Property Transfer Form Templates

Documents:

433

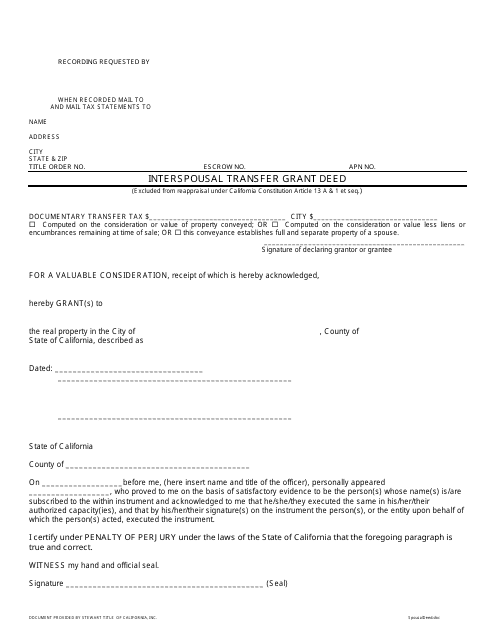

This document is used for transferring property between spouses in California. It is a legal form that allows one spouse to transfer ownership of property to the other spouse.

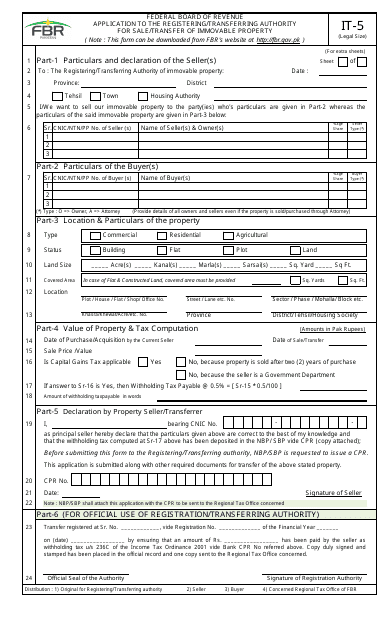

This Form is used for applying to the Registering/Transferring Authority in Pakistan for the sale or transfer of immovable property.

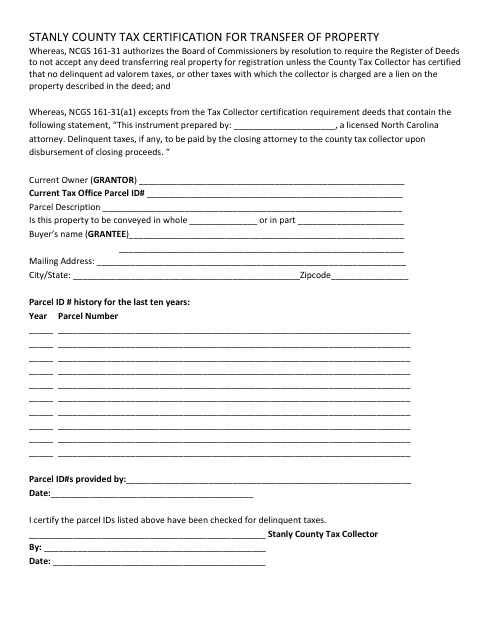

This document certifies the tax status of a property transfer in Stanly County, North Carolina. It verifies that all taxes related to the property have been paid or are up to date.

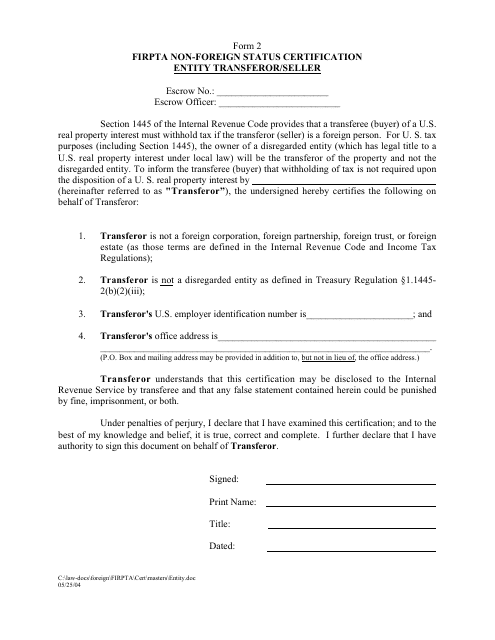

This document certifies the non-foreign status of an entity that is selling or transferring a property under the Foreign Investment in Real Property Tax Act (FIRPTA).

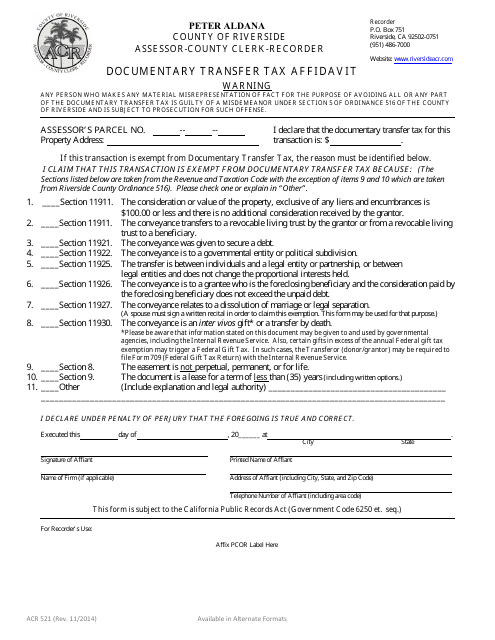

This Form is used for filing a Documentary Transfer Tax Affidavit in Riverside County, California. It is required when transferring real property and helps the county assess the appropriate transfer tax.

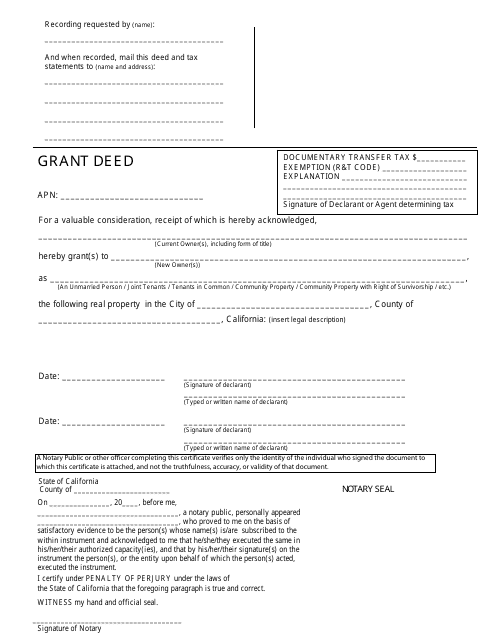

This is a form used to document the transfer of real property from a seller to a buyer in the state of California.

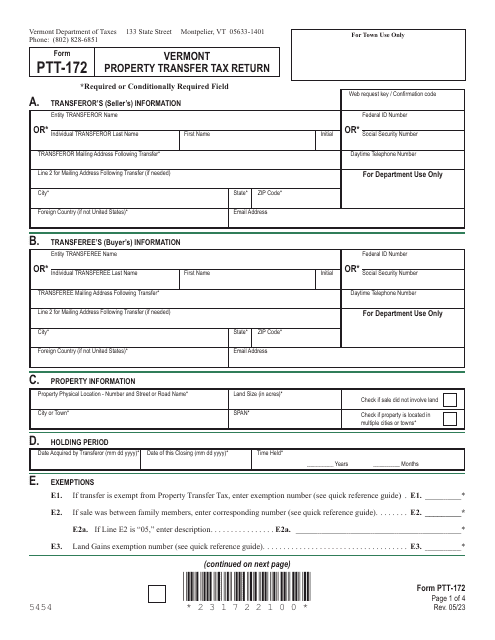

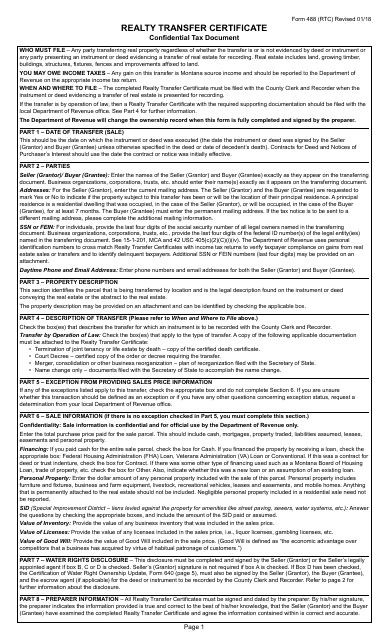

This form is used for reporting the transfer of real property in the state of Montana. It is required to be filled out and submitted to the appropriate authorities.

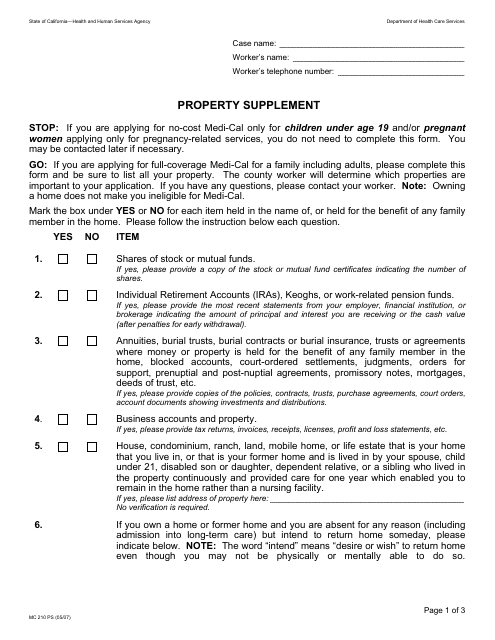

This Form is used for providing additional information about a property in California. It includes details such as the property's condition, history, and any improvements made.

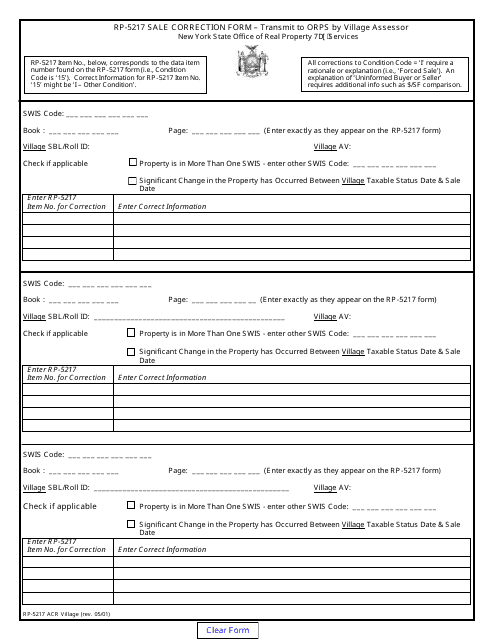

This form is used for correcting the sales information for a property in a village in New York.

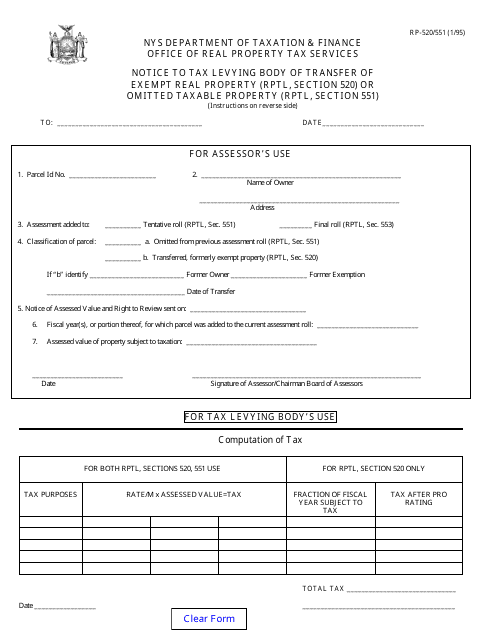

This form is used to notify the tax levying body in New York about the transfer of exempt real property or omitted taxable property in accordance with Rptl, Section 520 or Rptl, Section 551.

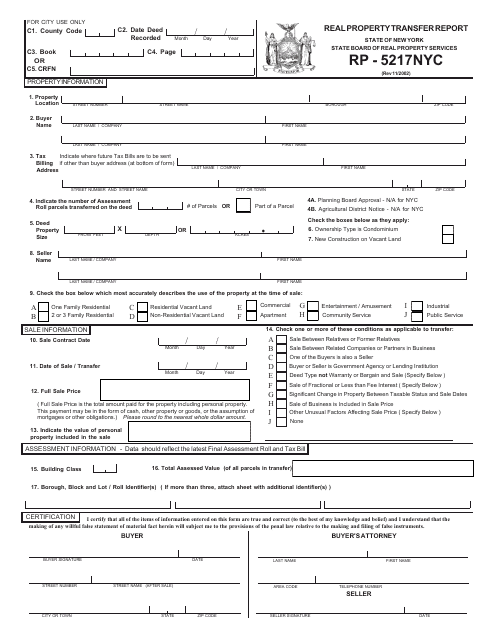

This form is used for reporting transfers of real property in New York City.

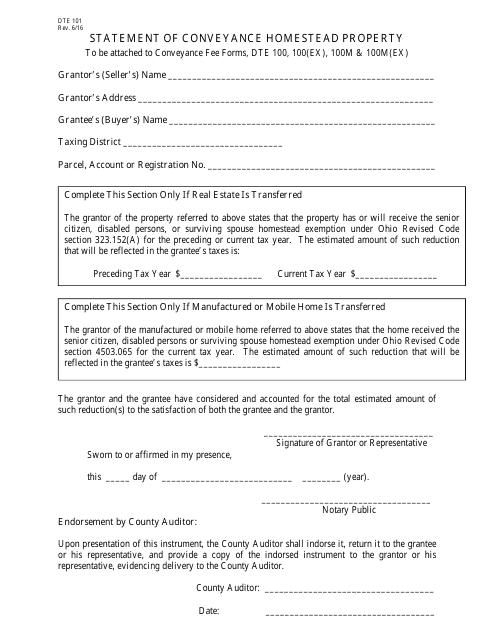

This form is used for submitting a statement of conveyance for homestead property in Ohio.

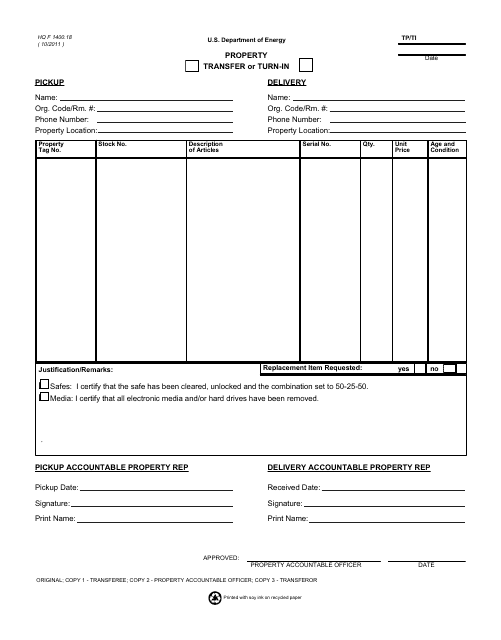

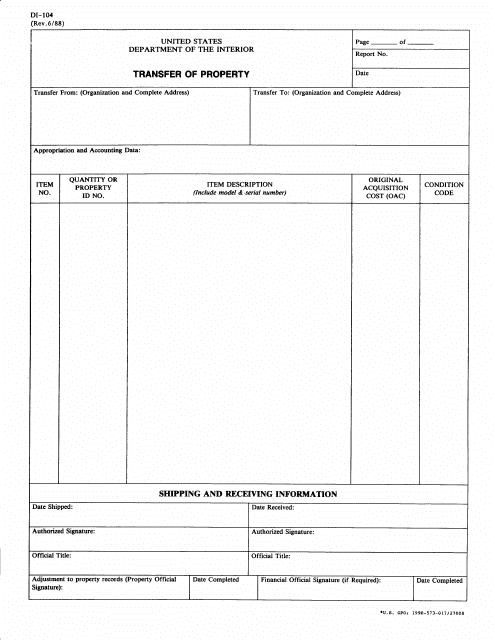

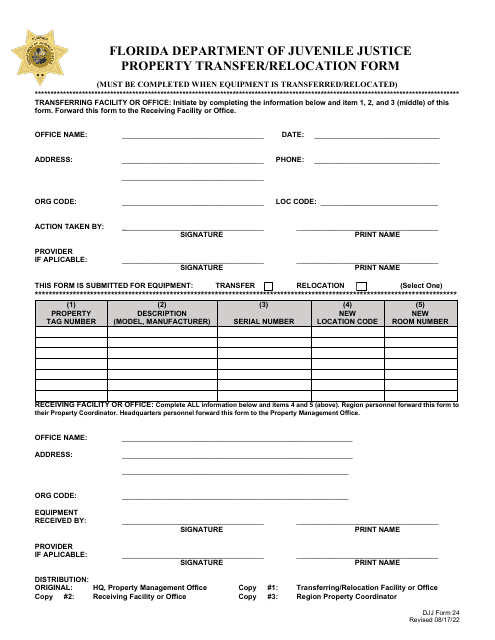

This Form is used for transferring or turning in property at the Department of Energy headquarters.

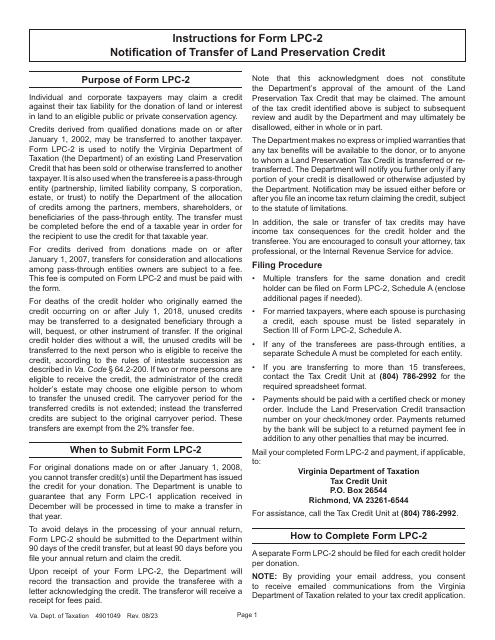

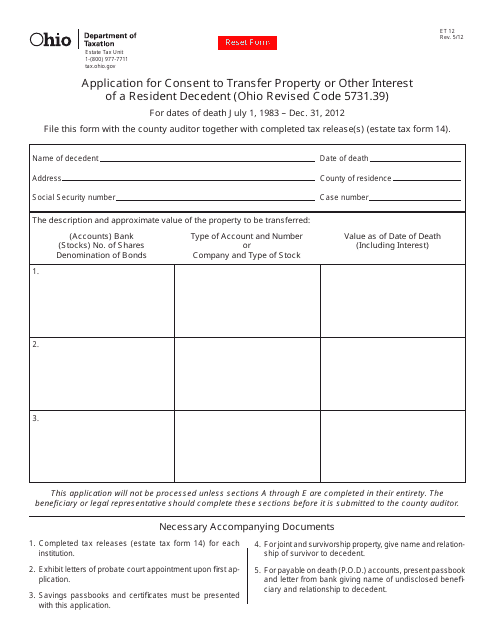

This form is used for applying for consent to transfer property or other interest of a deceased resident in Ohio who passed away between July 1, 1983, and December 31, 2012.

This form is used for transferring property ownership from one party to another. It must be filled out and submitted to the appropriate authority for legal transfer.

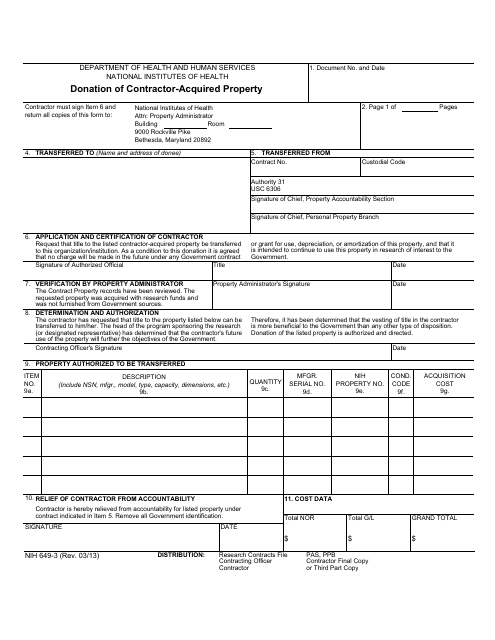

This document is used for the donation of property acquired by a contractor to the National Institutes of Health (NIH).

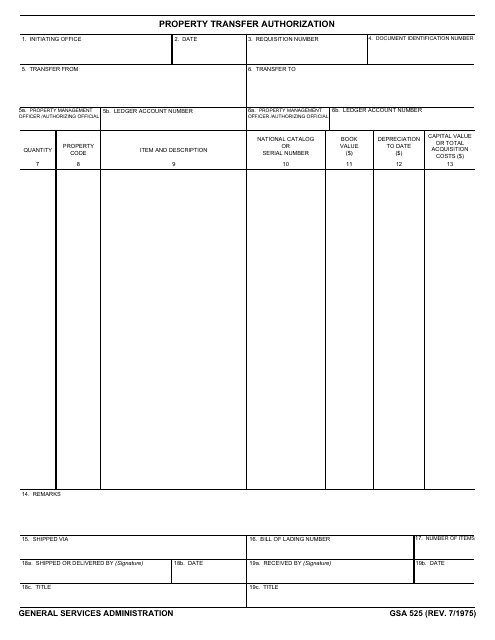

This document is used for authorizing the transfer of property within the General Services Administration (GSA).

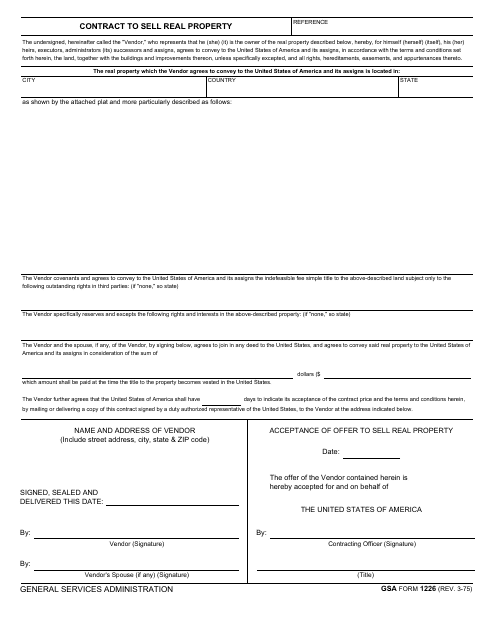

This Form is used for entering into a contract to sell real property.

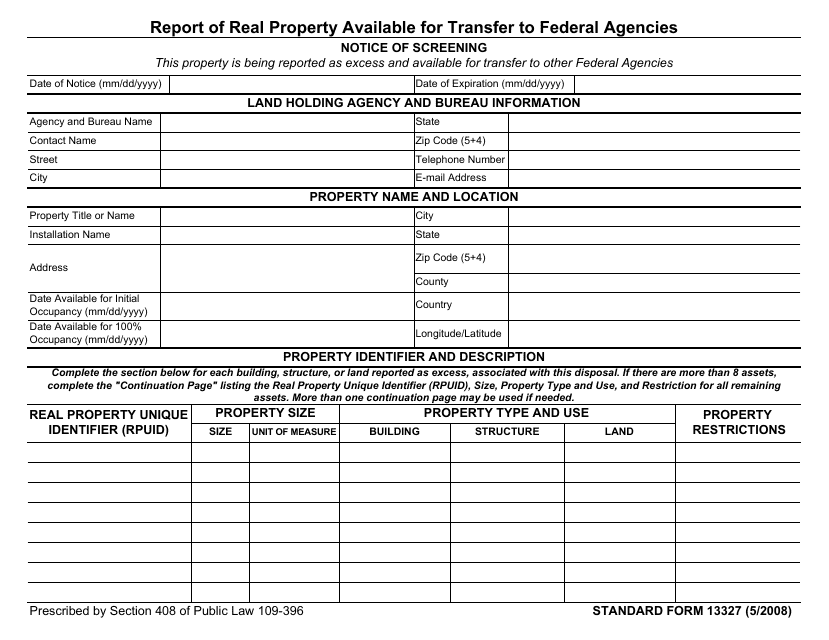

This Form is used for reporting real property that is available for transfer to federal agencies.

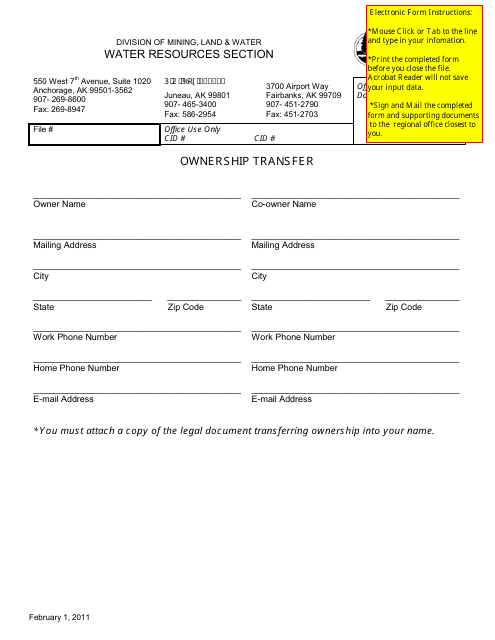

This Form is used for transferring ownership of a property or asset in Alaska.

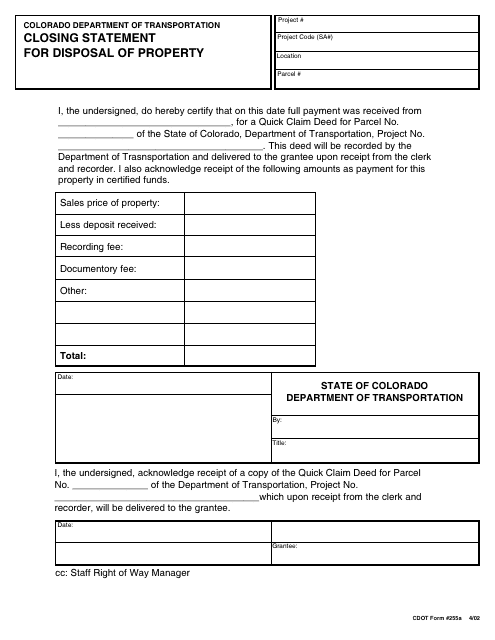

This document is used to create a closing statement when disposing of property in the state of Colorado. It helps ensure all necessary documentation is in order and provides a record of the transaction.

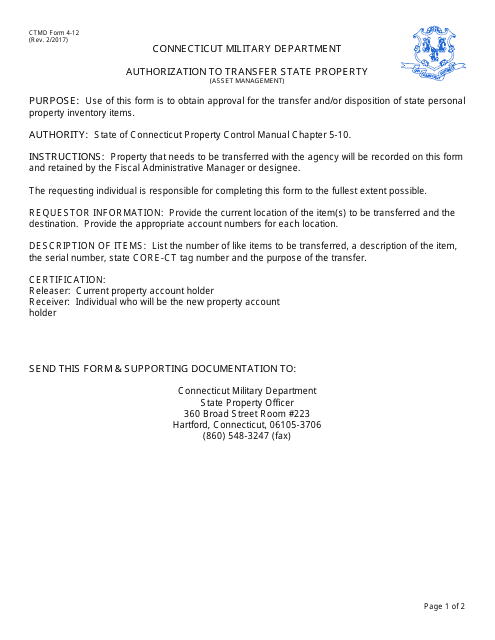

This form is used for authorizing the transfer of state property in Connecticut.

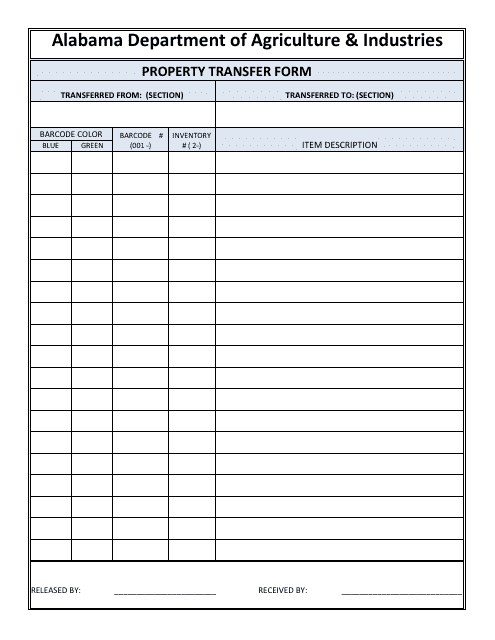

This Form is used for transferring property ownership in the state of Alabama.

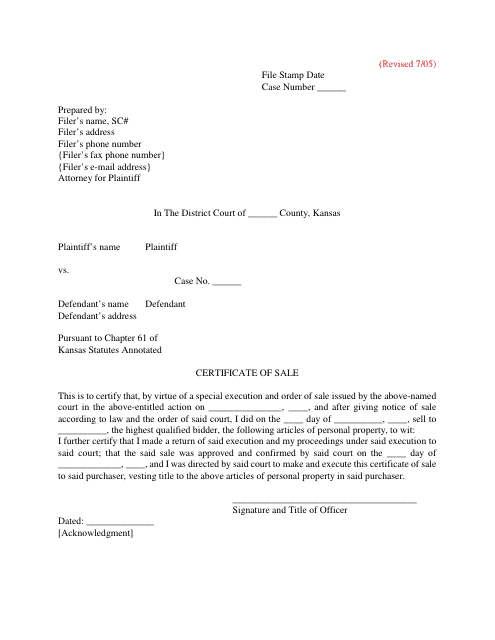

This document is a Certificate of Sale specific to the state of Kansas. It is used to officially record the sale of a property or other assets.

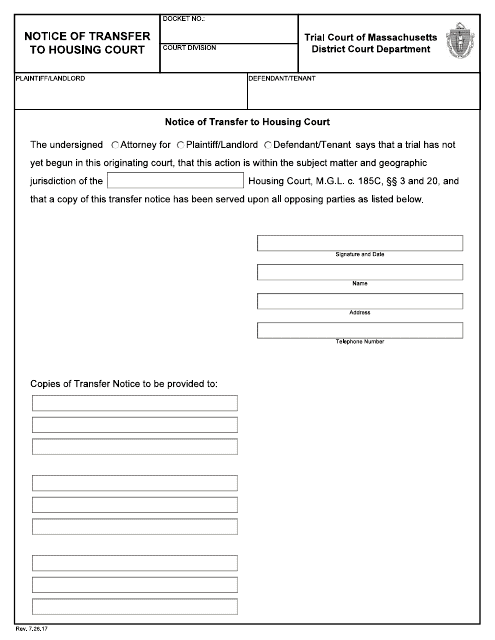

This document notifies the recipient that their case has been transferred to the Housing Court in Massachusetts.

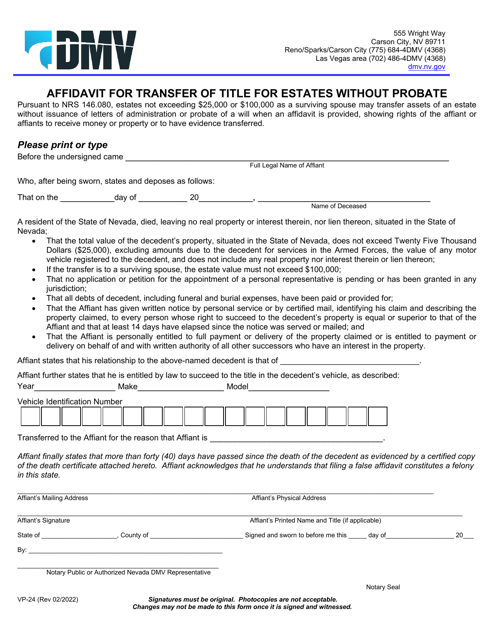

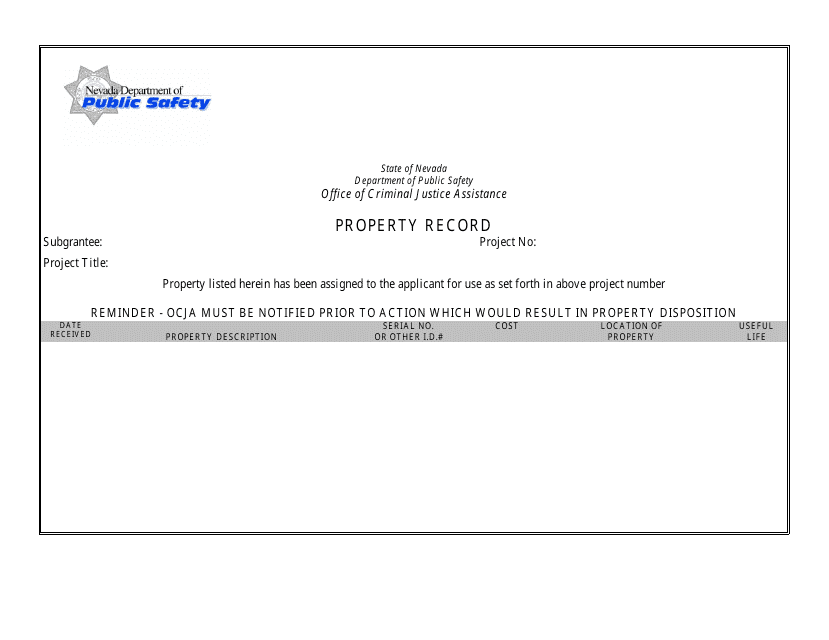

This type of document is used for recording property information in the state of Nevada. It includes details such as the property owner's name, address, and legal description.

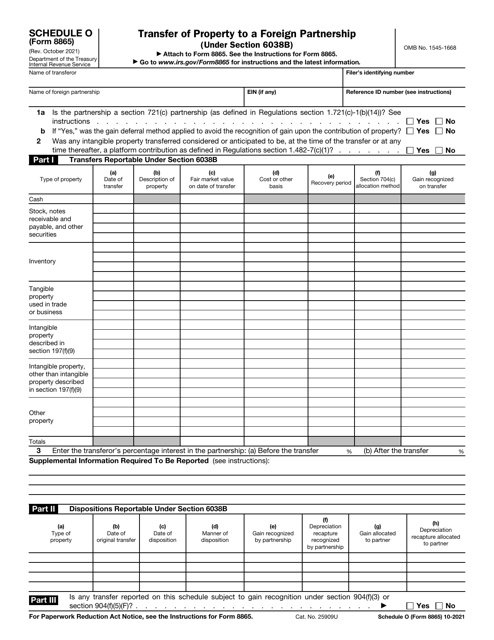

Use Instructions to Form 926 to fill in IRS Form 926 and report certain transfers of tangible or intangible property to a foreign corporation, as required by section 6038B.

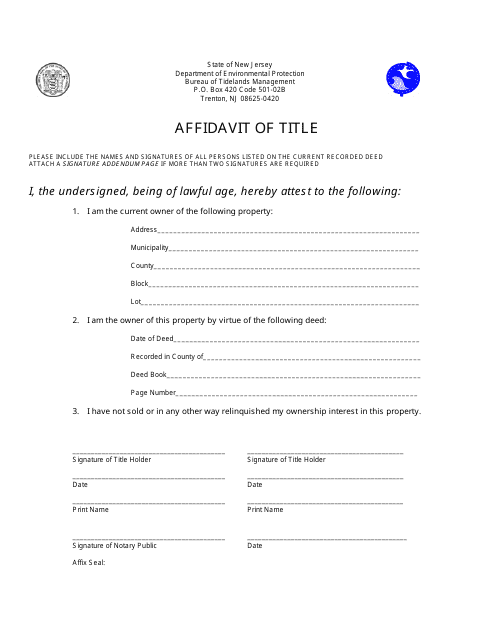

This document is used for stating ownership of property in New Jersey.

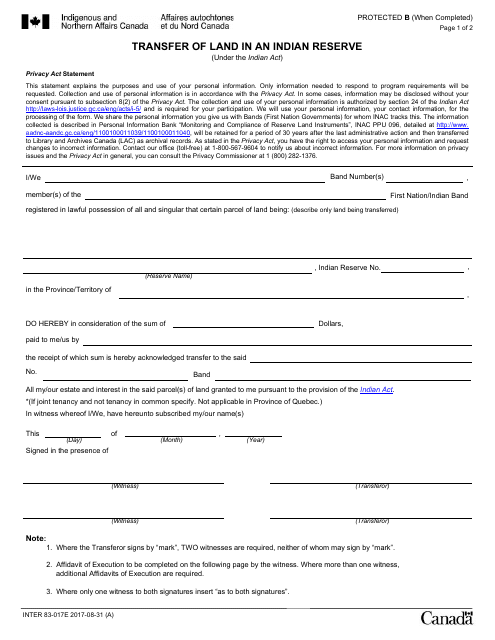

This form is used for transferring land located within an Indian Reserve in Canada. It is required for legal ownership changes and must be completed accurately and submitted to the appropriate authorities.

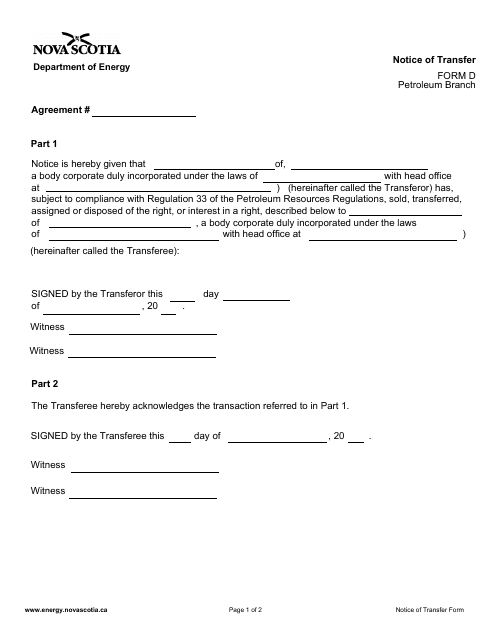

This document is used for notifying the transfer of ownership in Nova Scotia, Canada.

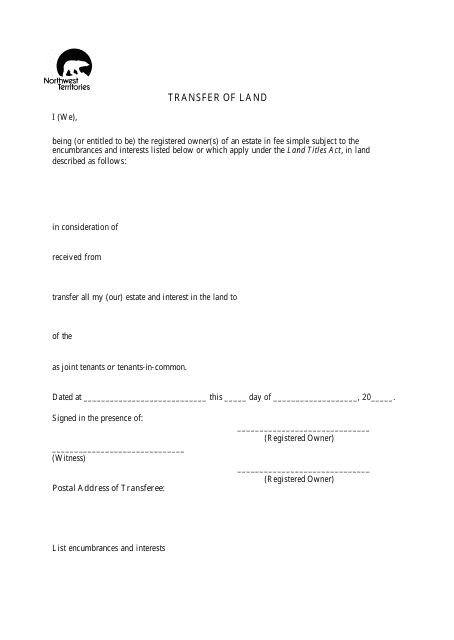

This document facilitates the transfer of land ownership in the Northwest Territories of Canada.

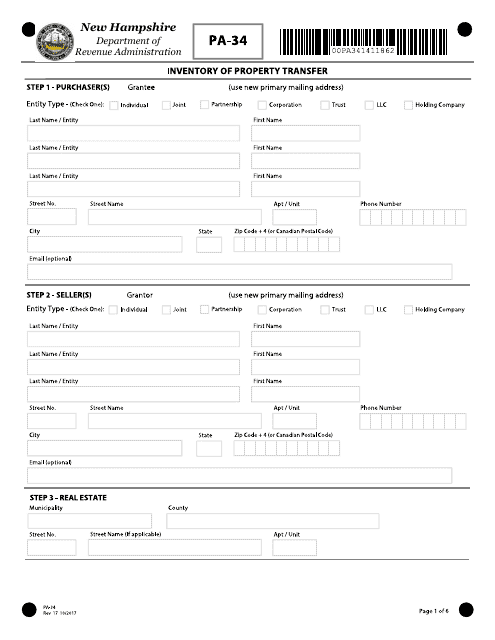

This form is used for documenting and reporting the transfer of property in the state of New Hampshire. It helps to maintain an inventory of property transfers and ensures compliance with state regulations.

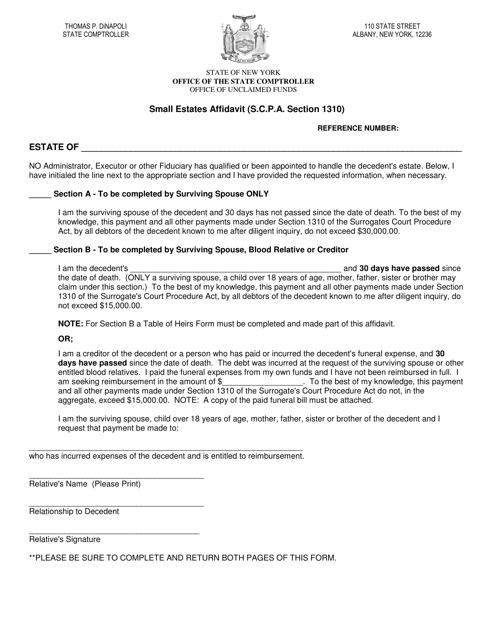

For individuals that reside in the state of New York, this type of form is a legal document that allows an individual inheriting a small estate to become the new legal owner after the decedent has passed away.