Real Estate Tax Form Templates

Documents:

35

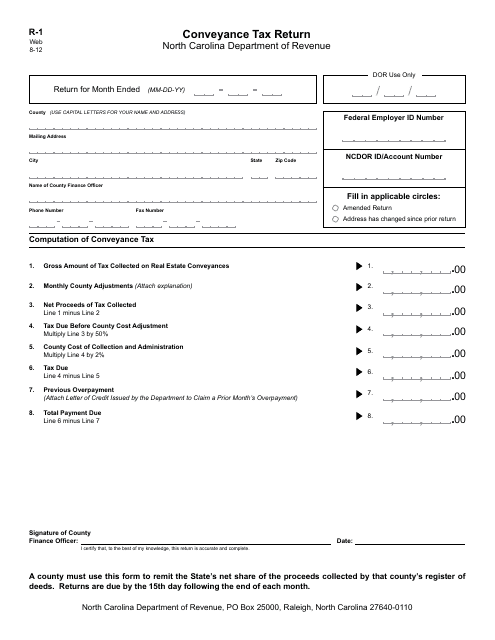

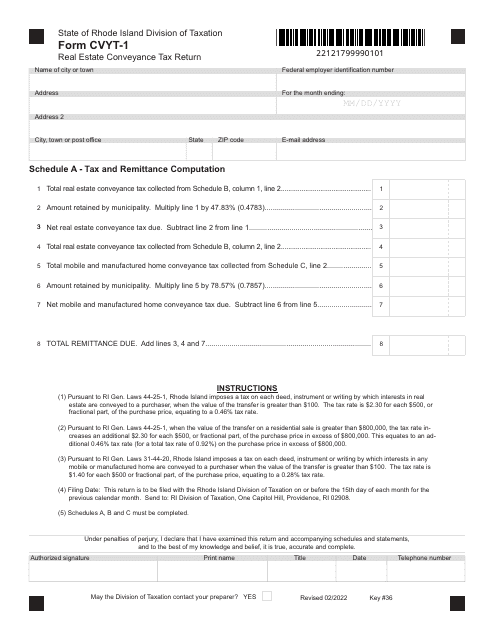

This Form is used for filing a Conveyance Tax Return in North Carolina.

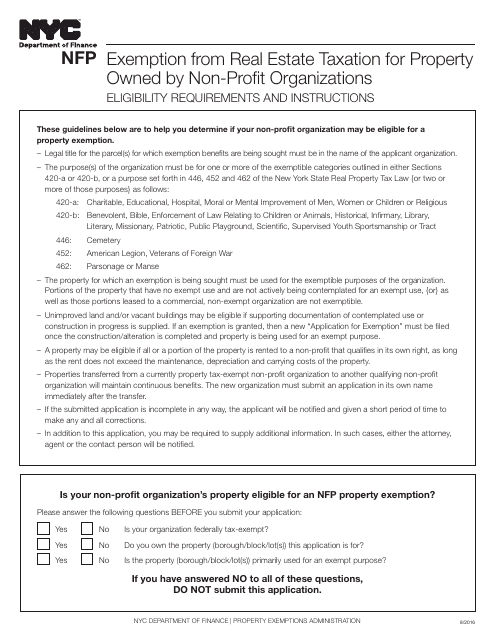

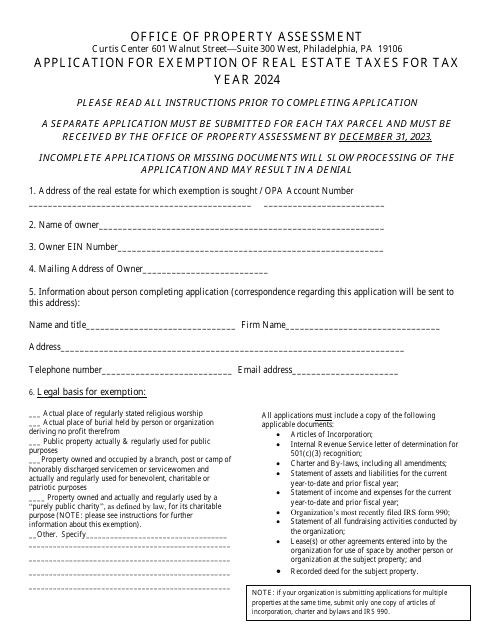

This Form is used for non-profit organizations in New York City to apply for exemption from real estate taxation for their properties.

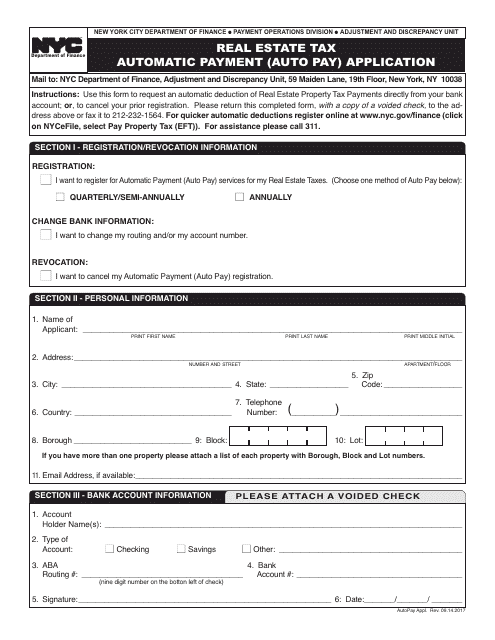

This document is an application form for enrolling in the automated real estate tax payment program in New York City. With this form, residents can apply to have their property taxes automatically deducted from their bank account each month.

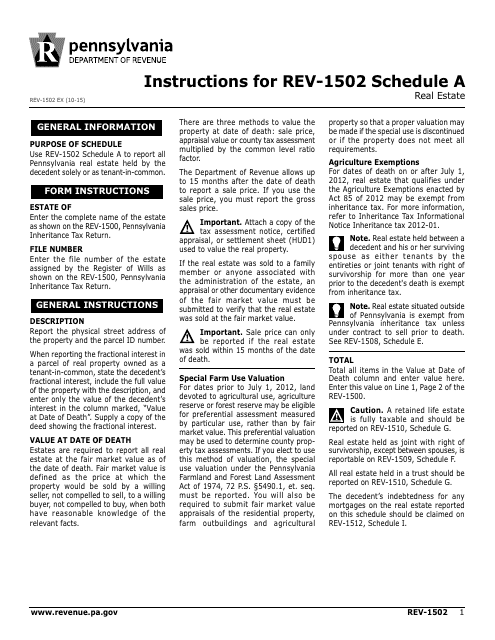

This document provides instructions for completing Form REV-1502 Schedule A, which is a real estate schedule in Pennsylvania. It guides taxpayers on how to report their real estate income and expenses accurately.

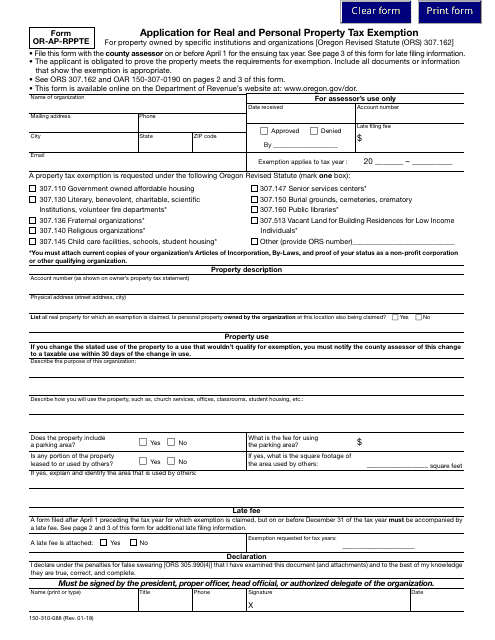

This Form is used for applying for a real and personal property tax exemption in Oregon.

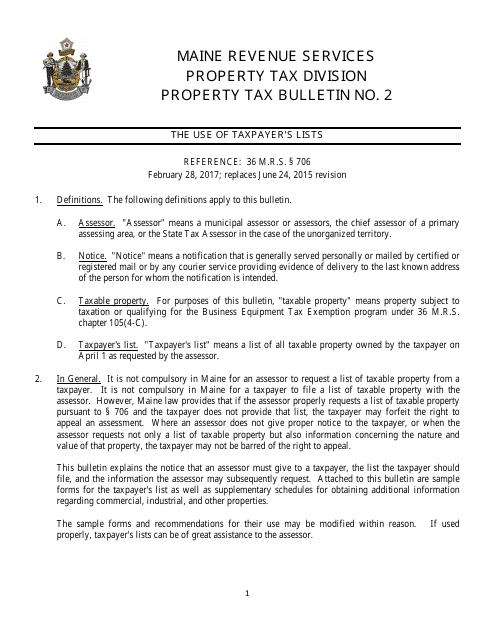

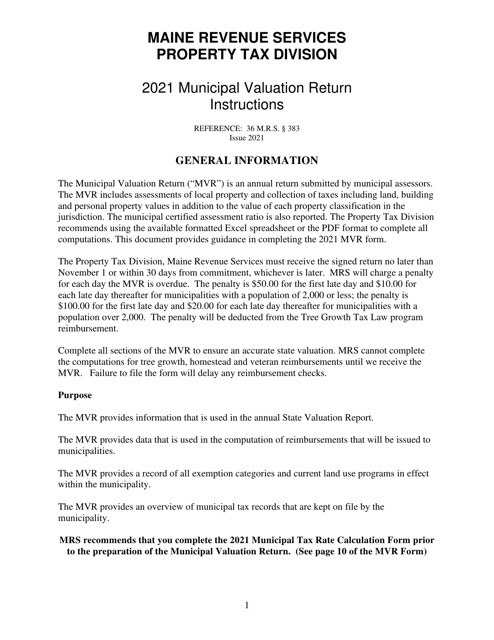

This document is a request for a list of taxable property in the state of Maine. It is used to gather information on properties that are subject to taxation.

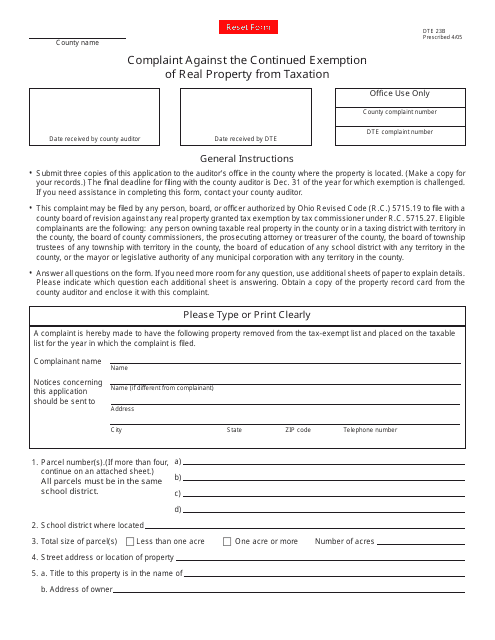

This form is used for filing a complaint against the continued exemption of real property from taxation in Ohio.

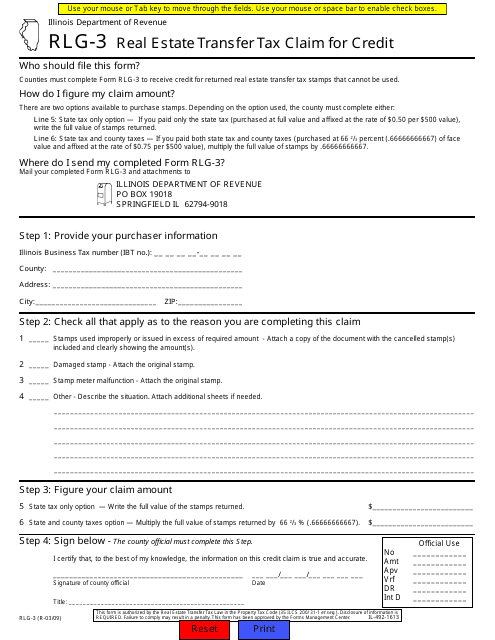

This form is used for claiming credit for real estate transfer tax in Illinois.

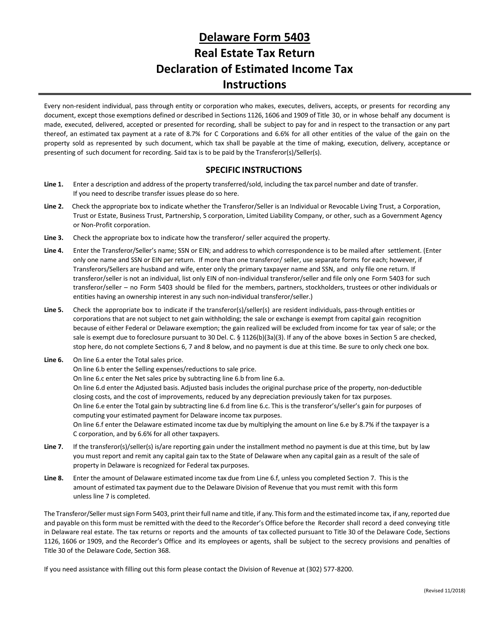

This form is used for declaring your estimated income tax and real estate tax return in the state of Delaware. It provides instructions on how to accurately complete the form and submit it to the appropriate authorities.

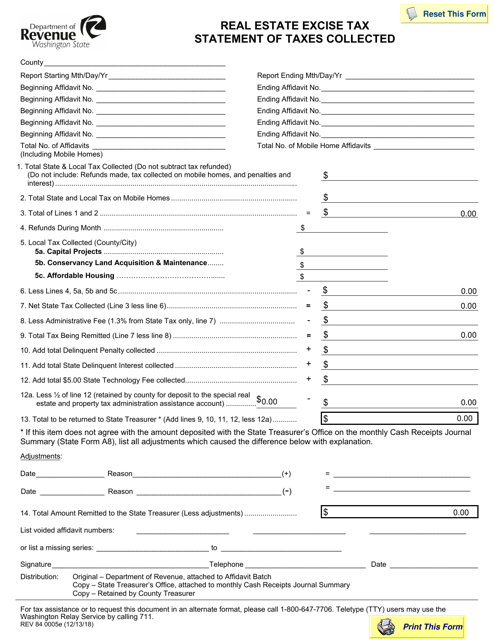

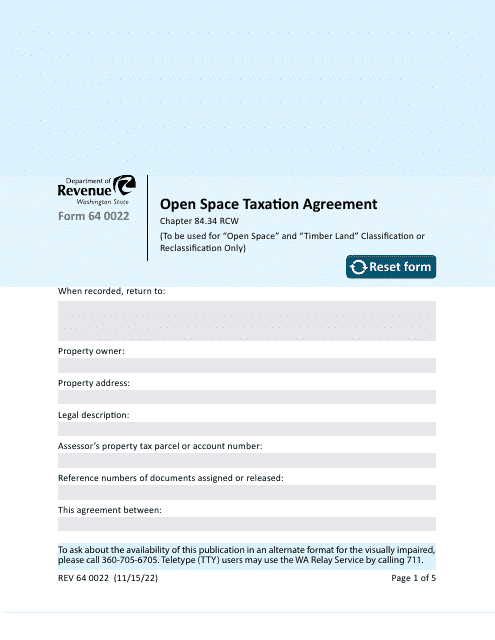

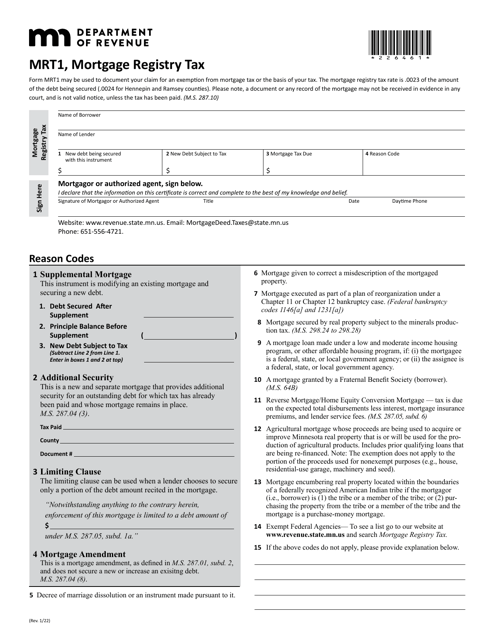

This form is used for reporting and documenting the real estate excise taxes collected in the state of Washington.

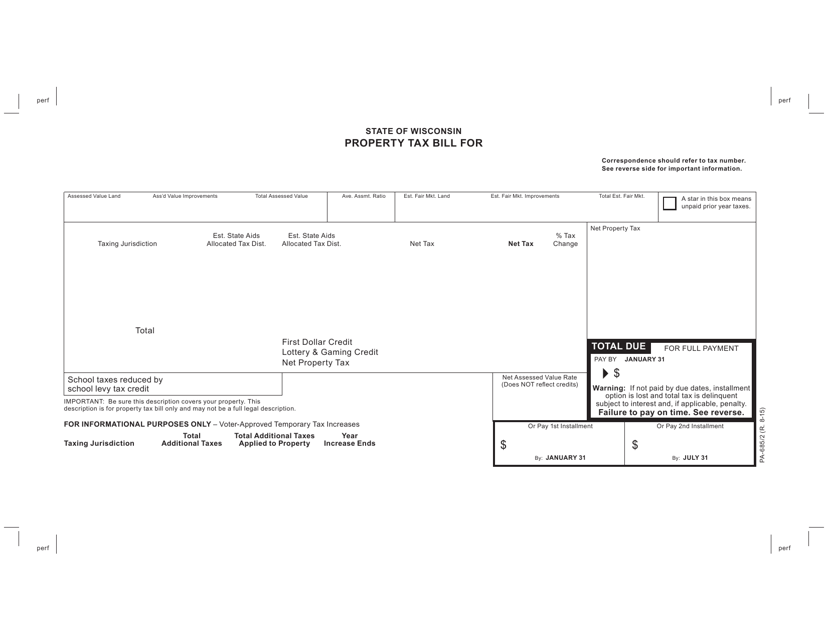

This document is used for paying property taxes in the state of Wisconsin. It provides a detailed bill of the amount owed for the property tax and instructions for payment.

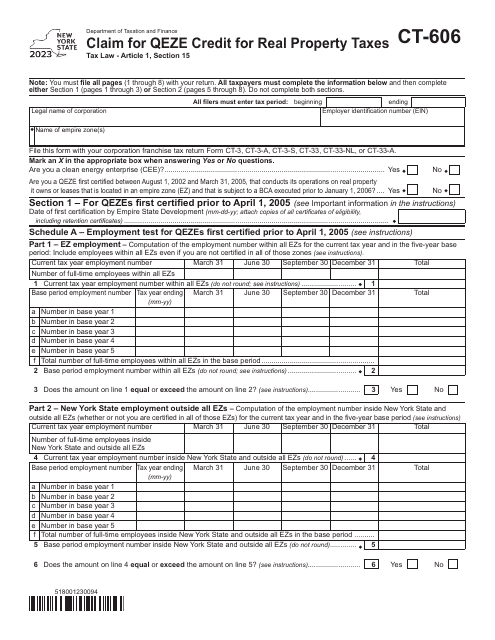

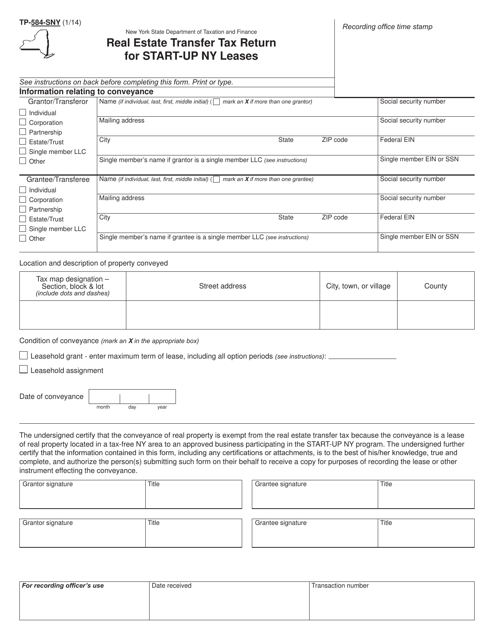

This form is used for reporting and paying the real estate transfer tax on Start-Up NY leases in New York.

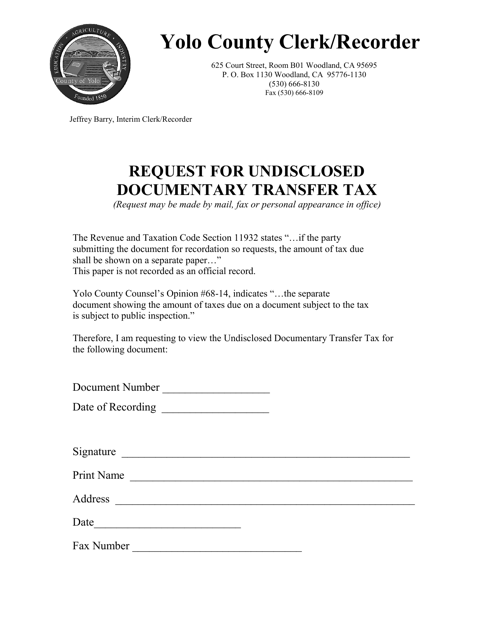

This document is a request for an undisclosed documentary transfer tax in the state of California. It is used for requesting the exemption or reduction of the tax for a specific transaction.

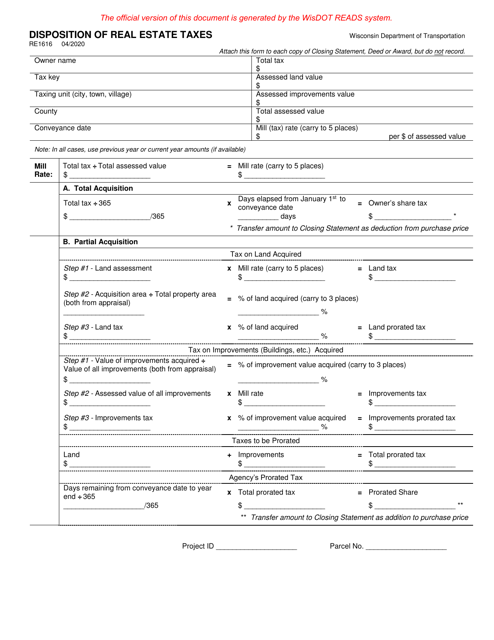

This form is used for reporting the disposition of real estate taxes in the state of Wisconsin.

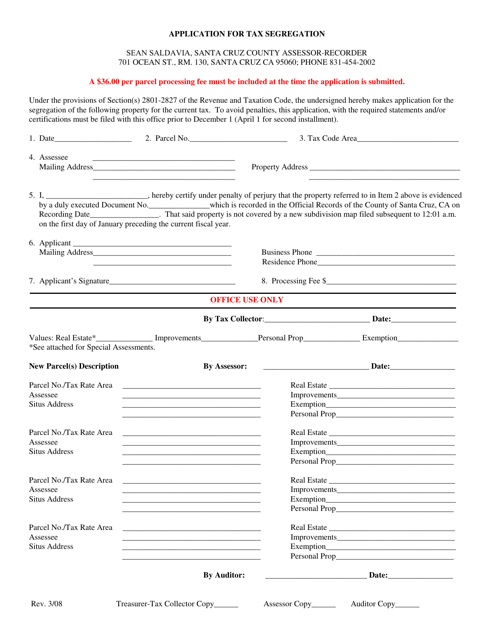

This document is an application form used in Santa Cruz County, California for requesting tax segregation. Tax segregation is a method of allocating costs of real property between different asset classes to optimize tax deductions.

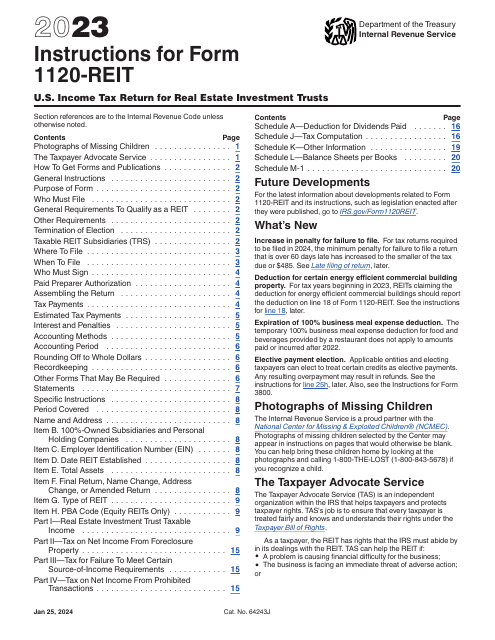

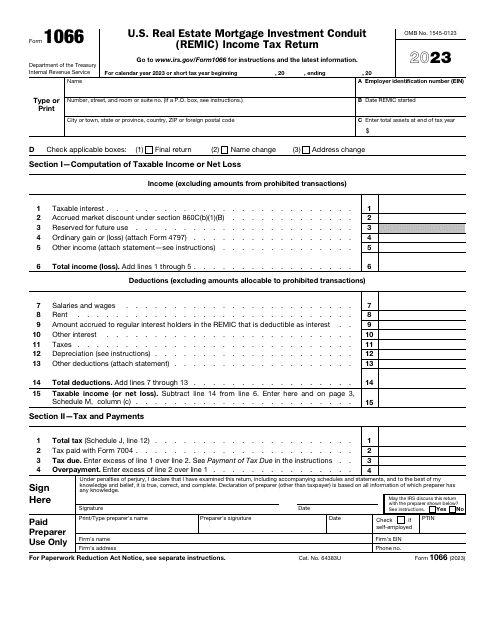

This is an IRS tax form used by a REMIC to inform the fiscal authorities about the details of its operation.

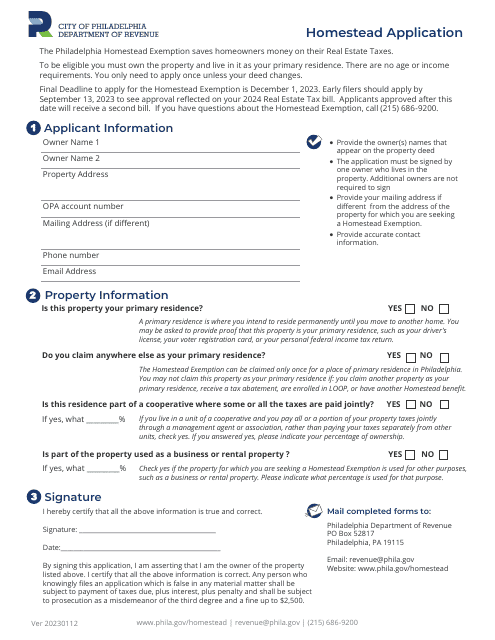

This document is used for applying for a homestead exemption in the city of Philadelphia, Pennsylvania. It is available in English and Spanish.

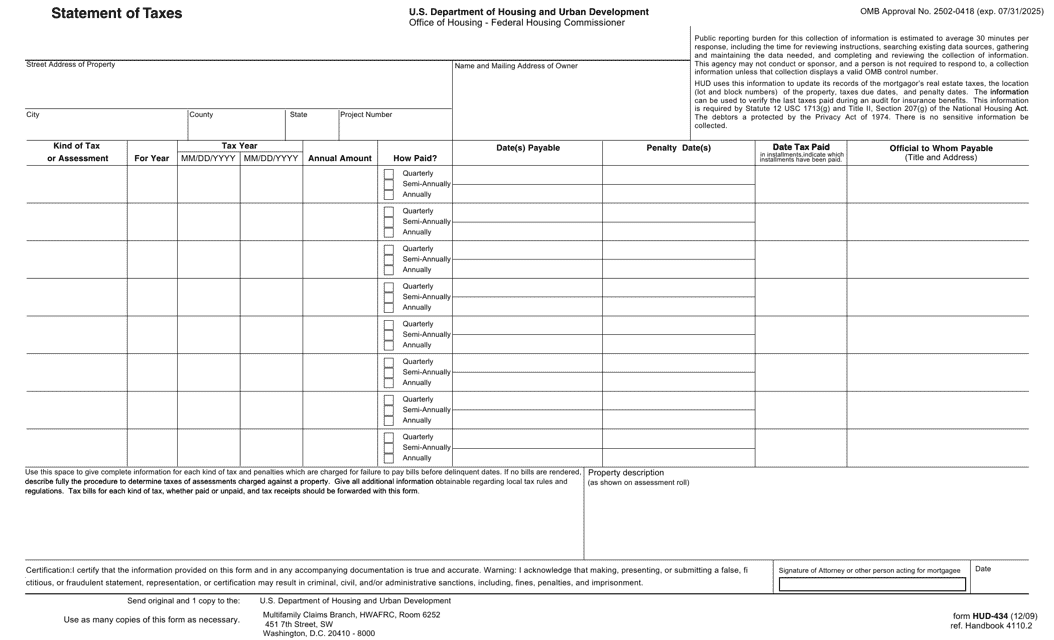

This Form is used for reporting taxes to the U.S. Department of Housing and Urban Development (HUD). It is typically used in the context of government-subsidized housing programs.