Tax Appeal Form Templates

Documents:

70

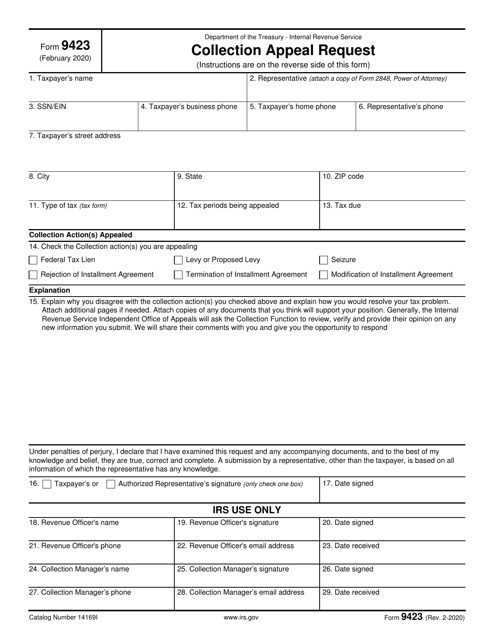

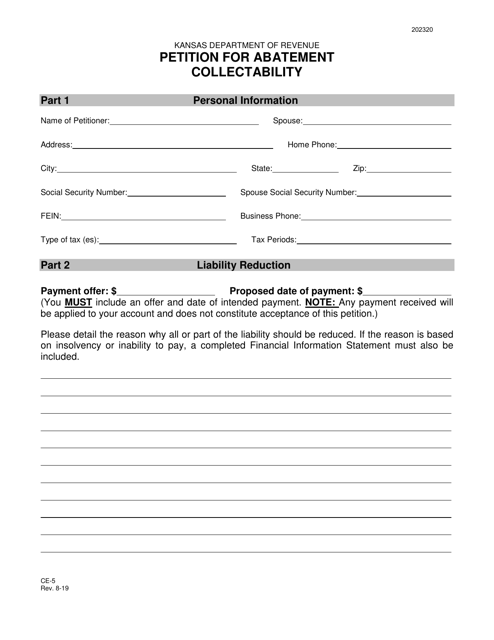

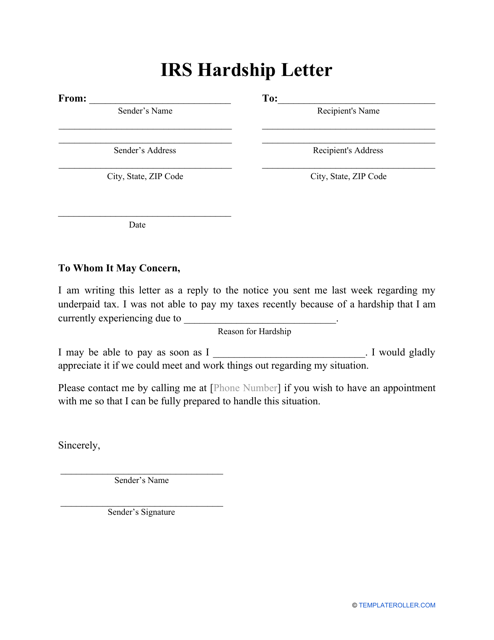

This is a written document prepared by a taxpayer with a tax debt, if they want to prevent or stop certain fiscal enforcement actions against them due to their failure to pay tax on time.

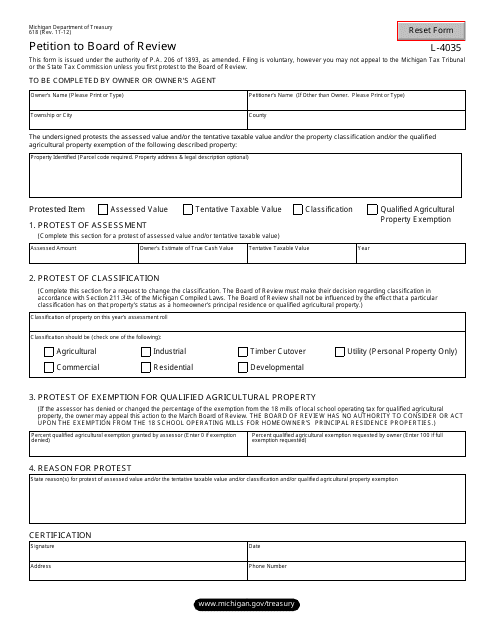

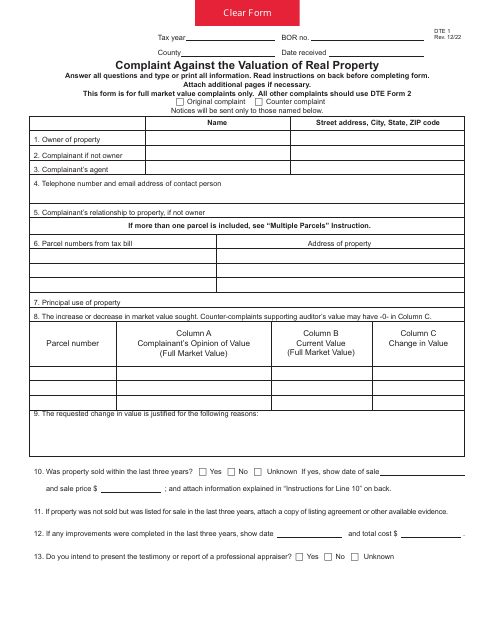

This form is used for filing a petition to the Board of Review in the state of Michigan.

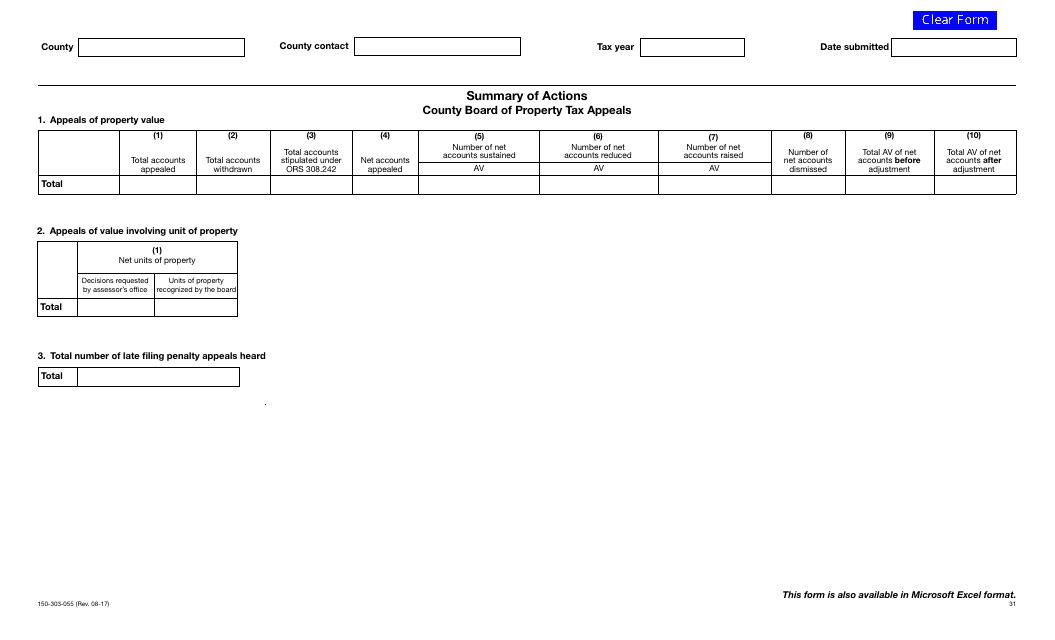

This form is used for submitting a summary of actions for the County Board of Property Tax Appeals in Oregon.

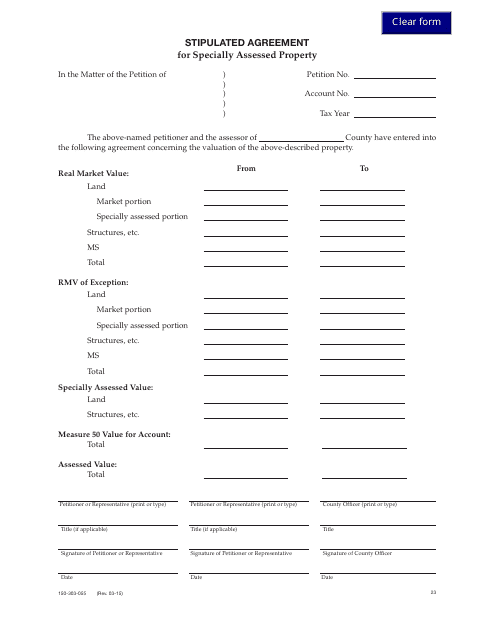

This form is used for entering into a stipulated agreement for specially assessed property in the state of Oregon.

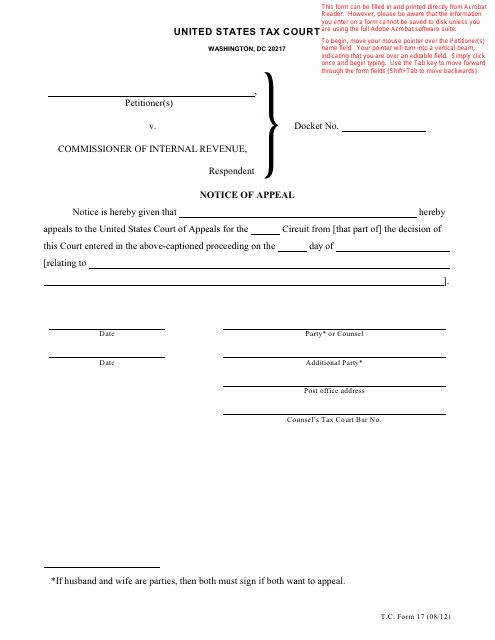

This Form is used for filing a Notice of Appeal in the T.C. Court.

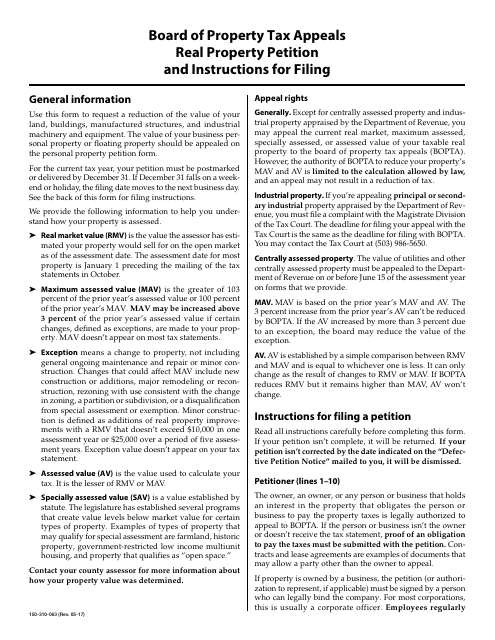

This Form is used for filing a Real Property Petition to the Board of Property Tax Appeals in Oregon.

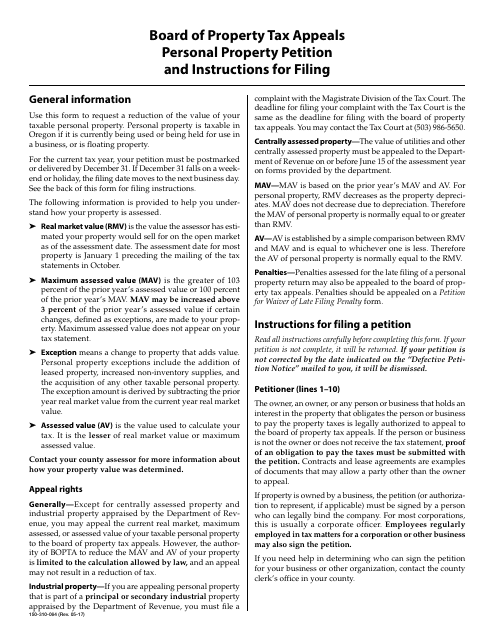

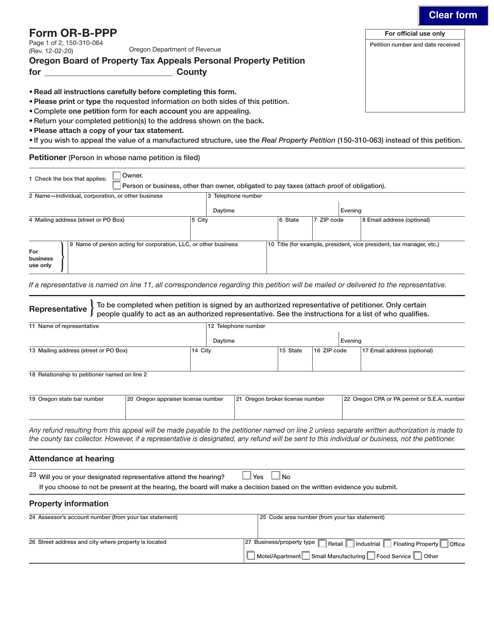

This form is used for filing a personal property petition with the Board of Property Tax Appeals in Oregon. It is used to request a review of the assessed value of personal property for tax purposes.

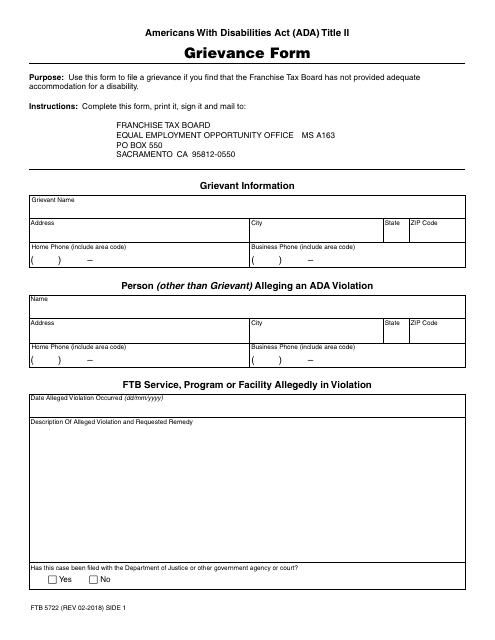

This form is used for filing a grievance with the California Franchise Tax Board (FTB).

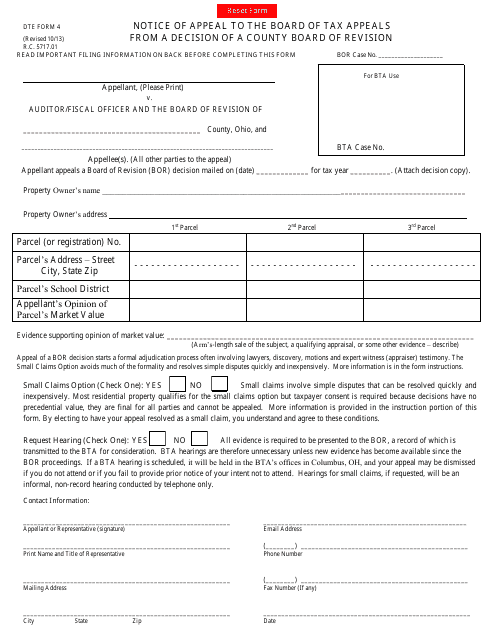

This form is used for filing an appeal to the Board of Tax Appeals in Ohio, following a decision made by the County Board of Revision. It provides a way for taxpayers to challenge property tax assessments and seek a review of their case.

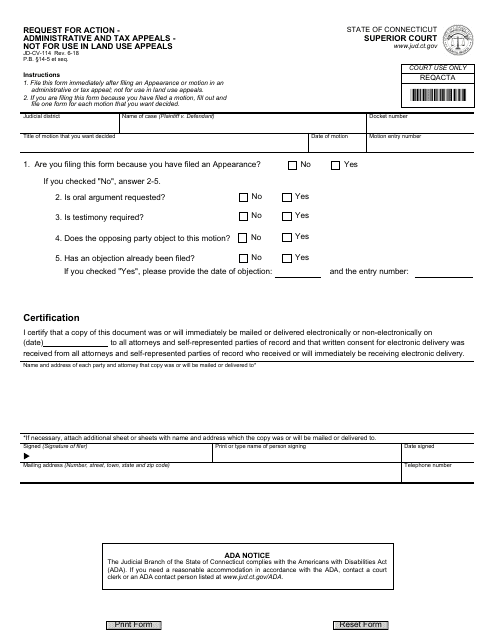

This type of document is a Request for Action form used in Connecticut for administrative and tax appeals. It is important to note that it cannot be used for land use appeals.

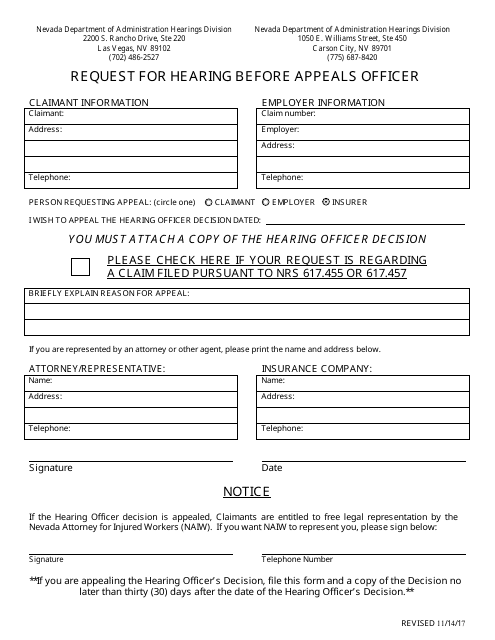

This document is used to request a hearing before an Appeals Officer in Nevada.

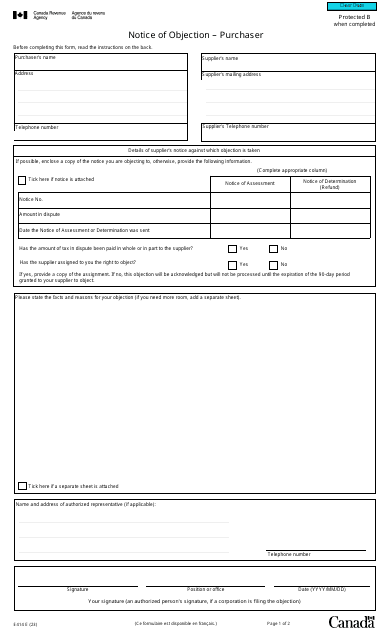

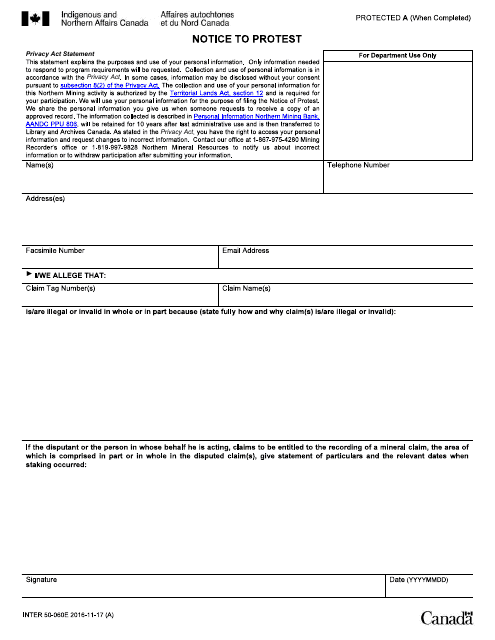

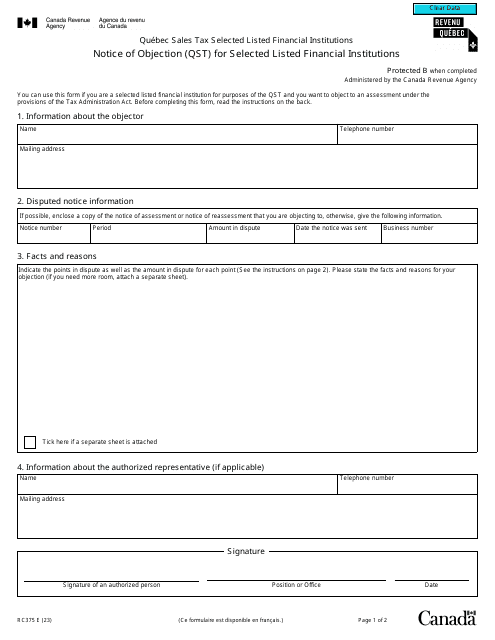

This form is used for providing a notice to protest in Canada. It is used to register a formal objection or disagreement regarding a specific matter.

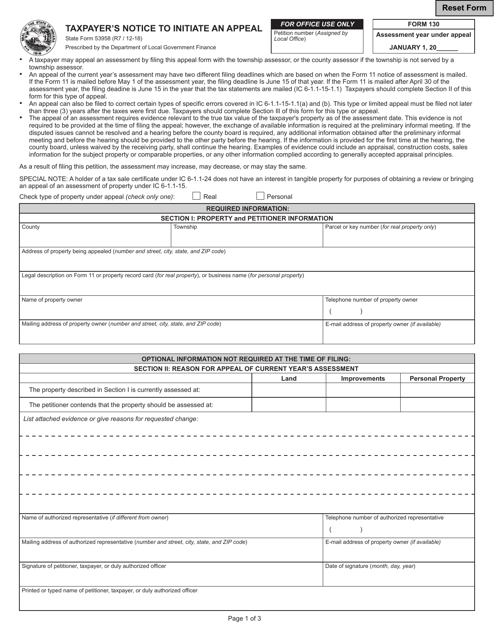

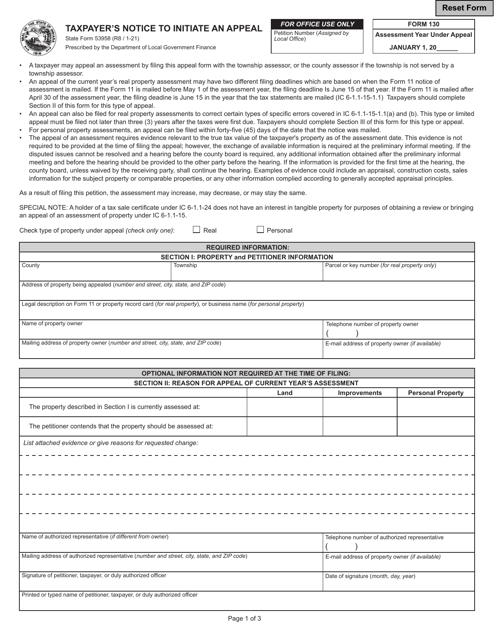

This form is used for Indiana residents who wish to initiate an appeal regarding their taxes.

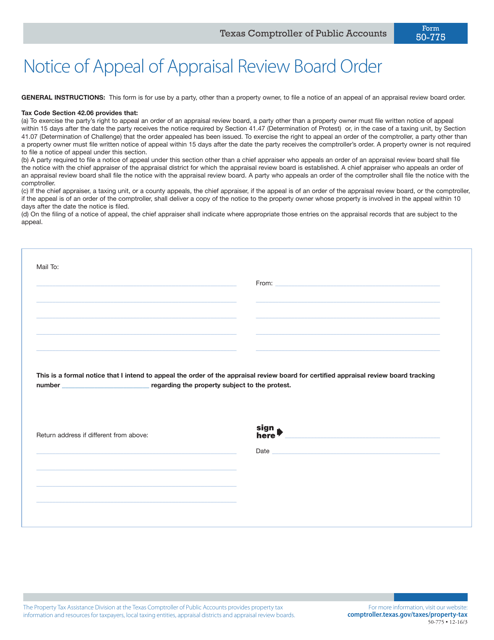

This form is used for filing a notice of appeal against an appraisal review board order in Texas. It allows property owners to challenge the valuation of their property for tax purposes.

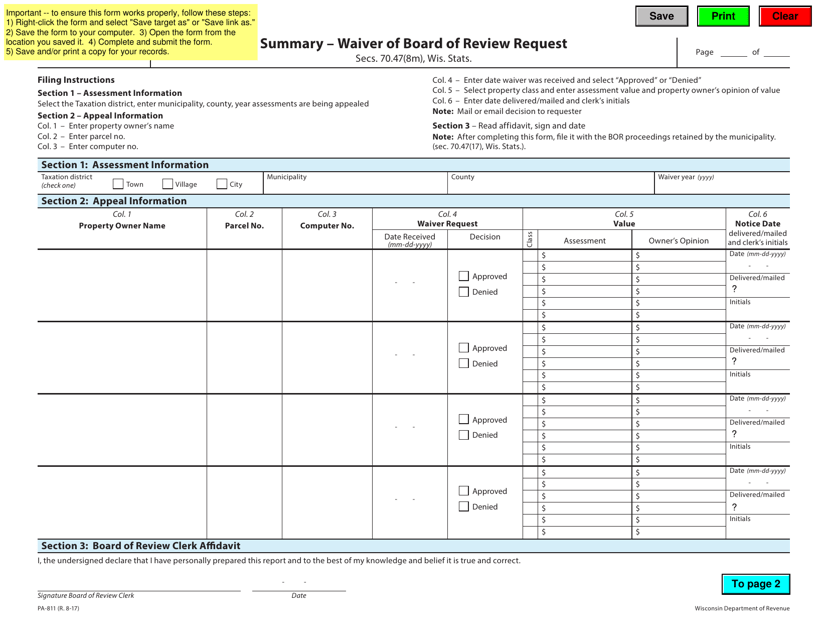

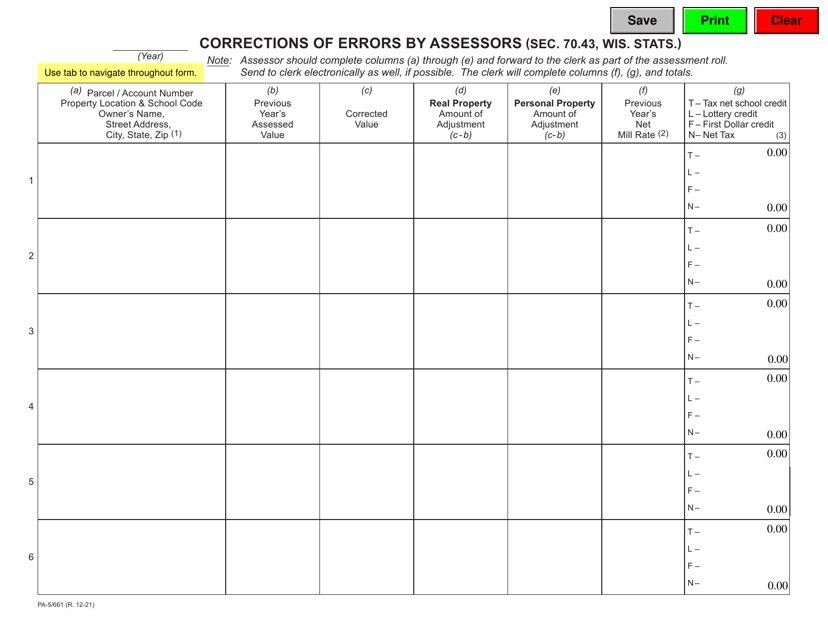

This form is used for requesting a waiver of the Board of Review in Wisconsin.

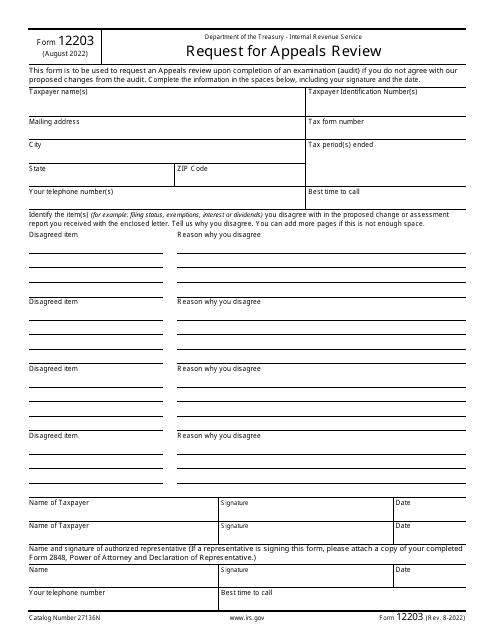

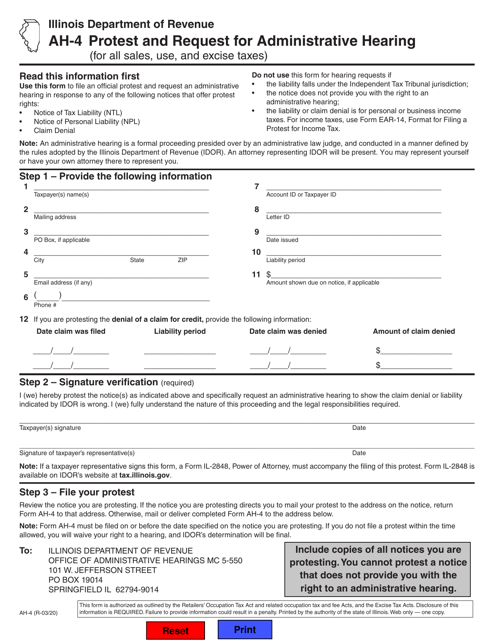

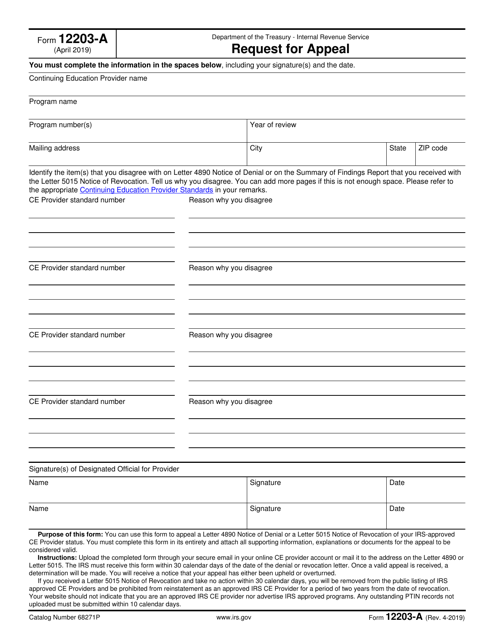

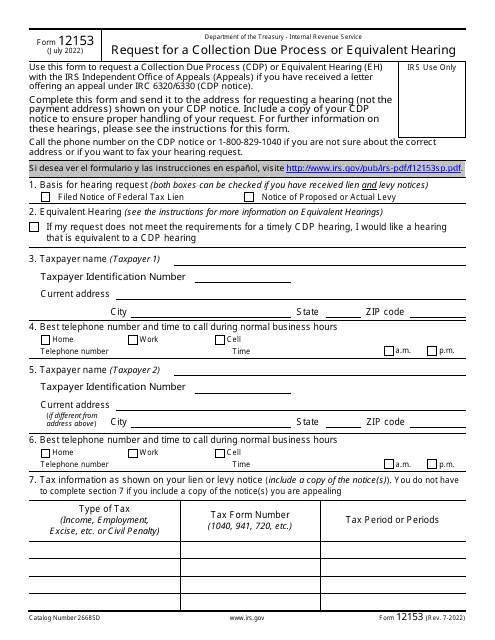

This is a fiscal form filled out by a taxpayer to appeal an upcoming tax levy or lien.

Form OR-B-PPP (150-310-064) Oregon Board of Property Tax Appeals Personal Property Petition - Oregon

This form is used for filing a personal property petition with the Oregon Board of Property Tax Appeals.

This document is used for taxpayers in Indiana who want to initiate an appeal regarding their taxes.

Complete this template and send it to the Internal Revenue Service (IRS) in order to describe a difficult financial situation you're experiencing, ask the IRS for leniency, or request a new payment deadline.

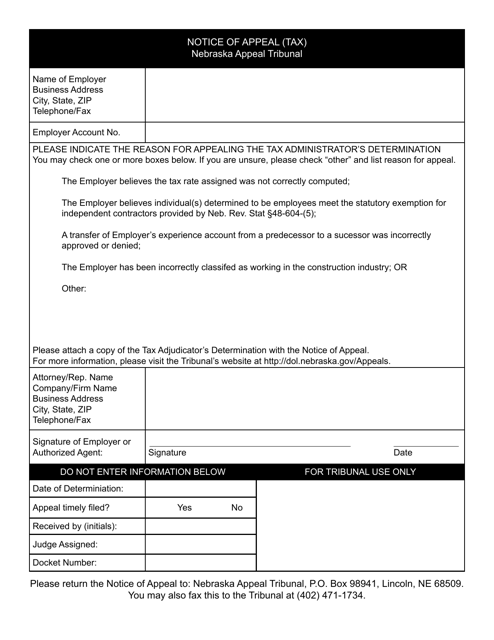

This document is used to appeal a tax decision in the state of Nebraska. It notifies the appropriate authority that the taxpayer is challenging the decision and provides the necessary information to proceed with the appeal process.

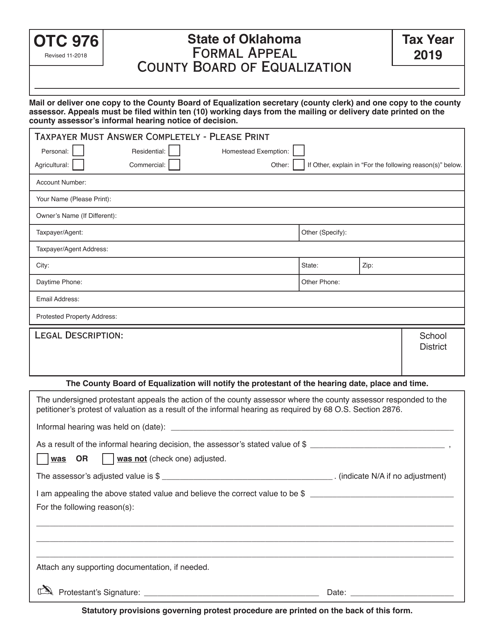

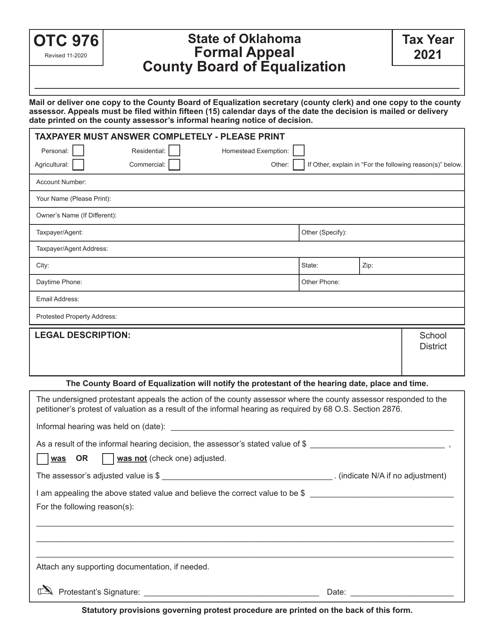

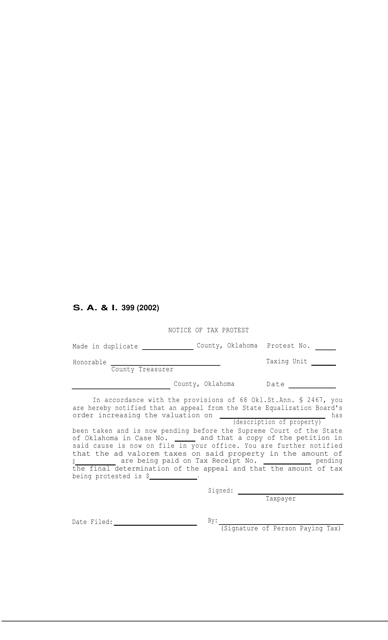

This form is used for filing a notice of tax protest in Oklahoma. It allows taxpayers to contest the amount of taxes owed or dispute other tax-related issues with the state.

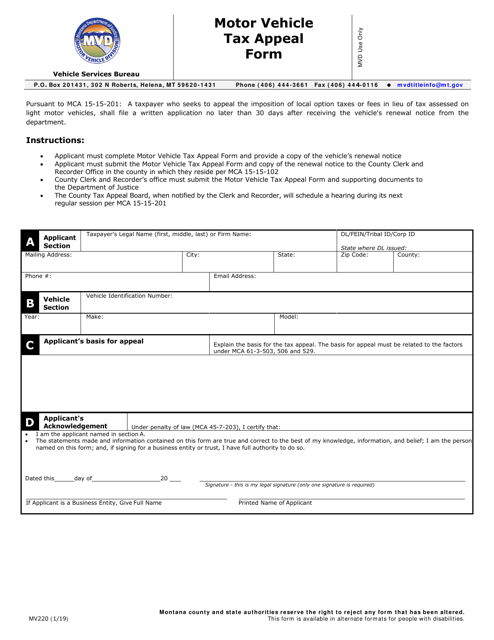

This form is used for appealing motor vehicle tax assessments in the state of Montana. It allows individuals to challenge the amount of tax owed on their vehicles.

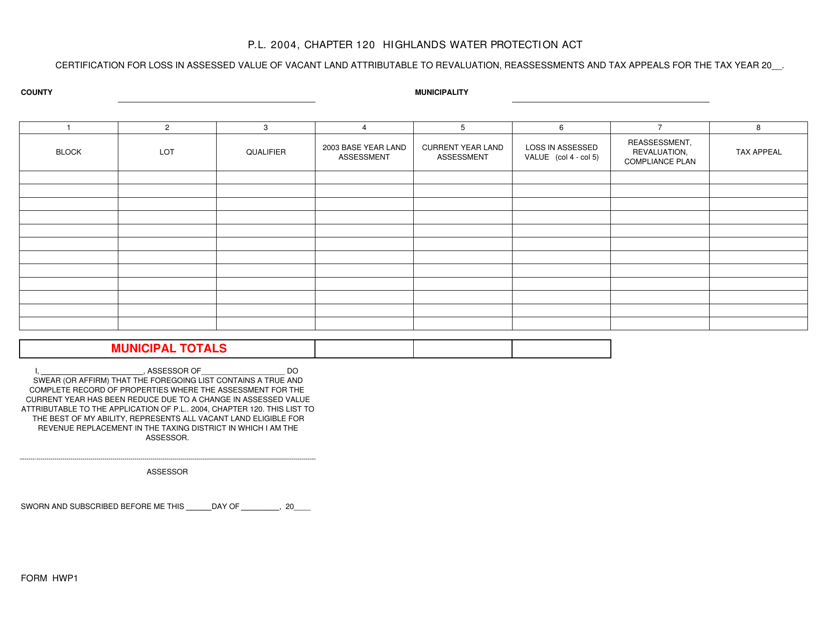

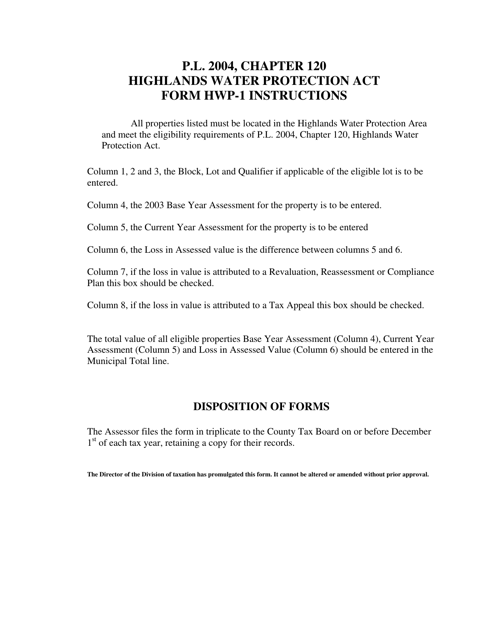

This form is used for certifying the loss in assessed value of vacant land in New Jersey due to revaluation, reassessments, and tax appeals.

This Form is used for certification of loss in assessed value of vacant land in New Jersey due to revaluation, reassessments, and tax appeals.

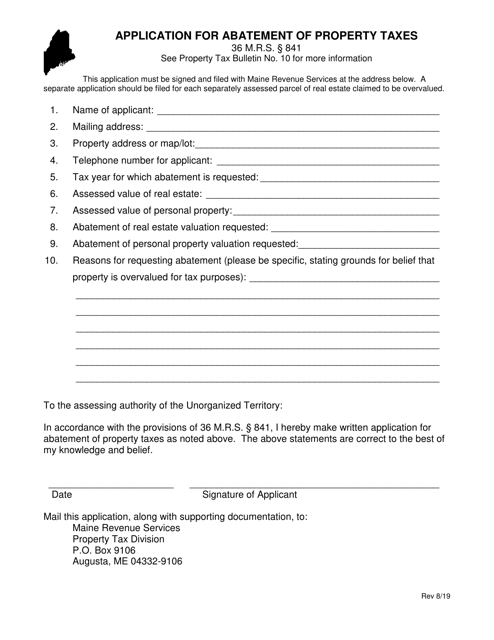

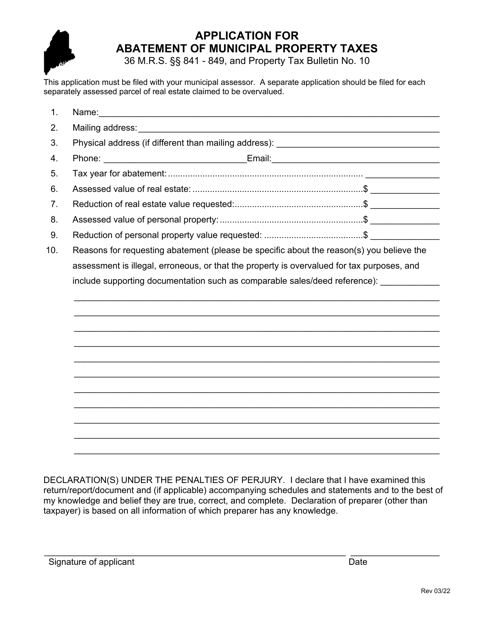

This form is used for requesting a reduction or elimination of municipal property taxes in the state of Maine. It allows property owners to seek relief from excessive tax payments.

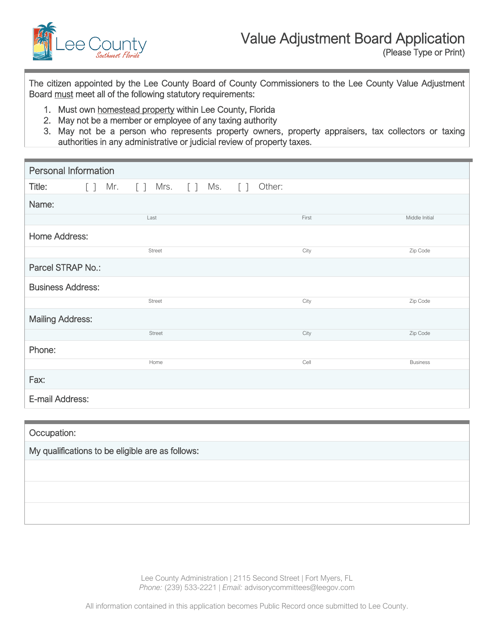

This document is for applying to the Value Adjustment Board in Lee County, Florida.

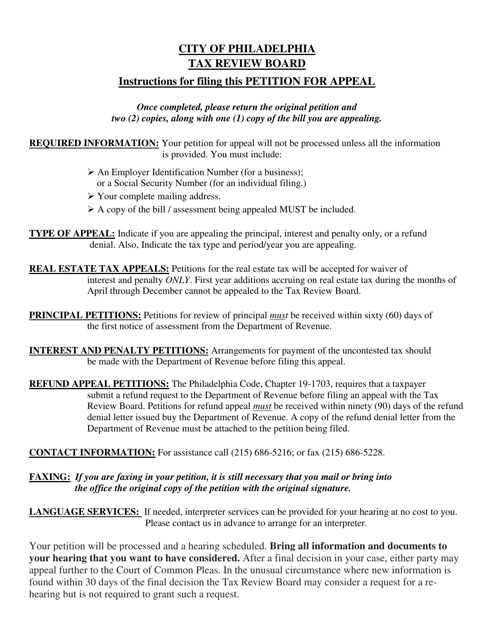

This document is for individuals in Philadelphia, Pennsylvania who wish to appeal a tax assessment made by the Tax Review Board. It provides instructions on how to complete a petition for appeal to challenge the assessment.