Financial Hardship Letter Templates and Samples

What Is a Financial Hardship Letter?

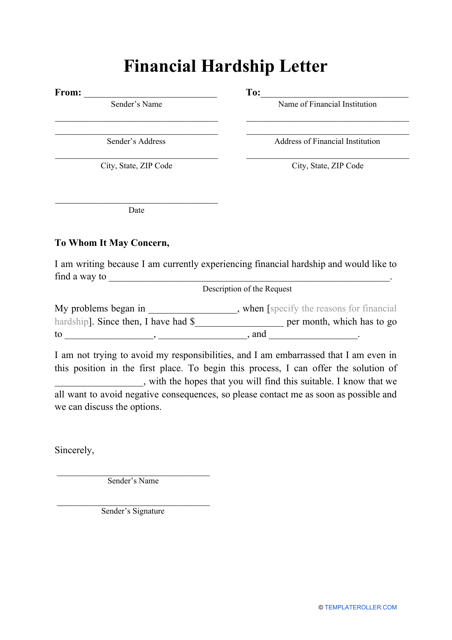

A Financial Hardship Letter is a formal document prepared by the borrower and sent to the lender with the intention to postpone payments, modify the existing loan or mortgage, or cancel the accumulated interest. You should provide the lender (usually, a financial institution) with the request to reconsider the existing loan and explain the reason why you have fallen behind with the payments you owe under the original agreement with the lender.

Whether you have lost your job, the wage earner in your household was imprisoned, or you had to deal with an illness or death in your family, you can prove the hardships you have encountered to avoid future problems and disputes with the lender. Do not waste time and do not ignore correspondence from the lender - it is highly recommended to explain the situation as it is and ask for leniency when you understand you will not be able to meet the contractual obligations.

If you are looking for a Financial Hardship Letter template, you may check out our library of documents below. Each sample Financial Hardship Letter can be customized to suit the needs of your particular situation.

Financial Hardship Letter Types

- Generic Financial Hardship Letter. This generic template will provide the lender with a reason you have not been able to fulfill your financial obligations - maybe, you were fired, fell ill, your family's wage earner was imprisoned, or you had to take care of your relatives.

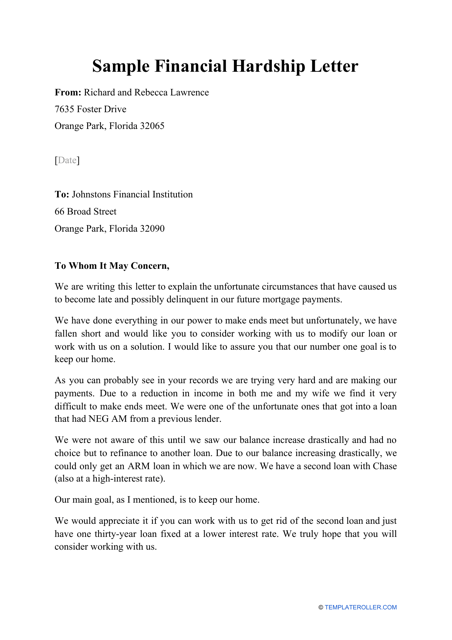

- Sample Financial Hardship Letter. You can use this document as a reference when drafting a letter to any financial institution you have signed an agreement with - for instance, you may have to explain the mortgage payment default and ask the recipient to consider a loan modification to help you keep your residence.

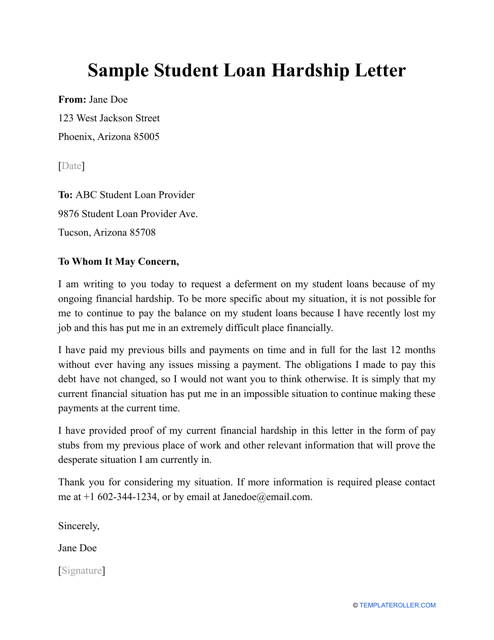

- Sample Student Loan Hardship Letter. Whether you are currently studying or dealing with loan payments years after you have graduated, it is possible you encounter financial difficulties that will not allow you to pay the balance on your student loans. Send a letter to your loan provider to confirm you are committed to your financial obligations and describe the extenuating circumstances that led to the default.

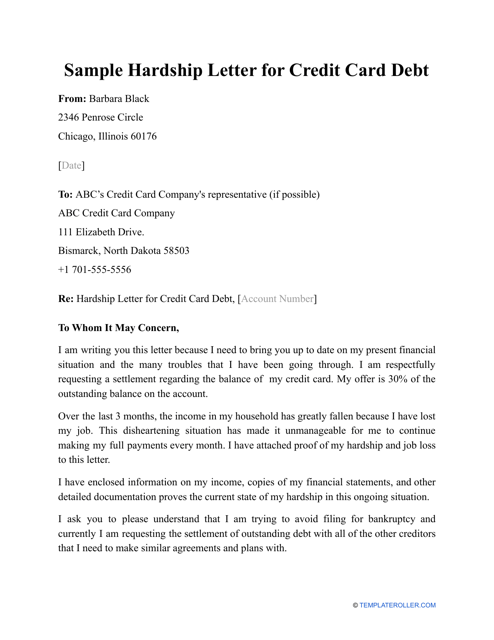

- Sample Hardship Letter for Credit Card Debt. If you have accumulated a credit card debt, it is recommended to contact a financial organization that issued a card and tell them about your current financial standing.

Related Letter Tags and Templates:

- Hardship Letter for Mortgage;

- Hardship Letter for Shortsale;

- Hardship Letter for Immigration;

- IRS Hardship Letter;

- Loan Modification Hardship Letter template and sample.

Documents:

4

Owners of credit cards can reduce their debt by submitting a Hardship Letter explaining their situation to their credit card company.

This form is used when an applicant needs to defer payments on their student loan (or decrease, modify, etc.) due to a financial hardship situation.

Use this sample letter to provide your lender with the reason you have not been able to fulfill your financial obligations.

This letter can be sent to the lender with the intention to postpone payments, change the existing loan or mortgage, or cancel the accumulated interest.