Tax Rebate Form Templates

Documents:

22

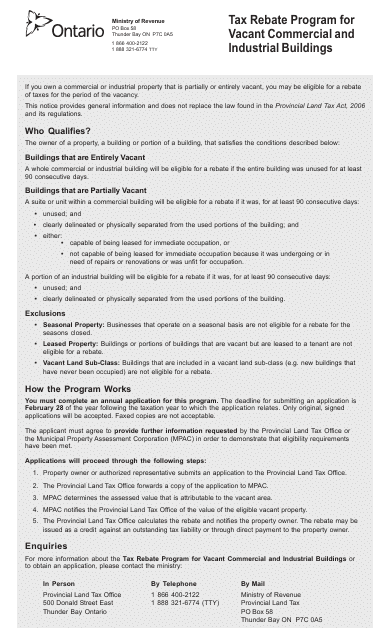

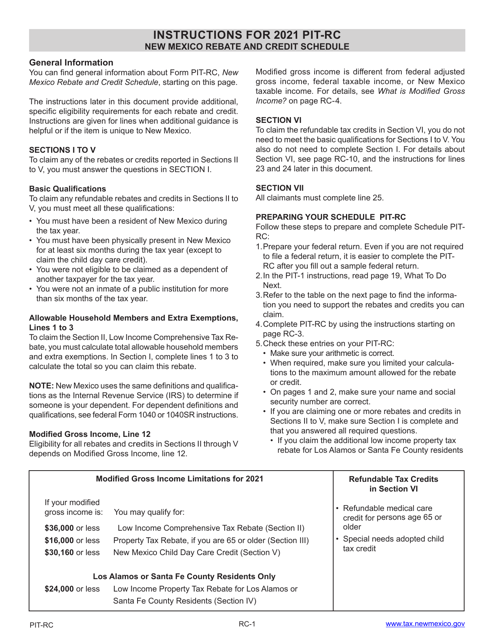

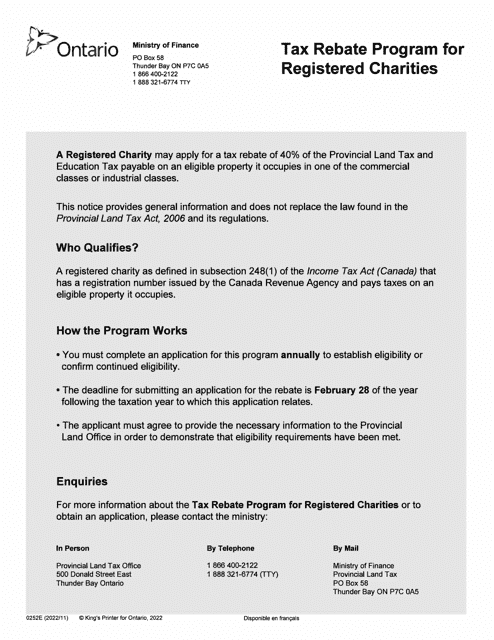

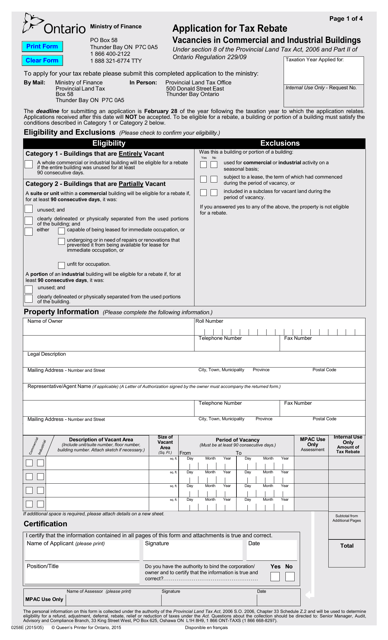

This document is an application for tax rebates available for vacant commercial and industrial buildings under Section 8 of the Provincial Land Tax Act in Ontario, Canada.

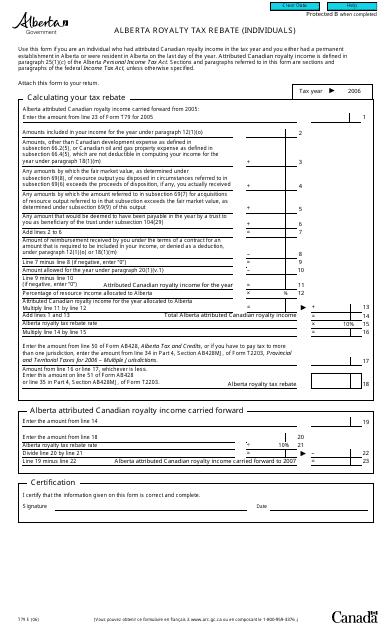

This form is used for individuals in Alberta, Canada to apply for a royalty tax rebate. It allows eligible individuals to claim a refund on the taxes paid on royalties received.

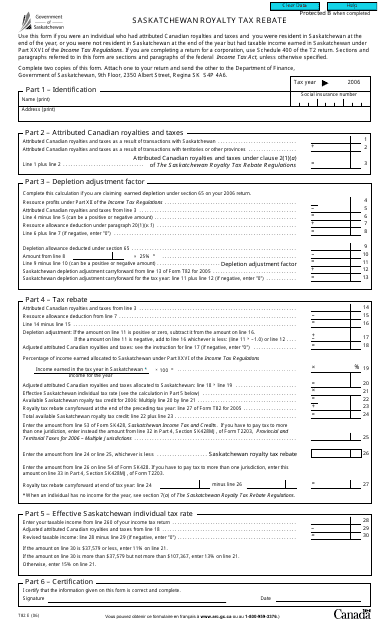

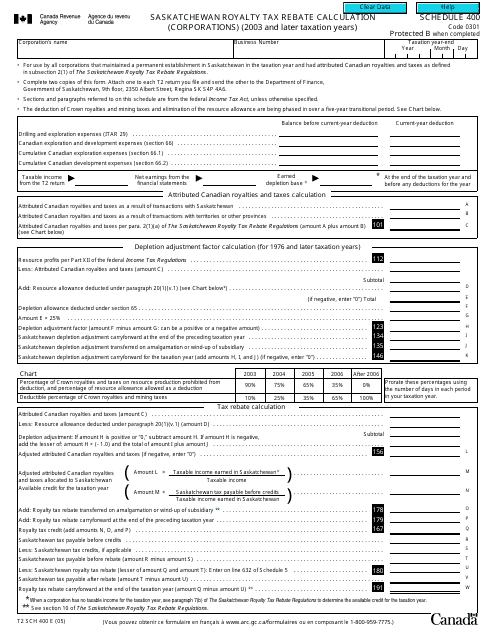

This form is used for applying for the Saskatchewan Royalty Tax Rebate in Saskatchewan, Canada. It allows individuals or businesses to claim back a portion of the royalties paid on certain types of resource extraction. The rebate is meant to encourage economic development and investment in the province.

This form is used for calculating the Saskatchewan royalty tax rebate for corporations in Canada for the taxation years 2003 and later.

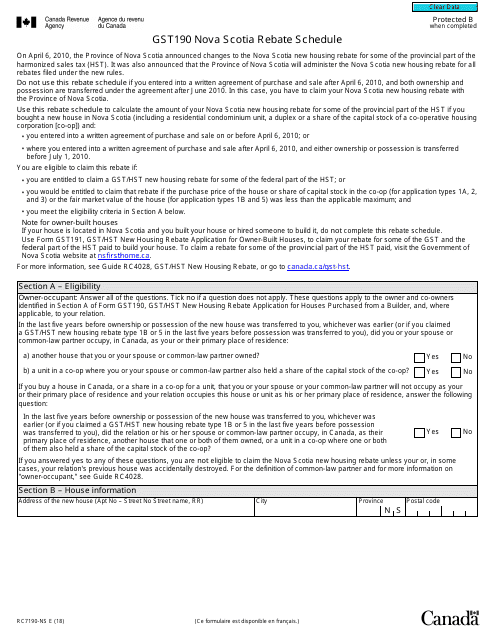

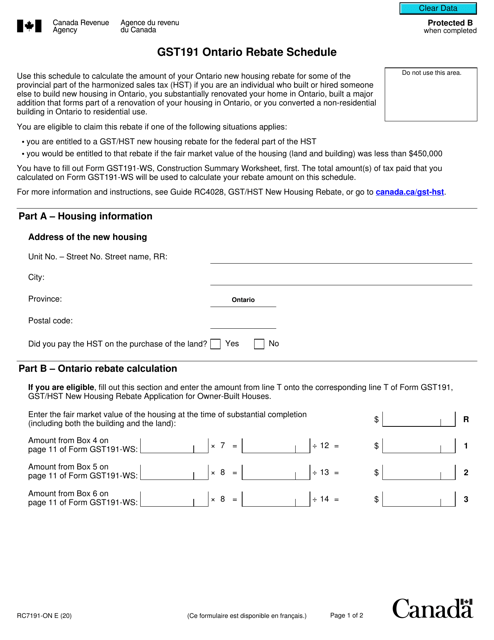

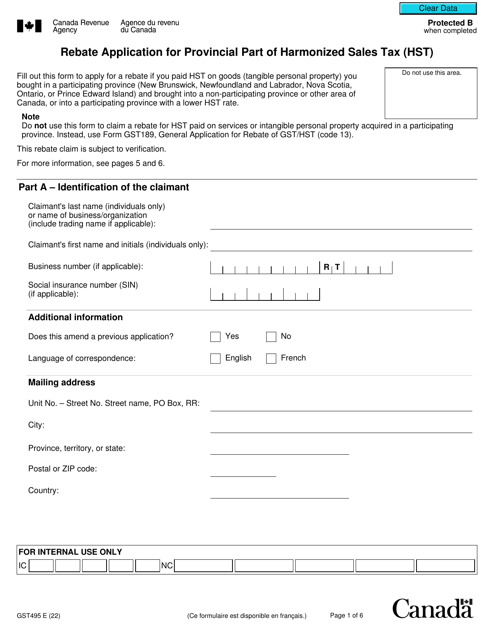

This form is used for claiming the Nova Scotia GST/HST rebate in Canada.

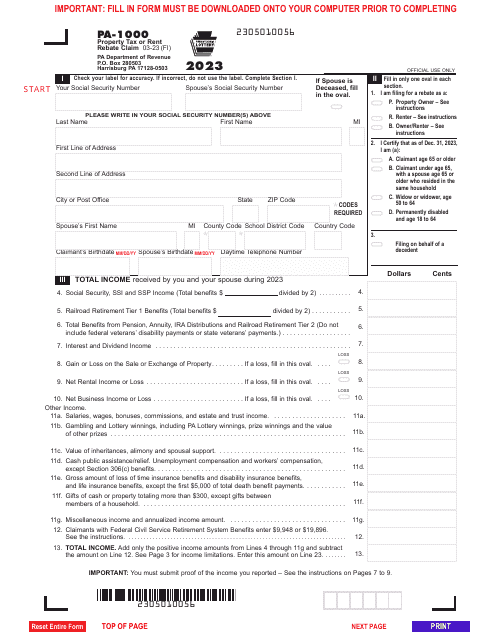

Pennsylvania residents may fill in this legal document if they wish to get a refund for a portion of rent or property tax paid on their residence.

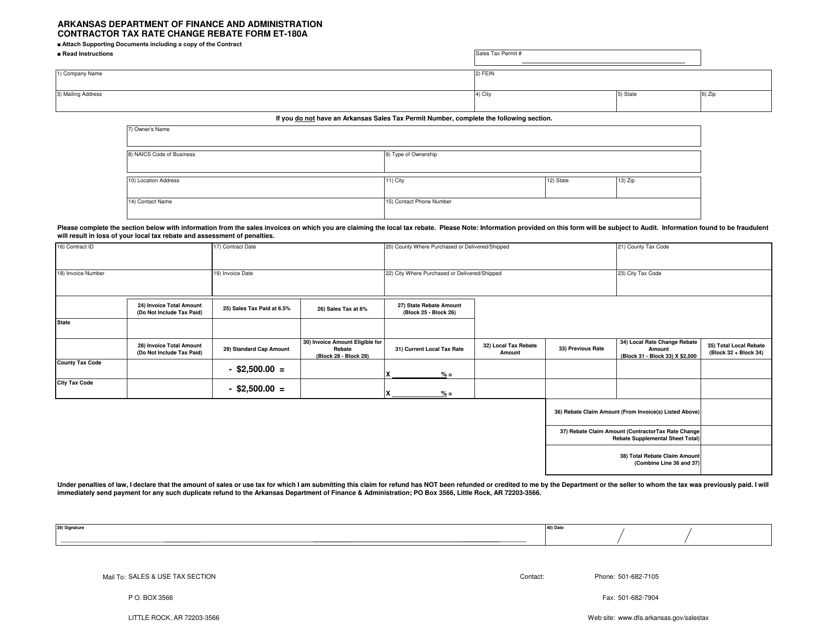

This form is used for contractors in Arkansas to apply for a rebate on tax rate changes.

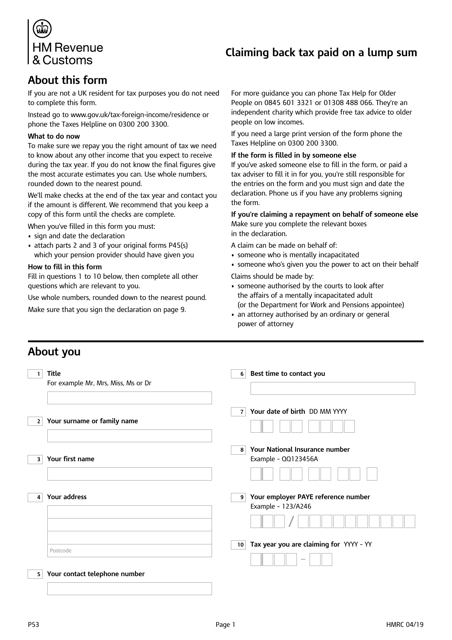

Individuals that reside in the United Kingdom may use this form when they want to claim back tax the government owes them on a lump sum they have obtained.

This form is used for applying for tax rebates on vacancies in commercial and industrial buildings in Ontario, Canada.

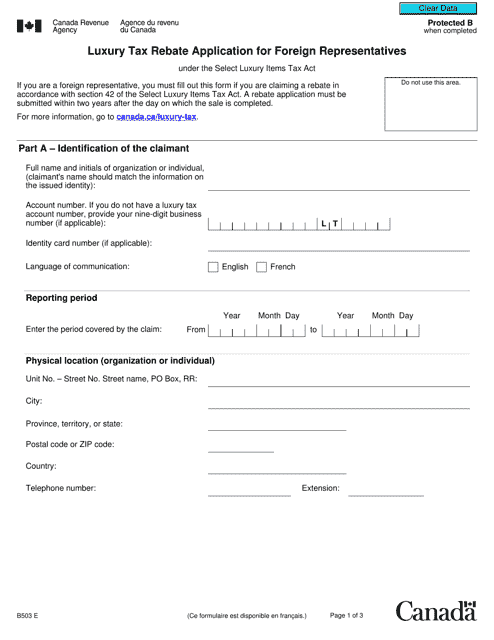

This form is used for foreign representatives in Canada to apply for a luxury tax rebate.