Tax Calculator Templates

Documents:

365

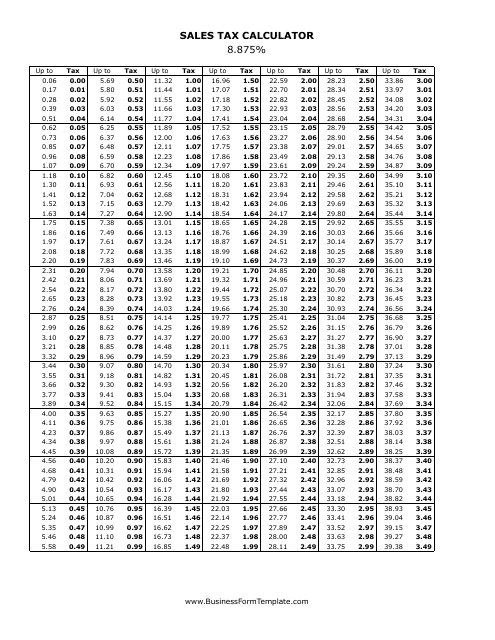

This document provides a tool to calculate sales tax at a rate of 8.875%.

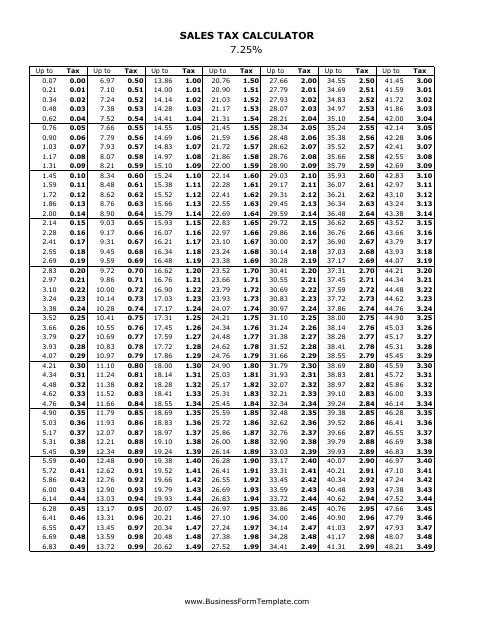

This document provides a calculator to determine the sales tax amount at a rate of 7.25%.

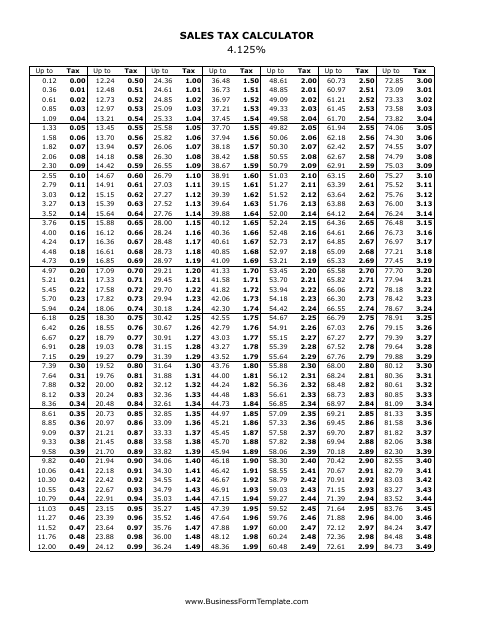

This document is a sales tax calculator that helps you determine the amount of sales tax you need to pay on a purchase.

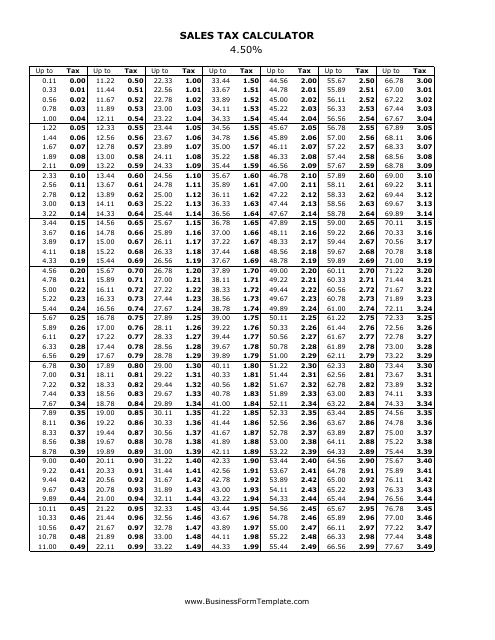

This document is a sales tax calculator that helps you determine the amount of sales tax you need to pay based on a 4.5% tax rate.

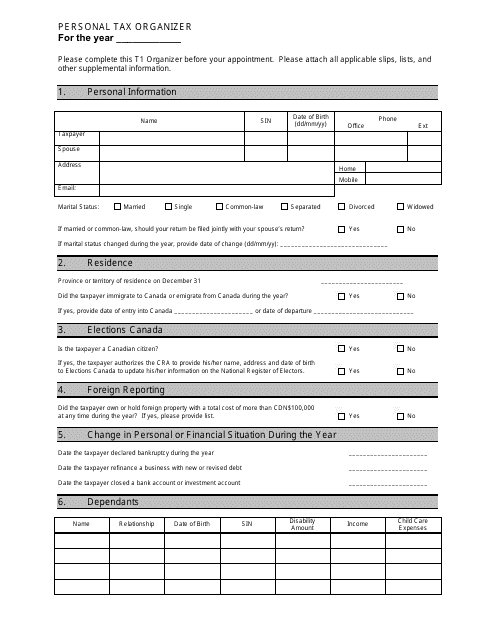

This document is a template that helps individuals organize their personal tax information for filing taxes. It provides sections to record income, expenses, deductions, and other relevant details. Using this template can help simplify the tax filing process.

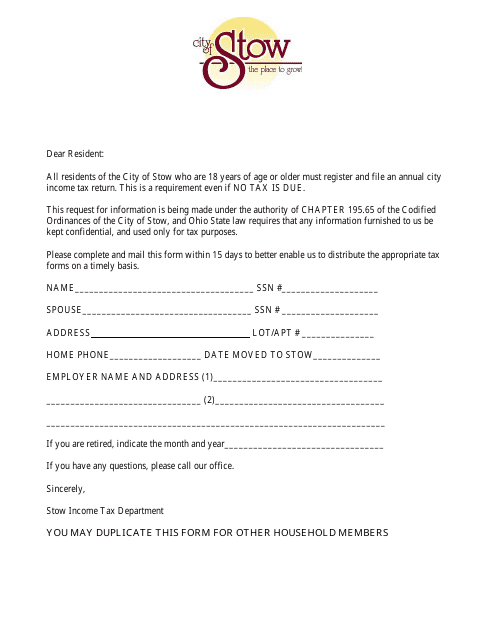

This Form is used for filing your income tax return in the City of Stow, Ohio.

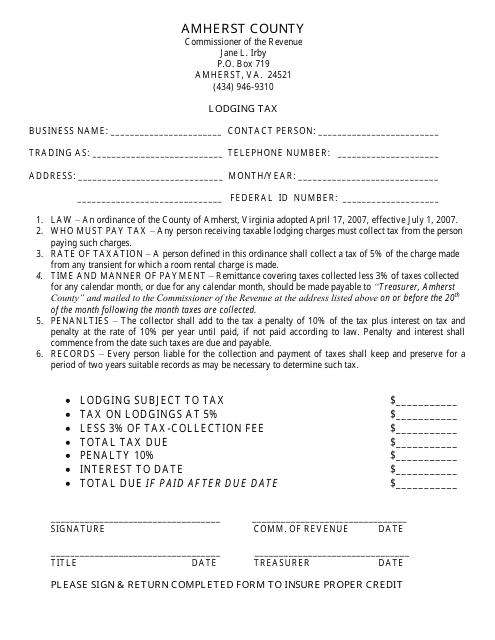

This form is used for paying lodging tax in Amherst County, Virginia.

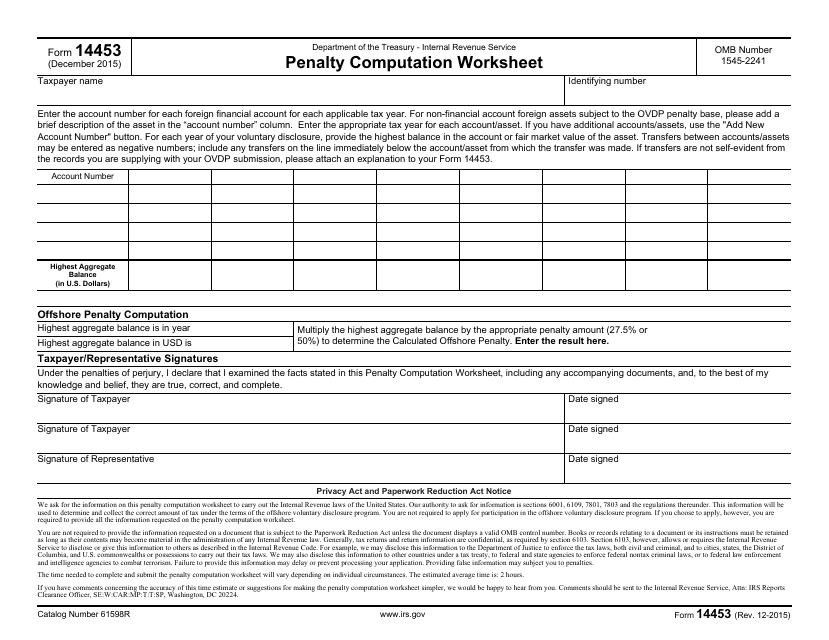

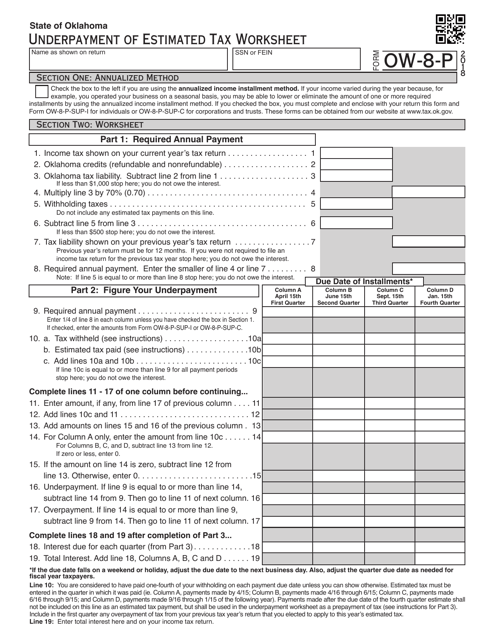

This document is used to calculate penalties owed to the IRS. It provides a worksheet for determining the amount of the penalty.

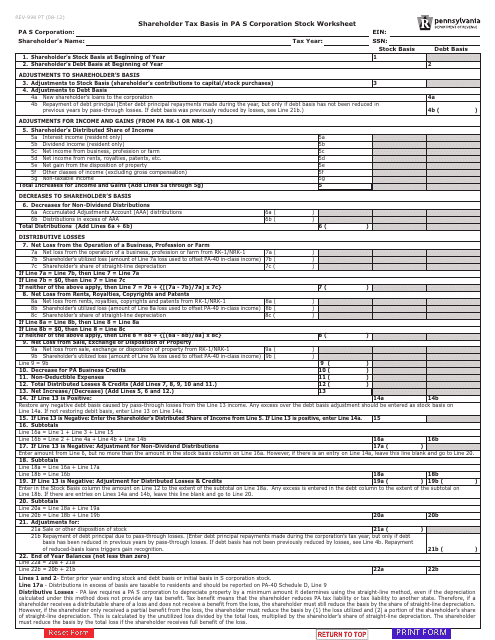

This form is used for calculating the tax basis in Pennsylvania S Corporation stock for shareholders.

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

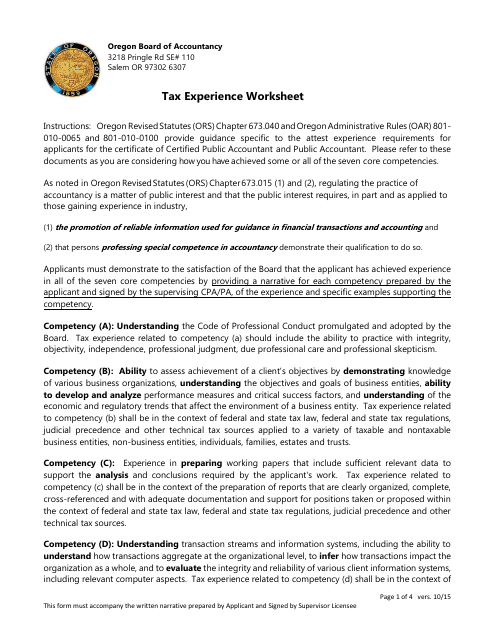

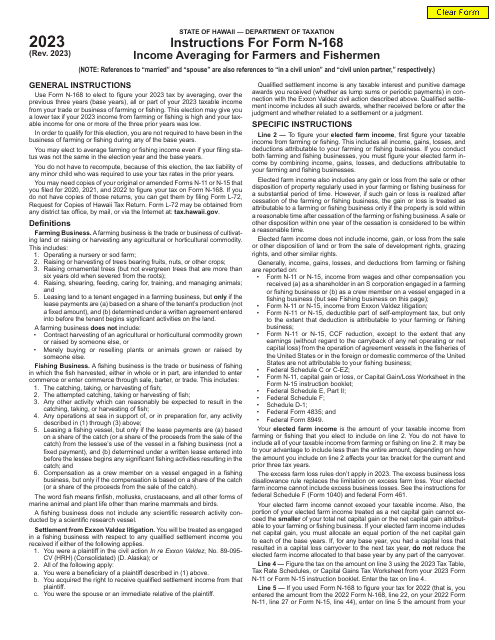

This document is a worksheet specifically for individuals with tax experience in Oregon. It can be used to organize and track relevant information when preparing state taxes in Oregon.

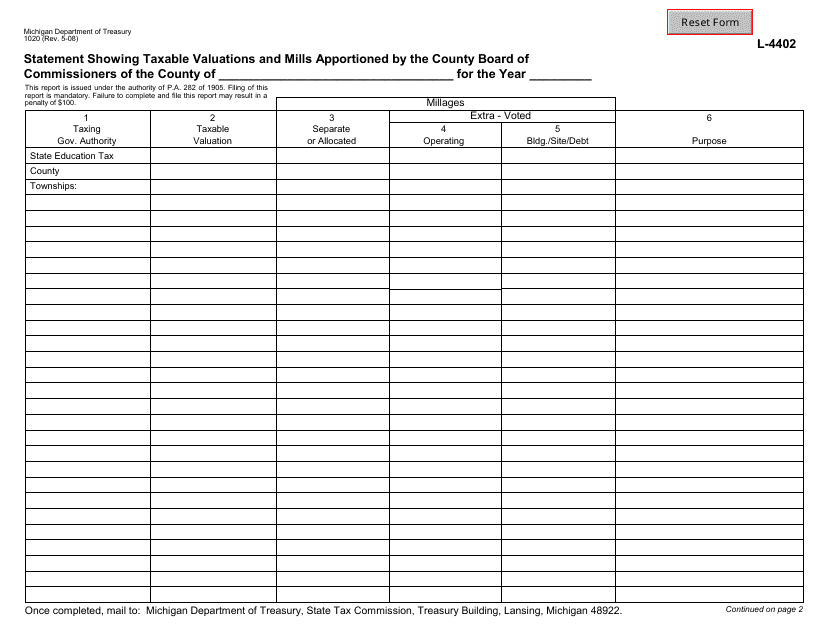

This form is used for showing the taxable valuations and mills apportioned by the County Board of Commissioners in Michigan.

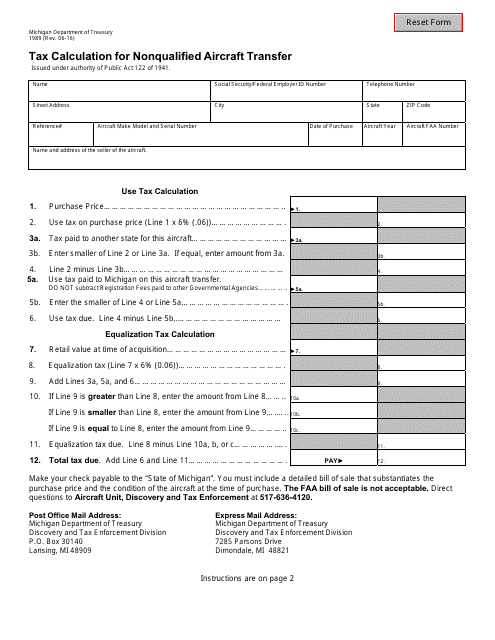

This form is used for calculating the tax for transferring nonqualified aircraft in the state of Michigan for the year 1989.

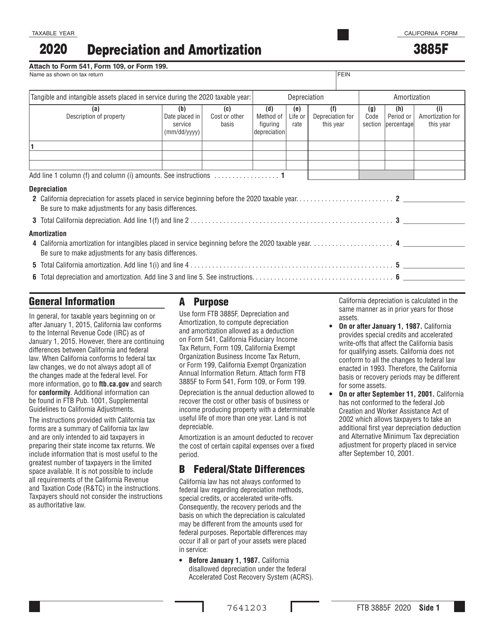

This is a supplementary form corporations were expected to fill out to compute the amount of estimated tax they owe to fiscal authorities.

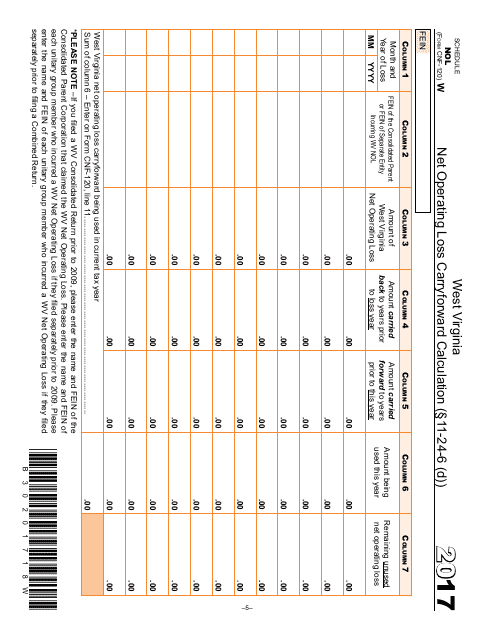

This form is used for calculating the Net Operating Loss (NOL) carryforward for individuals and businesses in West Virginia.

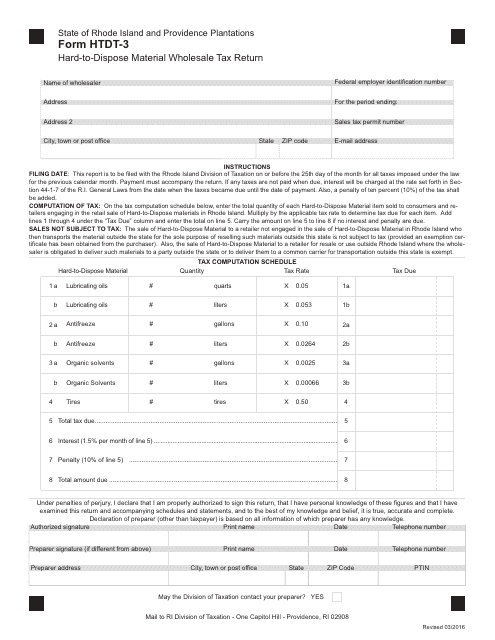

This Form is used for filing the Hard-To-Dispose Material Wholesale Tax Return in Rhode Island.

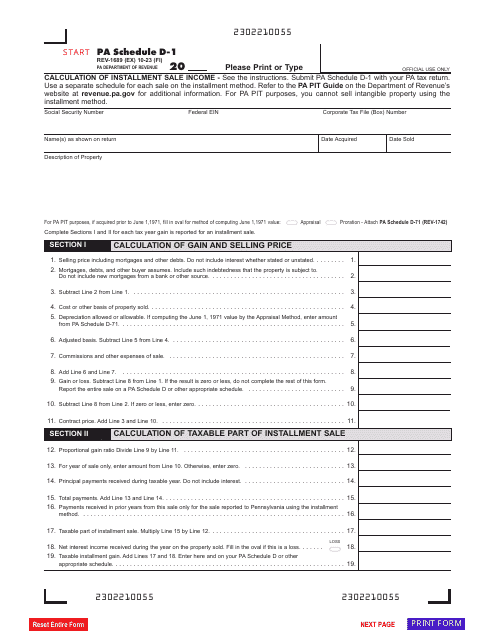

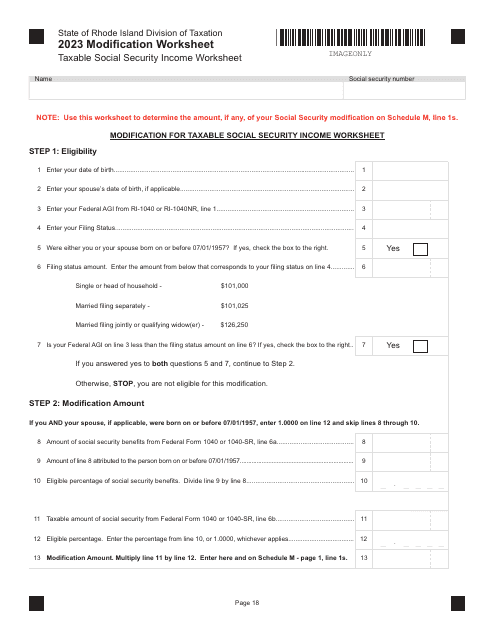

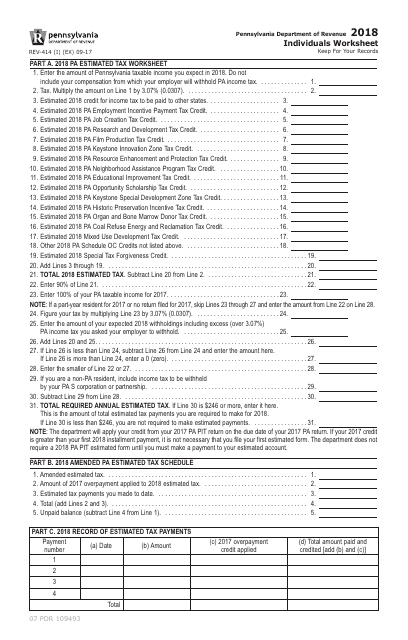

This form is used for individuals in Pennsylvania to complete a worksheet related to their taxes.

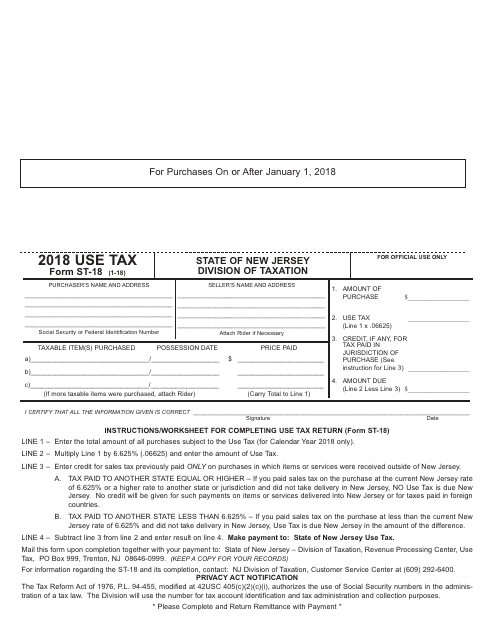

This form is used for reporting and paying use tax in the state of New Jersey. Use tax is a tax on goods purchased out-of-state and used within New Jersey. Use this form to calculate and remit the appropriate tax amount.

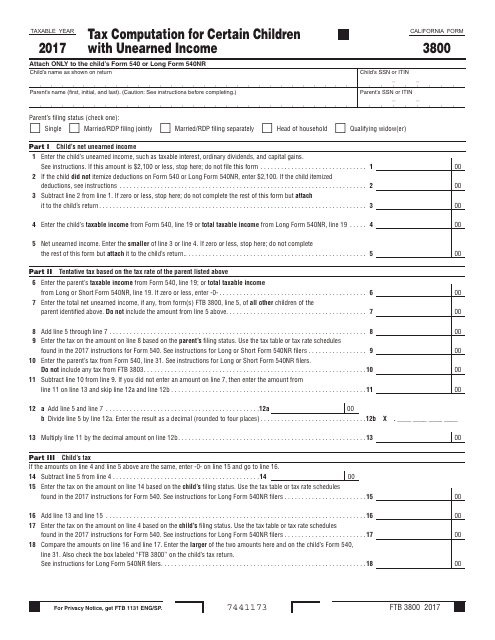

This form is used for calculating the tax for certain children in California who have unearned income. It helps determine the correct amount of tax owed based on the child's income.

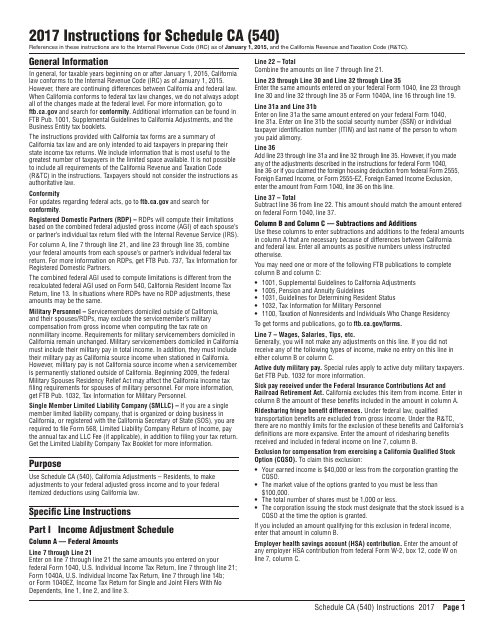

This Form is used for reporting California-specific tax adjustments for residents of California on their Form 540 tax return. It ensures accurate calculation of state tax liability for California residents.

This form is used for monthly tax calculation by occasional importers of motor fuel in Oklahoma.

This document is used for monthly tax calculation for motor fuel tankwagon importers in Oklahoma

This document is used for monthly tax calculation for motor fuel bonded importers in Oklahoma.

This Form is used for monthly tax calculation for motor fuel suppliers and permissive suppliers in Oklahoma.

This document is used for calculating the fuel blender tax in Oklahoma.