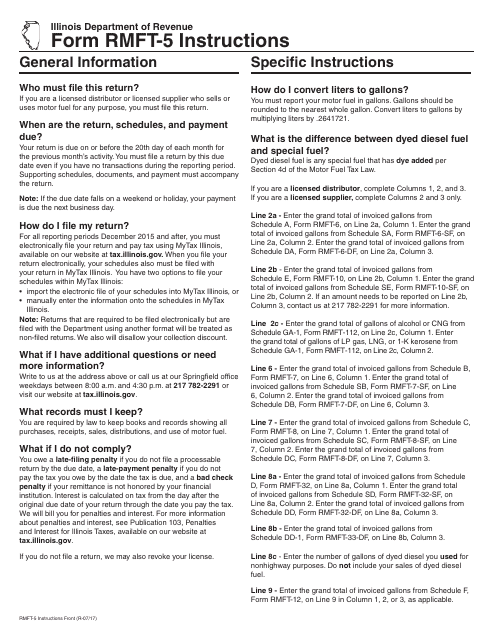

This Form is used for filing motor fuel distributor/supplier tax return in Illinois. It provides instructions on how to complete and submit the RMFT-5 form.

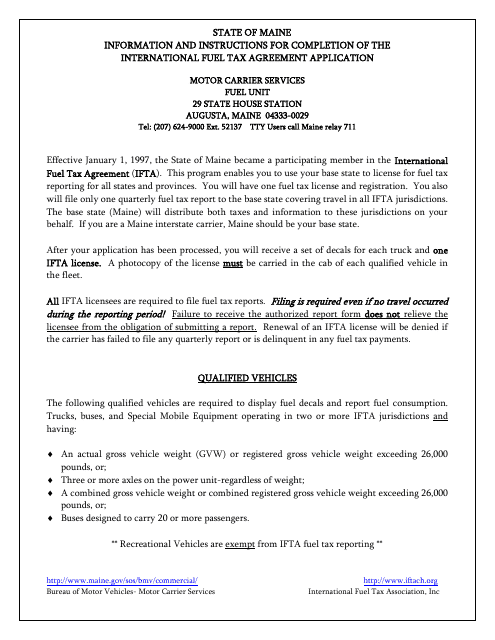

This Form is used for applying for the International Fuel Tax Agreement in the state of Maine. It provides instructions on how to complete the form accurately.

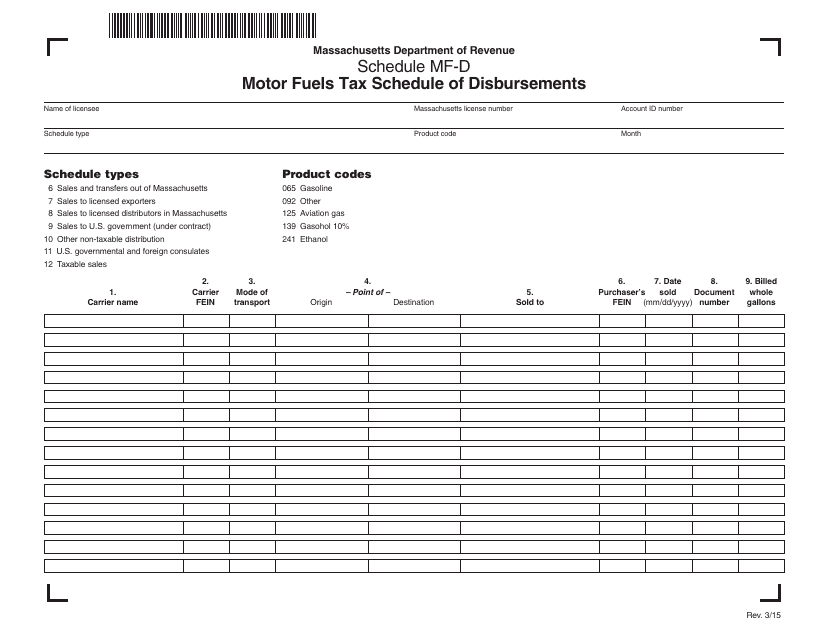

This type of document is used to report the disbursements of motor fuels tax in Massachusetts.

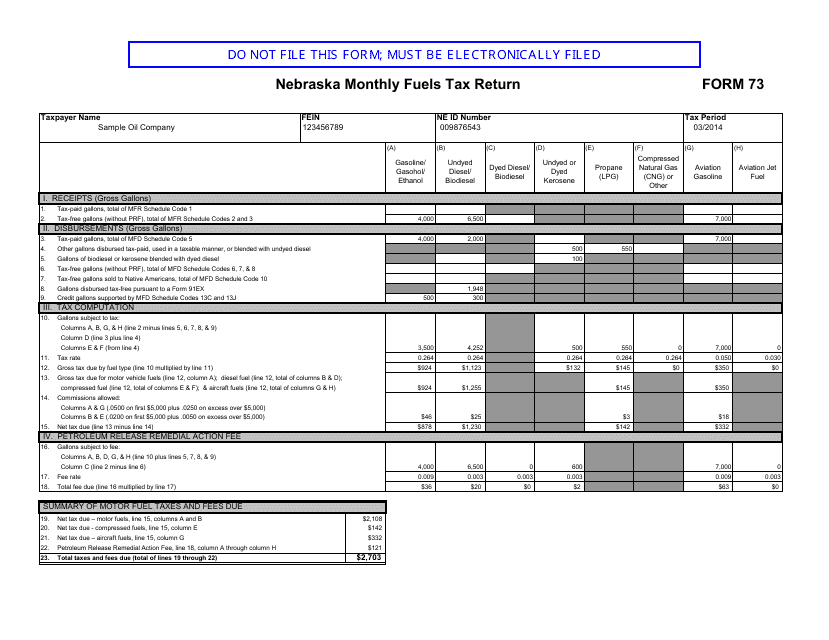

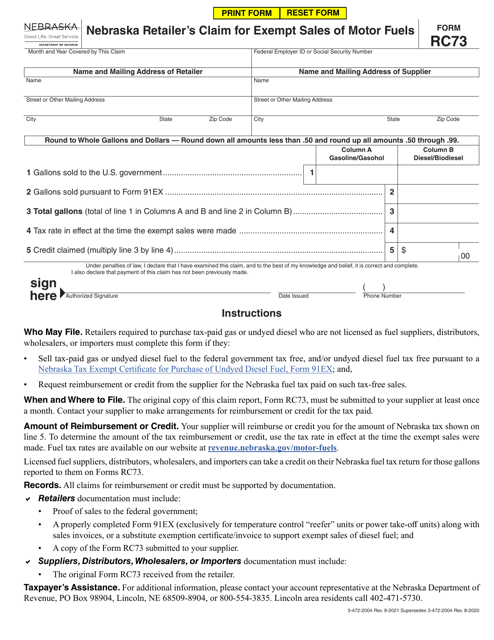

This Form is used for reporting and paying monthly fuels tax in Nebraska. It is required for businesses involved in the sale or distribution of motor fuels.

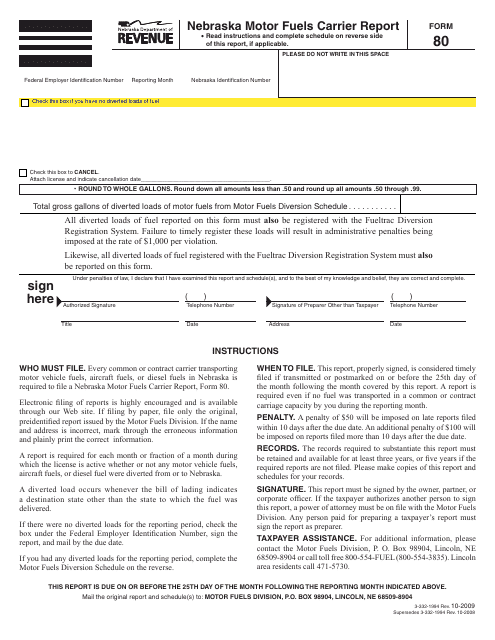

This Form is used for Nebraska motor fuels carriers to report their activities. It is required by the state to track fuel usage and compliance with regulations.

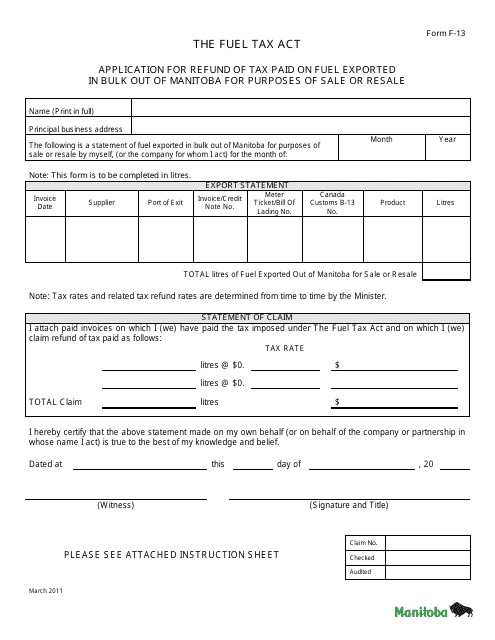

This Form is used for applying for a refund of tax paid on fuel that was exported in bulk out of Manitoba for purposes of sale or resale.

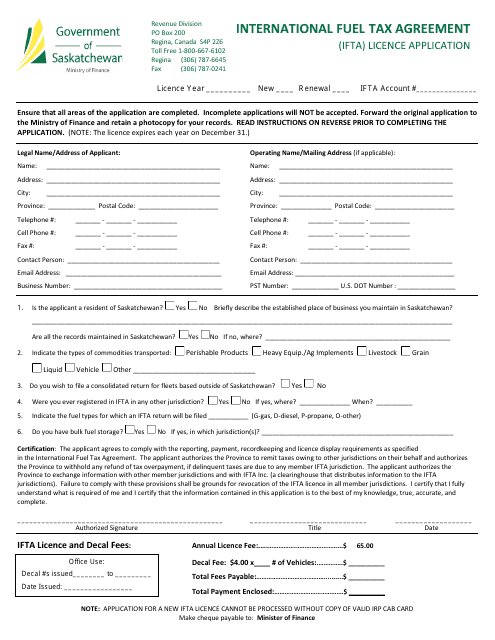

This document is used for applying for an International Fuel Tax Agreement (IFTA) license in Saskatchewan, Canada.

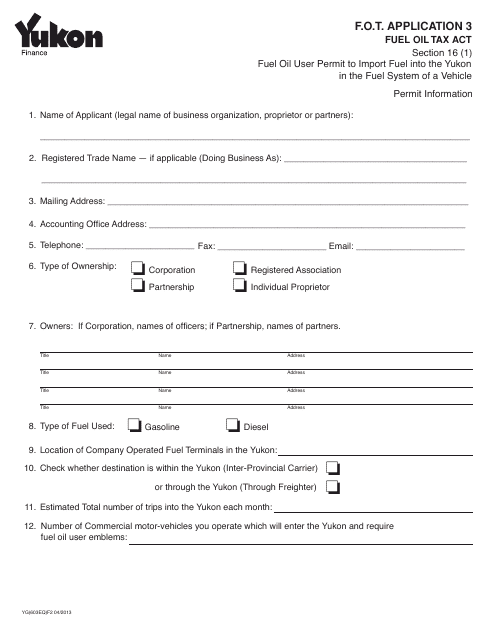

This form is used for applying for fuel oil tax in Yukon, Canada.

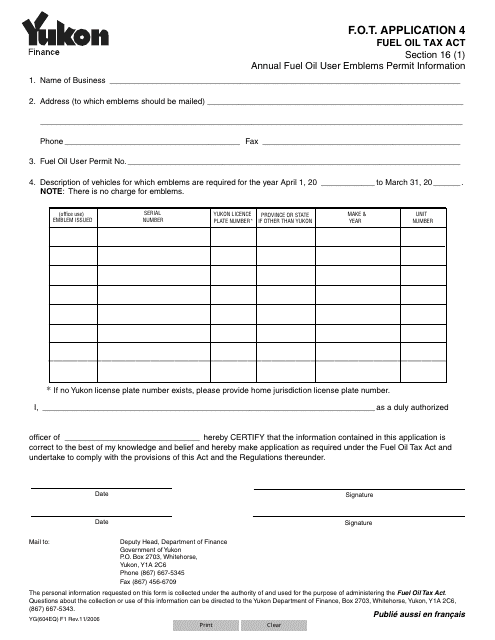

This Form is used for applying for fuel oil tax in the Yukon, Canada.