Tax Audit Form Templates

Documents:

24

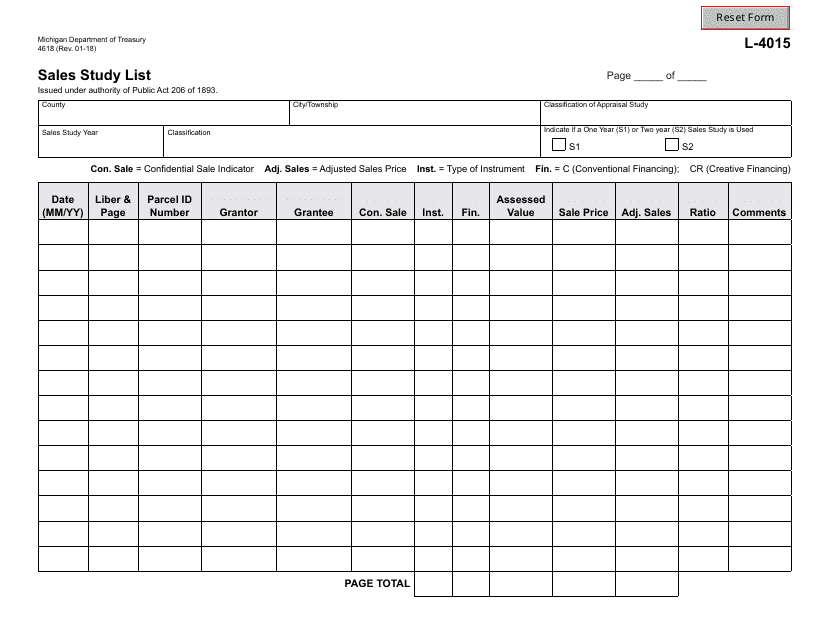

This form is used for submitting a sales study list in the state of Michigan.

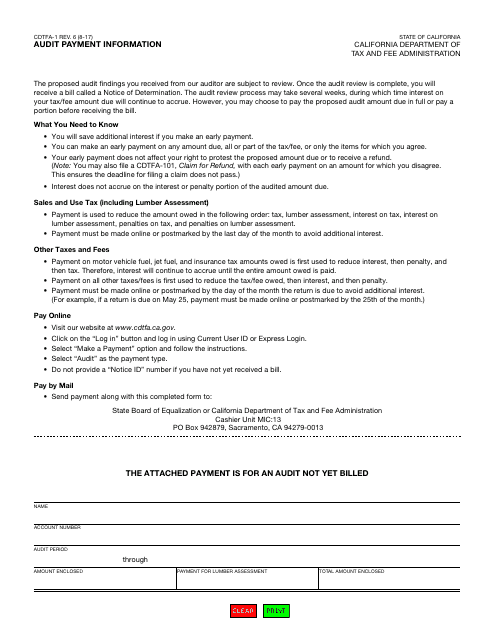

This Form is used for providing audit payment information to the California Department of Tax and Fee Administration (CDTFA).

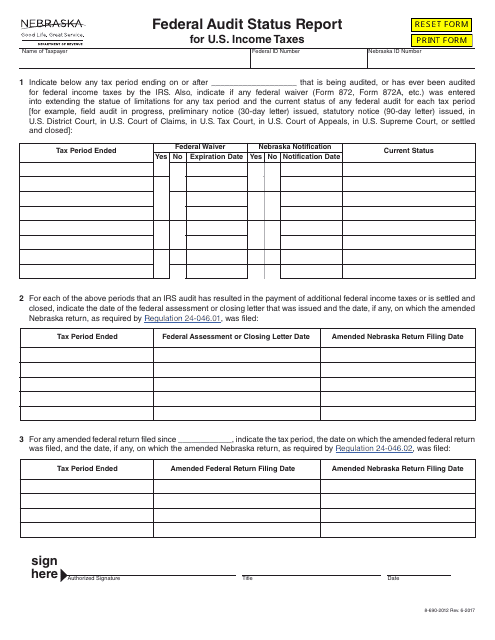

This type of document provides a status report on the federal audit of U.S. income taxes specifically for residents of Nebraska.

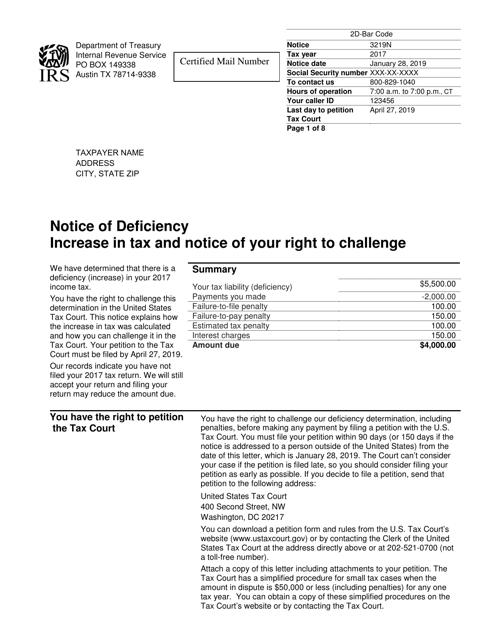

This document is a Notice of Deficiency from the Internal Revenue Service (IRS). It is sent to taxpayers who have underreported their income or have other tax liabilities. The notice provides information about the proposed changes to the tax return and the options available to the taxpayer to respond.

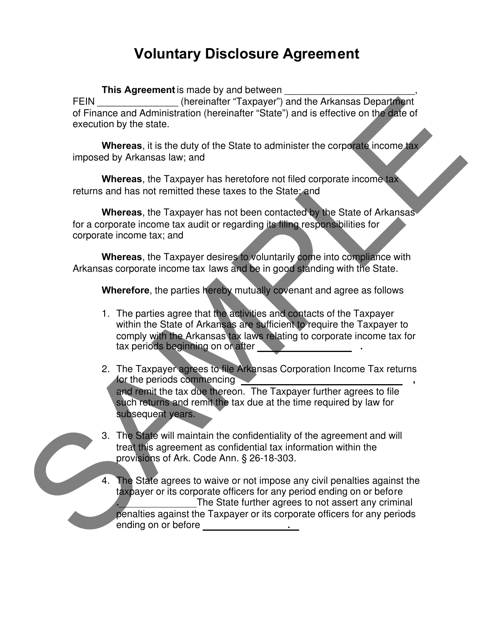

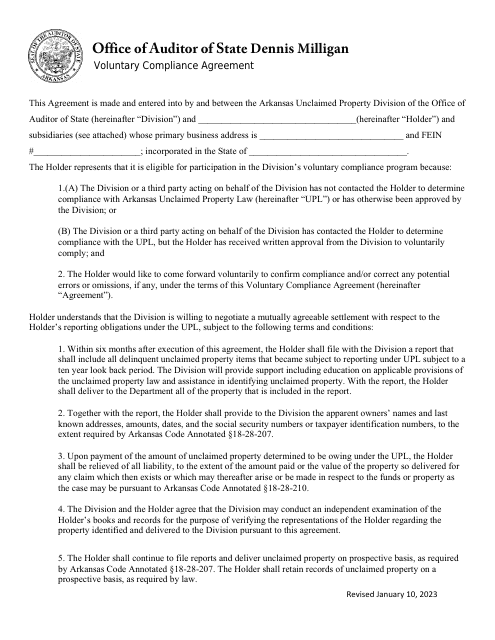

This form is used for corporate taxpayers in Arkansas to voluntarily disclose any errors or omissions in their previous corporate tax returns.

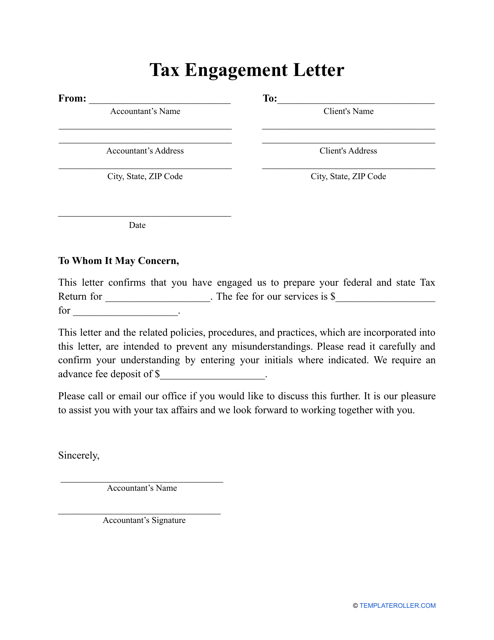

Complete this template to describe the work to be performed, the terms and conditions of performing that work, any limitations, and payment terms to the client.

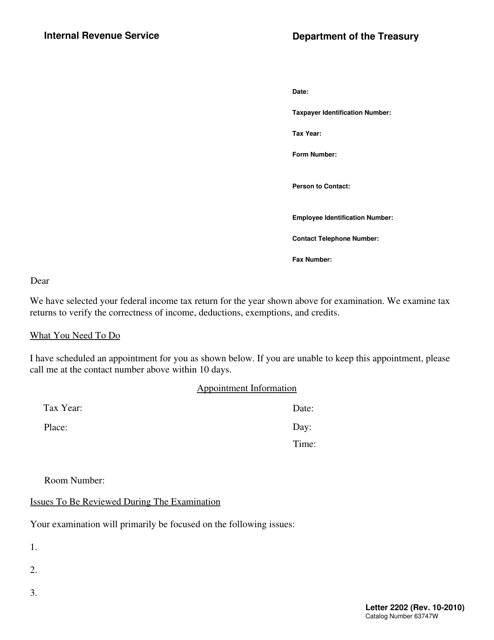

The IRS can initiate a review of the information you submit via your tax return by sending you an IRS Audit Letter in the mail.

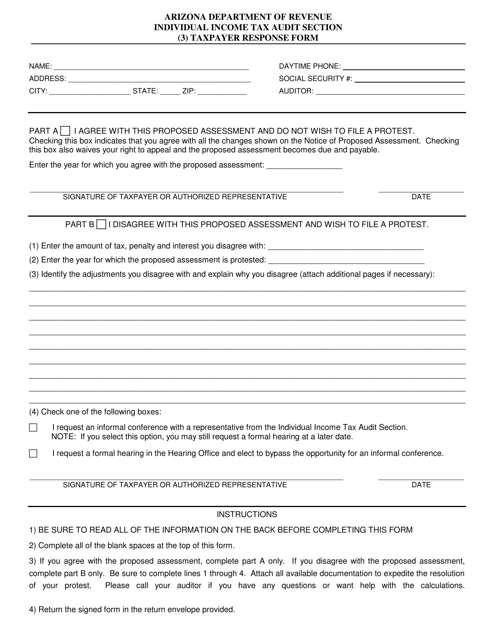

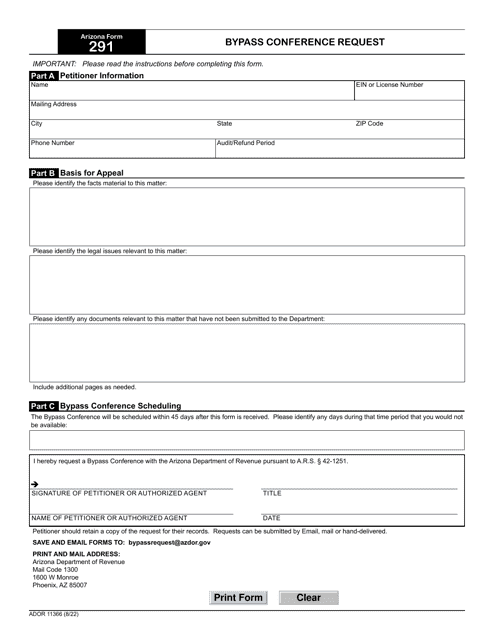

This Form is used for taxpayers in Arizona to respond to correspondence from the tax authorities.

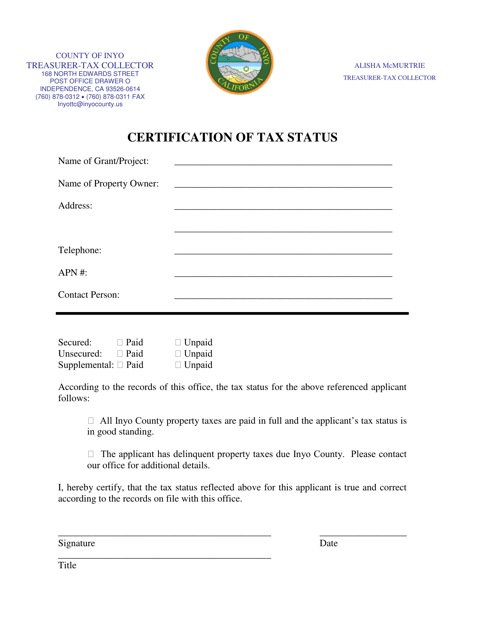

This document is used for certifying the tax status of individuals or entities in Inyo County, California. It verifies whether a person or organization is up to date with their tax obligations in the county.

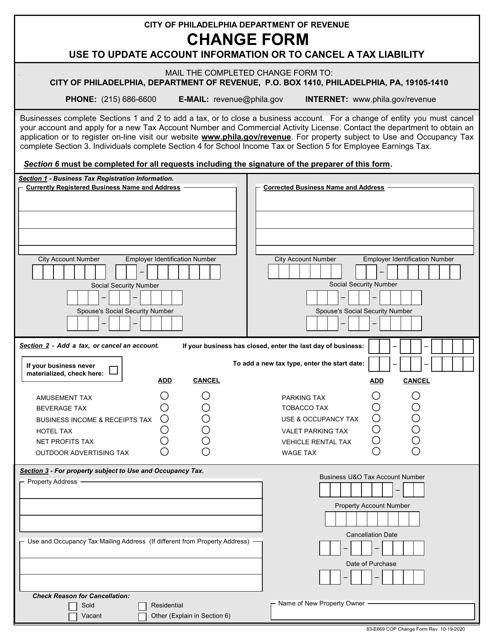

This form is used for changing your tax account information with the City of Philadelphia, Pennsylvania.

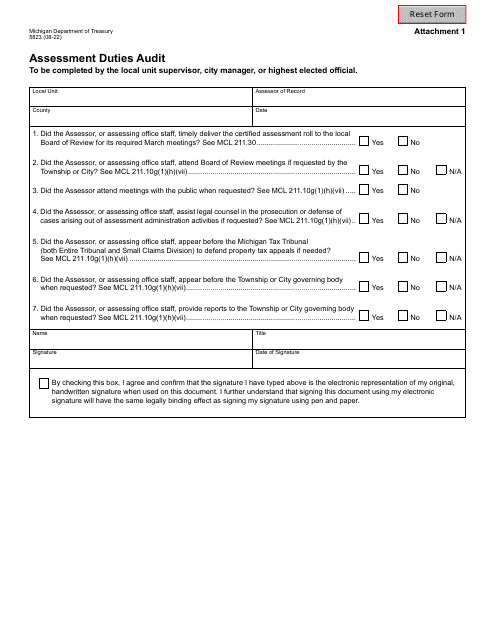

This form is used for conducting an assessment duties audit in the state of Michigan. It helps to ensure compliance and accuracy in assessing taxes and duties.

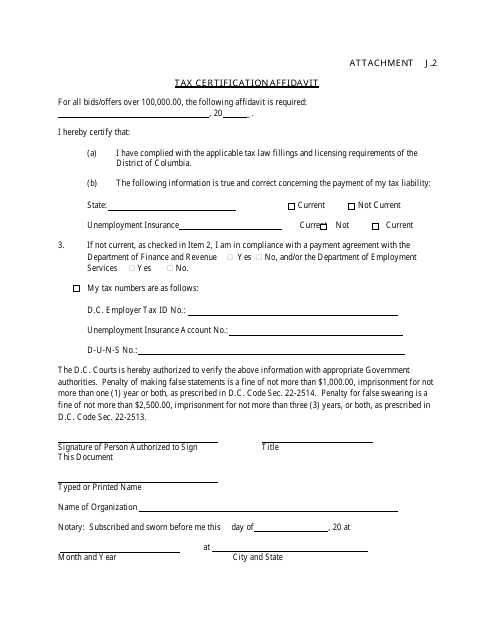

This document is for certifying tax information in Washington, D.C. It is used to confirm details related to tax obligations.

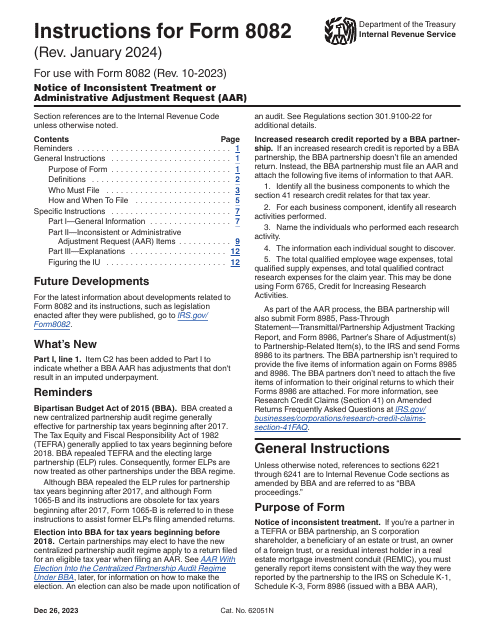

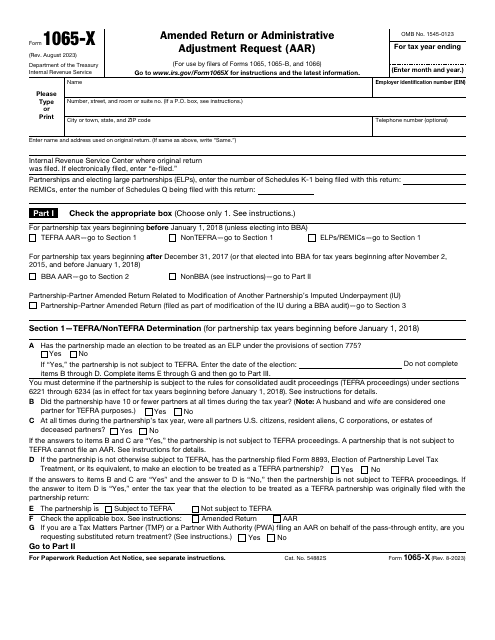

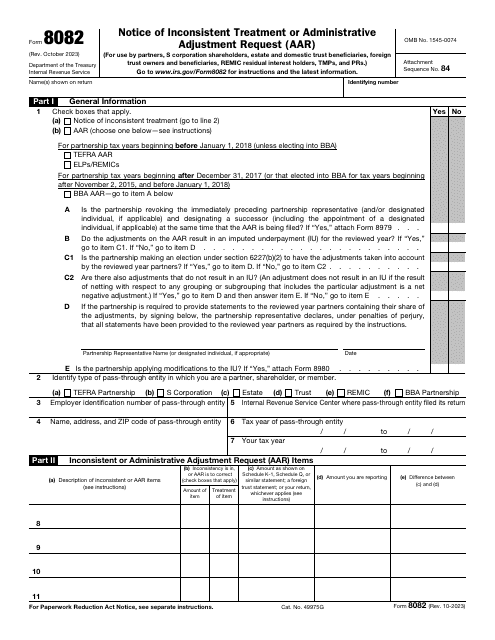

This is a fiscal statement used by partnerships and real estate mortgage investment conduits to fix the errors in previously filed IRS Form 1065, IRS Form 1065-B, IRS Form 1066.