Interest Calculator Templates

Documents:

11

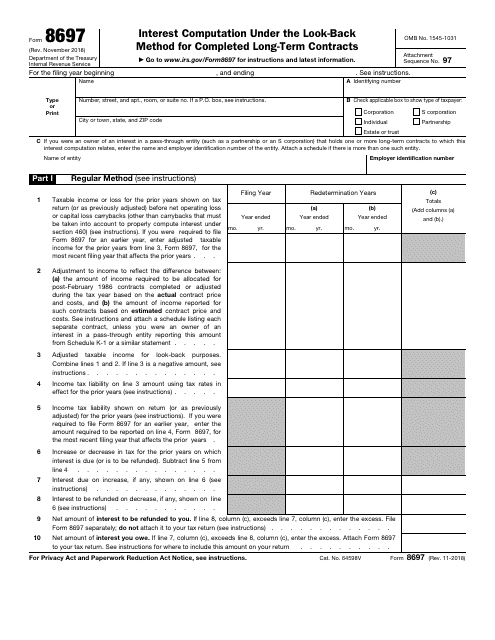

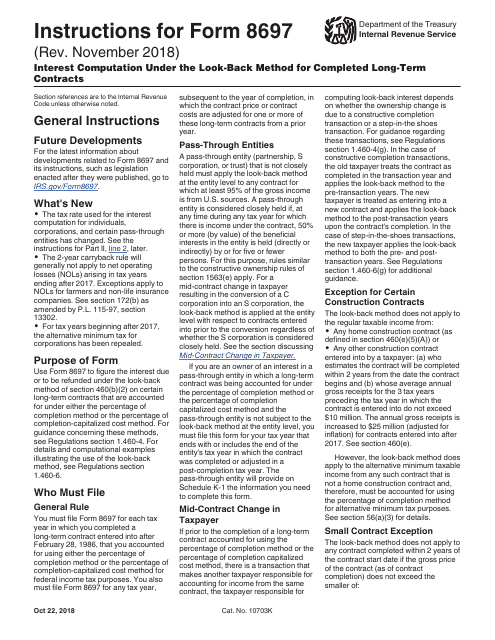

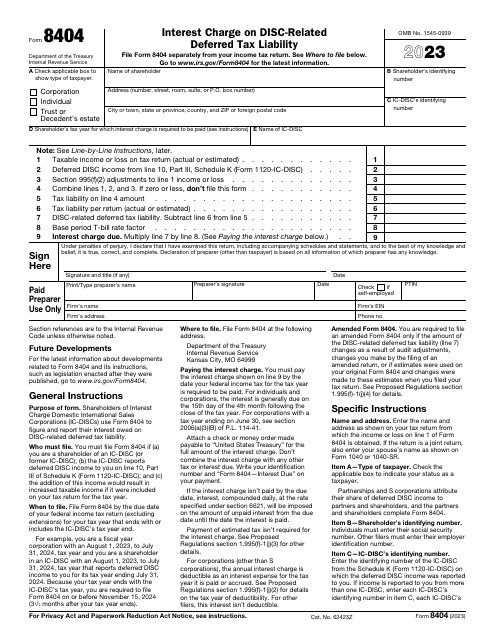

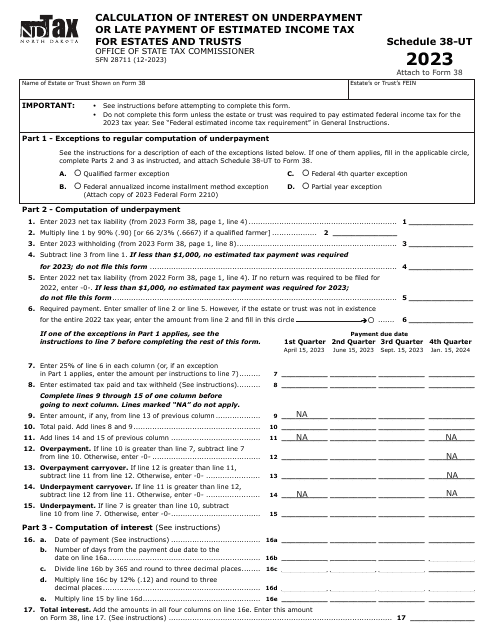

This form is used for calculating interest using the look-back method for completed long-term contracts.

This Form is used for calculating interest under the look-back method for long-term contracts completed by the IRS. It provides instructions on how to determine the interest amount and report it accurately on your tax return.

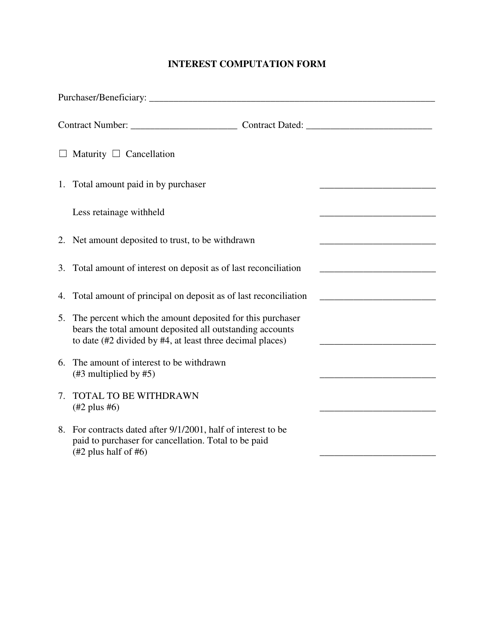

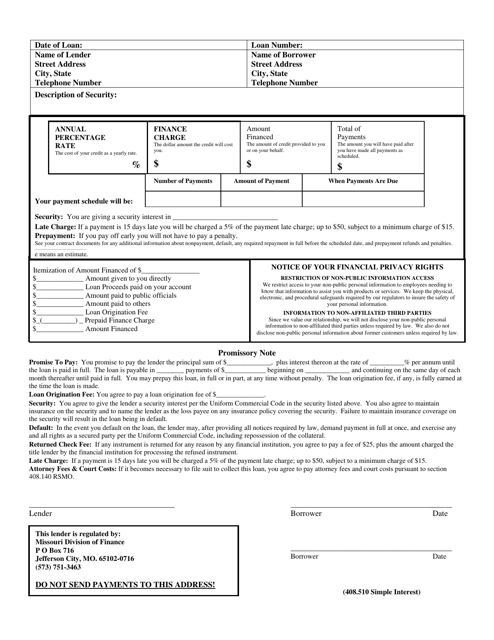

This form is used for calculating interest in the state of Texas. It is utilized to determine the amount of interest owed or earned on financial transactions such as loans, mortgages, or investments.

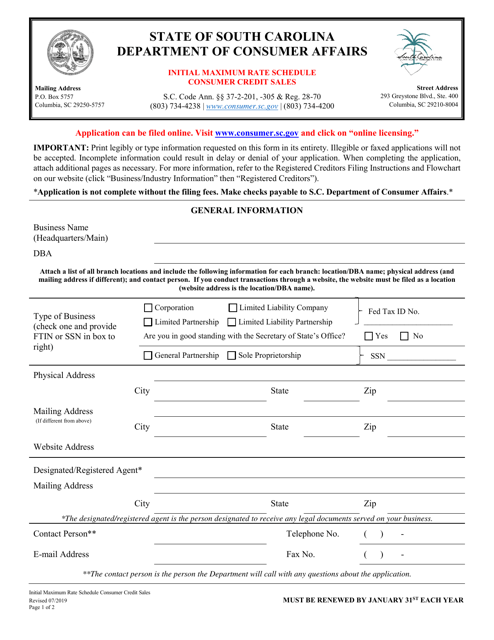

This document provides the maximum interest rates for consumer credit sales in South Carolina.

This document is for calculating simple interest in the state of Missouri. It is used to determine the amount of interest on a loan or investment.

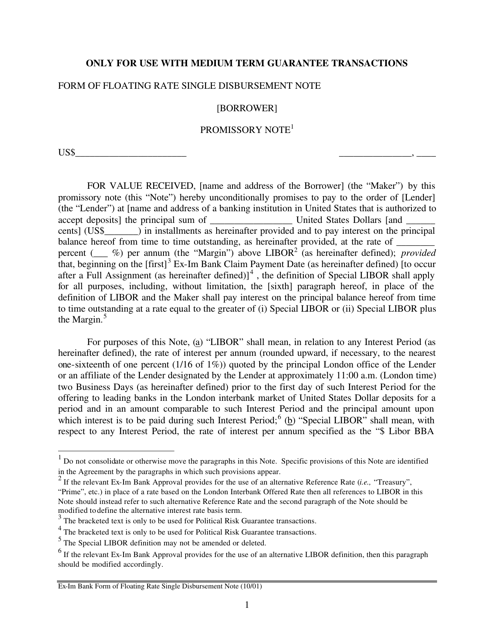

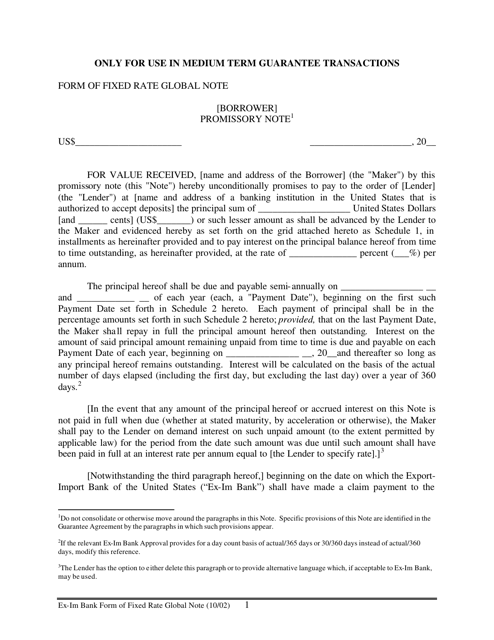

This Form is used for a type of loan agreement known as a Floating Rate Single Disbursement Note.

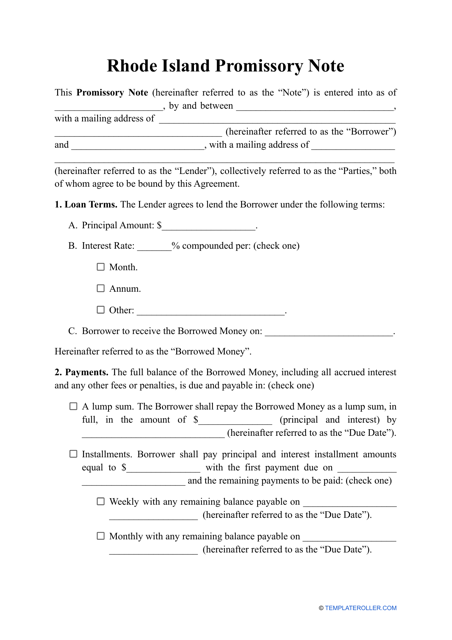

This document is a template for a promissory note in Rhode Island. It is used to outline the terms of a loan agreement between a lender and a borrower.