Fill and Sign Maryland Legal Forms

Documents:

3176

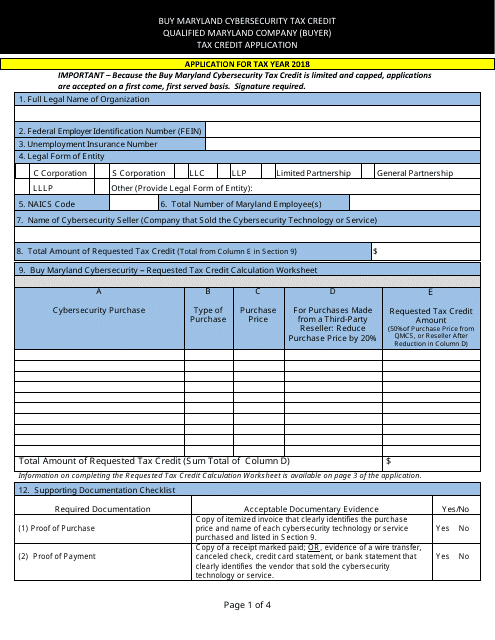

This form is used for applying for a tax credit as a qualified Maryland company buyer.

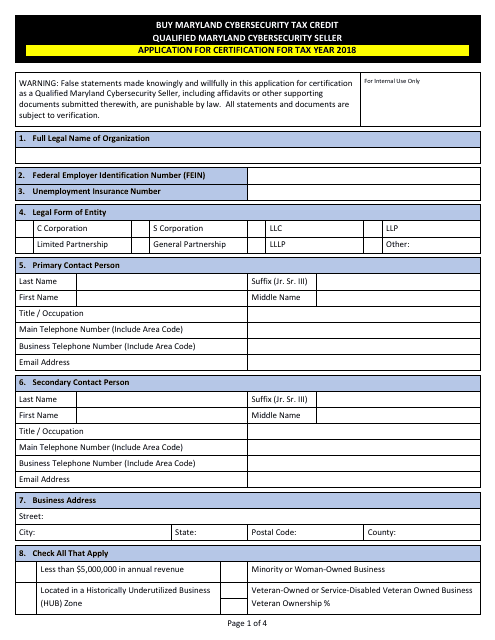

This Form is used for applying to become a certified cybersecurity seller in Maryland.

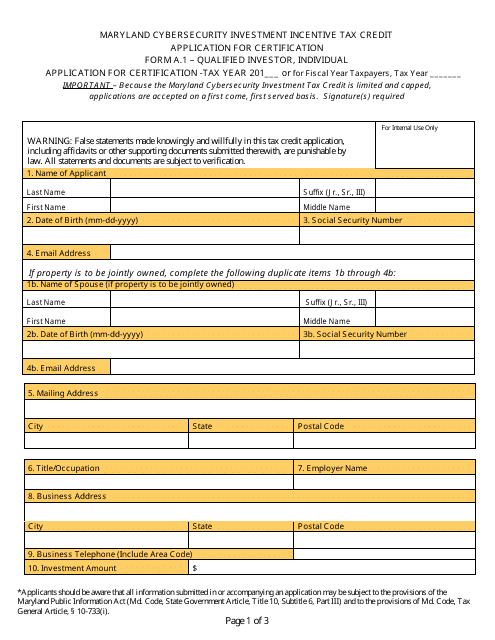

This Form is used for individuals in Maryland to apply for certification as a qualified investor for the Maryland Cybersecurity Investment Incentive Tax Credit.

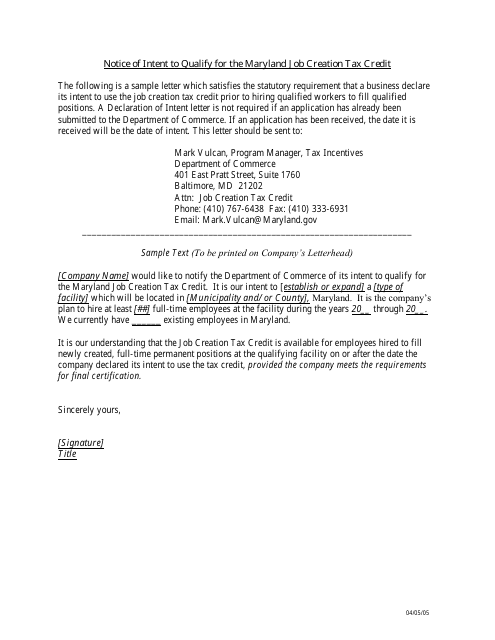

This document is used to notify the state of Maryland of your intent to qualify for the Job Creation Tax Credit.

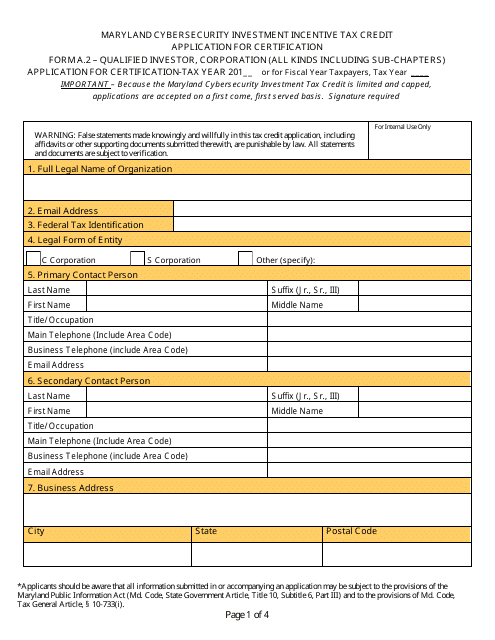

This Form is used for applying for certification as a qualified investor corporation in order to receive the Maryland Cybersecurity Investment Incentive Tax Credit.

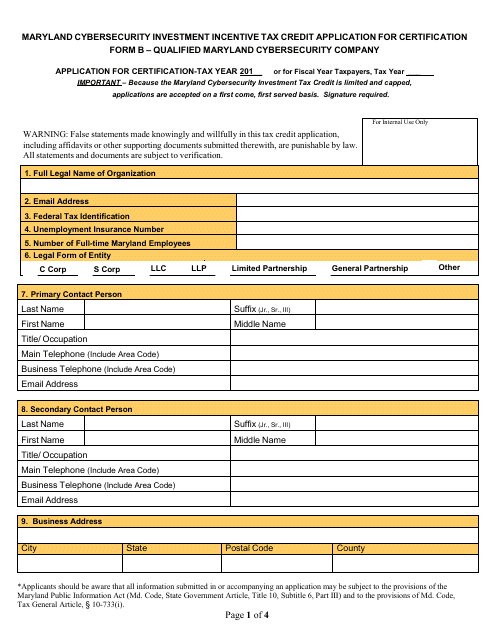

This form is used for applying for certification as a qualified Maryland cybersecurity company in order to be eligible for the Maryland Cybersecurity Investment Incentive Tax Credit.

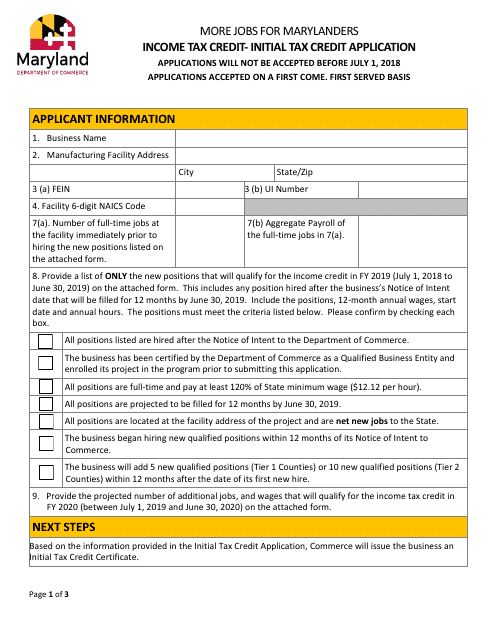

This Form is used for applying for the Initial Tax Credit in Maryland.

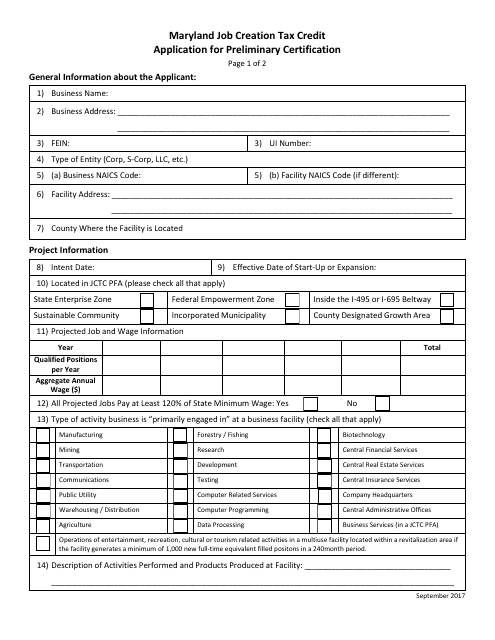

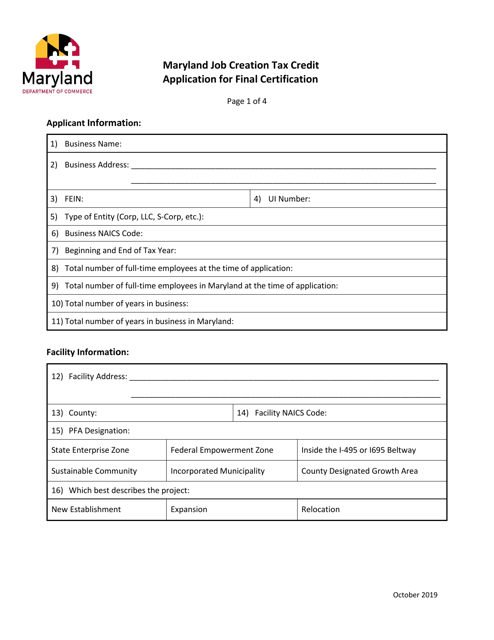

This form is used for applying for preliminary certification for the Maryland Job Creation Tax Credit in Maryland.

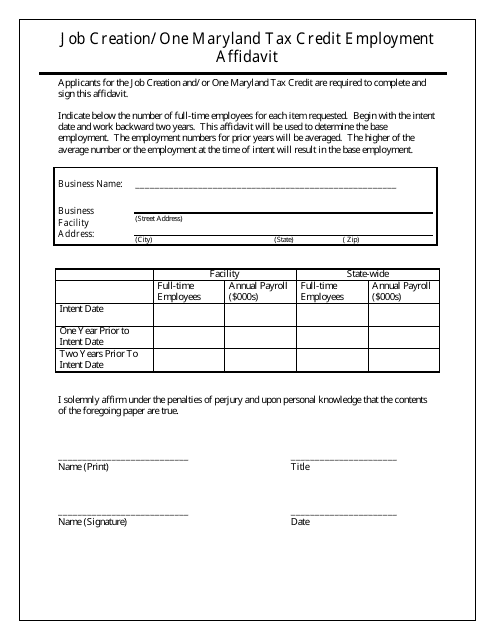

This Form is used for claiming the One Maryland Tax Credit Employment Affidavit, which encourages job creation in Maryland by providing tax credits to businesses that meet certain eligibility criteria.

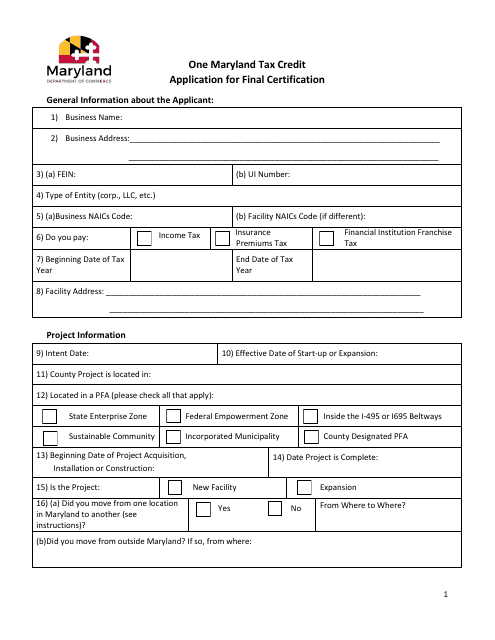

This application is for final certification for the One Maryland Tax Credit in Maryland.

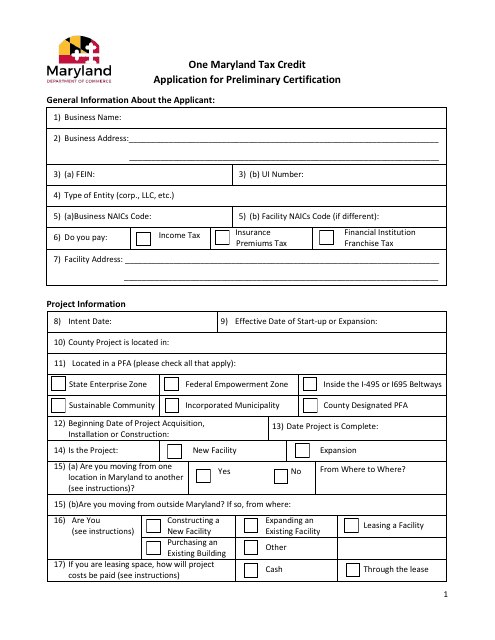

This form is used for applying for preliminary certification for the One Maryland Tax Credit in the state of Maryland. This tax credit is designed to incentivize businesses to create new jobs in certain designated growth areas within the state.

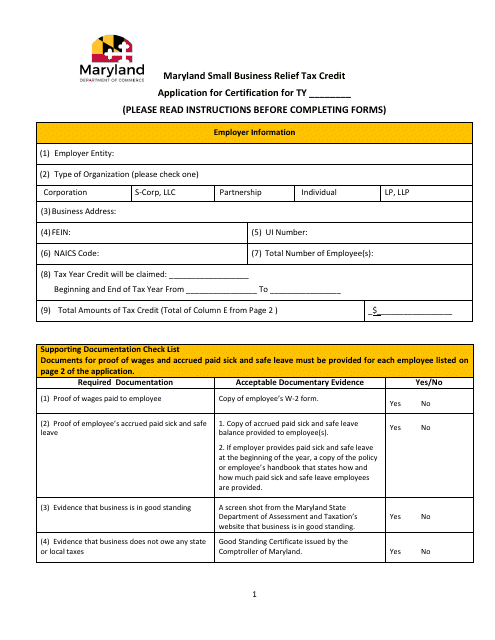

This document is an application for the Maryland Small Business Relief Tax Credit in the state of Maryland. It is used by small businesses to apply for certification and eligibility for the tax credit.

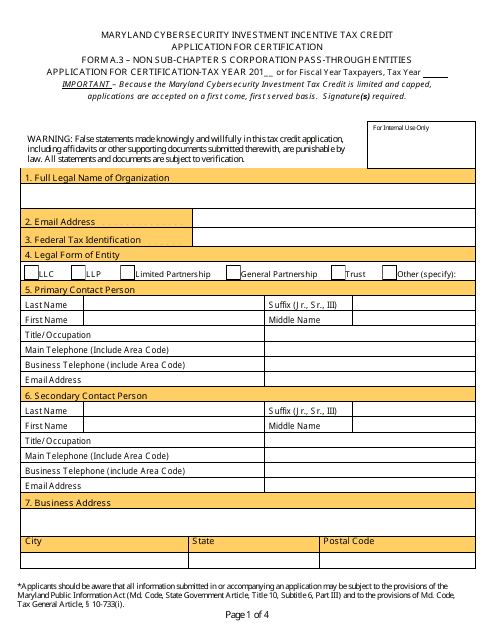

This Form is used for applying for certification as a non Sub-chapter S corporation pass-through entity for the Maryland Cybersecurity Investment Incentive Tax Credit.

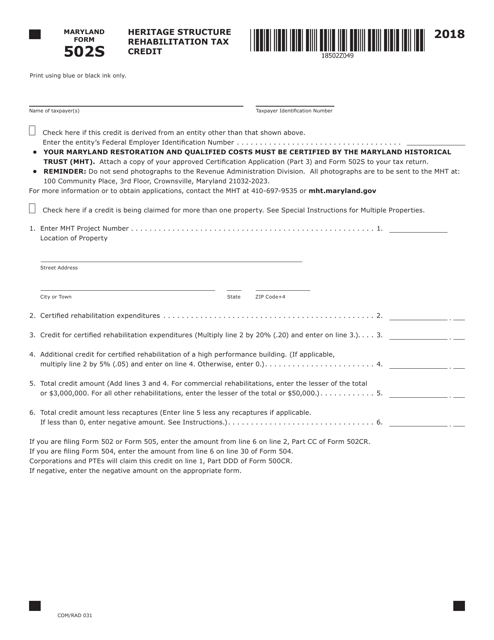

This form is used for applying for the Heritage Structure Rehabilitation Tax Credit in Maryland.

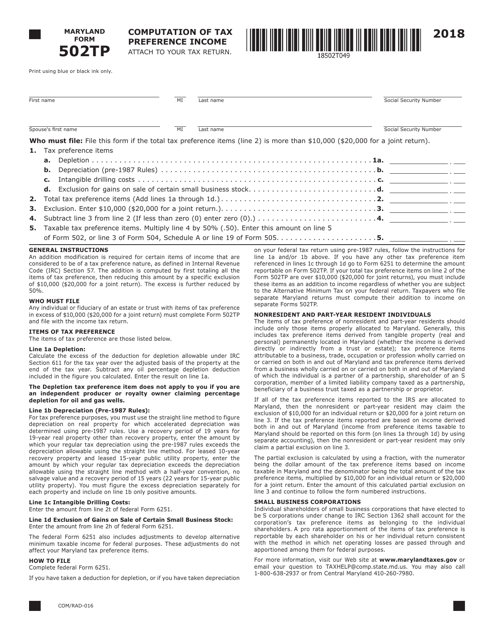

This Form is used for calculating tax preference income in the state of Maryland. It specifically applies to Maryland Form 502TP.

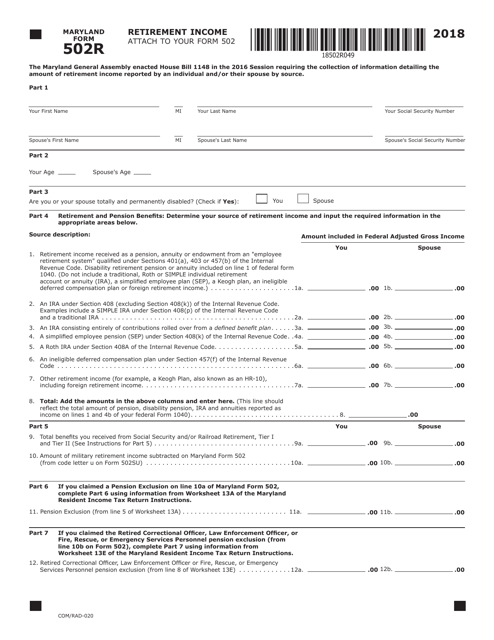

This Form is used for reporting retirement income in Maryland. It is known as Maryland Form 502R and is used for tax purposes.

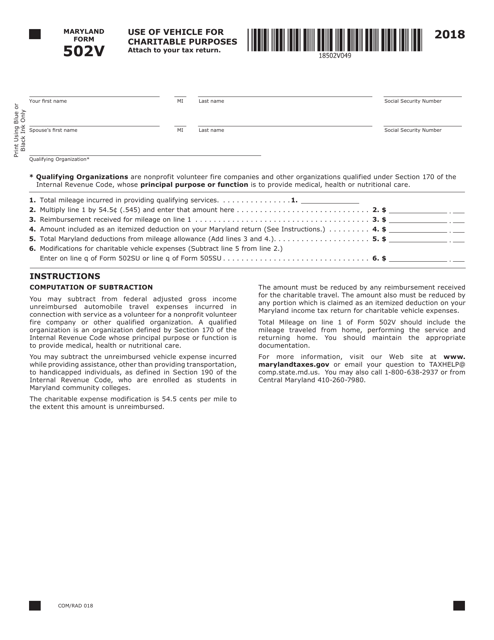

This form is used for reporting charitable purposes in the state of Maryland. It is specifically known as Maryland Form 502V.

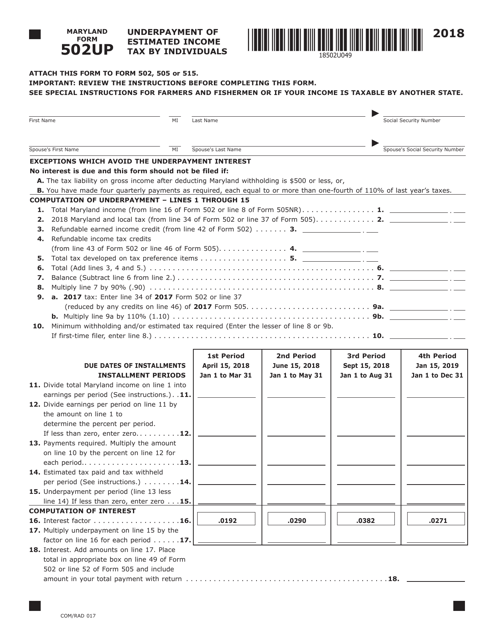

This form is used for reporting underpayment of estimated income tax by individuals in Maryland.

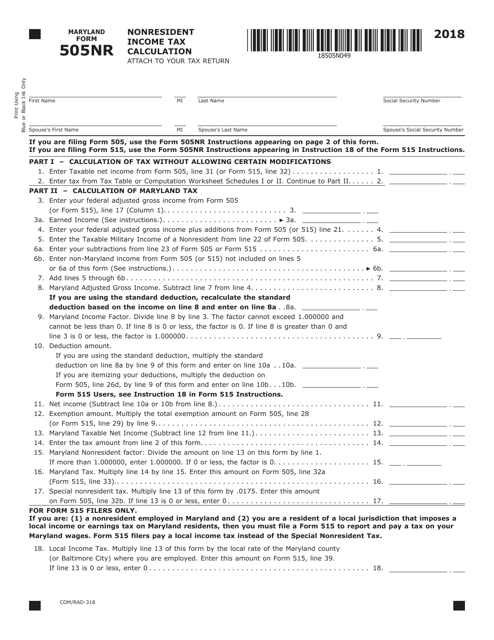

This form is used for calculating the income tax for nonresidents in Maryland.

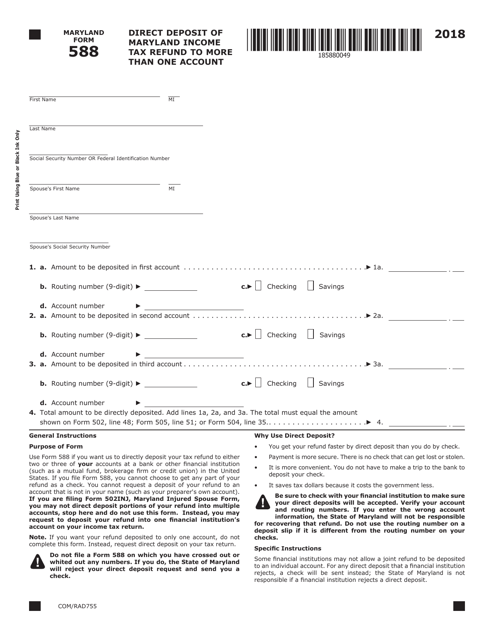

This document is used for requesting the direct deposit of Maryland income tax refunds into multiple bank accounts.

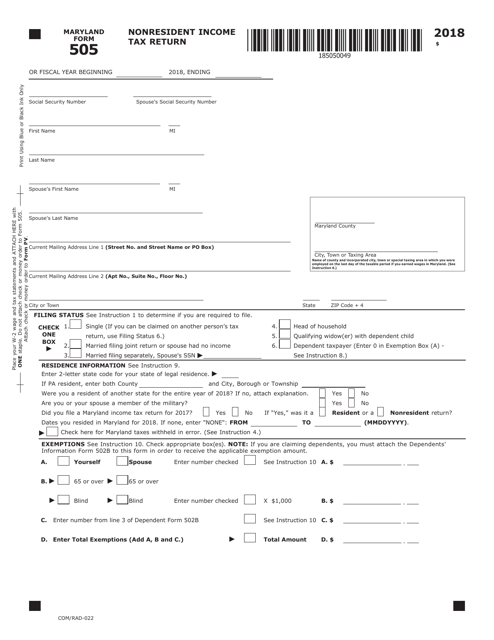

This form is used for reporting income tax for nonresidents in Maryland and is also known as Maryland Form 505.

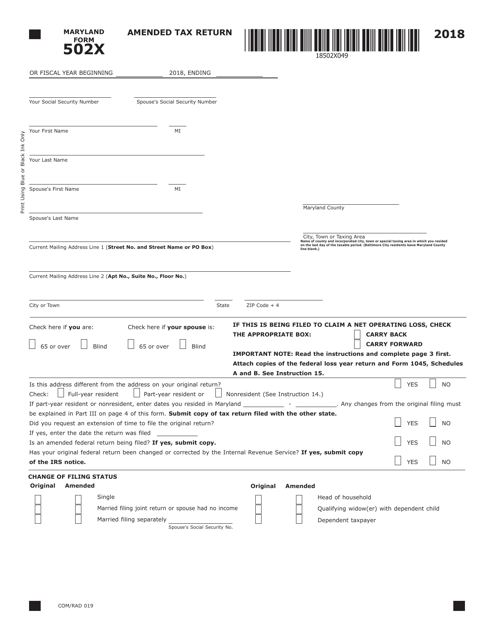

This form is used for filing an amended tax return in the state of Maryland. It is known as Form COM/RAD019 or Maryland Form 502X.

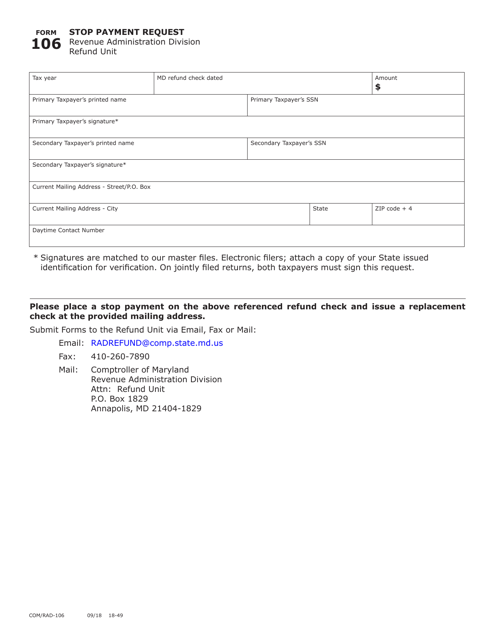

This form is used for submitting a stop payment request to the Maryland Department of Revenue.

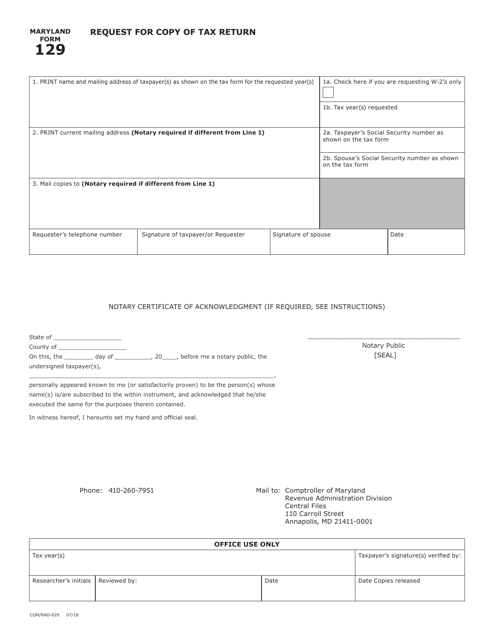

This form is used for requesting a copy of a tax return from the state of Maryland.

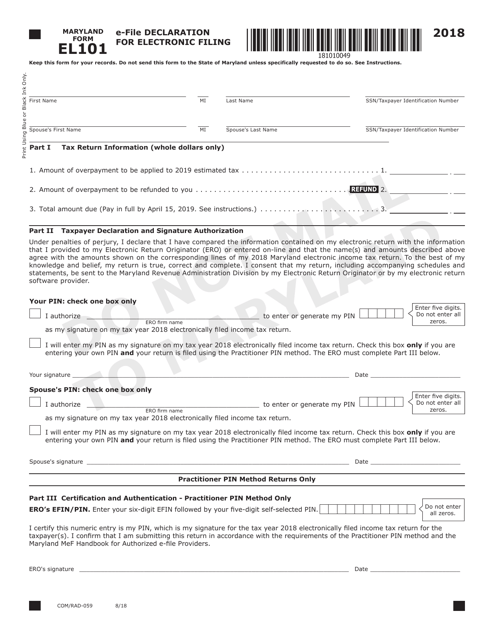

This form is used for declaring electronic filing in Maryland.

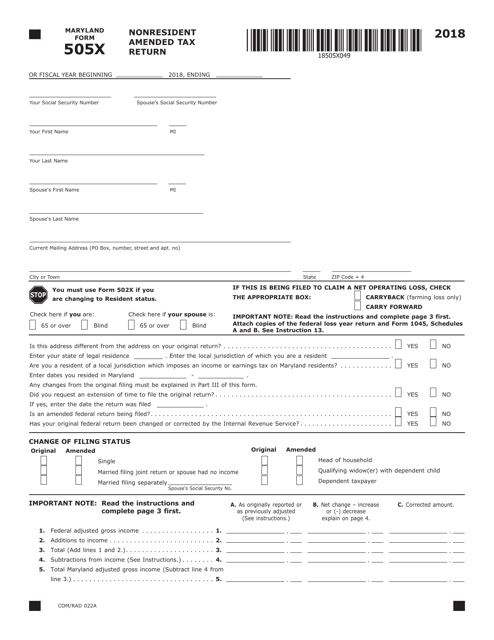

This form is used for filing an amended tax return if you are a nonresident of Maryland.

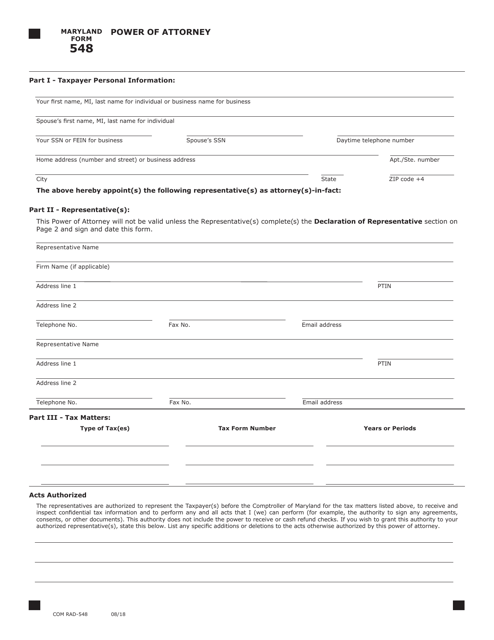

This form is used for creating a power of attorney in the state of Maryland. It allows an individual, known as the principal, to appoint someone else, known as the agent, to make legal and financial decisions on their behalf.

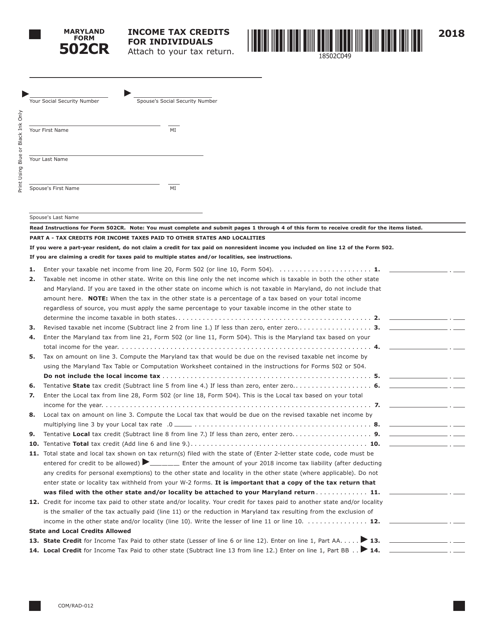

This form is used for claiming income tax credits for individuals in Maryland. It is designated as Form 502CR and is also referred to as COM/RAD-012.

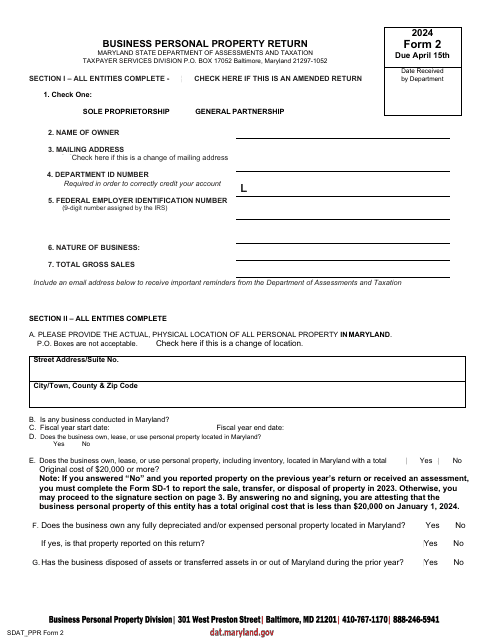

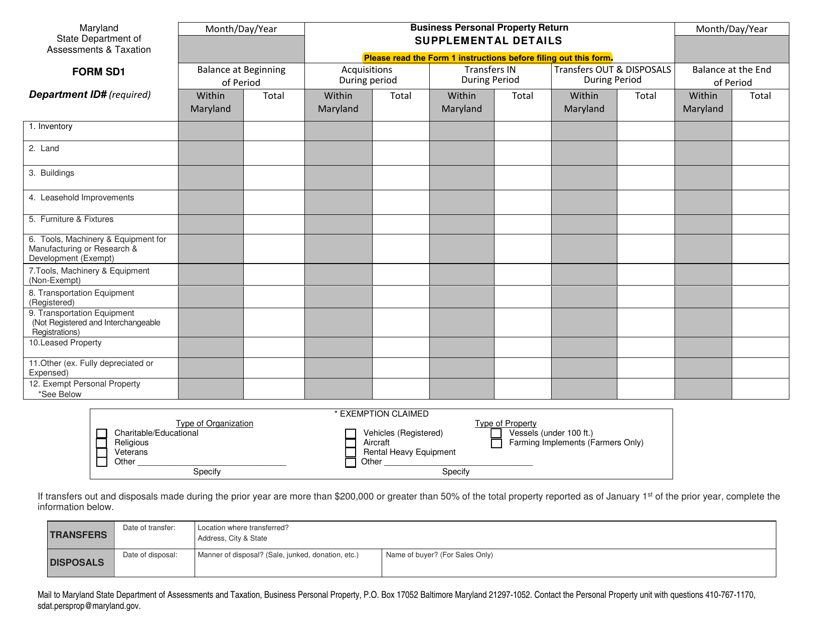

This form is used to provide supplemental details for the Business Personal Property Return in Maryland.

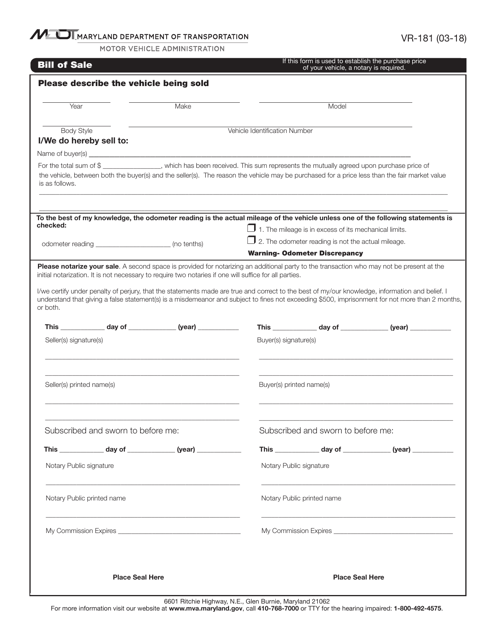

This form is the official state template issued by the Maryland Department of Transportation. It is used to verify and confirm the sale of a vehicle. It also provides essential information about the car and the terms and conditions of sale.

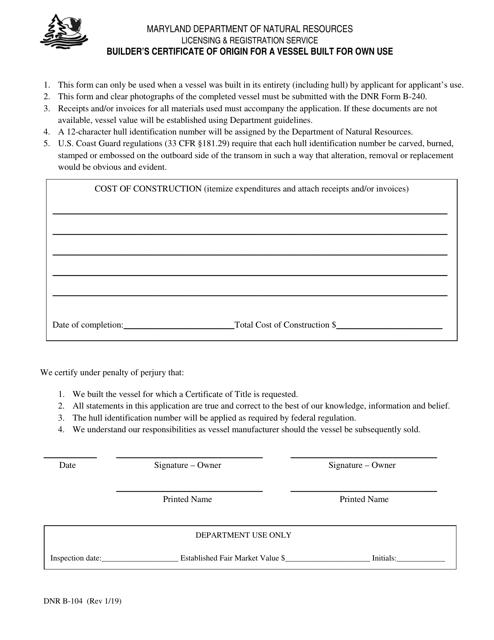

This Form is used for obtaining a Builder's Certificate of Origin for a Vessel Built for Own Use in the state of Maryland.

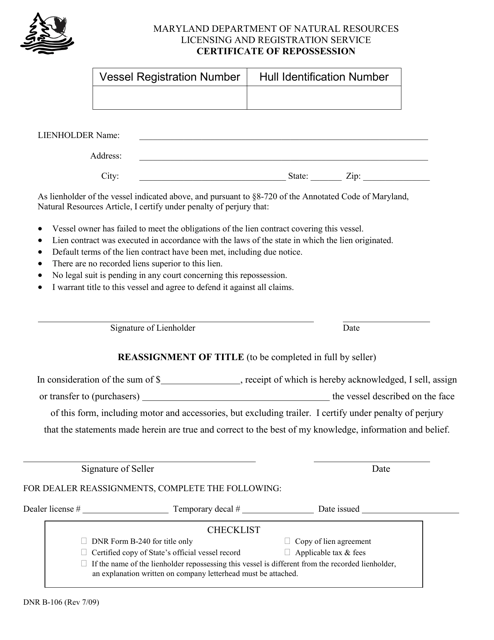

This form is used for certifying the repossession of a vehicle in Maryland.