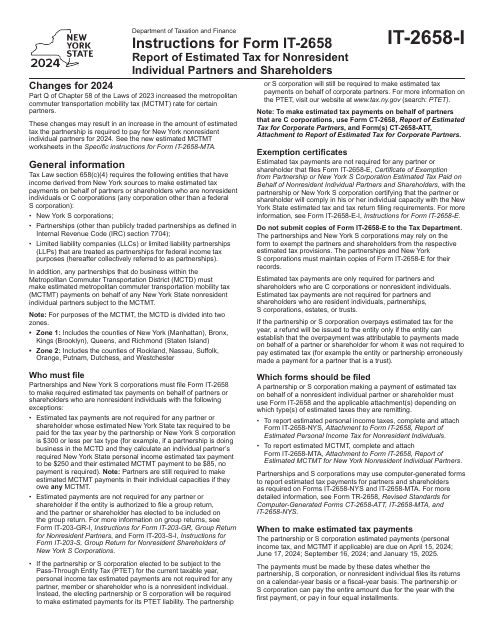

Personal Income Tax Form Templates

Documents:

109

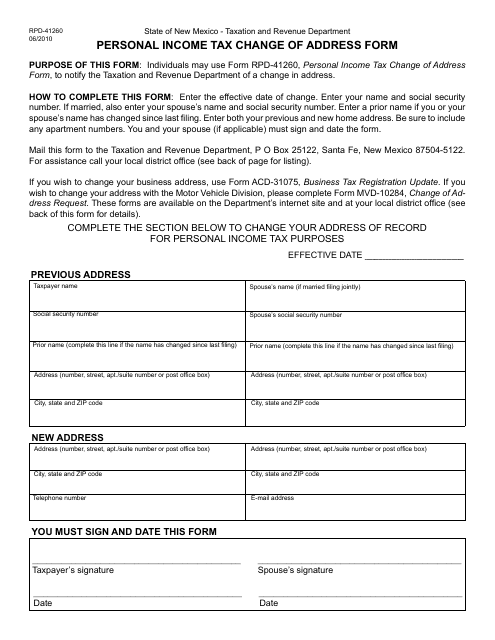

This Form is used for changing your address for personal income tax purposes in the state of New Mexico.

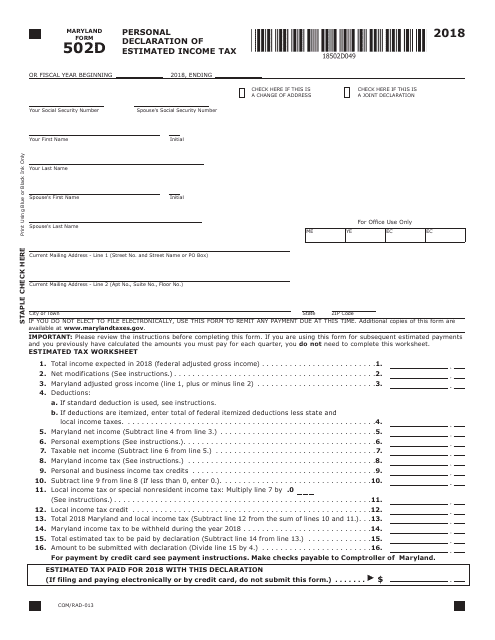

This form is used for residents of Maryland to declare their estimated income tax for the year. It allows individuals to calculate and submit their projected income tax liability to the state.

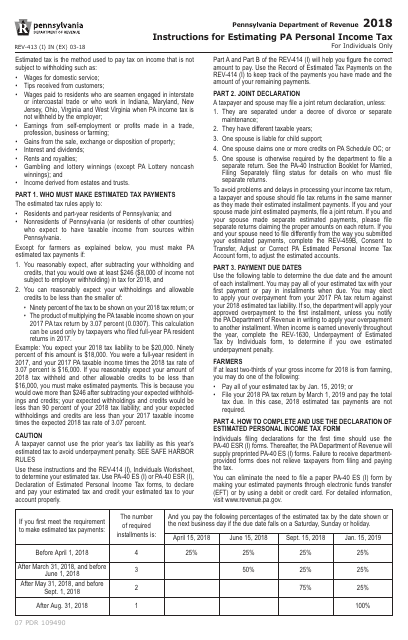

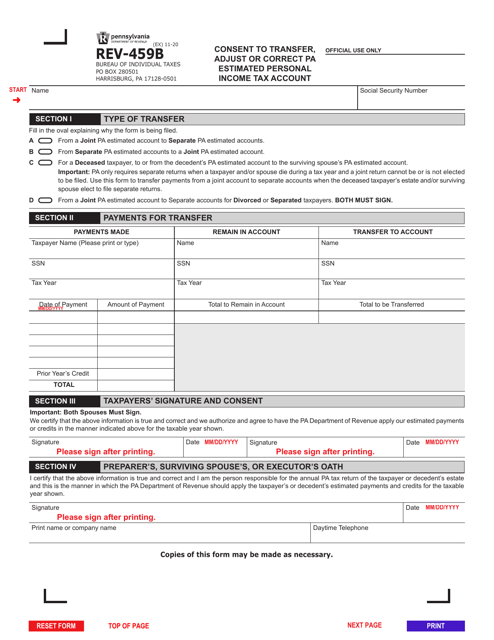

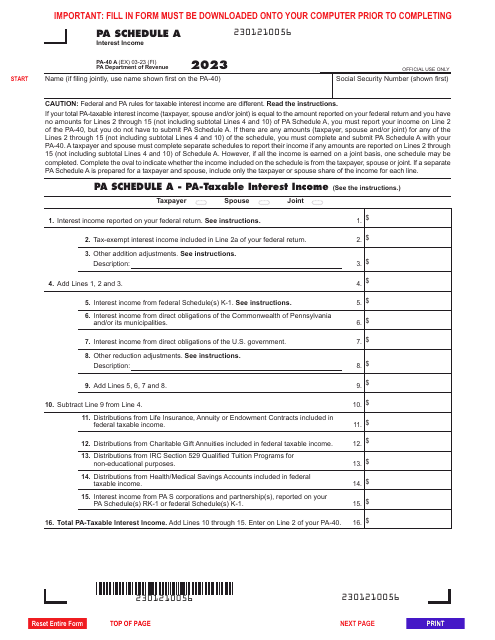

This document provides instructions for estimating Pennsylvania personal income tax. It guides taxpayers on how to accurately calculate and report their estimated tax liability.

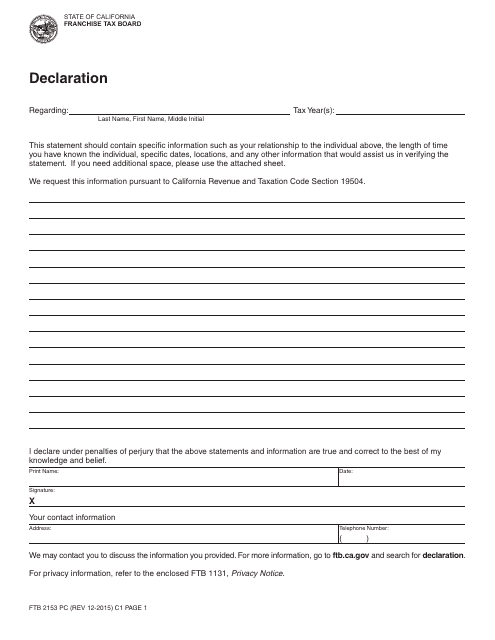

This form is used for filing a declaration of payment and/or communication of your personal income tax with the California Franchise Tax Board.

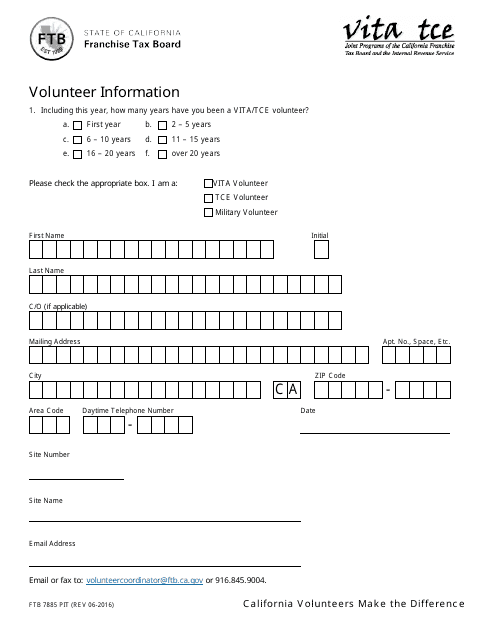

This form is used for providing volunteer information to the California Franchise Tax Board (FTB) for the Personal Income Tax (PIT) program.

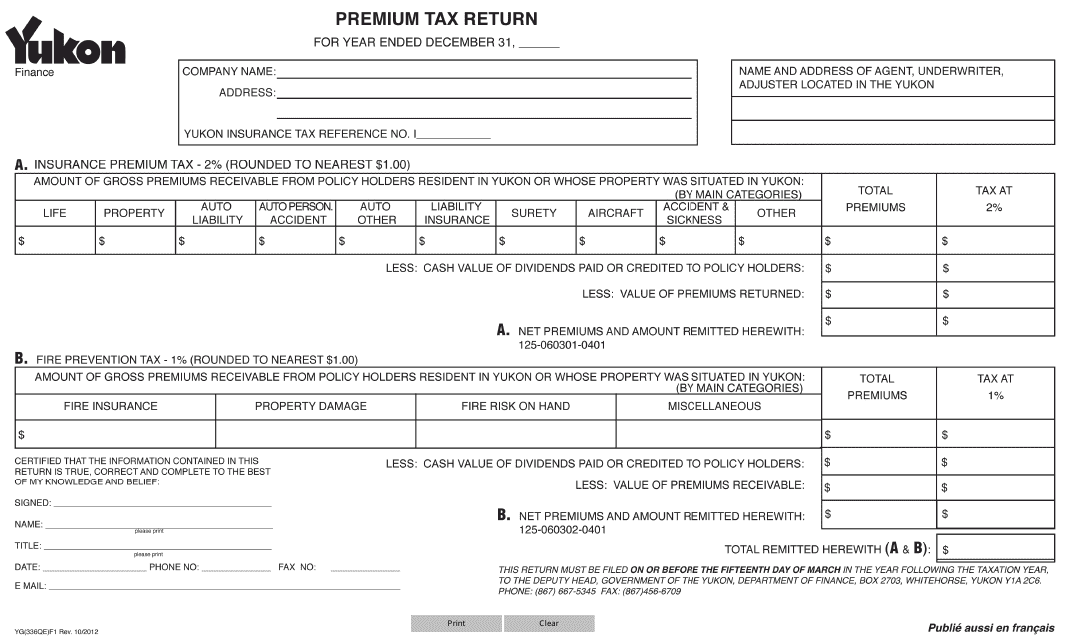

This form is used for filing premium tax returns in Yukon, Canada.

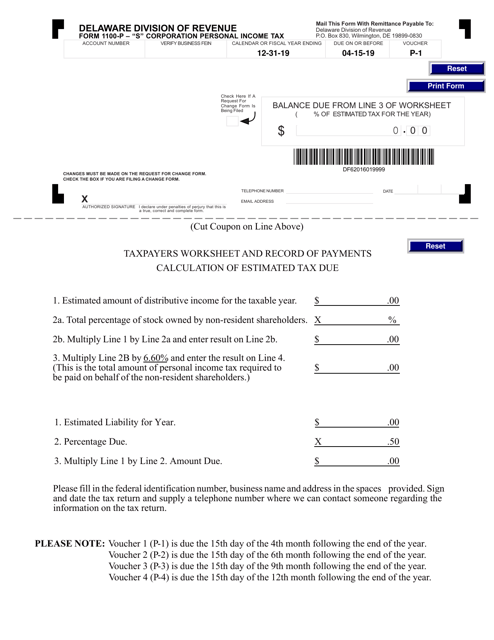

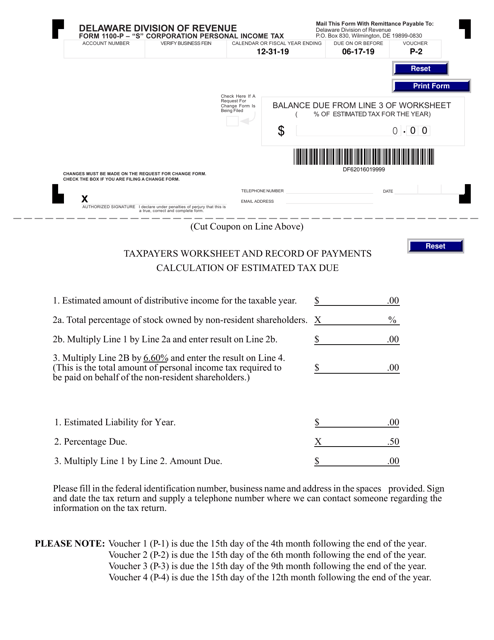

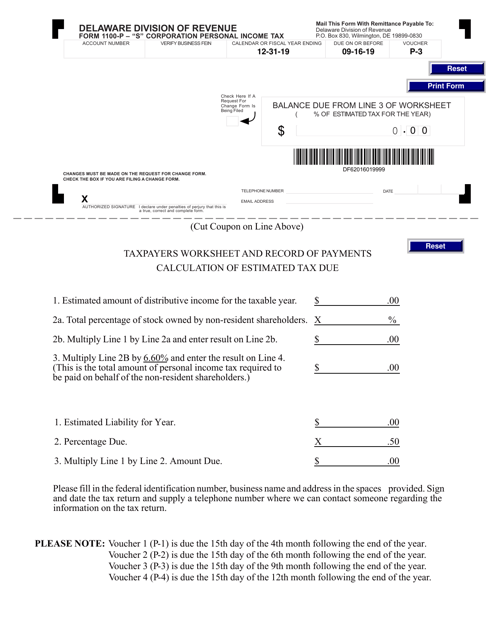

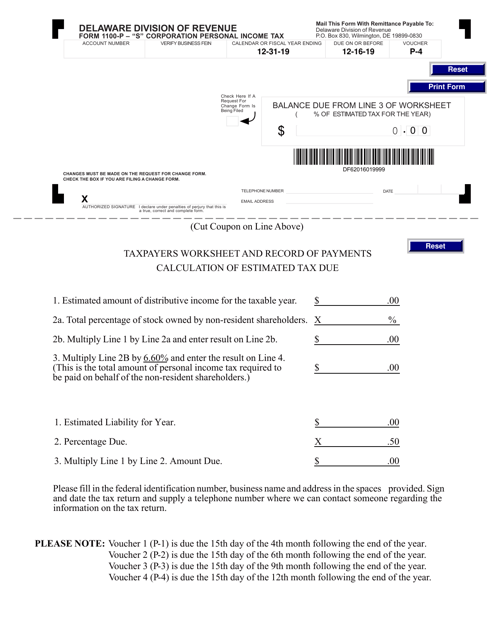

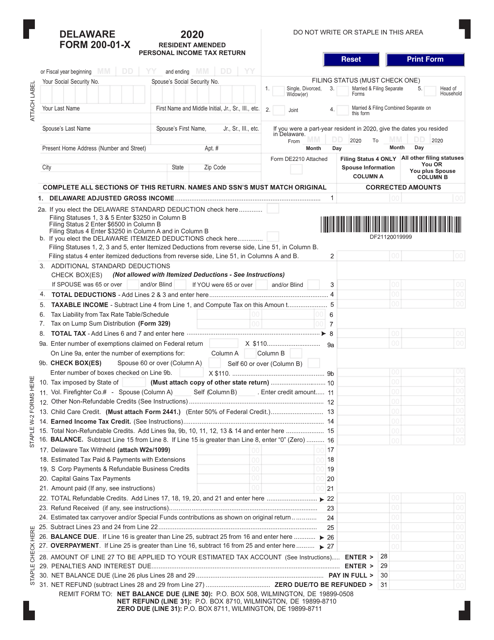

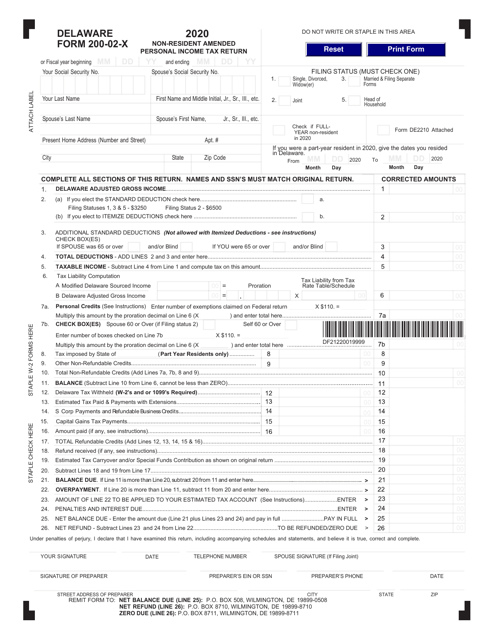

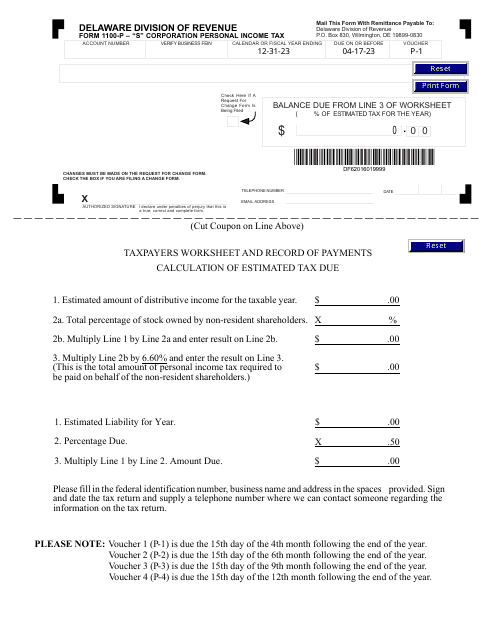

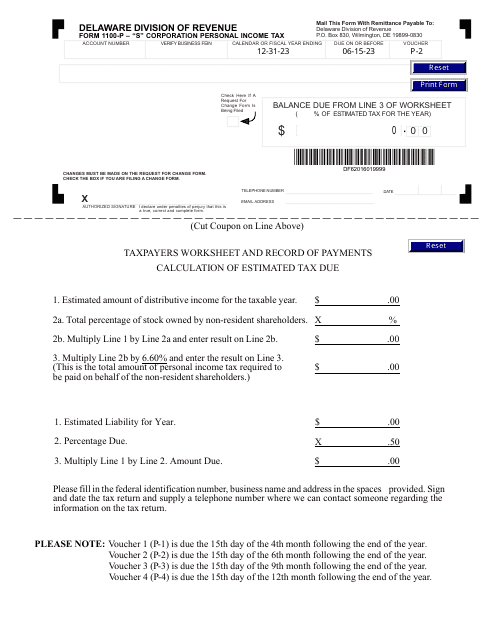

This Form is used for making personal income tax payments for "s" corporations in Delaware.

This form is used for making personal income tax payments for "S" corporations in Delaware.

This form is used for filing the personal income tax of an "s" Corporation in Delaware.

This document is used for submitting personal income tax payments for "S" Corporation in Delaware.

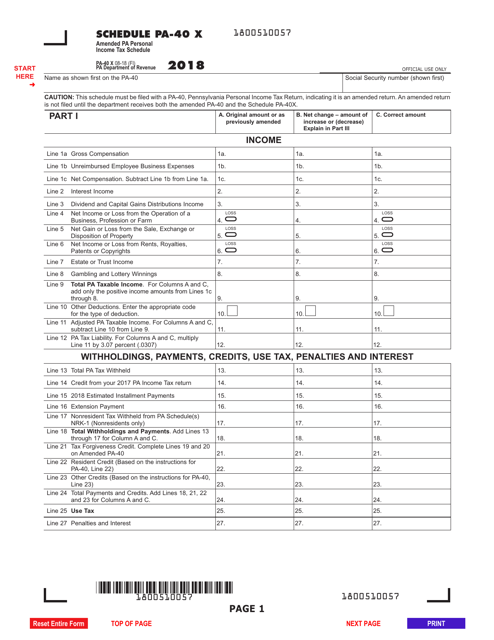

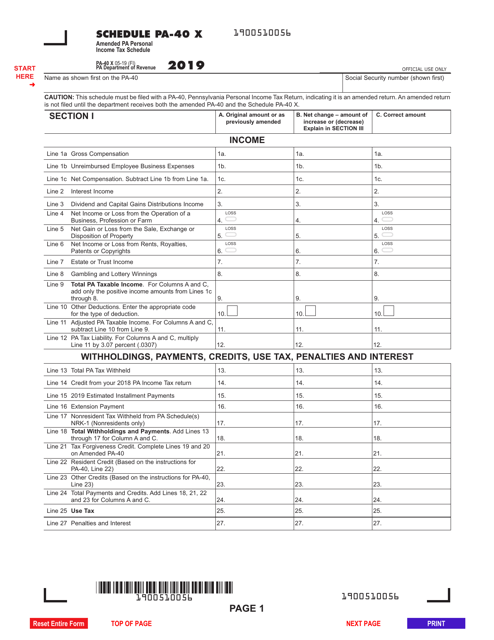

This form is used for amending the Pennsylvania Personal Income Tax Schedule.

This document is used for filing an amended Pennsylvania Personal Income Tax Schedule, known as PA-40 X. It is used when you need to make changes or corrections to your previously filed state income tax return in Pennsylvania.