Tax Clearance Form Templates

Documents:

48

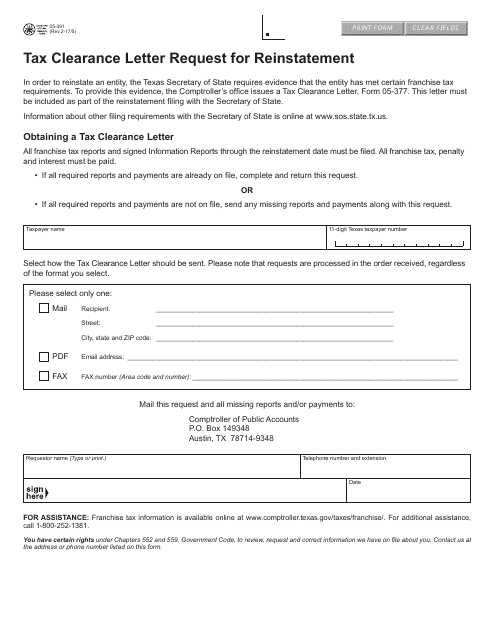

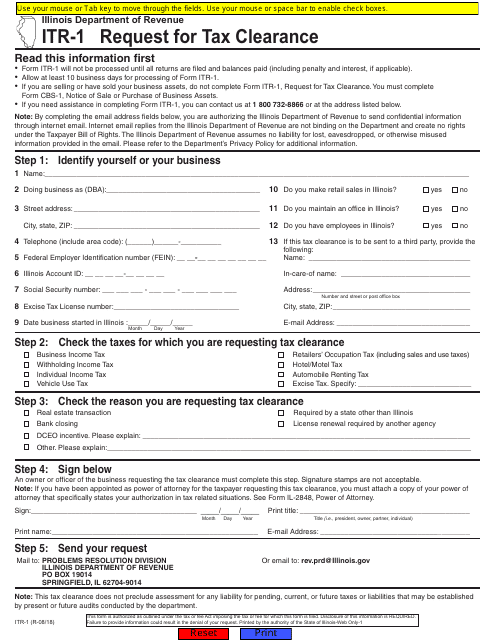

This form is used for requesting a tax clearance letter for reinstatement in the state of Texas.

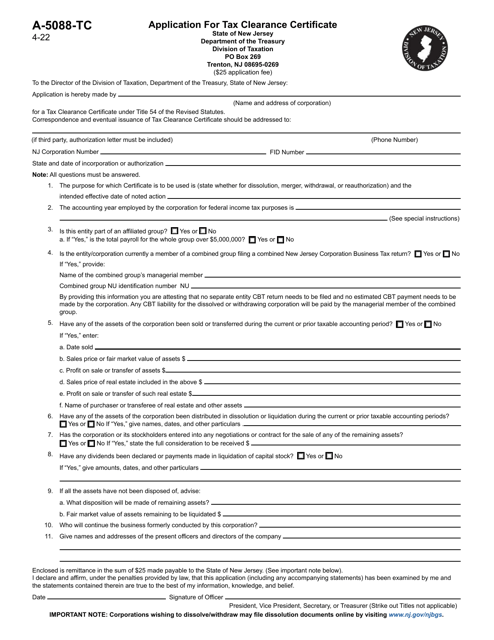

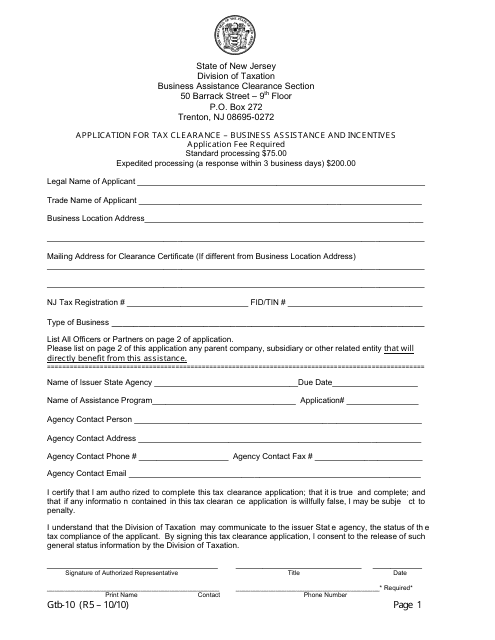

This form is used for applying for tax clearance and business assistance and incentives in New Jersey.

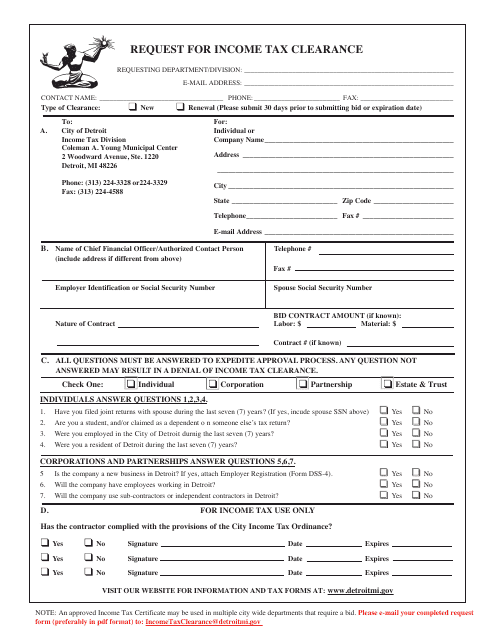

This form is used for requesting an income tax clearance in Detroit, Michigan. It is required to ensure all income taxes have been paid before certain transactions or activities can take place.

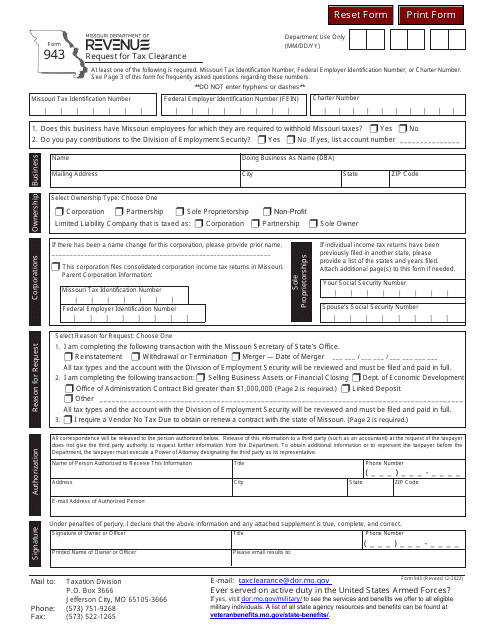

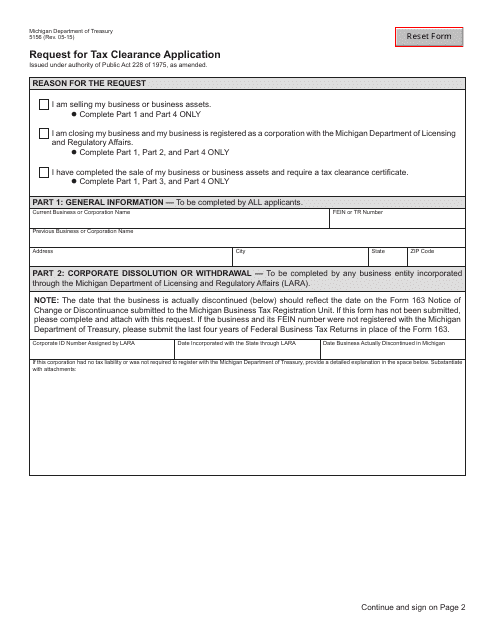

This form is used for requesting tax clearance in the state of Michigan.

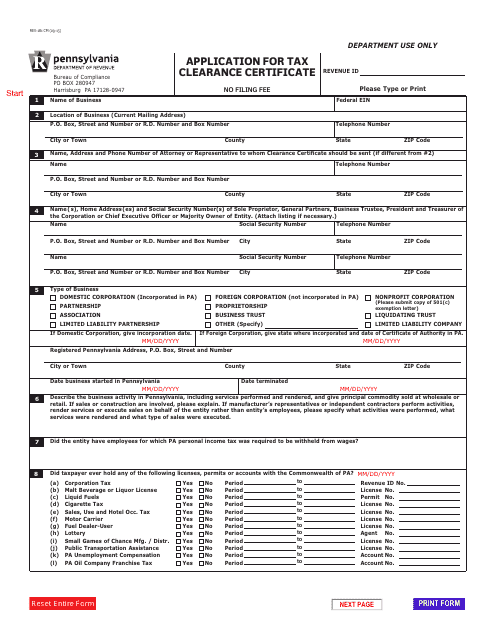

This form is used for applying for a Tax Clearance Certificate in Pennsylvania.

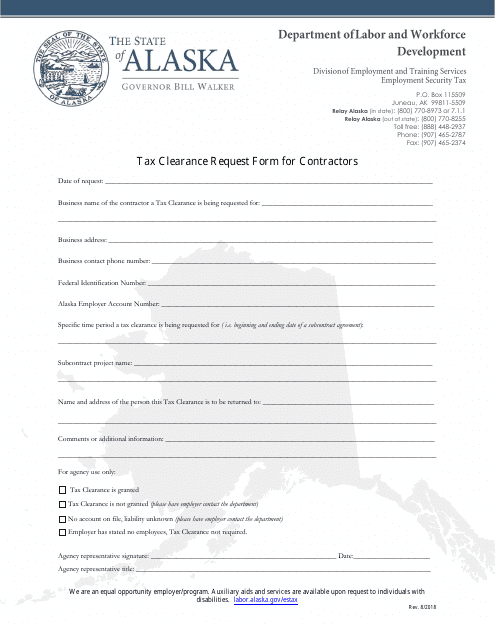

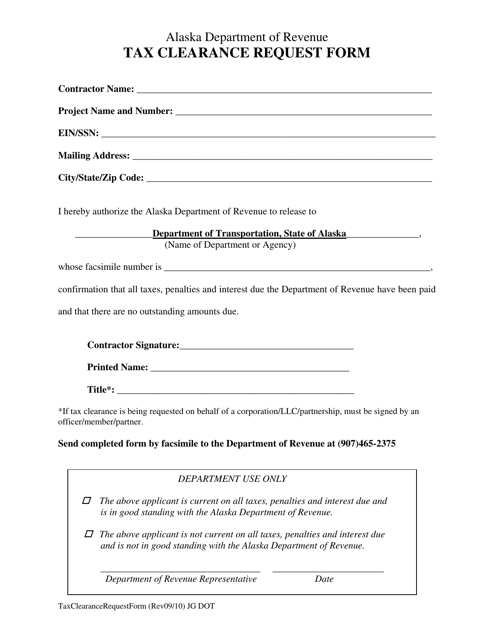

This Form is used for requesting tax clearance for contractors in Alaska. It is necessary for contractors to obtain tax clearance before starting their projects.

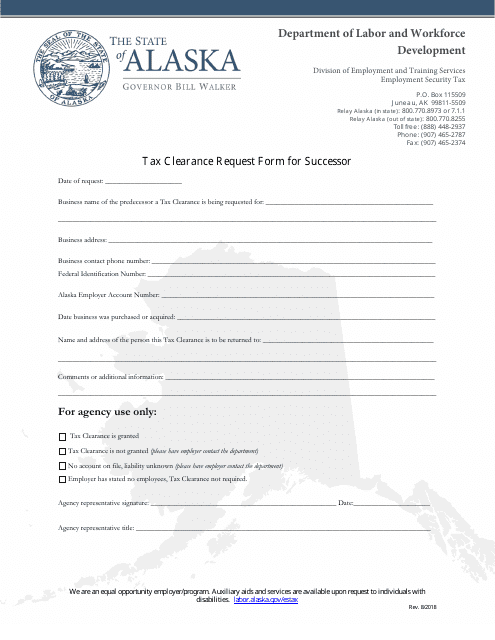

This form is used for requesting tax clearance as a successor in the state of Alaska. It allows individuals or businesses to certify that they have paid all necessary taxes and have no outstanding tax liabilities.

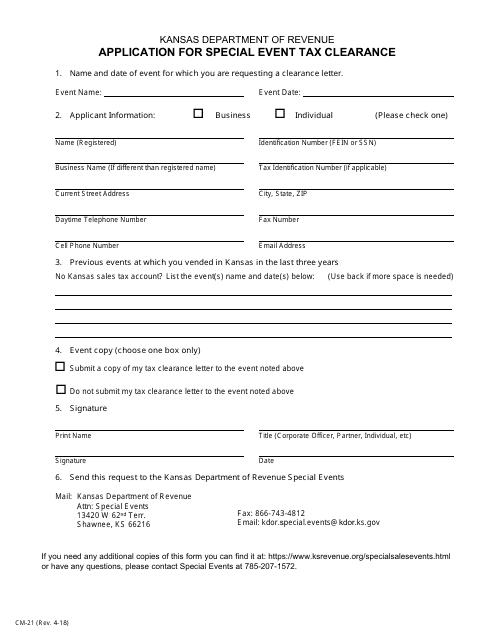

This form is used for applying for a special event tax clearance in the state of Kansas. It is required for organizers planning to hold a special event that may be subject to taxes.

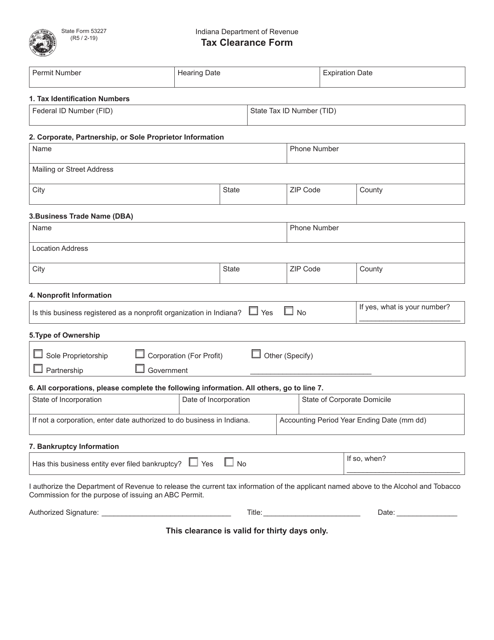

This form is used for obtaining tax clearance in the state of Indiana.

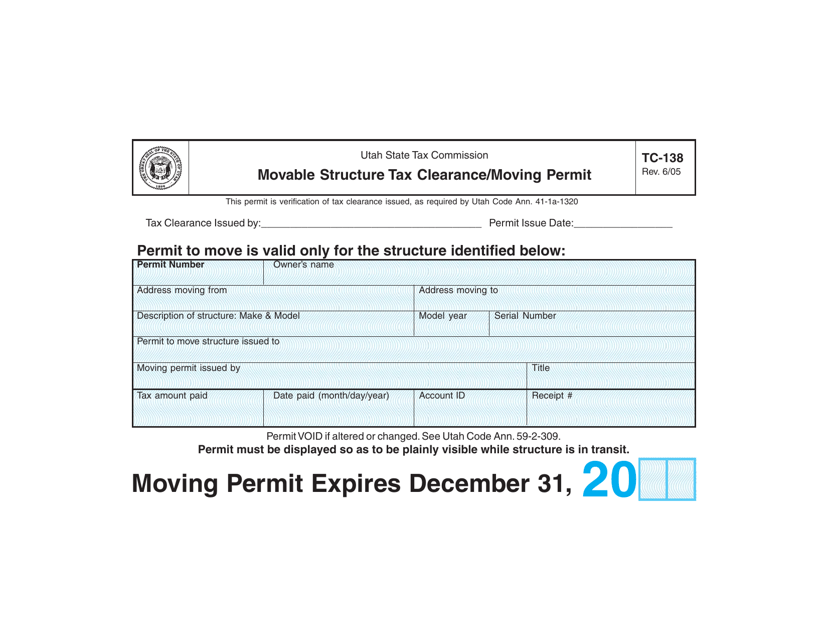

This form is used for obtaining a tax clearance and moving permit for movable structures in Utah.

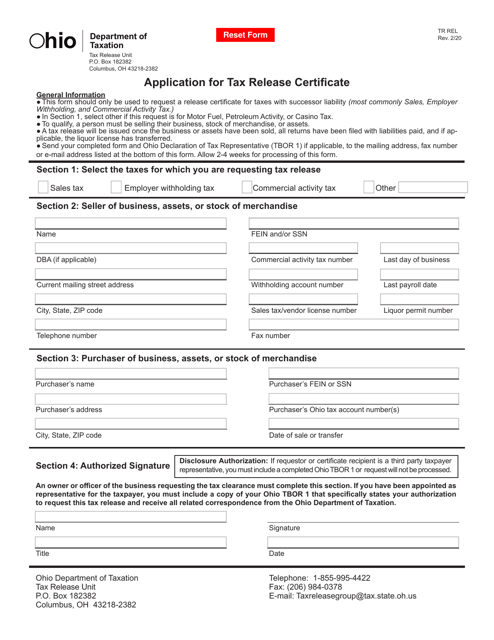

This form is used for acquiring a tax release certificate in Ohio. It helps individuals to request the release of their tax liabilities.

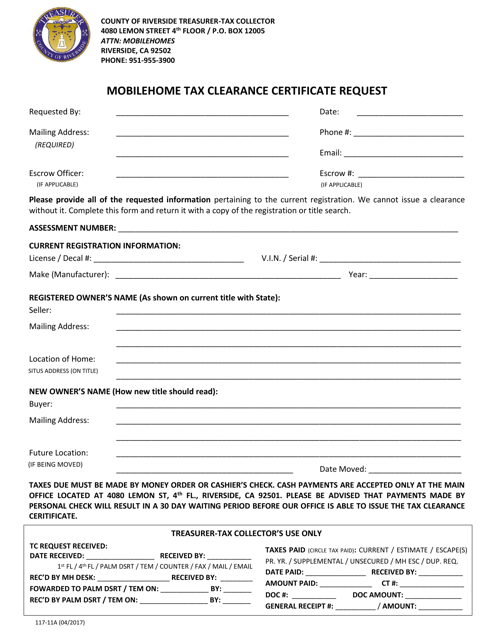

This form is used for requesting a Mobilehome Tax Clearance Certificate in Riverside County, California.

This form is used for requesting a tax clearance in the state of Alaska. It is used to verify that all taxes owed by an individual or business have been paid or are in good standing.

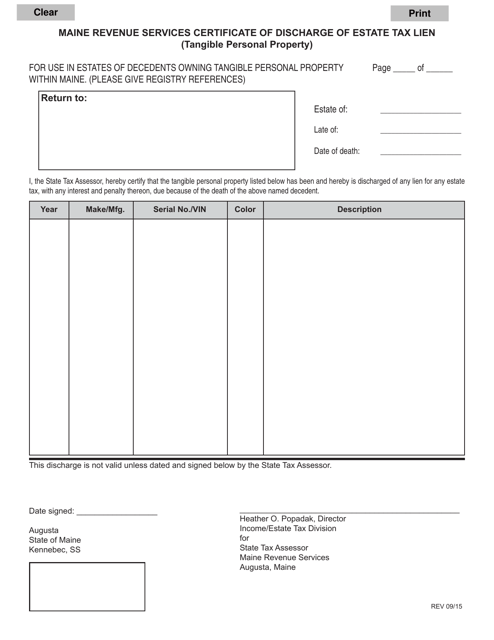

This document is a certificate issued by the Maine Revenue Services to discharge a lien on tangible personal property for estate taxes in the state of Maine.

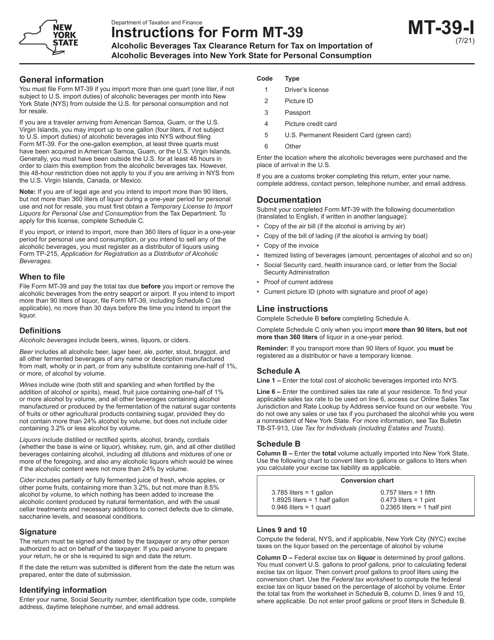

This form is used for reporting and paying the taxes on the importation of alcoholic beverages into New York State for personal consumption. It provides instructions on how to fill out and submit Form MT-39, which is required by the New York State Department of Taxation and Finance.

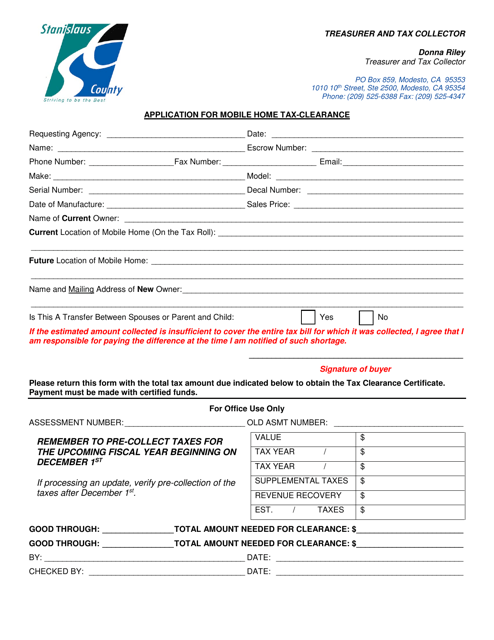

This document is used for applying for a tax-clearance for a mobile home in Stanislaus County, California.