Fill and Sign United States Legal Forms

Documents:

235709

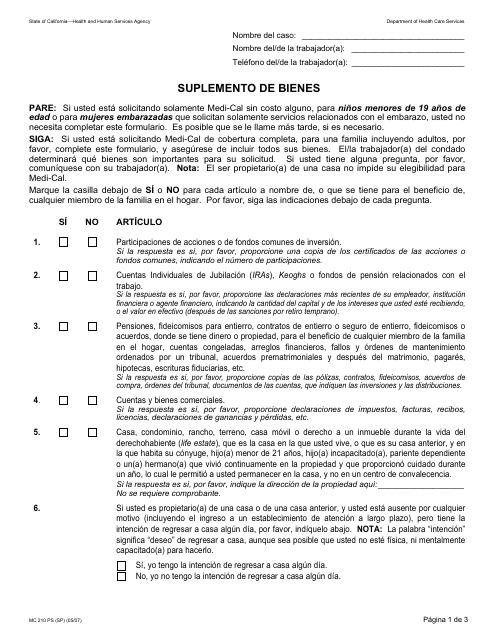

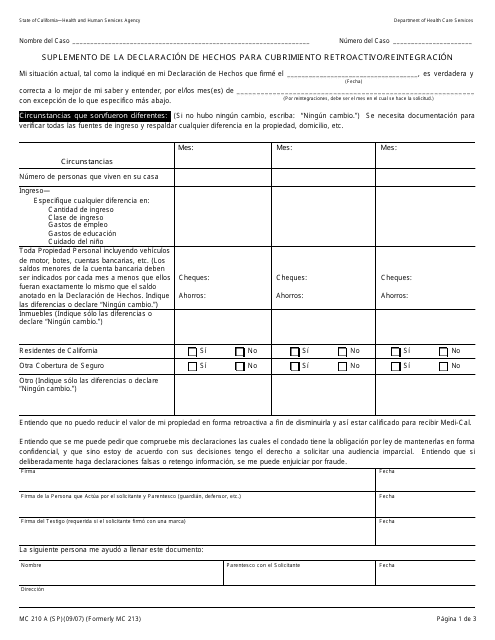

This Form is used to supplement the MC210 Form for reporting assets in California.

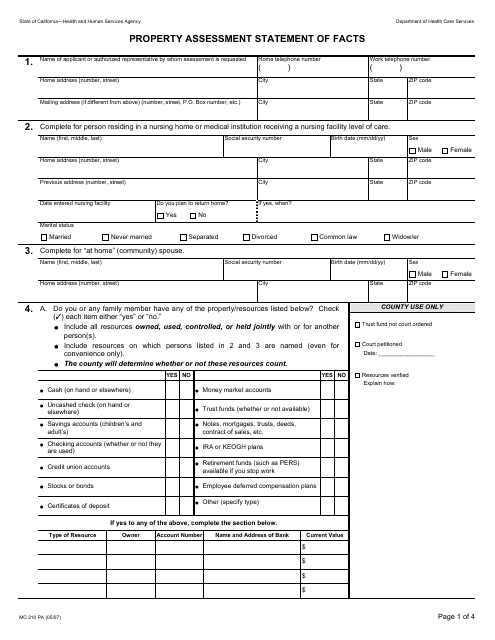

This form is used for property assessment in the state of California. It is used to provide factual information about the property.

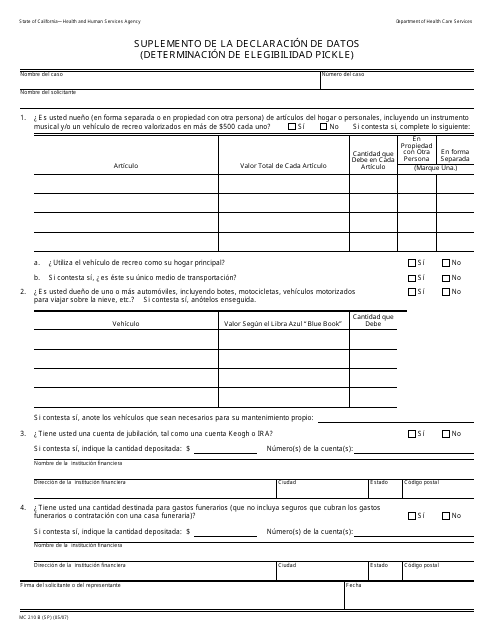

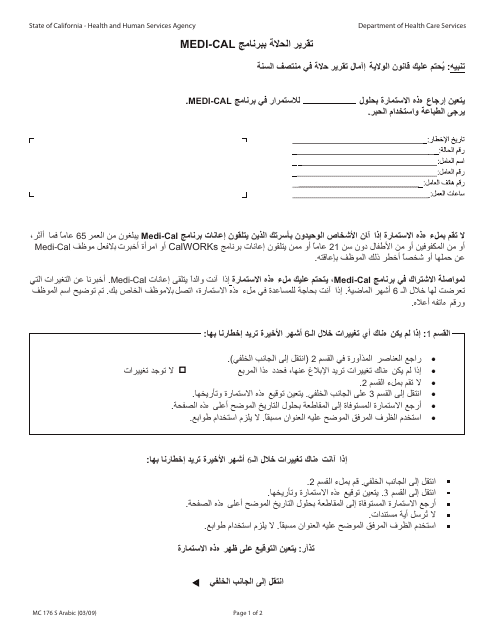

This document is a form used in California called "Form MC210 B", which is a supplement to the Data Declaration (Eligibility Determination Pickle). It is written in Spanish.

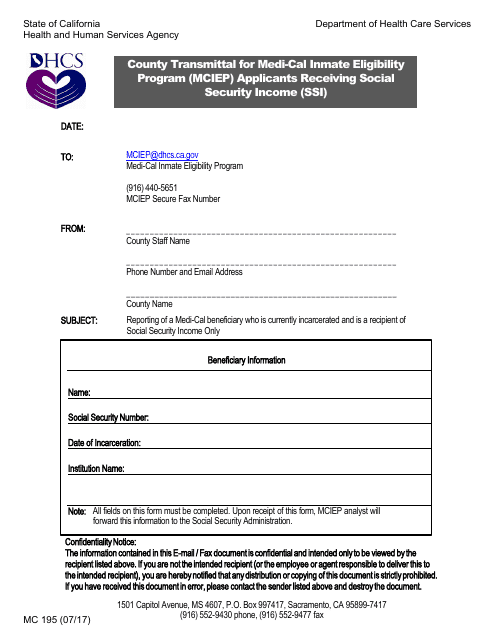

This form is used for transmitting county information for Medi-Cal Inmate Eligibility Program (MCIEP) applicants who are receiving Social Security Income (SSI) in California.

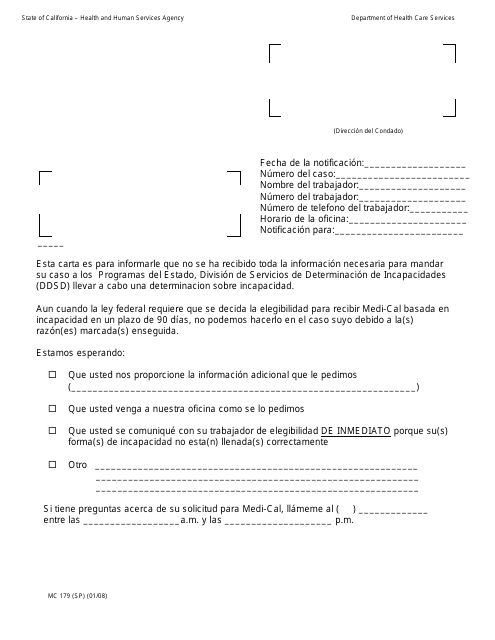

This document is an information letter in Spanish about Form MC179. It provides information and guidance to individuals in California.

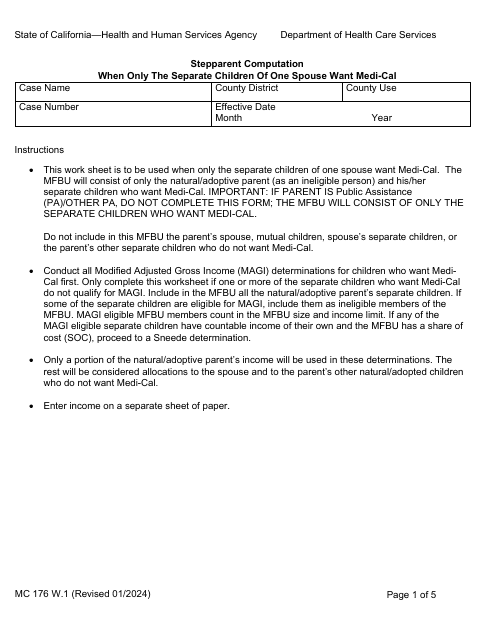

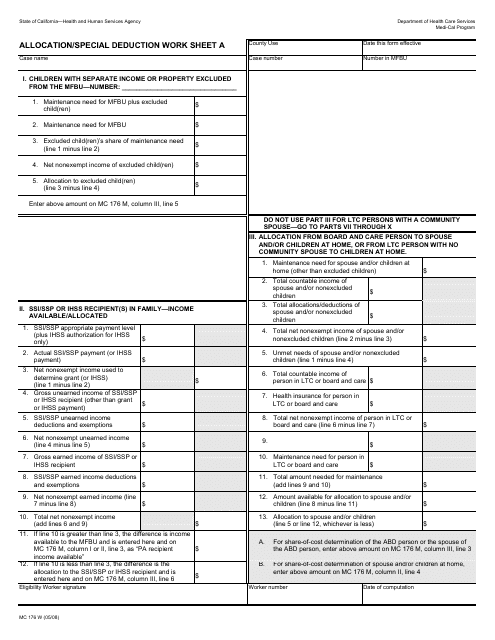

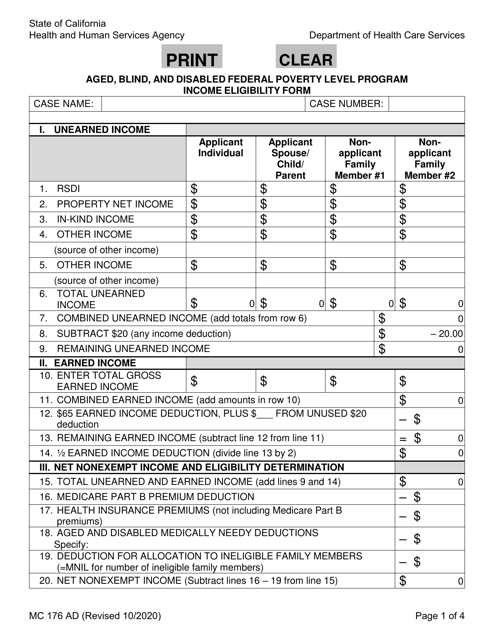

This form is used for calculating allocations and special deductions in the state of California. It helps taxpayers determine the correct amount to deduct from their income.

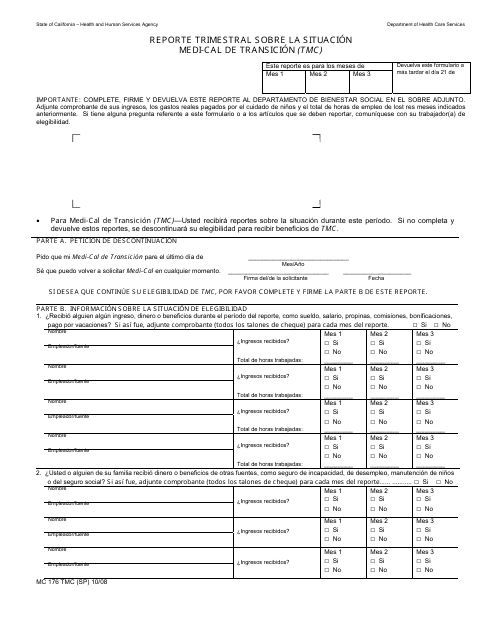

This Form is used for reporting quarterly information about the Medi-Cal Transition Case (TMC) situation in California.

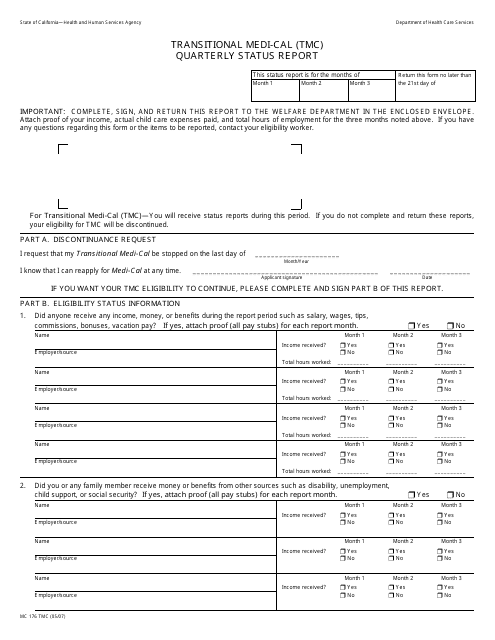

This form is used for reporting the quarterly status of Transitional Medi-Cal (TMC) in California.

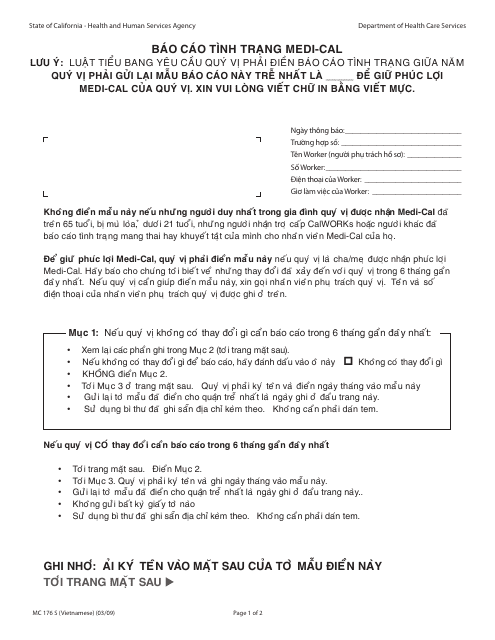

This form is used for reporting Medi-Cal status in California. It is available in Vietnamese.

This form is used for reporting Medi-Cal status in California for individuals who speak Tagalog.

This Form is used for reporting the family situation for Medi-Cal in California.

This form is used for reporting the status of Medi-Cal benefits in California. It is available in the Russian language.

This form is used for reporting the Medi-Cal status for individuals in California who speak Korean.

This form is used for reporting the Medi-Cal status of Cambodian individuals in the state of California.

This document is a Form MC176 S used for reporting Medi-Cal status in California for Hmong individuals. It is used to provide updates on the Medi-Cal eligibility and coverage for Hmong residents in California.

This form is used for reporting the status of Medi-Cal benefits in California for individuals who speak Farsi.

This document is used for reporting the status of Medi-Cal benefits in California. It is specifically for Chinese-speaking individuals.

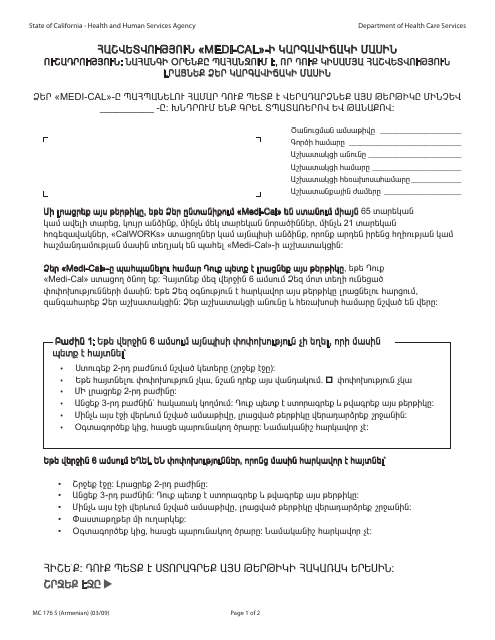

This form is used for reporting the Medi-Cal status in California for individuals who speak Armenian.

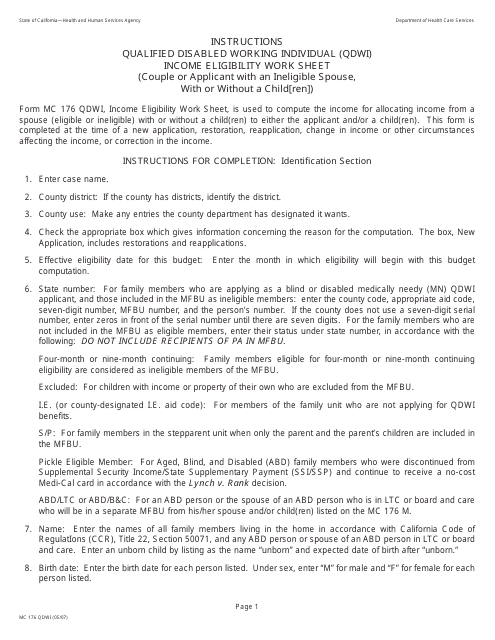

This form is used to determine income eligibility for the Qualified Disabled Working Individual (QDWI) program in California. It is specifically for couples or applicants with an ineligible spouse, with or without a child.

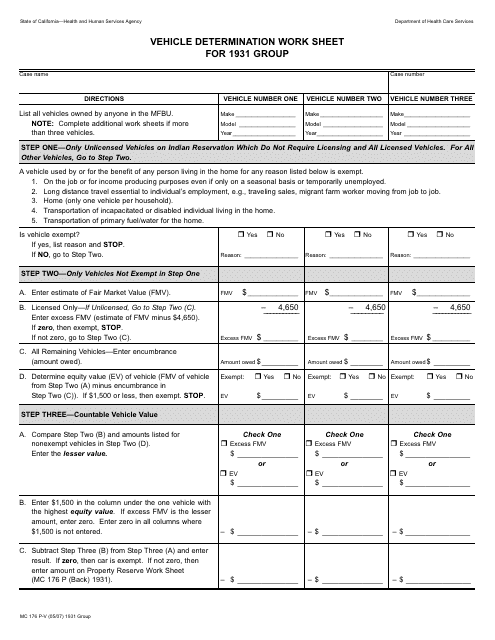

This form is used for determining the vehicle type for the 1931 Group in California.

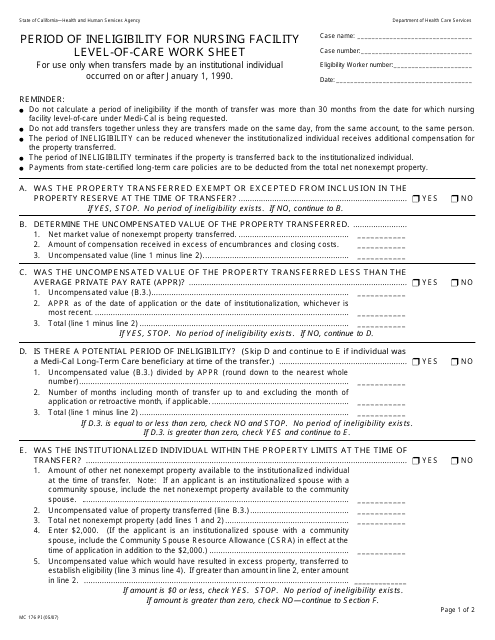

This form is used for determining the period of ineligibility for nursing facility level-of-care in California.

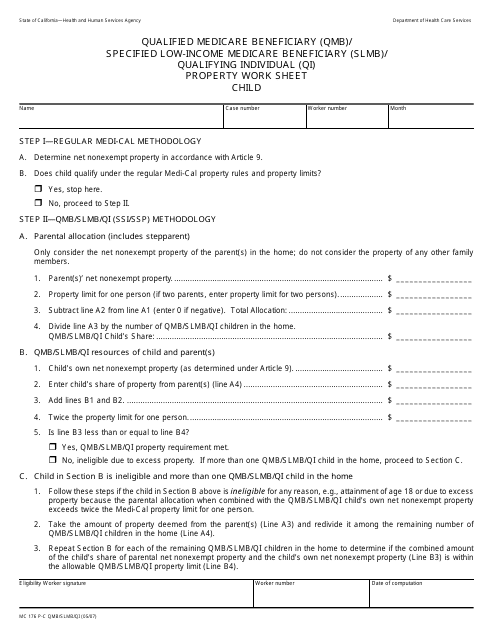

This form is used for calculating property values for applicants of QMB/SLMB/QI programs in California who are applying for Medicare benefits.

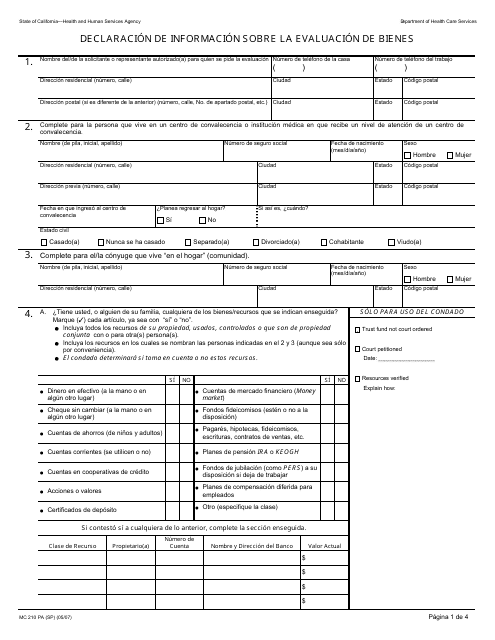

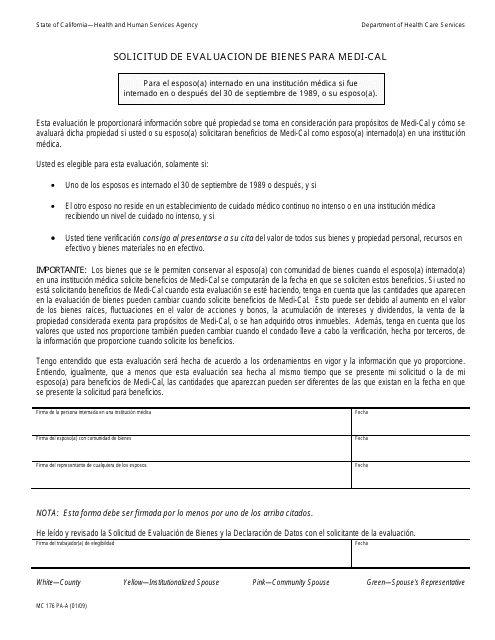

This form is used for requesting a evaluation of assets for Medi-Cal benefits in California.

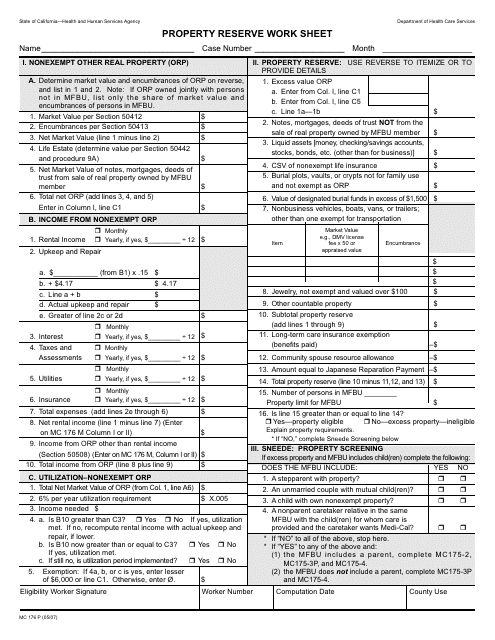

This form is used for property owners in California to keep track of reserve funds for maintenance and repairs. It helps in budgeting and planning for future property expenses.

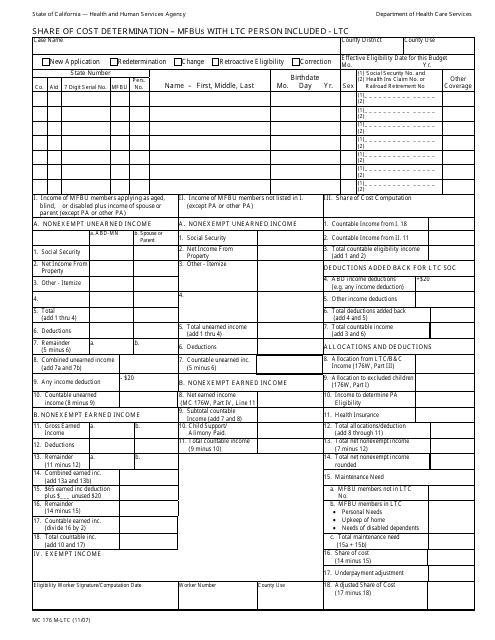

This form is used for determining the share of cost for long-term care (LTC) services in California. It is specifically for the M-LTC program and includes the calculation for the LTC person included in the household.

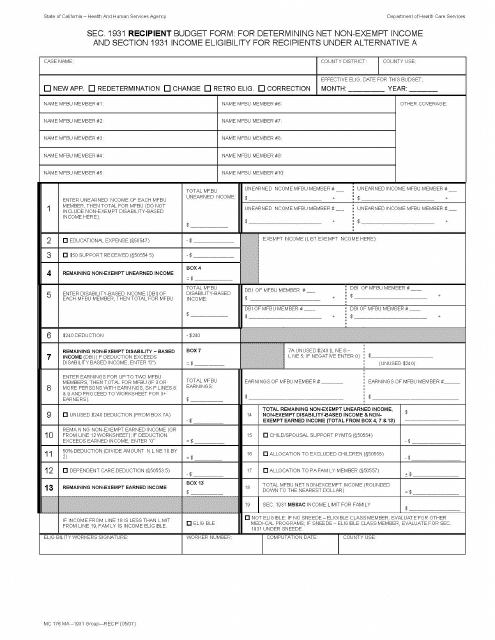

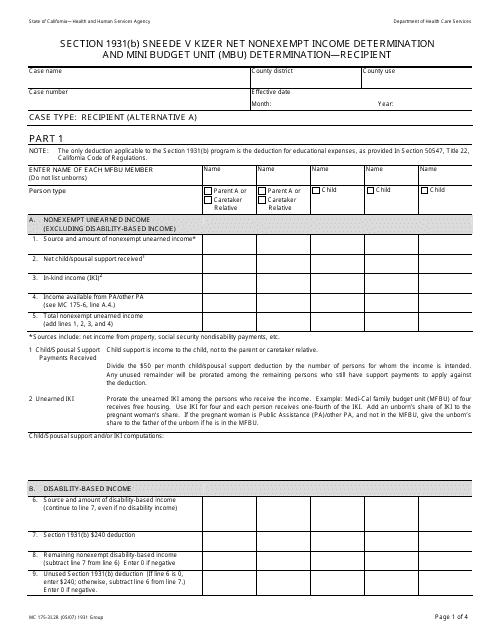

This form is used for determining the net non-exempt income and section 1931 income eligibility for recipients in California under Alternative A.

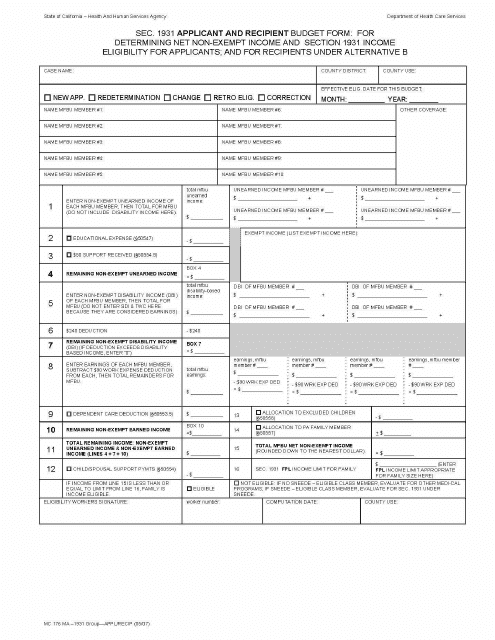

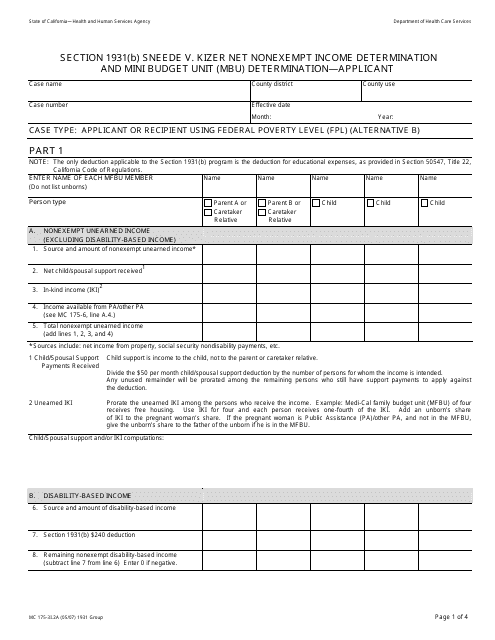

This form is used for determining net non-exempt income and section 1931 income eligibility for applicants and recipients under Alternative B in California.

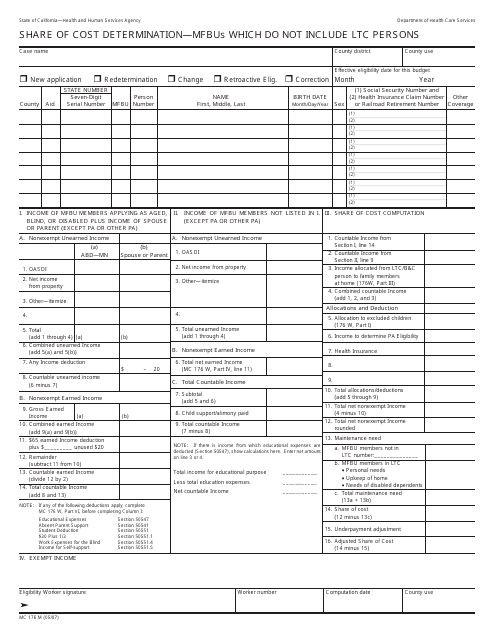

This Form is used for determining the share of cost for Medical Foster Homes for Individuals who do not include long-term care persons in California.

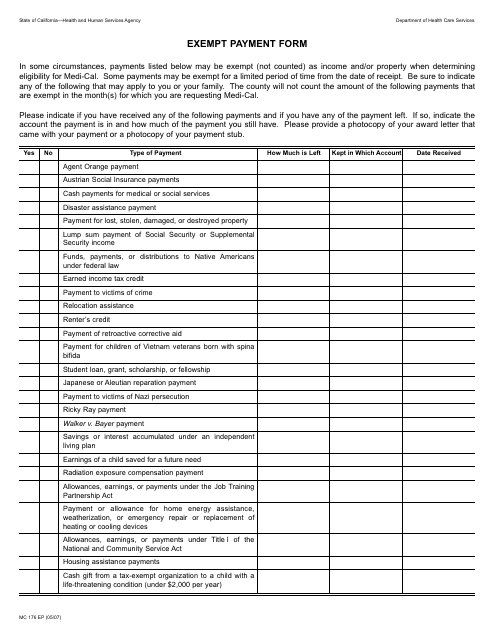

This form is used for reporting exempt payments made in California.

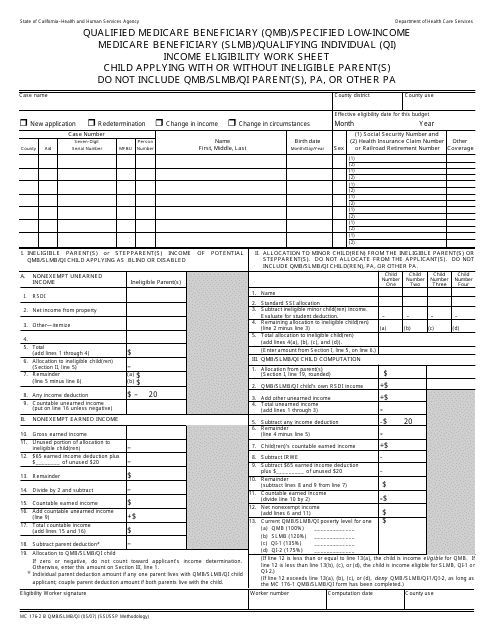

This Form is used for determining income eligibility for children applying for the QMB/SLMB/QI program in California, whether they have an ineligible parent or not.

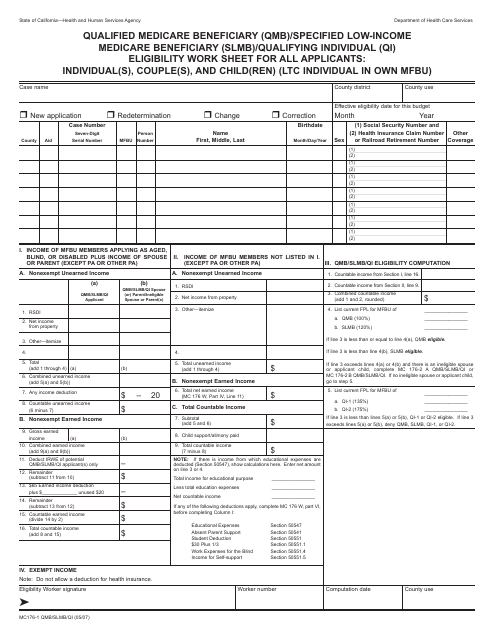

This form is used for checking the eligibility of individuals, couples, and children for Qualified Medicare Beneficiary, Specified Low-Income Medicare Beneficiary, and Qualifying Individual programs in California.

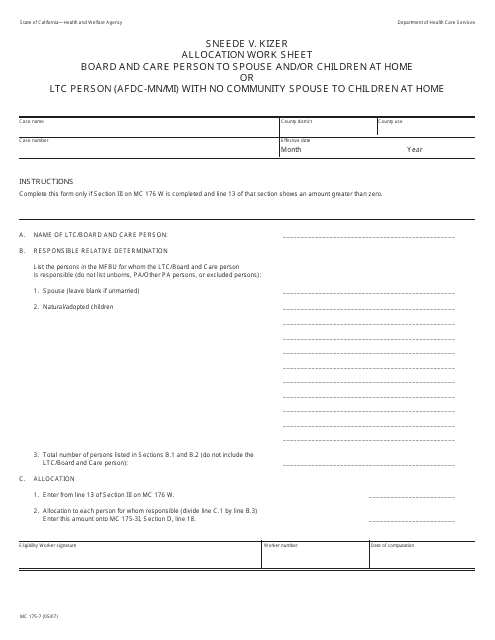

This form is used for allocating work tasks and responsibilities between a board and care person and their spouse and/or children at home or long-term care person in California who is receiving AFDC-Mn/Mi benefits and does not have a community spouse.

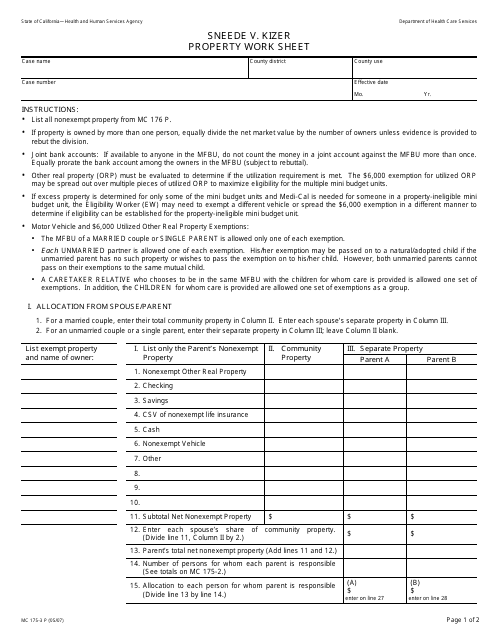

This form is used for identifying and documenting property details in a legal case between Sneede and Kizer in California.