Fill and Sign United States Legal Forms

Documents:

235709

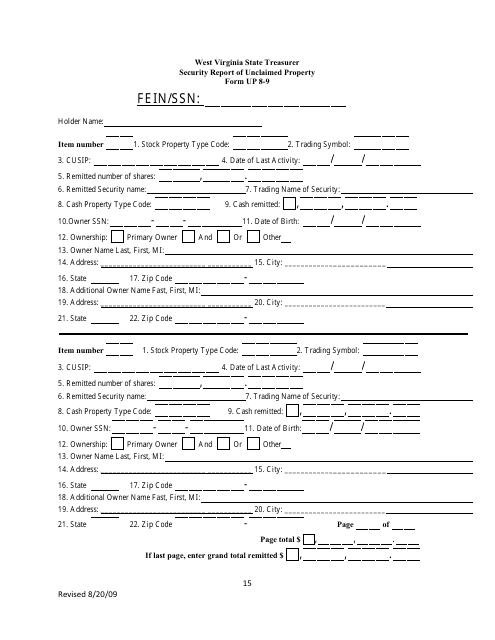

This form is used for reporting unclaimed property in the state of West Virginia. It is a security report that helps ensure that unclaimed assets are properly accounted for and protected.

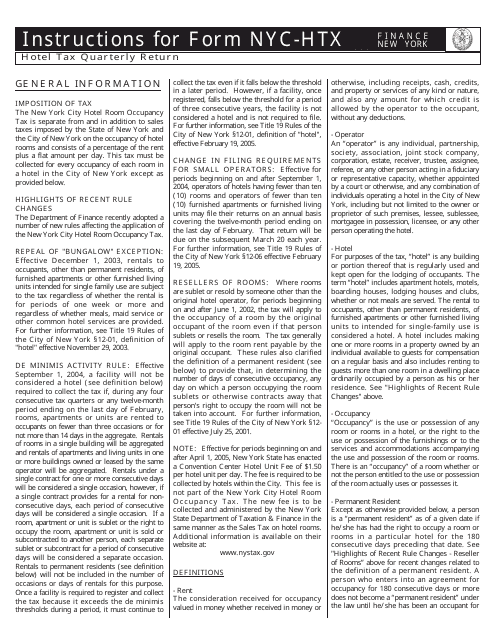

This form is used for reporting and paying hotel taxes on a quarterly basis in New York City. It provides instructions on how to complete the form and submit the necessary documentation.

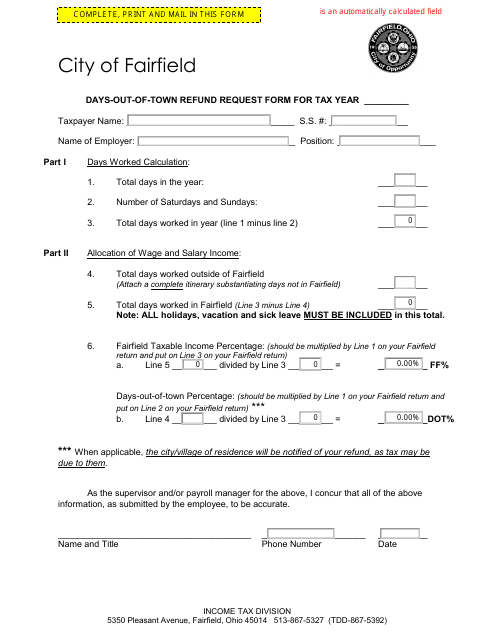

This Form is used for requesting a refund for days spent out of town in Fairfield, Ohio.

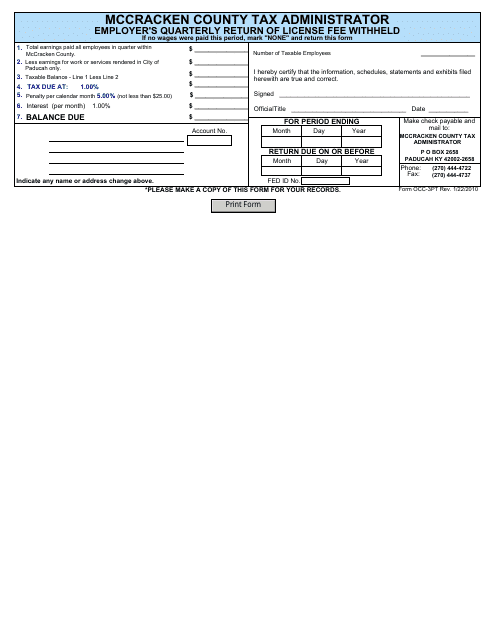

This form is used for employers in McCracken County, Kentucky to report and remit license fee withheld on a quarterly basis.

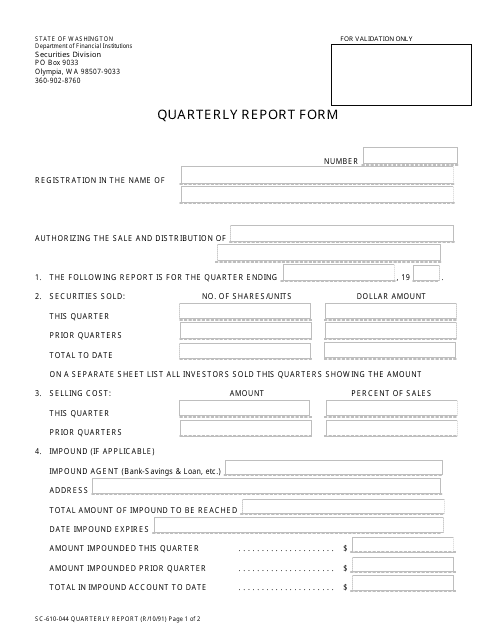

This Form is used for submitting quarterly reports in the state of Washington.

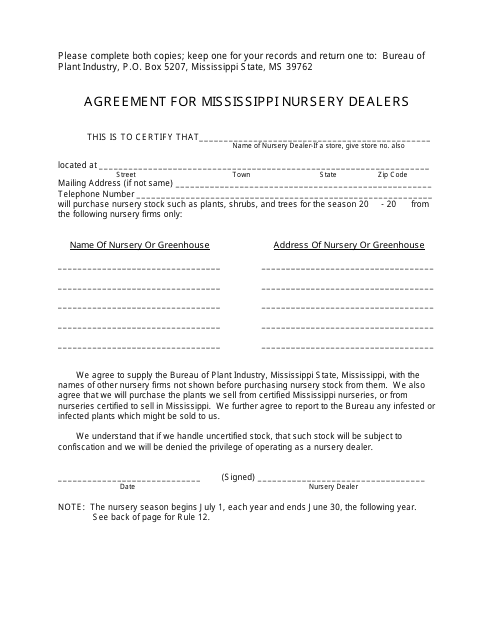

This type of document is an agreement specifically designed for nursery dealers in the state of Mississippi. It outlines the terms and conditions for the sale and distribution of nursery plants within the state.

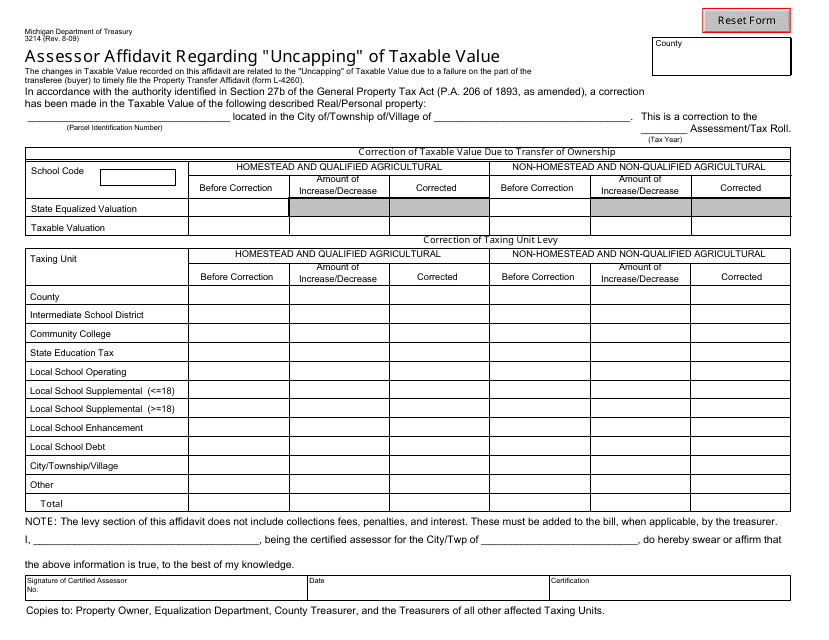

This form is used for submitting an Assessor Affidavit in Michigan regarding the "uncapping" of taxable value for property taxes.

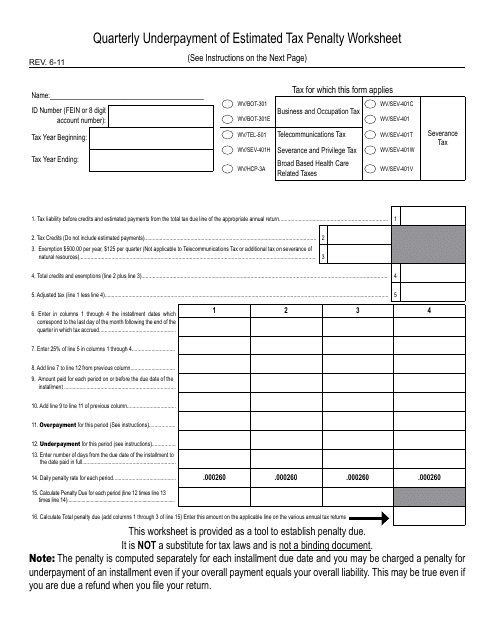

This type of document is used for calculating the penalty for underpayment of estimated tax in West Virginia on a quarterly basis.

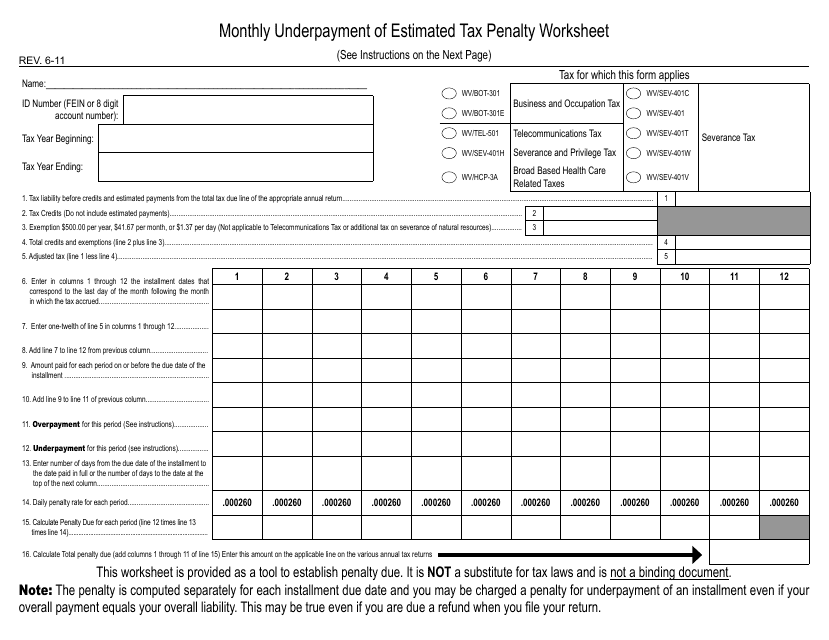

This form is used for calculating the penalty for underpayment of estimated taxes on a monthly basis for taxpayers in West Virginia.

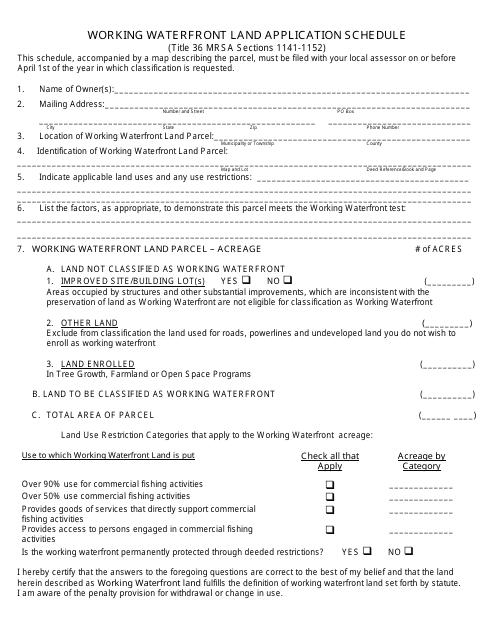

This type of document provides information about the application schedule for working waterfront land in the Town of Harpswell, Maine.

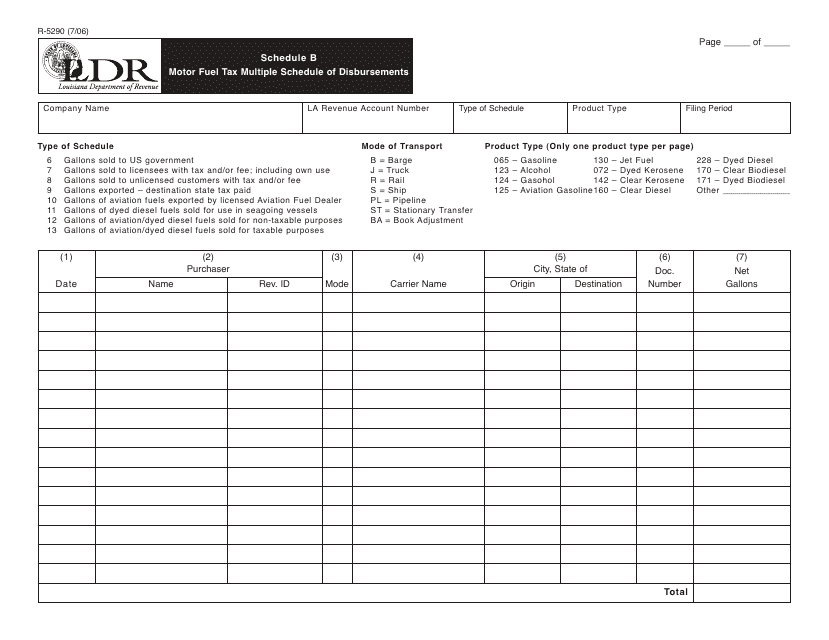

This form is used for reporting multiple schedules of disbursements for motor fuel tax in the state of Louisiana.

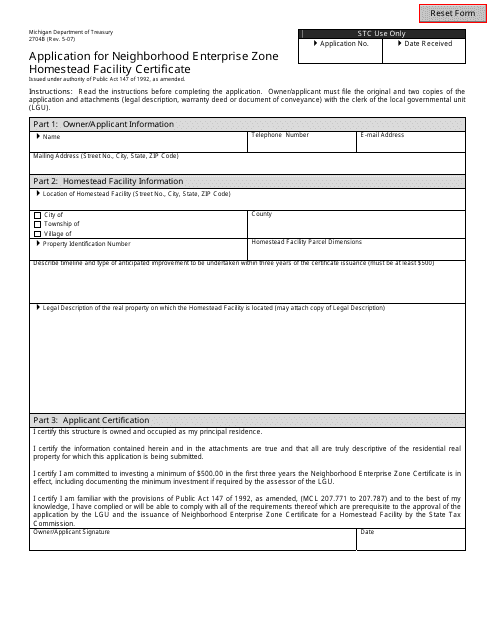

This form is used for applying for a Homestead Facility Certificate in the Neighborhood Enterprise Zone in Michigan.

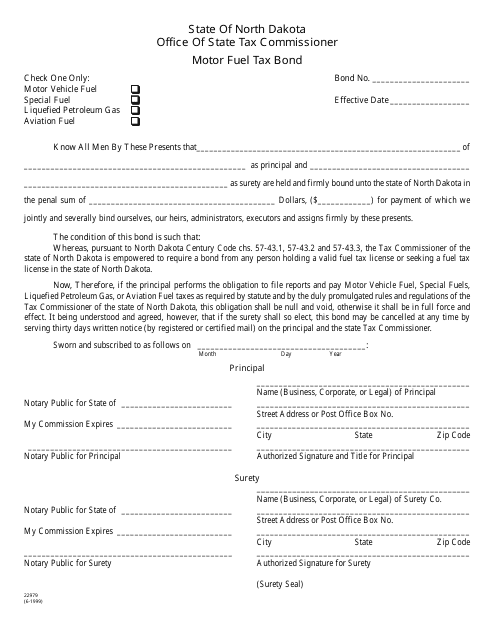

This Form is used for obtaining a motor fuel tax bond in North Dakota.

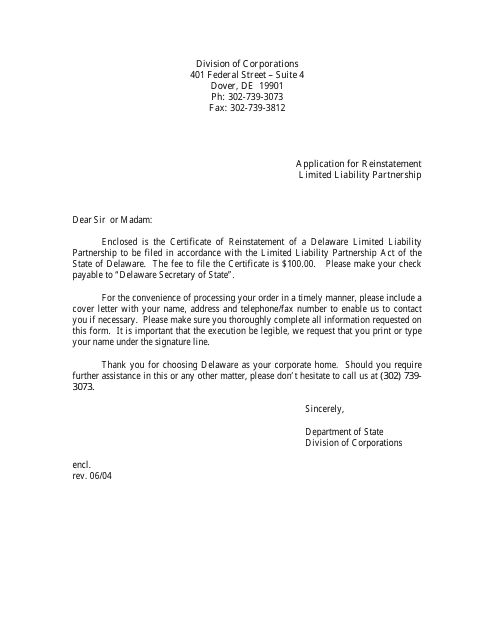

This document is used for applying for reinstatement of a limited liability partnership in Delaware.

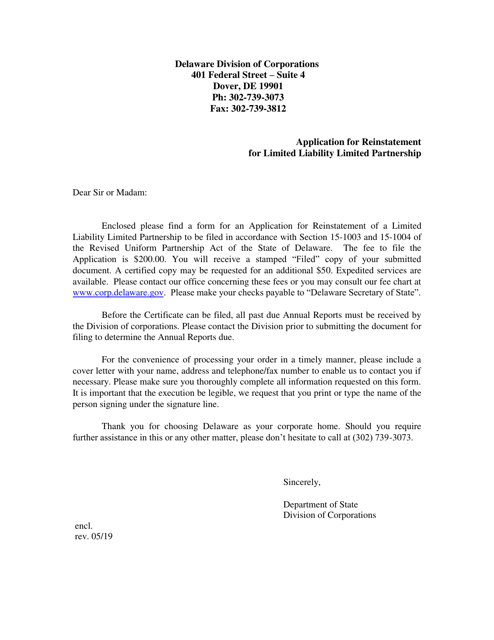

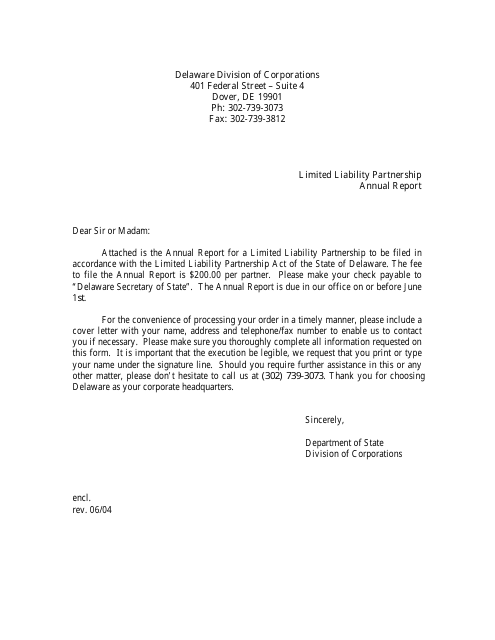

This document is used for filing the annual report for a limited liability partnership in the state of Delaware.

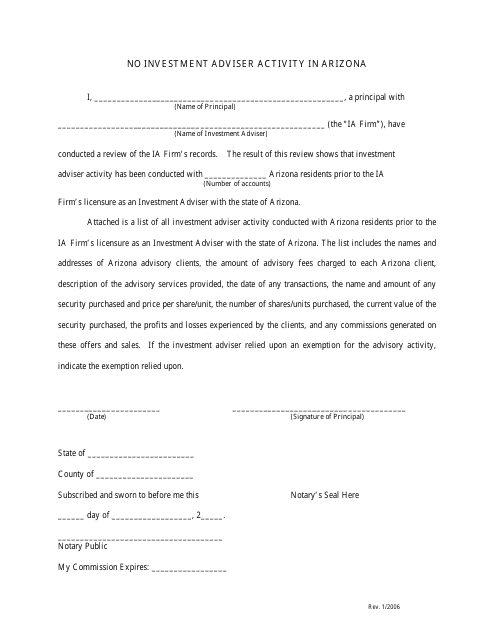

This document states that there is no investment adviser activity in the state of Arizona.

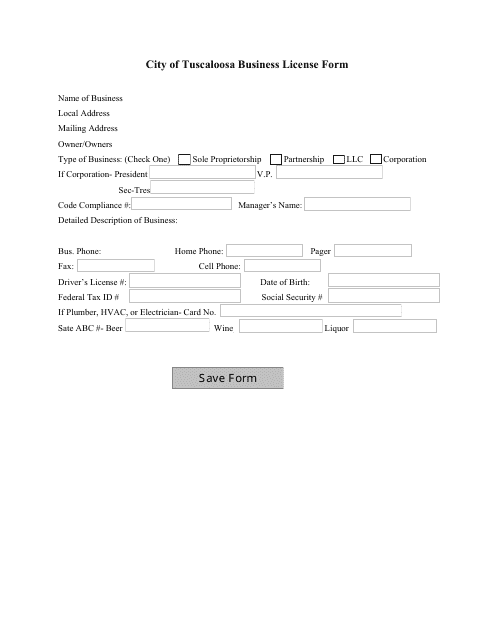

This form is used for obtaining a business license in the City of Tuscaloosa, Alabama.

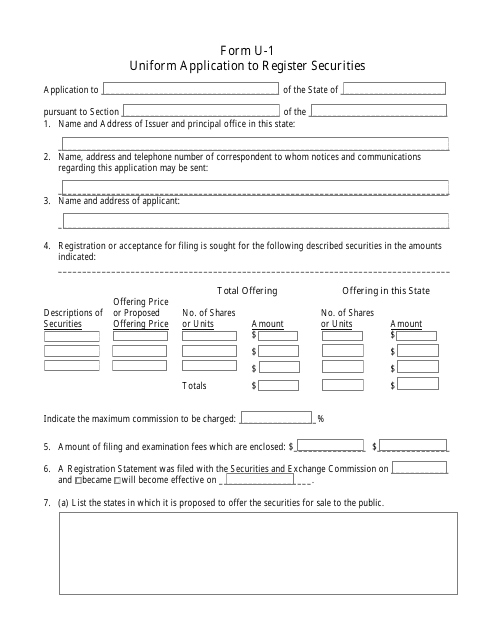

This form is used for registering securities in the state of Louisiana.

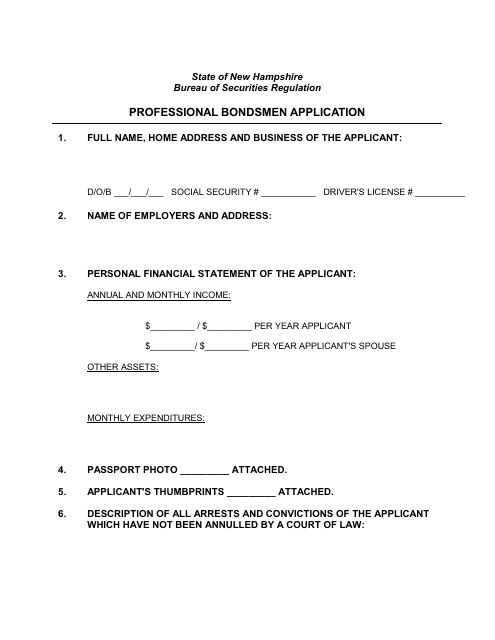

This form is used for applying to become a professional bondsman in the state of New Hampshire.

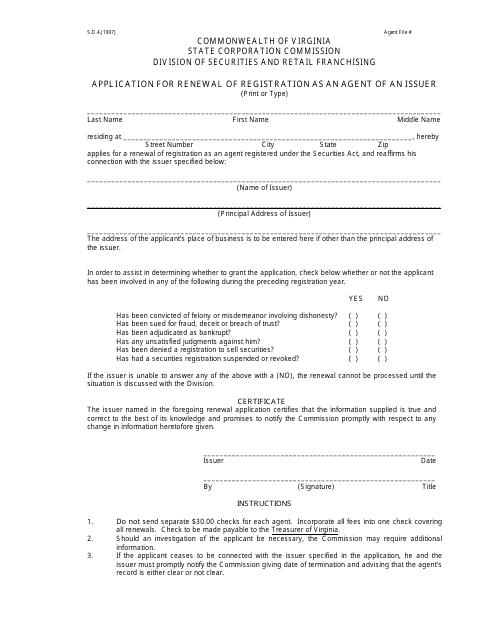

This Form is used for applying to renew the registration as an agent of an issuer in the state of Virginia.

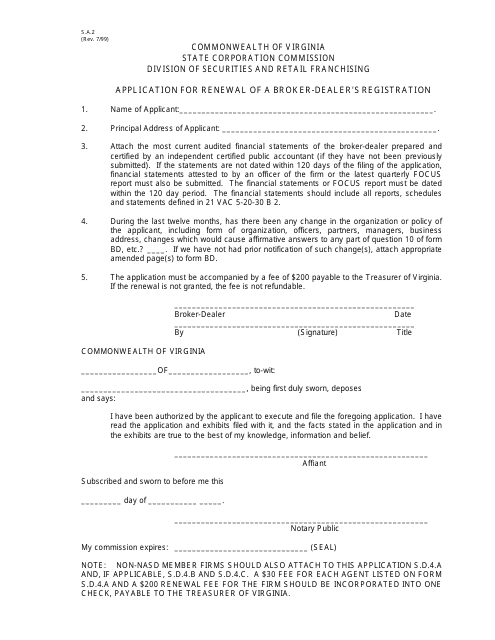

This form is used for broker-dealers in Virginia to apply for the renewal of their registration.

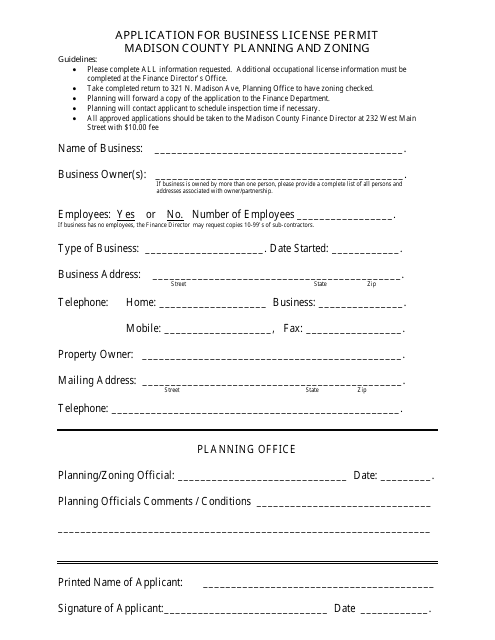

This document is the application form for obtaining a business license permit in Madison County, Kentucky. It is used by individuals and businesses who want to start a new business or operate an existing business within the county.

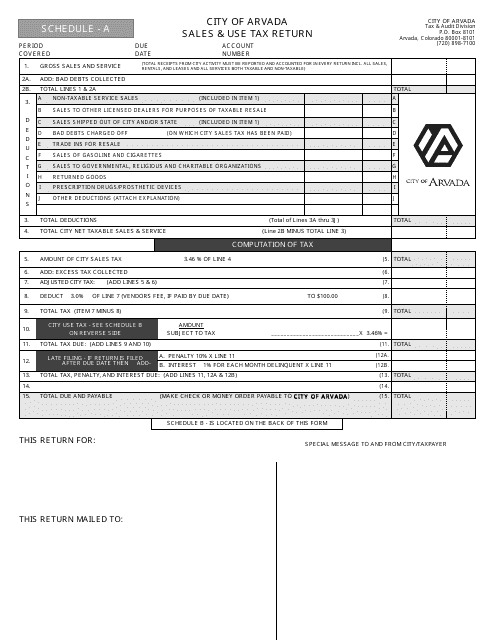

This document is used for filing Sales & Use Tax returns for businesses in the City of Arvada, Colorado.

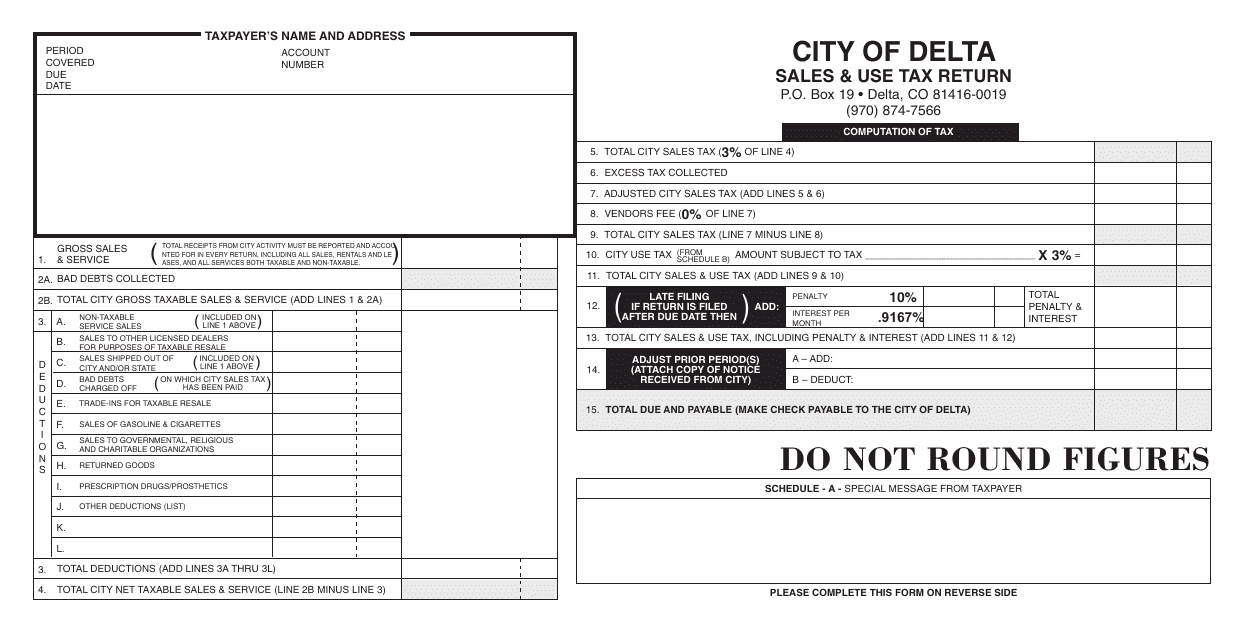

This form is used for reporting and submitting sales and use tax to the City of Delta, Colorado.

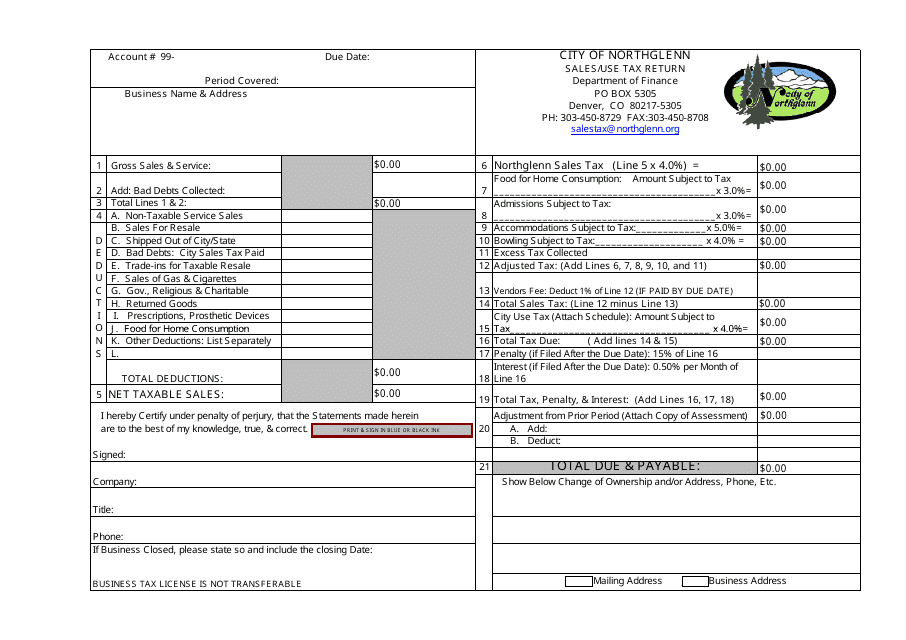

This form is used for reporting and remitting sales and use tax to the City of Northglenn, Colorado.

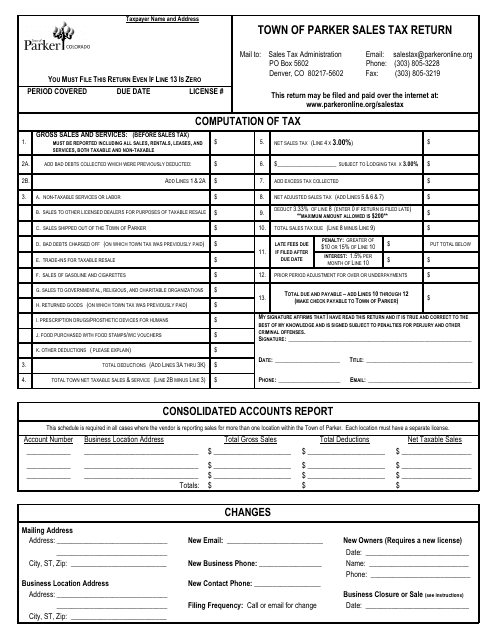

This form is used for filing sales tax returns in the Town of Parker, Colorado. It is used by businesses to report and remit the sales tax collected from their customers.

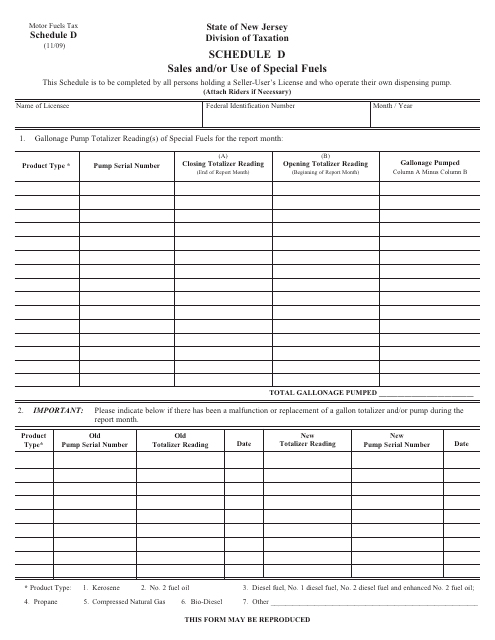

This form is used for reporting the sales and/or use of special fuels in New Jersey. It is specifically for Schedule D of Form MFT-10.

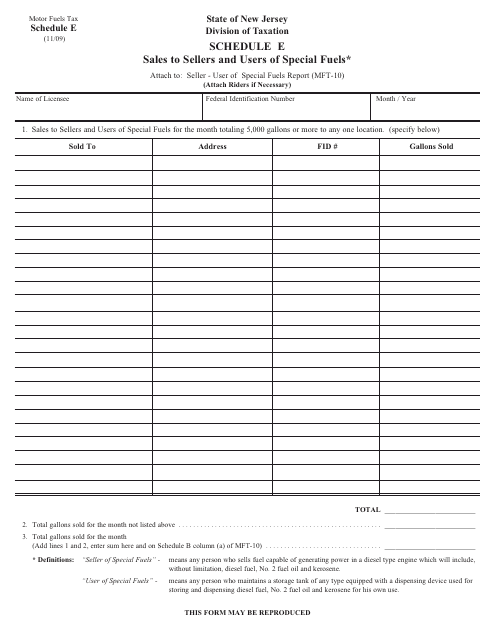

This form is used for reporting sales of special fuels to sellers and users in New Jersey. It is known as Schedule E of Form MFT-10.

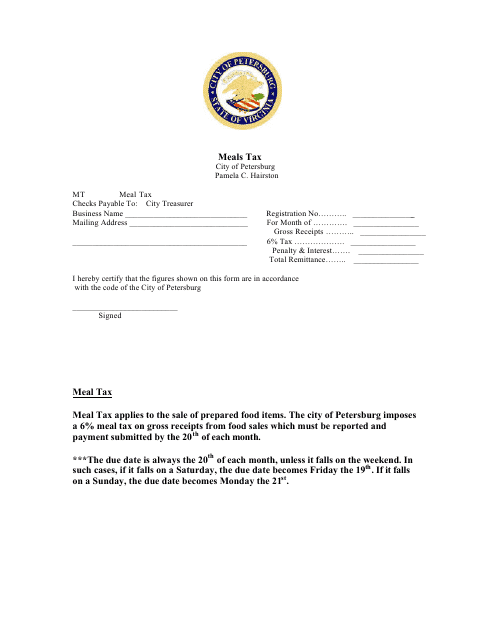

This form is used for reporting and paying the meals tax in Petersburg, Virginia. Businesses in the city that sell prepared meals are required to complete and submit this form to the local tax authority.

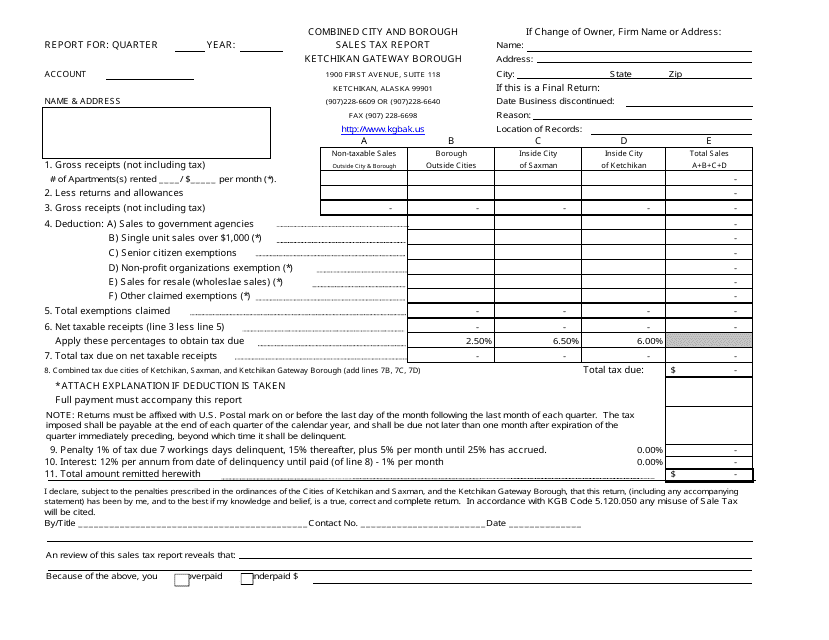

This document is a combined sales tax report for the Ketchikan Gateway Borough in Alaska. It includes information on the sales tax collected from both the city and borough within the area.

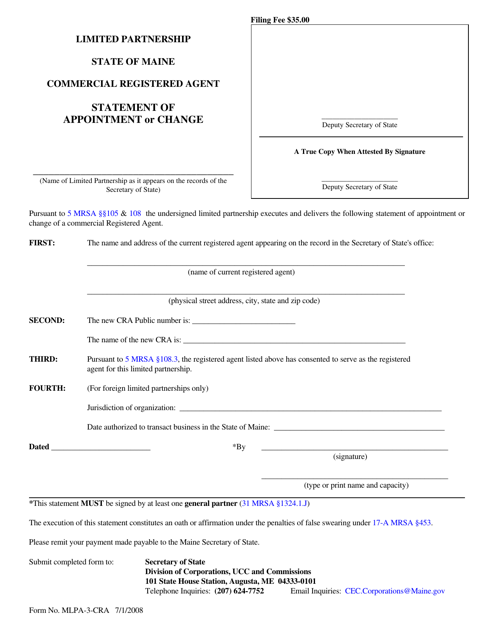

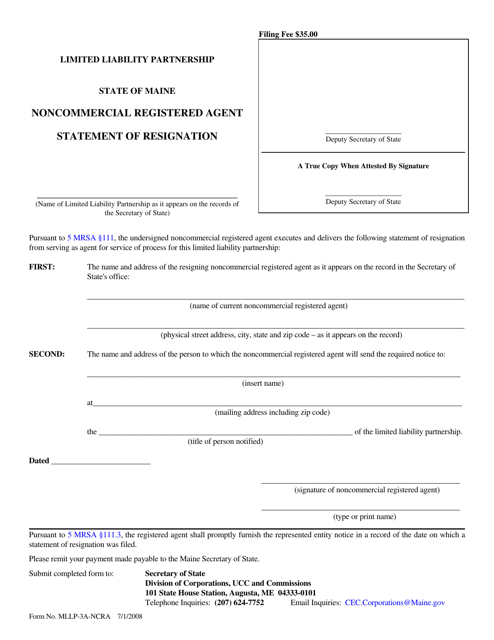

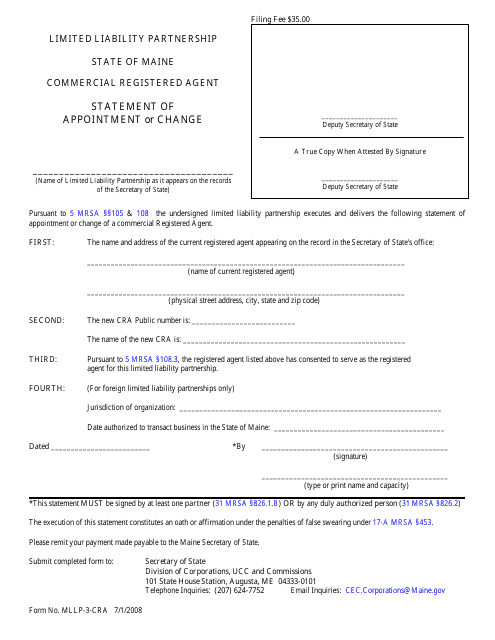

This document is used for appointing or changing a commercial registered agent in the state of Maine.

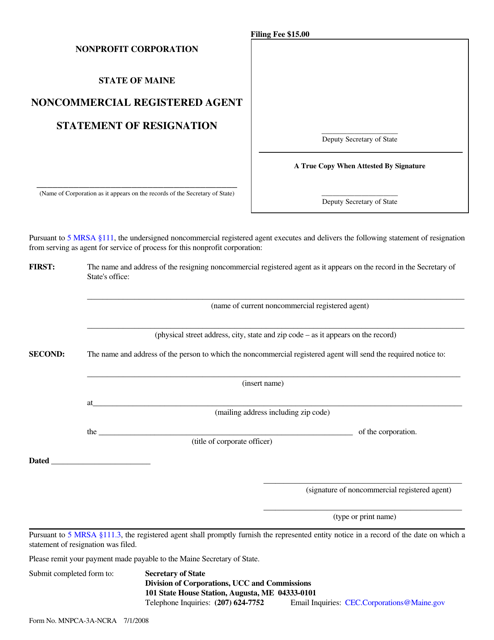

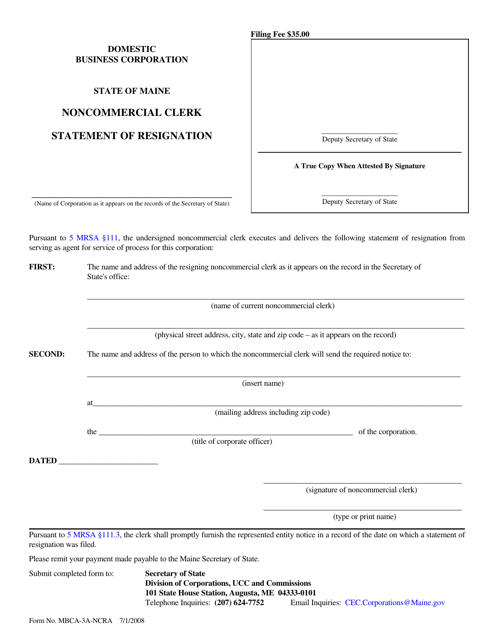

Form MBCA-3A-NCRA Domestic Business Corporation Noncommercial Clerk Statement of Resignation - Maine

This document is used for converting a non-Delaware limited partnership into a Delaware limited partnership. It is necessary for complying with the state laws and regulations in Delaware.

This document is used for converting a non-Delaware limited liability partnership into a Delaware partnership.

This document is used for converting a non-Delaware LLC into a Delaware LLC. It is a legal certificate that allows the LLC to operate under the laws and regulations of Delaware. This conversion may offer certain benefits and advantages for the company.