Fill and Sign United States Legal Forms

Documents:

235709

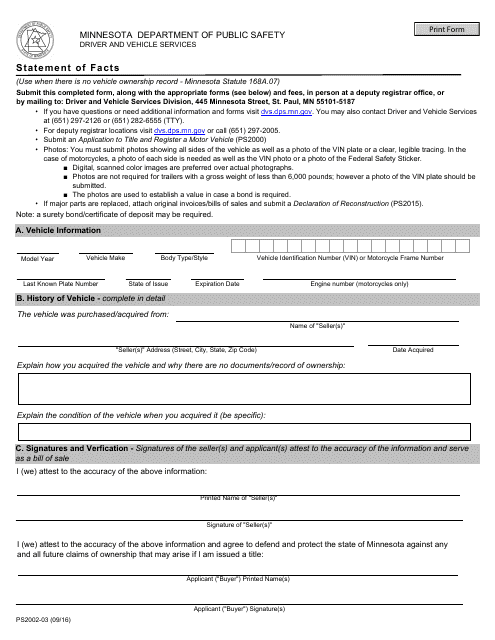

This form is used for providing a statement of facts in the state of Minnesota.

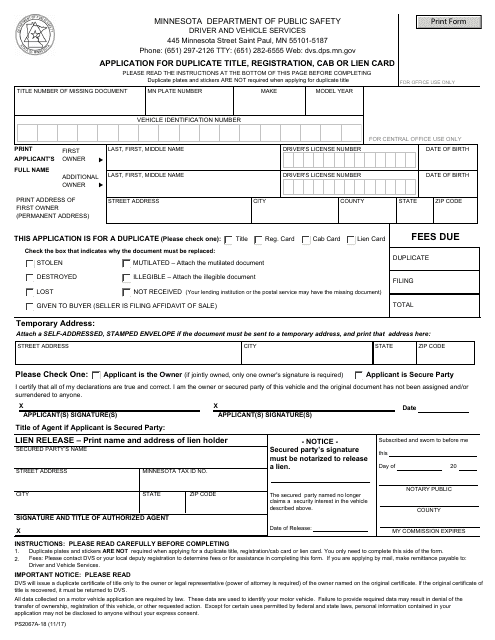

This form is used for applying for a duplicate title, registration, cab, or lien card in Minnesota.

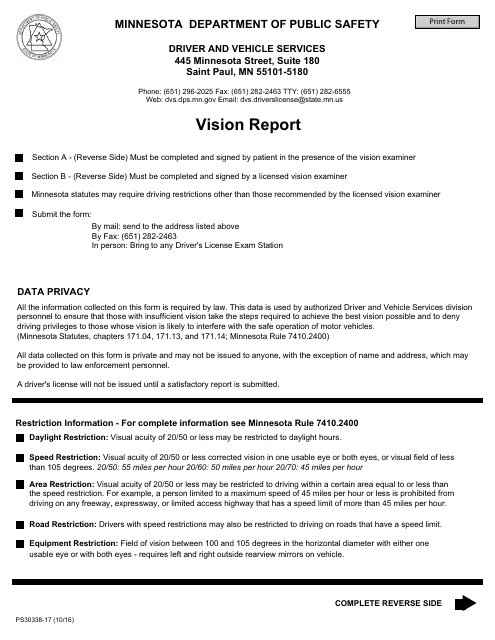

This Form is used for reporting vision test results in the state of Minnesota.

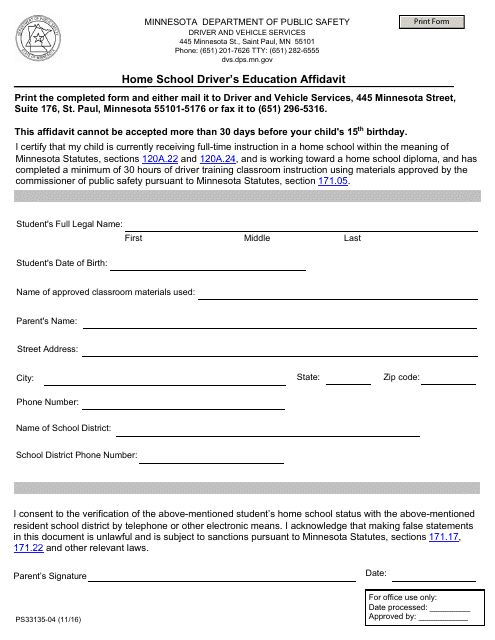

This Form is used for providing an affidavit for home-schooled students in Minnesota who are seeking a driver's education program.

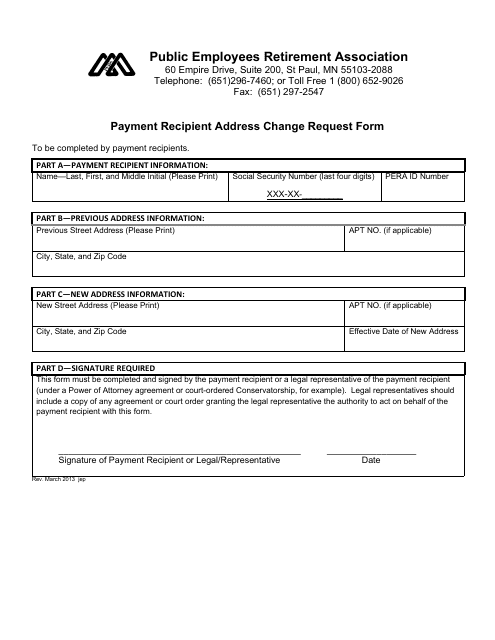

This form is used for requesting a change of address for the payment recipient in the state of Minnesota.

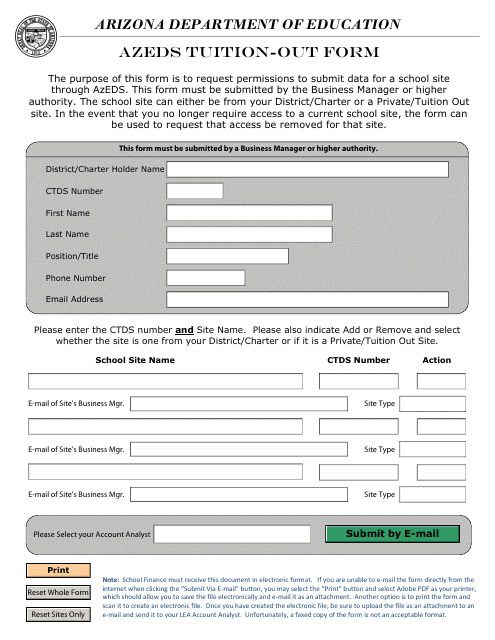

This Form is used for requesting tuition-out in Arizona through the AzEDS system.

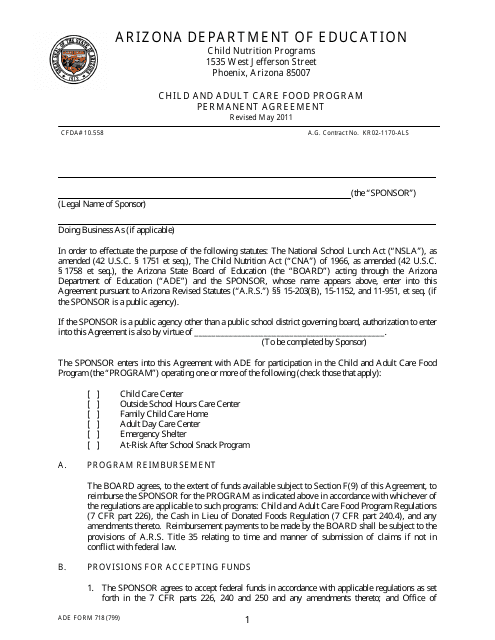

This Form is used for child care providers in Arizona to enter into a permanent agreement with the Child and Adult Care Food Program.

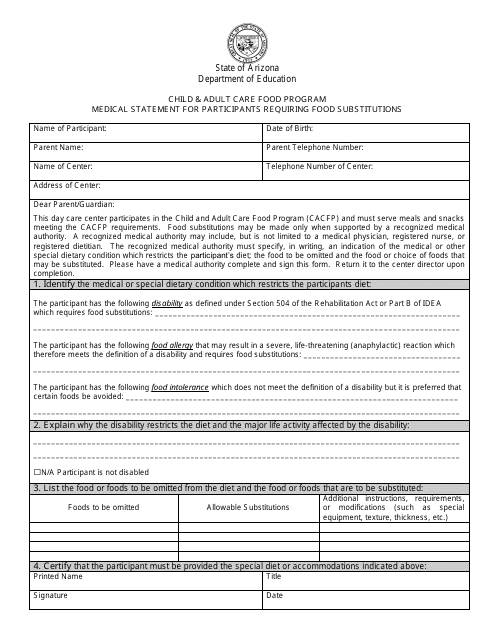

This form is used for participants in the Child & Adult Care Food Program in Arizona who require food substitutions due to medical reasons.

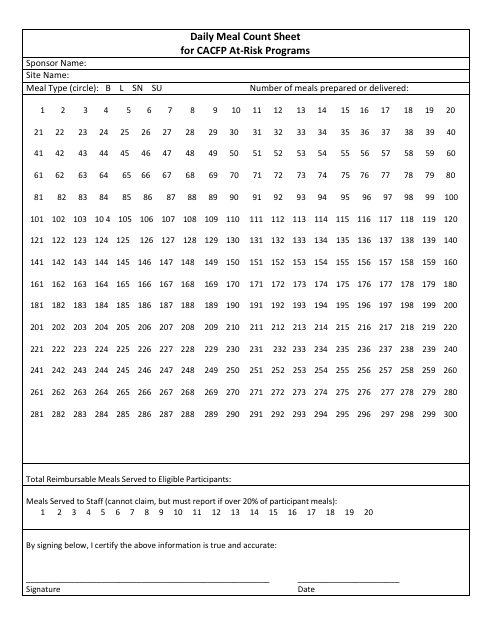

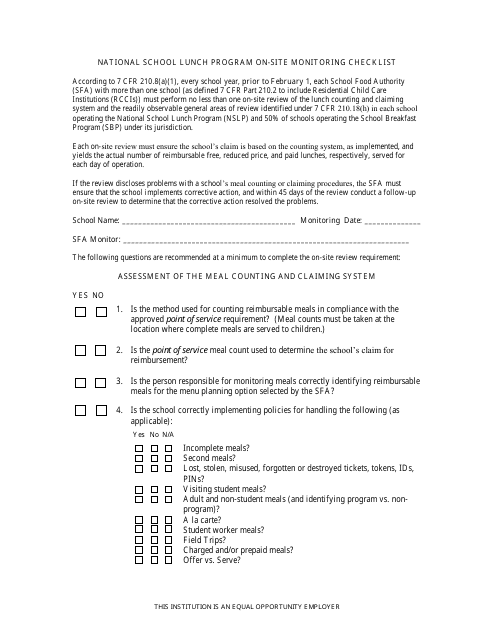

This type of document is used for recording the daily meal count for the CACFP at-risk programs in Arizona.

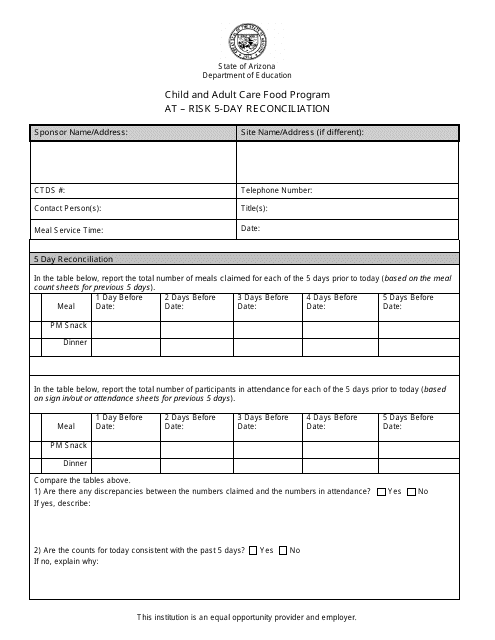

This document is used for reconciling the meals served in the Child and Adult Care Food Program in Arizona over a 5-day period. It helps ensure accuracy and accountability in reporting.

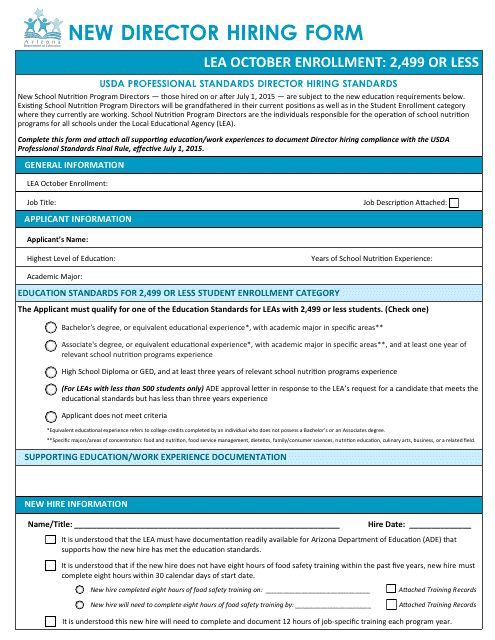

This form is used for hiring a new director position. It is specifically for the Lea October Enrollment period in Arizona, where the student count is 2,499 or less.

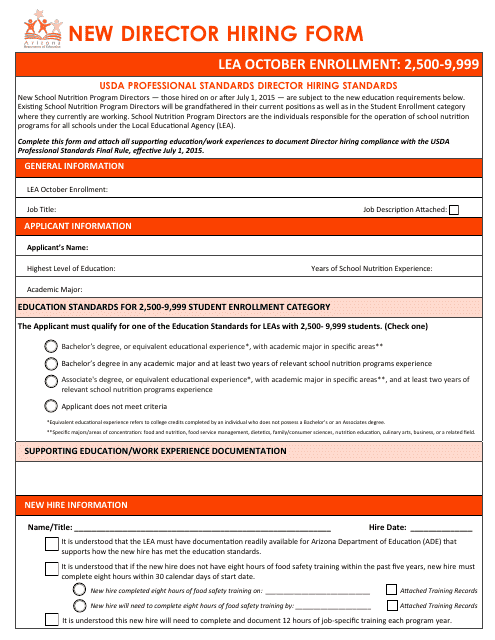

This Form is used for hiring a new director for Lea October Enrollment, which is a school or educational institution in Arizona.

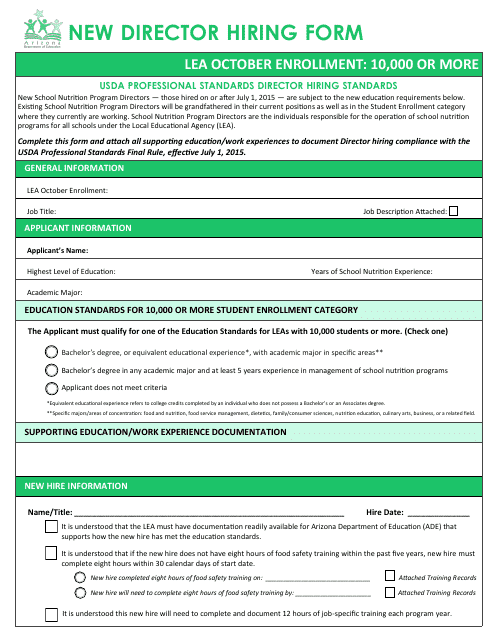

This document is used for hiring a new director. It pertains to the October enrollment period in Arizona with 10,000 or more students.

This document is used to track the training of non-nutrition staff in Arizona. It helps to ensure that all staff members receive the necessary training for their designated roles.

This form is used for tracking the training of part-time staff in Arizona.

This form is used for tracking the training progress of managers in Arkansas.

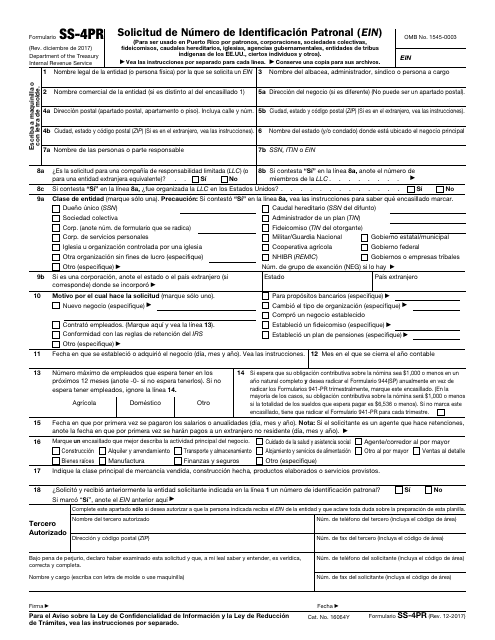

This form is used to apply for an Employer Identification Number (EIN) in Puerto Rico.

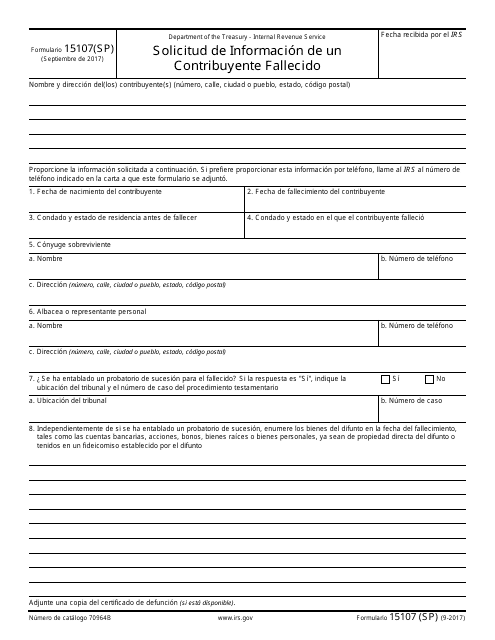

This document is a Spanish version of IRS Form 15107 (SP), which is used to request information about a deceased taxpayer.

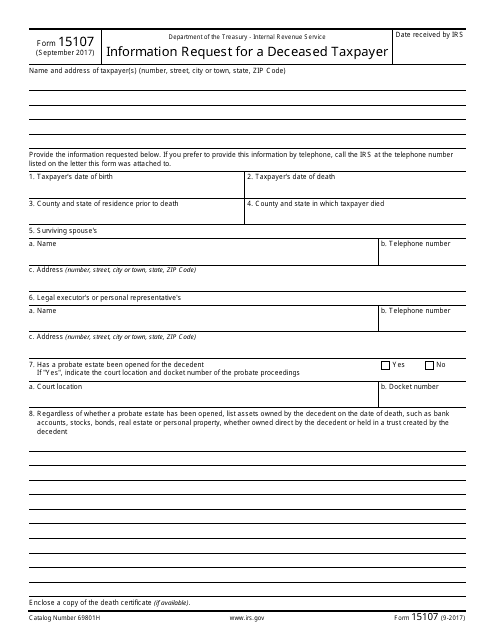

This form is used for requesting information from the IRS for a deceased taxpayer.

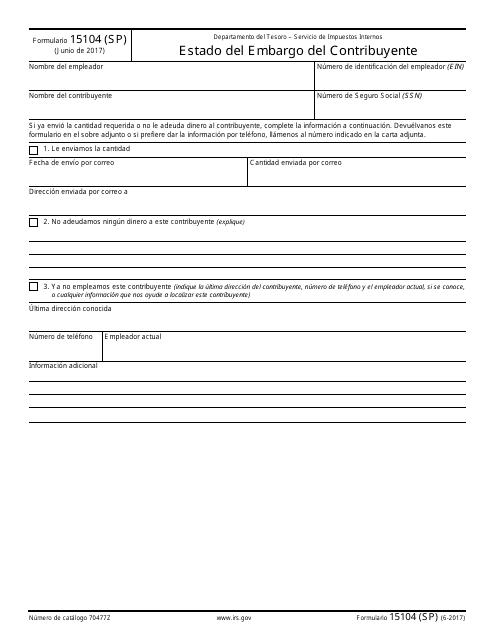

This Form is used for reporting the status of a taxpayer's embargo by the IRS. It is written in Spanish.

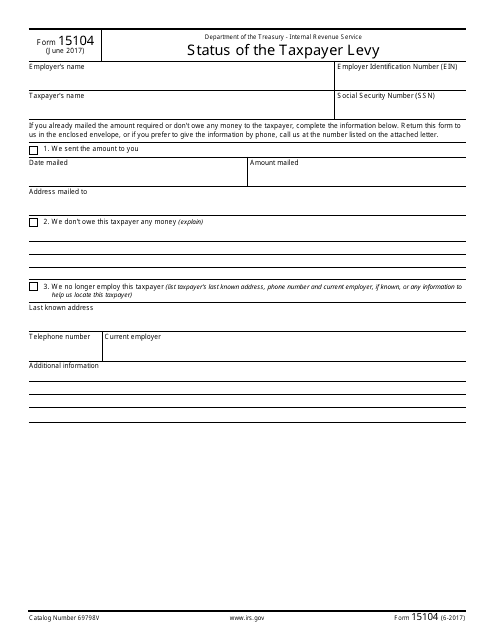

This form is used to check the status of a taxpayer levy with the IRS.

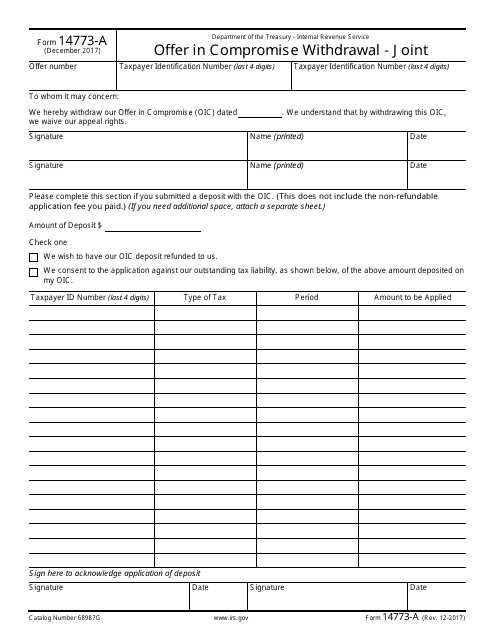

This form is used for withdrawing a joint offer in compromise submission to the IRS.

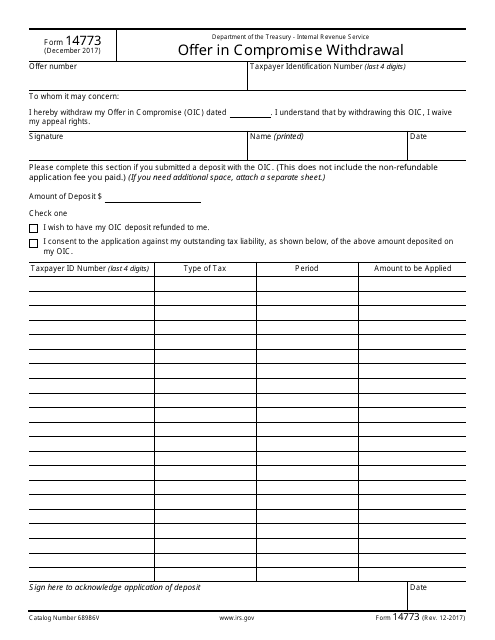

This Form is used for withdrawing an offer in compromise with the Internal Revenue Service (IRS).

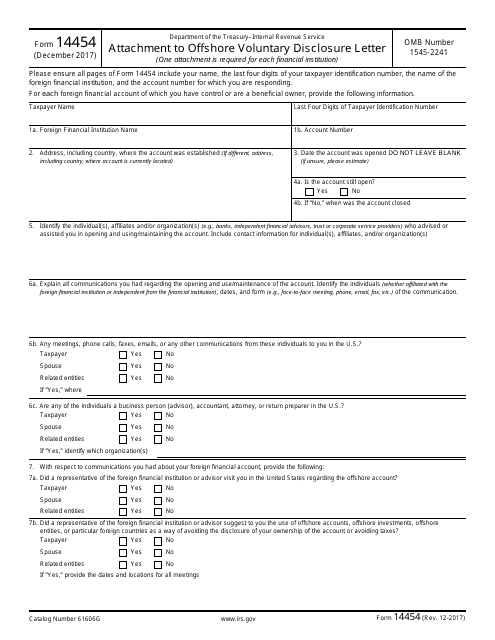

This form is used as an attachment to the Offshore Voluntary Disclosure Letter, which is submitted to the IRS. It provides additional information and documentation related to offshore accounts and income.

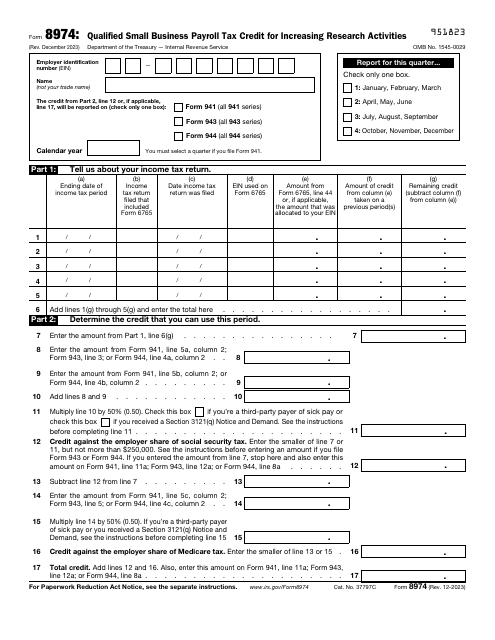

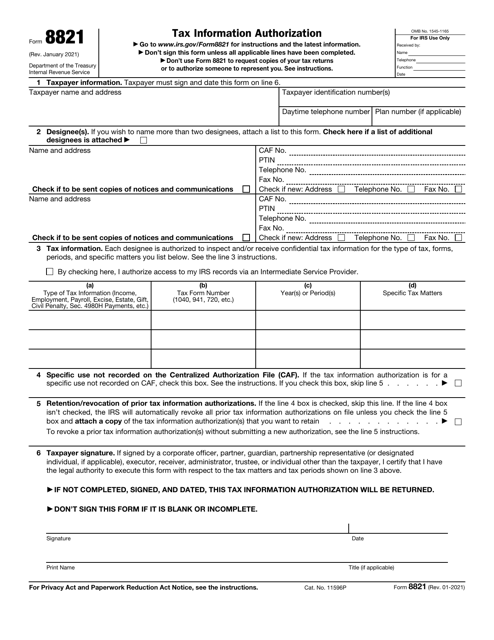

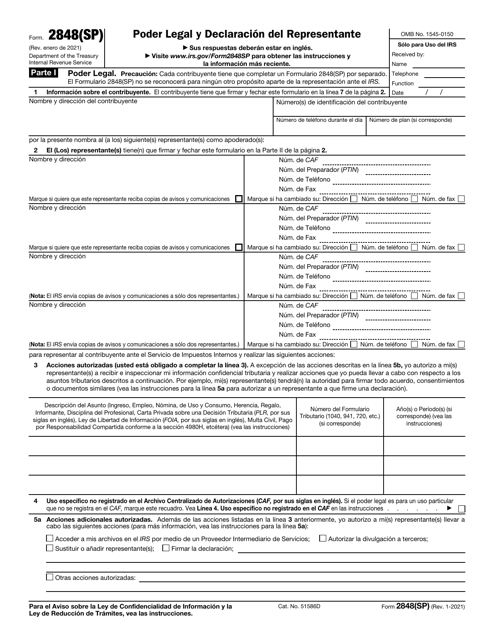

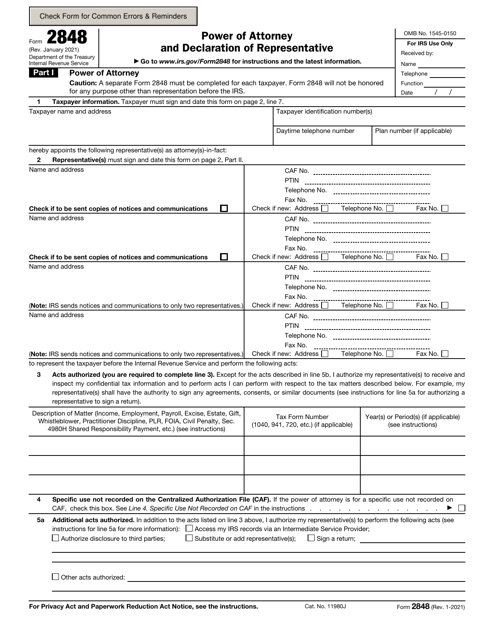

This is a formal document filled out by a taxpayer who wants another individual or company to obtain access to their tax information.

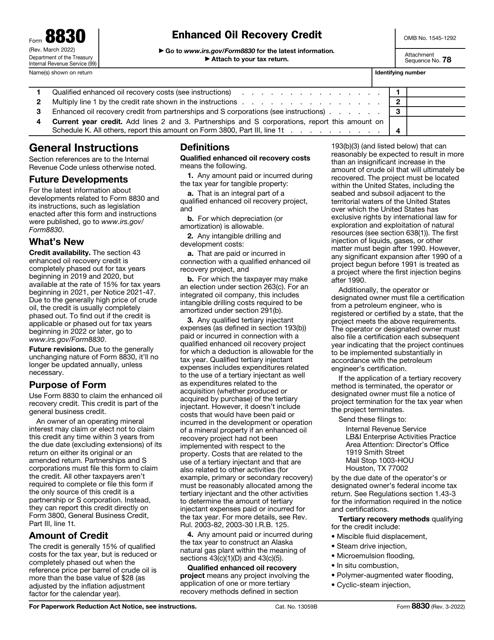

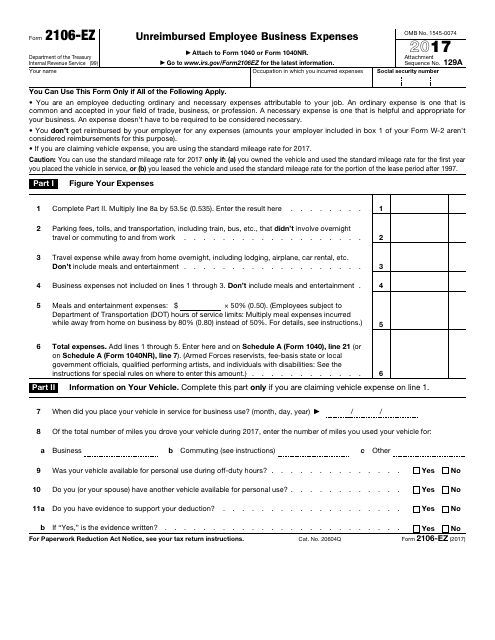

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

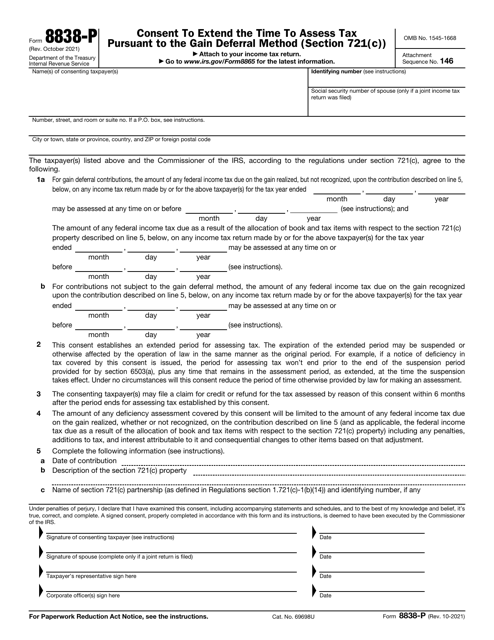

This is a formal statement used by a taxpayer to entrust their representative to perform specific actions in their name.

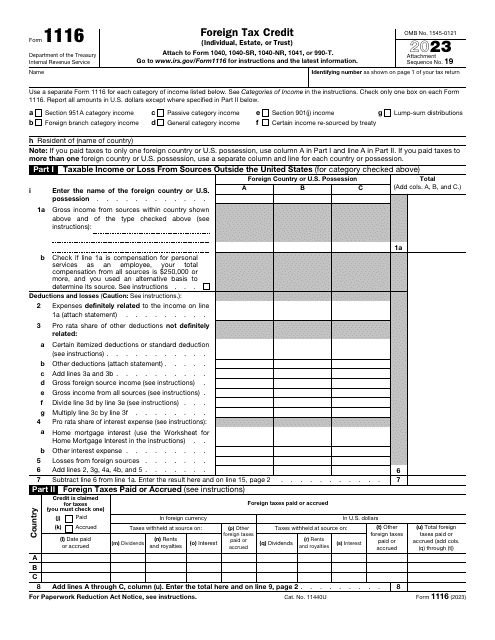

This is a formal document that allows American taxpayers that reside, work, and manage businesses overseas to lower the amount of tax they owe to the U.S. government.