Business Loan Form Templates

Documents:

55

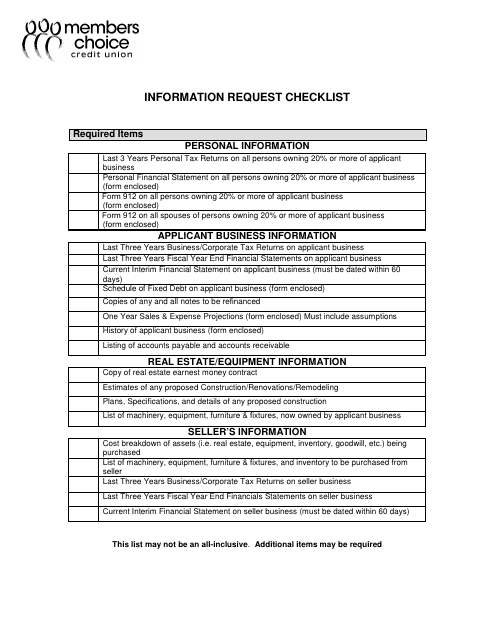

This Form is used for applying for a business loan at Members Choice Credit Union.

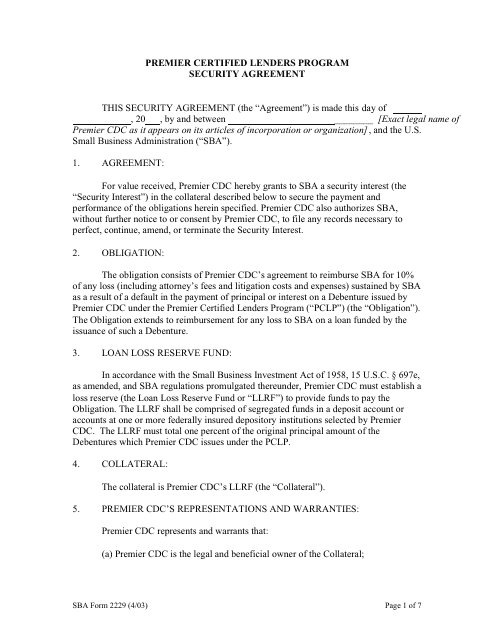

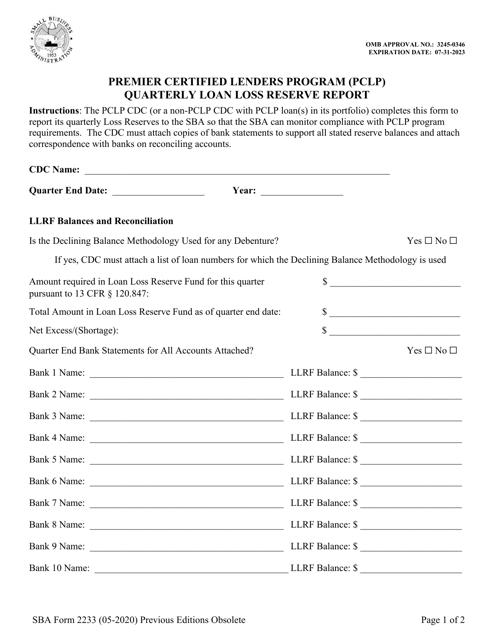

This type of document is a security agreement used in the Premier Certified Lenders Program of the Small Business Administration (SBA).

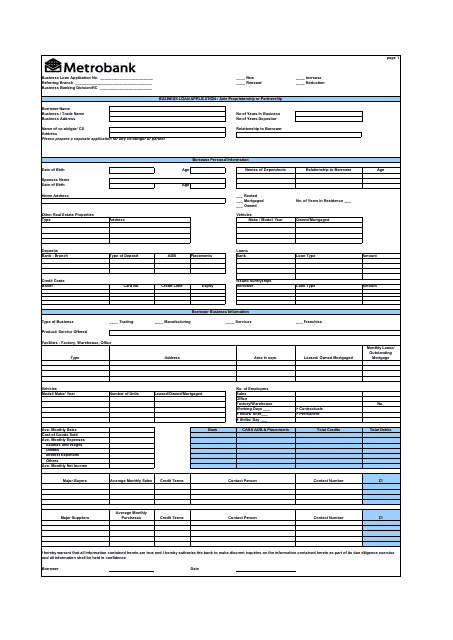

This document is used for applying for a business loan with Metrobank.

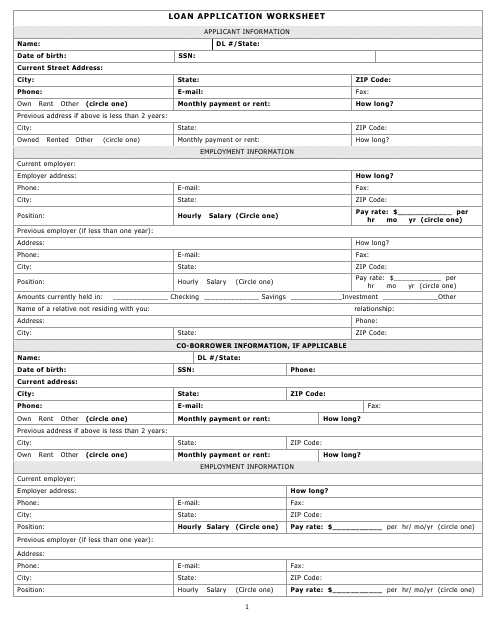

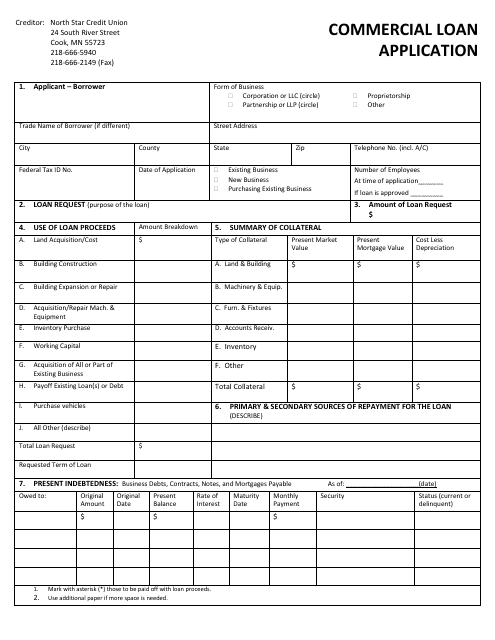

This form is used for applying for a commercial loan at North Star Credit Union.

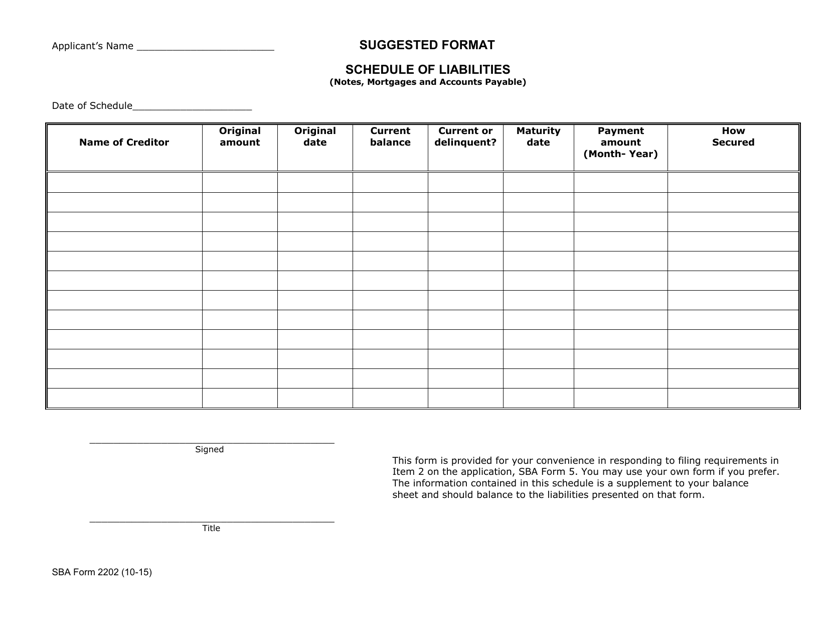

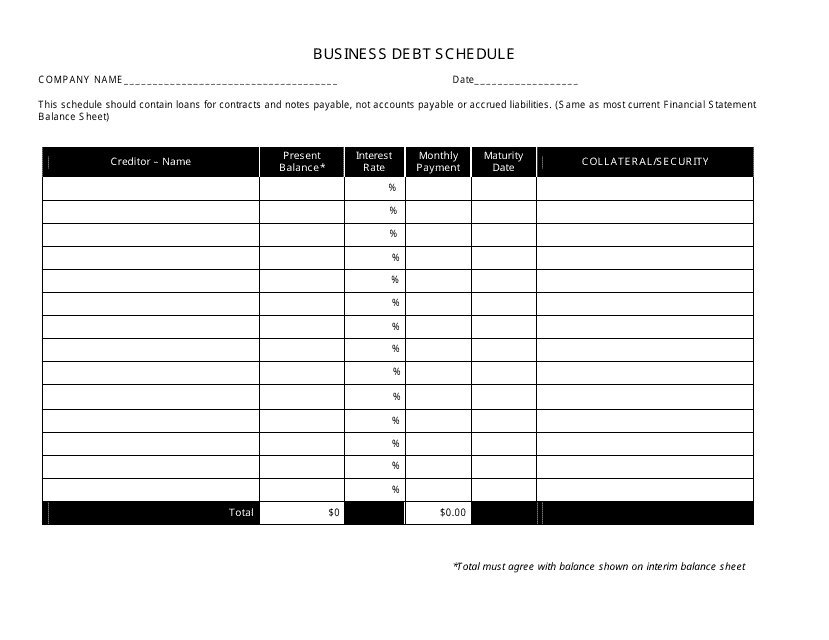

This document provides a template for creating a schedule of business debts. It is designed in a black and white format for easy printing and use.

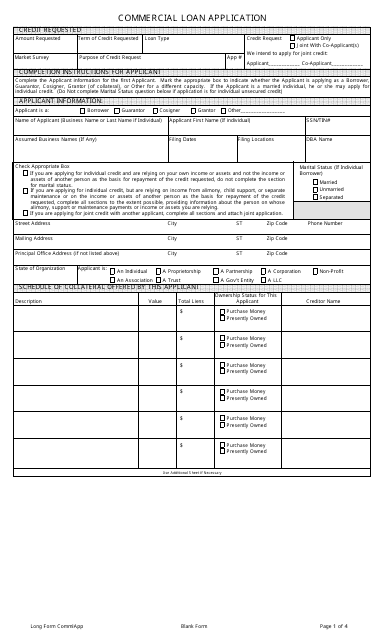

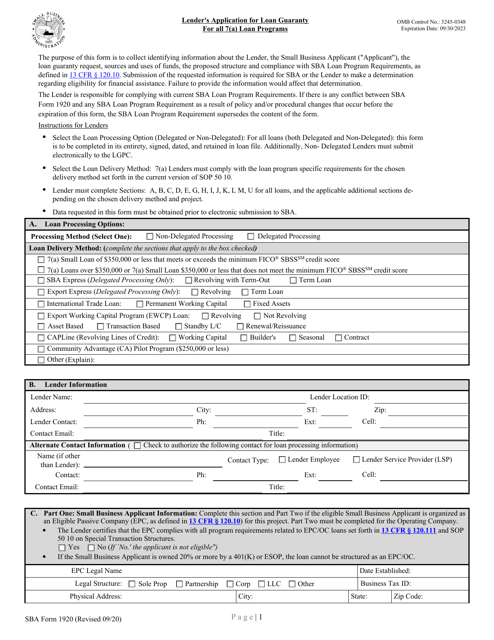

This Form is used for applying for a commercial loan in the United States. It collects important information about the borrower's business and financials.

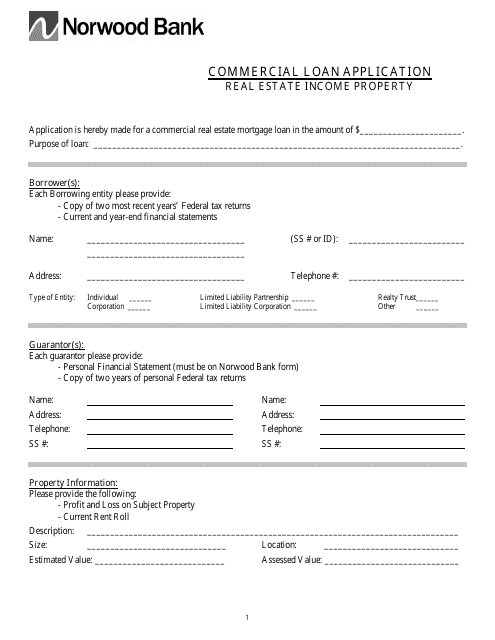

This Form is used for applying for a commercial loan at Norwood Bank in Massachusetts.

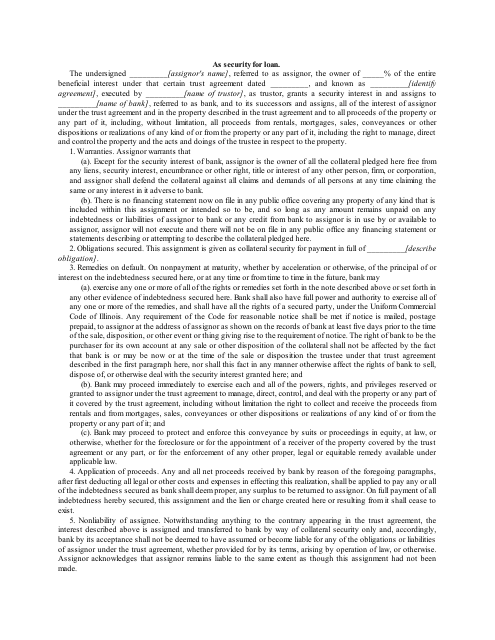

This document is a template that is used when providing security for a loan. It helps outline the terms and conditions of the security agreement between the lender and the borrower.

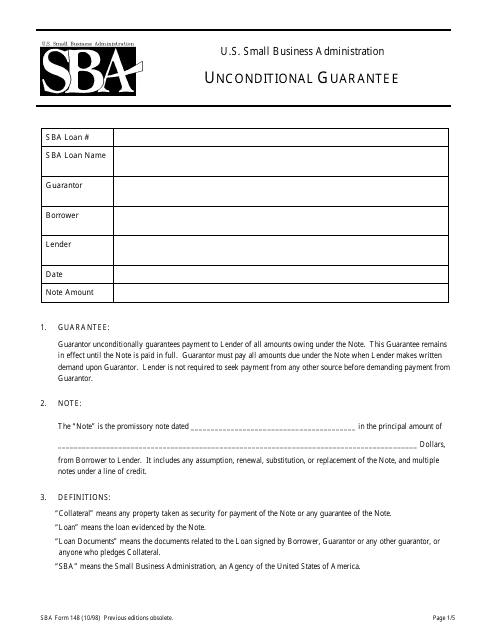

Use this document if you are a lender and the guarantor is liable for the repayment of the entire amount of the borrower's loan.

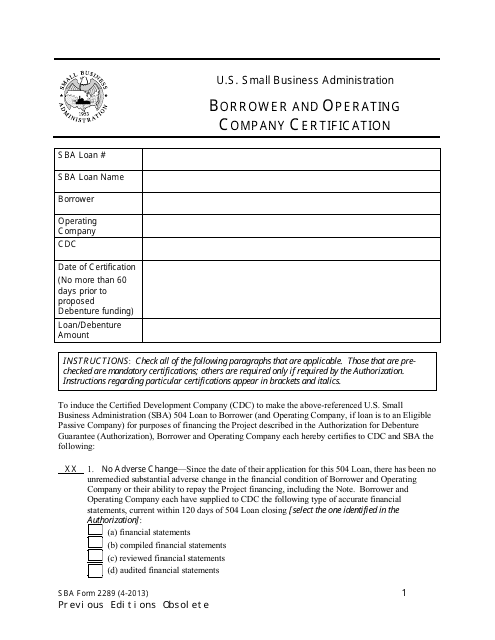

This form is used for the certification of borrowers and operating companies in the Small Business Administration (SBA) loan program.

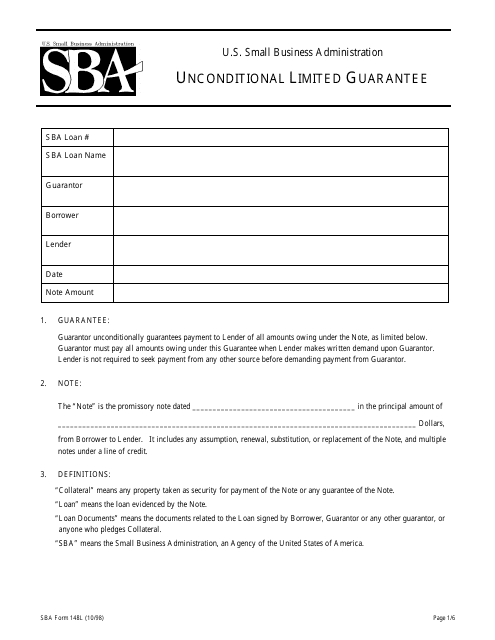

This form is completed by a guarantor of the loan. It contains an unconditional promise to pay the debt on the loan, in case the borrower fails to pay it.

This Form is used for businesses to agree to comply with certain regulations or requirements set by the Small Business Administration (SBA).

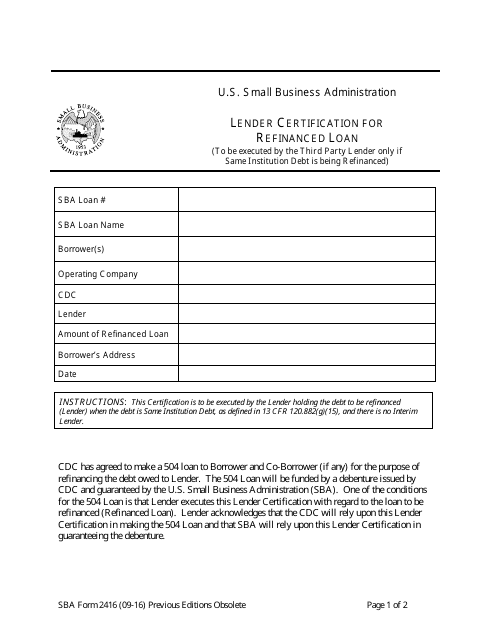

This certification is to be executed by the Third Party lender holding the debt to be refinanced. The debt is from the same institution and there is no interim lender.

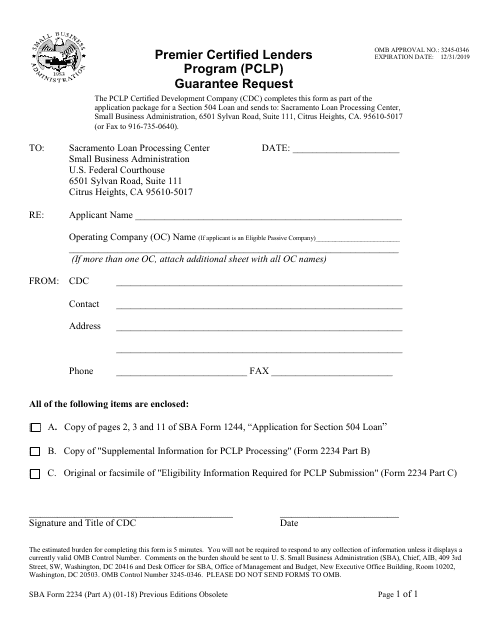

This form is used for requesting a guarantee through the Premier Certified Lenders Program (PCLP) offered by the Small Business Administration (SBA).

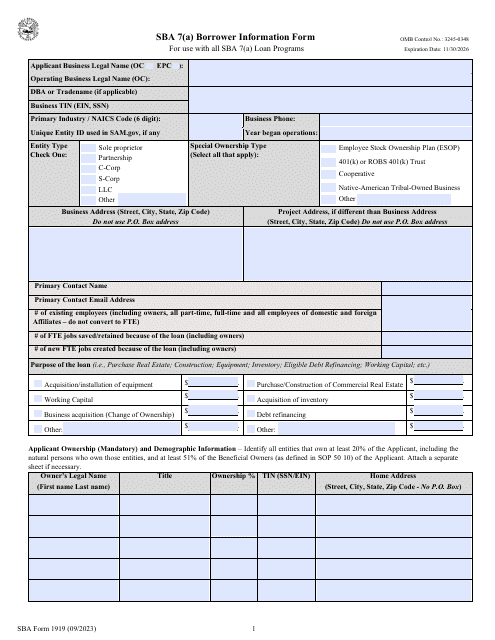

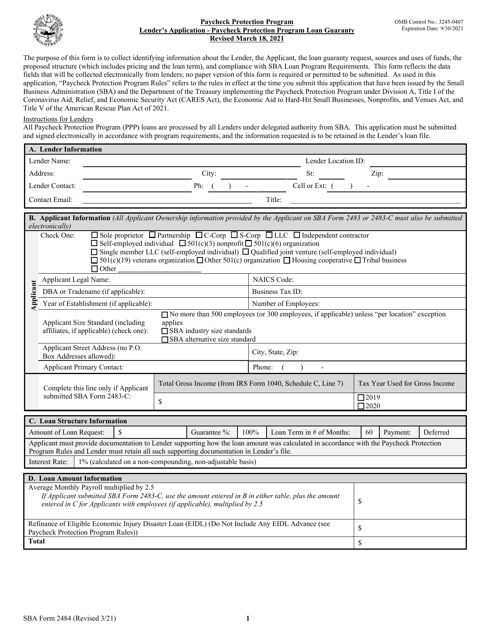

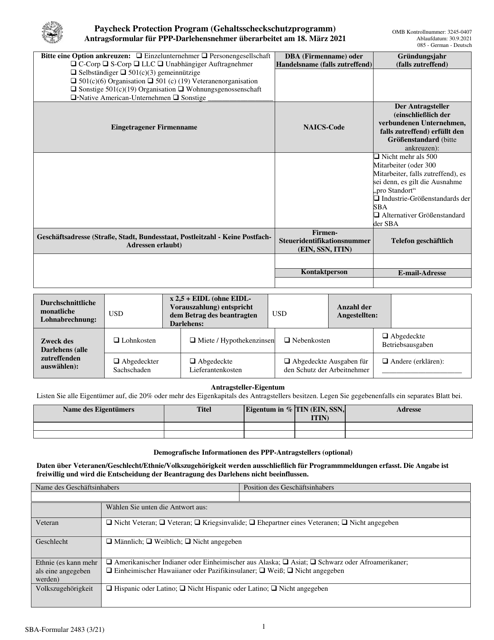

This form is issued by the Small Business Administration (SBA) and used by small businesses applying for a 7(a) loan and submitted to the SBA participating lender.

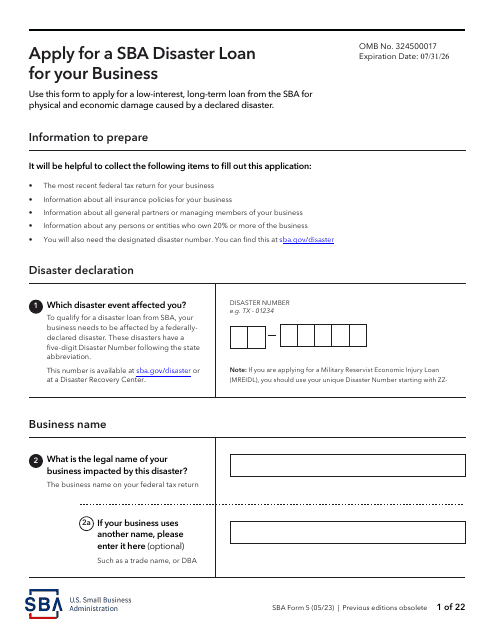

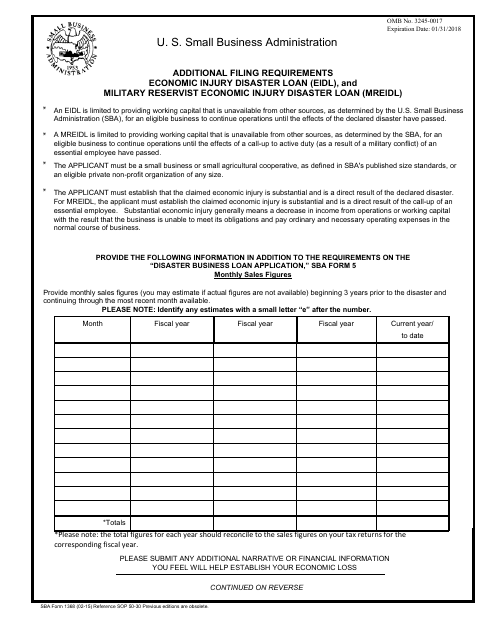

Use this form to enter information on the business's monthly revenue for three years prior to the disaster. You can also use this form to provide your financial forecast of income and expenses until the time when you estimate your business will operate normally.

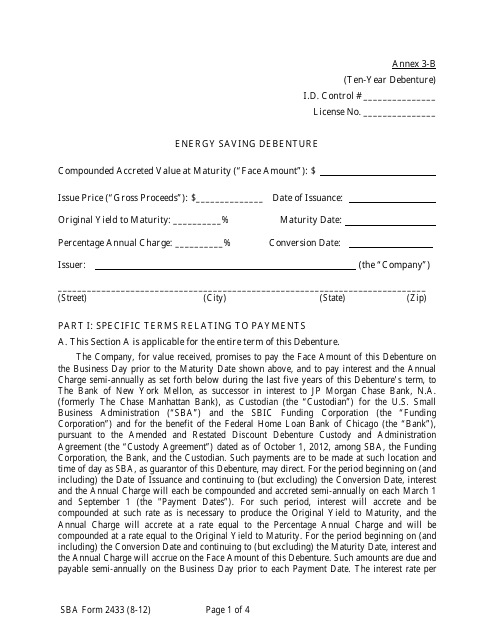

This document is an annex to SBA Form 2433 and is used for applying for an energy-saving debenture. It provides important information about the debenture program and helps borrowers in qualifying for energy-saving projects.

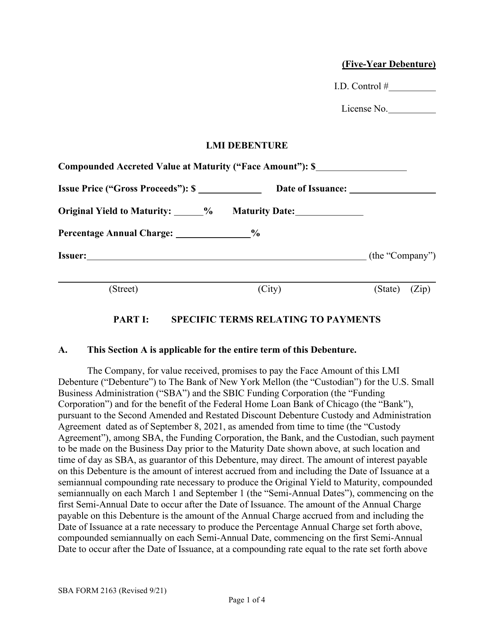

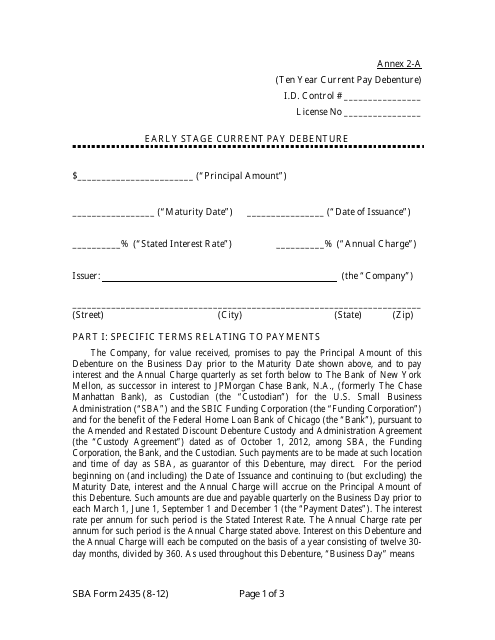

This document is used for applying for an early stage current pay debenture with the Small Business Administration (SBA).

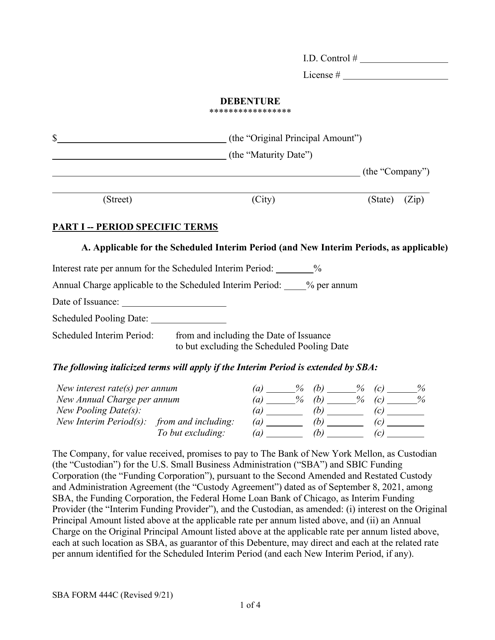

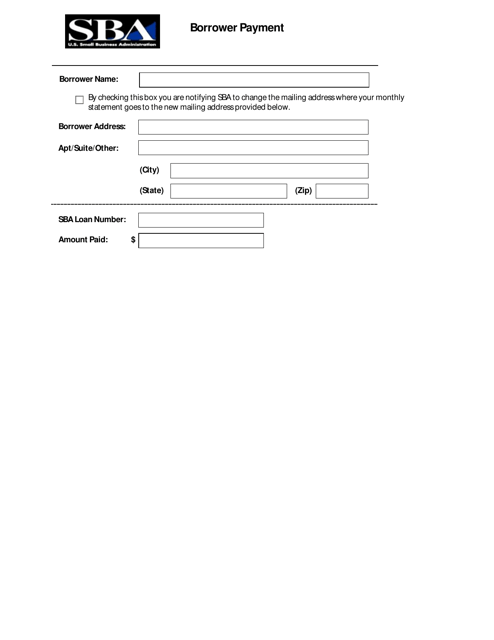

This form is used for making borrower payments in relation to a Small Business Administration (SBA) loan.

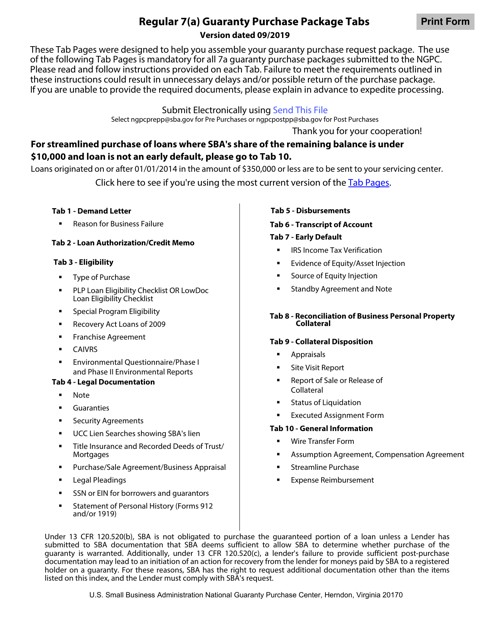

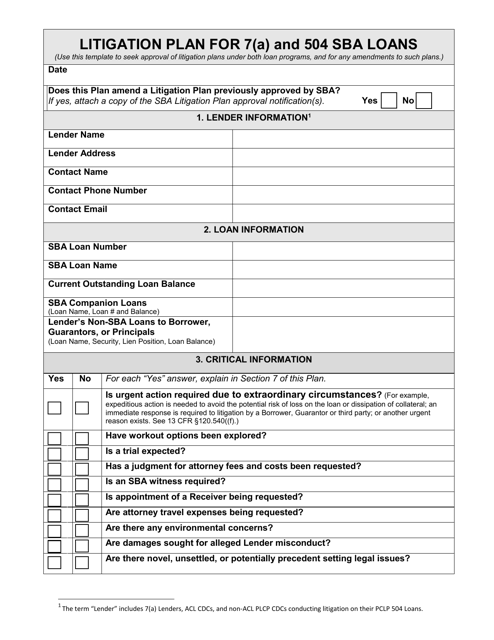

This document outlines the plan for handling legal disputes related to 7(A) and 504 SBA loans. It covers strategies and steps to take in litigation proceedings.

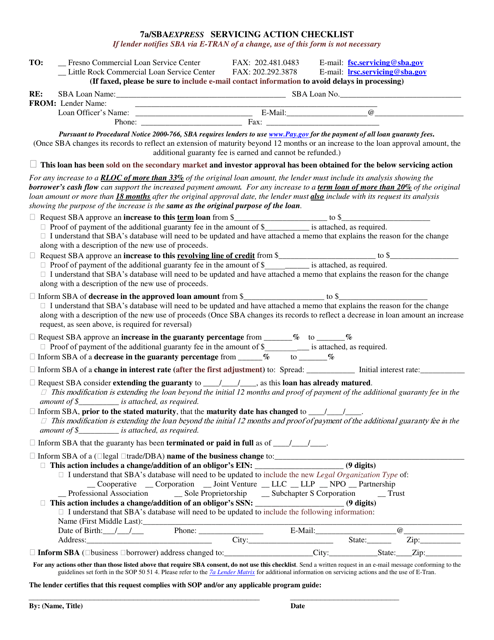

This document is a checklist for the Small Business Administration (SBA) Express Servicing Action. It provides a step-by-step guide for completing various tasks related to SBA Express loans. Use this checklist to ensure all necessary actions are taken to service SBA Express loans effectively.

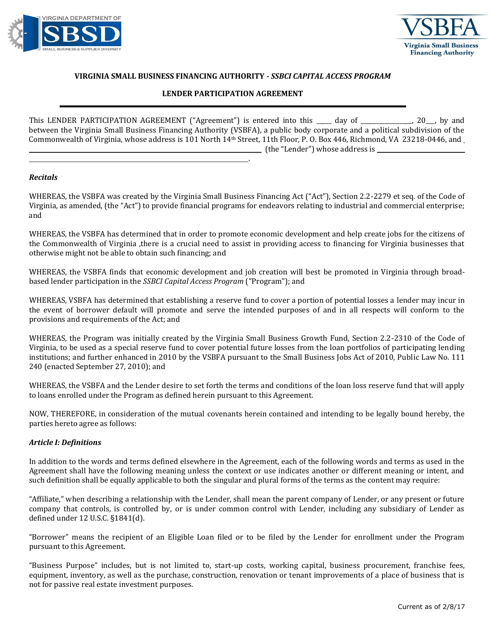

This document outlines the agreement between a lender and the state of Virginia for participation in the State Small Business Credit Initiative (SSBCI) Capital Access Program (CAP). It specifies the terms and conditions of the lender's participation.

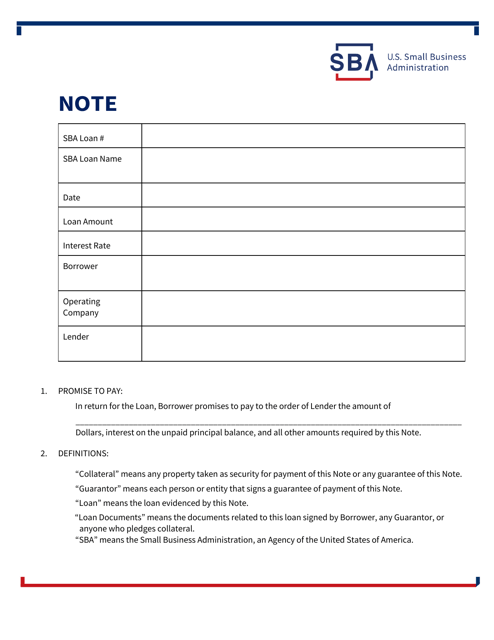

This document is used for issuing standard loan notes by the Small Business Administration (SBA). It outlines the terms and conditions of the loan, including repayment terms and interest rates.

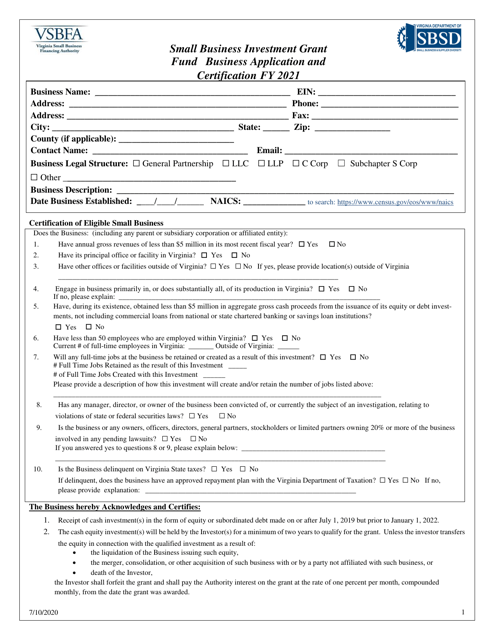

This document is for individuals or businesses applying for funding in the state of Virginia. It includes a certification process to ensure compliance with state regulations.

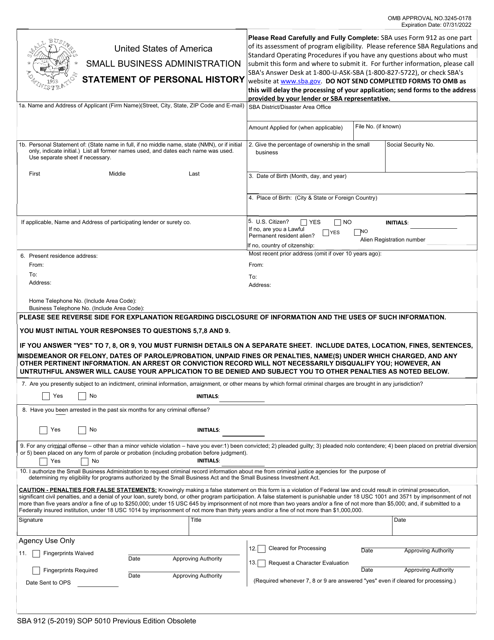

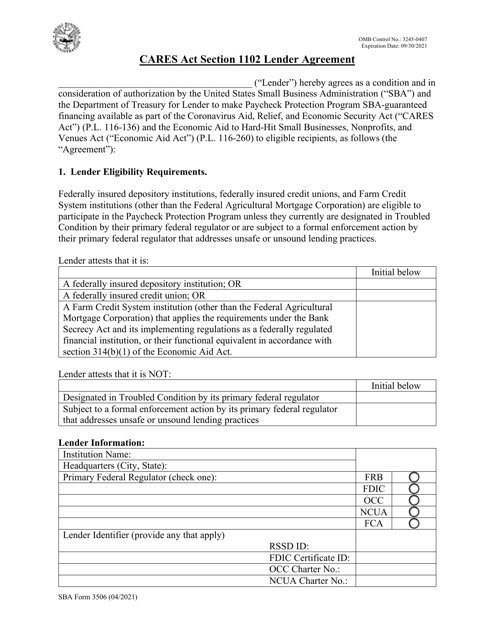

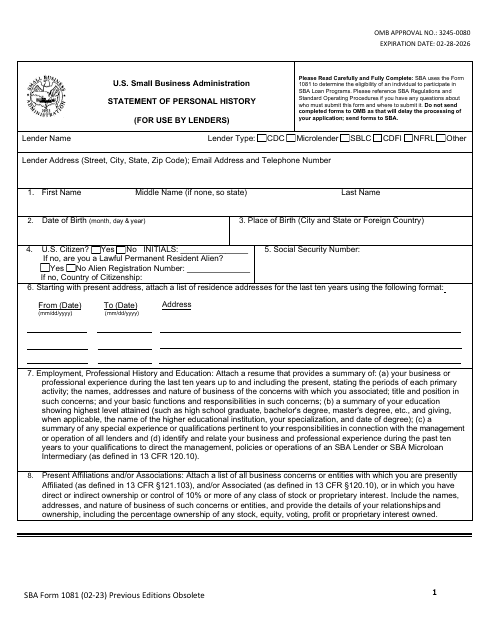

This form is used and sent to the Small Business Administration (SBA). It verifies your eligibility for participation in the Agency's loan programs.

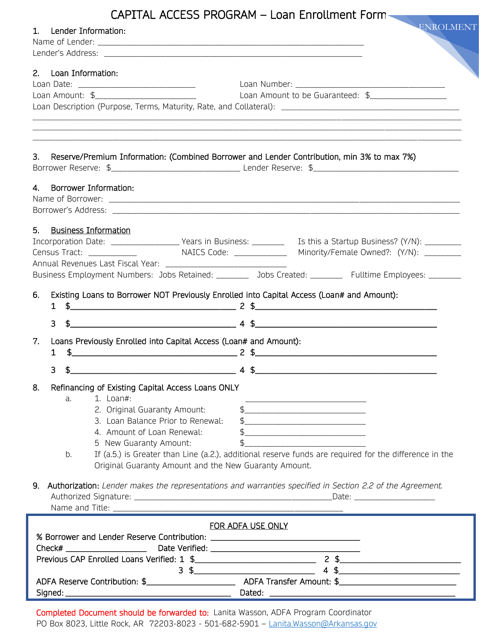

This form is used for enrolling in the Capital Access Program, which is a loan program in Arkansas.

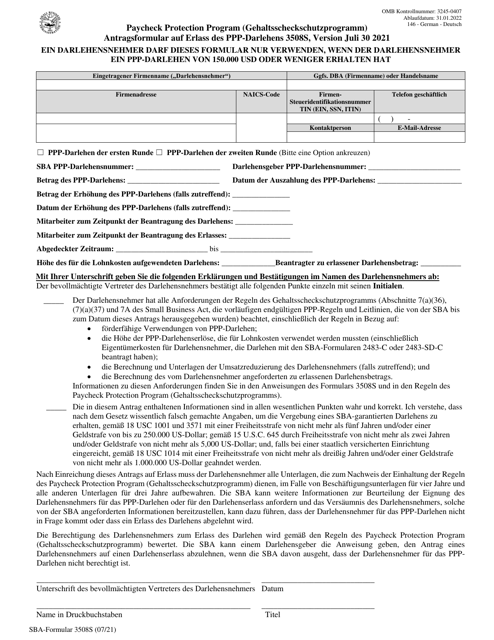

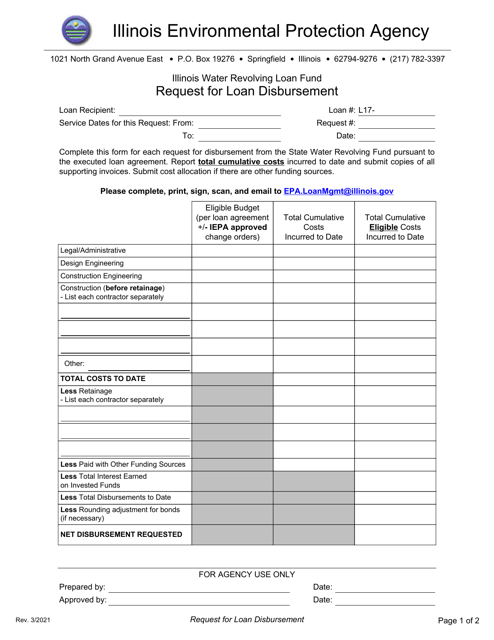

This document is used for requesting the disbursement of a loan in the state of Illinois.