Transfer Tax Form Templates

Documents:

66

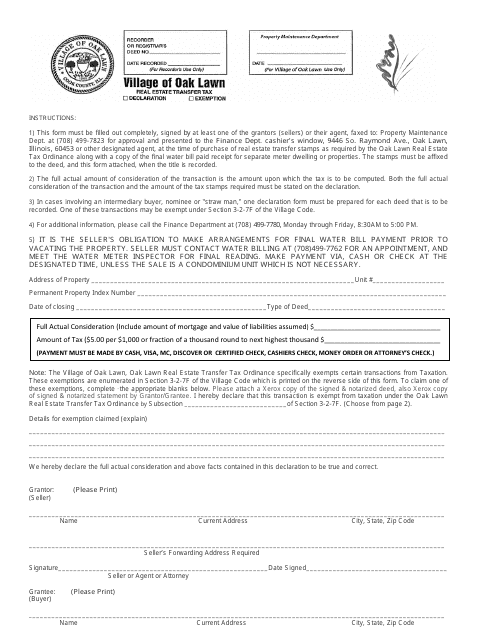

This form is used for reporting and paying the real estate transfer tax in Oak Lawn, Illinois. The tax is levied on the transfer of real property within the city limits.

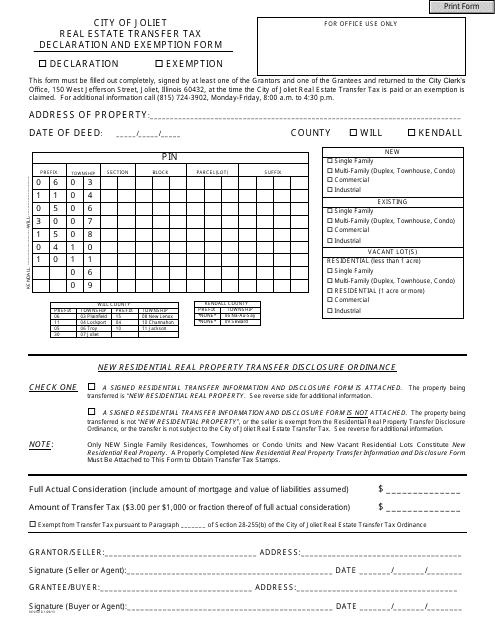

This document is used for declaring and seeking exemptions from real estate transfer taxes in the City of Joliet, Illinois.

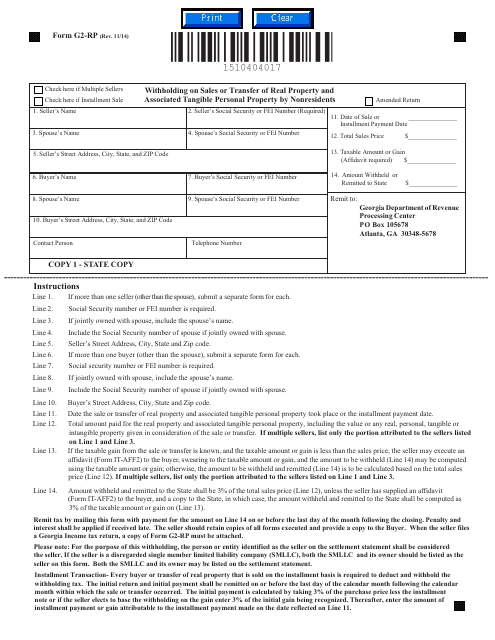

This form is used for reporting and withholding taxes on the sale or transfer of real property and associated tangible personal property by nonresidents in the state of Georgia, United States.

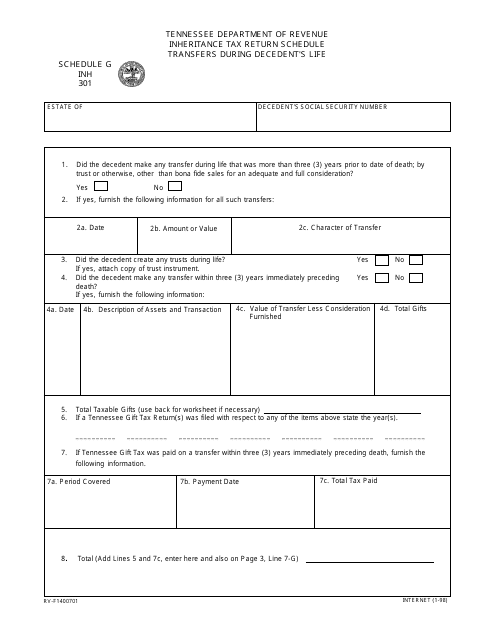

This form is used for reporting transfers made by the deceased person during their lifetime for the purpose of calculating inheritance tax in Tennessee.

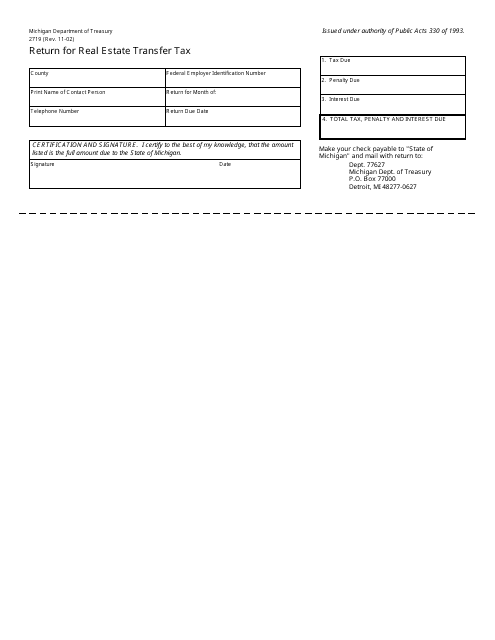

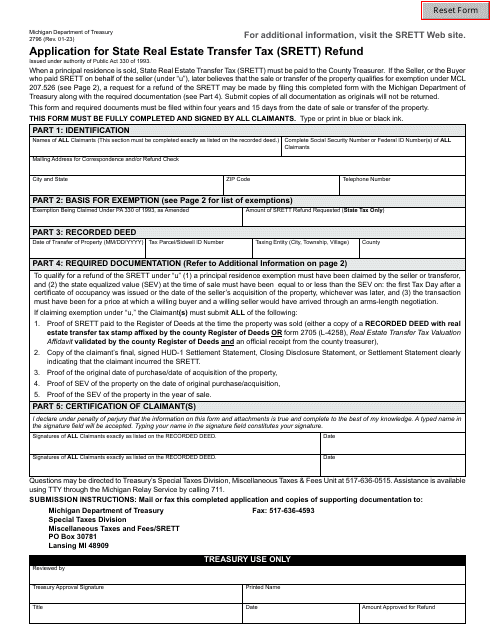

This form is used for reporting and paying the real estate transfer tax in the state of Michigan. It is required when a property is sold or transferred.

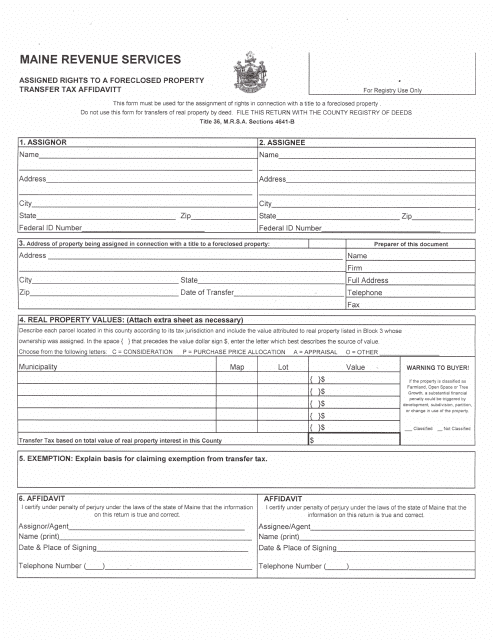

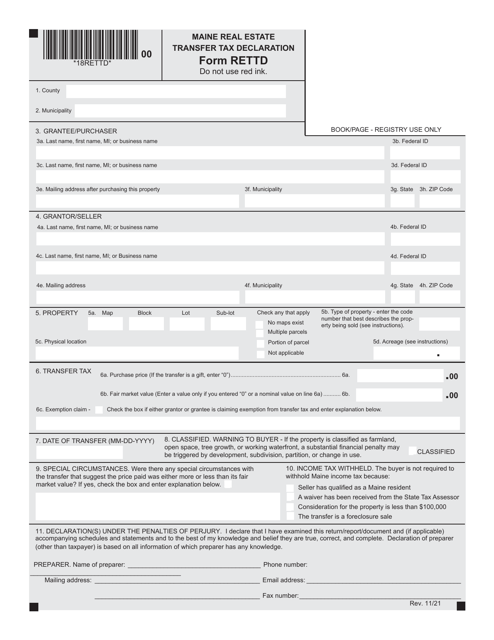

This document is used for transferring the rights to a foreclosed property and paying the transfer tax in the state of Maine.

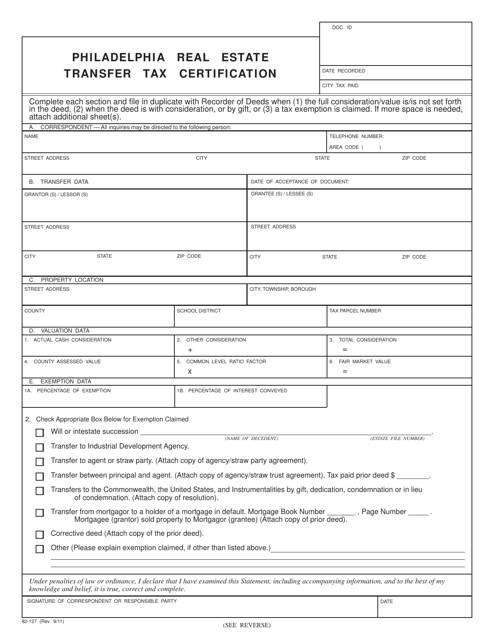

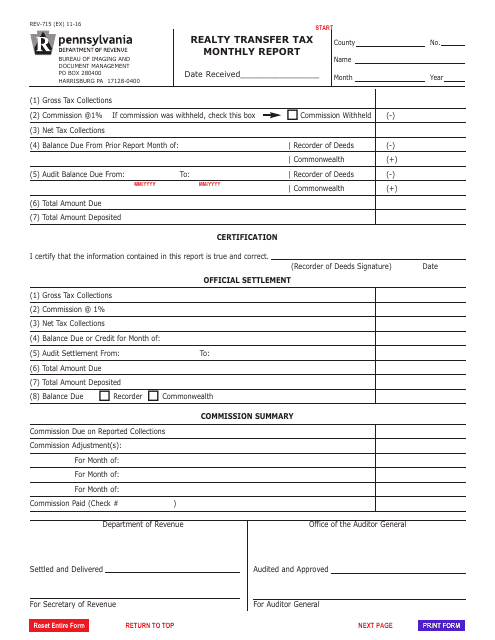

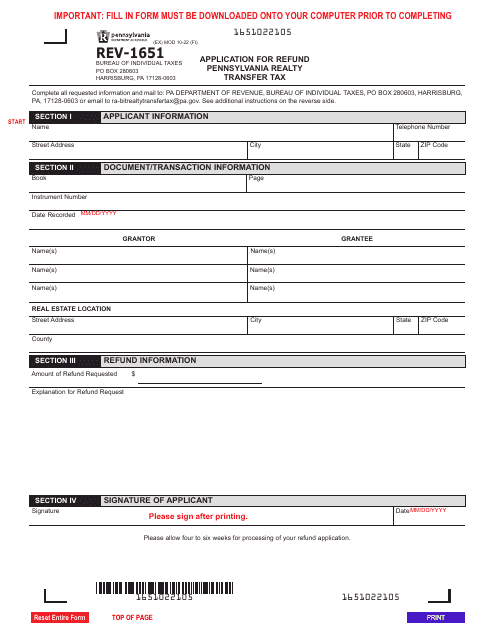

This form is used for reporting monthly realty transfer tax in Pennsylvania. It is used by individuals and businesses to report and pay taxes related to property transfers.

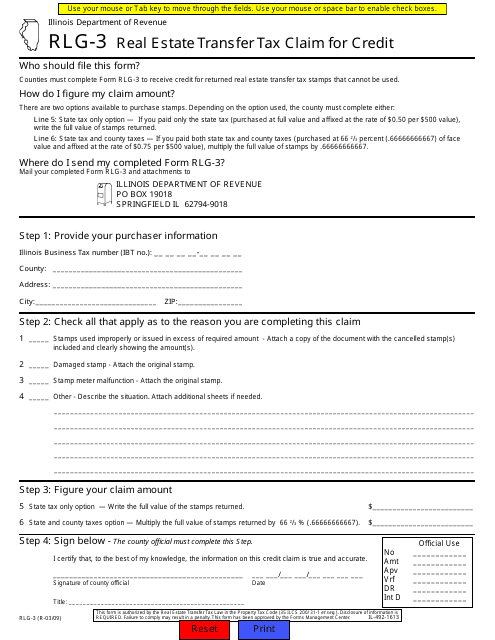

This form is used for claiming credit for real estate transfer tax in Illinois.

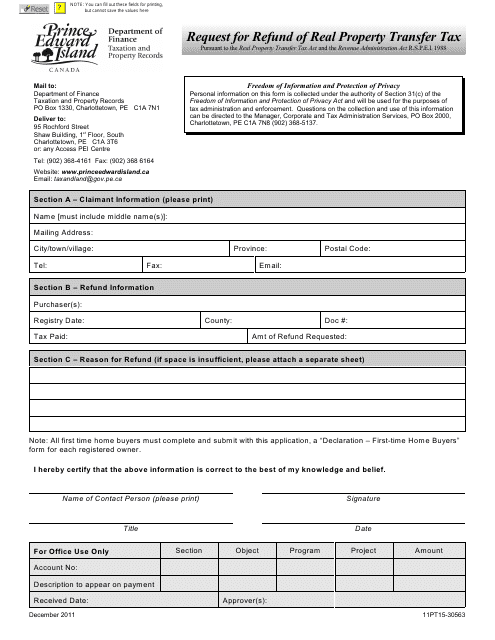

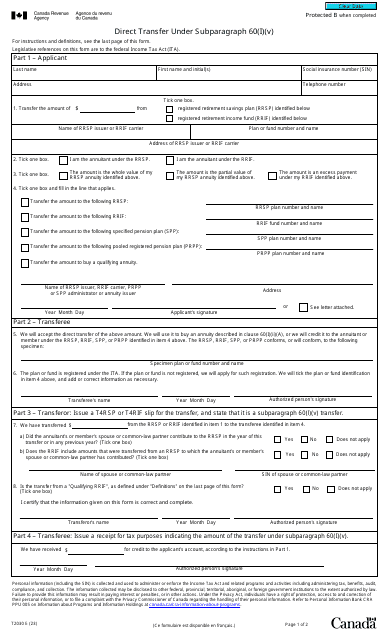

This Form is used for requesting a refund of real property transfer tax in Prince Edward Island, Canada.

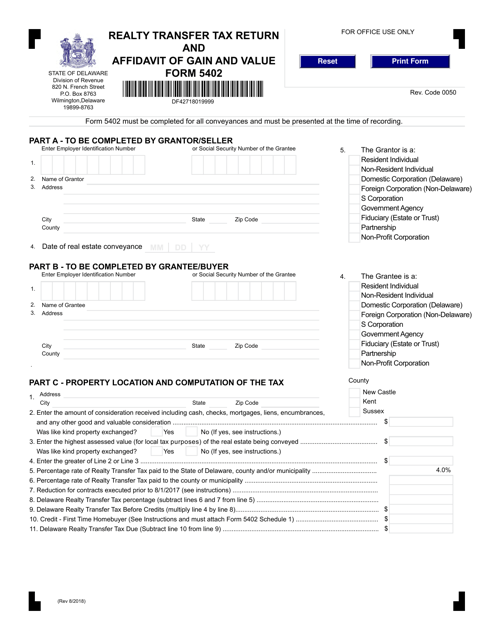

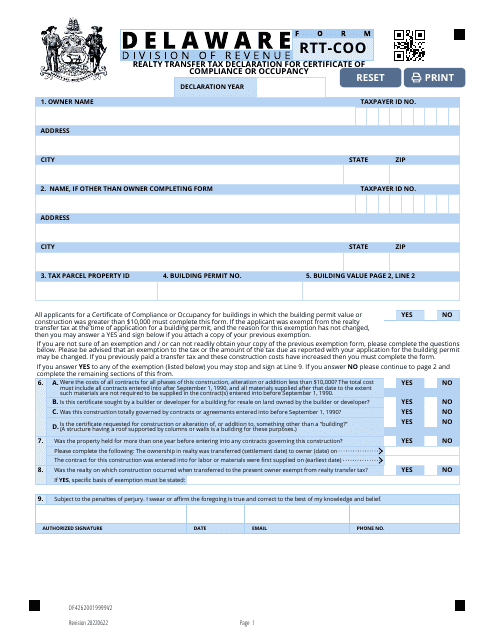

This form is used for reporting and paying realty transfer tax in the state of Delaware, as well as providing information about the gain and value of the property being transferred.

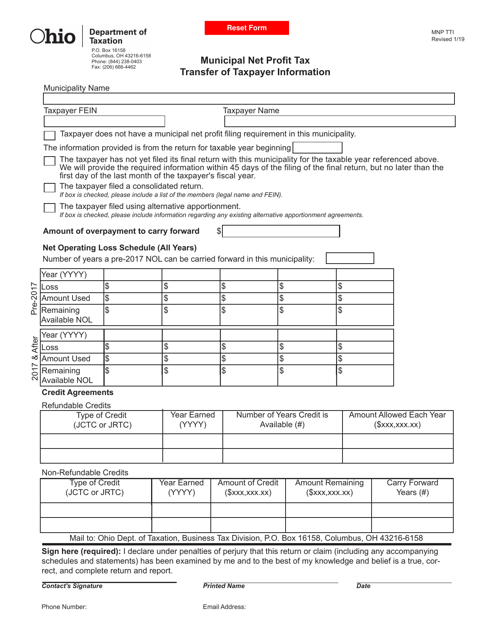

This form is used for transferring taxpayer information related to the Municipal Net Profit Tax in Ohio.

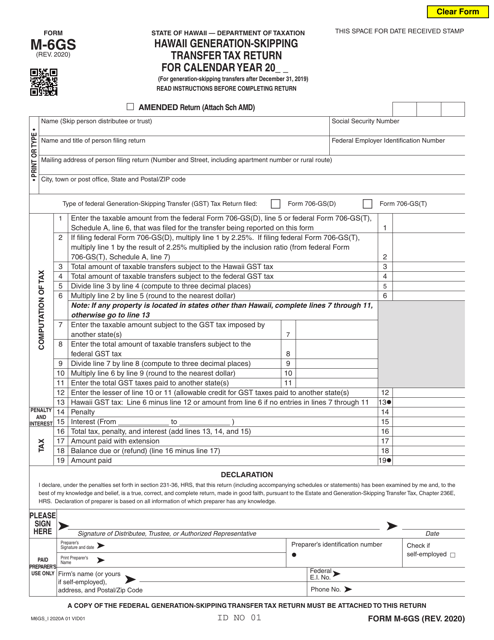

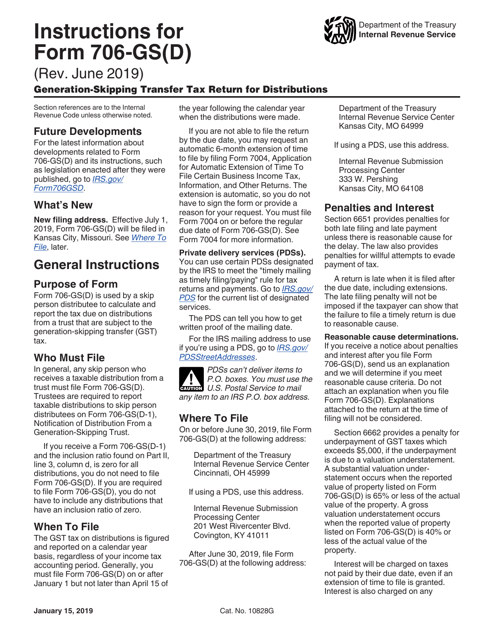

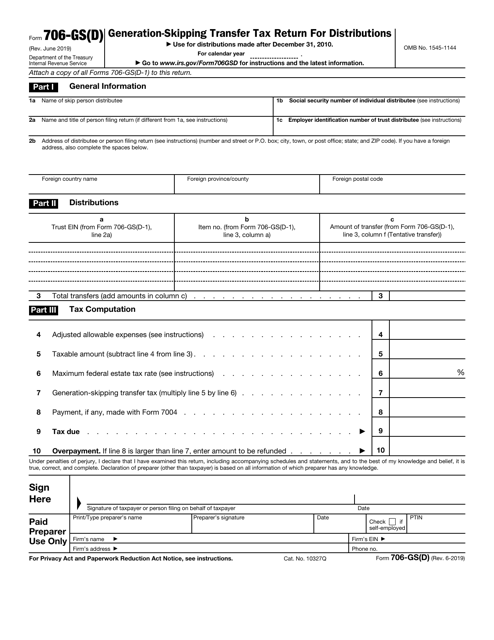

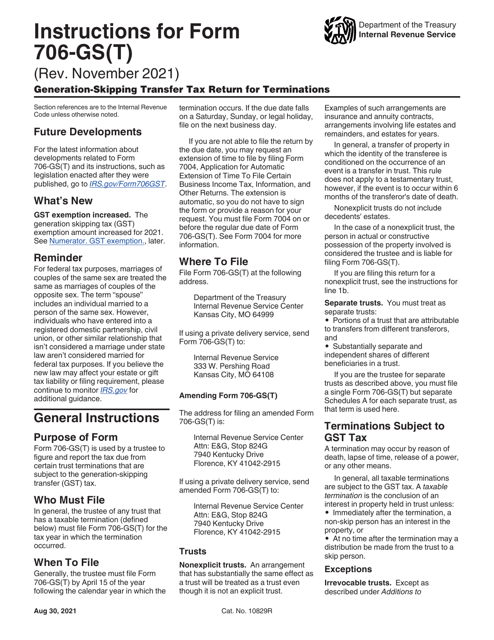

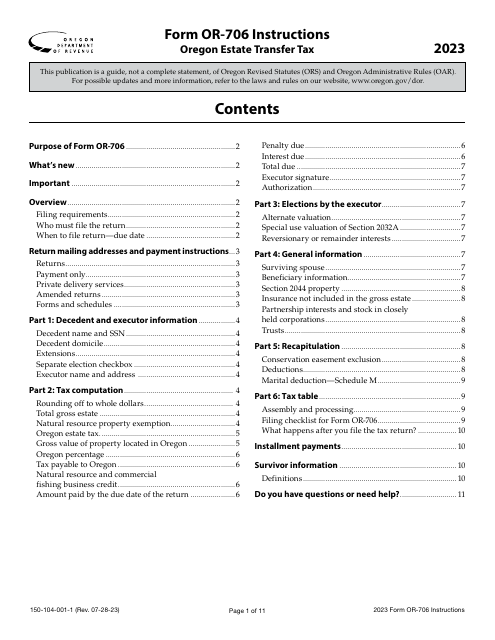

This form is used for reporting generation-skipping transfer tax returns for distributions. It provides instructions on how to accurately complete IRS Form 706-GS(D).

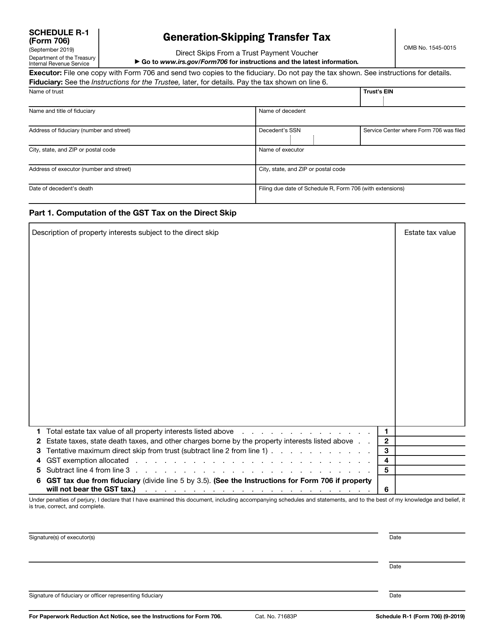

This form is used for reporting and paying the generation-skipping transfer tax on distributions from certain trusts.

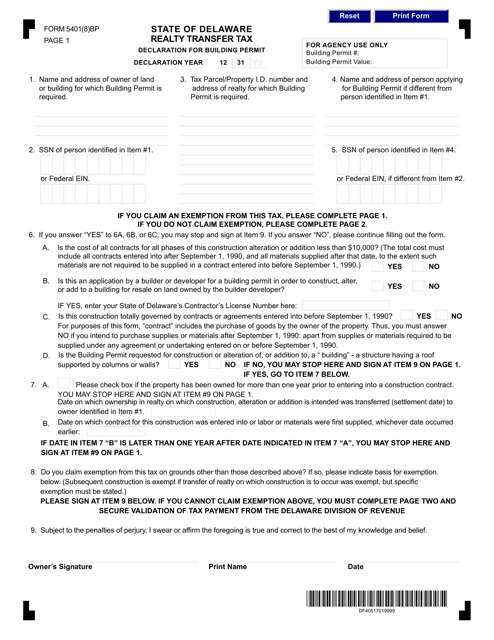

This document is used for declaring the realty transfer tax for building permits in the state of Delaware.

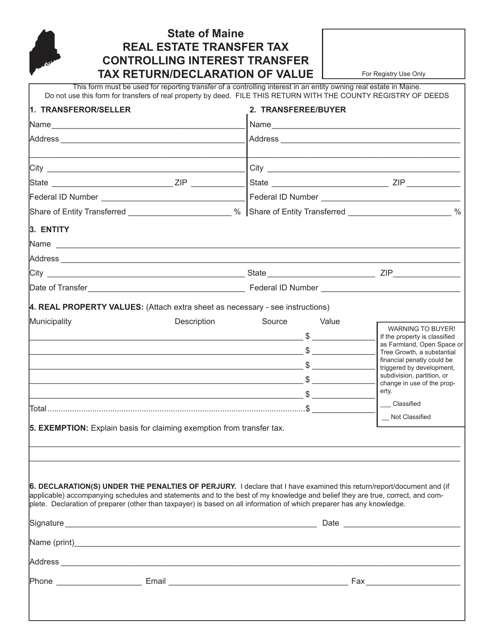

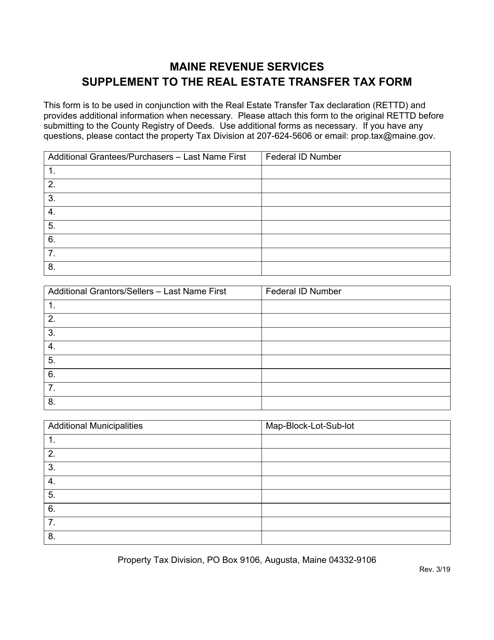

This form is used as a supplement to the Real Estate Transfer Tax Form in the state of Maine.