Tax Instructions Templates

Documents:

488

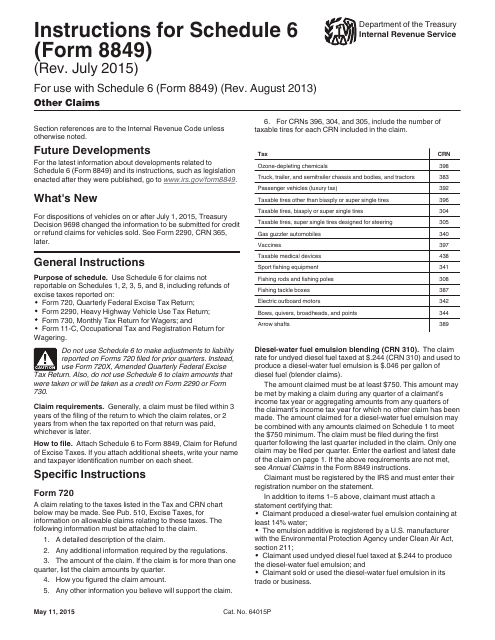

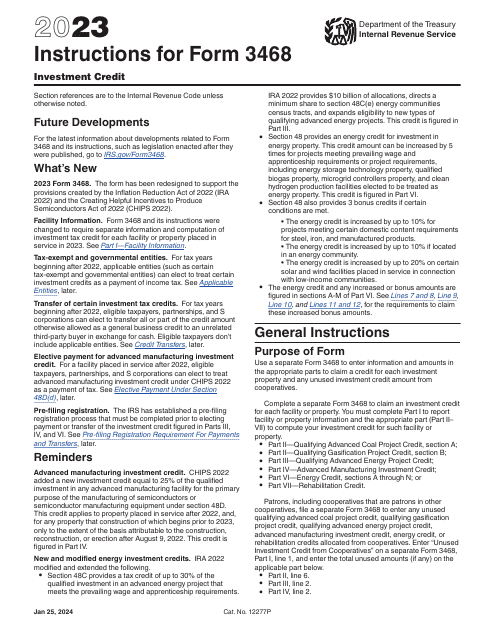

This Form is used for claiming other types of tax credits or refunds not covered in other schedules of Form 8849. It provides instructions on how to complete Schedule 6 to claim these other claims.

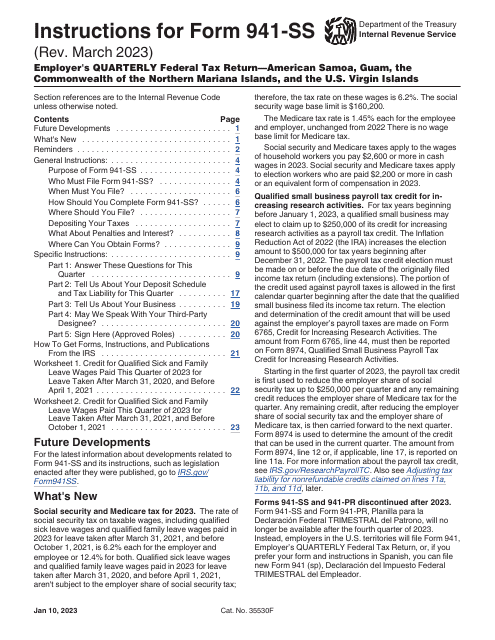

This Form is used for making adjustments to the annual return of withheld federal income tax or claiming a refund. It is specifically designed for the IRS Form 945-X.

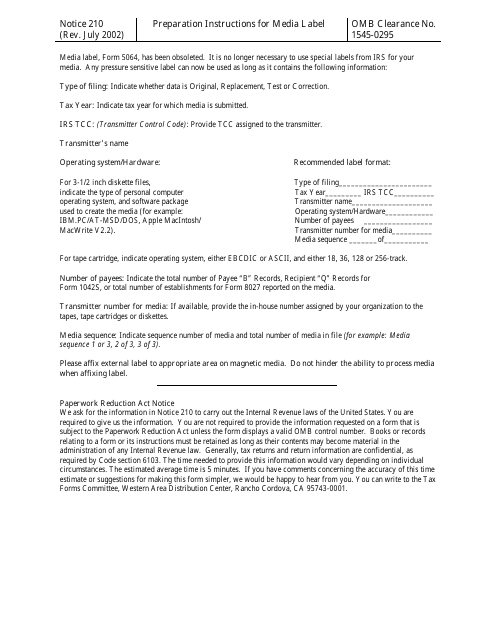

This document provides instructions for preparing media labels as required by the IRS for tax-related purposes.

This form is used for reporting and claiming the extraterritorial income exclusion. It provides instructions on how to accurately complete IRS Form 8873.

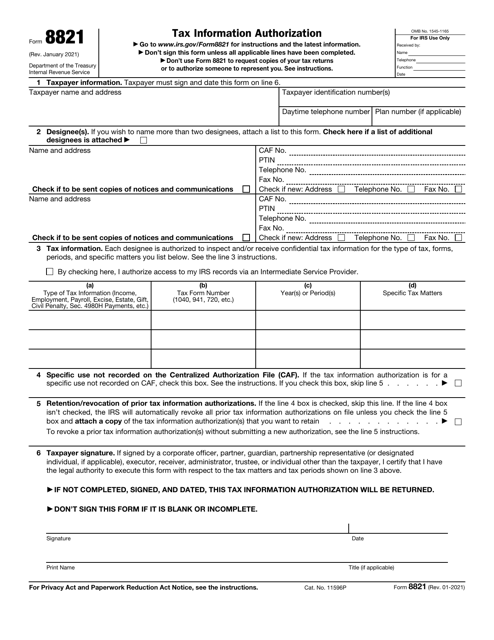

This is a formal document filled out by a taxpayer who wants another individual or company to obtain access to their tax information.

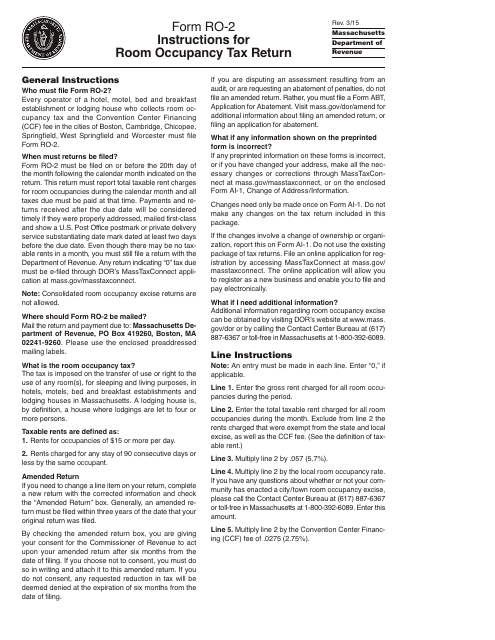

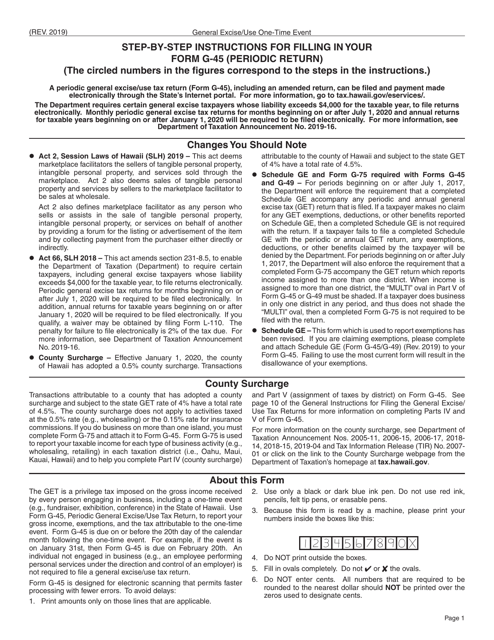

This Form is used for filing the Room Occupancy Tax Return in Massachusetts. It provides instructions on how to accurately complete and submit the form for reporting and paying the room occupancy tax.

This Form is used for reporting mortgages and notes receivable in Pennsylvania. It provides instructions on how to accurately fill out Schedule D.

This form is used for filing the quarterly tax return for interstate motor fuels users in Louisiana. The instructions provide information on how to properly fill out and submit the form.

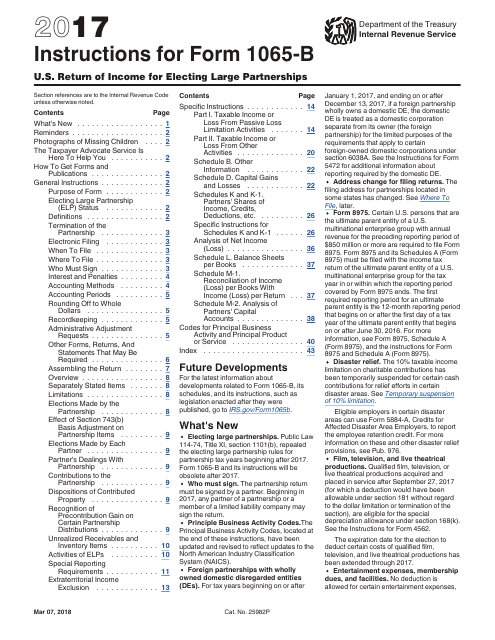

This Form is used for reporting income and expenses of electing large partnerships in the United States.

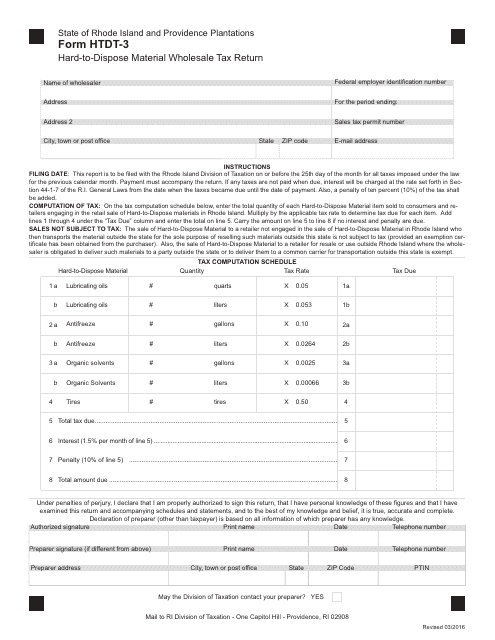

This Form is used for filing the Hard-To-Dispose Material Wholesale Tax Return in Rhode Island.

This Form is used for reporting underwriting profits tax for domestic and foreign marine insurance companies in Pennsylvania. It provides instructions on how to accurately complete and file Form RCT-124.

This Form is used for filing corporate net income tax for Cooperative Agriculture Associations in Pennsylvania. It provides instructions on how to accurately complete the form and submit it to the appropriate authorities.

This Form is used for reporting and paying the Gross Receipts Tax for private bankers in the state of Pennsylvania. It provides instructions on how to calculate and submit the tax owed.

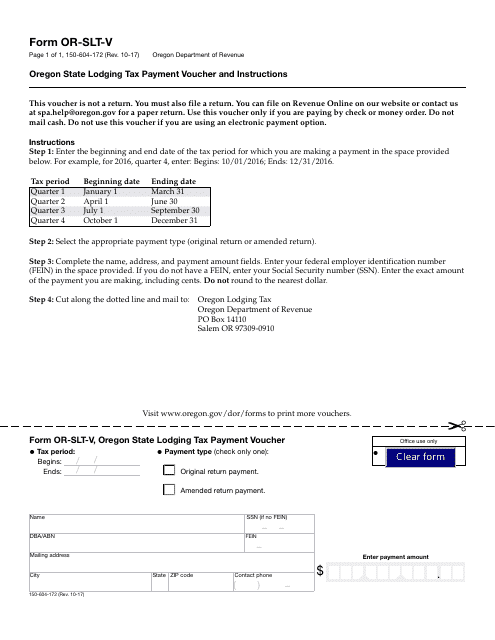

This Form is used for making lodging tax payments in the state of Oregon. It includes instructions on how to fill out the form and submit the payment.

This form is used for reporting and paying the Forest Products Harvest Tax in the state of Oregon.

This document provides the necessary forms and instructions for filing partnership income taxes in the state of Oklahoma.

This Form is used for reporting and paying the beer and malt beverage tax in Cuyahoga County, Ohio. Beer distributors and retailers are required to fill out this form and submit it along with the corresponding payment to the county tax department. The form provides instructions on how to complete it accurately and where to send it.

This Form is used for filing the Ohio Wine and Mixed Beverage Tax Return in Ohio. It provides instructions for completing and submitting the tax return.

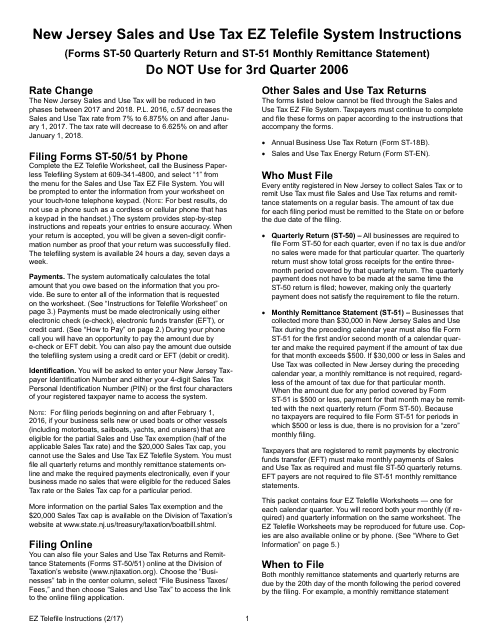

This Form is used for New Jersey sales and use tax reporting through the EZ Telefile System.

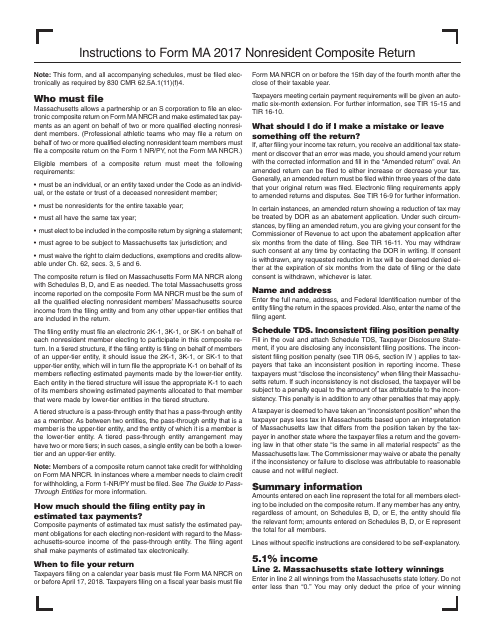

This form is used for filing a nonresident composite return in Massachusetts. It provides instructions for completing and submitting the Form MA Nonresident Composite Return.

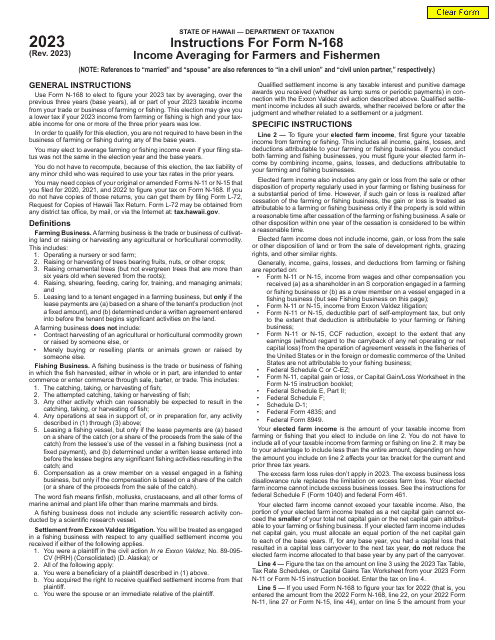

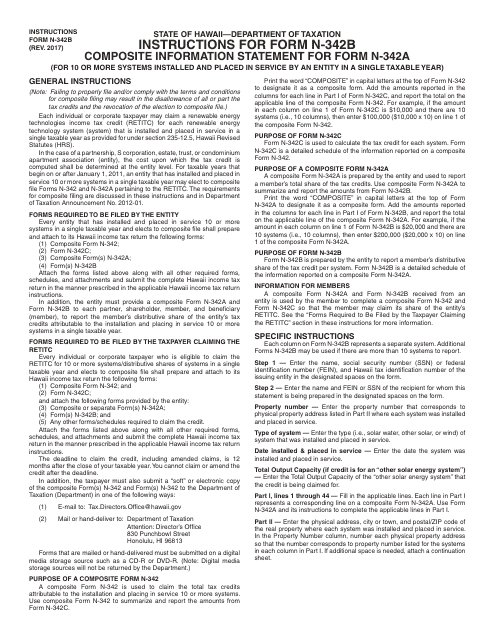

This Form is used for providing composite information for Form N-342a in Hawaii.

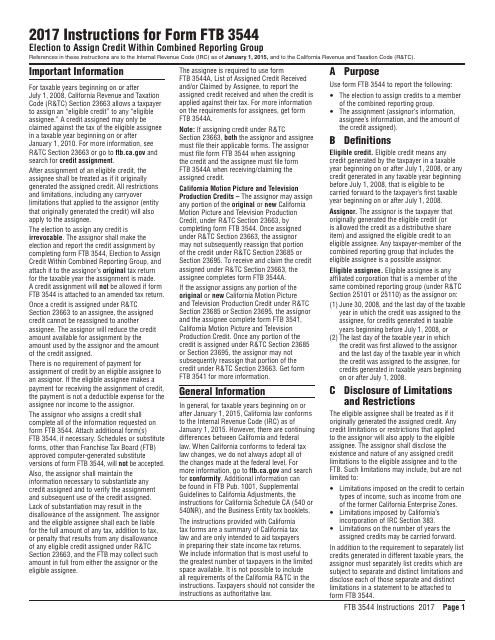

This Form is used for making an election to assign credit within a combined reporting group in California. The form provides instructions on how to complete the election process.