Self Employment Income Form Templates

Documents:

35

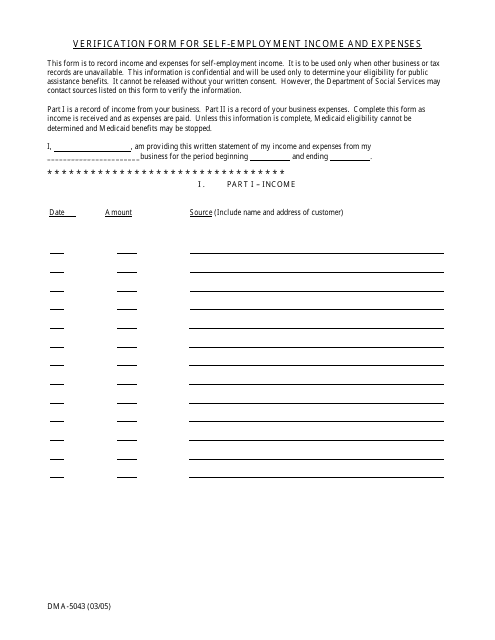

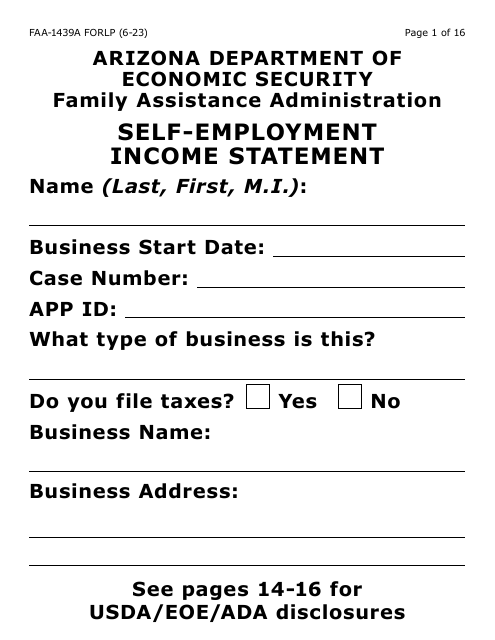

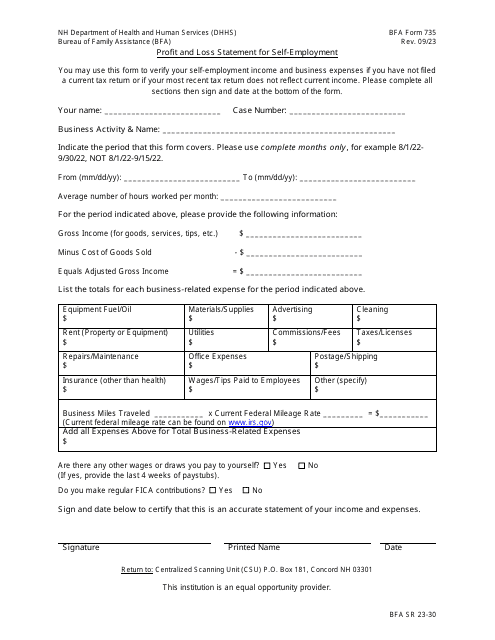

This form is used for verifying self-employment income and expenses in North Carolina.

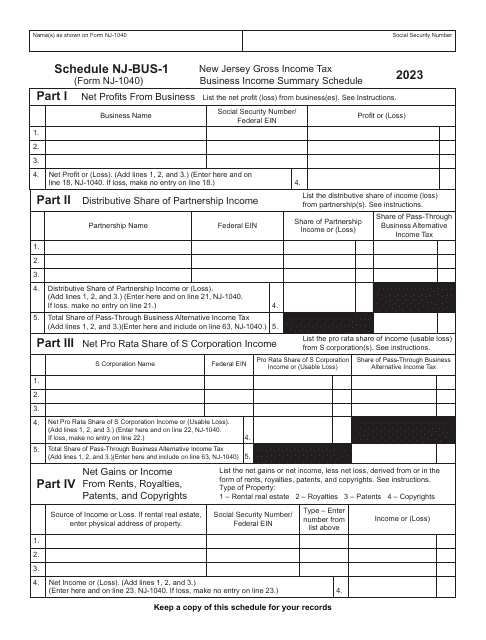

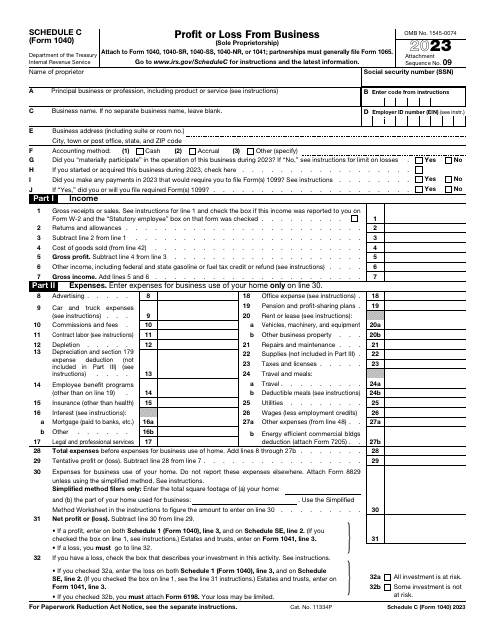

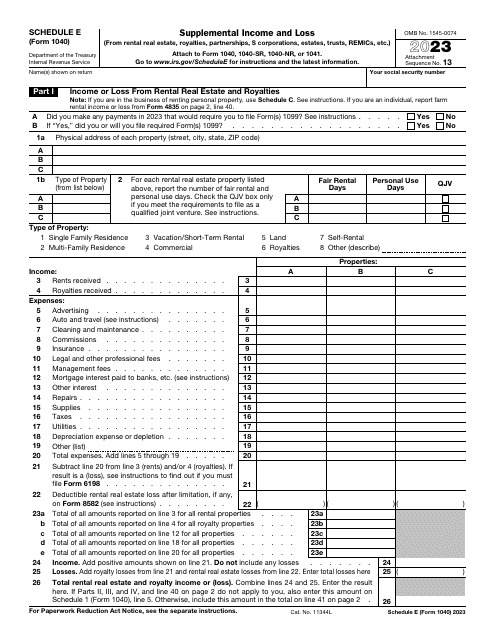

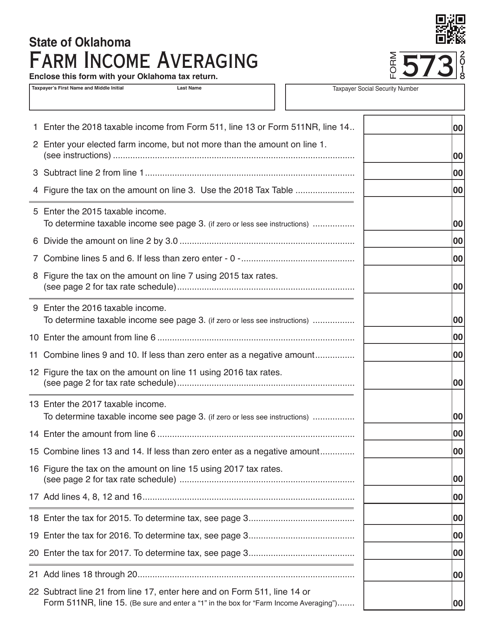

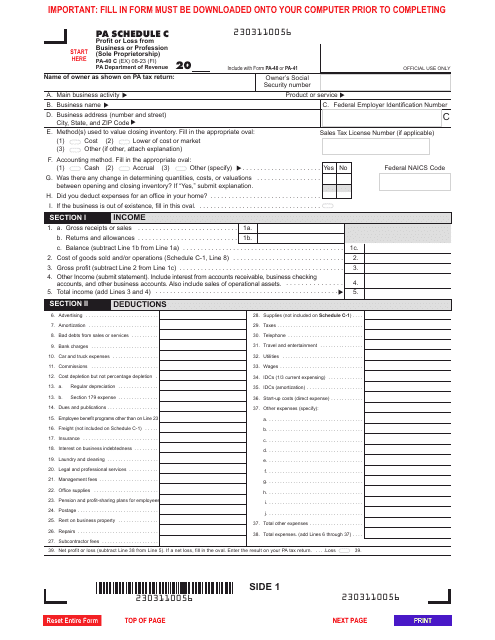

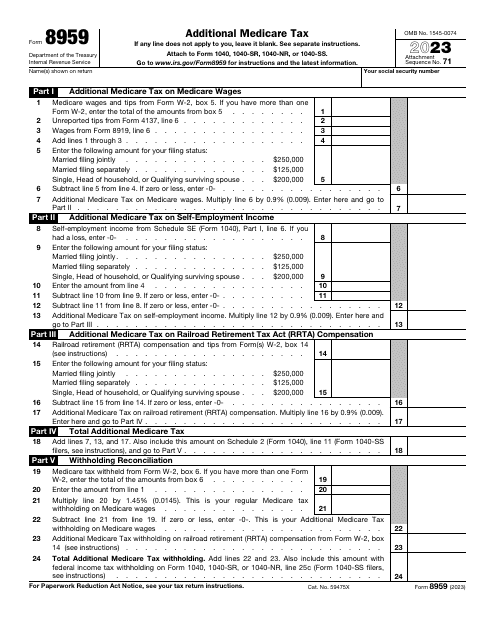

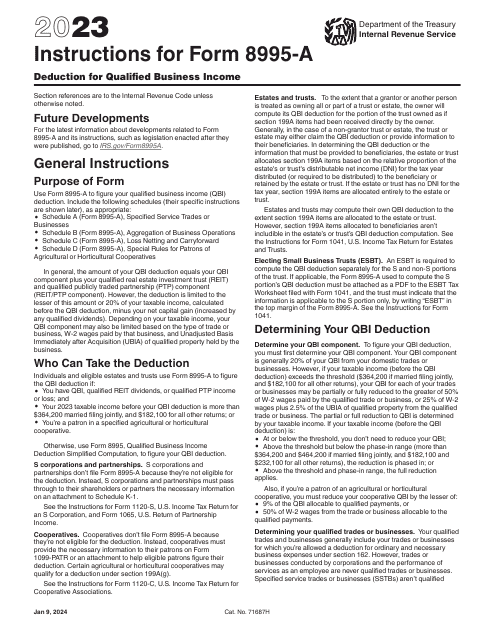

This form is part of the IRS 1040 series, which is used to calculate and submit different types of federal individual income tax returns. File this form to inform the Internal Revenue Service (IRS) about your income and loss from royalties, rental real estate, trusts, and S corporations among others.

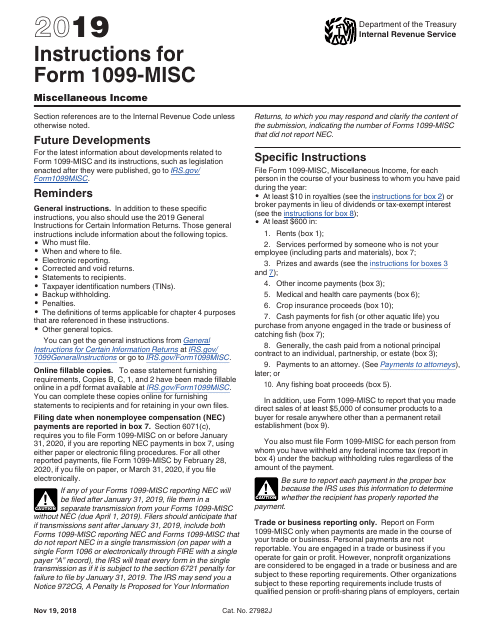

This form is used for reporting miscellaneous income received, such as freelance work or rental income. It provides instructions on how to fill out Form 1099-MISC accurately.

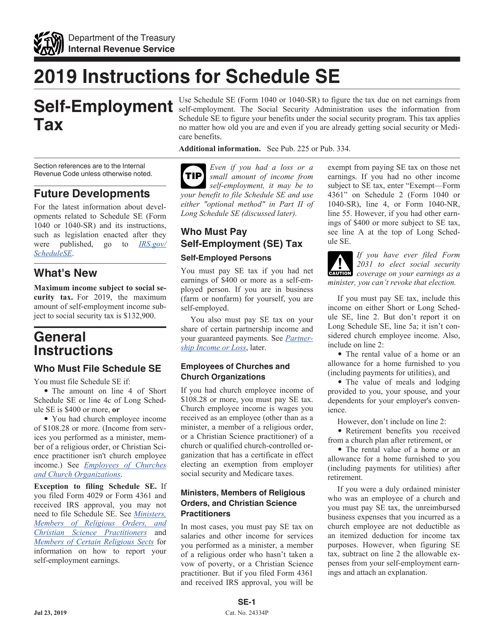

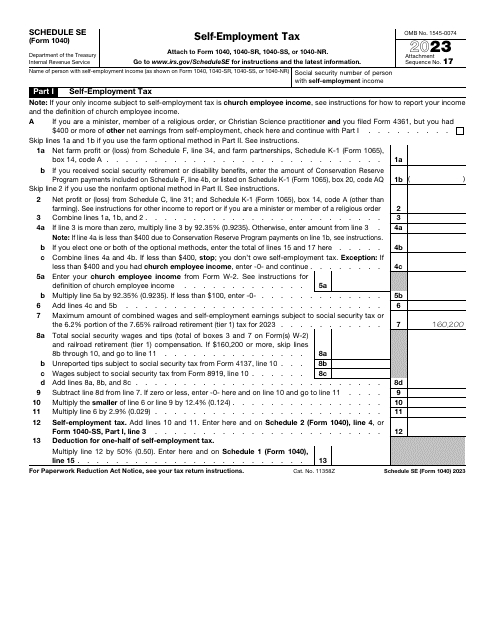

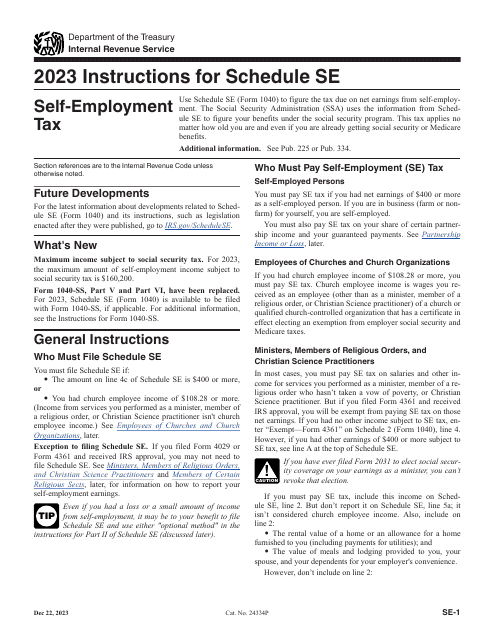

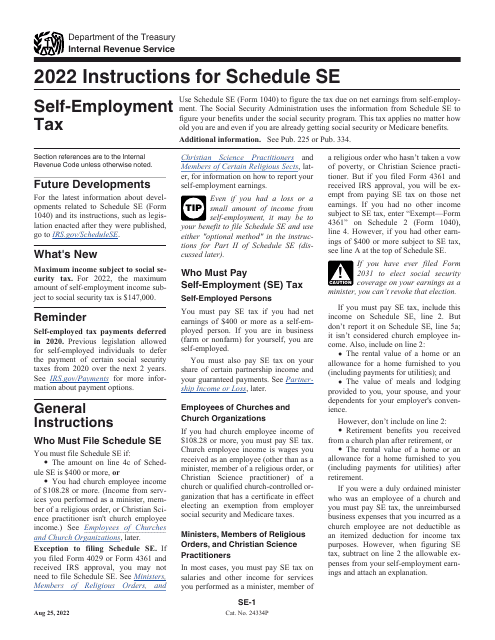

This document provides instructions for filling out and filing IRS Form 1040 and 1040-SR Schedule SE, which are used to calculate and report self-employment taxes. It includes step-by-step guidance on how to report income, deductions, and calculate the amount of self-employment tax owed.

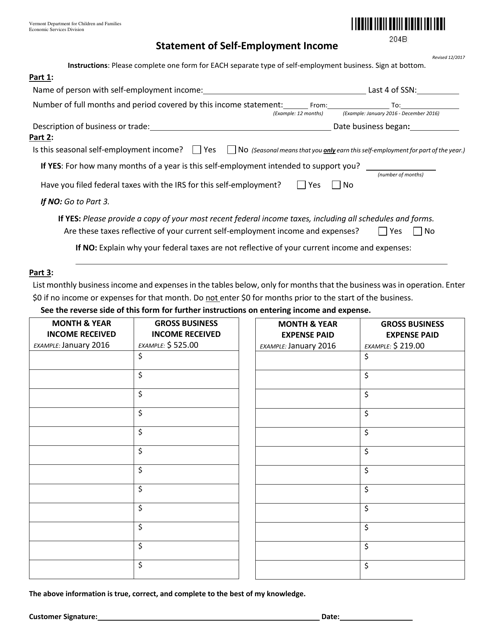

This Form is used for reporting self-employment income in the state of Vermont.

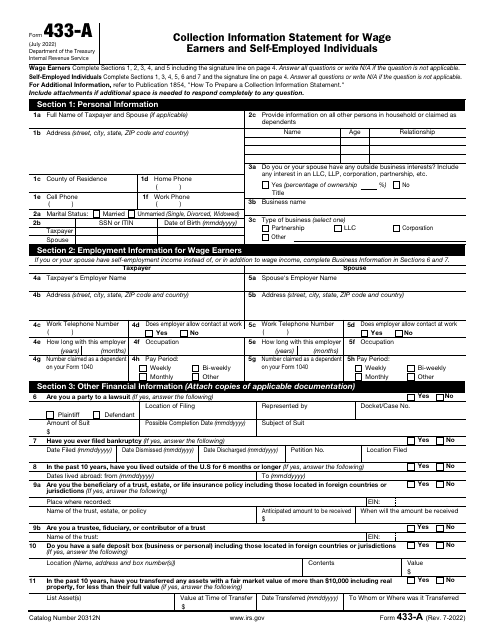

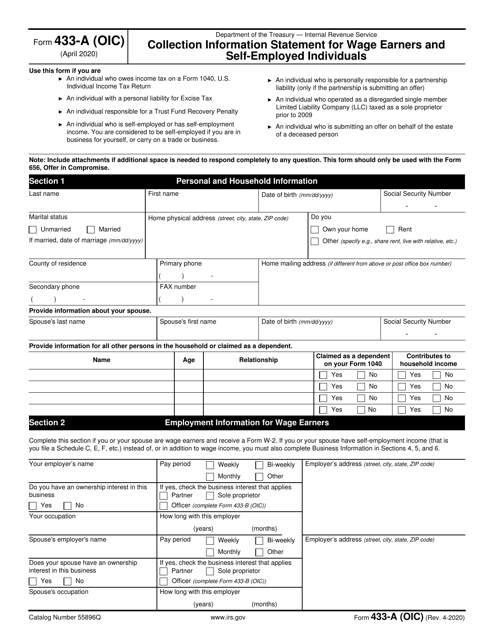

This Form is used for individuals who owe taxes to provide detailed financial information to the IRS in order to request an offer in compromise (OIC) and settle their tax debt.

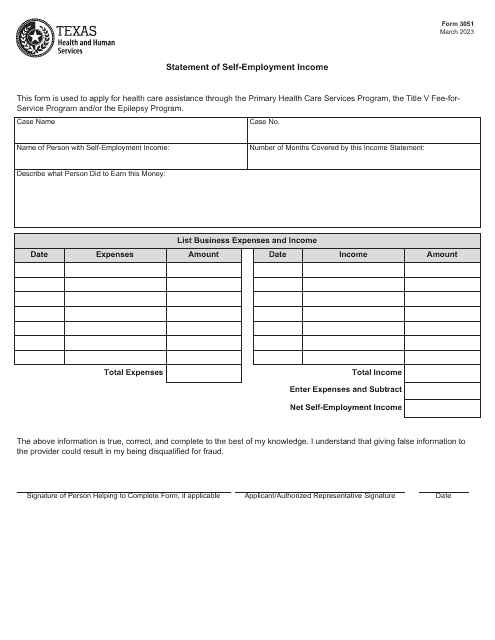

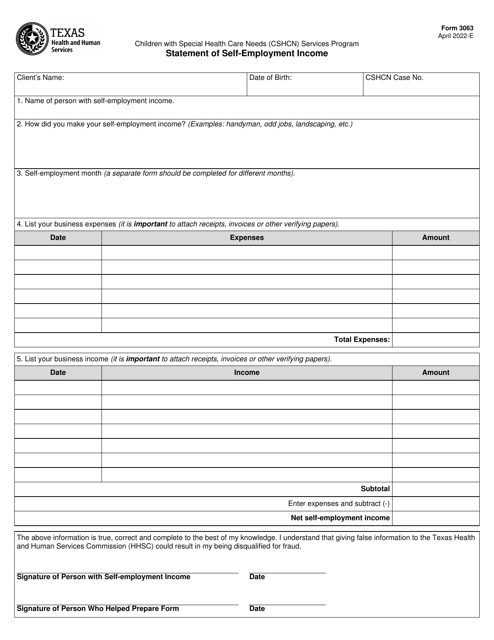

This form is used for reporting self-employment income in the state of Texas.

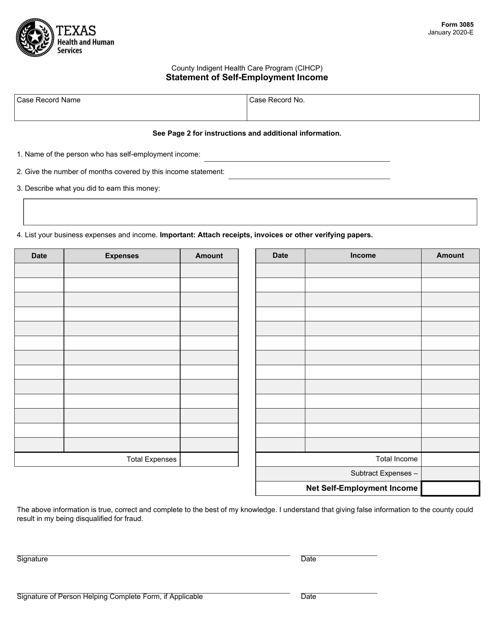

This form is used for clients in Texas to declare their self-employment income. It helps the state determine eligibility for certain assistance programs.

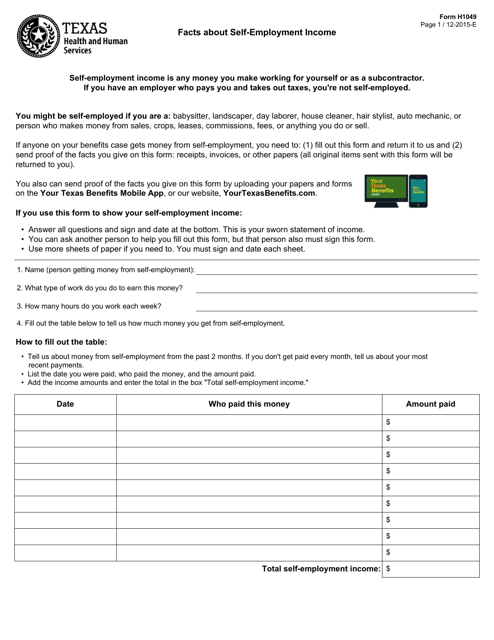

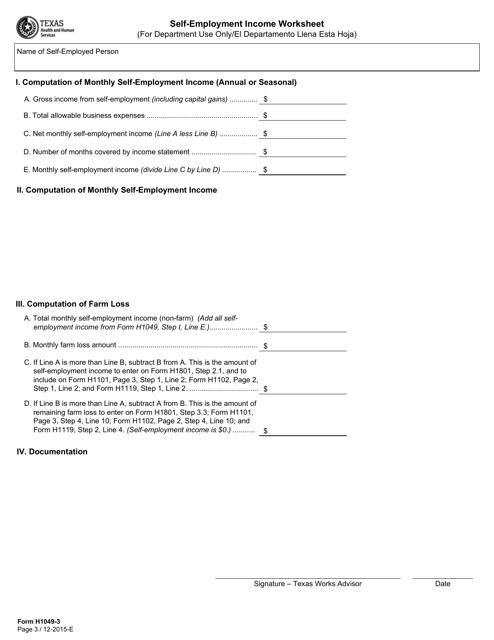

This document is used for calculating self-employment income in the state of Texas. It is a worksheet that helps individuals determine their self-employment earnings for various purposes.

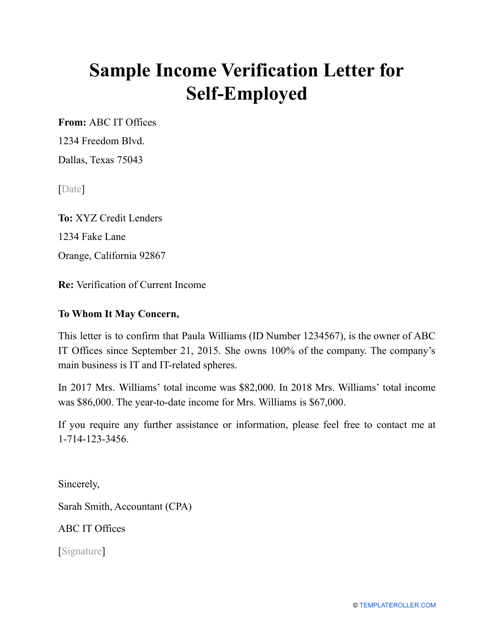

This letter verifies the amount of money an individual receives as a self-employed worker.

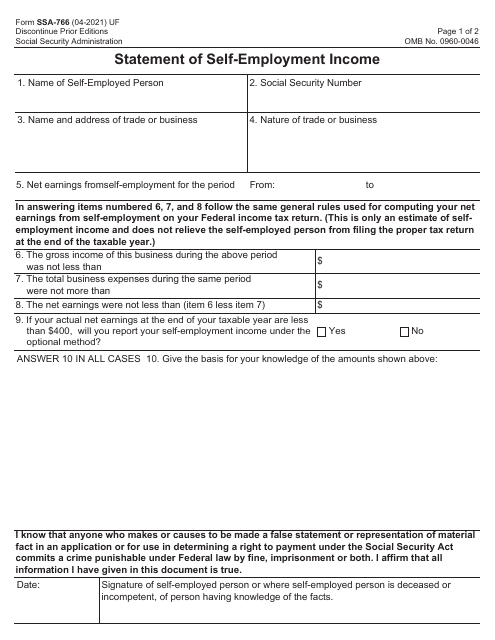

This is an IRS form that contains the breakdown of the self-employment tax the taxpayer figures out after analyzing their net earnings.

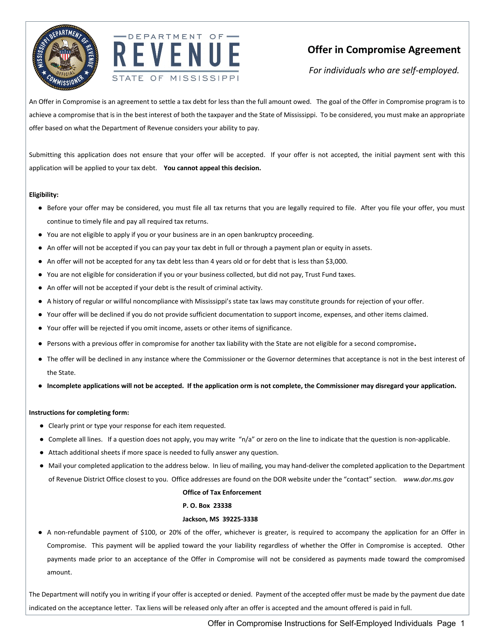

This Form is used for self-employed individuals in Mississippi who want to apply for an Offer in Compromise to settle their tax debt with the state. It provides instructions on how to complete the application process.

This is a fiscal IRS document business entities have to use to report compensation they have paid to individuals and companies they do not consider their employees.

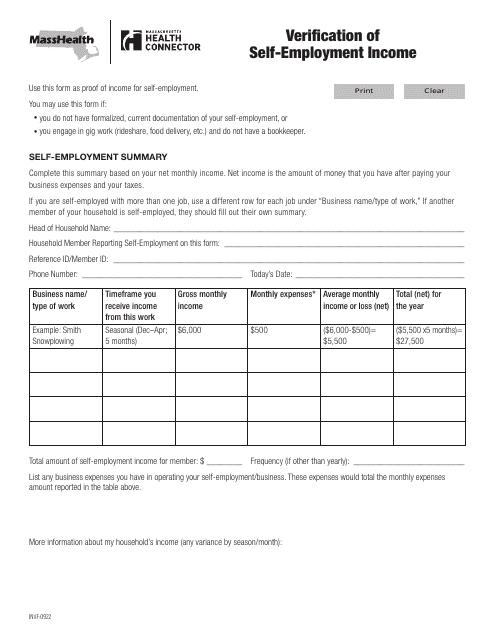

This form is used for verifying self-employment income in Massachusetts.

This document provides instructions for filling out Schedule SE, which is used to calculate and report self-employment tax. It covers step-by-step guidance on how to accurately complete this form.

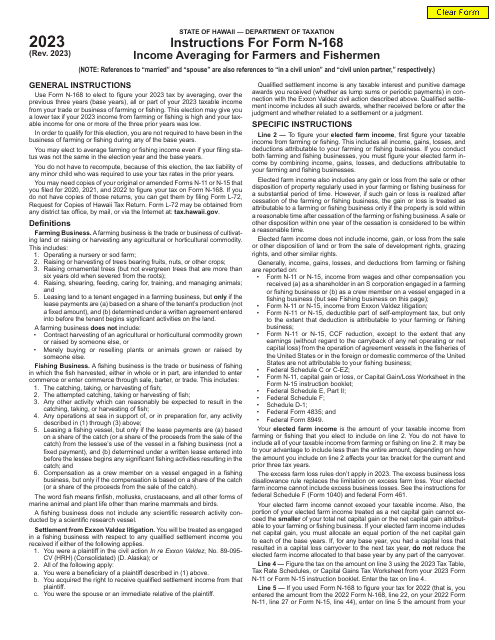

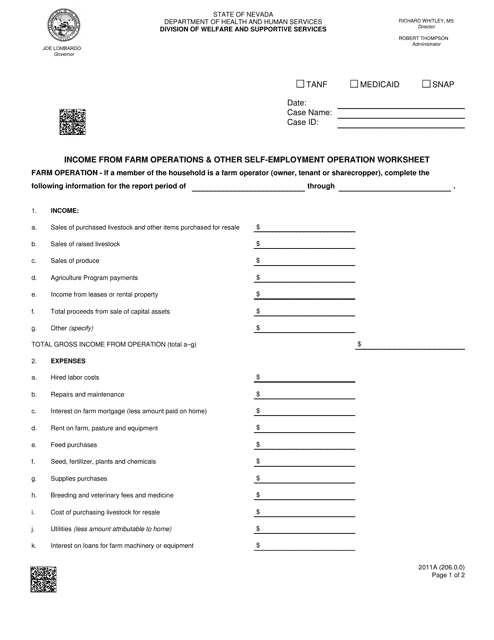

This form is used for calculating income from farm operations and other self-employment activities in Nevada. It is a worksheet that helps individuals keep track of their earnings and expenses related to these types of activities.