Free Financial Power of Attorney Forms

What Is a Financial Power of Attorney?

A Financial Power of Attorney is a legally binding instrument that allows one individual (principal) to grant the other person (agent) the authority to act on their behalf in various financial matters. Anyone is entitled to select a legal representative who will manage their finances on a daily basis, for a limited period of time, or in the event of circumstances indicated in writing.

Whether you are letting your spouse sign documents in your name, giving a friend permission to collect the benefits the government offers you, or hiring a lawyer who will guide you in intricate matters like taxation, investments, inheritance, or legal disputes related to money, this document will specify the limits of the authorization, spell out the duties of the agent, and certify your true intention to let the other person make arrangements for you and your financial well-being.

Financial Power of Attorney Forms by State

While as a general rule power of attorney is recognized by authorities, courts, and financial institutions across states, there may be exceptions. If your legal representative shows up in Alaska with a document issued and notarized in Virginia, your documentation may be processed longer because the bank employee might need to check whether the document is up to existing standards and does not contain any provisions at odds with the local legislation. This is why a state-specific Financial Power of Attorney form will be the safest bet whether you are moving between states or your agent comes from a different location - select the suitable template below.

What Does a Financial Power of Attorney Do?

Financial Power of Attorney forms are widely used by individuals that are incapable of monitoring their finances due to their poor health, frequent travel, or temporary absence, prefer to appoint a more knowledgeable person who will help them address the existing issue (a conflict with a bank, submitting tax returns, investments, managing a small business), or want to secure their money in the event of incapacitation.

No matter how much money you have at your disposal, an authorization that prescribes exactly how to deal with your financial affairs is a great idea especially if the choice is not immediately clear. For instance, in the event of a serious illness that does not let you find solutions and make decisions of your own, your relatives may disagree about the future of the company you own - a document that clearly states your wishes regarding the business operations of the organization and the allocation of funds and resources and names the individual who will be in charge of the business will be indispensable in preventing long-term disputes and financial loss.

How to Get a Financial Power of Attorney?

If you are working with a professional lawyer who is willing to represent you in different financial matters, it is likely they will offer you to sign a uniform legal document that authorizes them to make financial decisions in your name. However, if you are planning to authorize a friend or relative to use your credit card to make purchases for you, invest your funds in stocks, or manage your benefits, it should not be a challenge to create your own authorization that appoints an agent. Here is how you need to draft a general Financial Power of Attorney:

-

State the full names of the principal and agent and date the document.

-

Indicate whether the power of attorney comes into force immediately upon signing or it goes into effect only upon the incapacitation of the person that issued it . You should also state when the authorization expires if the issues in question are temporary or you just do not want to sign a power of attorney that will last forever.

-

Include the full list of responsibilities granted to your legal representative . There must be precise limitations put in writing to make sure the person that handles your finances does not exceed their authority. For instance, if you are giving your agent a task to deal with a financial institution negotiating the terms of the mortgage and signing a legal agreement on your behalf, this should be explicitly stated in the form - otherwise, with vague and ambiguous wording, the document may be interpreted differently and the individual in charge of your finances may choose to put their signature on a different contract you were not asking for.

-

It is necessary to obtain a notary seal for your Financial Power of Attorney . Book an appointment with a local notary public who will certify your identities, confirm the authorization is not issued under duress or false pretenses, and witness you signing the papers. This will give the document an extra level of protection since notarized documents are traditionally considered more secure in the eyes of the general public and various financial institutions.

Haven't found the template you're looking for? Take a look at the related templates below:

Documents:

50

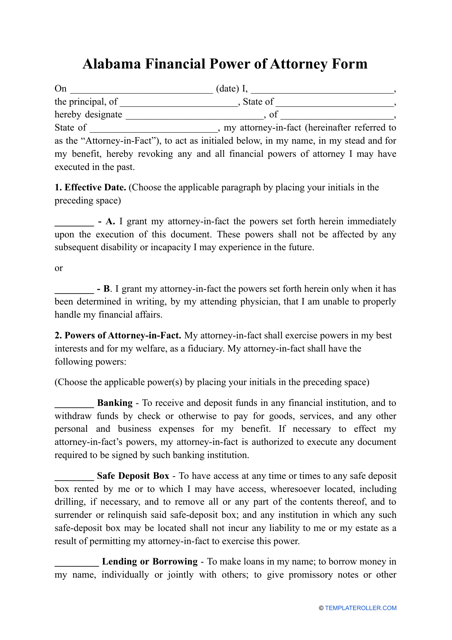

This form is used for granting someone the authority to make financial decisions on your behalf in the state of Alabama.

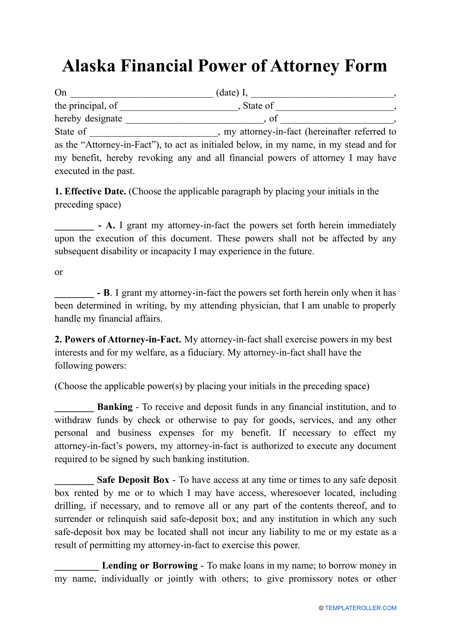

This document grants someone the power to handle your financial matters on your behalf in the state of Alaska.

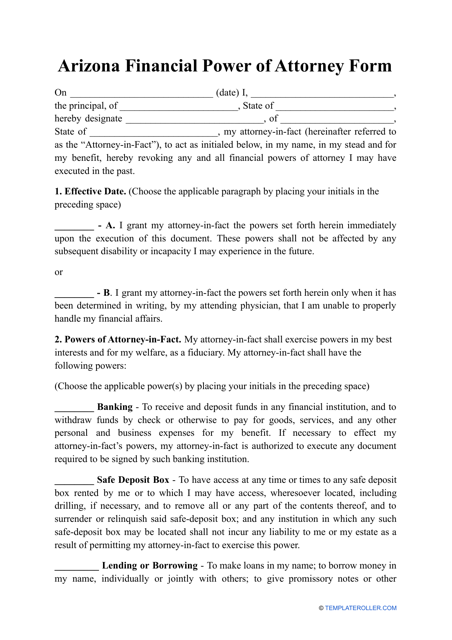

This Form is used for granting someone the authority to manage your financial affairs in Arizona.

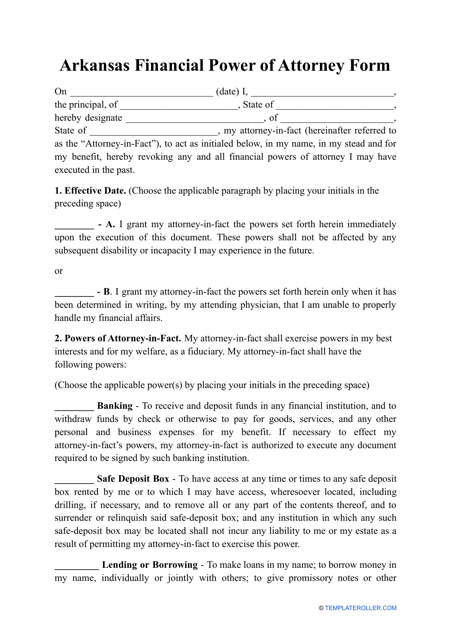

This document grants someone the authority to make financial decisions on your behalf in Arkansas.

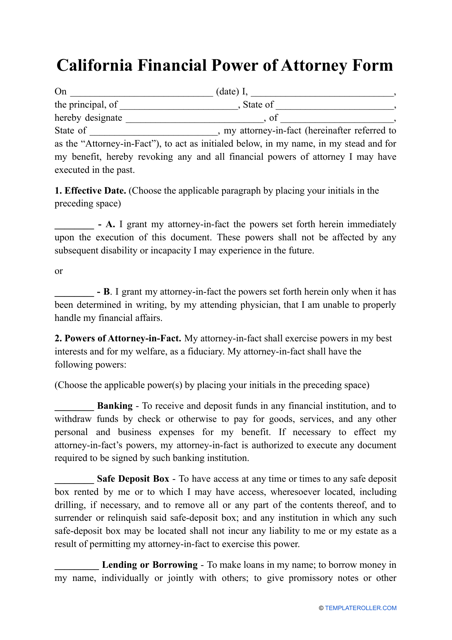

This document grants someone the power to make financial decisions on behalf of another person in the state of California.

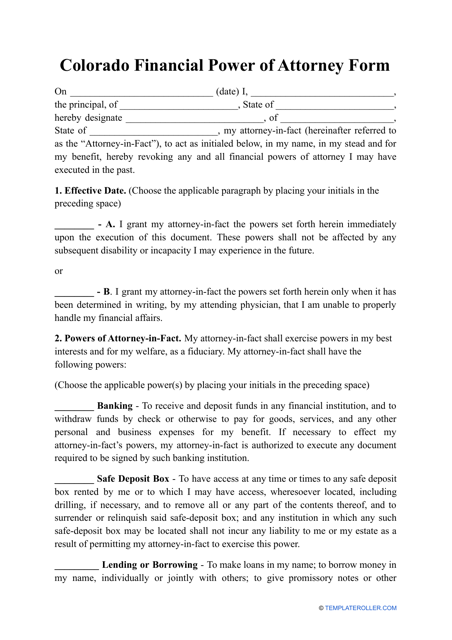

This document grants someone the authority to handle your financial affairs in Colorado.

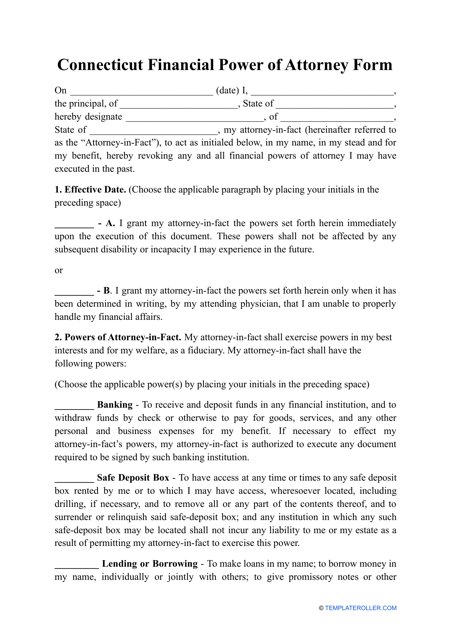

This Form is used for granting someone the authority to handle financial matters on your behalf in the state of Connecticut.

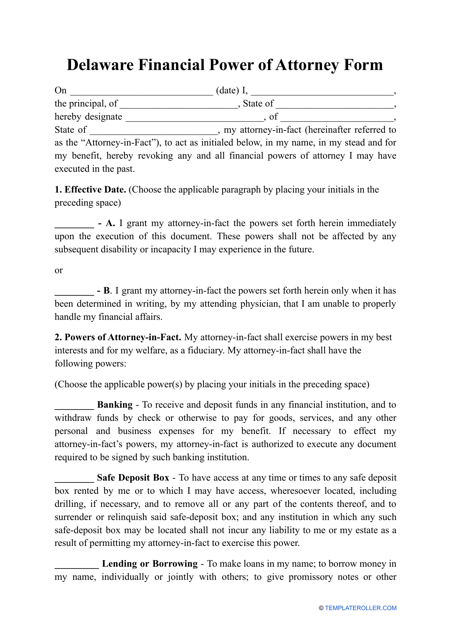

This form is used for granting someone the authority to manage your financial affairs and make decisions on your behalf in the state of Delaware.

This form is used for granting someone the power to make financial decisions on your behalf in the state of Florida.

This document allows someone to make financial decisions on your behalf in Georgia.

This document grants someone the authority to handle your financial affairs in Hawaii when you are unable to do so yourself.

This document grants someone the authority to make financial decisions on your behalf in Idaho.

This document allows someone to make financial decisions on your behalf in Illinois.

This Form is used for granting someone the authority to handle your financial matters on your behalf in the state of Indiana.

This Form is used for granting someone the authority to handle financial matters on your behalf in Iowa.

This type of document, the Financial Power of Attorney Form, is used in the state of Kansas to grant someone the authority to make financial decisions on your behalf. It is typically used in situations where you may be unable to make these decisions yourself, such as due to illness or disability.

This document grants someone the authority to make financial decisions on your behalf in Kentucky.

This document authorizes someone to manage your finances in Louisiana when you are unable to do so yourself.

This document grants someone the authority to manage your financial affairs in the state of Maine if you are unable to do so yourself.

This document gives another person the power to make financial decisions on your behalf in the state of Maryland.

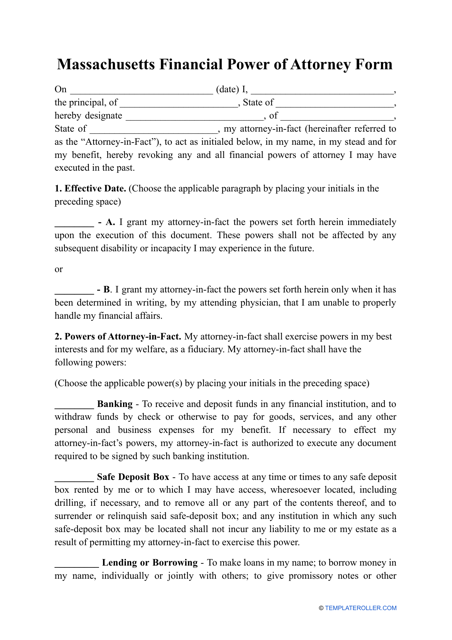

This Form is used for granting someone the authority to make financial decisions on your behalf in Massachusetts.

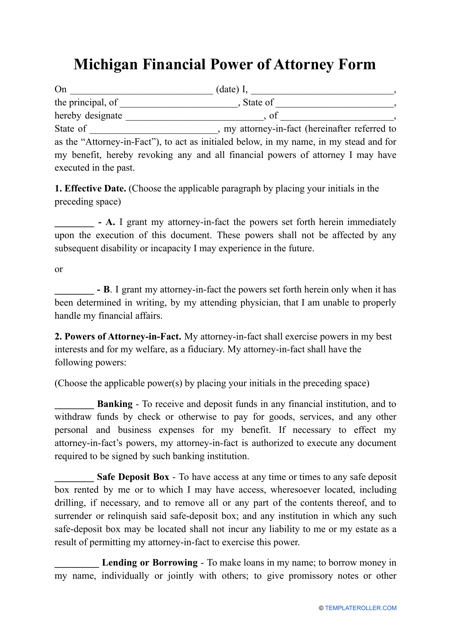

This type of document is used for granting someone the authority to make financial decisions on your behalf in the state of Michigan.

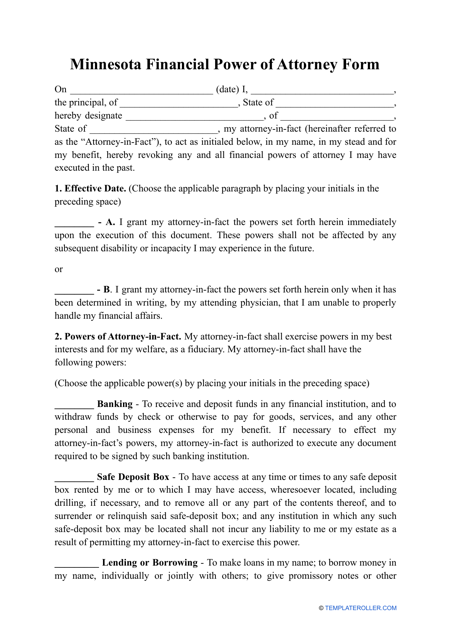

This document is used for appointing a person to handle your financial matters in the state of Minnesota when you are unable to do so yourself.

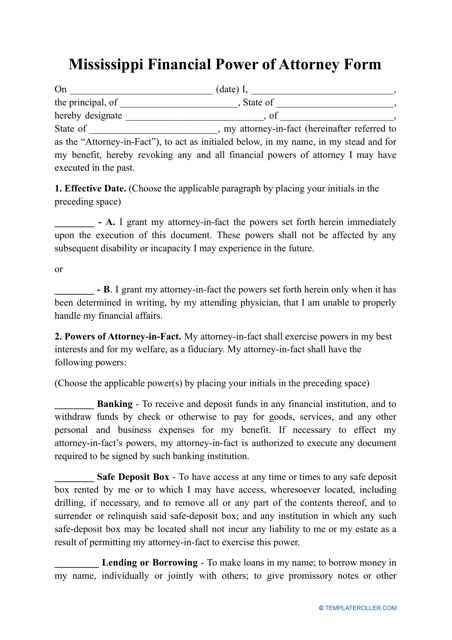

This document gives someone the authority to make financial decisions on behalf of another person in Mississippi.

This document grants someone the authority to manage your financial affairs in Missouri if you are unable to do so.

This document allows someone to appoint another person to handle their financial matters in Montana.

This document grants someone the power to manage your financial affairs in Nebraska if you are unable to do so yourself.

This form is used to grant someone the authority to manage your financial affairs in the state of Nevada.

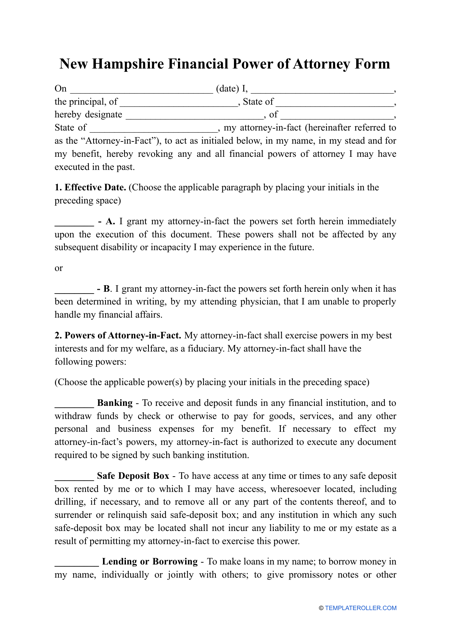

This document allows you to designate someone to handle your financial affairs in the state of New Hampshire.

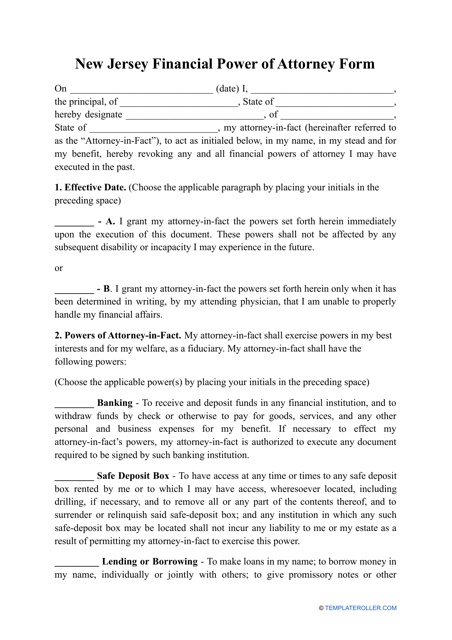

This form is used for granting someone the authority to manage your financial affairs in New Jersey.

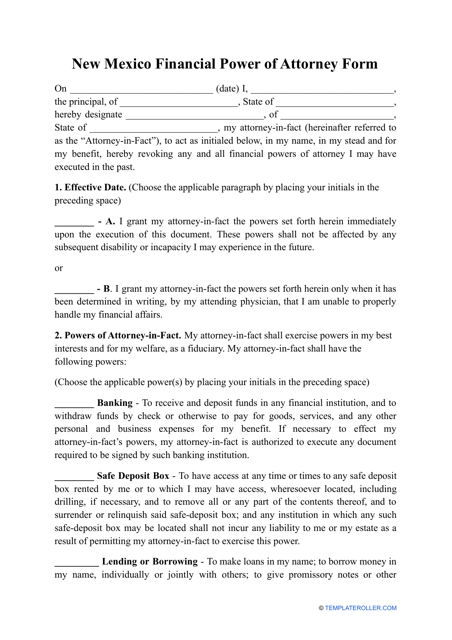

This form is used for granting someone the authority to make financial decisions on behalf of the individual in the state of New Mexico.

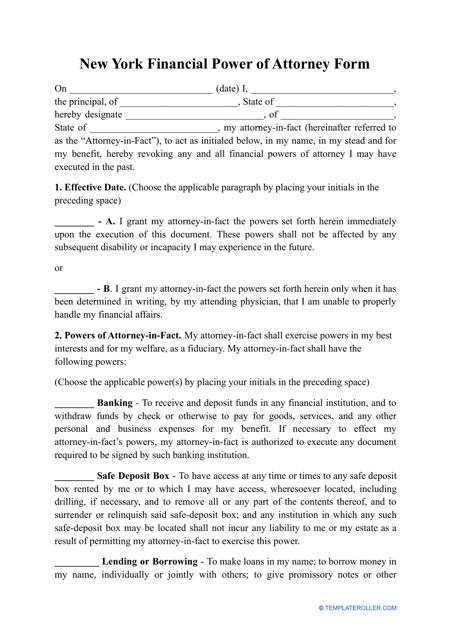

This document grants someone the authority to handle financial matters on behalf of another person in New York.

This document grants someone the authority to handle financial matters on behalf of another person in North Carolina.

This type of document, the Financial Power of Attorney Form, is used specifically for individuals residing in North Dakota. It allows someone to appoint another person to make financial decisions on their behalf in case they become unable to do so themselves.

This document is used to grant someone the authority to make financial decisions on your behalf in the state of Ohio.

This document gives someone the power to handle your finances on your behalf in Oklahoma.

This document grants someone the power to handle your financial affairs in case you become unable to do so yourself.

This form is used for granting someone the power to make financial decisions on your behalf in the state of Pennsylvania.

This document grants someone the power to handle your financial affairs in Rhode Island.

This document grants someone the power to make financial decisions on your behalf in South Carolina.