Net Worth Templates

Documents:

45

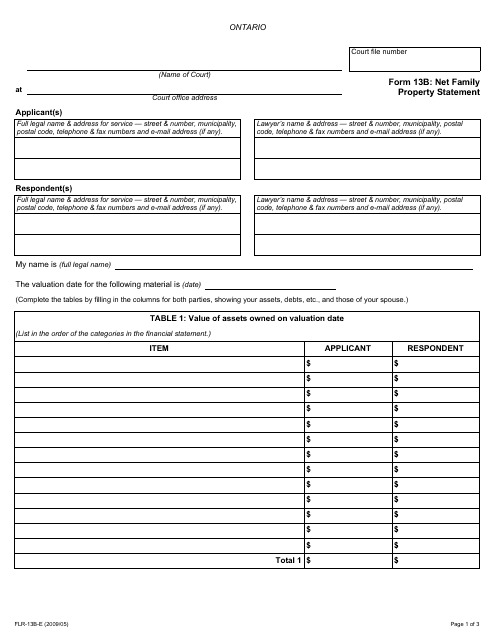

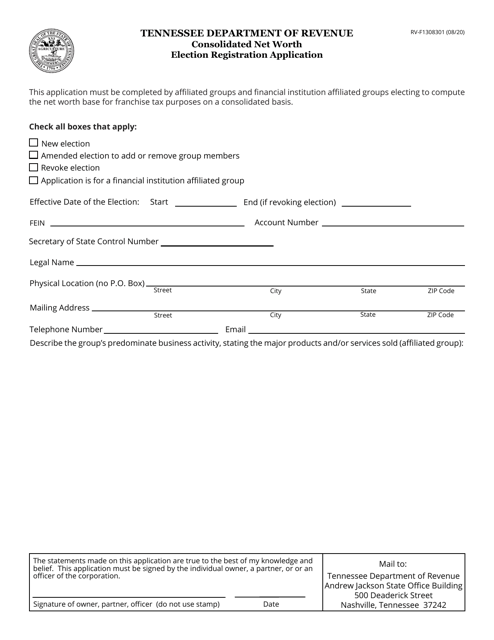

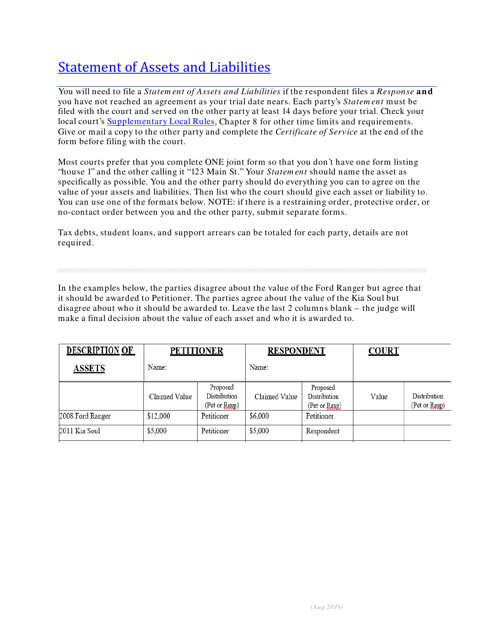

This form is used for calculating and disclosing the net family property in Ontario, Canada during a divorce or separation.

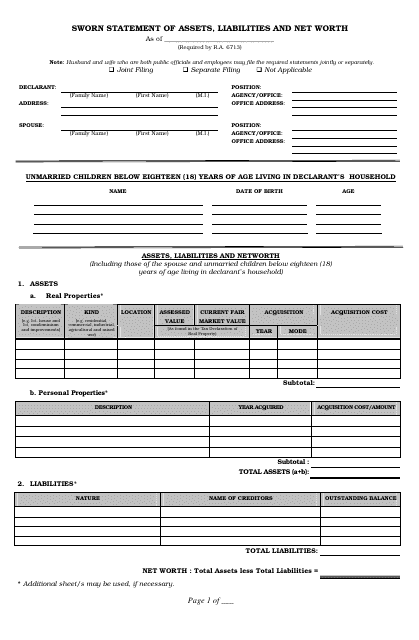

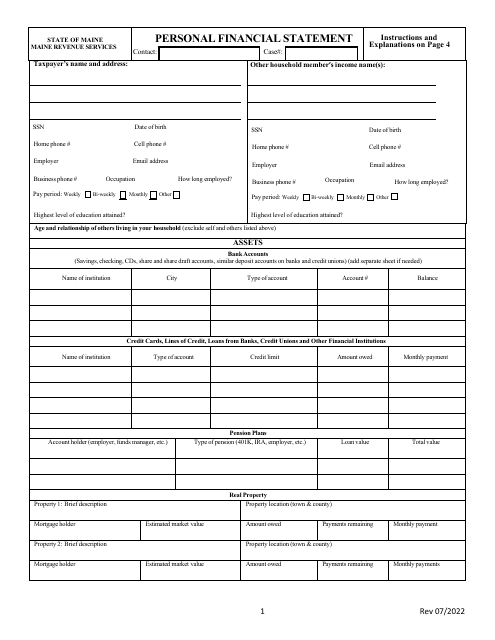

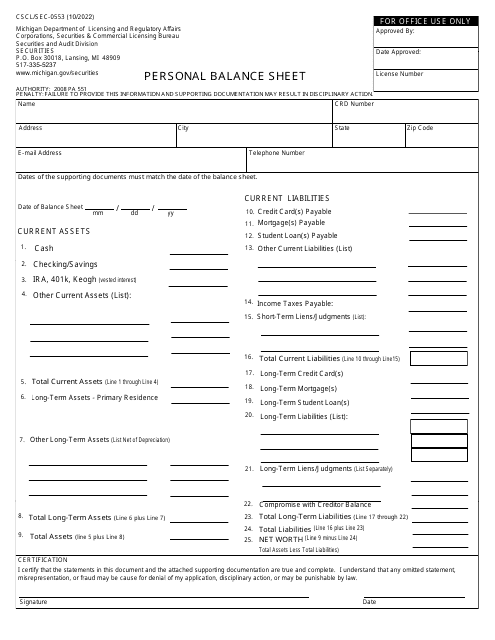

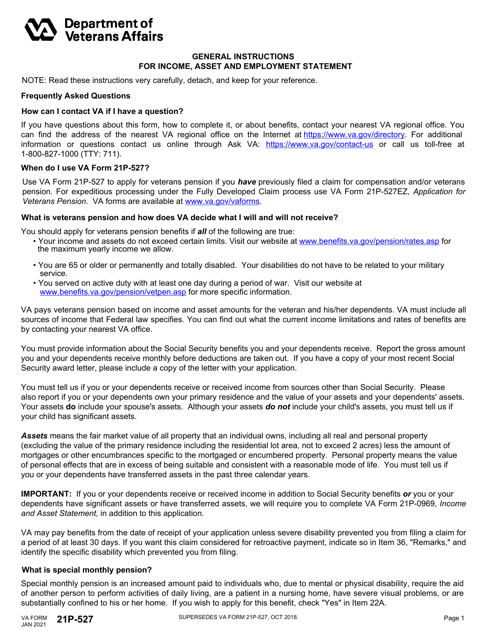

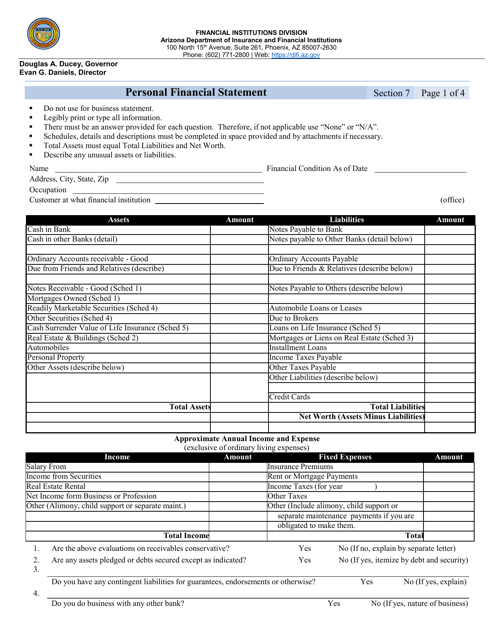

This document is used for declaring and providing information about an individual's assets, liabilities, and net worth.

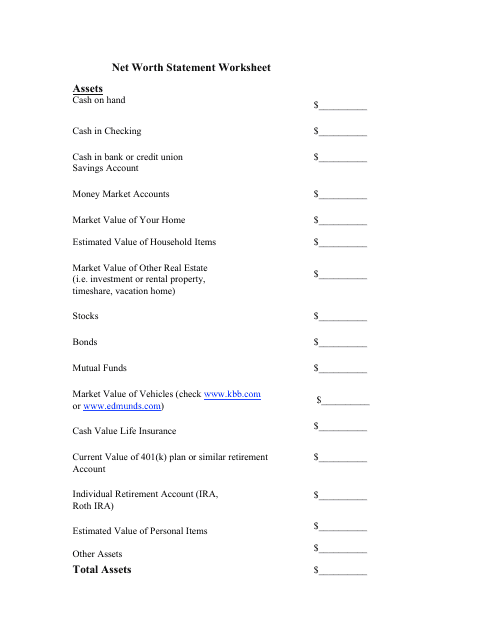

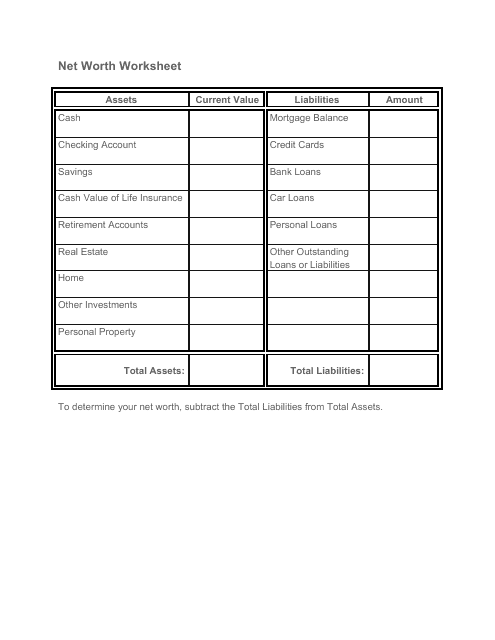

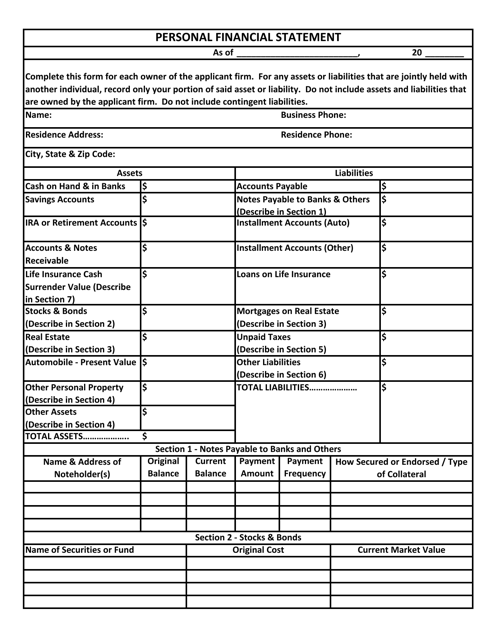

This document is a worksheet used to calculate and track your net worth. It helps you understand your financial situation by detailing your assets and liabilities.

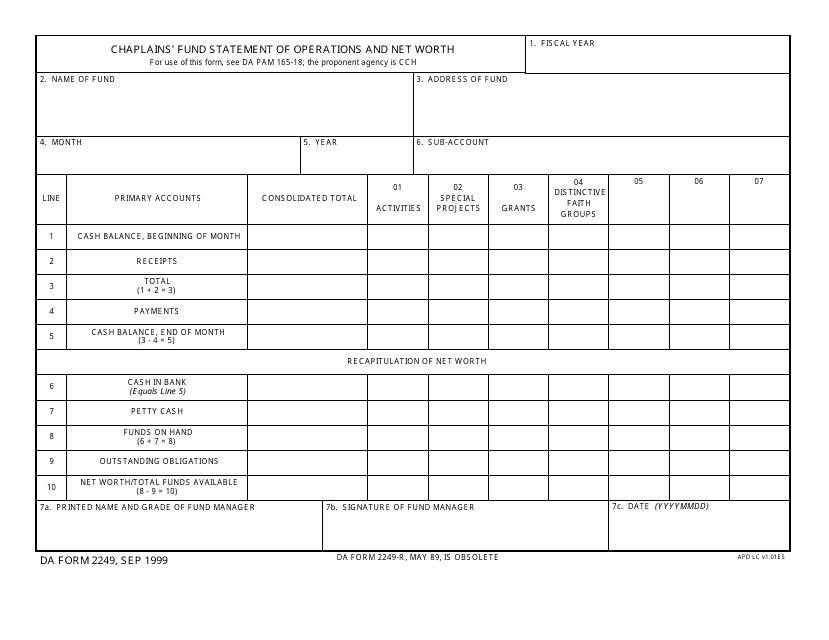

This document is used for recording the financial operations and net worth of the Chaplains' Fund.

This document is a template for a net worth worksheet, which helps individuals calculate their total assets and liabilities to determine their net worth. It can be useful for financial planning and tracking personal finances.

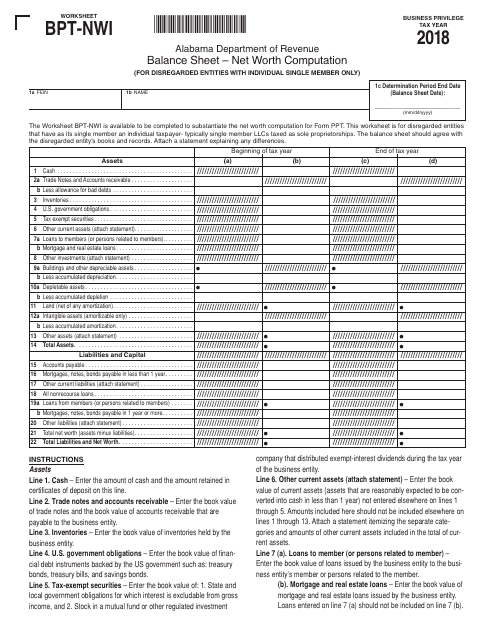

This document is a worksheet titled Bpt-Nwi, which is used for calculating the net worth on a balance sheet in the state of Alabama.

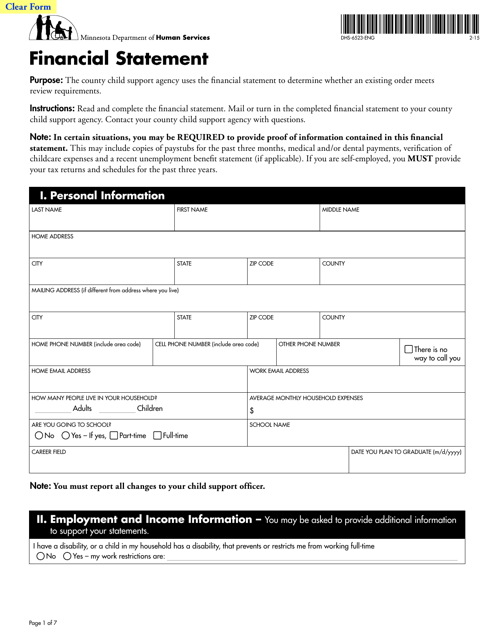

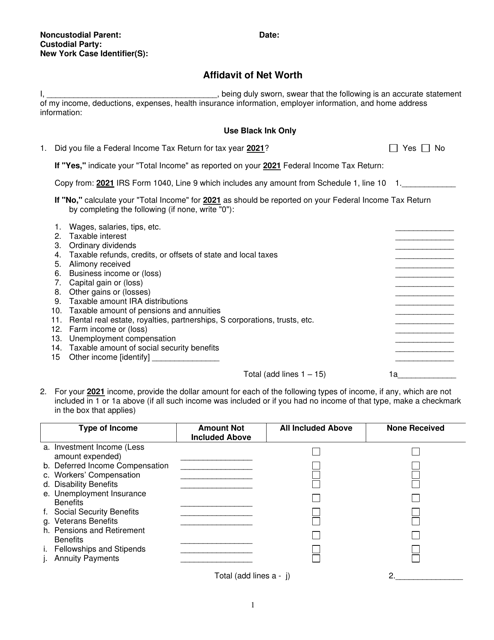

This form is used for filing a financial statement in Minnesota. It is used to provide information about one's financial condition and assets.

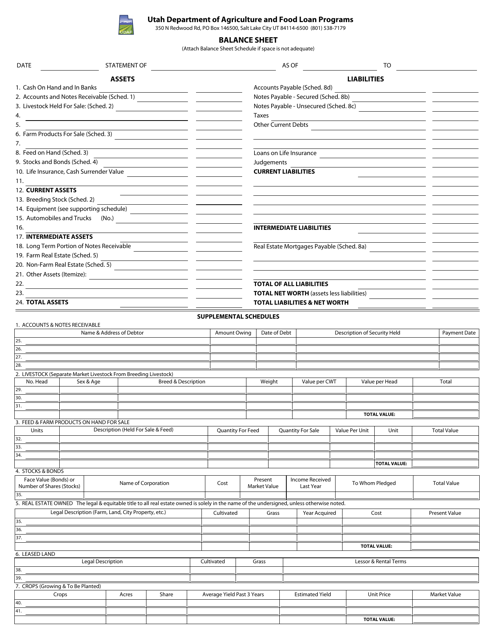

This document provides a summary of a company's assets, liabilities, and equity in Utah. It shows the financial position of the company at a specific point in time.

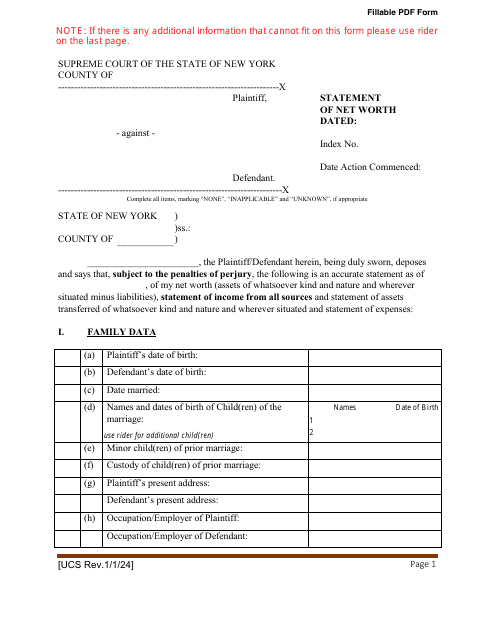

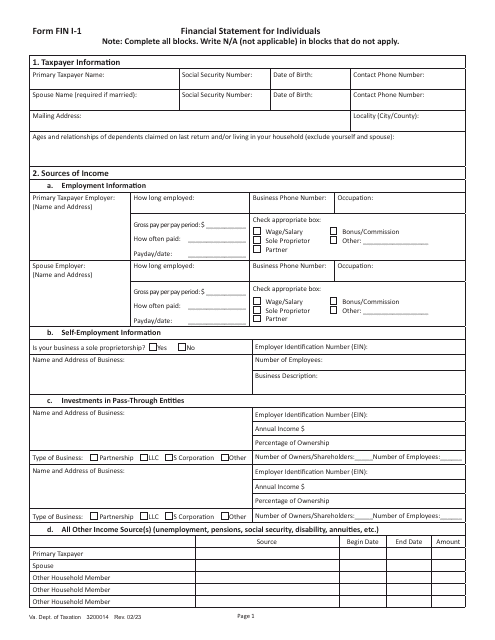

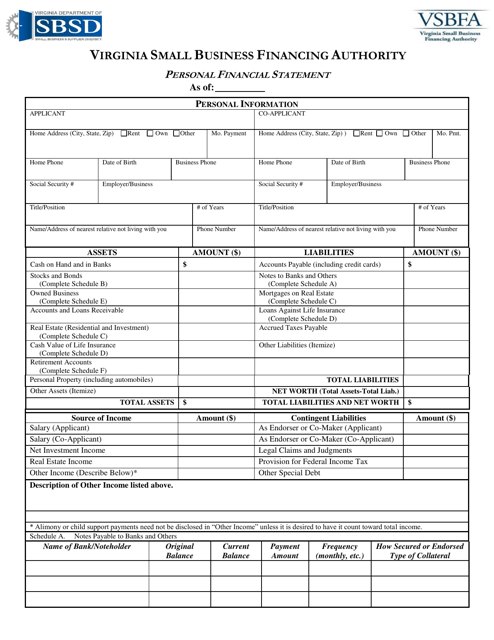

This document is used for summarizing an individual's financial situation in the state of Virginia. It includes details about assets, liabilities, income, and expenses.

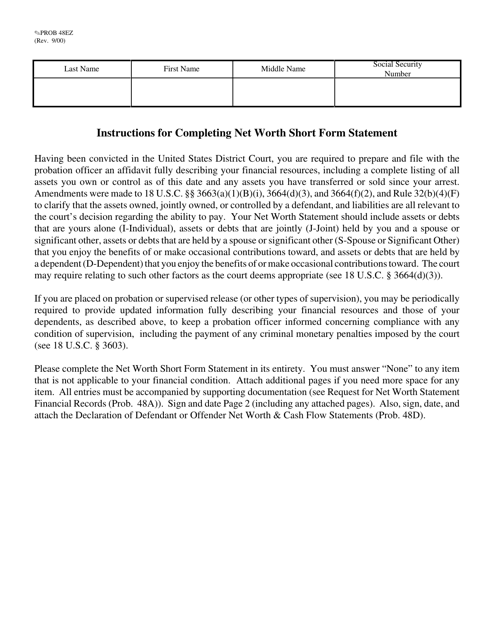

This Form is used for reporting net worth on a short form statement. This document helps individuals to provide a concise summary of their assets and liabilities.

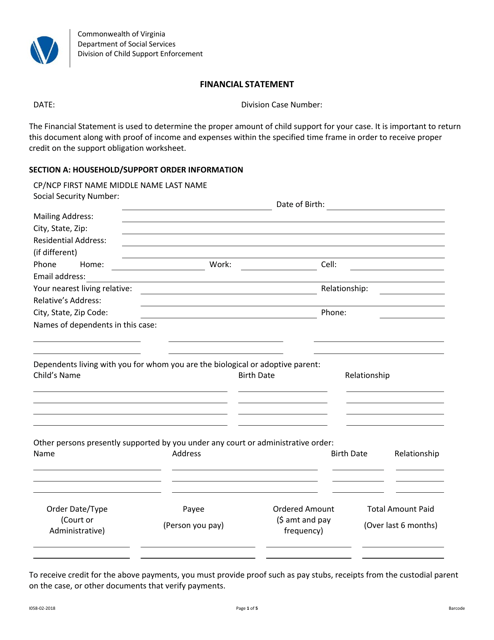

This Form is used for filing a financial statement in the state of Virginia. It is typically used for disclosing income, assets, and debts for legal or financial purposes.

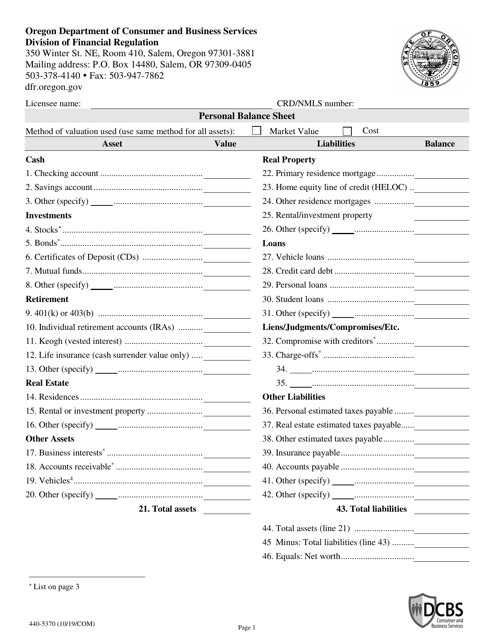

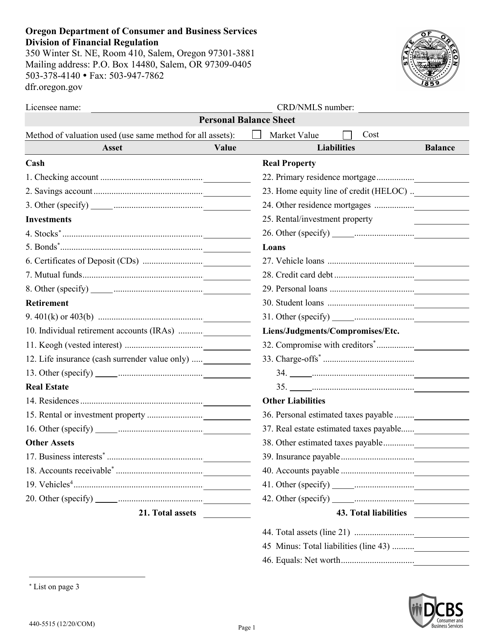

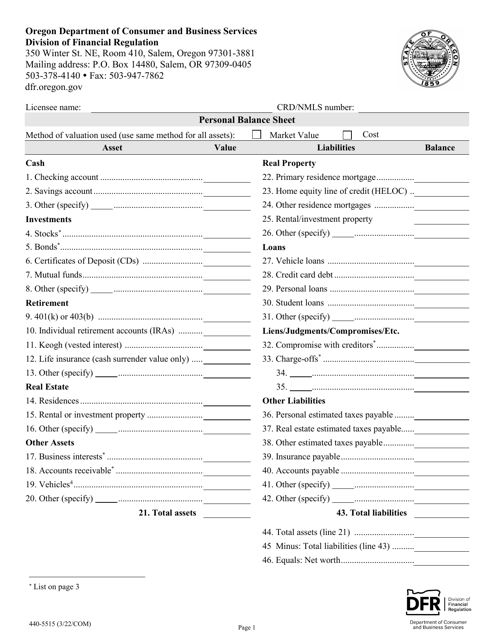

This Form is used for calculating your personal assets and liabilities in the state of Oregon.

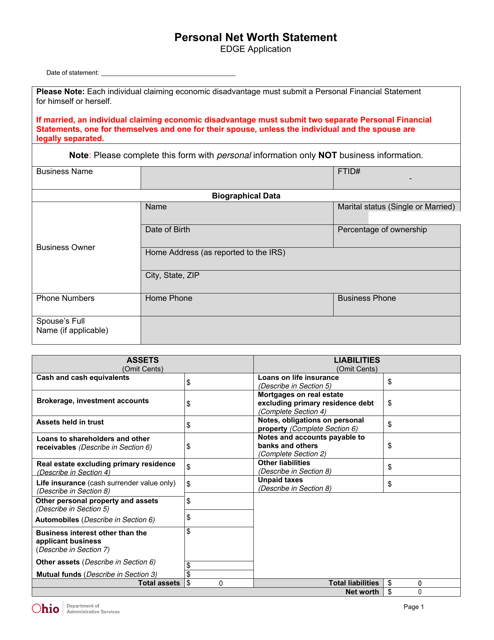

This document is used to assess and track an individual's financial worth in the state of Ohio. It includes details about their assets, liabilities, and overall net worth.

This document is used for providing a comprehensive overview of an individual's financial situation in Rhode Island. It includes information about assets, liabilities, income, and expenses.

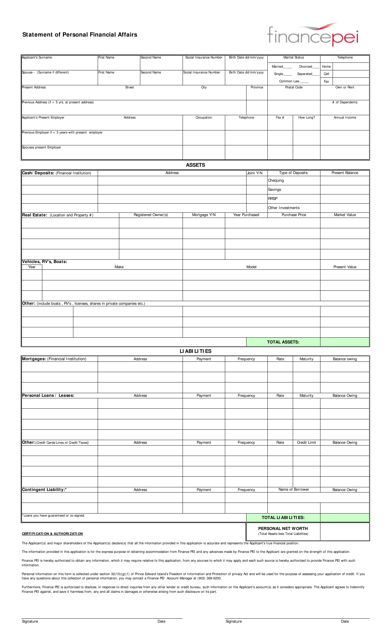

This form is used for disclosing personal financial information in Prince Edward Island, Canada. It helps individuals provide a detailed overview of their financial situation, including assets, liabilities, and income.

This form is used for disclosing personal assets and liabilities in the state of Oregon. It helps individuals provide a comprehensive overview of their financial situation.

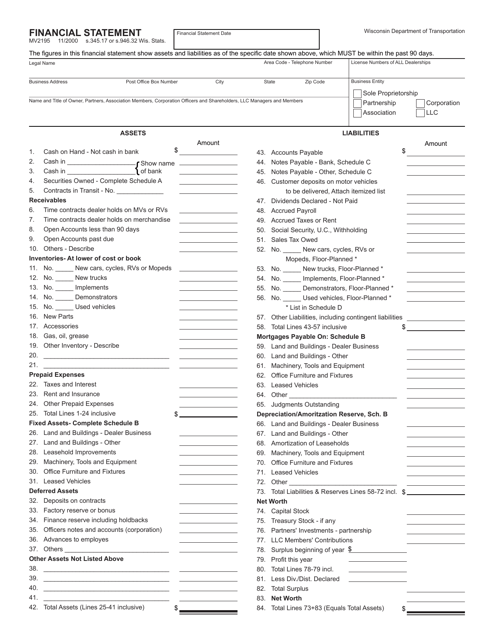

This form is used for submitting a financial statement in the state of Wisconsin. It is typically required in certain legal proceedings, such as divorce cases, to provide information about a person's income, assets, and liabilities.

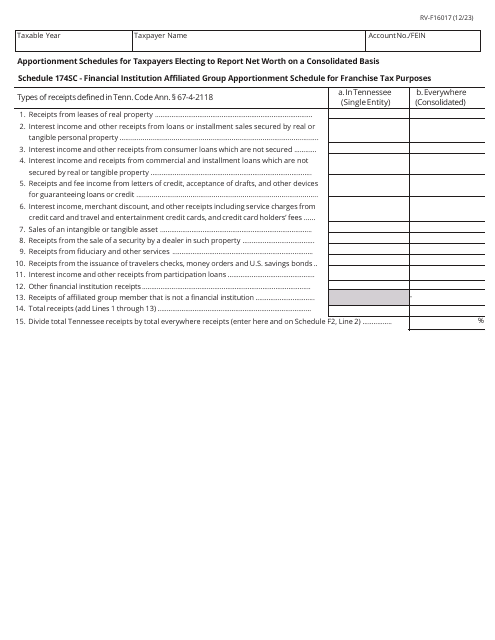

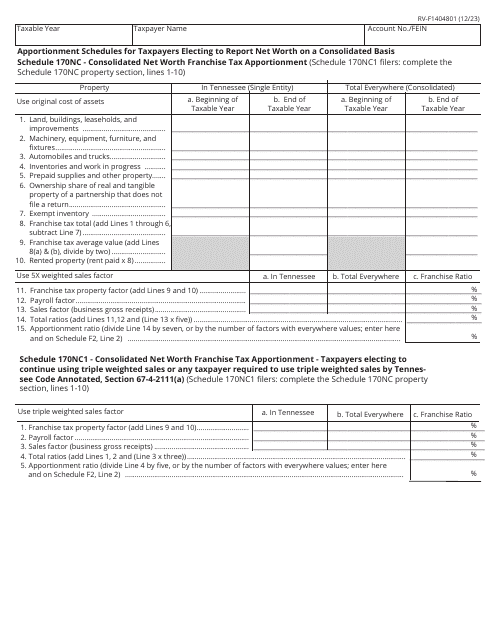

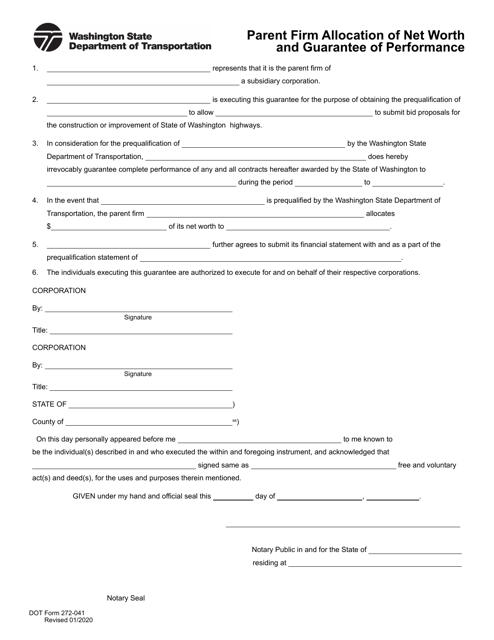

This Form is used for Parent firms in Washington to allocate net worth and guarantee performance.

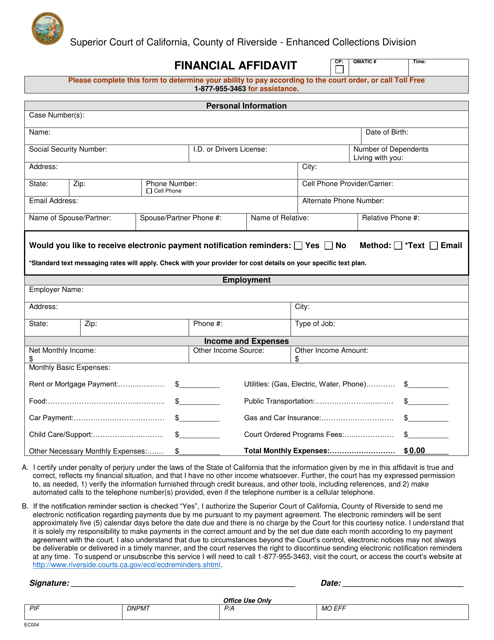

This form is used for submitting a financial affidavit in Riverside County, California. It is required for individuals involved in legal proceedings to disclose their financial information.

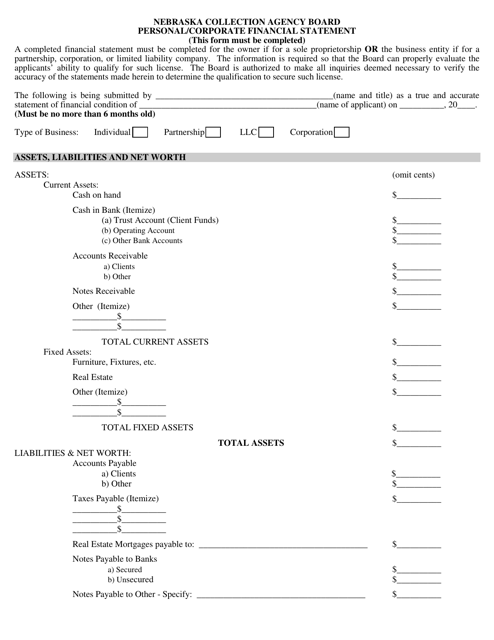

This document is used for assessing the financial standing of individuals or businesses in Nebraska. It includes details of assets, liabilities, income, and expenses.

This document is used for personal financial planning in the state of Oregon. It helps individuals assess their assets, liabilities, and income to create a comprehensive view of their financial situation.

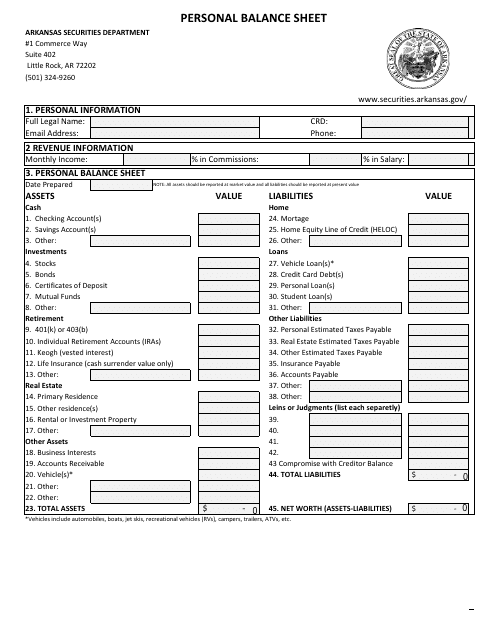

This document provides a snapshot of an individual's financial position in Arkansas, including assets, liabilities, and net worth. It helps individuals assess their financial health and plan for the future.

This type of document provides instructions for creating a personal balance sheet in the state of Arkansas. It helps individuals assess their financial standing by listing assets, liabilities, and net worth.

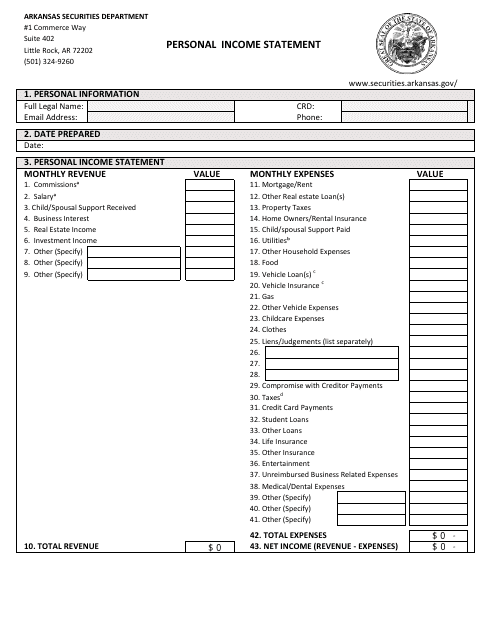

This document is used for preparing a personal income statement in the state of Arkansas. It provides instructions on how to accurately report your income and expenses.

This document is used for keeping track of your personal income in the state of Arkansas. It helps you calculate your earnings and expenses to better manage your finances.