Free Operating Agreement Templates

What Is an Operating Agreement?

An Operating Agreement is a formal statement that outlines the roles of the limited liability company's management and its day-to-day and long-term strategy.

Alternate Names:

- LLC Operating Agreement;

- Partnership Operating Agreement.

The purpose of this document is to confirm the owners have limited liability and their assets and debts are separate from the business, outline the current and upcoming operations of the company, explain what to do in case the business owner passes away or is incapacitated so that they are unable to make crucial decisions for the business, and prepare a set of rules the entity will follow in accordance with its financial state to avoid complying with default regulations and laws enacted by the state.

Operating Agreement Template Types

- Limited Liability Company (LLC) Operating Agreement Template. You may use this generic document to describe how the business will be run whether you just founded your company or want to make significant changes to the existing agreement;

- Single-Member LLC Operating Agreement Template. If the LLC only has one owner, it is important to establish its status properly separating the personal assets of the individual from the entity assets and protecting the person in question from personal liability that may occur as a result of business activities;

- Multi-Member LLC Operating Agreement Template. Compose this document in case your LLC has no managers but two or more owners. It is even more important to agree upon the structure of the company and the regulations everyone must adhere to if several people vote on major decisions regarding the survival of the business.

Operating Agreement Templates by State

To offer protection to every member of the LLC and prevent the authorities or courts from making decisions on behalf of your company, you need internal documentation that will help you govern the business without unnecessary distractions including those that may come from the inside - if, for example, you have a conflict with other members. Every state has its own regulations when it comes to limited liability companies, so it is essential to check the local laws and compose a state-specific Operating Agreement that will be considered valid even in the most extreme circumstances. See the documents below to select an Operating Agreement appropriate for your location and situation.

Do I Need an Operating Agreement for My LLC?

While certain states require every limited liability to create and maintain an updated version of the basic LLC Operating Agreement, most states do not ask business owners to set out the hierarchy of the company in writing explaining how the entity will determine its policy and vote on the most important matters that impact the future of the organization. However, even if there is no legal requirement to write a document of this kind, you should consider the benefits of this agreement: you will need guidance regarding the choices your company makes and procedures to follow whenever there is a major disagreement between the members of the LLC and the management. There will be no need to submit an Operating Agreement with any local or state authorities; however, it may come in handy whenever you are negotiating with potential business partners or suppliers that might want to learn more about the way your business works.

What Does an Operating Agreement Look Like?

Usually, an LLC Operating Agreement template contains the following sections:

- Mission statement of the company . List the name of the business, its contact details, and the goals the entity is planning to pursue. Describe the business type you have chosen, indicate the categories of goods and services you are going to provide, and mention the jurisdiction you subject the organization to.

- Ownership of the LLC . Name the owners, outline the distribution of capital and shares, and prepare to deal with the sudden passing of the owner or the decision of several members to leave the business.

- Management of the entity . It is crucial to include several sentences that illustrate the hierarchy of the LLC and determine who answers to whom in your business. You may have to act quickly, so it is important to have a precise protocol in place.

- Meetings of the LLC owners and the voting process . It is required to know how the major decisions of the company will be made - include the amendment procedures for the Operating Agreement in question. Moreover, you have to describe the potential dissolution of the entity.

How to Create an Operating Agreement?

To establish the framework and the governing structure of the LLC, one or several members of the company need to prepare a simple Operating Agreement that will include the main information about the entity in question. You should consider working on this legal instrument before your first transaction or contact with a business partner to know the foundation you are standing on. It is recommended to request the presence of all the limited liability company members at the meeting that allows the business to draft and approve several documents that define the future of the company. Every person involved in making a decision of this magnitude will be allowed to vote on the definitive draft of the Operating Agreement template - as a rule, it is necessary to secure the majority of votes to document how the company is going to be run.

How Much Does an Operating Agreement Cost?

If you are making your first steps on the market or inheriting the business from a more experienced individual, you may need to consult a lawyer who will help you to create an Operating Agreement from scratch. Since this document is essential for any company, at a minimum, you should reach out to a lawyer that will review the document you prepare on your own. Depending on your location, the cost of the Operating Agreement may vary from $500 to $1.000. It will cost less if you compose the document yourself, and the lawyer spends some time pointing out the flaws in your writing - however, make sure to find out whether they bill their services using an hourly rate or ask for a flat fee.

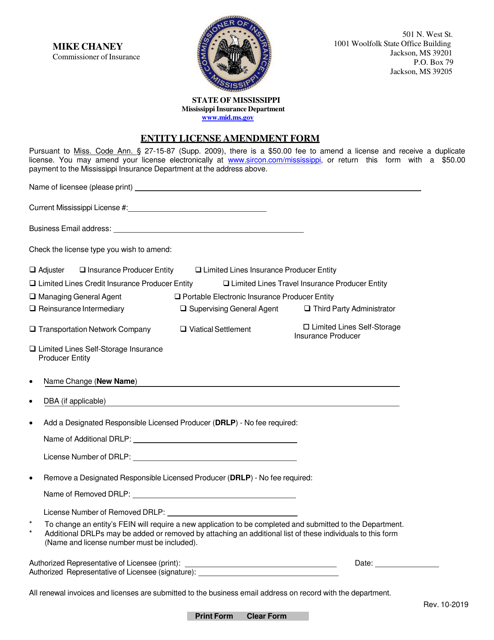

How to Amend an Operating Agreement?

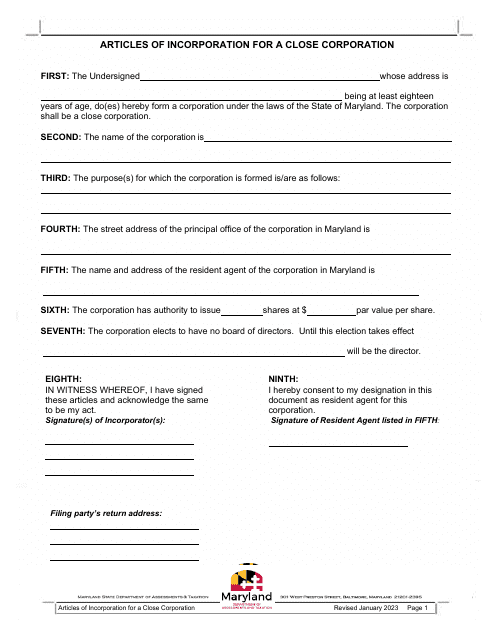

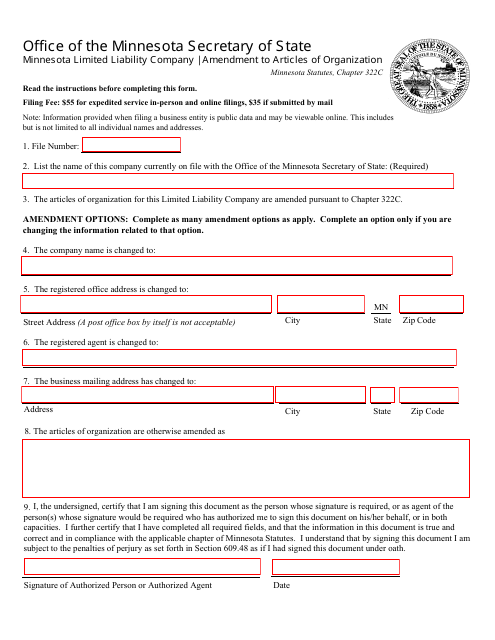

It is quite simple to change the terms and conditions the Operating Agreement contains. To modify the text of the document, you need to propose an amendment and ask the members of the limited liability company to express their opinion about your ideas and vote following the procedures established by the original agreement. If the majority of members vote in favor of the amendment, you are allowed to draft a resolution - every member must sign this document before it is added to the internal records of the business. Do not forget to amend other documents if necessary - for instance, if you add a new LLC member, you may need to change the articles of incorporation.

Haven't found the template you're looking for? Take a look at the related topics below:

Documents:

210

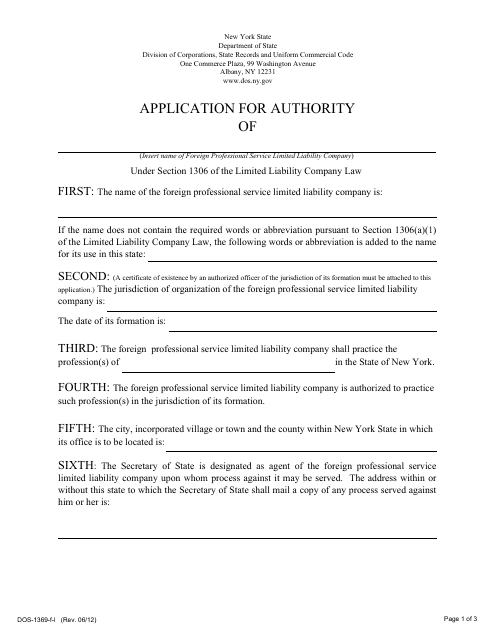

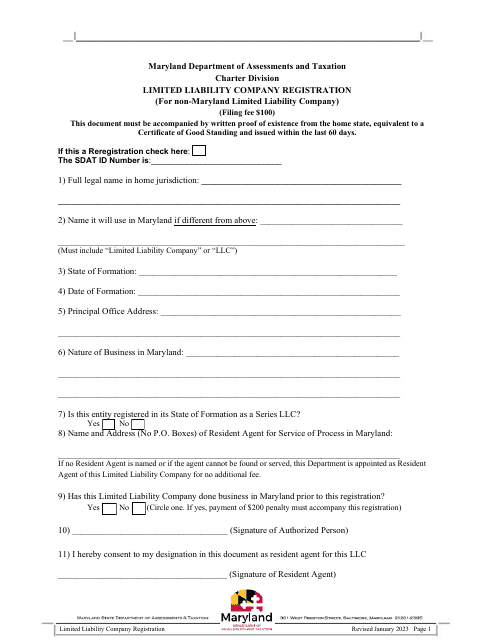

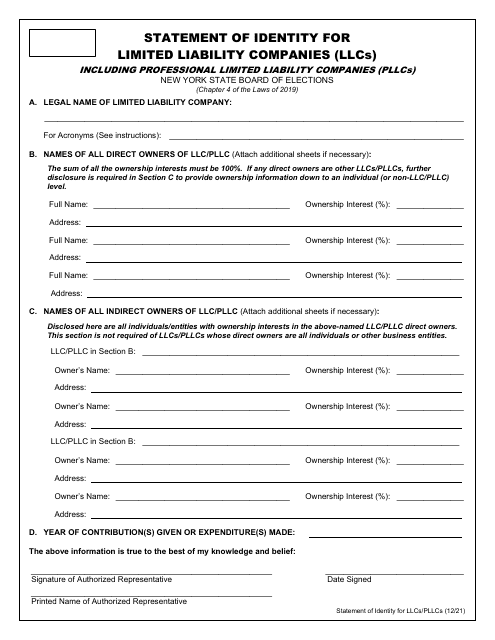

This form is used for applying for authority in the state of New York.

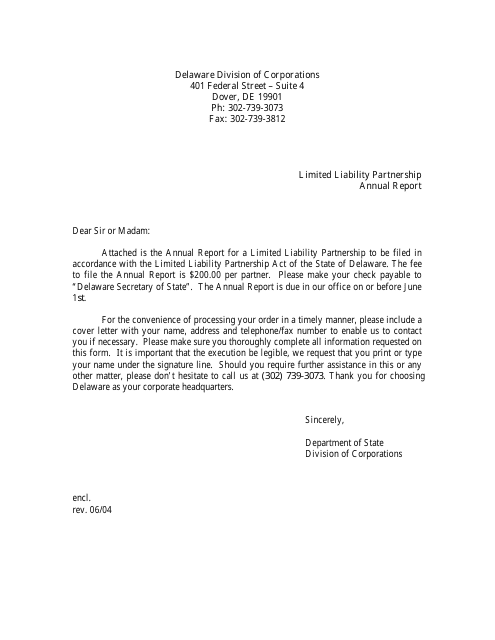

This document is used for filing the annual report for a limited liability partnership in the state of Delaware.

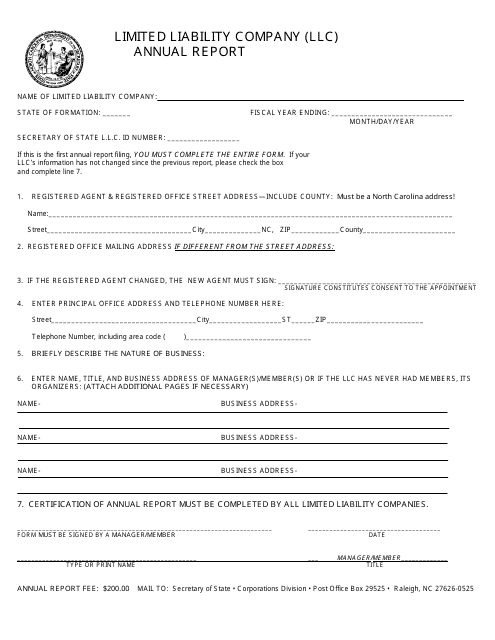

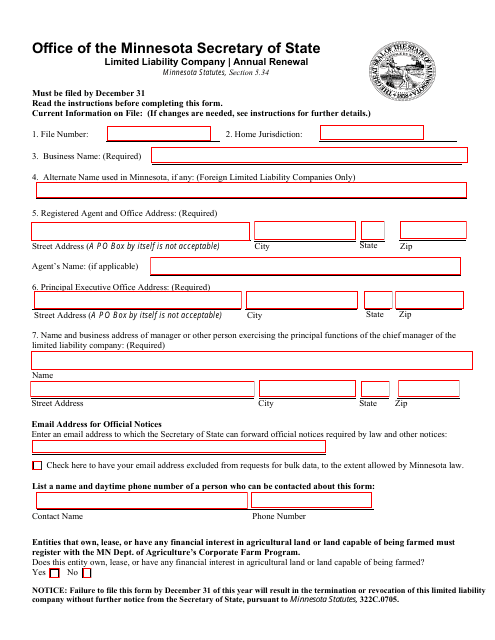

This Form is used for filing the annual report by Limited Liability Companies (LLCs) in North Carolina. It is a legal requirement to provide updated information about the business and its members to maintain active status as an LLC in the state.

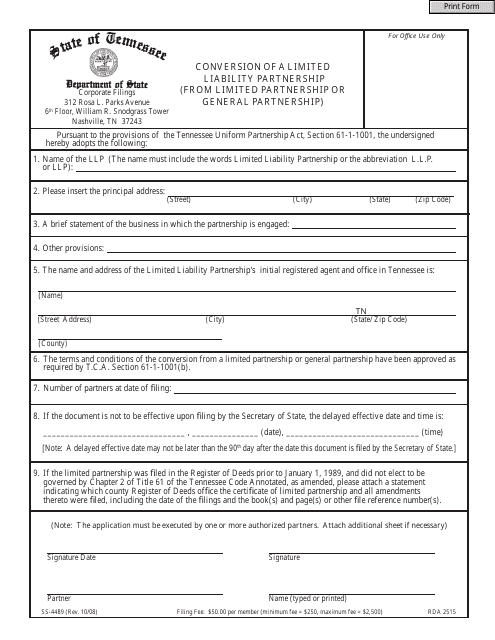

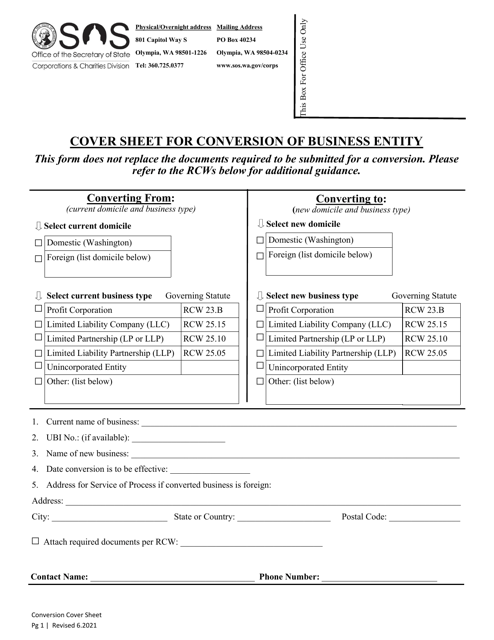

This form is used for converting a limited liability partnership in Tennessee from either a limited partnership or a general partnership.

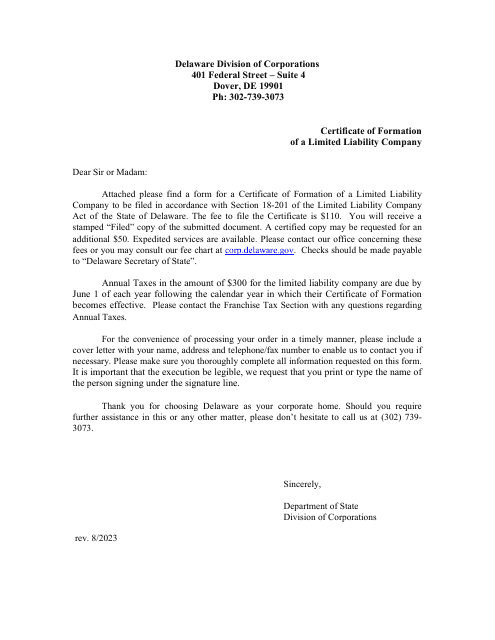

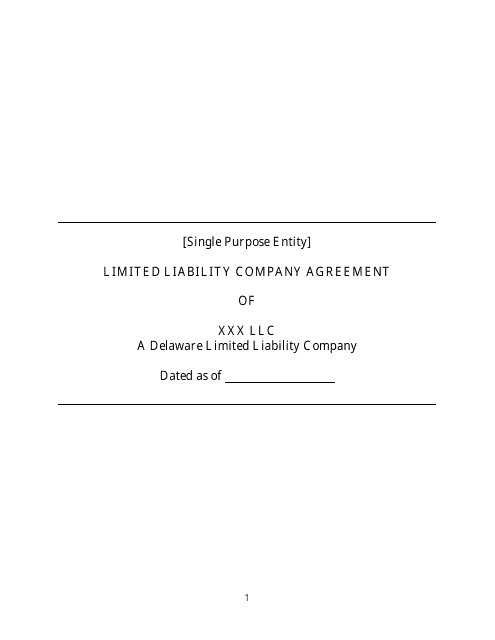

This document is a legal agreement form used for forming a Limited Liability Company (LLC) in the state of Delaware. It outlines the rights, responsibilities, and obligations of the LLC members.

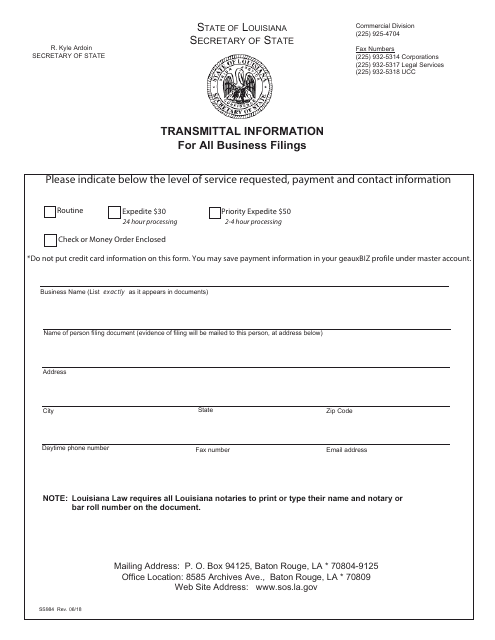

This form is used for organizing a domestic limited liability company in the state of Louisiana.

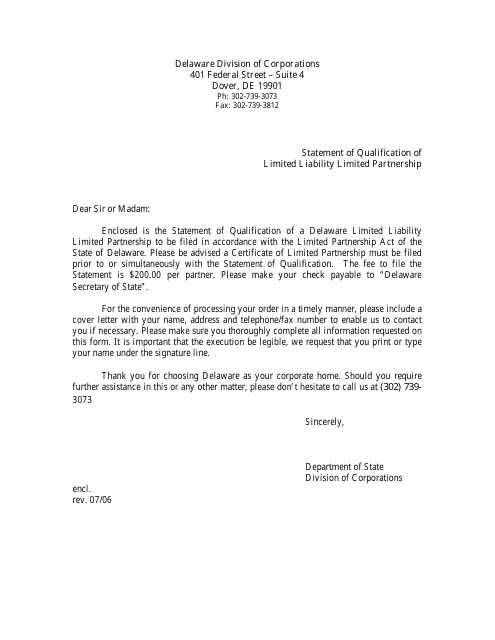

This document is for stating the qualifications of a limited liability limited partnership in Delaware.

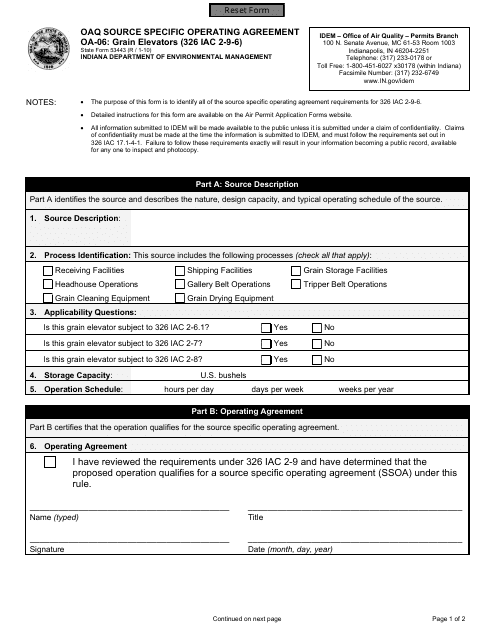

This form is used for obtaining a Source Specific Operating Agreement for grain elevators in Indiana.

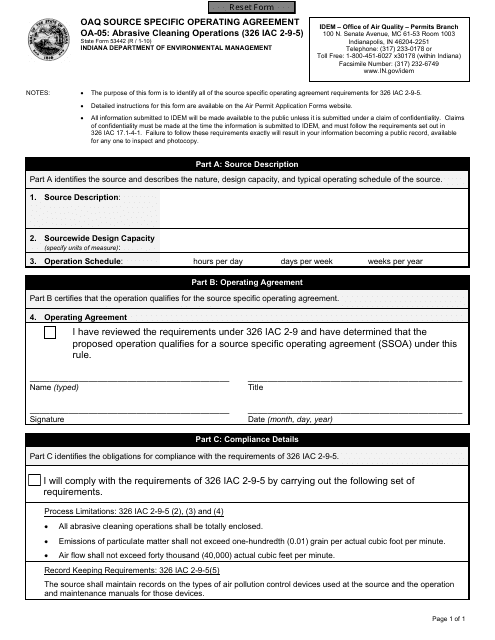

This form is used for an Oaq Source Specific Operating Agreement for abrasive cleaning operations in Indiana.

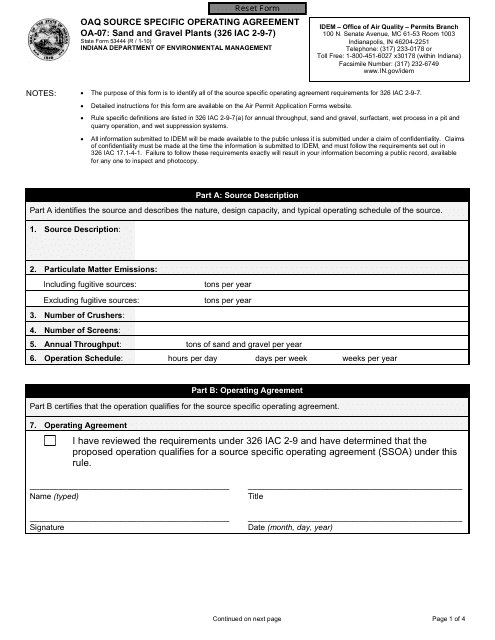

This Form is used for obtaining an Operating Agreement for Sand and Gravel Plants in the state of Indiana.

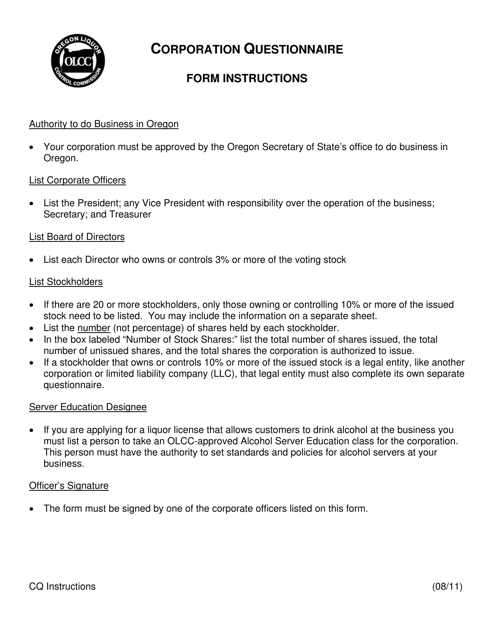

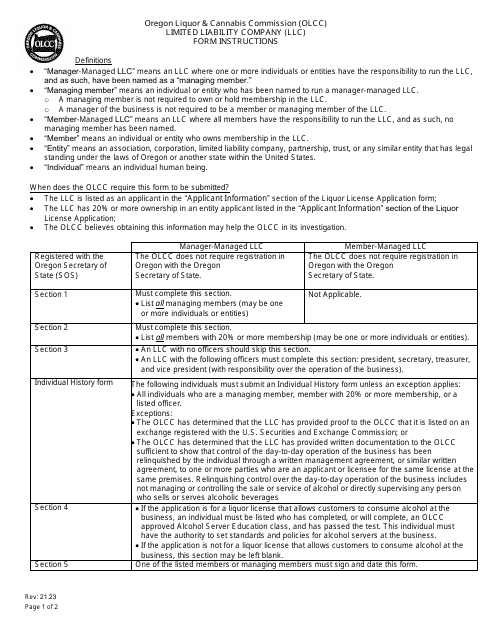

This document is used to gather information about a corporation in the state of Oregon. It helps in understanding the structure and operations of the corporation.

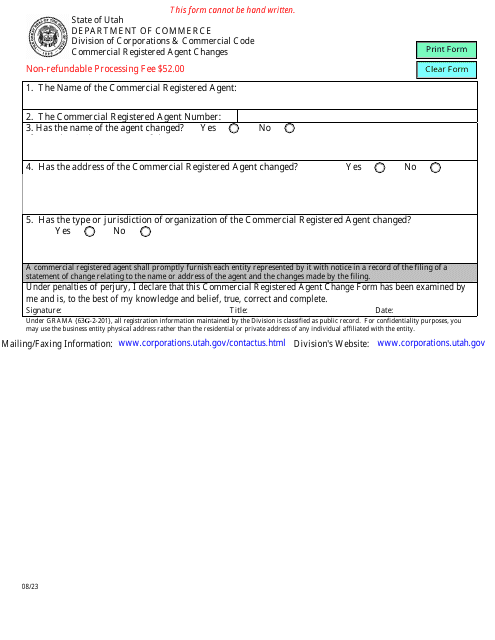

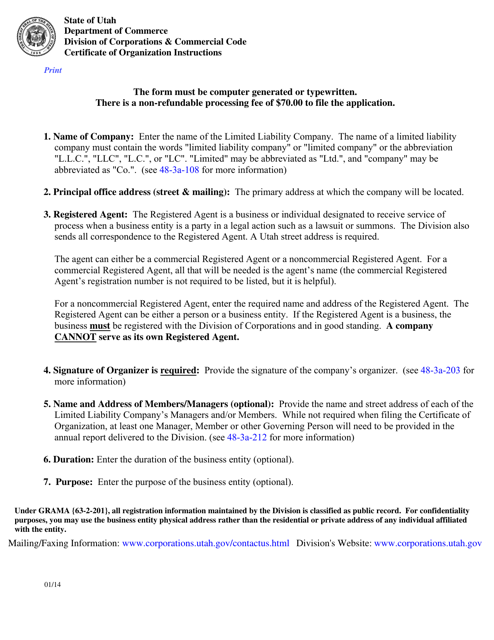

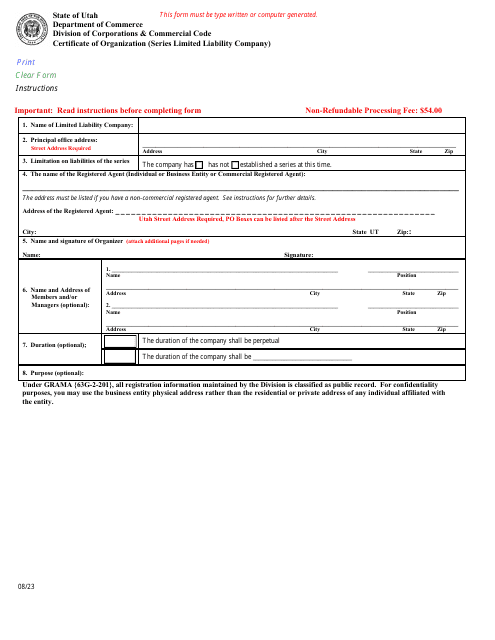

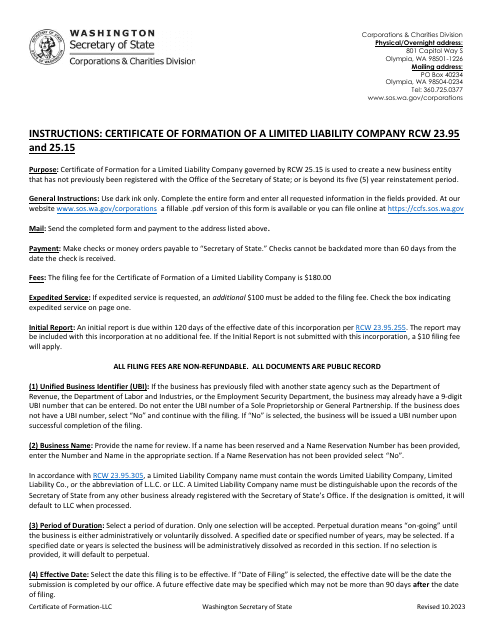

This document provides instructions for completing the Certificate of Organization for a business entity in the state of Utah. It outlines the required information and steps to be taken to form a new business or register an existing business in Utah.

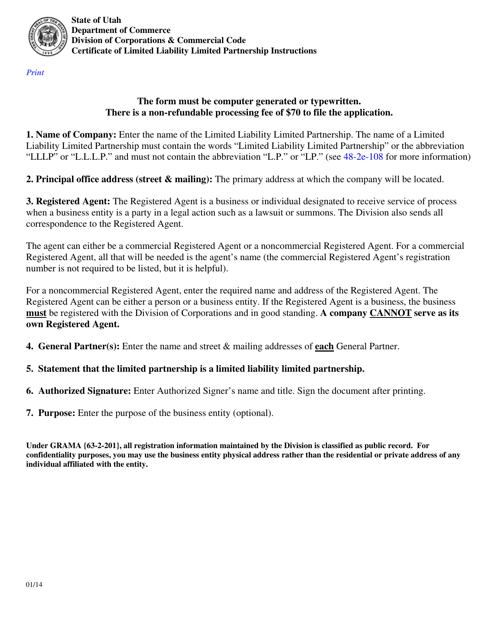

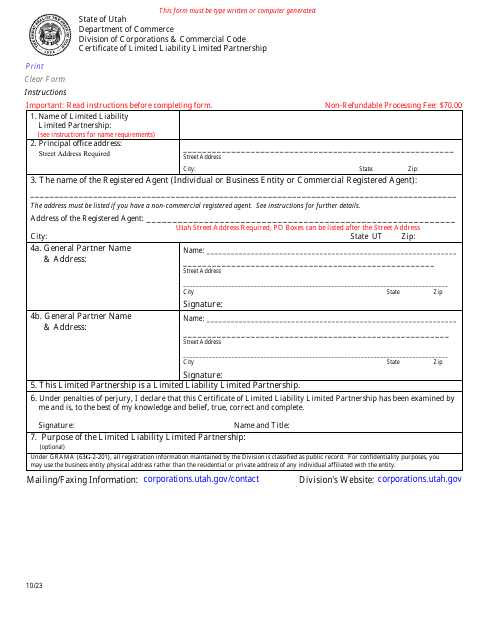

This document provides instructions on how to complete the Certificate of Limited Liability Limited Partnership in the state of Utah. It outlines the required information and steps to follow to properly file for this type of partnership.

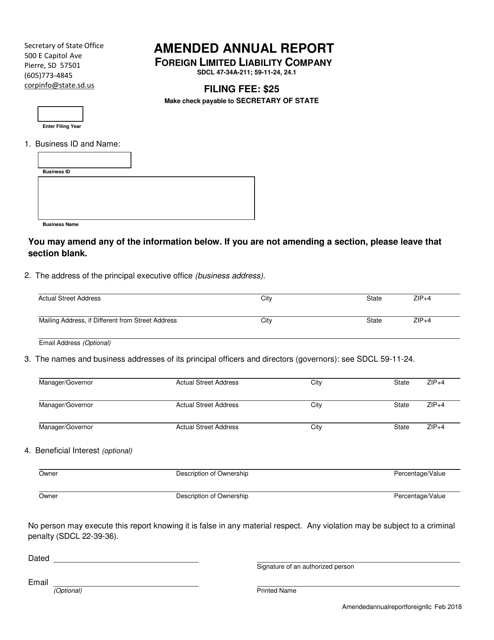

This document is used to update and correct the annual report filed by a foreign limited liability company in South Dakota.

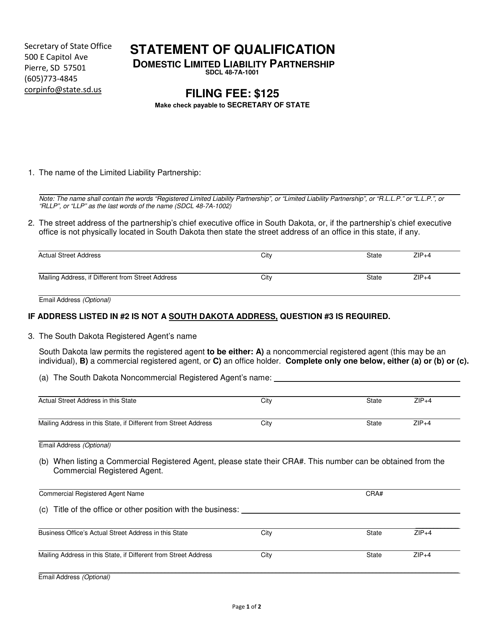

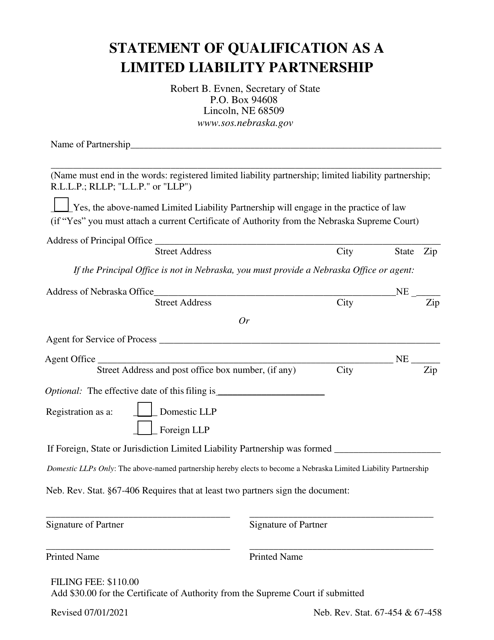

This document certifies the qualification of a domestic limited liability partnership in South Dakota. It provides important information about the partnership's structure and legal status.

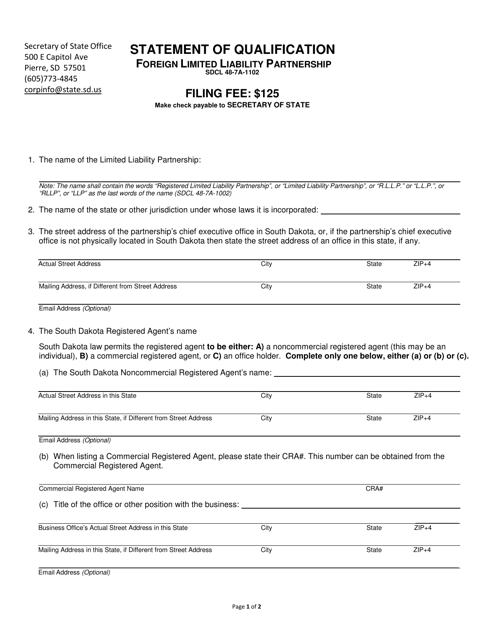

This document is used for disclosing the qualifications of a foreign limited liability partnership operating in the state of South Dakota.

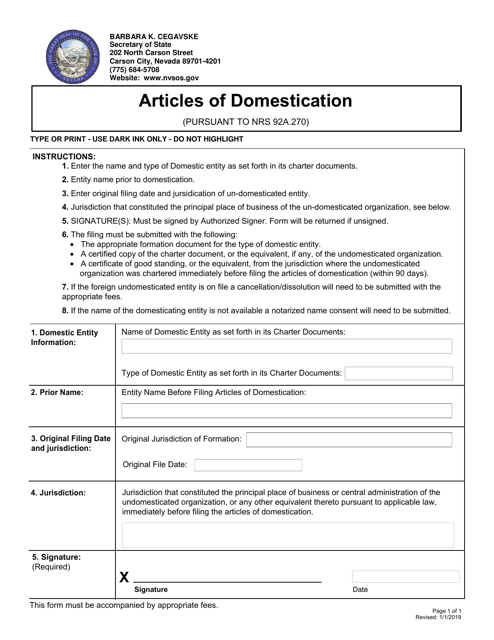

This document is used for domesticating a foreign business entity into a Nevada corporation.

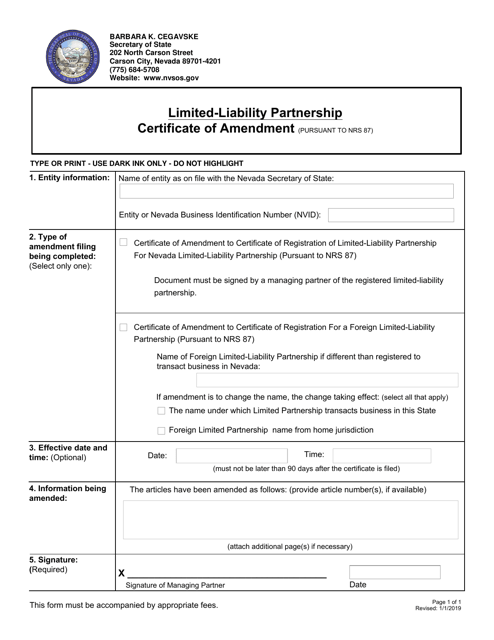

This type of document is used for making changes to the certificate of a limited-liability partnership in the state of Nevada.

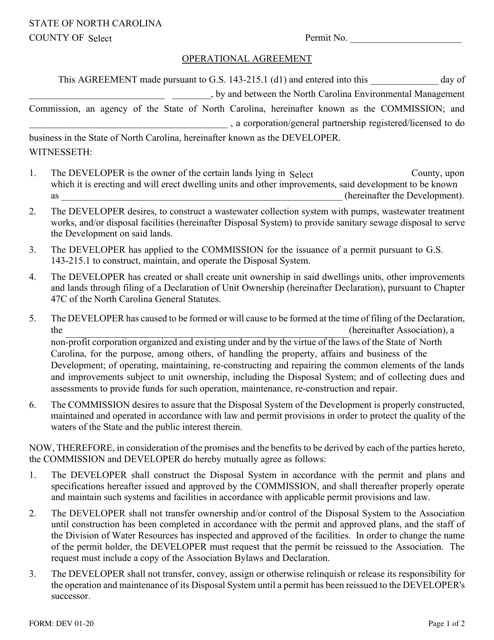

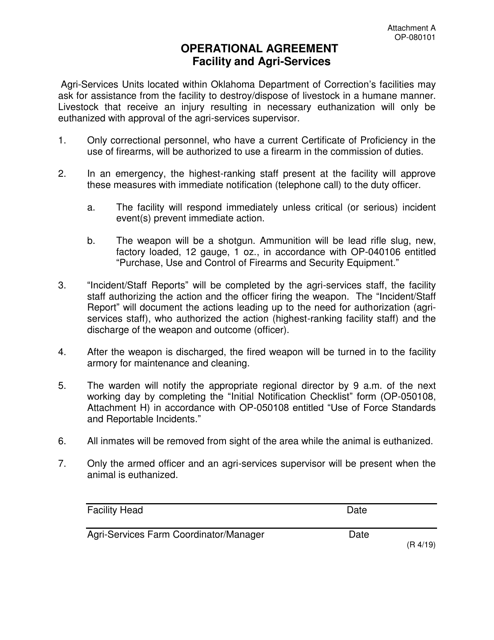

This document is an operational agreement form, specifically designed for use in the state of Oklahoma. It is designated as Attachment A to Form OP-080101. This form is used to outline the operational guidelines and responsibilities of a business or organization operating in Oklahoma.