Unemployment Claim Forms by State

What Is an Unemployment Claim?

An Unemployment Claim is a document in which individuals who have lost their job file in the state where they used to work in order to apply for unemployment compensation benefits.

Alternate Name:

- Claim For Unemployment.

The application is supposed to be filled out and submitted to the state’s unemployment agency, most of which support an opportunity to file a claim online or by mail. To claim unemployment an applicant must meet the requirements designated by the state they live in.

Unemployment Claims by State

A Claim for Unemployment is an initial document that starts a laborious process of estimating if a filer is eligible for unemployment insurance. The U.S. government provides states with insurance programs that have basic requirements and gathers information from them to form a statistical database, which helps to foresee time periods where more of these claims are generally submitted.

However, unemployment claims can differ from one state to another and can require different types of information that must be provided by a filer. In order not to miss any important details typical for a certain state, it is necessary to contact the state's unemployment program.

| Alabama | Hawaii | Massachusetts | New Mexico (e-filing only) | South Dakota |

| Alaska | Idaho | Michigan | New York | Tennessee |

| Arizona | Illinois | Minnesota (e-filing only) | North Carolina | Texas (e-filing only) |

| Arkansas | Indiana | Mississippi | North Dakota | Utah |

| California | Iowa | Missouri | Ohio (e-filing only) | Vermont |

| Colorado | Kansas | Montana | Oklahoma | Virginia |

| Connecticut | Kentucky (e-filing only) | Nebraska (e-filing only) | Oregon | Washington |

| Delaware | Louisiana | Nevada (e-filing only) | Pennsylvania (e-filing only) | West Virginia |

| Florida | Maine | New Hampshire | Rhode Island (e-filing only) | Wisconsin |

| Georgia | Maryland | New Jersey | South Carolina | Wyoming (e-filing only) |

How to Claim Unemployment?

Claiming unemployment is an important process for those individuals who have lost their job and need financial help in maintaining their basic needs. A claimant cannot afford to make mistakes here since it can end up with rejection and, as a result, losing the opportunity to receive unemployment compensation benefits. To avoid it, an applicant should follow a few steps to claim unemployment, such as:

- Gather Information. To claim unemployment benefits an applicant must provide information about their past employer (including company name, address and telephone number), the reason why they are unemployed, earnings in the last week they worked, information about all employers an applicant has had over the last 18 months, a filer’s social security number, current address, etc.;

- File an Unemployment Claim. The process of submitting a claim differs from state to state, however, most of them support the opportunity to file a claim online or by mail. To learn more about the applicable procedure in their state, an applicant should contact their state’s unemployment program.

- Monitor Progress. A filer will be mailed information connected with their claim. It can be a request to provide additional data, information about their benefits, information on whether they were found eligible or not. It’s important to pay attention to each document they receive and respond to it on time if they are required to do so. Ignoring them or responding late can cause payment delays.

How to Fight Unemployment Claim Denial?

If your Unemployment Claim was denied it is necessary to understand why it was denied. After receiving a Notice of Determination with a denial, an applicant should thoroughly examine the part where their state’s unemployment agency gives a motivated explanation on why they made such a decision.

One of the most common reasons why filers get denied unemployment bonuses is because they quit their job, which makes them ineligible for the state’s unemployment program. However, if an applicant believes that there was a mistake and they are eligible for benefits they should file an appeal, providing proof of their point of view. Information about an applicant’s appeal rights will be provided on the other side of the Notice of Determination, it includes the period when the appeal must be filed and the address where to file the appeal.

Unemployment Claim FAQ

How to Check Status of Unemployment Claim?

Each state uses its own unemployment program. To check the status of their unemployment claim an applicant should visit the official website of the state in which they reside.

How Will I Know If My Unemployment Claim Was Approved?

An applicant will receive a Notice of Determination by mail (or by email if they have chosen to receive information electronically) where they will find information on whether they have qualified for unemployment compensation or not.

What If I Forgot to File My Weekly Unemployment Claim?

If a filer forgets to claim their weekly unemployment benefits, the state will stop paying their compensation. In this case, an applicant has three options: to file a weekly claim on a makeup day, to double the payment on the next claim, or to contact the unemployment program for a backdating of the claim.

How to Cancel an Unemployment Claim?

Each state has its own regulations on how to cancel a claim, but most recommend contacting your state’s unemployment division to request the canceling of payments.

Useful Links and Related Documents:

- Unemployment Tax Form (IRS Form 1099-G). This document is used by governments of all levels (local, state, and federal) to claim payments which include unemployment compensation, local income tax refunds, agricultural payments, etc.;

- Federal Unemployment Tax Form (IRS Form 940). The document is used by taxpayers to report their yearly Federal Unemployment Tax Act (FUTA) tax;

- Unemployment Deferment Request. Students may use this form to apply for a deferment on loans if they are temporarily unavailable to pay their student loan payments because they cannot find work;

- Notice of Determination. After a filer has applied for unemployment compensation benefits they will receive a Notice of Determination, which states whether they have qualified for the benefits or not;

- Unemployment Verification Letter. If an applicant needs proof of their unemployment, they can request their state’s unemployment division to provide an Unemployment Verification Letter, by mail or online;

- Unemployment Appeal Letter. If an applicant was disqualified for unemployment compensation bonuses and they disagree with it, they can file an Unemployment Appeal Letter where they prove that they qualify for the bonuses.

Related Articles

Documents:

224

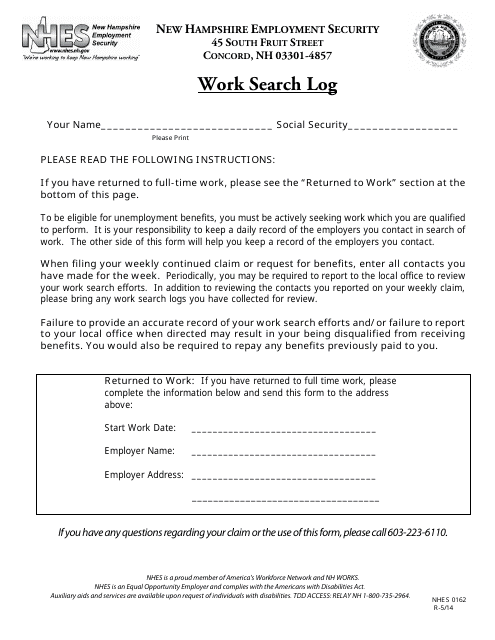

This form is used for keeping track of a person's work search efforts in the state of New Hampshire.

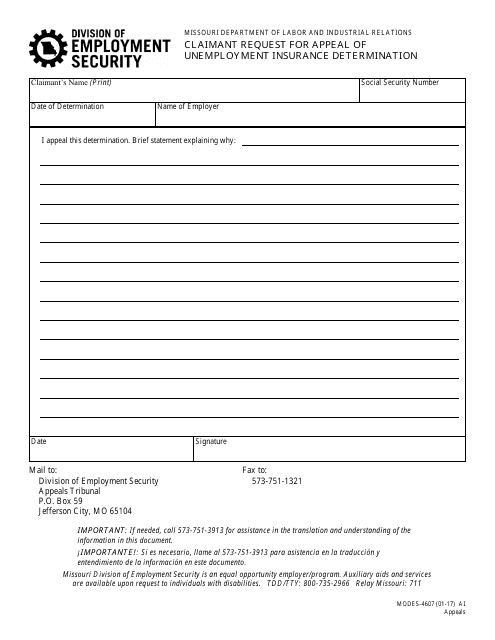

This form is used for claimants in Missouri to request an appeal

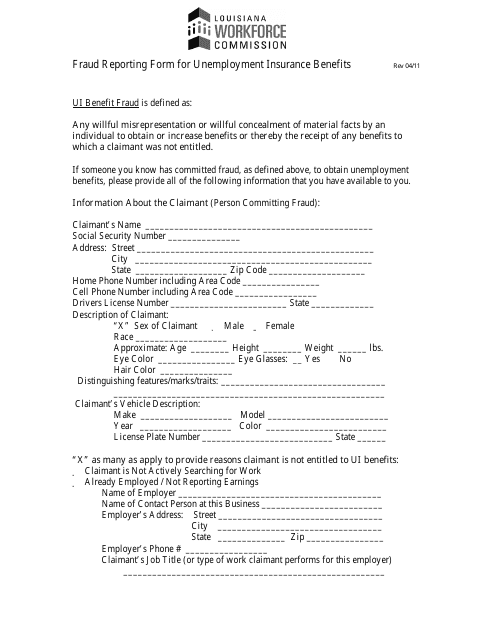

This form is used for reporting fraud related to unemployment insurance benefits in the state of Louisiana.

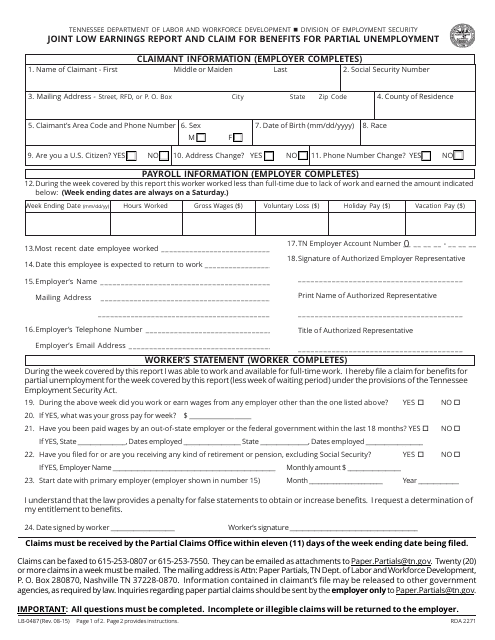

This form is used for filing a joint low earnings claim for partial unemployment benefits in the state of Tennessee.

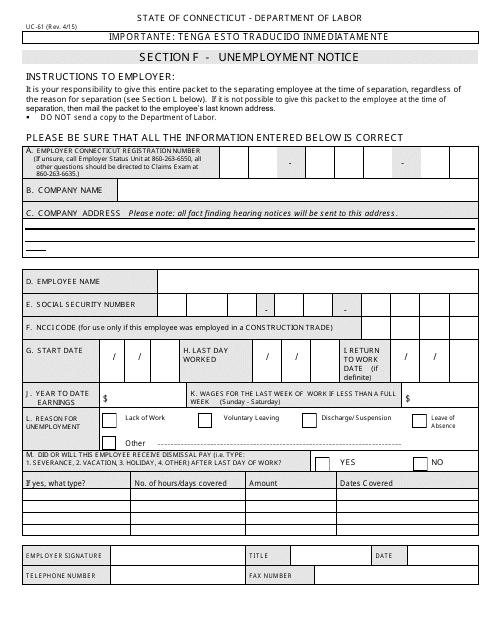

This form is used for filing an Unemployment Separation Notice in the state of Connecticut. It is a document that notifies the unemployment office about the separation of an employee from their job.

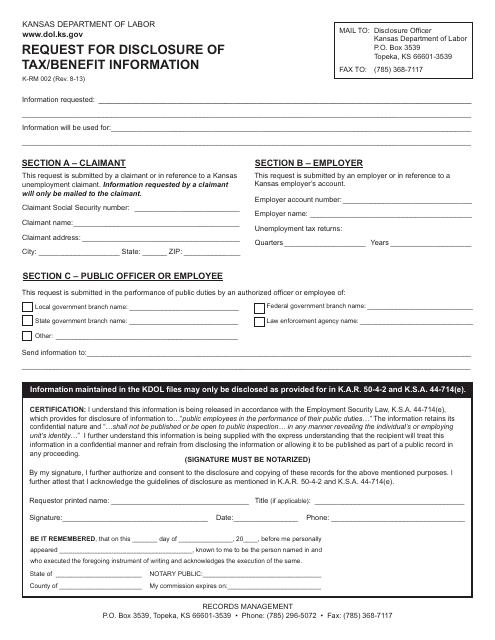

This form is used for requesting disclosure of tax and benefit information in the state of Kansas. It is necessary when taxpayers need access to their tax and benefit records.

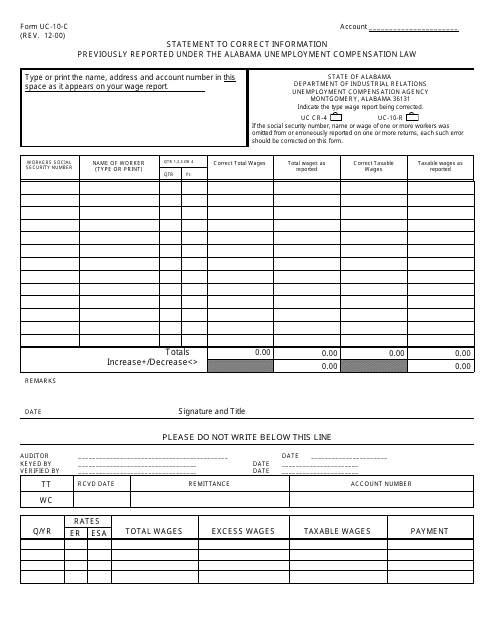

This Form is used for correcting information that was previously reported under the Alabama Unemployment Compensation Law in Alabama.

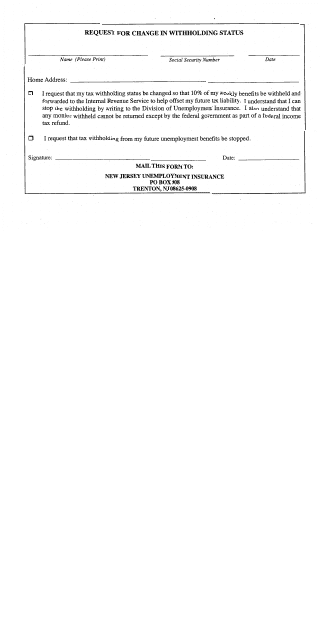

This form is used for requesting a change in withholding status for residents of New Jersey.

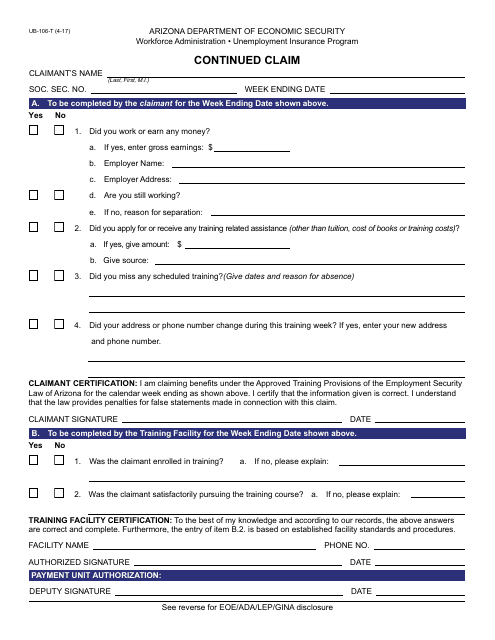

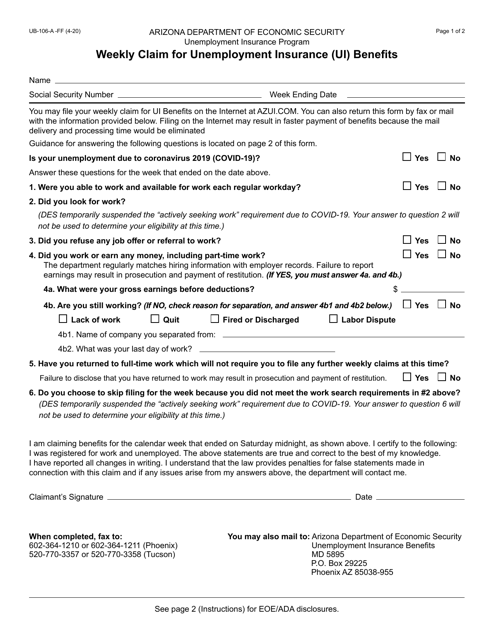

This form is used for filing a continued claim for unemployment benefits in Arizona.

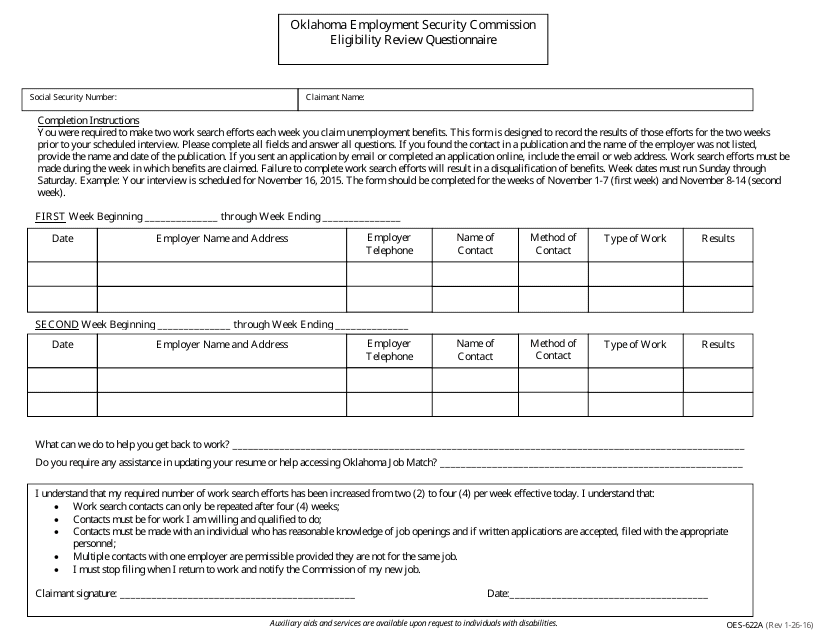

This Form is used for the Eligibility Review Questionnaire in the state of Oklahoma. It is a questionnaire that individuals must fill out to determine their eligibility for certain benefits or programs in Oklahoma.

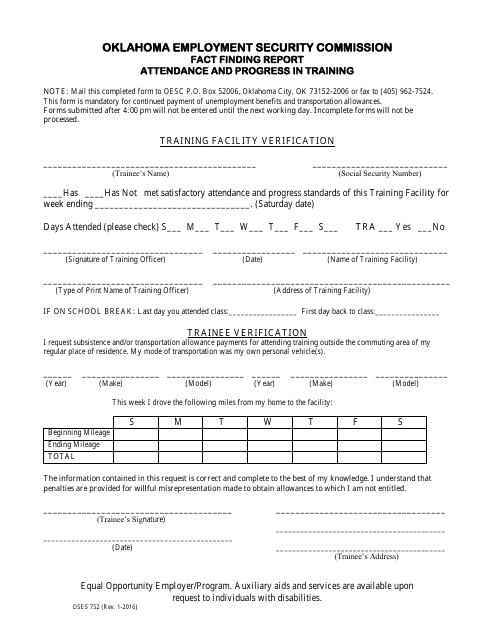

This form is used for reporting and documenting attendance and progress in training programs in the state of Oklahoma.

This is an Arizona legal document needed to verify that you were unemployed during the report week and are eligible to receive Arizona Unemployment Insurance or AZUI.

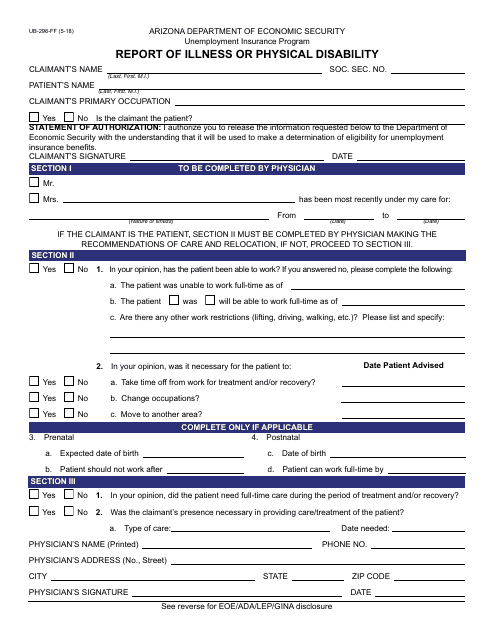

This document is used for reporting illness or physical disability in the state of Arizona.

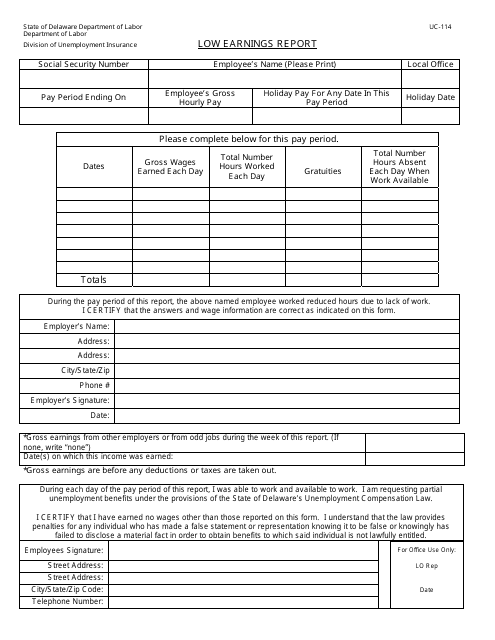

This form is used for reporting low earnings in the state of Delaware.

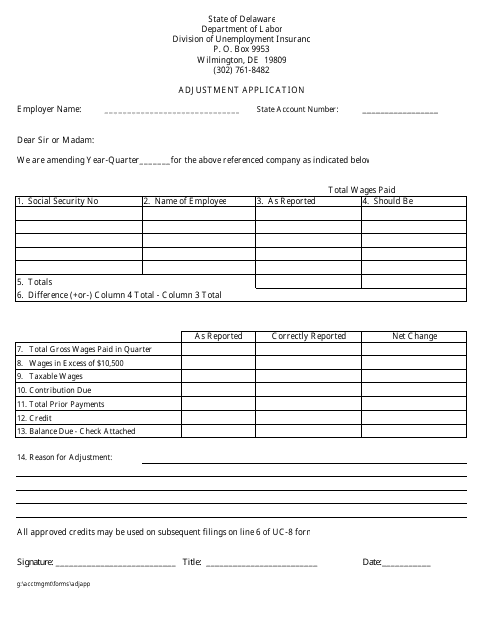

This document is used for submitting an adjustment application in the state of Delaware. It allows individuals or businesses to request a change or correction to a previous filing.

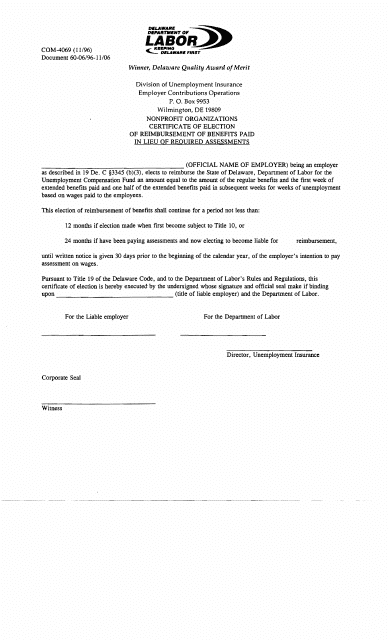

This Form is used for nonprofit organizations in Delaware to elect reimbursement of benefits paid instead of required assessments.

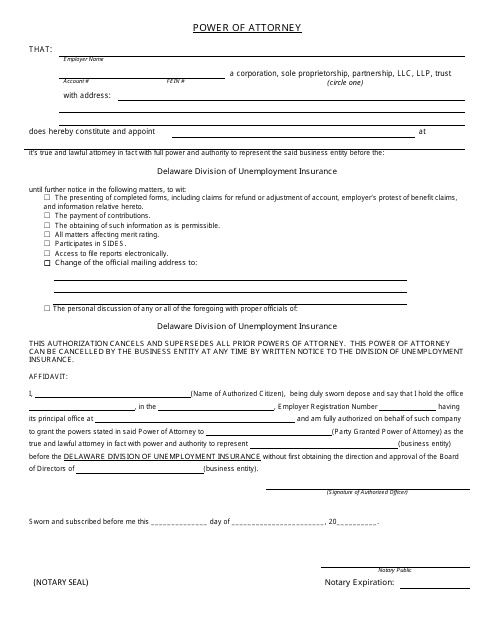

This type of document, known as a Power of Attorney, is used in Delaware. It grants someone the legal authority to make decisions and act on behalf of another person.

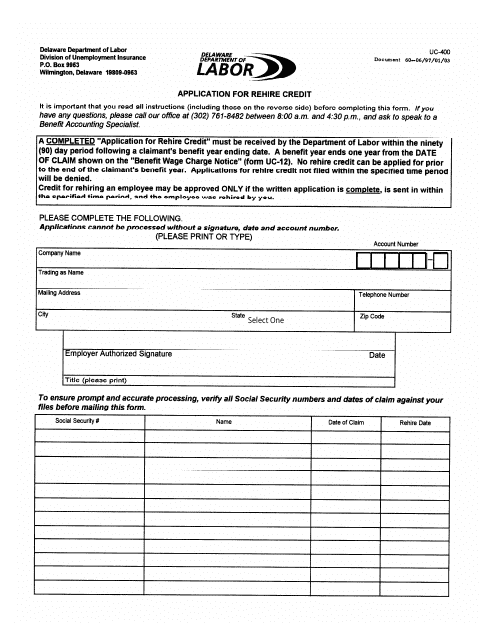

This form is used for applying for rehire credit in the state of Delaware.

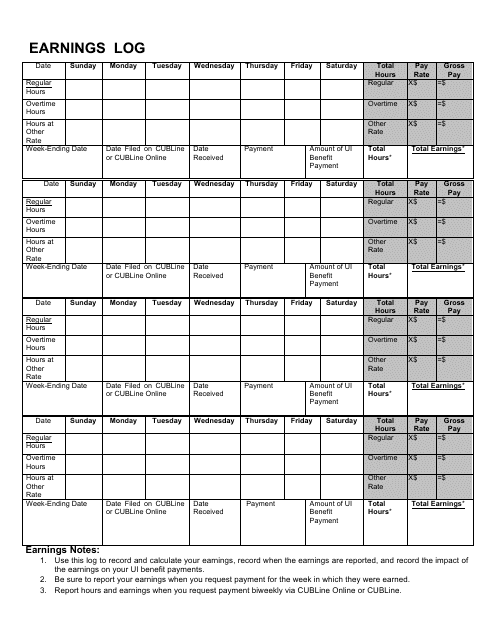

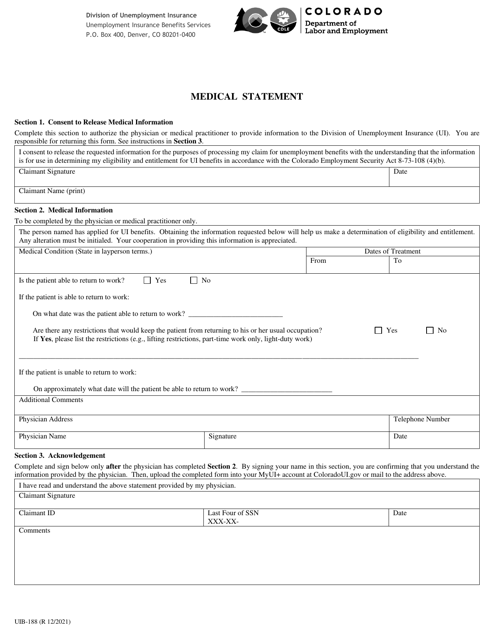

This document is used for keeping a record of earnings in the state of Colorado. It helps individuals track their income and ensure accurate tax reporting.

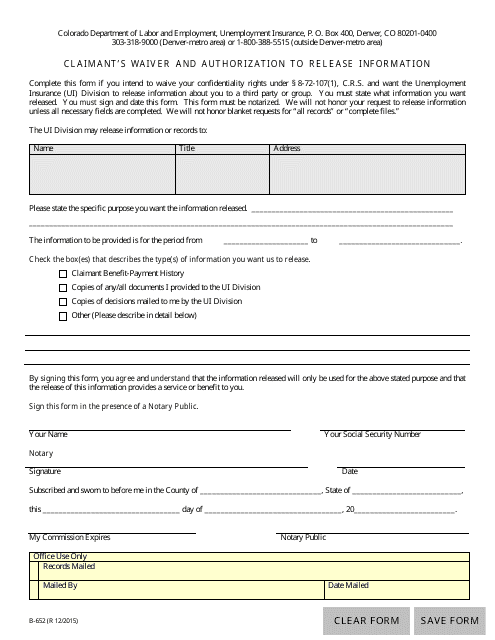

This form is used for claimants in Colorado to waive their rights and authorize the release of information.

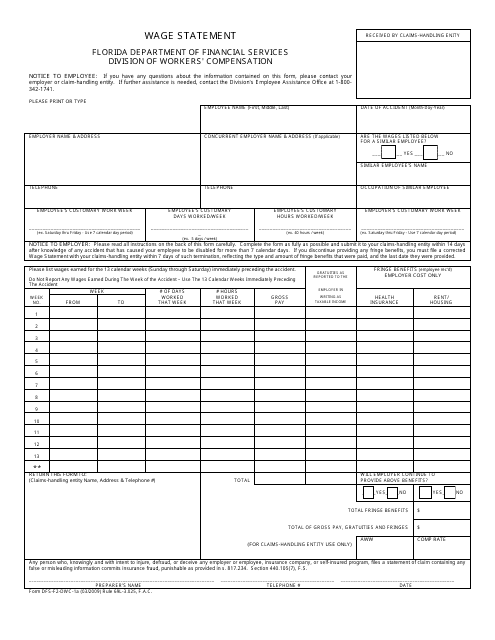

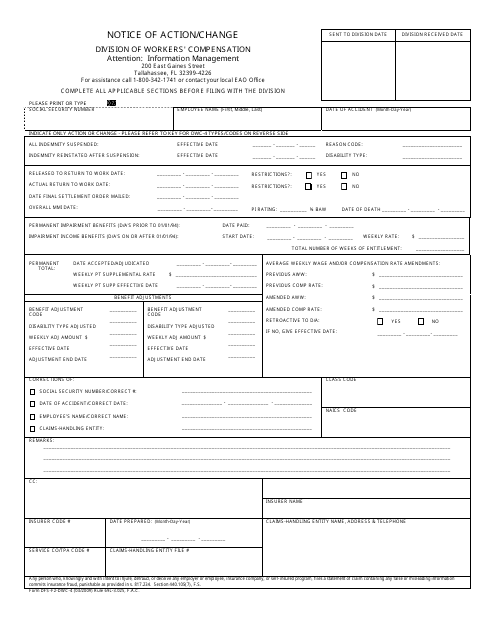

This Form is used for Wage Statement purposes in the state of Florida. It is a document that reports an employee's wages and other compensation.

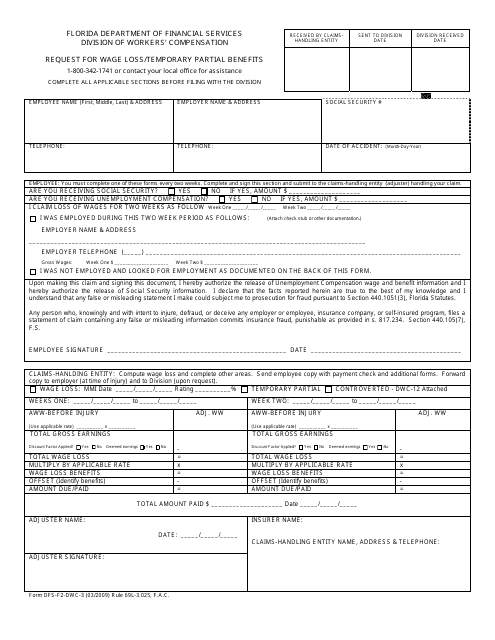

This form is used for requesting wage loss or temporary partial benefits in the state of Florida.

This form is used for notifying the Department of Children and Families in Florida about any changes or actions related to your case.

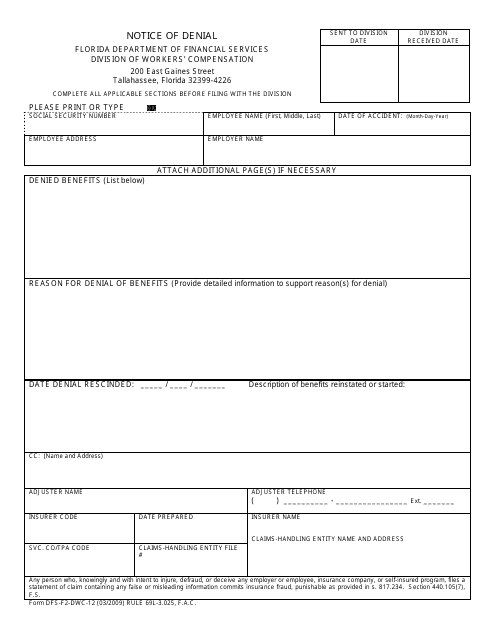

This document is used to notify individuals in Florida of a denial.

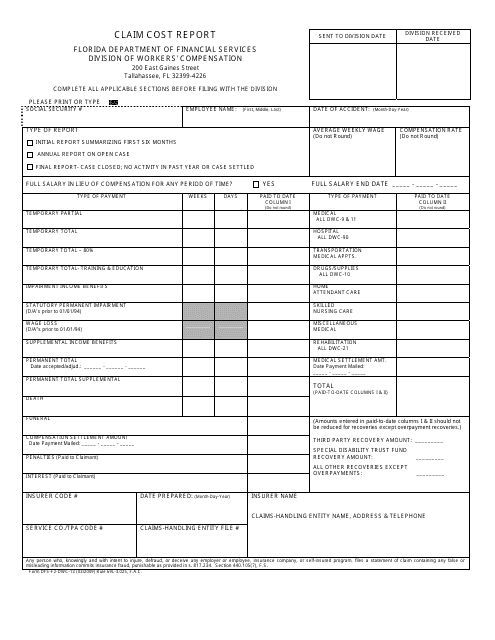

This form is used for submitting a Claim Cost Report in the state of Florida. It is required to report and document the costs associated with a claim.

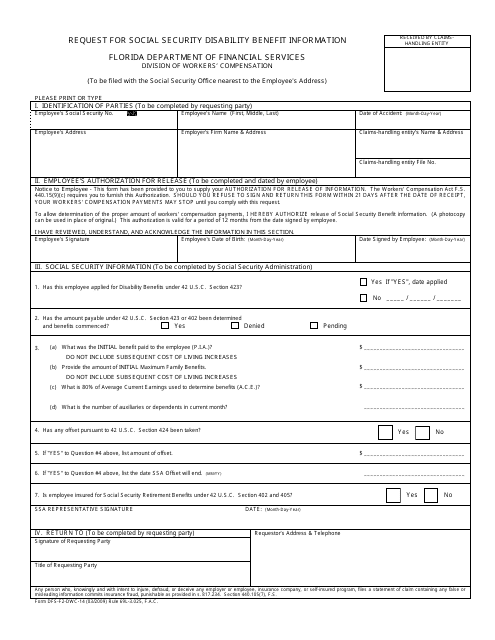

This Form is used for requesting information regarding Social Security Disability Benefits in Florida.

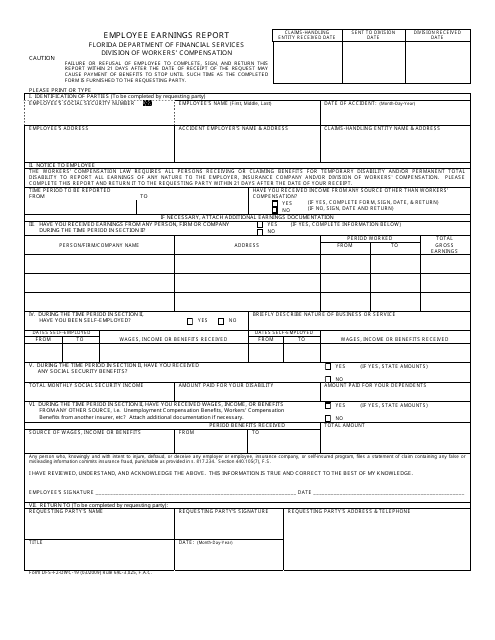

This Form is used for reporting employee earnings in the state of Florida. It helps employers keep track of their employees' wages and hours worked. The form includes information such as employee's name, social security number, and earnings for each pay period.

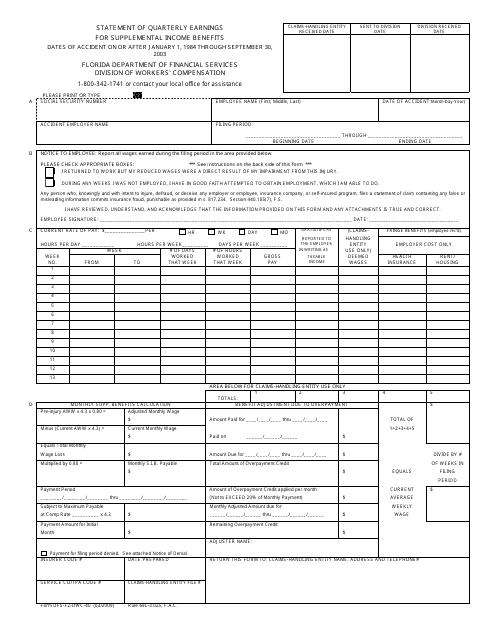

This form is used for reporting quarterly earnings for individuals receiving supplemental income benefits in the state of Florida.

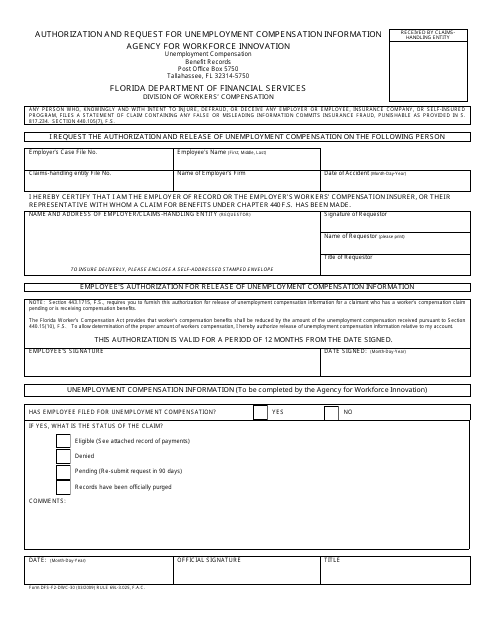

This document is used for authorizing and requesting information related to unemployment compensation in the state of Florida.

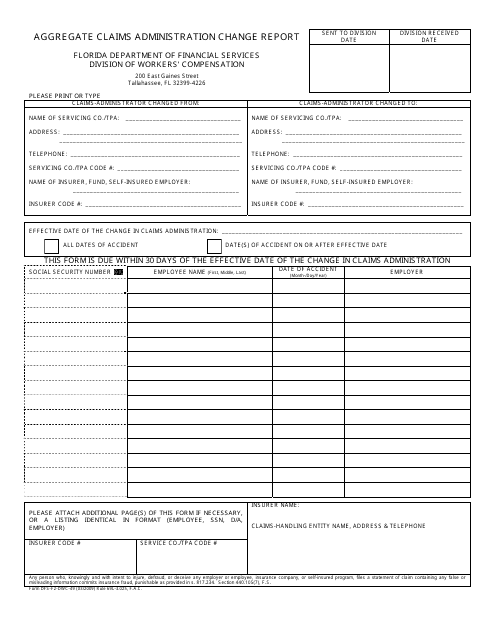

This form is used for reporting changes in aggregate claims administration in the state of Florida.

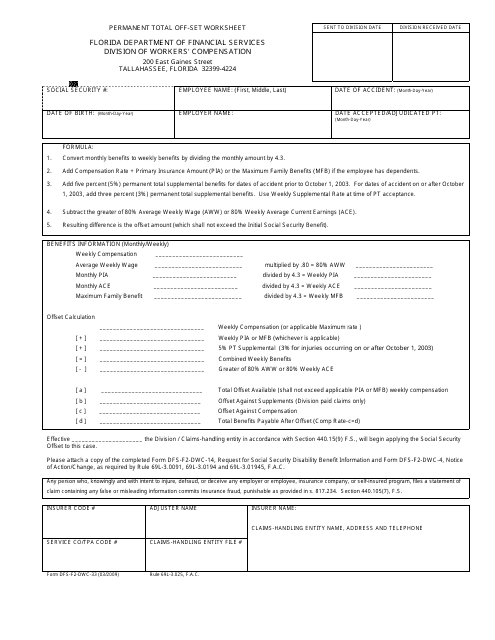

This form is used in Florida for calculating permanent total offset benefits in workers' compensation cases.

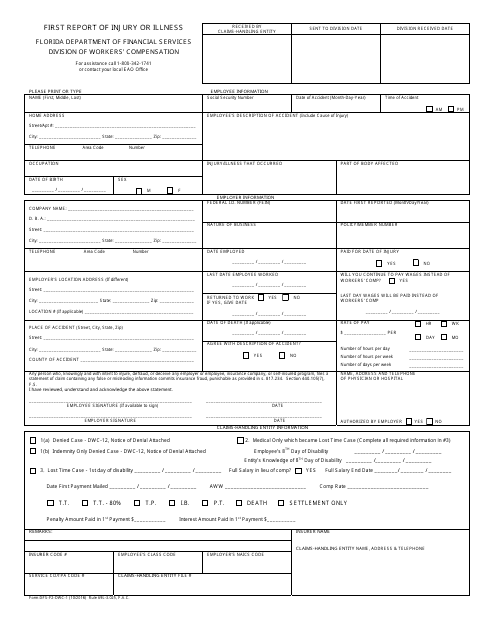

This form is used for reporting the first occurrence of an injury or illness in the state of Florida. It is important to complete and submit this form as soon as possible after the incident.

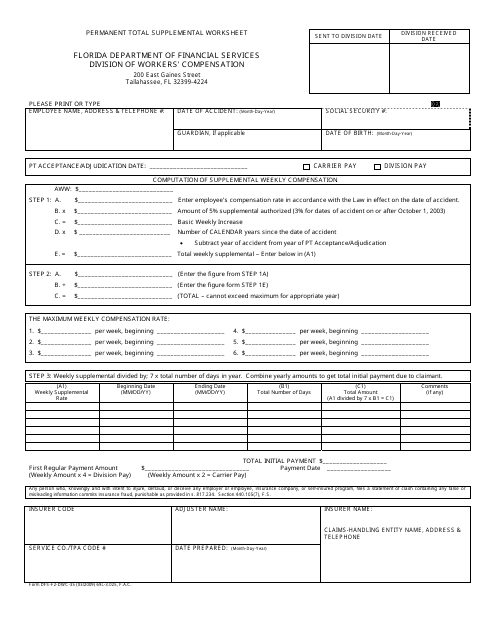

This Form is used for filing a Permanent Total Supplemental Worksheet in the state of Florida.

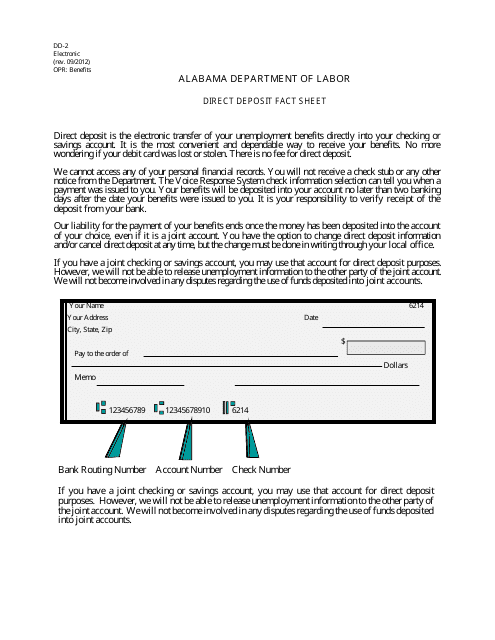

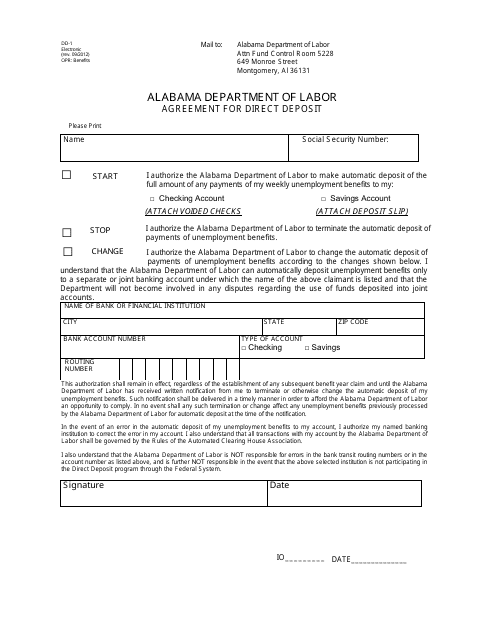

This document provides information about direct deposit for employees in Alabama. It explains how to set up and use direct deposit for payroll purposes.

This form is used for setting up a direct deposit agreement in Alabama. It allows individuals to authorize their employer or another entity to deposit funds directly into their bank account.

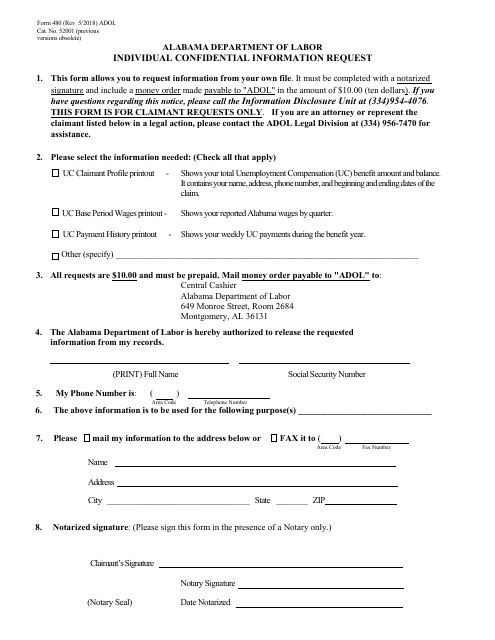

This form is used for requesting confidential information on an individual in the state of Alabama.

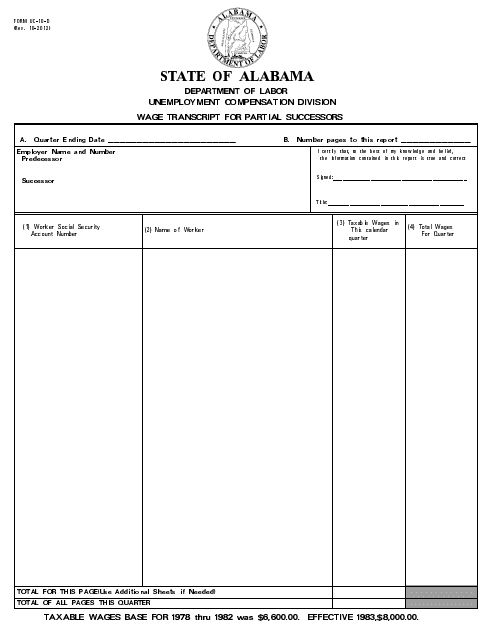

This form is used for obtaining a wage transcript for partial successors in Alabama.

This Form is used for granting someone the authority to act on your behalf in legal matters in the state of Alabama.