Wage Statement Form Templates

Documents:

57

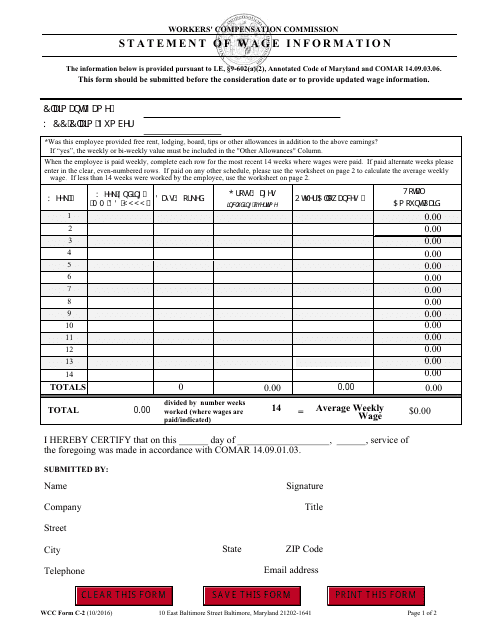

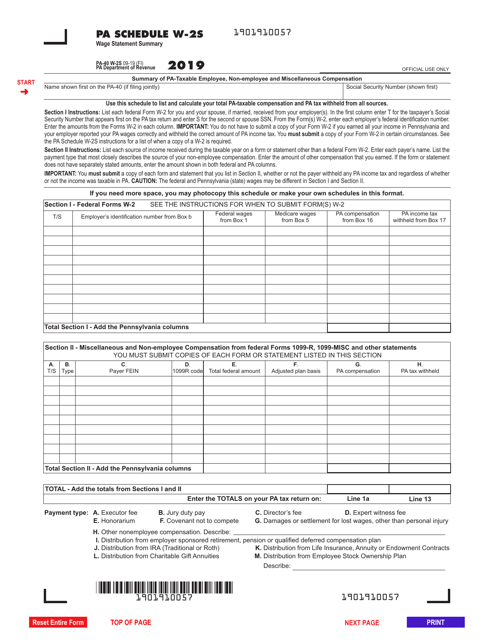

This form is used for reporting wage information in the state of Maryland.

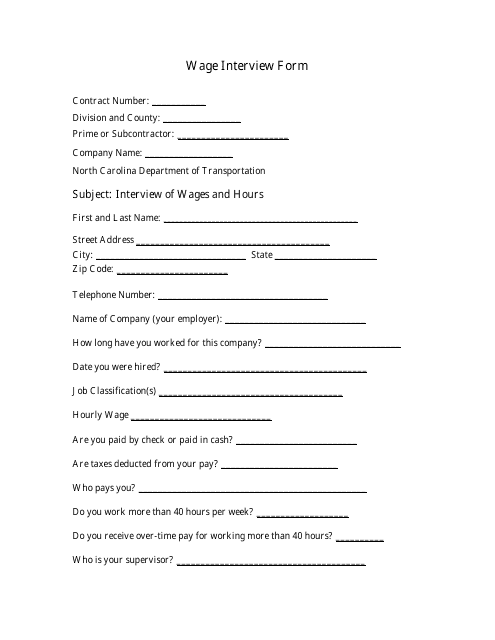

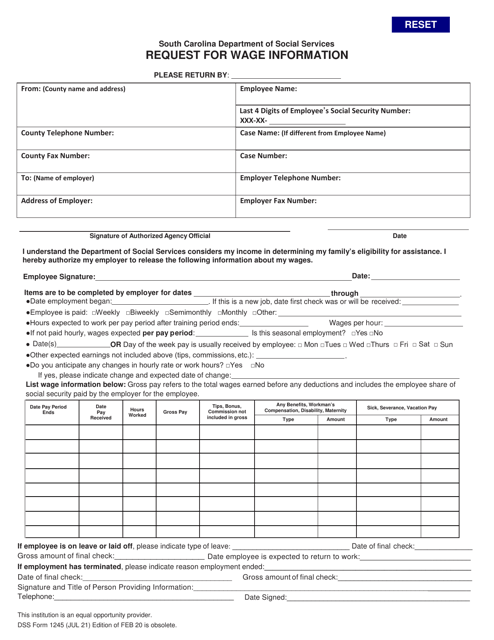

This Form is used for conducting wage interviews in North Carolina.

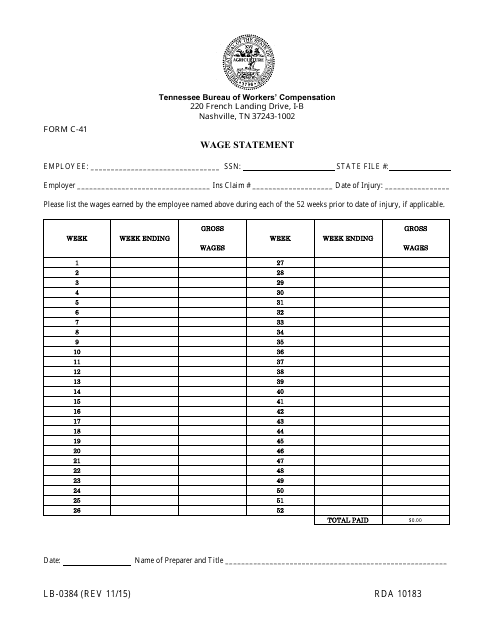

This Form is used for reporting wage information in Tennessee. It is used by employers to provide a detailed statement of wages and deductions to their employees.

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.

This document is designed to inform the Internal Revenue Service (IRS) about the United States Virgin Islands salaries and the amount of taxes deducted from them. This document was issued by the IRS, which can send you this form in a paper format, if you wish.

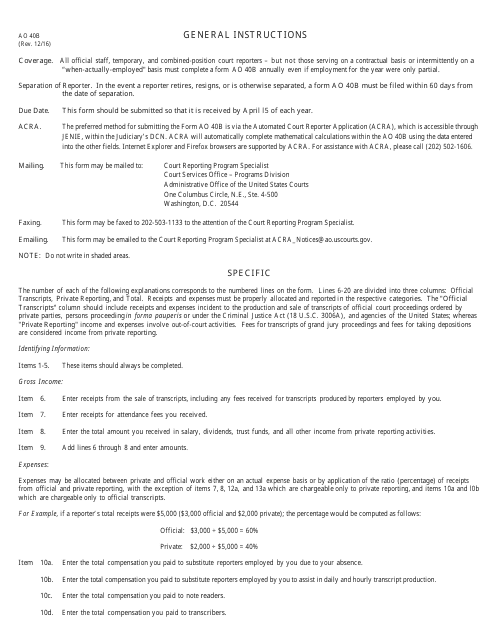

This Form is used for reporting the earnings of United States Court Reporters. It provides instructions on how to accurately fill out the form.

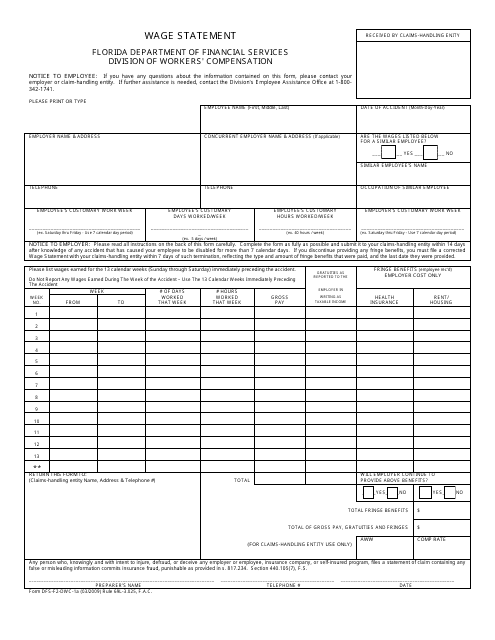

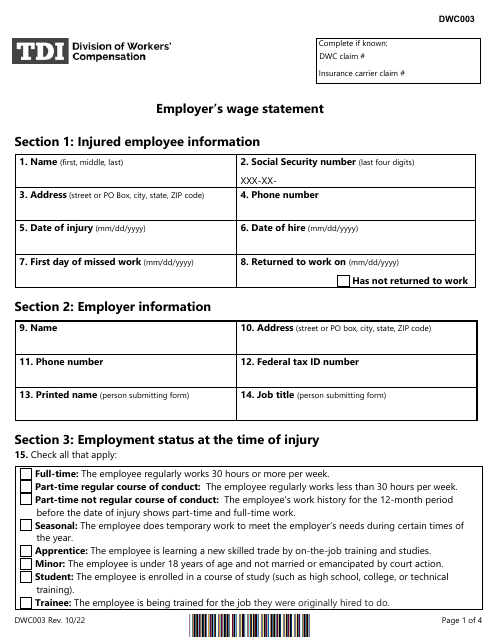

This Form is used for Wage Statement purposes in the state of Florida. It is a document that reports an employee's wages and other compensation.

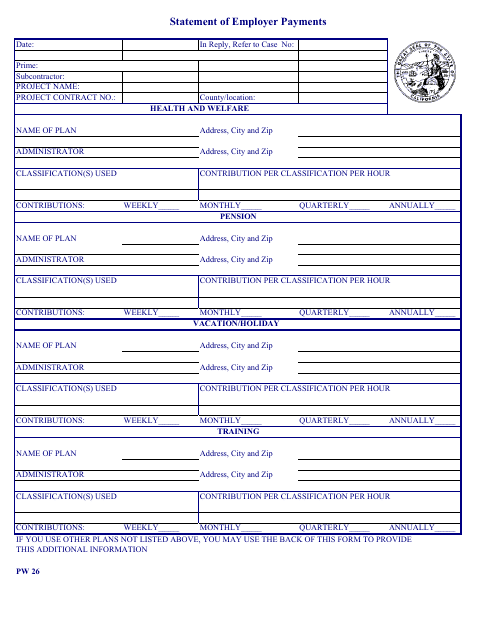

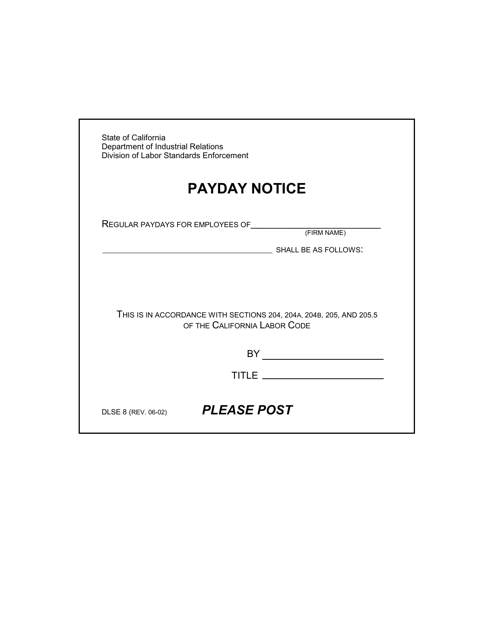

This form is used for reporting employer payments in the state of California. It is used by employers to provide a statement of the payments made to their employees.

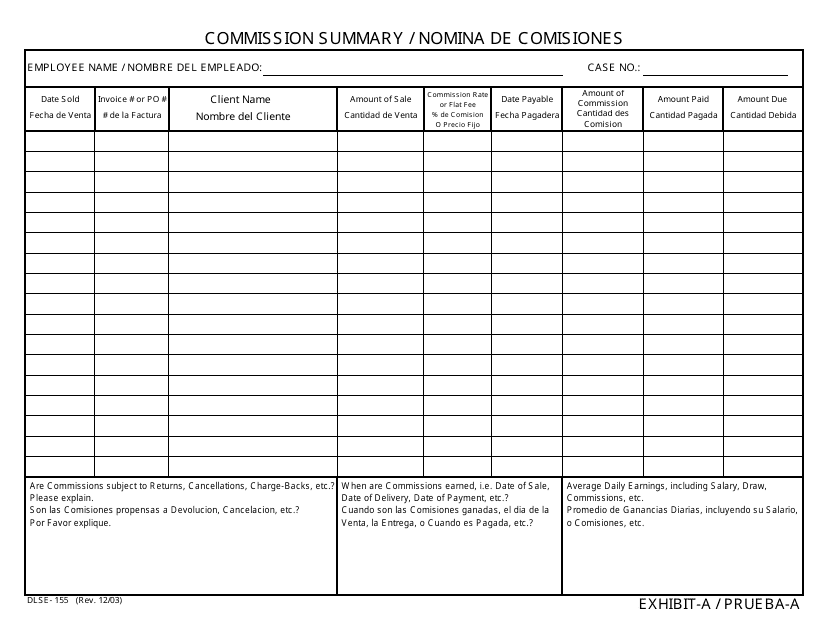

This form is used for providing a summary of commissions earned in California, available in both English and Spanish.

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

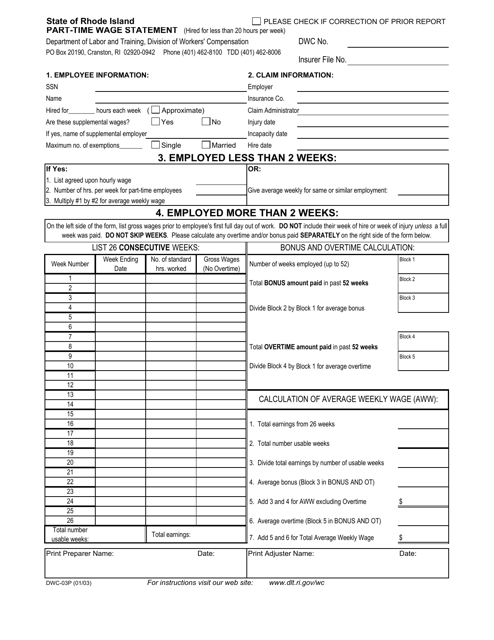

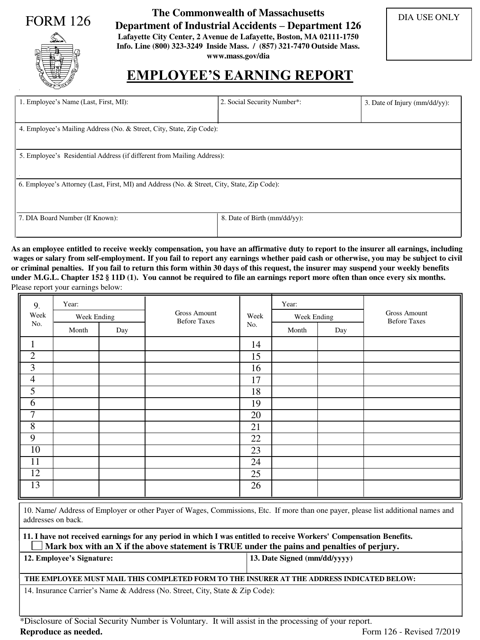

This document is used for reporting part-time wages in Rhode Island.

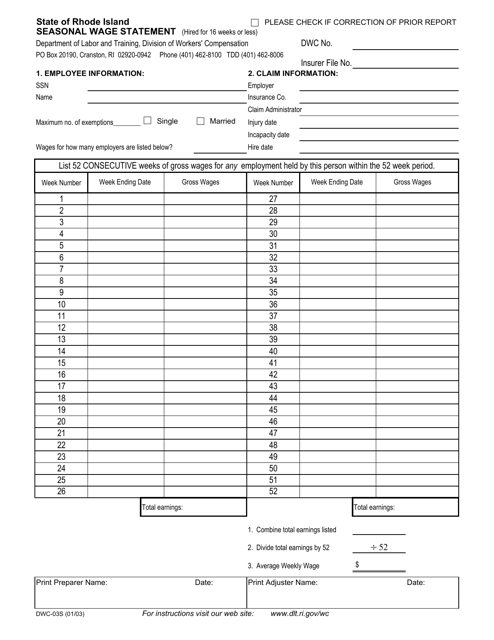

This form is used for reporting seasonal wages in Rhode Island. It is used by employers to provide a statement of wages paid to seasonal workers.

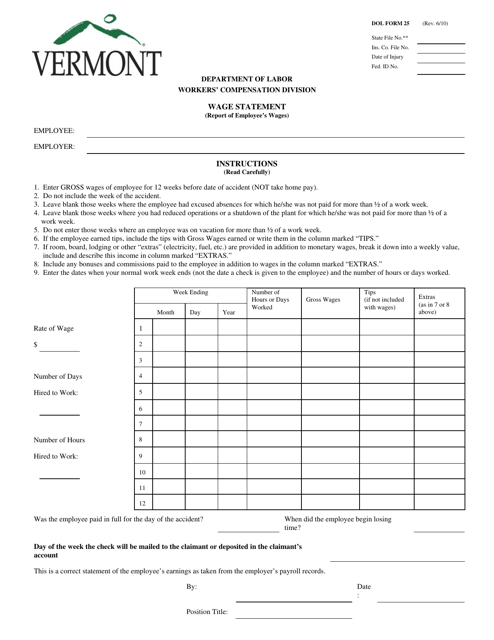

This form is used for reporting wage information in the state of Vermont. It is required by the Department of Labor (DOL).

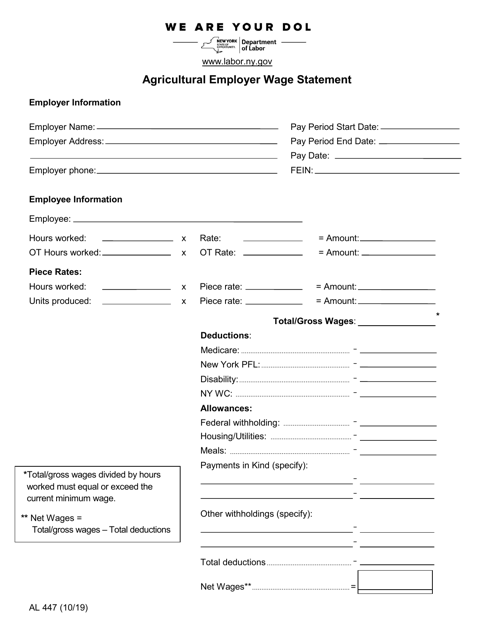

This form is used for agricultural employers in New York to report wage information.

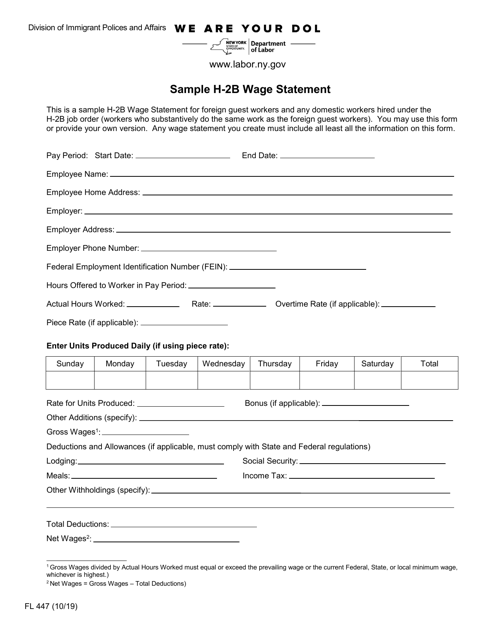

This form is used for providing a sample H-2B wage statement for employers in New York.

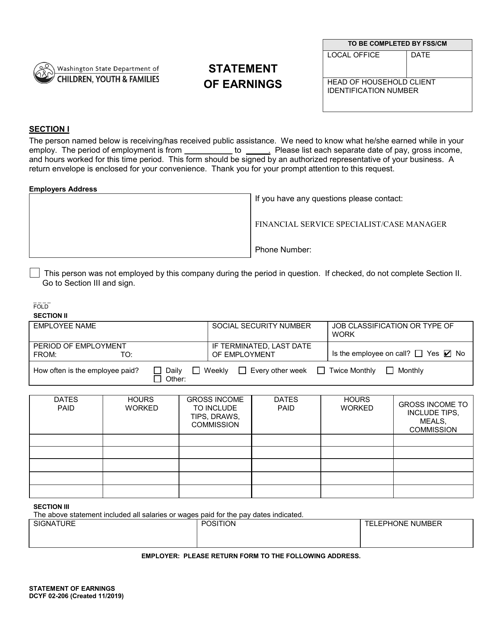

This form is used for reporting earnings in Washington State as part of the DCYF program. It is required to provide accurate financial information for the determination of benefits.

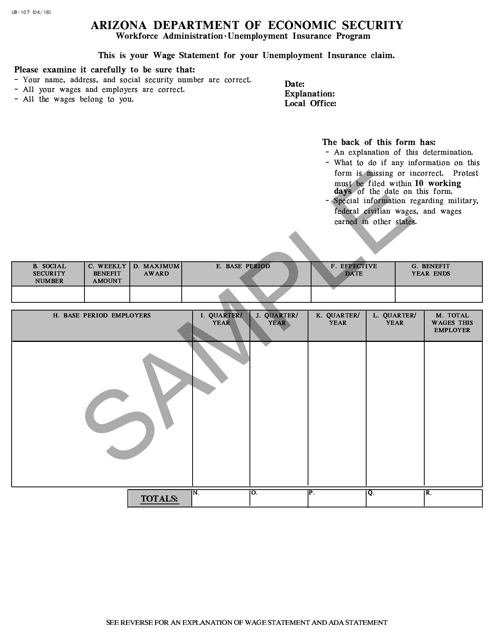

This form is used for reporting an employee's wages in the state of Arizona. It includes information such as the employee's name, Social Security number, and total wages earned during a specific period of time.

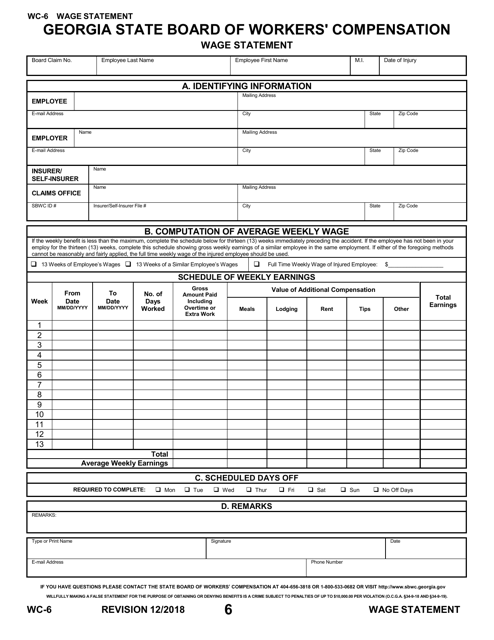

This Form is used for submitting wage statements in the state of Georgia, United States. It is necessary for employers to provide this document to their employees to report the wages earned during a specific period.

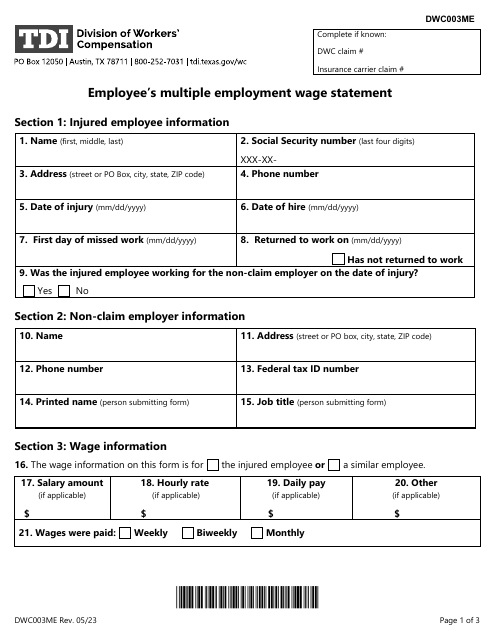

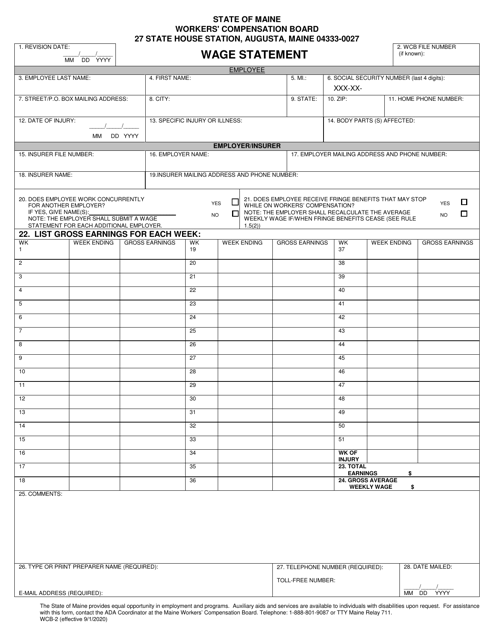

This form is used for reporting wage information in the state of Maine.

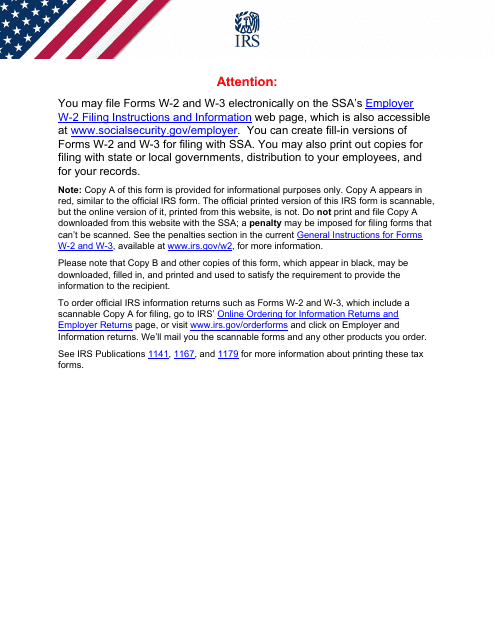

If you are an employer and have to file Form W-2, Wage and Tax Statement, you need to fill out this form. This form is needed for transmitting a paper Copy A of Form W-2, to the SSA. Make sure you supply your employees with a copy of Form W-2.

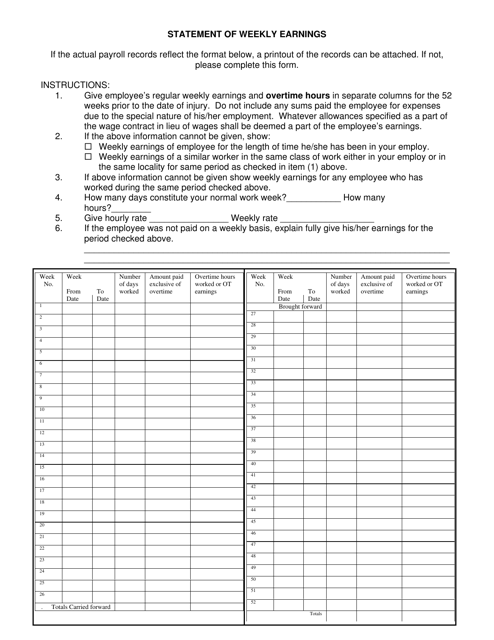

This document calculates and keeps track of the weekly earnings in South Dakota.

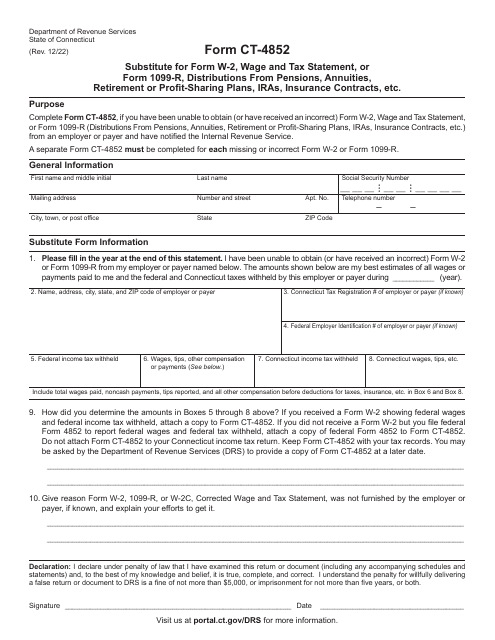

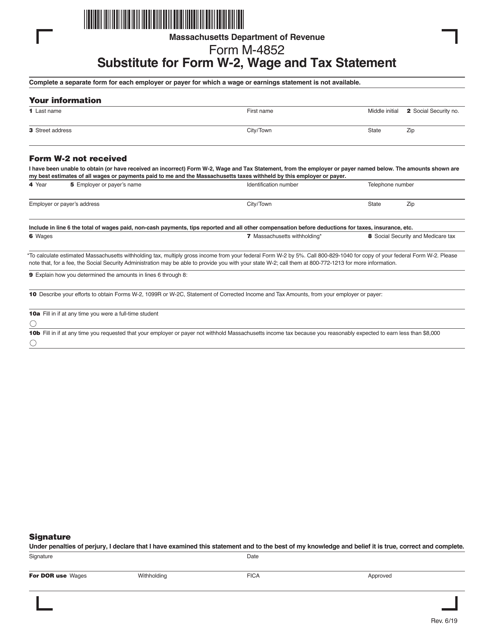

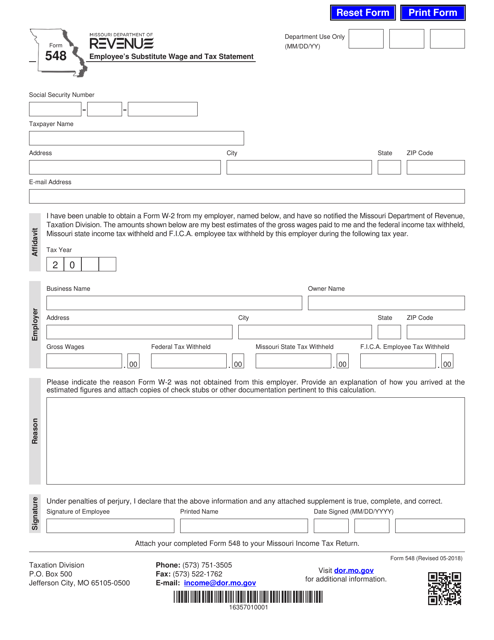

This form is used for reporting substitute wage and tax information for employees in Missouri.

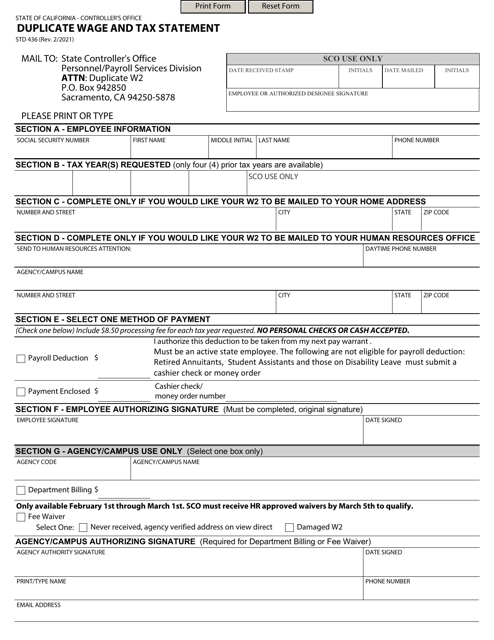

This form is used for requesting a duplicate copy of your wage and tax statement in California.