Tax Payment Form Templates

Documents:

681

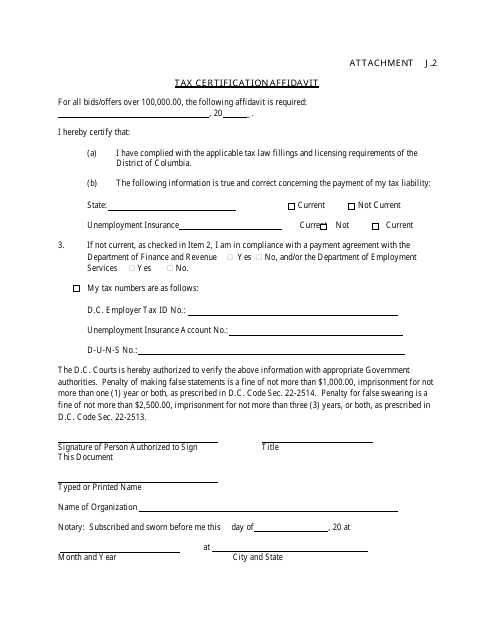

This document is for certifying tax information in Washington, D.C. It is used to confirm details related to tax obligations.

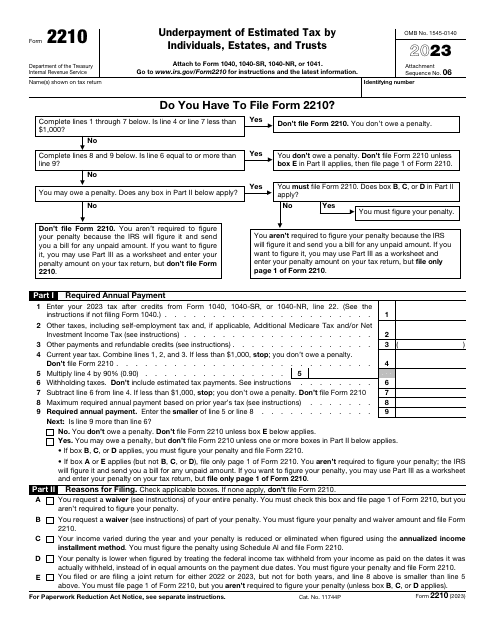

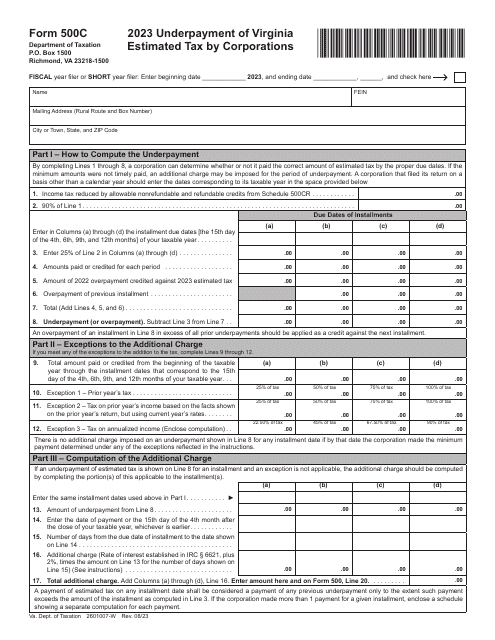

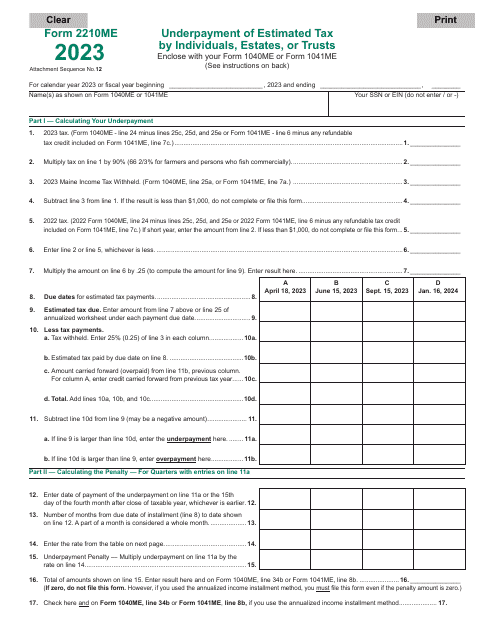

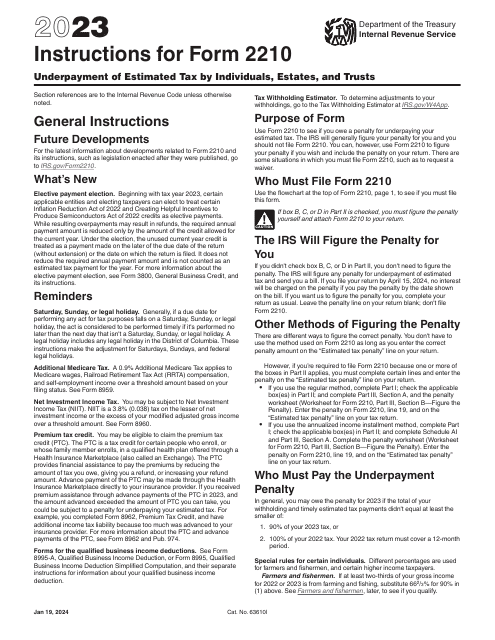

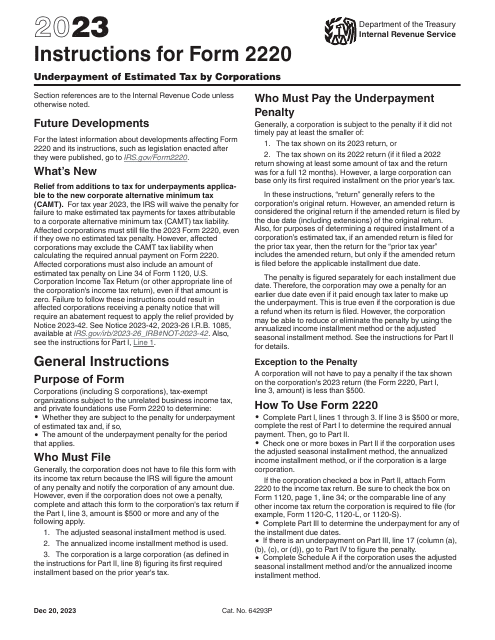

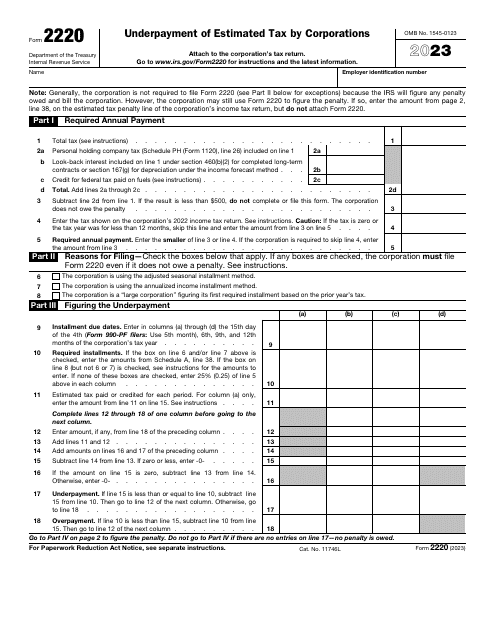

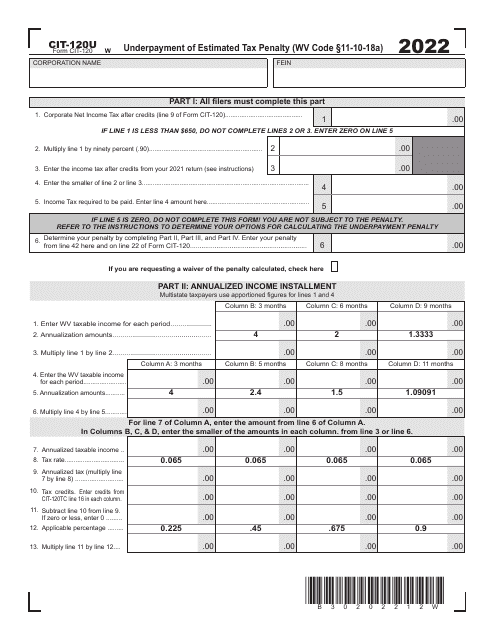

This is a fiscal instrument used by a taxpayer to find out whether they are liable for paying a penalty after underpaying their estimated tax.

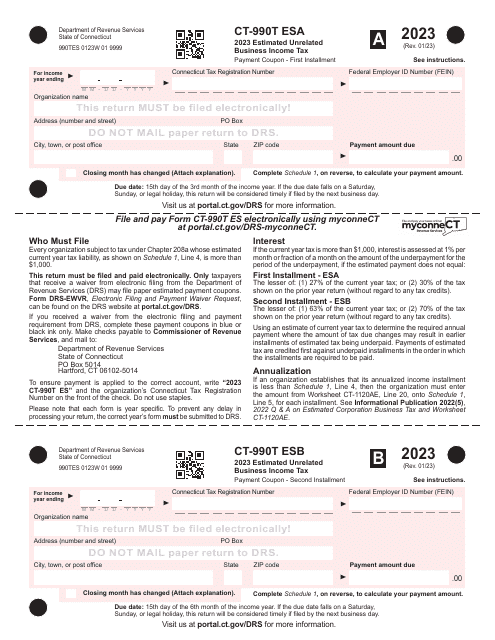

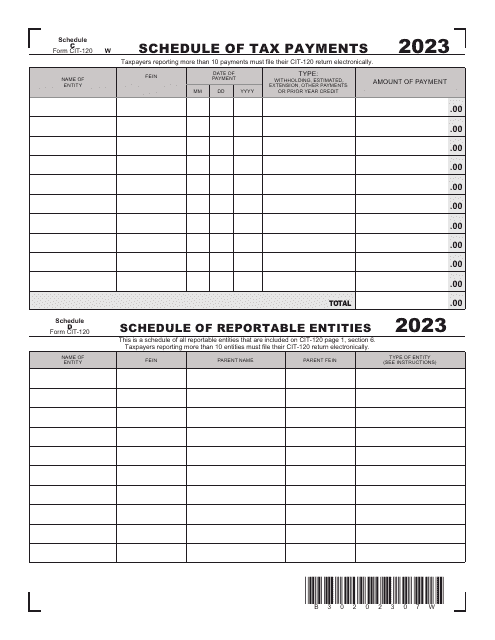

This form is used for making estimated tax payments for unrelated business income tax in Connecticut.

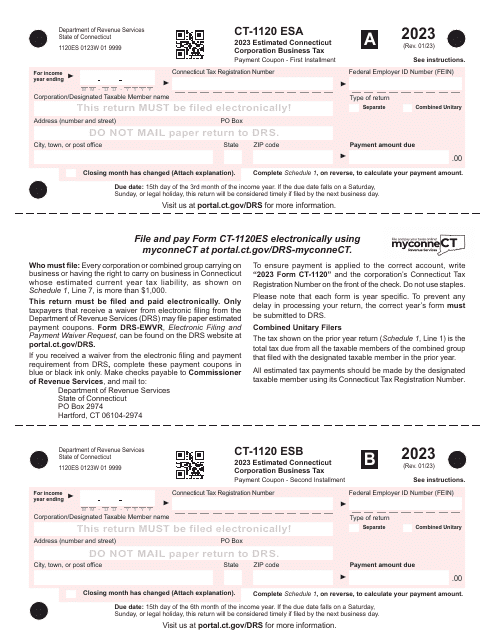

This form is used for making estimated corporation business tax payments in Connecticut.

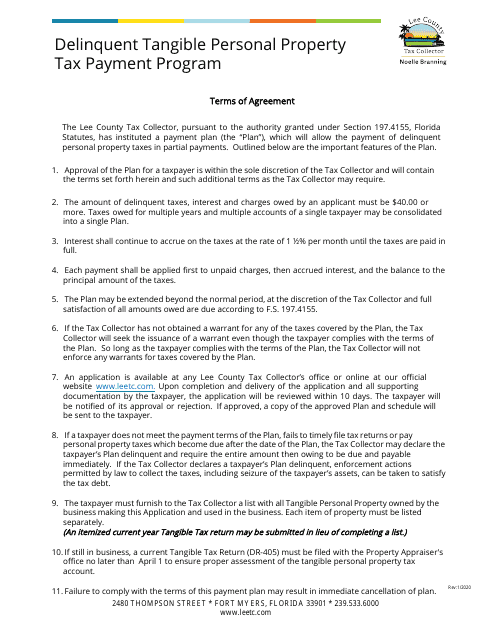

This document is for applying for a payment plan to pay delinquent tangible personal property taxes in Lee County, Florida.

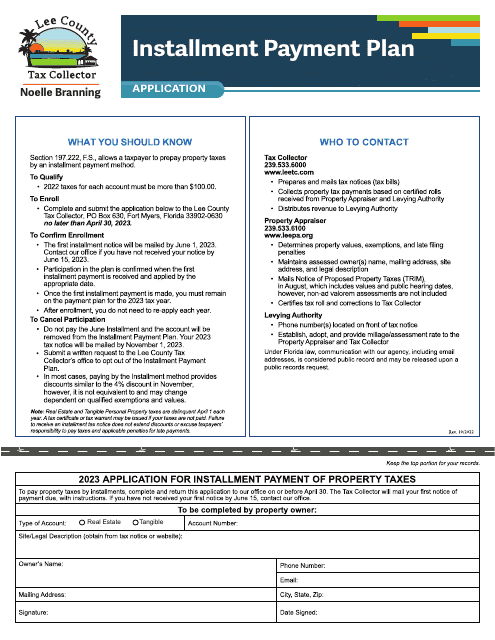

This document is for residents of Lee County, Florida who want to apply for an installment payment plan for their property taxes.

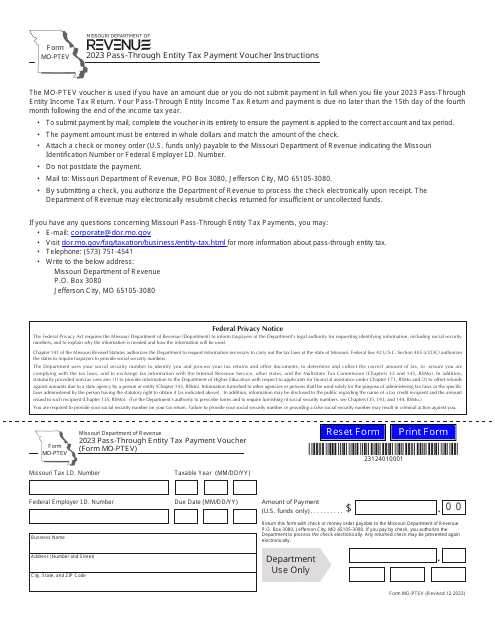

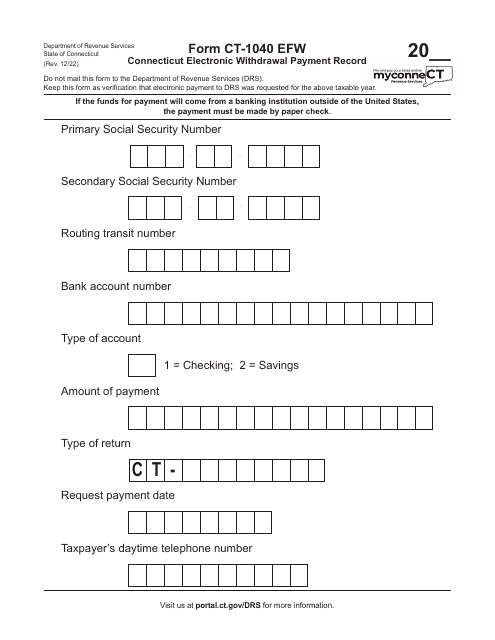

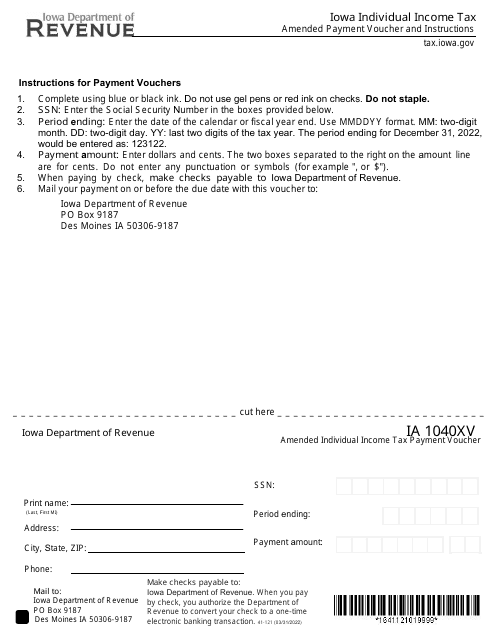

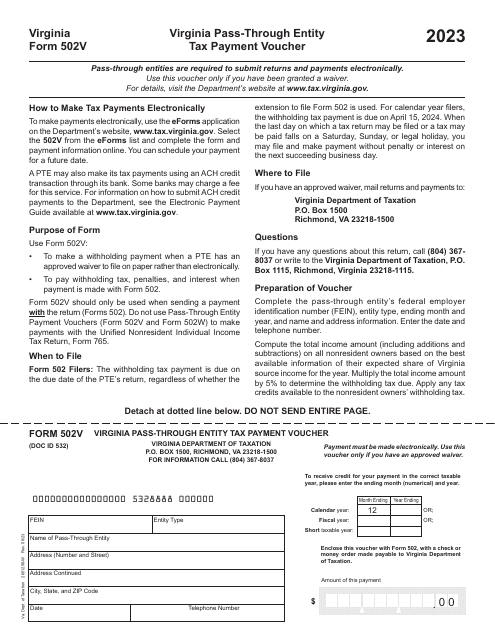

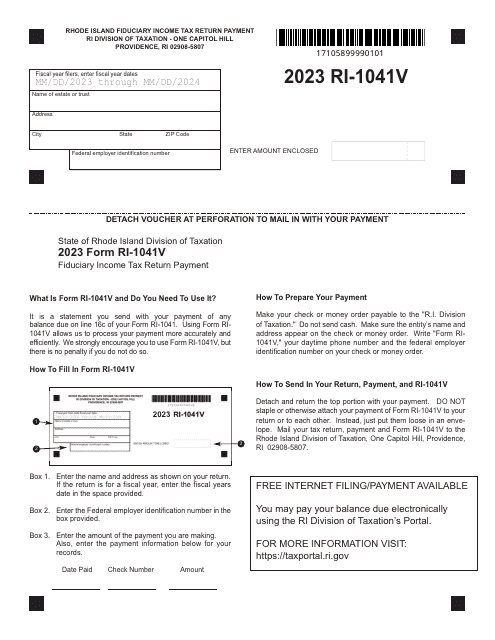

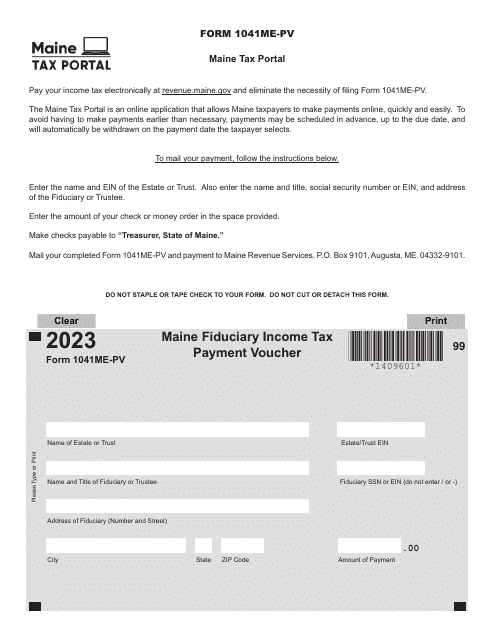

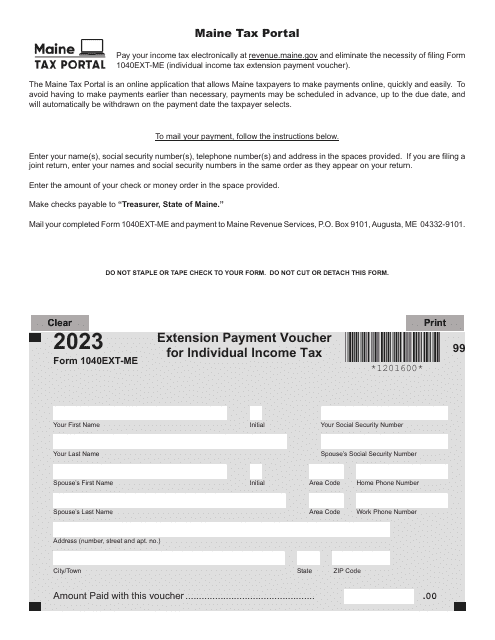

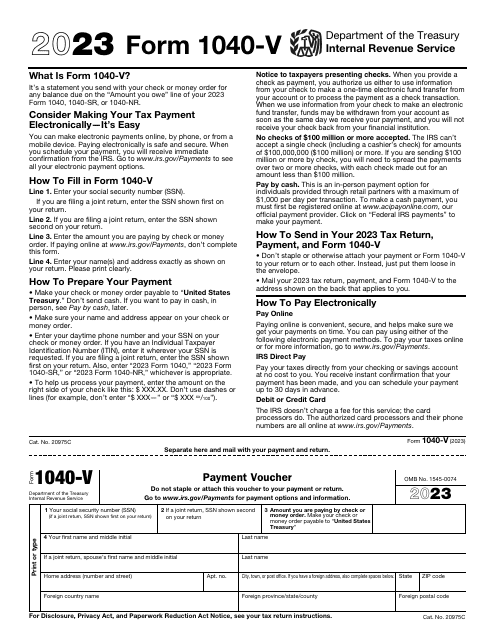

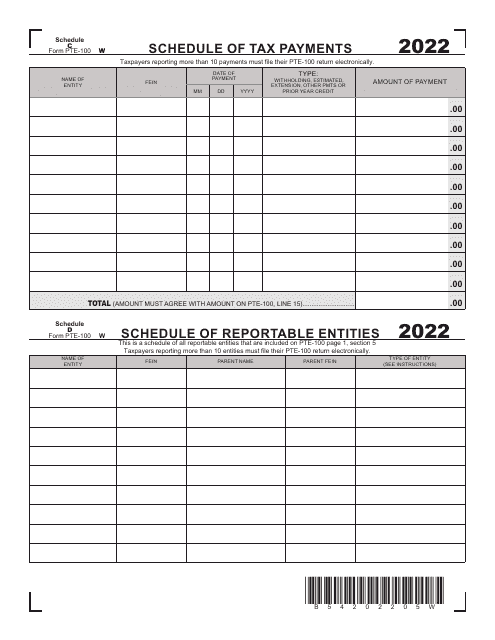

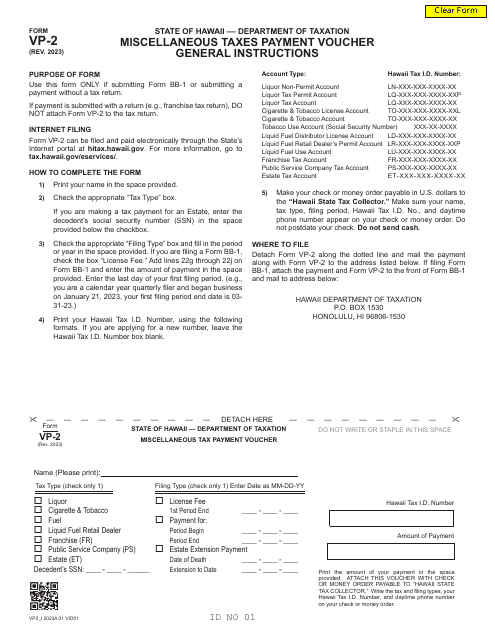

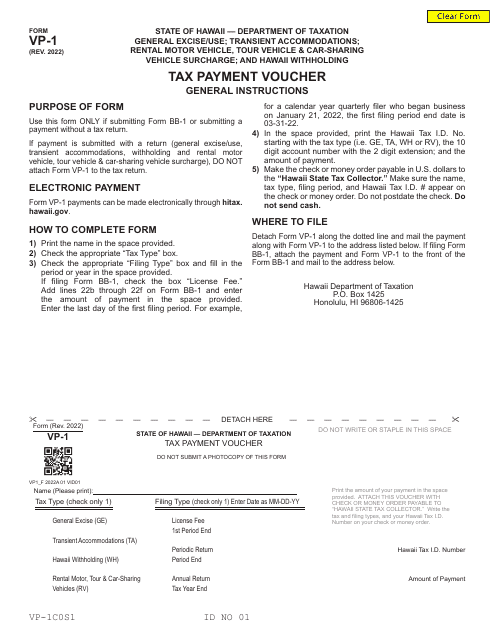

This is a supplementary document completed by taxpayers that chose to fulfill their financial obligations to fiscal organizations with the help of a check or money order.