Fill and Sign United States Legal Forms

Documents:

235709

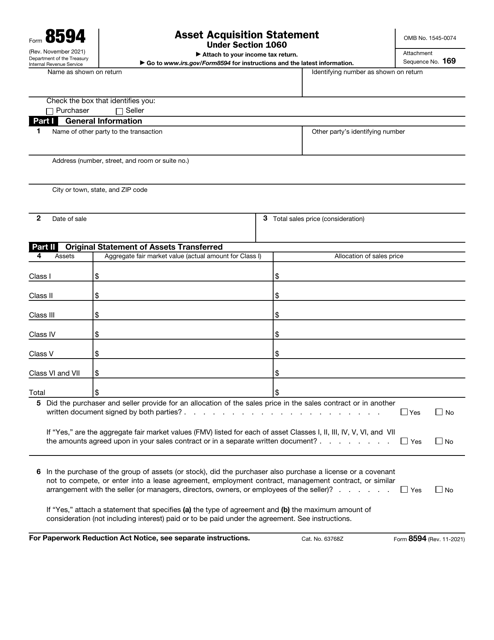

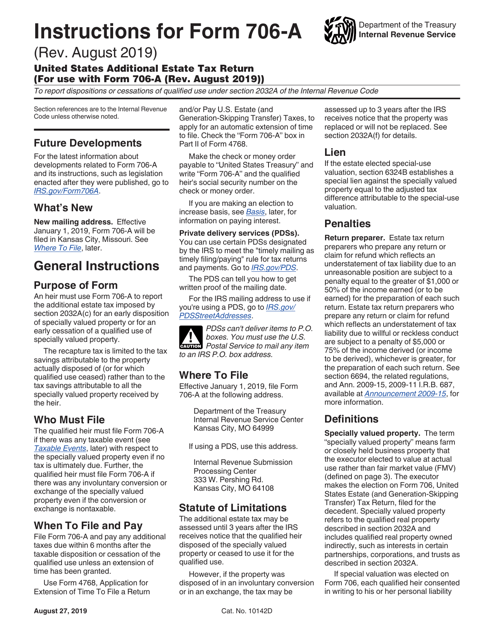

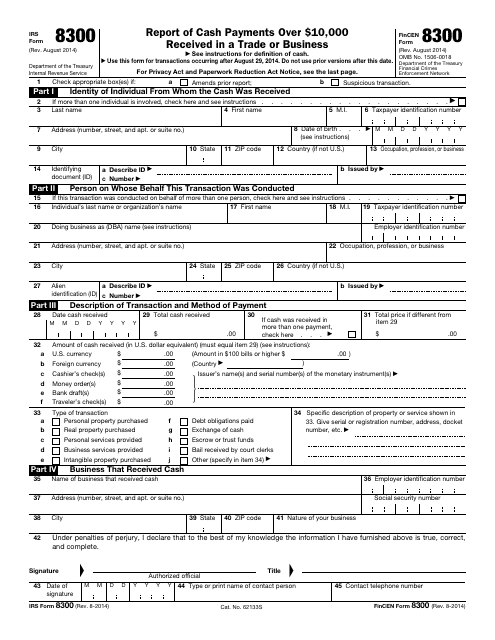

This is a fiscal form designed for taxpayers that carried out a sale of assets used for a business or trade.

This type of document provides instructions for completing Schedule C and providing additional information for filers of Schedule M-3 on IRS Form 1065.

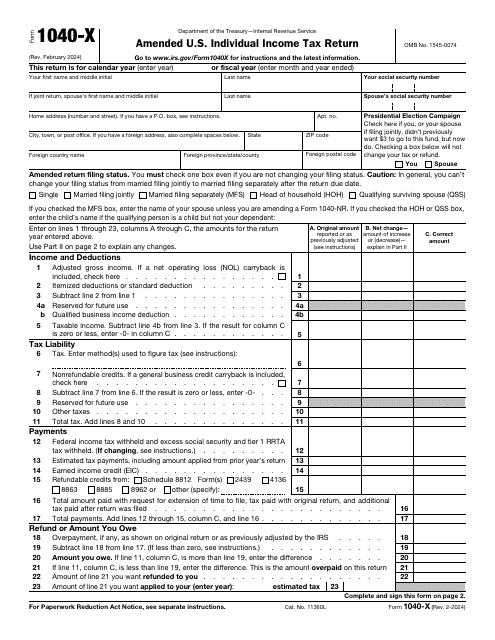

This document is used for correcting records on your tax return form. A separate form is used every year for which information is changed. Do not submit this document to request a refund of interest and penalties, or addition to the tax you have already paid.

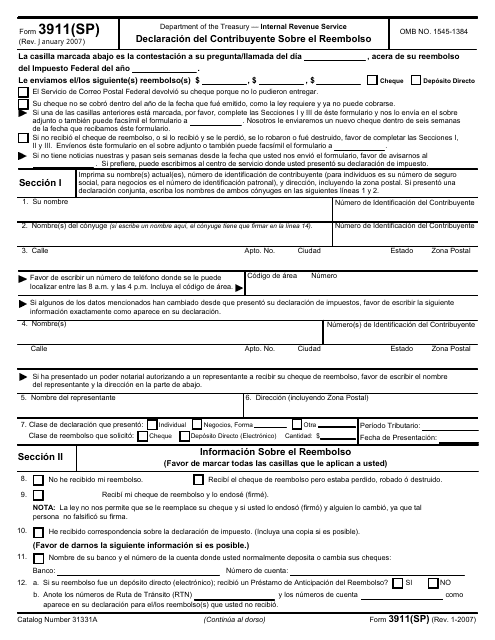

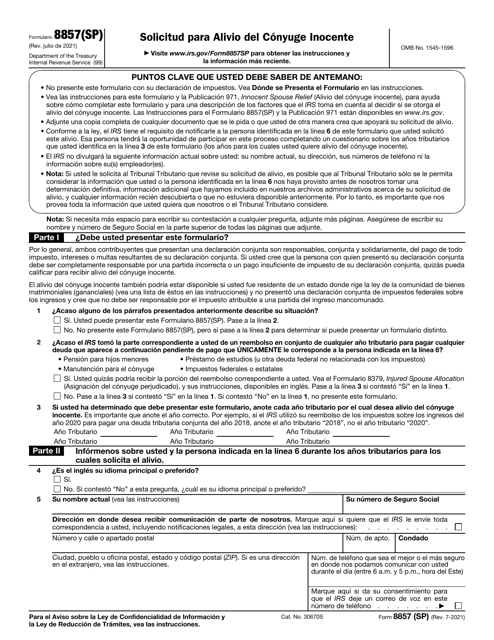

This Form is used for Spanish-speaking taxpayers to declare information about their refund with the IRS.

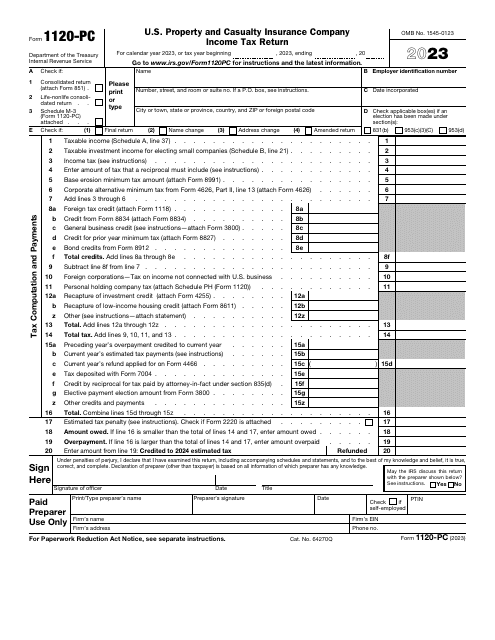

This form is filed by non-life insurance companies wishing to inform the Internal Revenue Service (IRS) of their income, deductions, and credits, as well as to figure their income tax liability.

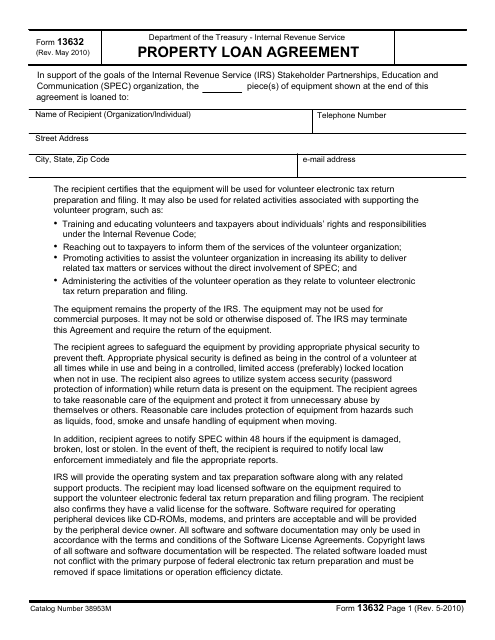

This document is used for property loan agreements with the Internal Revenue Service (IRS).

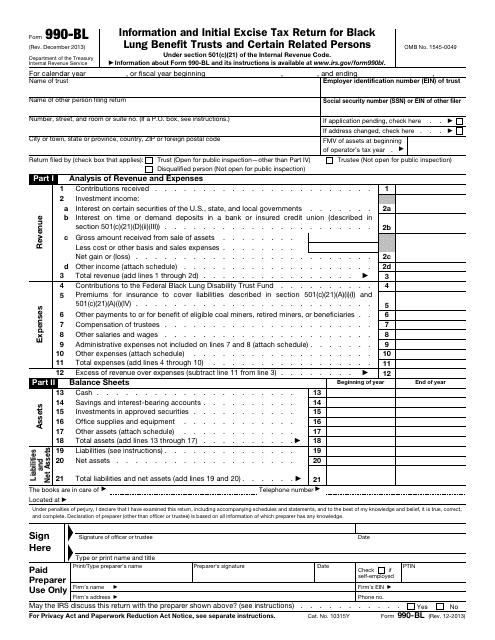

This Form is used for reporting information and paying initial excise tax by Black Lung Benefit Trusts and certain related persons.

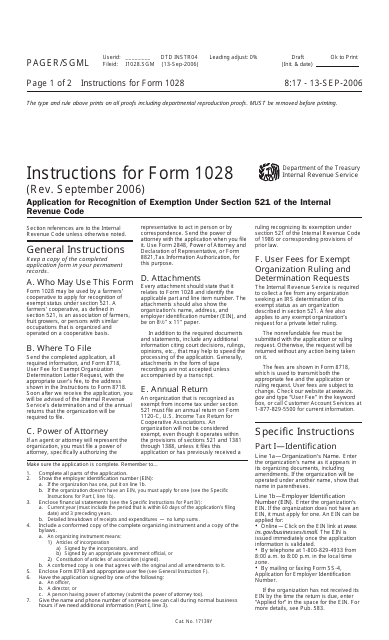

This form is used for applying for recognition of exemption under section 521 of the Internal Revenue Code. It is specifically for organizations seeking tax-exempt status as a farmers' cooperative. The form provides instructions on how to accurately complete and submit the application to the IRS.

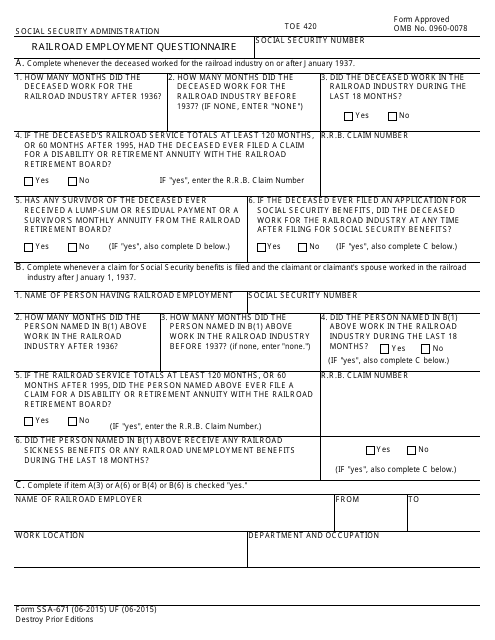

This form is used for gathering information regarding an individual's employment in the railroad industry. It helps determine eligibility for certain Social Security benefits.

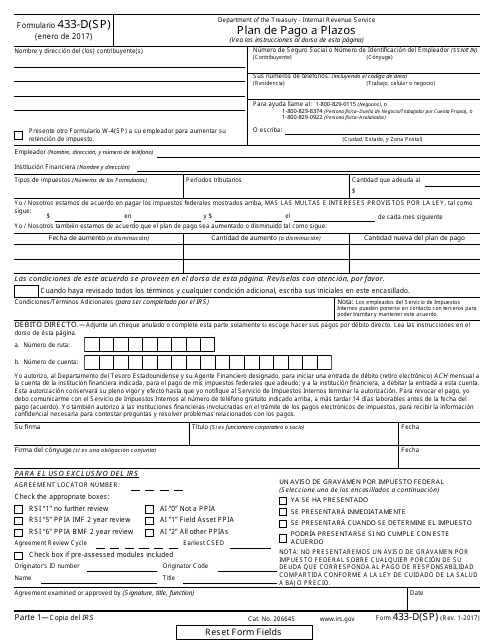

This Form is used for setting up a payment plan with the IRS in Spanish.

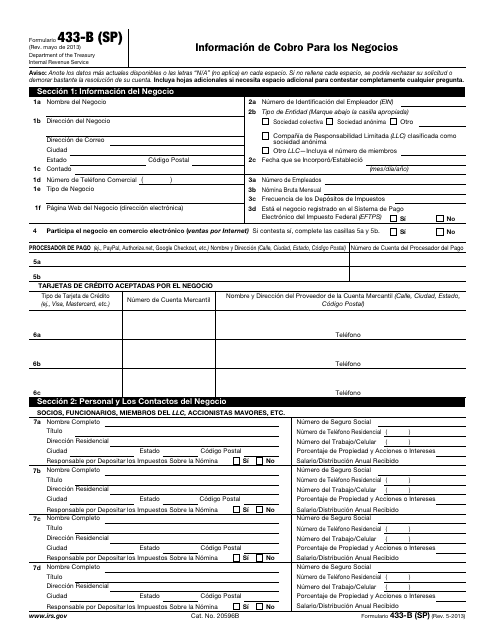

This form is used for businesses to provide information about their collection activity to the IRS. (Note: The description is in Spanish)

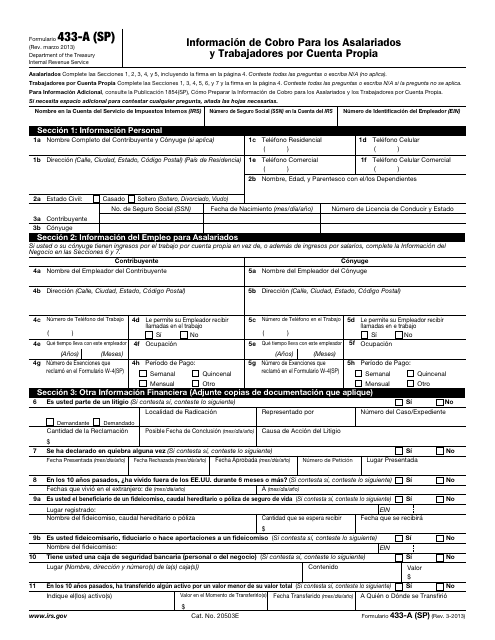

This document provides information for employees and self-employed individuals on payment collection.

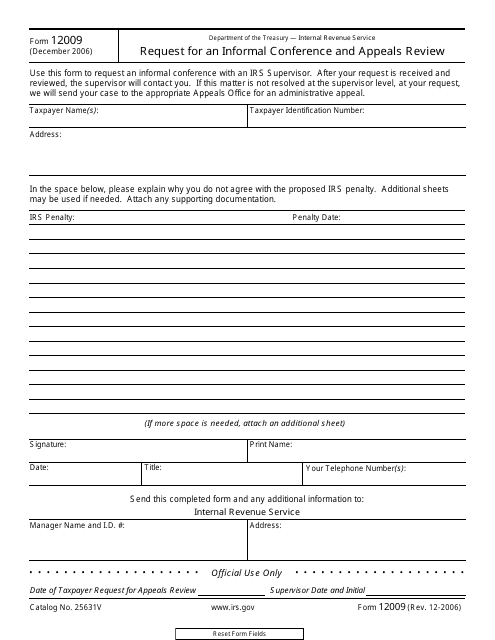

This form is used to request an informal conference and appeals review with the IRS. It provides a way for taxpayers to resolve their tax disputes in a more informal setting.

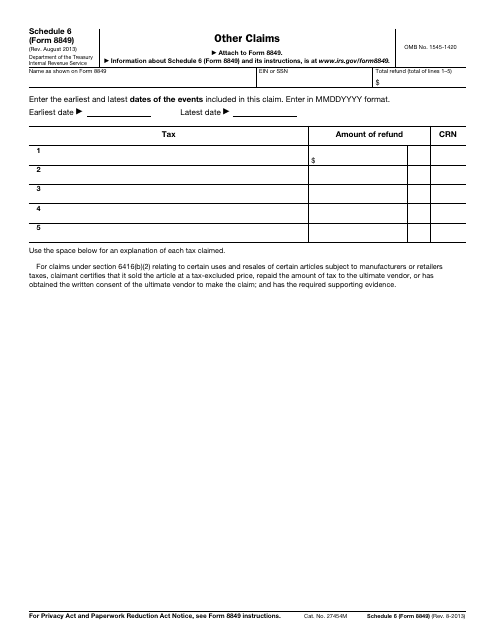

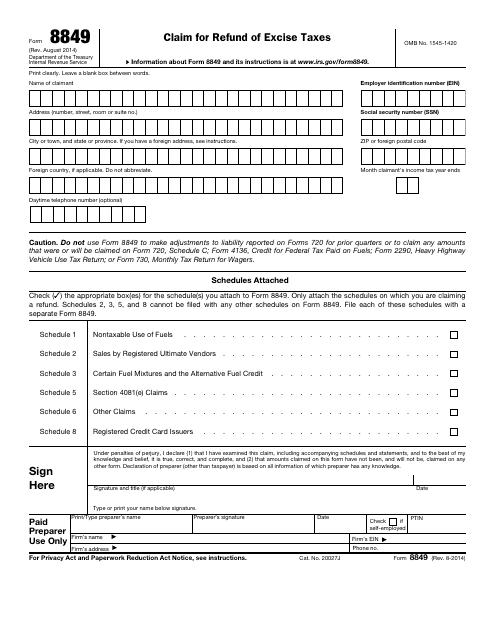

This Form is used for making other claims such as refunds for certain fuel-related taxes paid in error or excessive amounts.

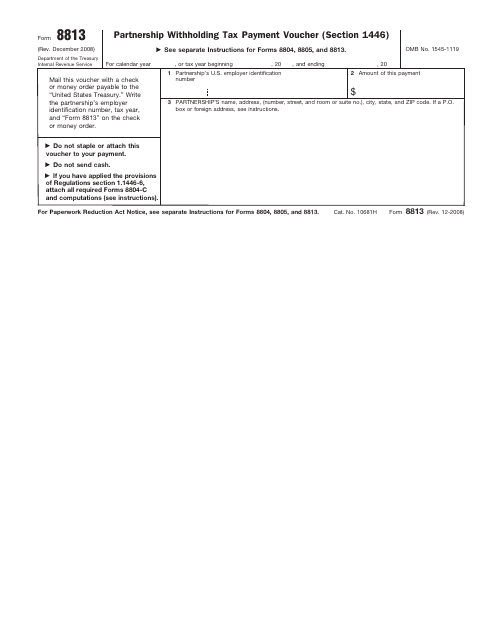

This form is used for making tax payments by partnerships to comply with Section 1446 of the Internal Revenue Code.