Free Cash Sheet Templates

What Is a Cash Sheet?

A Cash Sheet is a document that records payments and transactions made in cash. Usually prepared by small businesses, this document allows you to not lose track of your money – unlike credit card payments, cash payments are easily lost or forgotten – and streamline your cash balance.

Alternate Names:

- Cash Count Sheet;

- Cash Balance Sheet.

A proper Cash Balance Sheet is a crucial document for any company that carries out its transactions in the form of cash. There are several reasons to compose and manage a Cash Sheet:

- Get a financial record of all the cash transactions that the company has entered into during the day.

- Save money – if you prepare a Cash Sheet yourself, you do not have to seek a professional to do it for you for the accounting fee.

- Avoid writing checks for operations that involve small amounts of money – if you maintain documentation of all cash payments, you work faster.

- Find cash discrepancies and what leads to them. For instance, the business may deal with theft or mistakes in calculations. In this case, the owner or manager will be able to analyze the Cash Sheet and figure out the causes of the shortage.

If you’re looking for a sample Cash Sheet template you can browse our library of forms through the links below.

There is a similar document you should compose, especially if you need to review your bills and monitor payments, some of them made in cash – a Bill Tracker. With a Bill Tracker, you will see the whole picture – all the monthly and yearly bills, amounts you owe, and their due dates.

What Is a Daily Cash Sheet?

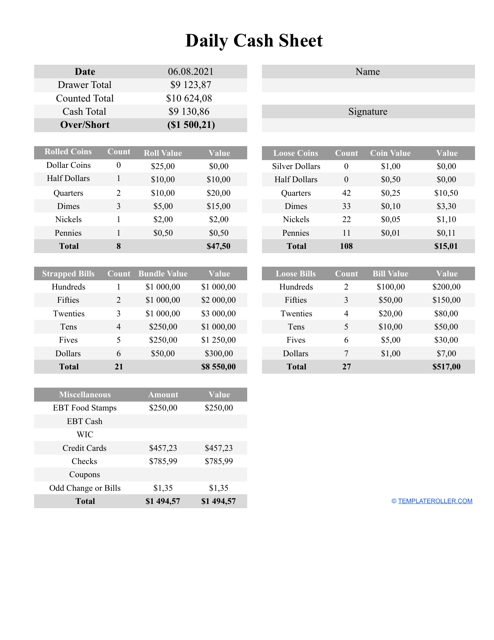

A Daily Cash Sheet (or Daily Cash Report) is a written statement prepared each day to indicate daily cash totals at the beginning and the end of every business day. It can serve as a reference when comparing two days of business operations – you can see which items bought with cash are in demand, you will be able to control major cash transactions, and monitor the activity of your employees, in particular cashiers.

There are two ways to compose a Daily Cash Sheet to keep a record of your cash transactions:

- Write down the current date on the page of the form. Draft a table of five columns - cash on hand (at the beginning of the day), number of daily sales (plus their short description if you need it), the cash you were paid, the cash you paid, and total cash left at the end of the day.

- Create a more elaborate Cash Count Sheet if you need to count different forms of cash for your records - strapped bills, loose bills, rolled coins, and loose coins. Specify their types (dollars, half dollars, quarters, dimes, nickels, and pennies for coins and hundreds, fifties, twenties, tens, fives, and dollars for bills) and calculate their total amount in separate sections or small tables. Add the amounts and check your register or drawer to make sure the actual cash and its written amount are equal.

Related Templates and Topics:

Documents:

3

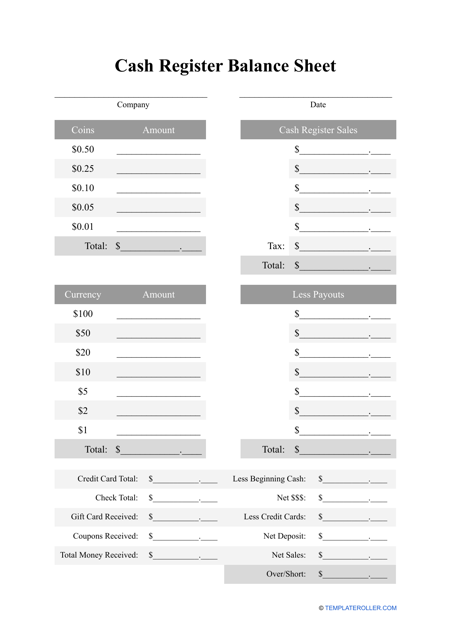

If you manage a business that requires using a cash register, keeping a daily Cash Register Balance Sheet is necessary to track how the business is performing over time.

This is a written document designed to keep track of all cash transactions of the business on daily basis.

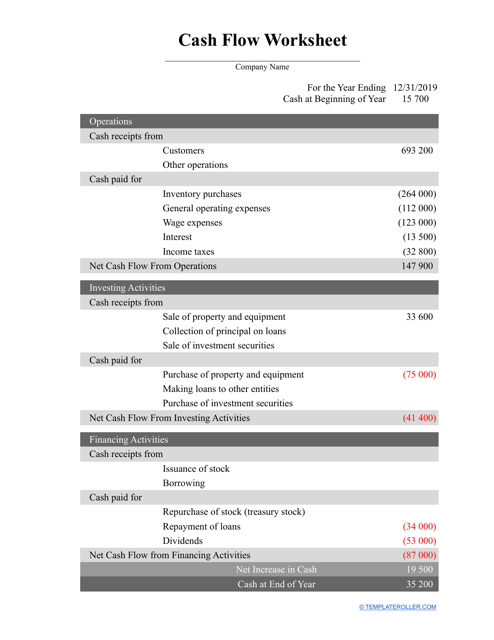

When operating a business, it is important to use this type of template to understand what money you are expecting to receive in the coming weeks or months and how that money is used.