Excise Tax Form Templates

Documents:

309

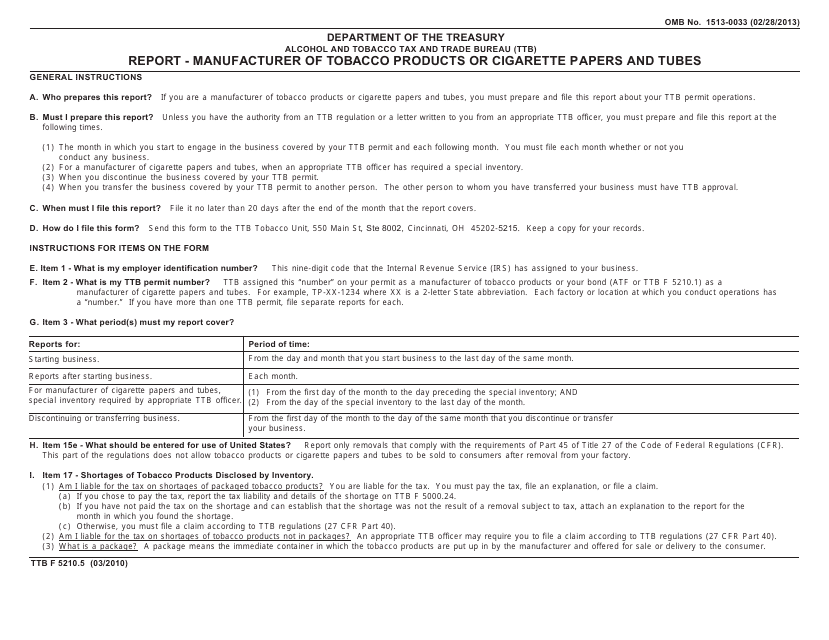

This document is used for reporting the information of manufacturers of tobacco products, cigarette papers, and tubes.

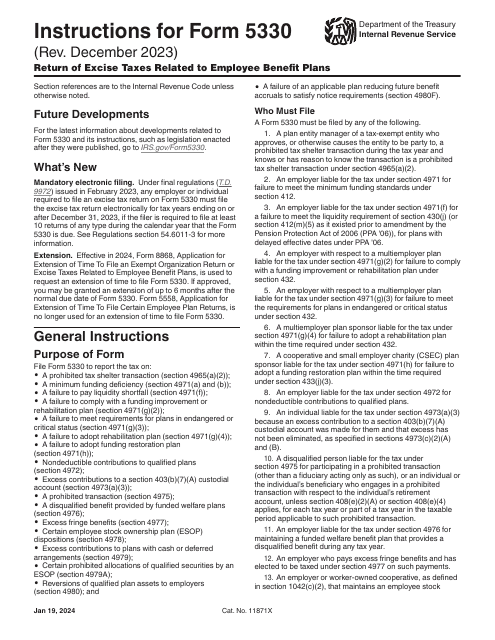

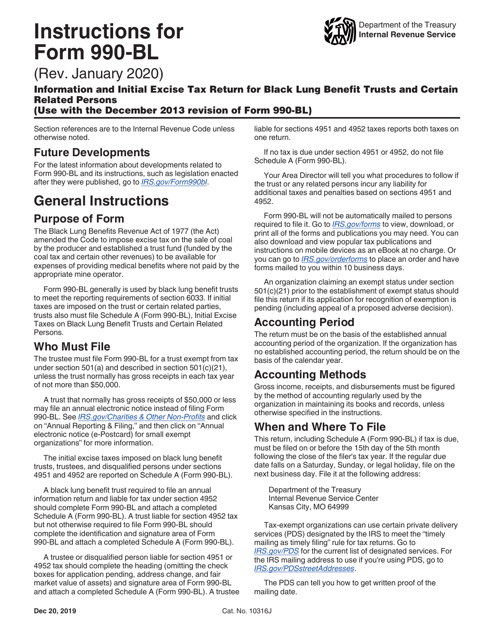

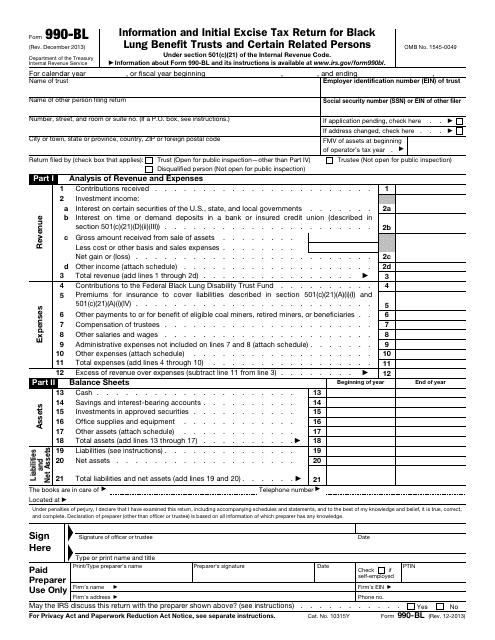

This Form is used for reporting information and paying initial excise tax by Black Lung Benefit Trusts and certain related persons.

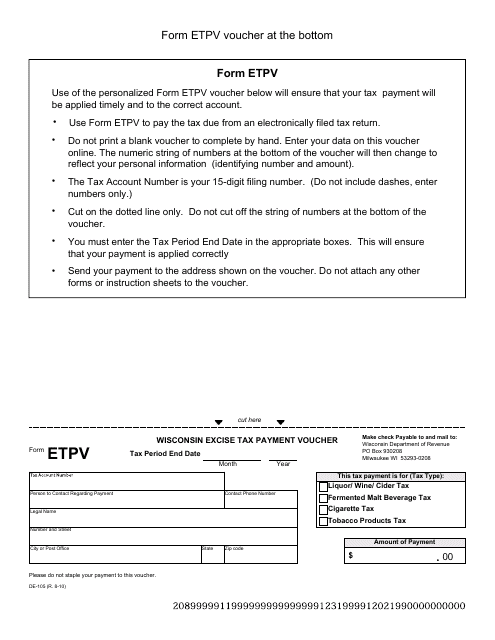

This Form is used for making excise tax payments in the state of Wisconsin.

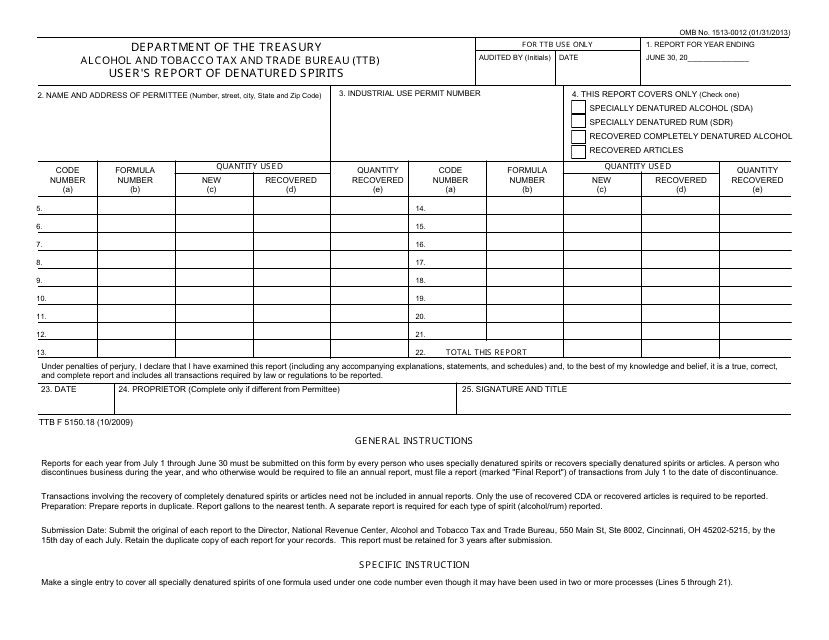

This form is used for reporting the use of denatured spirits.

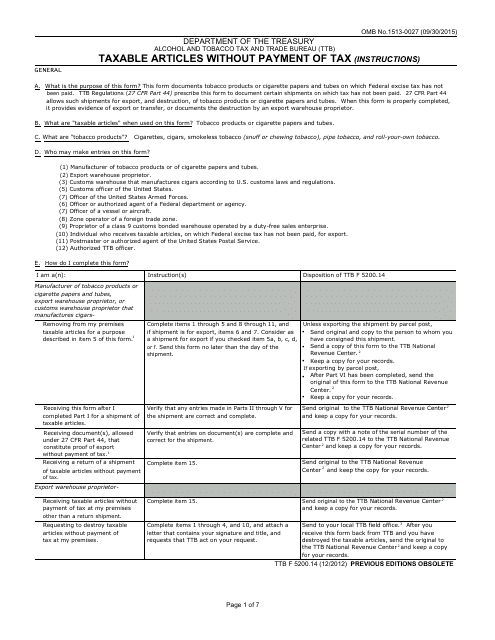

This document is used for reporting the taxable articles that are not paid for with tax.

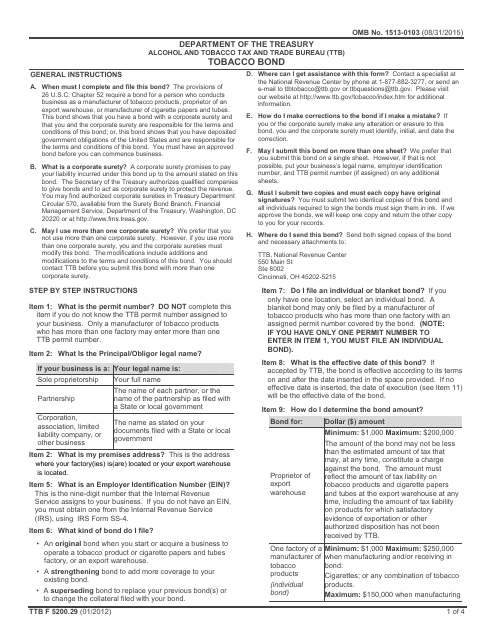

This document is a Tobacco Bond form used by the Alcohol and Tobacco Tax and Trade Bureau (TTB) to ensure compliance with regulations related to the production and distribution of tobacco products.

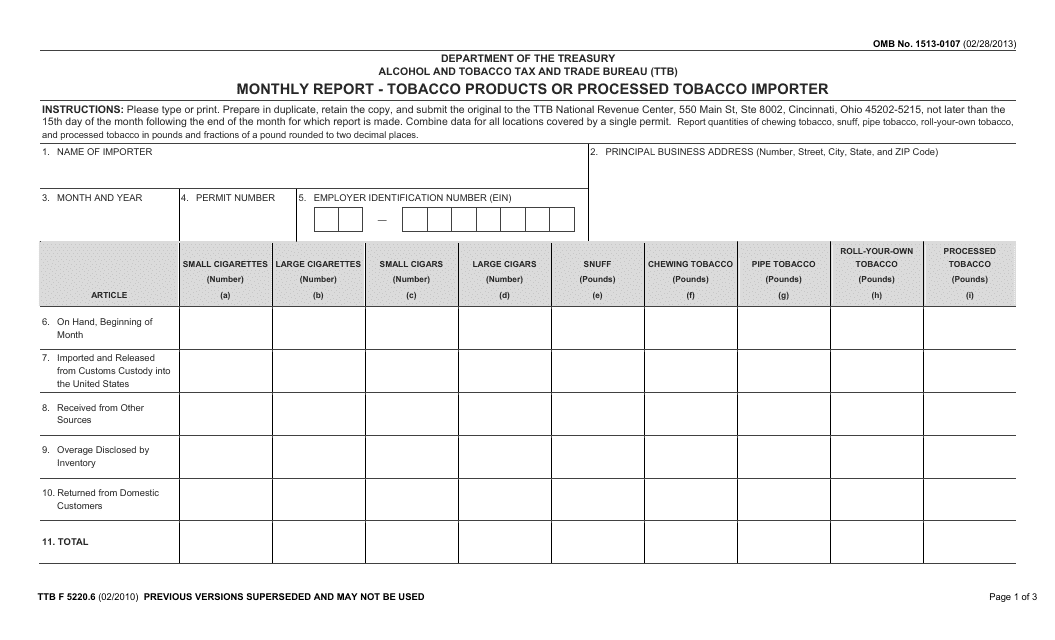

This Form is used for monthly reporting by importers of tobacco products or processed tobacco. It helps track import activities and compliance with regulations.

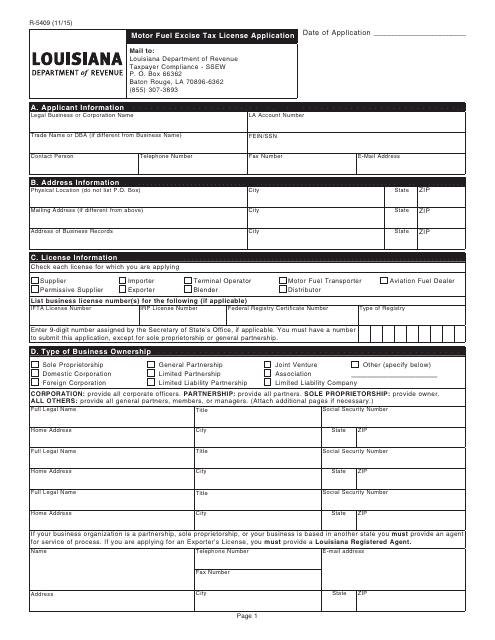

This Form is used for applying for a motor fuel excise tax license in the state of Louisiana.

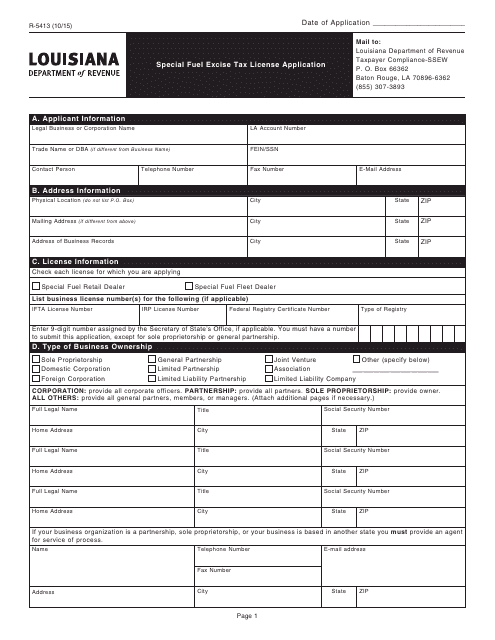

This form is used for applying for a special fuel excise tax license in the state of Louisiana.

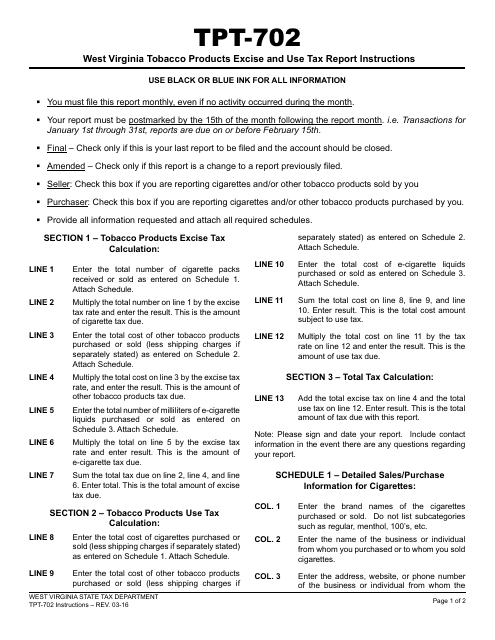

This document is used for reporting and paying tobacco products excise and use tax in West Virginia. It provides instructions on how to fill out Form WV/TPT-702. The form is used by businesses that sell tobacco products in the state.

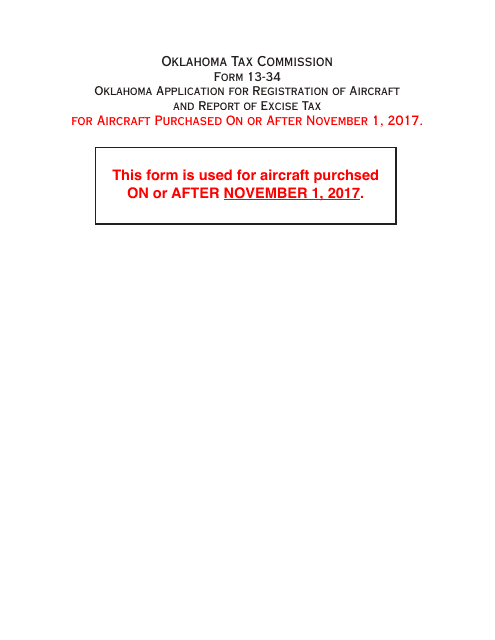

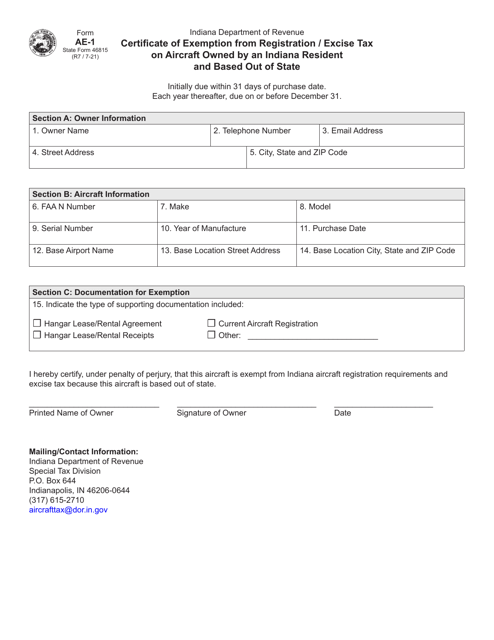

This form is used for registering an aircraft and reporting excise tax in Oklahoma.

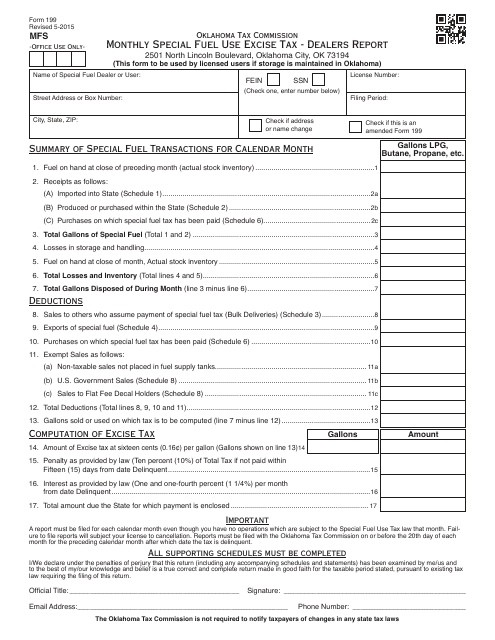

This document is for Oklahoma dealers to report their monthly special fuel use excise tax.

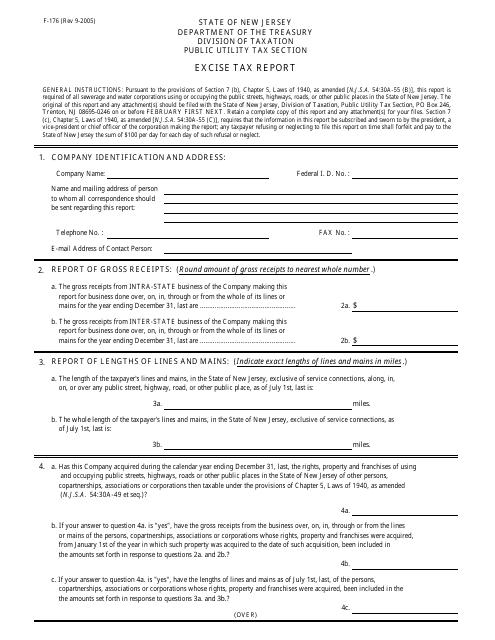

This form is used for reporting excise tax in the state of New Jersey.

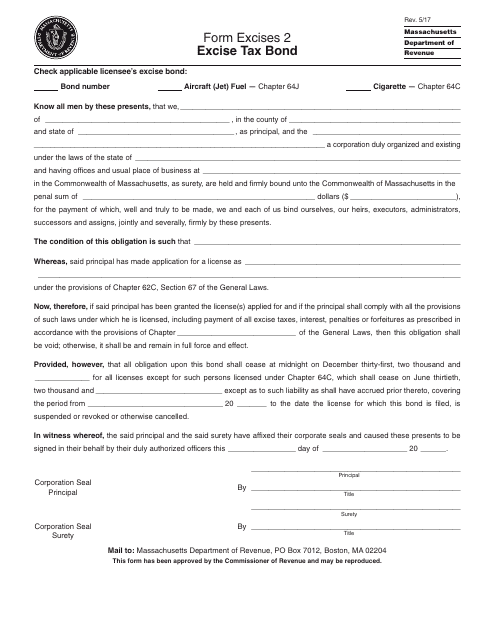

This document is used for obtaining an excise tax bond in Massachusetts. It is required by the state as a guarantee that the taxpayer will fulfill their obligations to pay excise taxes on certain goods or activities.

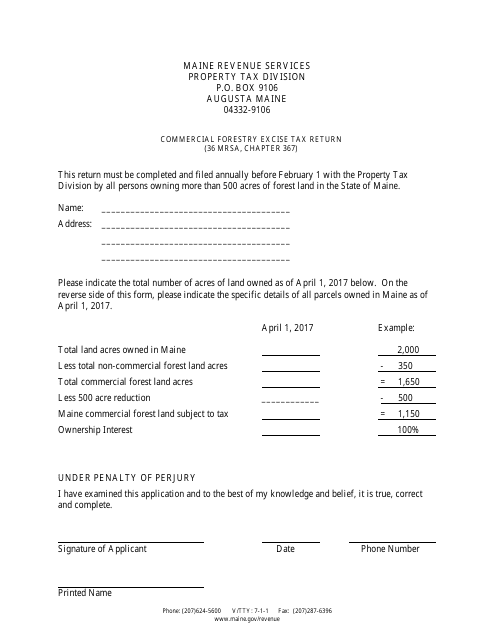

This form is used for filing the Commercial Forestry Excise Tax Return in the state of Maine.

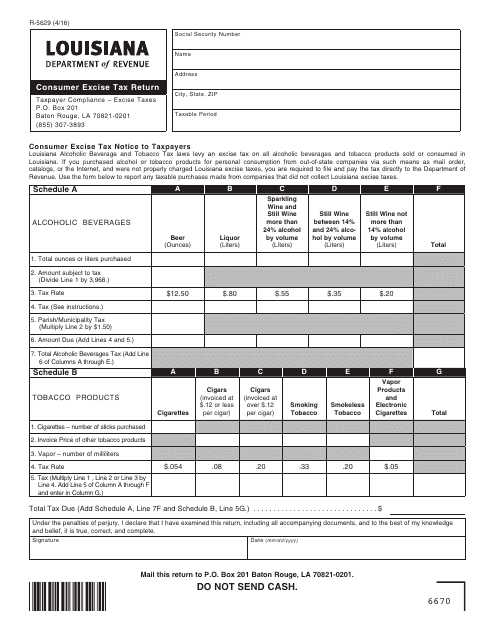

This Form is used for reporting and paying consumer excise taxes in the state of Louisiana.

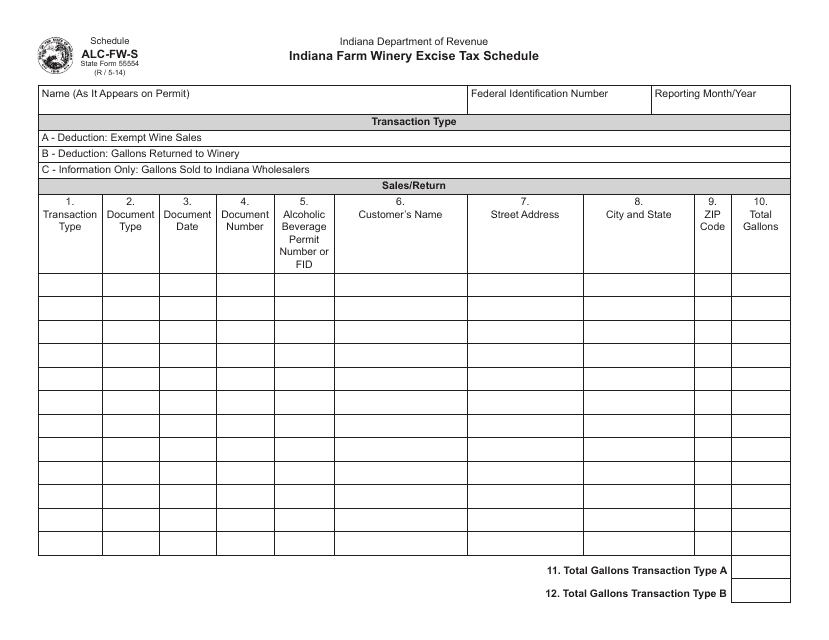

This document is used for reporting and paying excise taxes for farm wineries in Indiana.

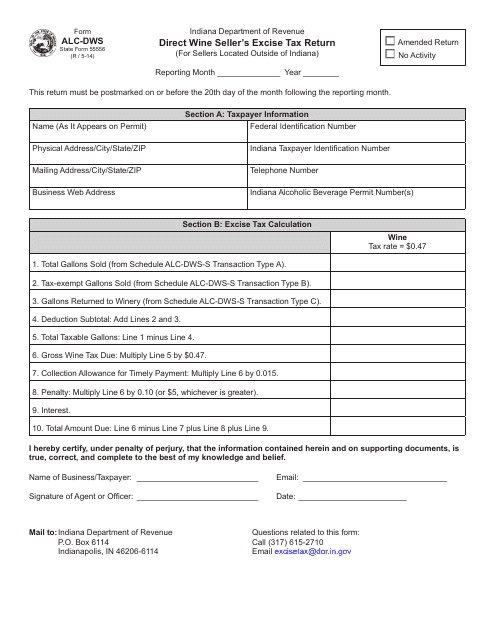

This form is used for monthly excise tax return for out-of-state direct wine sellers in Indiana.

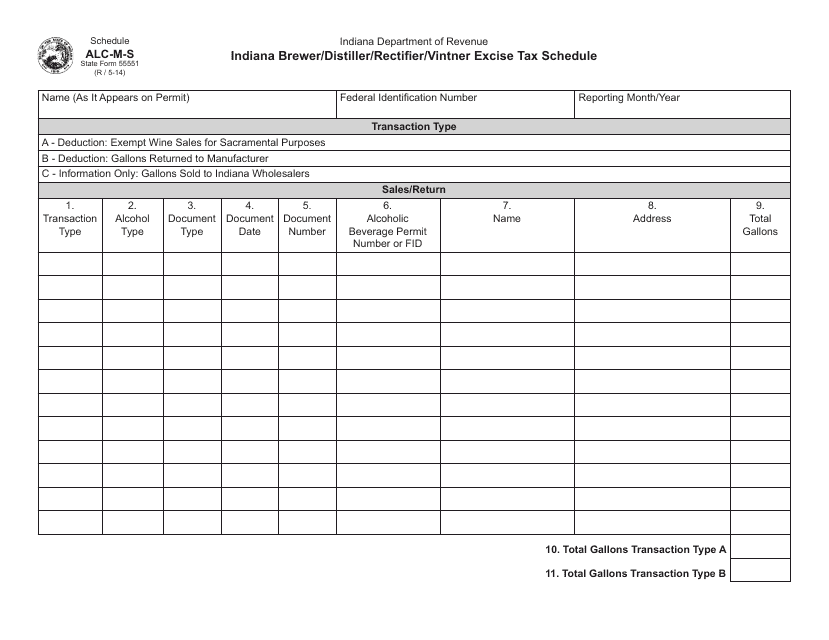

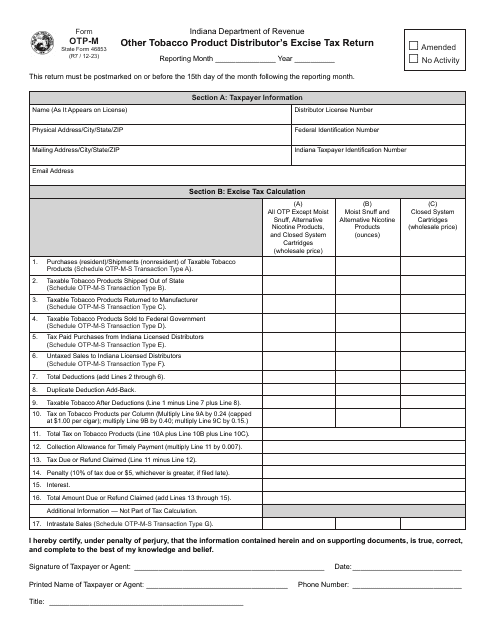

This document is a tax form used by brewers, distillers, rectifiers, and vintners in Indiana to report and pay excise taxes.

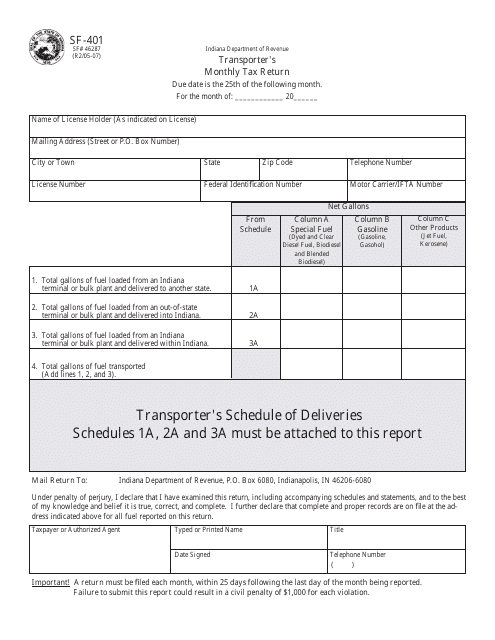

This document is used for reporting and submitting monthly taxes for transporters in the state of Indiana.

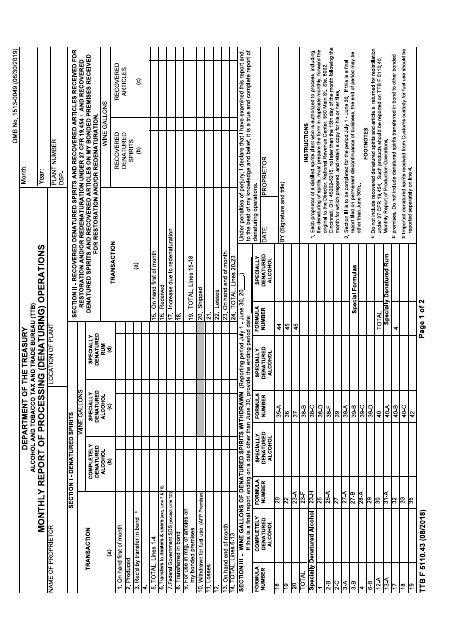

This form is used for reporting monthly processing (denaturing) operations.

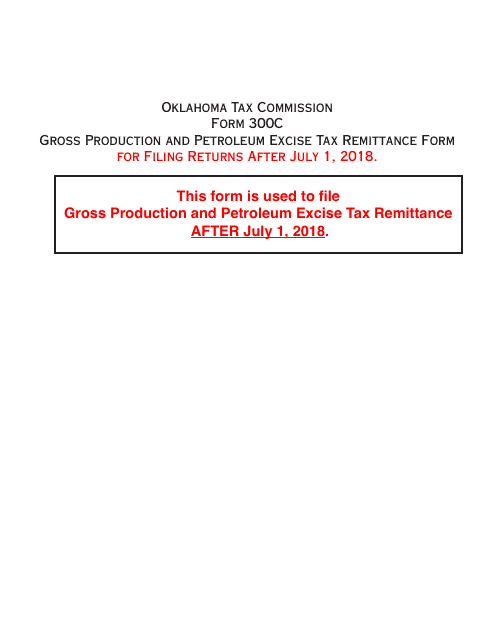

This Form is used for remitting gross production and petroleum excise tax in Oklahoma.

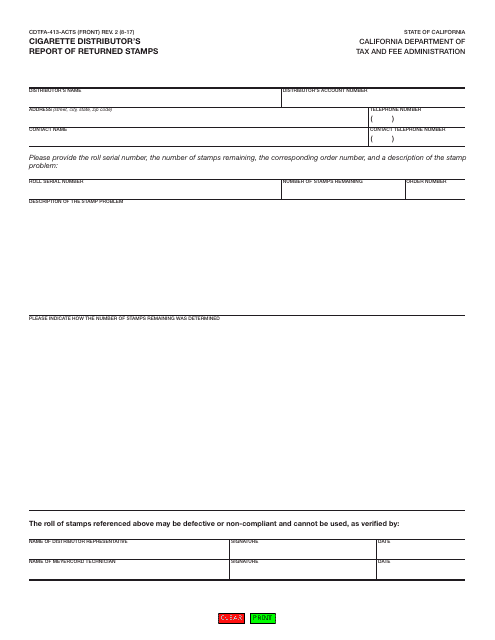

This form is used for cigarette distributors in California to report returned stamps.