Voluntary Disclosure Form Templates

Documents:

25

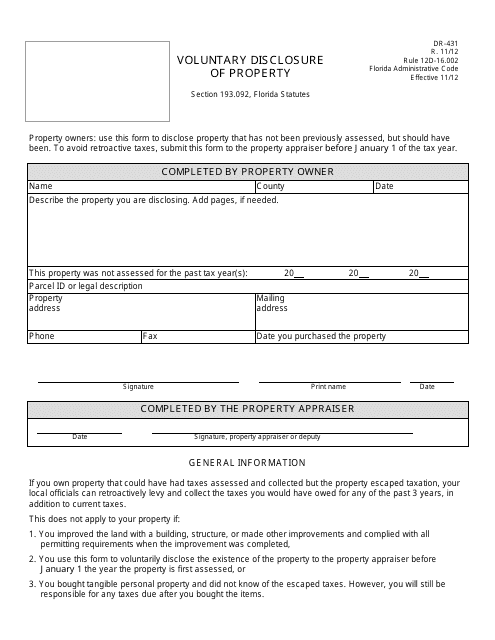

This form is used for voluntary disclosure of property in the state of Florida. It allows individuals to disclose any previously unreported property to the state and avoid potential penalties or legal consequences.

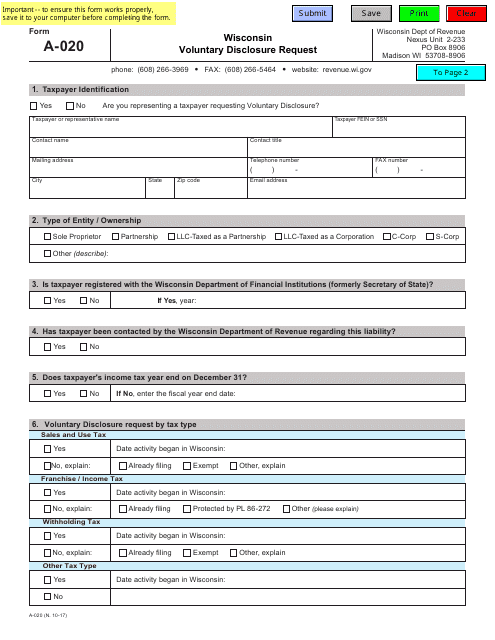

This form is used for individuals or businesses in Wisconsin to request a voluntary disclosure of taxes owed to the state.

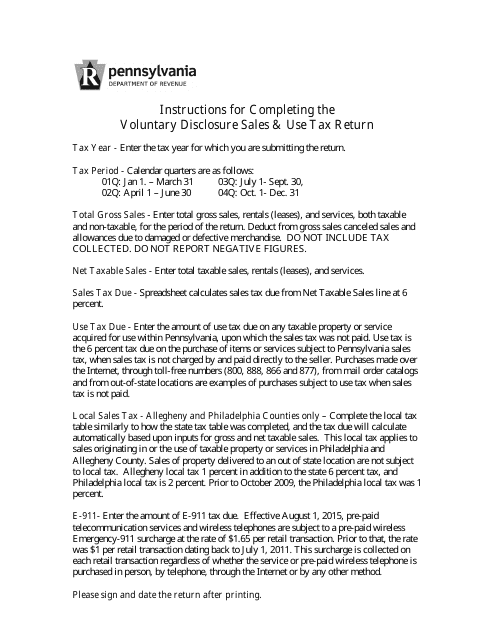

This document provides instructions for filing a Voluntary Disclosure Sales & Use Tax Return in Pennsylvania. It guides individuals on how to report and pay their sales and use taxes through the voluntary disclosure program.

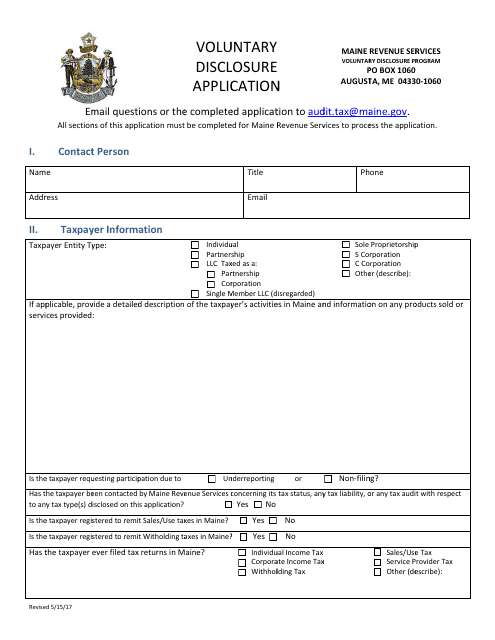

This form is used for the voluntary disclosure application in the state of Maine.

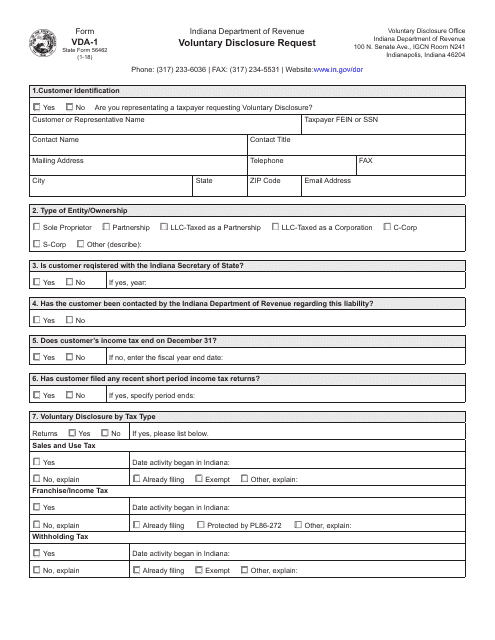

This form is used for requesting a voluntary disclosure in Indiana. It is known as the State Form 56462 (VDA-1) and is used to report any undisclosed tax liabilities.

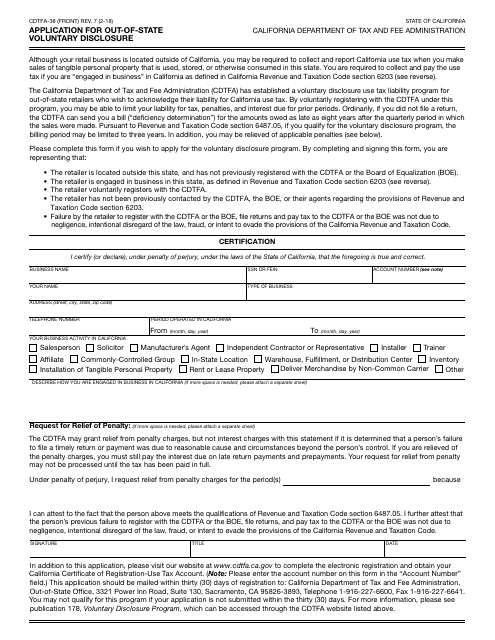

This Form is used for applying for out-of-state voluntary disclosure in California.

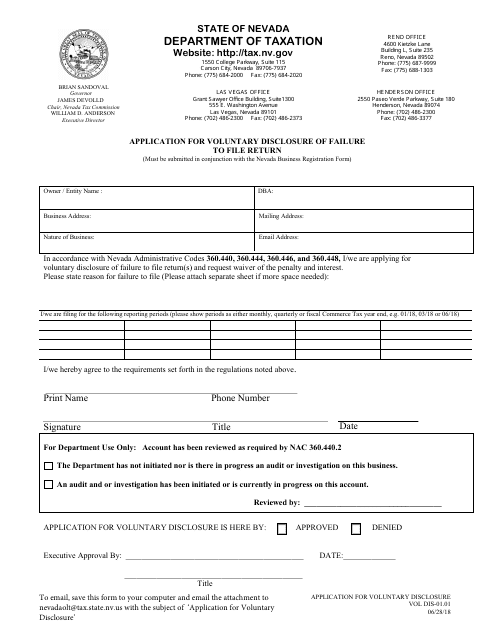

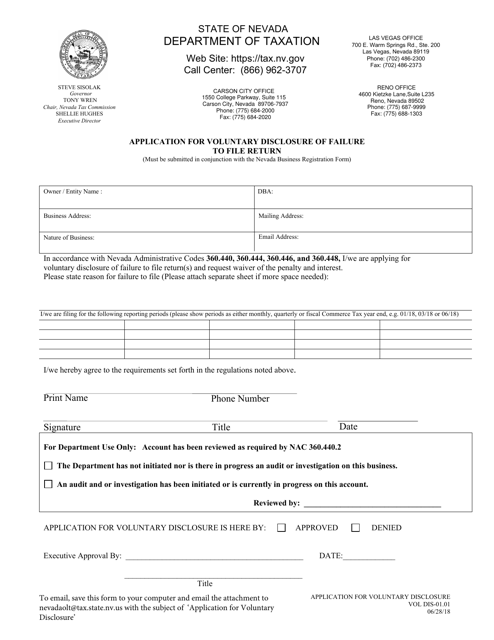

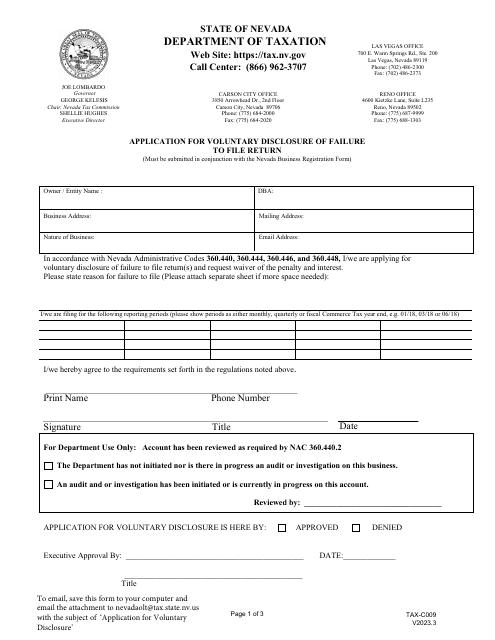

This form is used for individuals or businesses in Nevada who have failed to file a tax return and want to voluntarily disclose their mistake to the state. By filling out this application, you can avoid penalties and potential legal consequences.

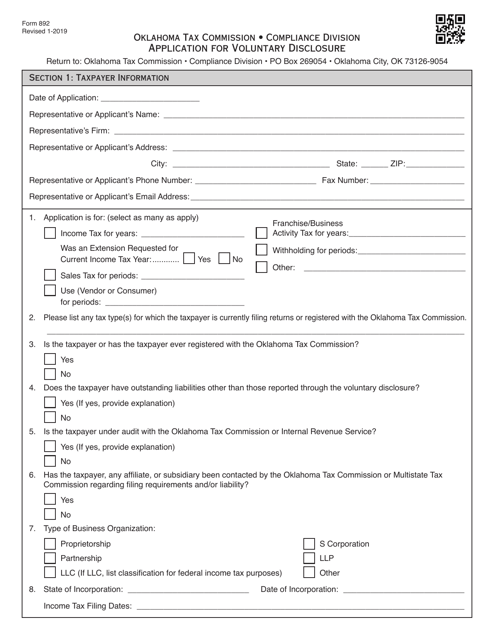

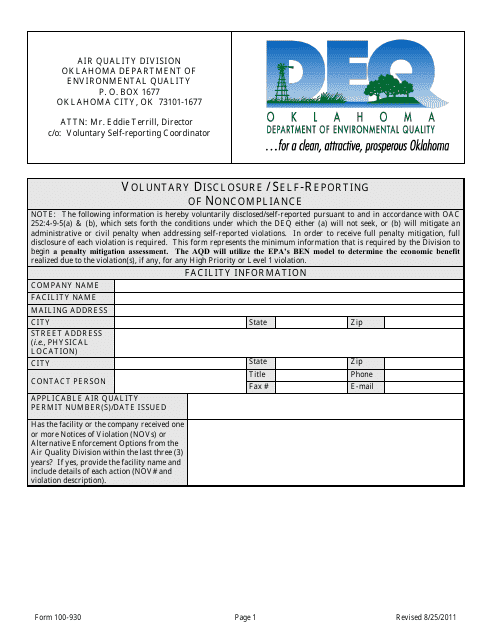

This Form is used for voluntary disclosure or self-reporting of noncompliance by individuals or businesses in Oklahoma to the Department of Environmental Quality (DEQ).

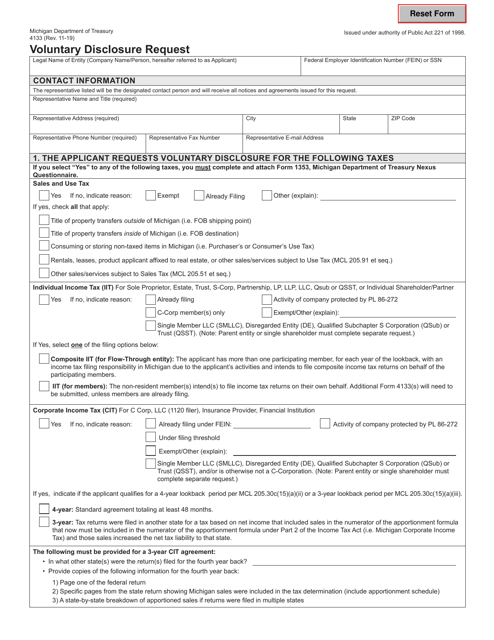

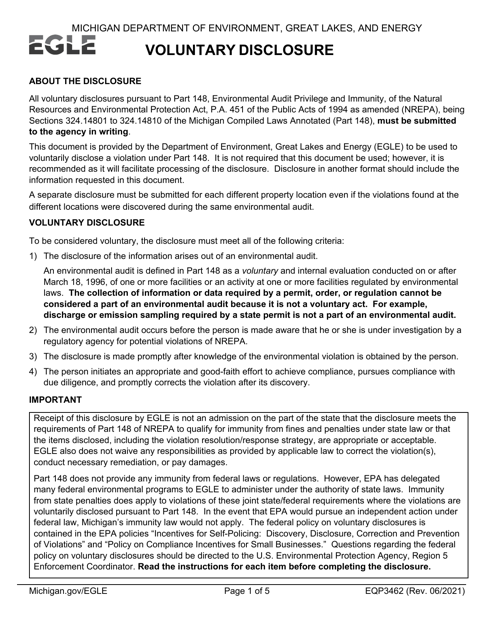

This form is used for submitting a voluntary disclosure request in the state of Michigan.

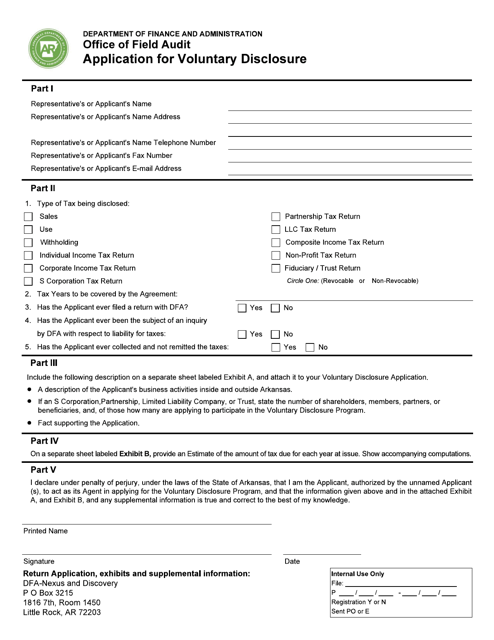

This document is an application for voluntary disclosure in the state of Arkansas. It is used for individuals or businesses to voluntarily disclose any past tax liabilities and come into compliance with state tax laws.

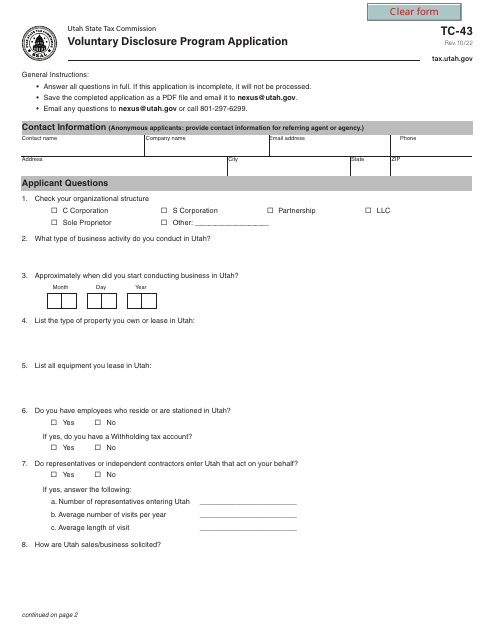

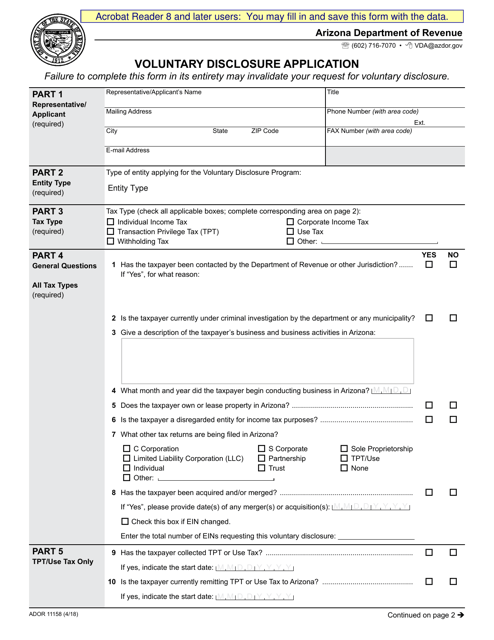

This form is used for submitting a voluntary disclosure application in the state of Arizona.

This form is used for voluntary disclosure in the state of Michigan.

This Form is used for individuals or businesses to apply for voluntary disclosure of failure to file a return in the state of Nevada.

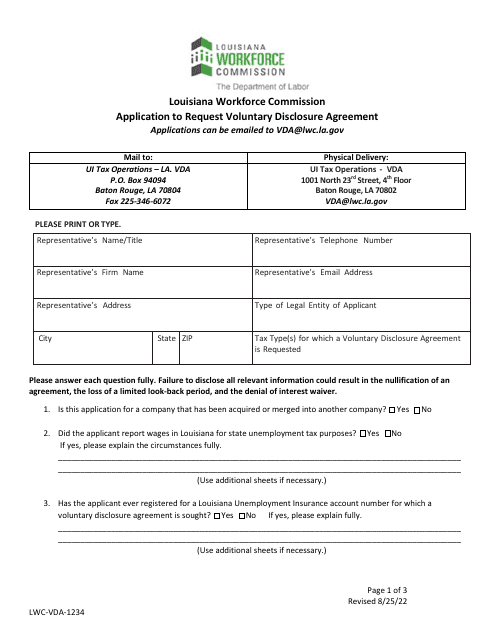

This form is used for applying to request a Voluntary Disclosure Agreement in the state of Louisiana.