Business Income Form Templates

Documents:

102

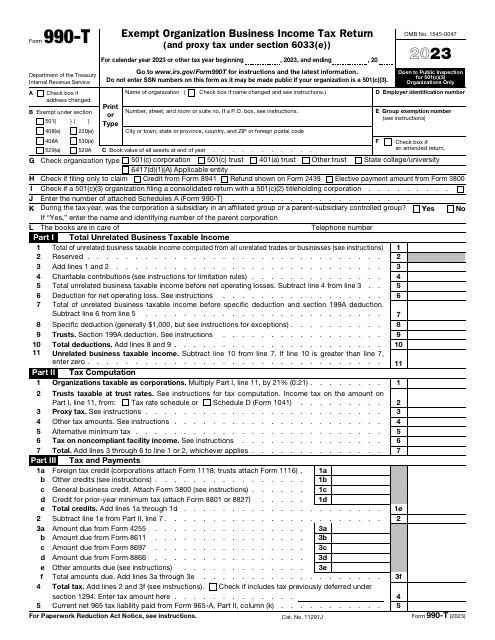

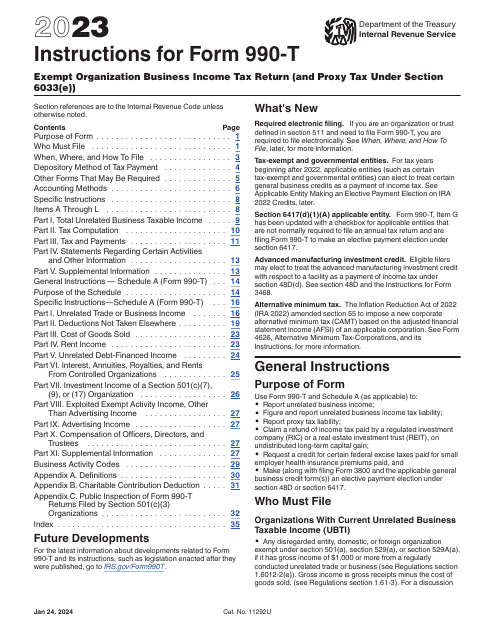

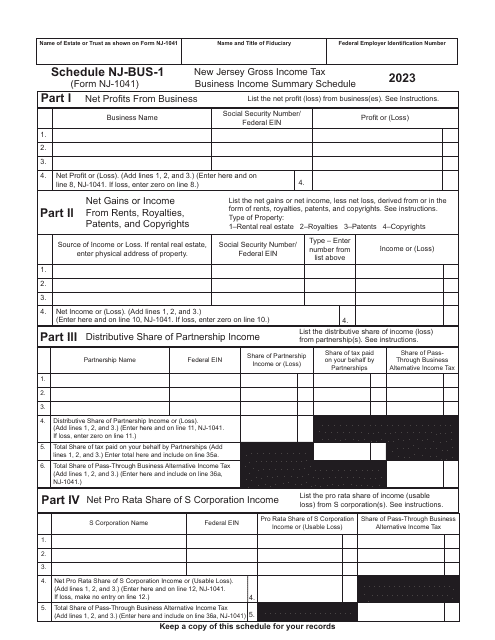

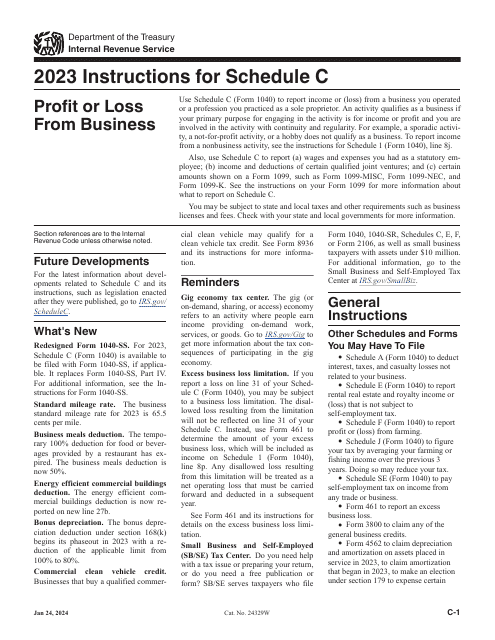

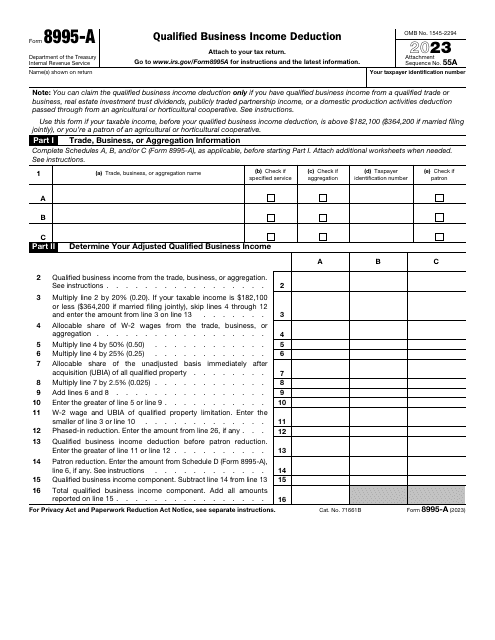

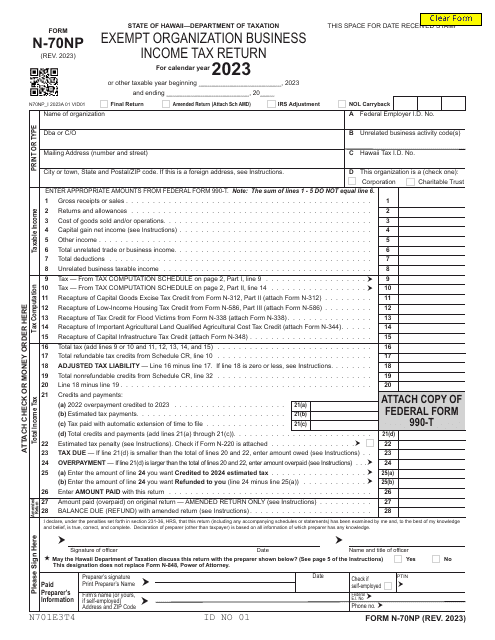

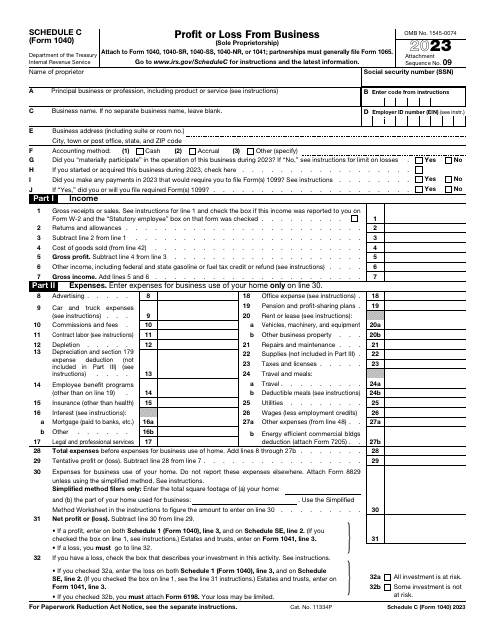

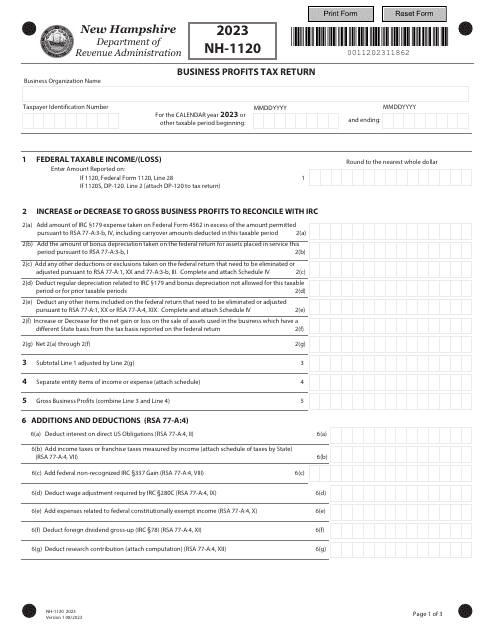

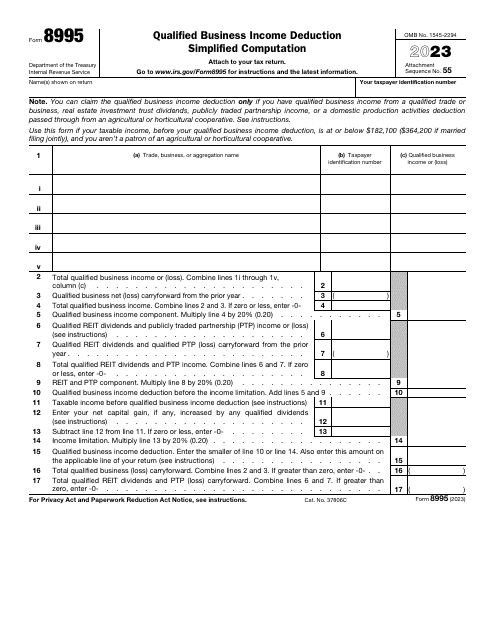

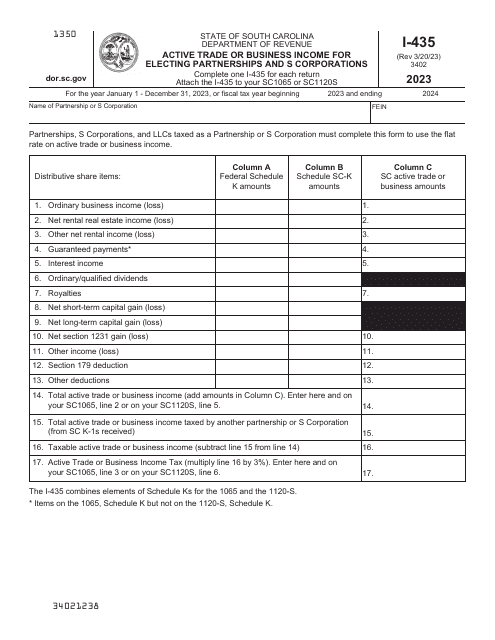

This is a formal IRS document that outlines the financial health of a business entity that owes a tax debt to the government.

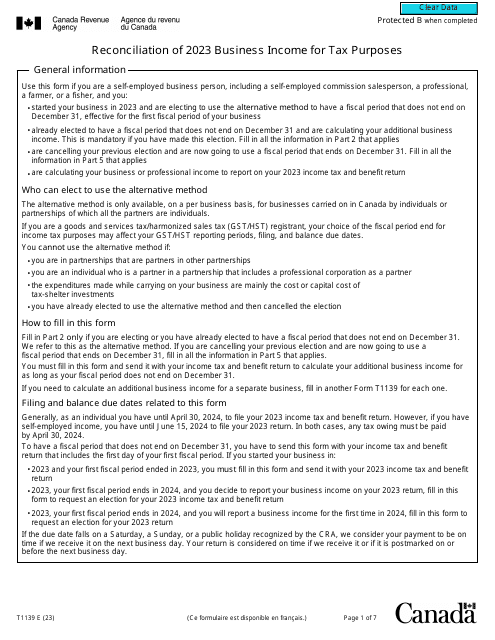

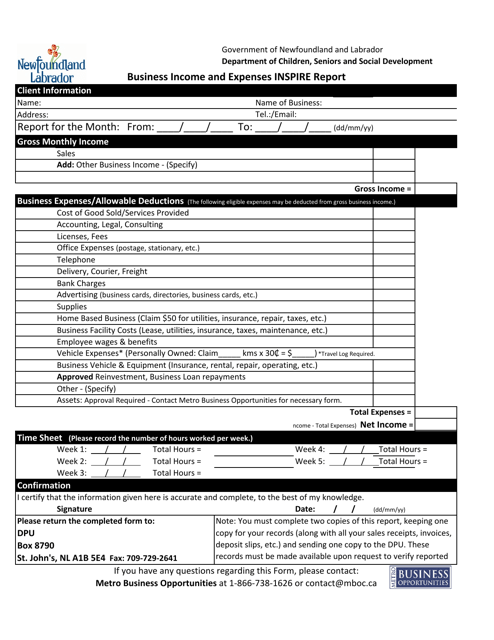

This form is used for reporting business income and expenses in Newfoundland and Labrador, Canada.

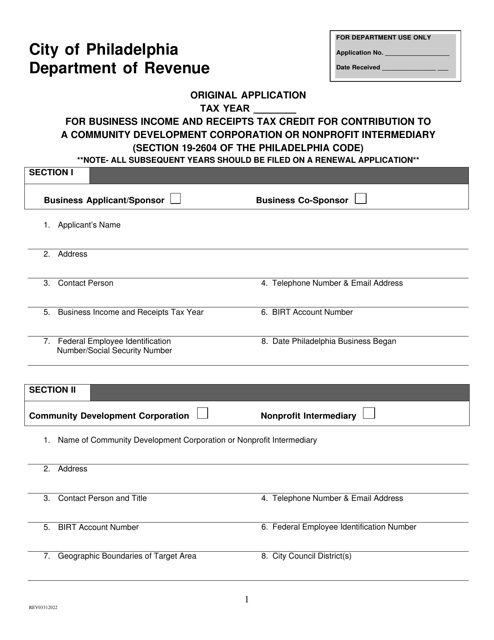

This document is used for applying for a tax credit in Philadelphia, Pennsylvania, for making a contribution to a Community Development Corporation or Nonprofit Intermediary.

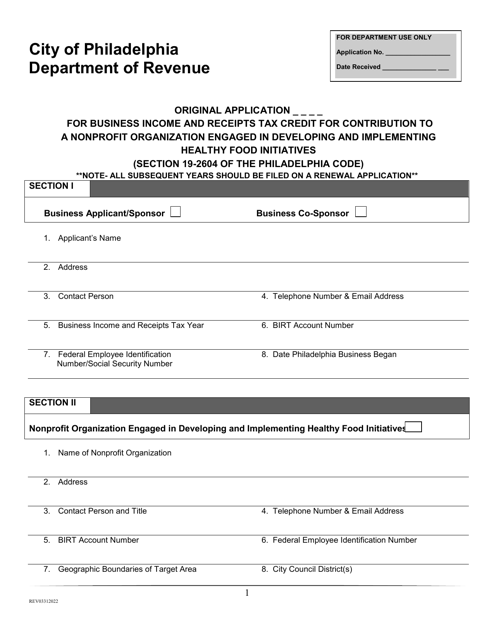

This document is used for applying for a tax credit in Philadelphia, Pennsylvania for contributing to a nonprofit organization that works on developing and implementing healthy food initiatives.

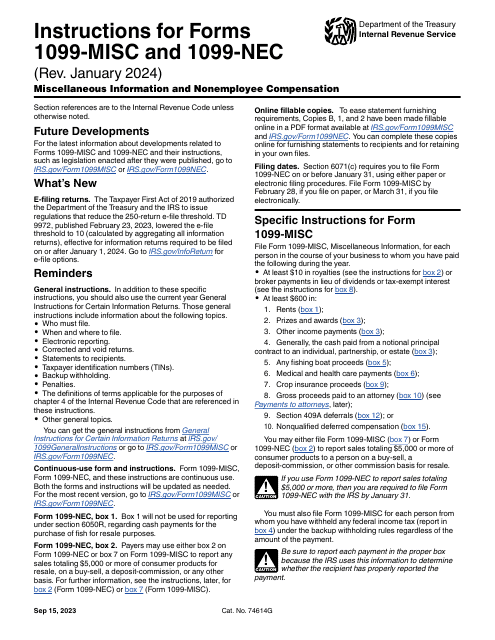

This is a fiscal IRS document business entities have to use to report compensation they have paid to individuals and companies they do not consider their employees.

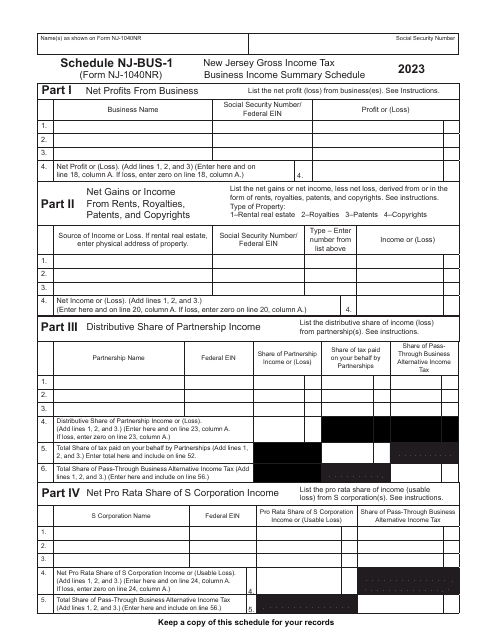

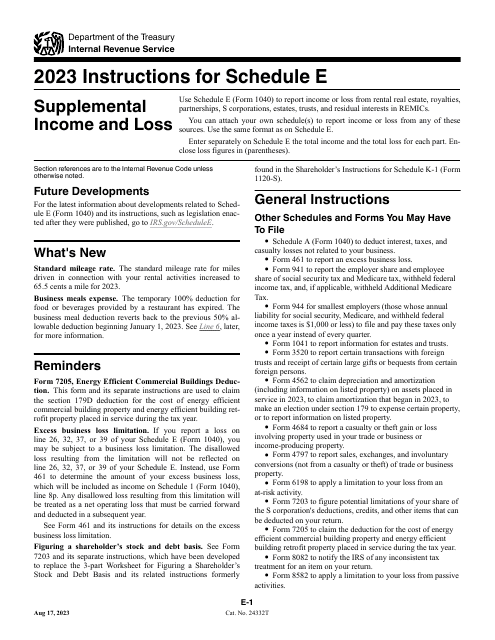

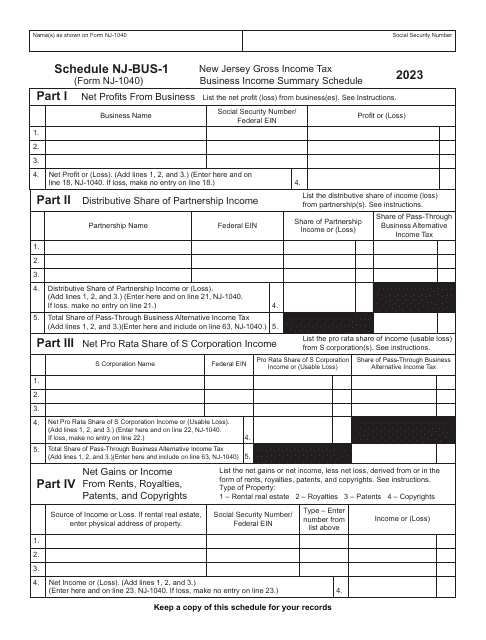

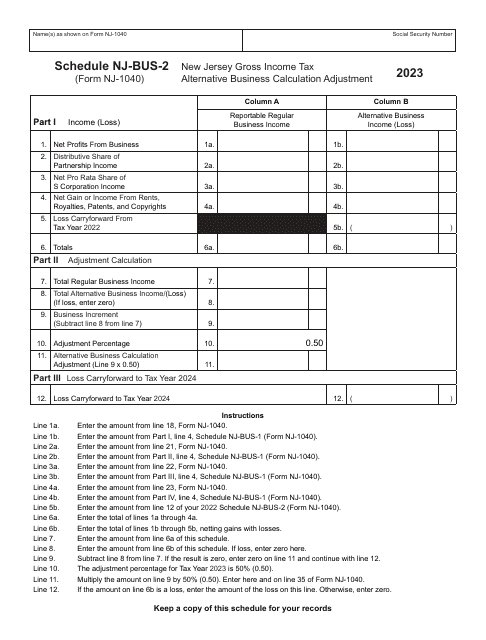

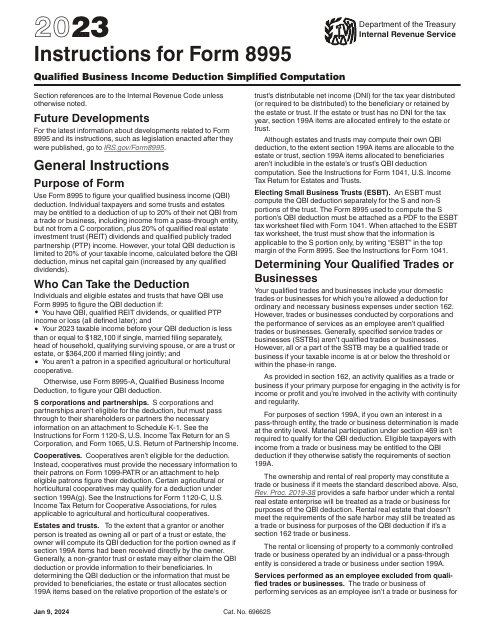

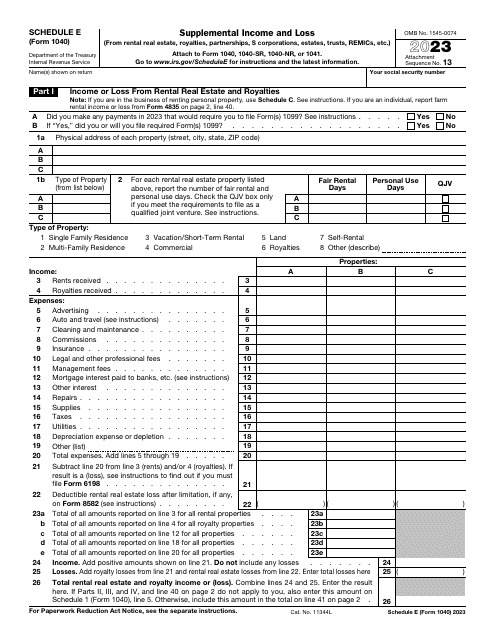

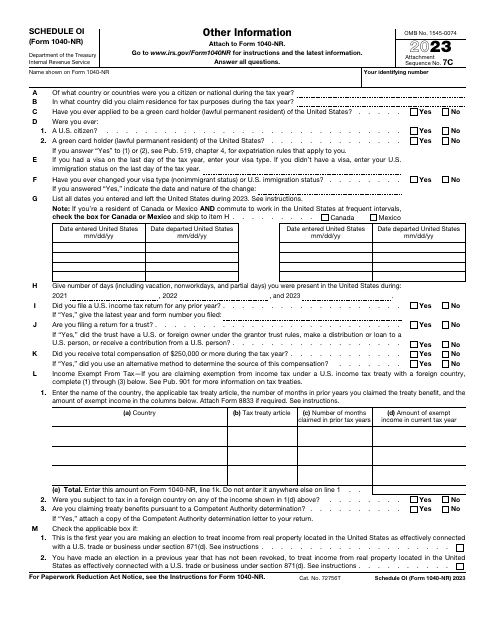

This form is part of the IRS 1040 series, which is used to calculate and submit different types of federal individual income tax returns. File this form to inform the Internal Revenue Service (IRS) about your income and loss from royalties, rental real estate, trusts, and S corporations among others.