Fill and Sign United States Legal Forms

Documents:

235709

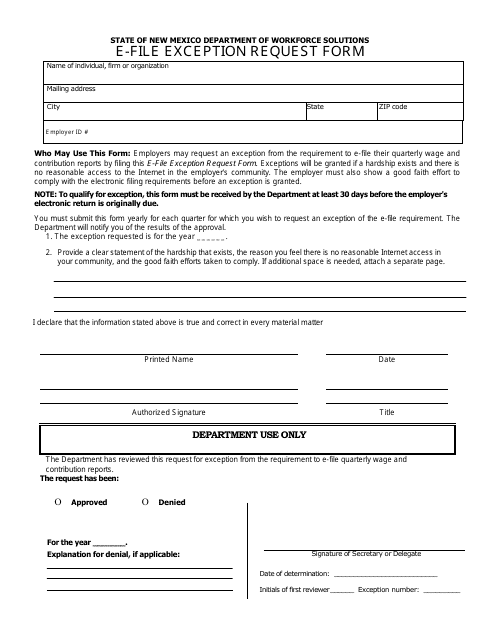

This Form is used for requesting an exception for electronically filing taxes in New Mexico.

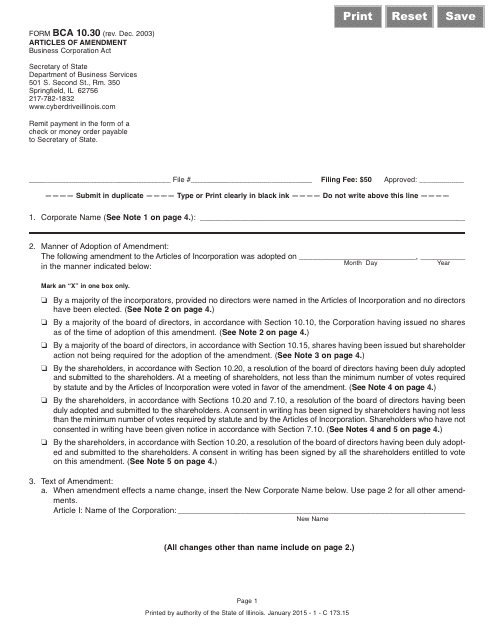

This form is used for making amendments to the articles of incorporation for a business registered in Illinois. It is necessary to update information such as the company's name, purpose, or registered agent.

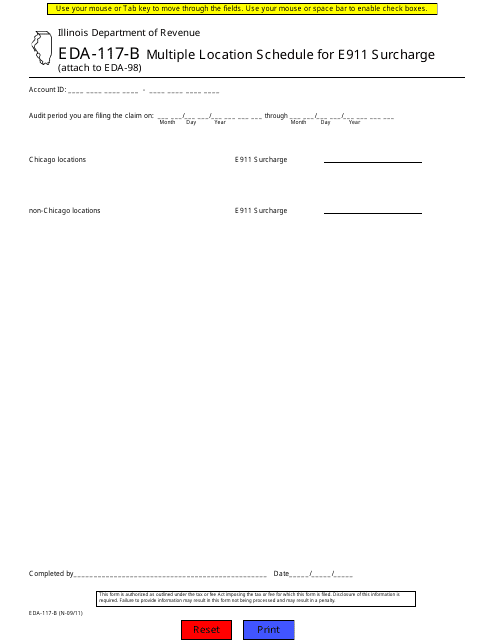

This form is used for reporting multiple locations for E911 surcharge in Illinois.

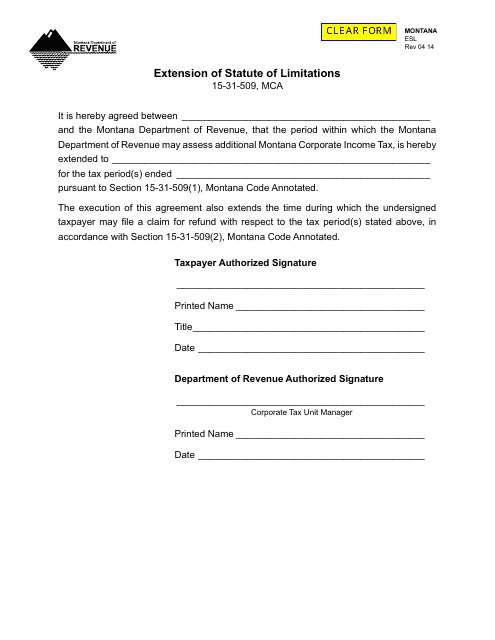

This Form is used for requesting an extension of the statute of limitations in the state of Montana for ESL-related matters.

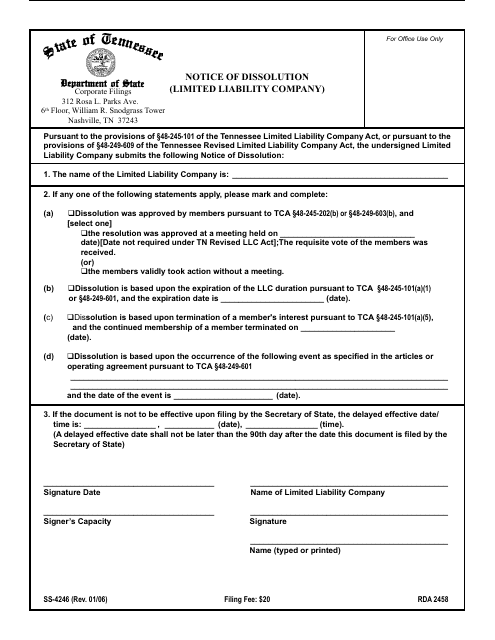

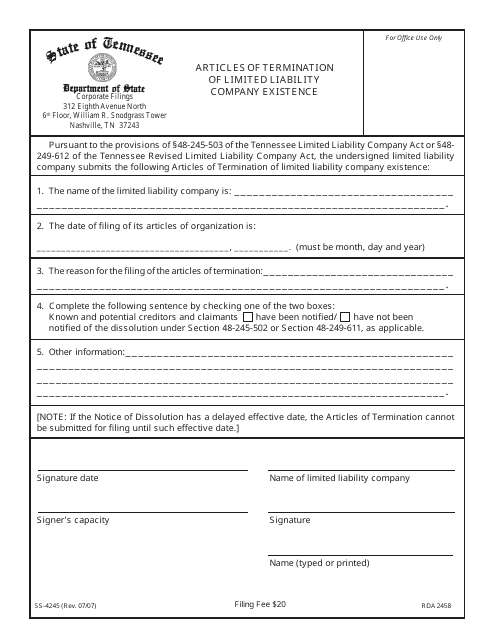

This form is used for notifying the State of Tennessee about the dissolution of a Limited Liability Company (LLC).

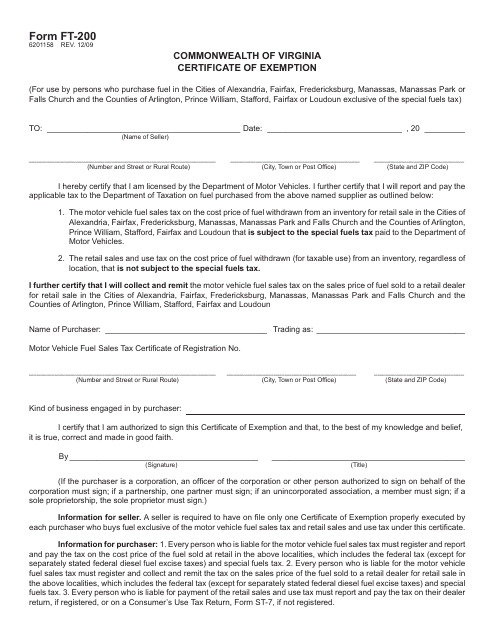

This Form is used for applying for a certificate of exemption in Virginia. It is a document that allows certain individuals or organizations to be exempt from certain taxes or fees in the state.

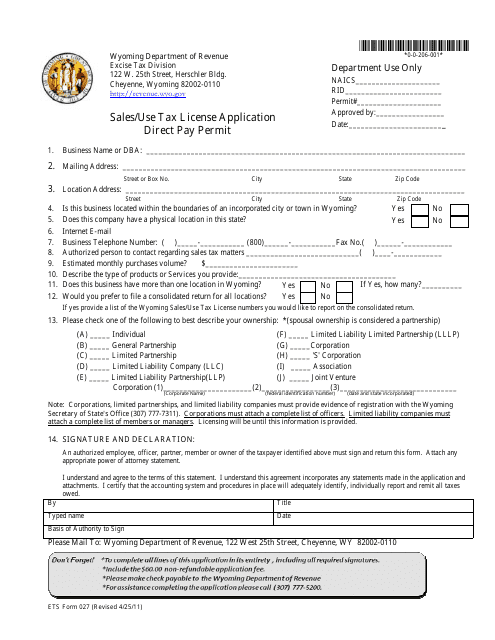

This form is used for applying for a sales use tax license or direct pay permit in the state of Wyoming.

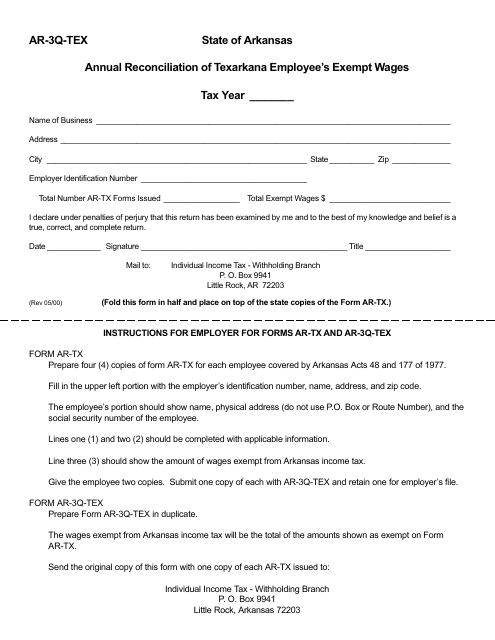

This Form is used for reporting quarterly sales and use tax information in the state of Arkansas. It provides instructions on how to fill out the AR-TX, AR-3Q-TEX form.

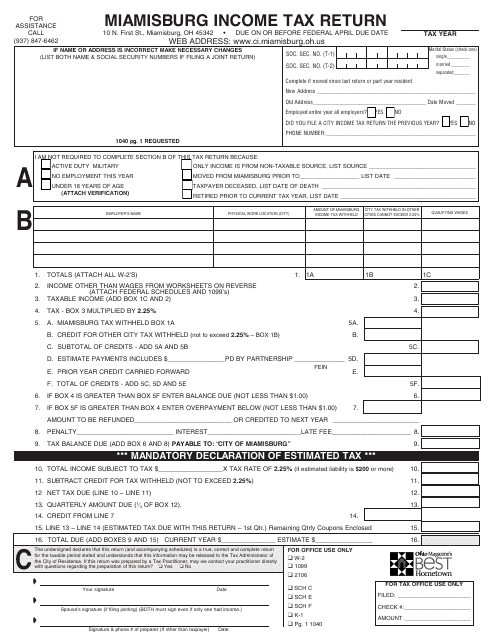

This form is used for filing the income tax return specifically for residents of the city of Miamisburg, Ohio.

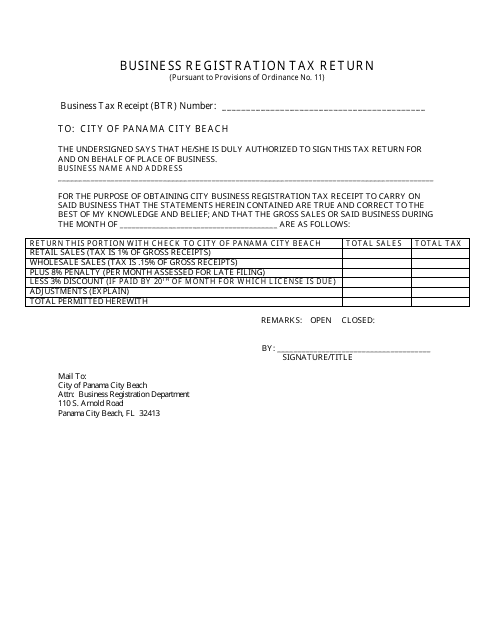

This form is used for registering a business and filing tax returns in the City of Panama City Beach, Florida.

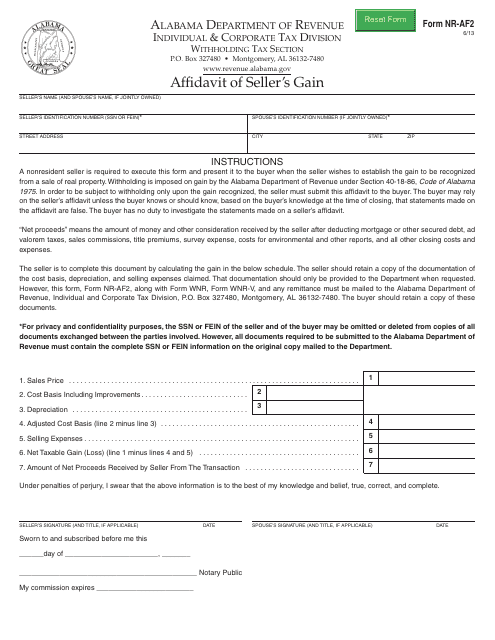

This form is used for sellers in Alabama to declare and affirm their gains from a transaction.

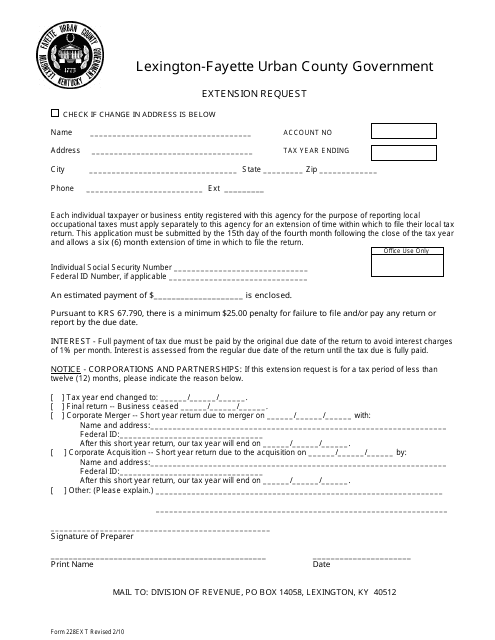

This Form is used for requesting an extension from the City of Lexington, Kentucky.

This form is used for submitting Articles of Termination to officially dissolve a limited liability company (LLC) in Tennessee.

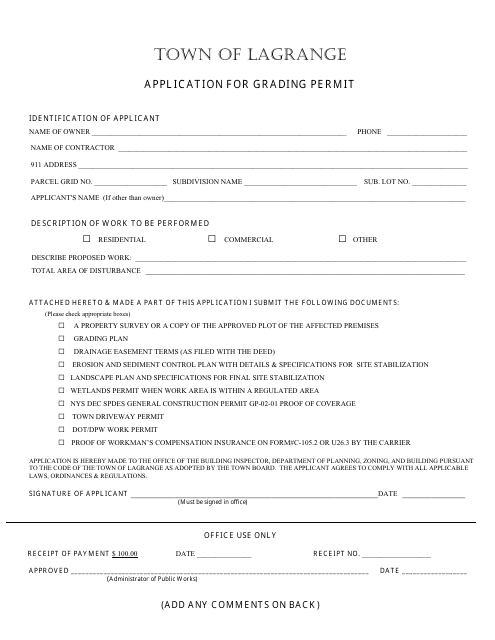

This document is an application for a grading permit in the Town of LaGrange, New York. It is used to request permission to make changes to the land's grade or contour.

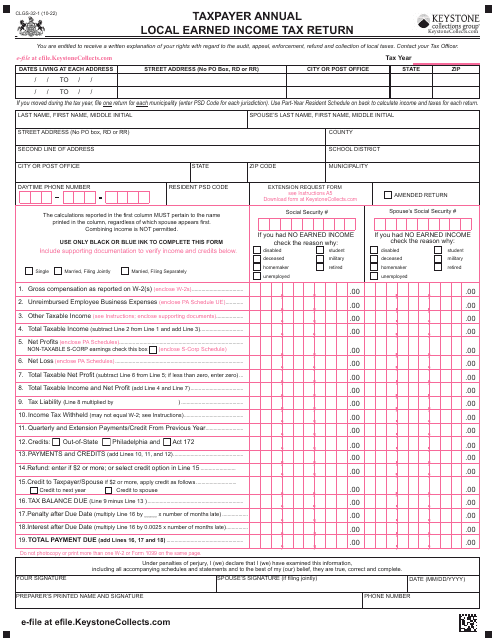

This is a legal document filled out by Pennsylvania residents with earned income, net profits, wages, dividends, and capital gains.

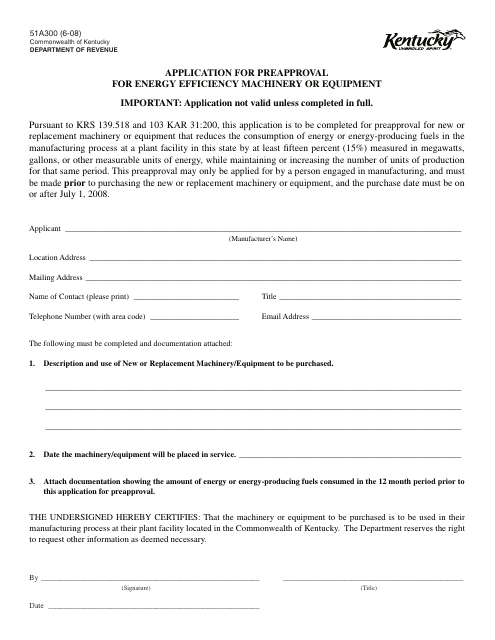

This form is used for applying for preapproval for energy efficiency machinery or equipment in the state of Kentucky.

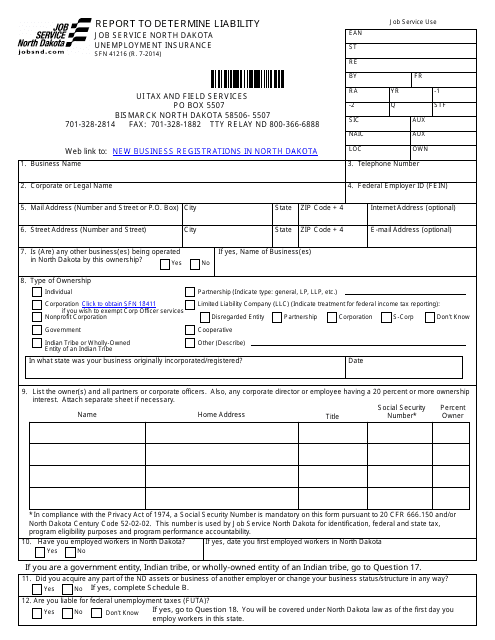

This form is used for reporting and determining liability in North Dakota.

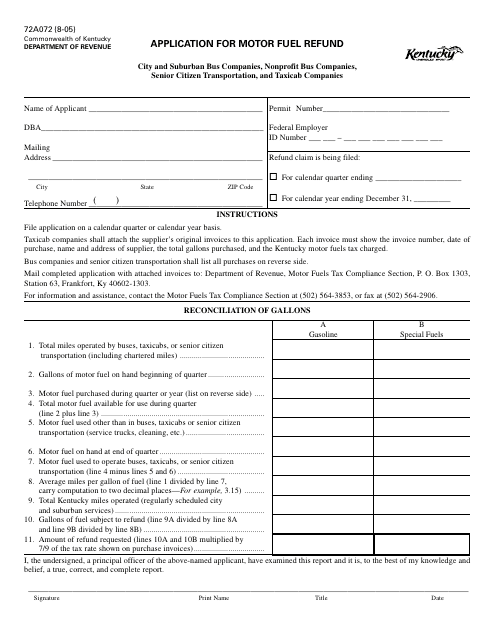

This form is used for applying for a motor fuel refund in Kentucky.

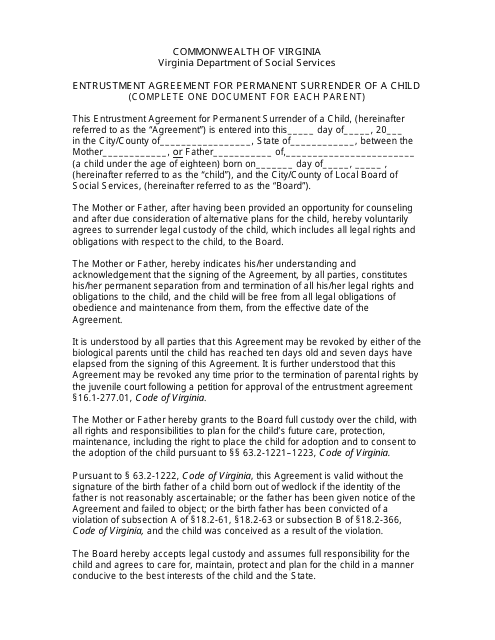

This Form is used for the permanent surrender of a child in the state of Virginia. It is an agreement that legally transfers the custody and responsibility of the child to another individual or agency.

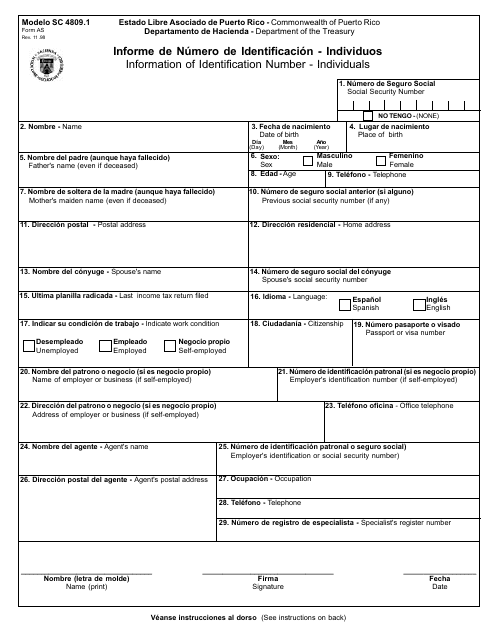

This form is used for providing information regarding identification numbers for individuals in Puerto Rico. It is available in both English and Spanish.

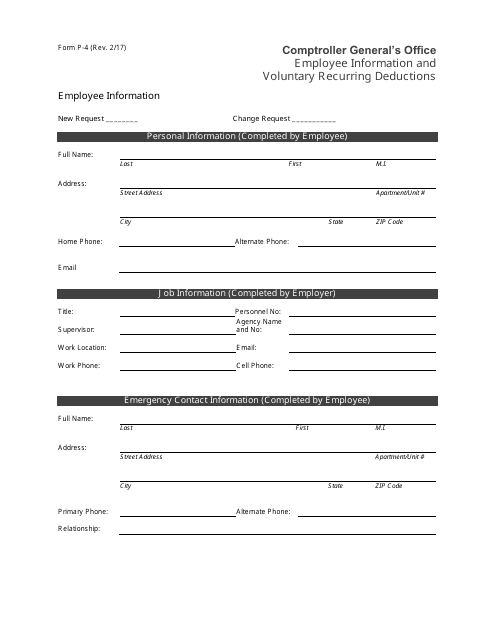

This Form is used for providing employee information and authorizing voluntary recurring deductions for employees in South Carolina.

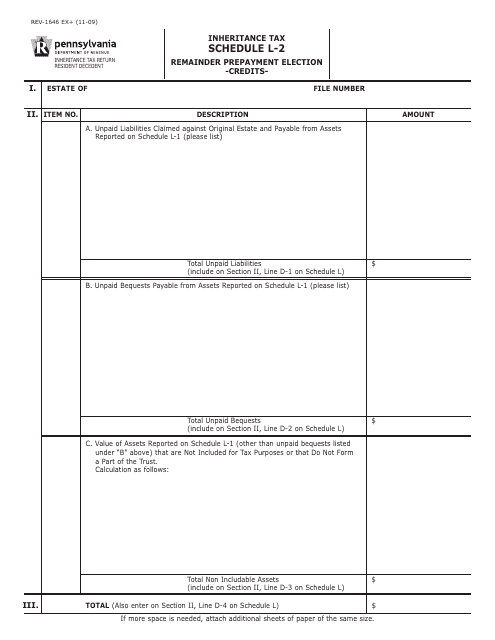

This form is used in Pennsylvania to make a prepayment election for tax credits.

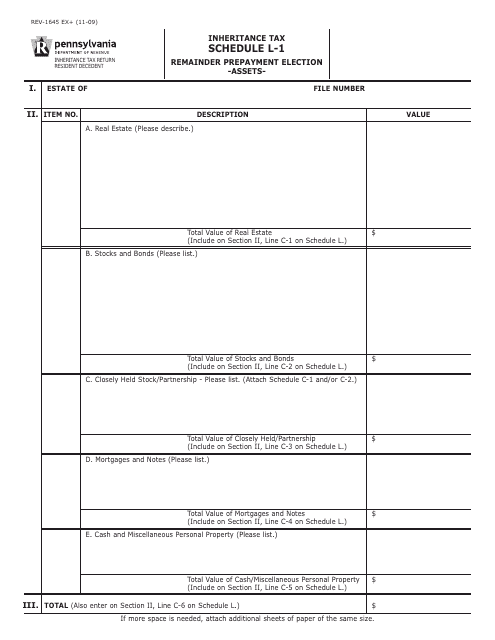

This form is used for making a prepayment election for assets in Pennsylvania.

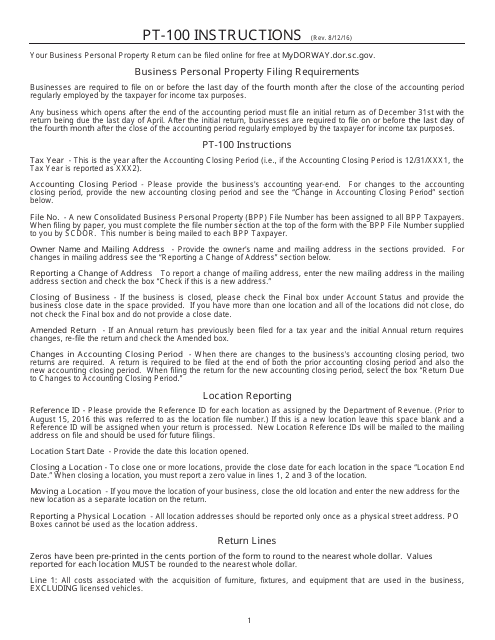

This Form is used for filing the Business Personal Property Return in South Carolina. It provides instructions on how to properly fill out and submit the form for reporting business personal property for taxation purposes.

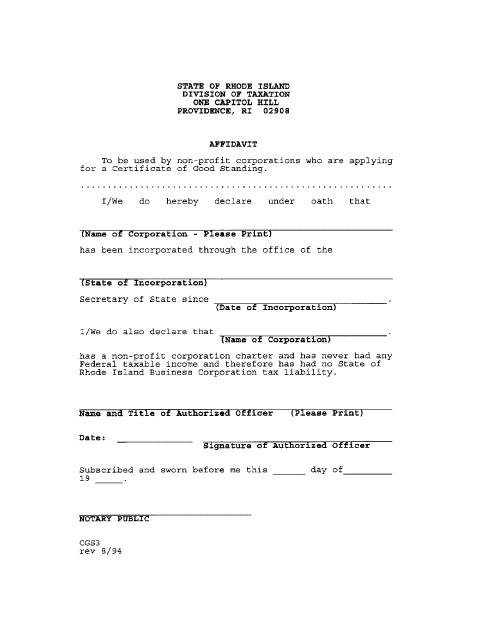

This form is used for non-profit corporations in Rhode Island to obtain a certificate of good standing. It is an affidavit confirming the corporation's compliance with state regulations.

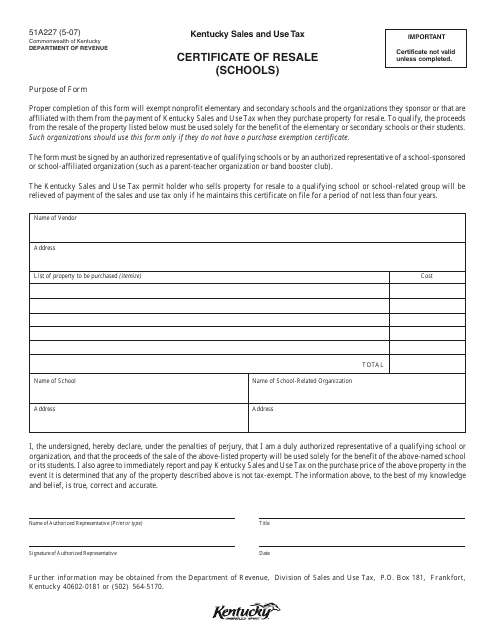

This document is used for schools in Kentucky to certify their resale status for tax purposes.

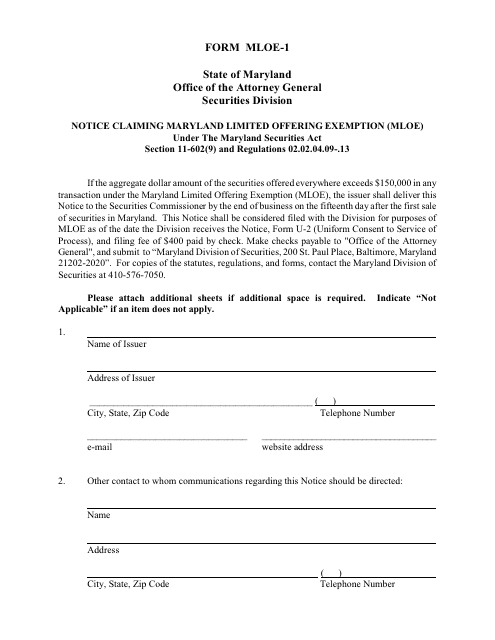

This form is used for submitting a notice claiming a limited offering exemption in the state of Maryland.

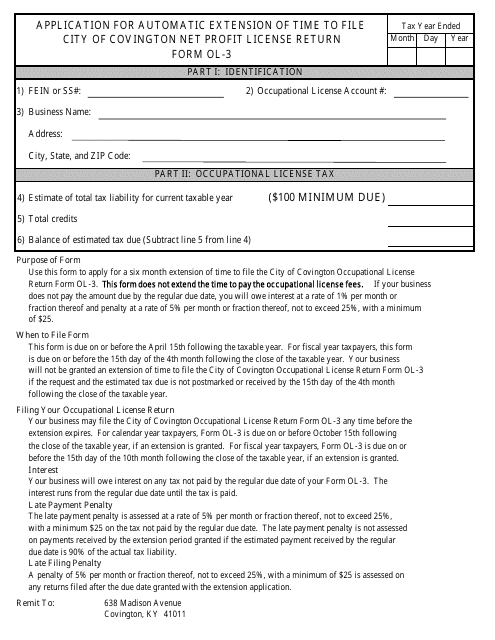

This form is used for requesting an automatic extension of time to file the Net Profit License Return form in the City of Covington, Kentucky.

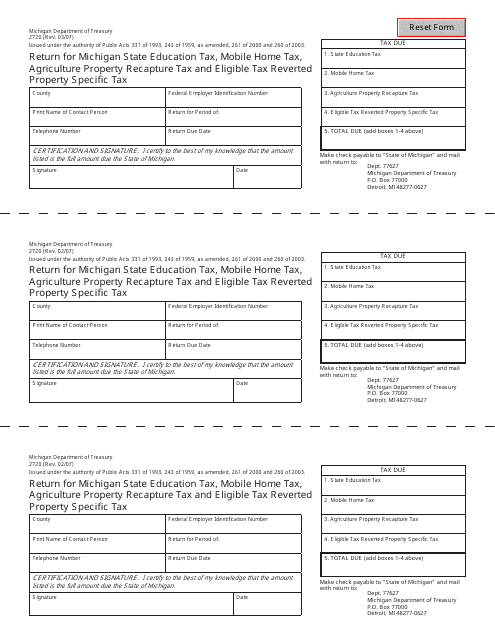

This form is used for reporting education tax, mobile home tax, agriculture property recapture tax, and eligible tax reverted property specific tax in the state of Michigan.

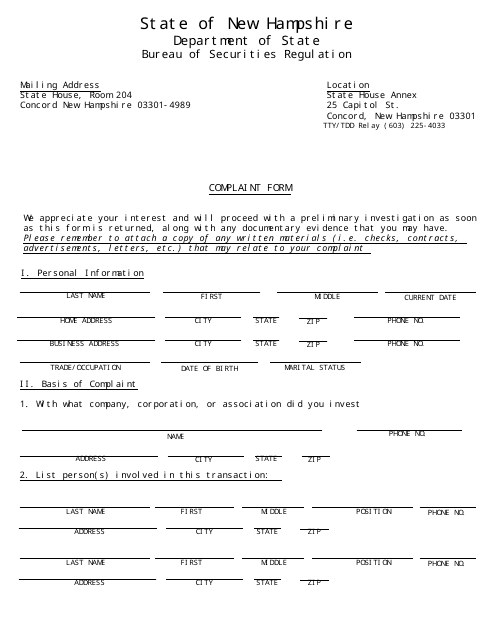

This document is used for filing a complaint in the state of New Hampshire.

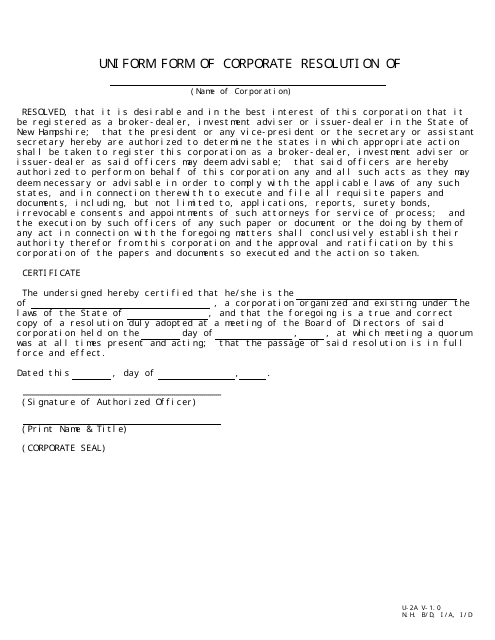

This document is a form that can be used for creating a corporate resolution in the state of New Hampshire. It helps businesses outline and make official decisions or actions.

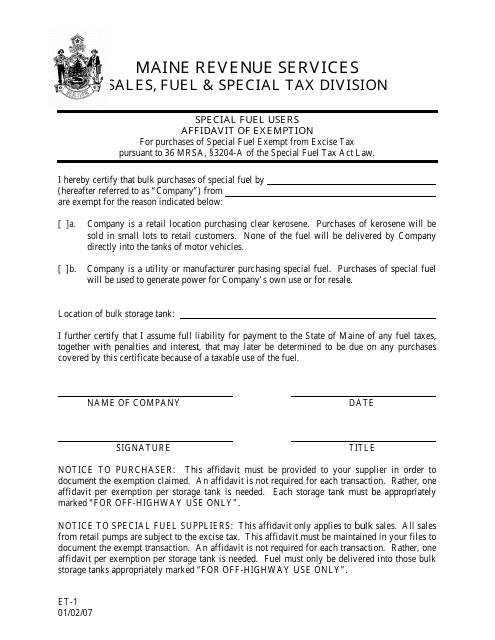

This form is used for Maine residents who are exempt from special fuel taxes and need to declare their exemption status.

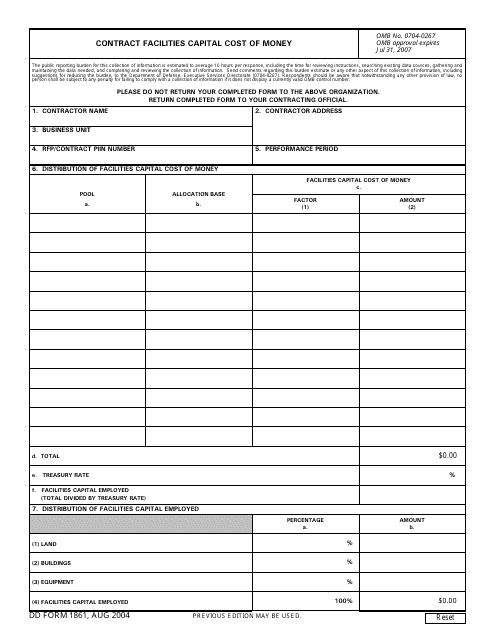

This document is used for calculating the capital cost of money for contract facilities.