Non Resident Tax Form Templates

Documents:

31

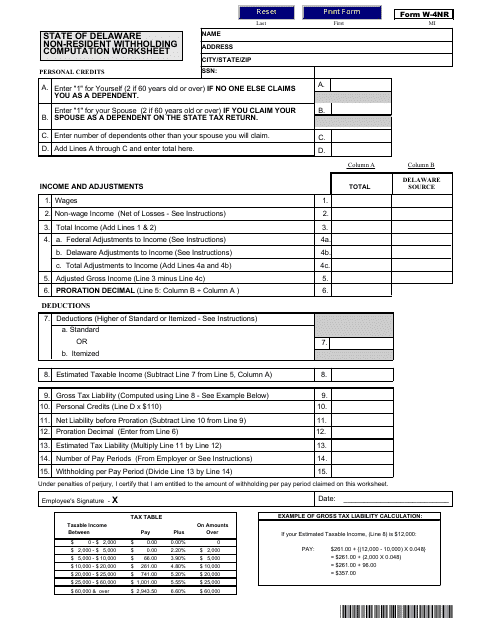

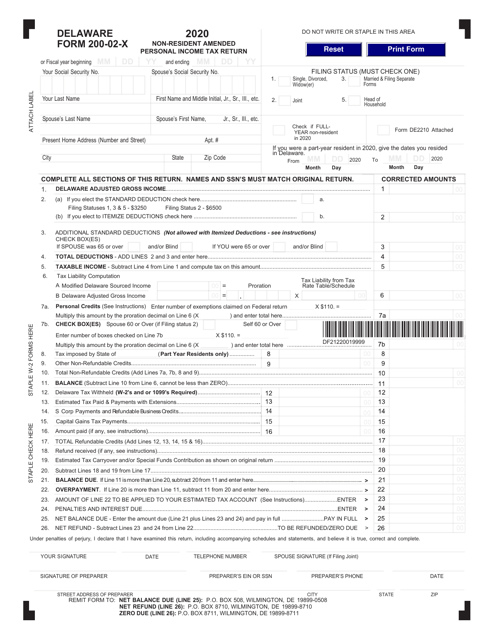

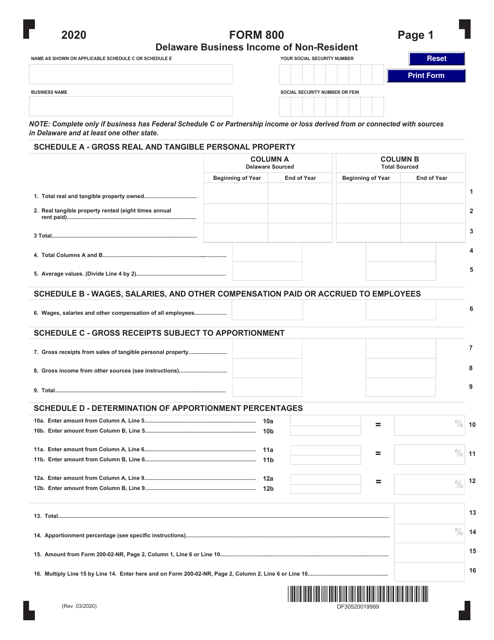

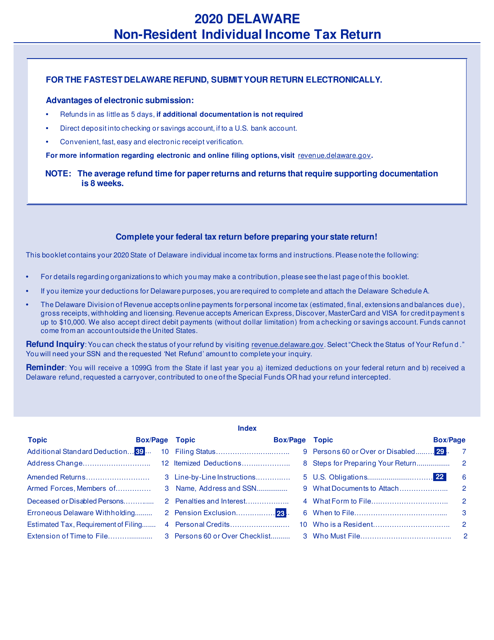

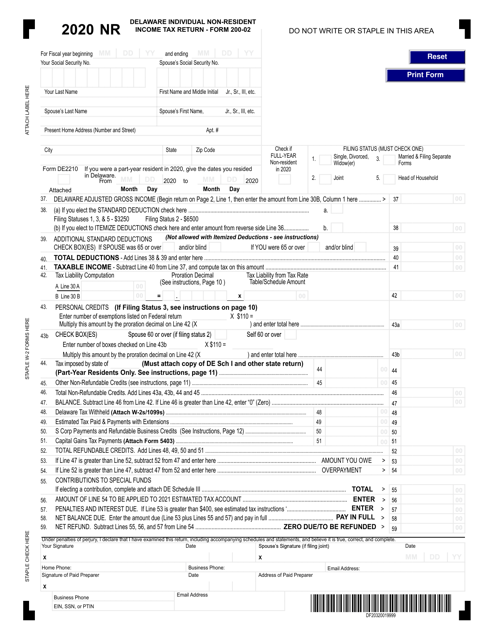

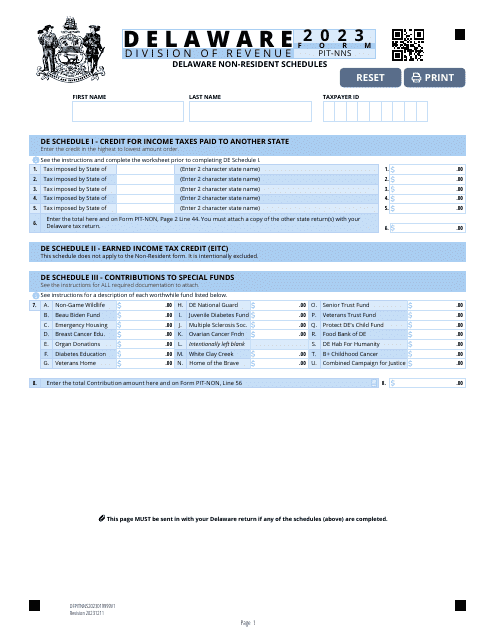

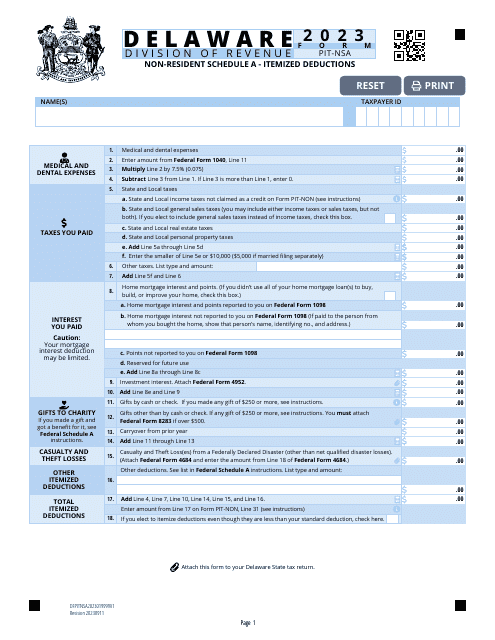

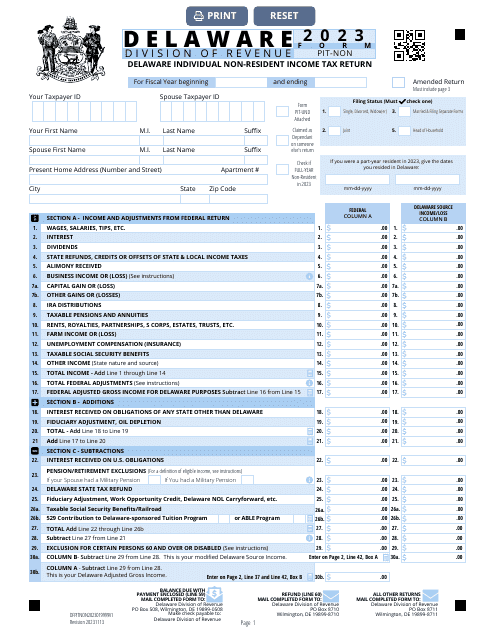

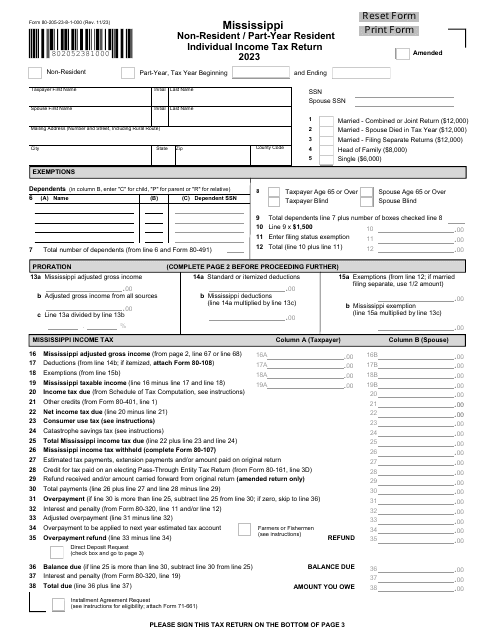

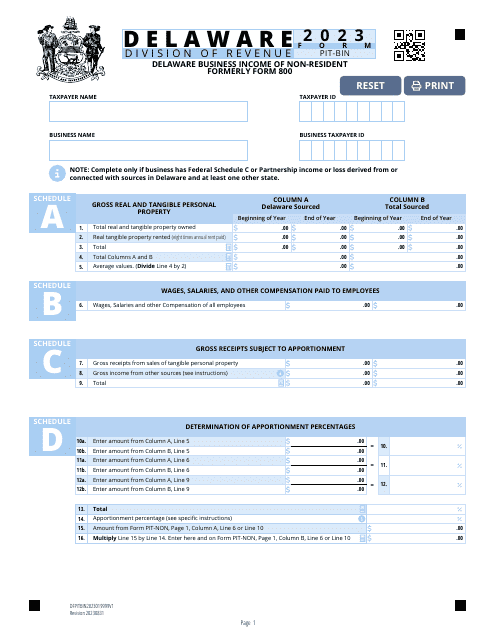

This form is used for calculating withholding taxes for non-resident taxpayers in Delaware.

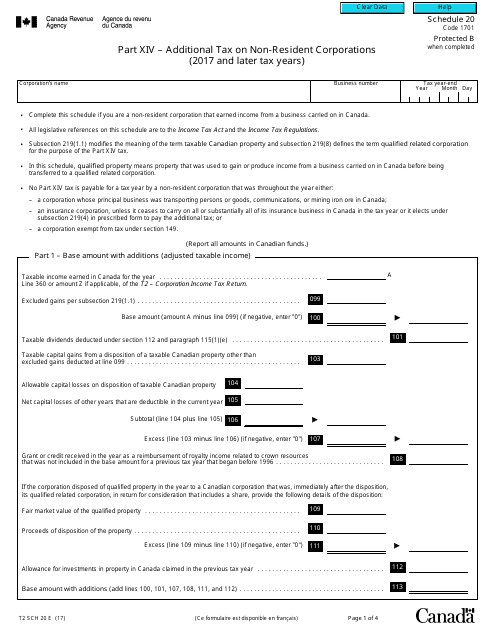

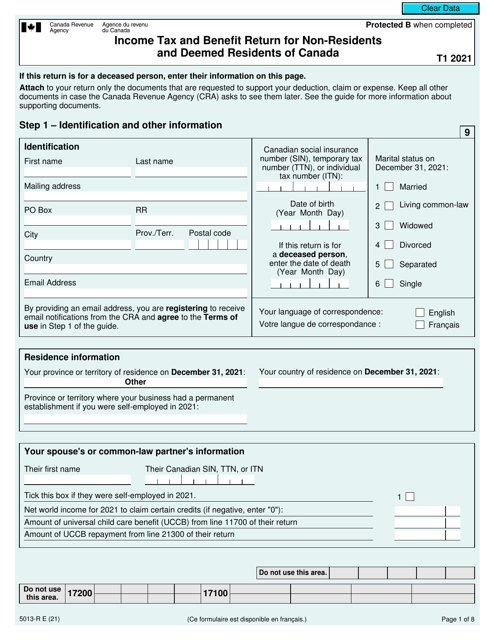

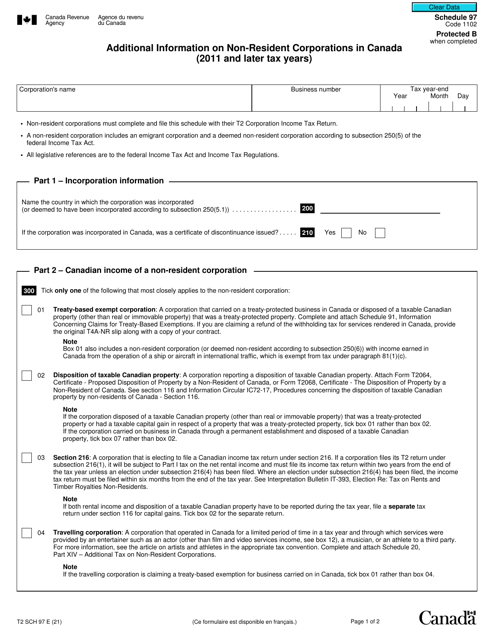

This document is a tax form used in Canada for non-resident corporations to report and calculate additional taxes for the 2017 and later tax years.

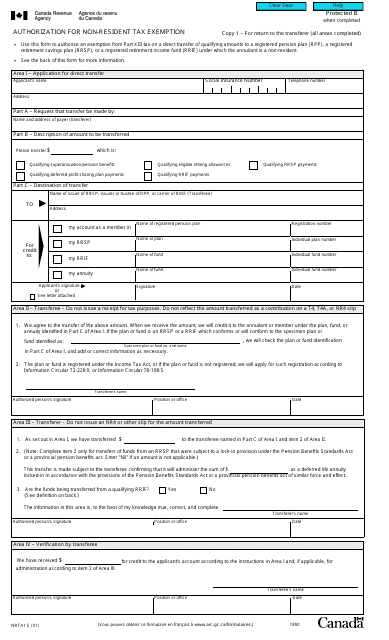

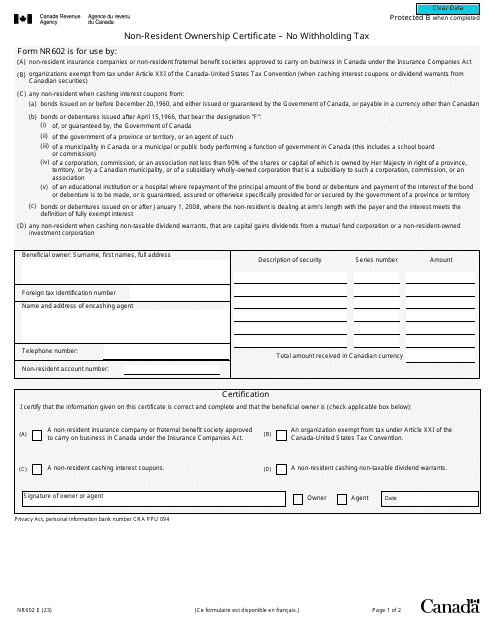

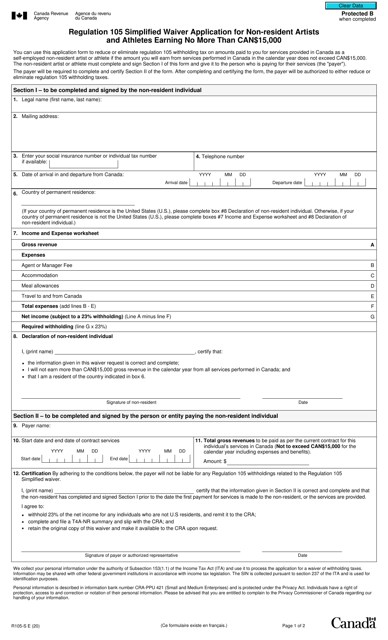

This form is used for non-residents to request a tax exemption in Canada. It authorizes the individual to be exempt from certain taxes typically paid by residents.

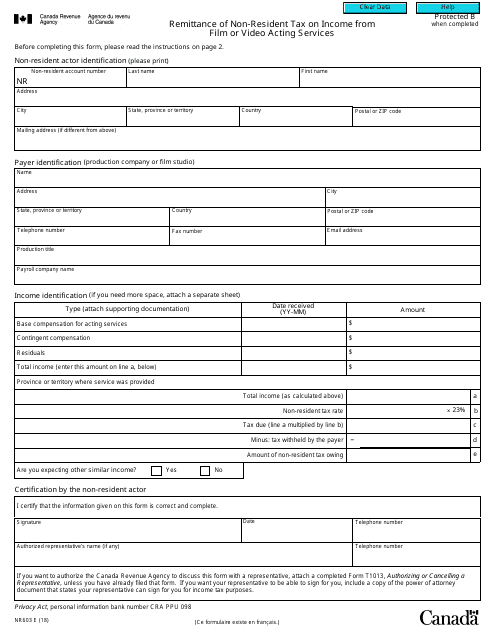

This form is used for Canadian non-residents to remit taxes on income earned from acting services in the film or video industry.

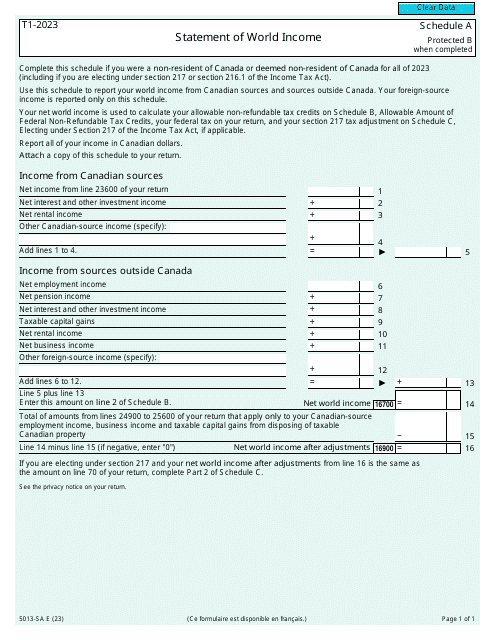

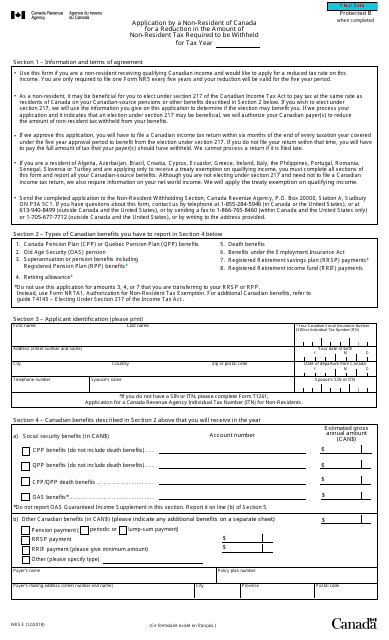

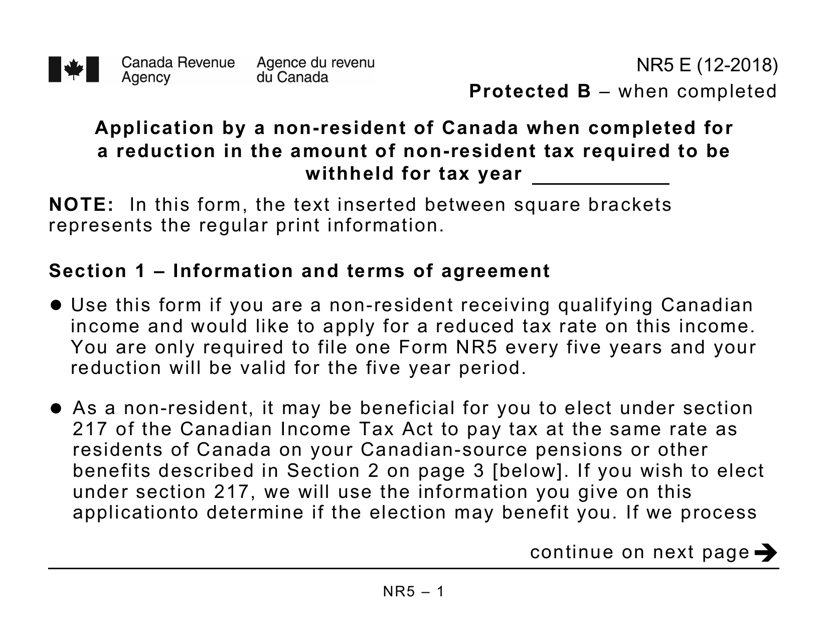

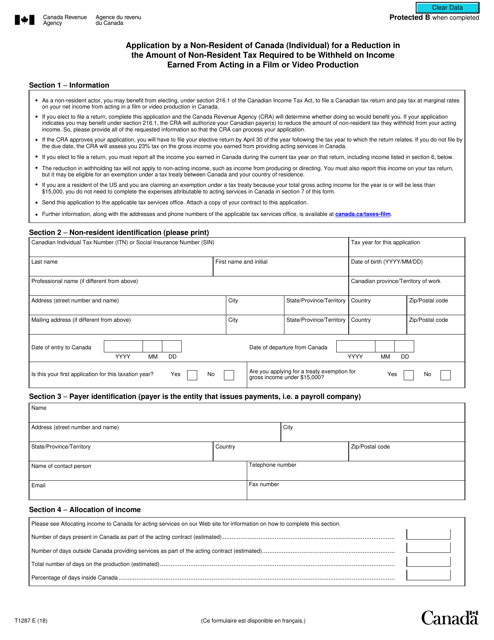

This form is used for non-residents of Canada to apply for a reduction in the amount of non-resident tax that needs to be withheld for the tax year.

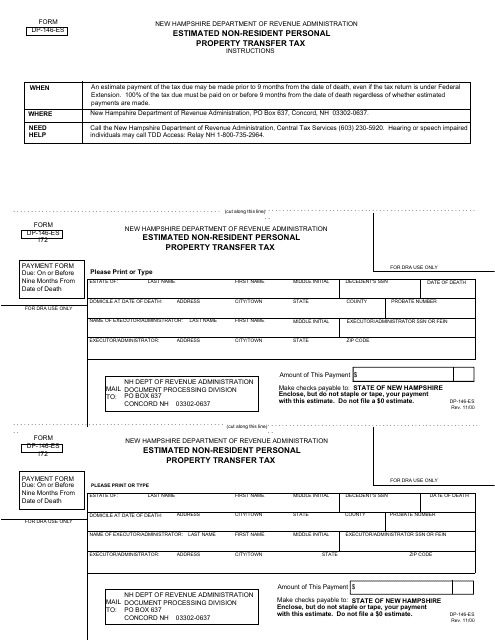

This document is used for estimating the non-resident personal property transfer tax in New Hampshire.

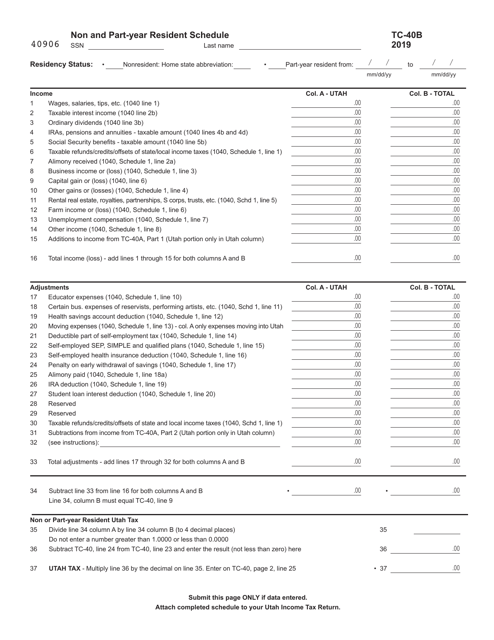

This form is used for non-resident and part-year residents of Utah to report their income and calculate their tax liability.

This document is used for non-residents of Canada to apply for a reduction in the amount of non-resident tax that is required to be withheld. The large print version of the form is available for easier reading.

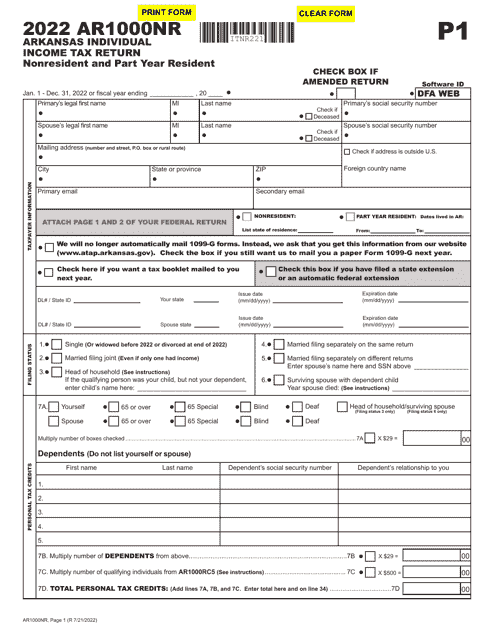

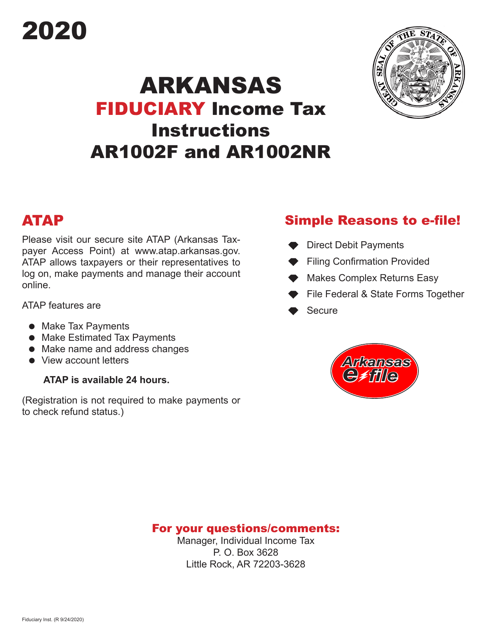

This Form is used for filing Arkansas state income tax returns for foreign individuals and non-resident taxpayers. It provides instructions on how to accurately complete the AR1002F and AR1002NR forms.

This form is used for non-residents of Canada to apply for a reduction in the amount of non-resident tax required to be withheld on income earned from acting in a film or video production in Canada.

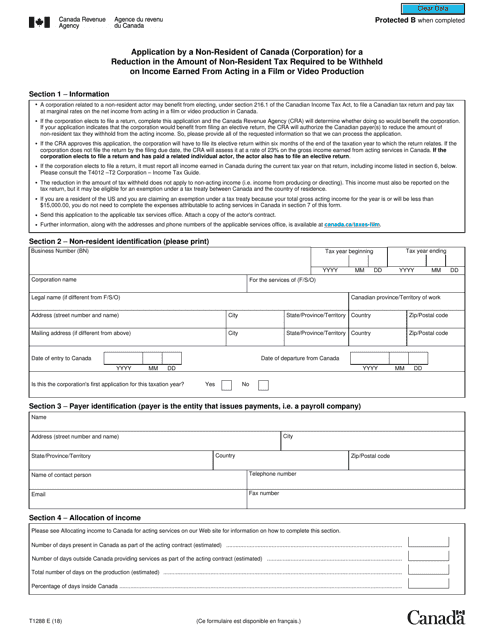

This form is used by non-resident corporations in Canada to apply for a reduction in the amount of non-resident tax that needs to be withheld on income earned from acting in a film or video production.