Certified Payroll Forms and Templates

Certified Payroll Forms are used for reporting the wages and benefits paid to employees by contractors or subcontractors working on government-funded construction projects. These forms help ensure that workers are being paid the correct prevailing wage rates as required by law. The forms provide documentation of the hours worked, wages earned, deductions withheld, and other relevant information for each employee on the project. This helps ensure compliance with prevailing wage laws and allows for better oversight and transparency in government construction projects.

Documents:

4

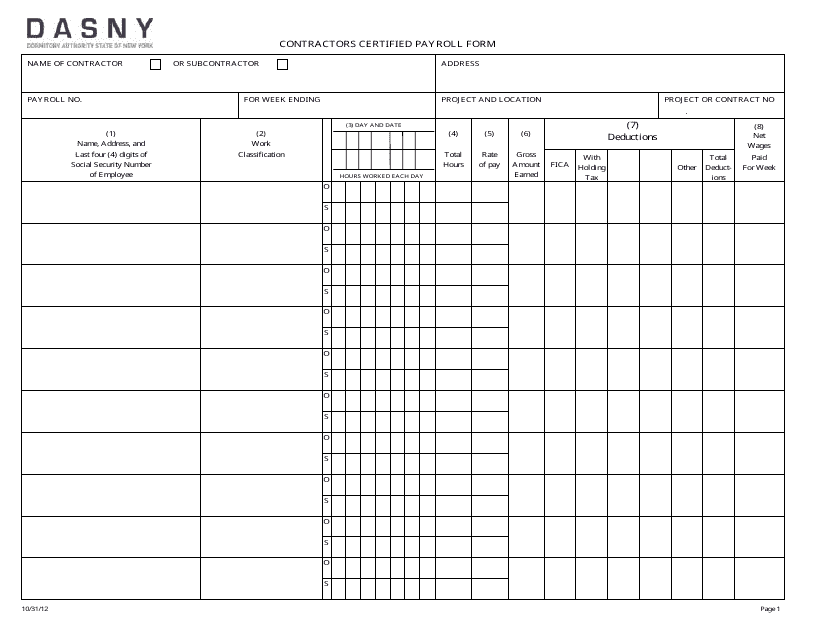

This form is used for contractors to submit certified payroll information to the Dormitory Authority of the State of New York (DASNY) for construction projects.

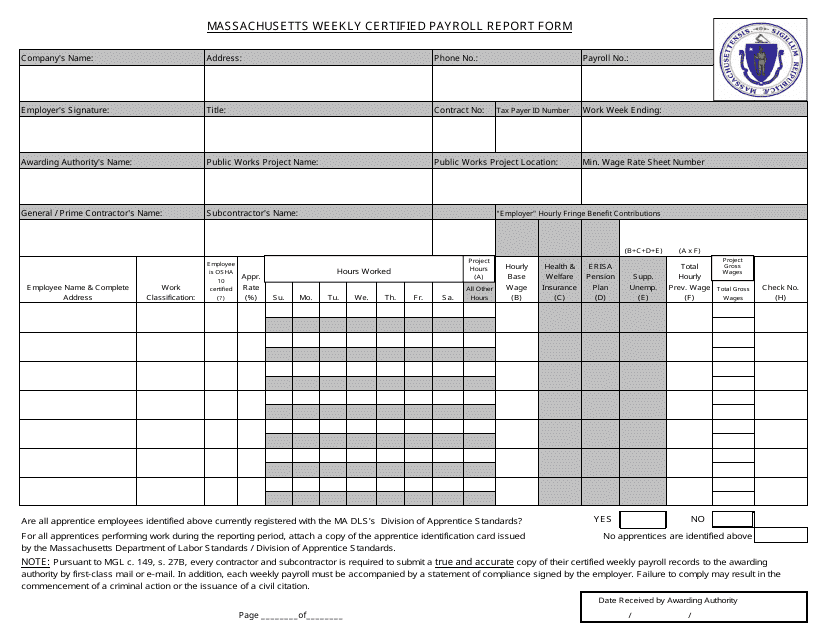

This form is used for reporting the weekly certified payroll in the state of Massachusetts. It is required for construction contractors to show details about the employees, wages, and hours worked on public works projects.

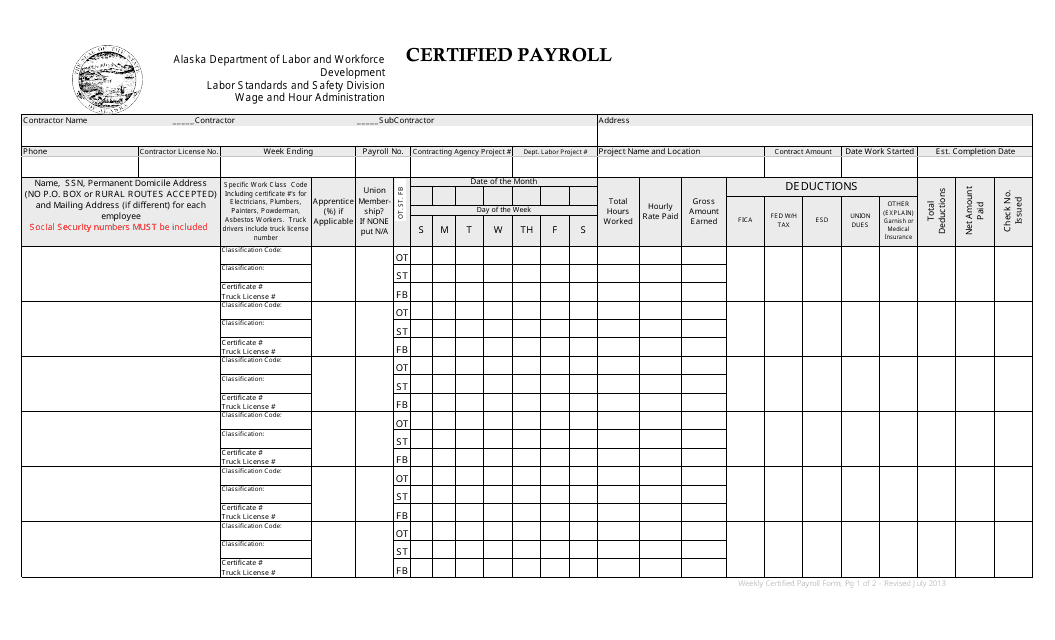

This Form is used for reporting certified payroll information in Alaska. It helps ensure compliance with prevailing wage laws and ensures that workers are being paid correctly.

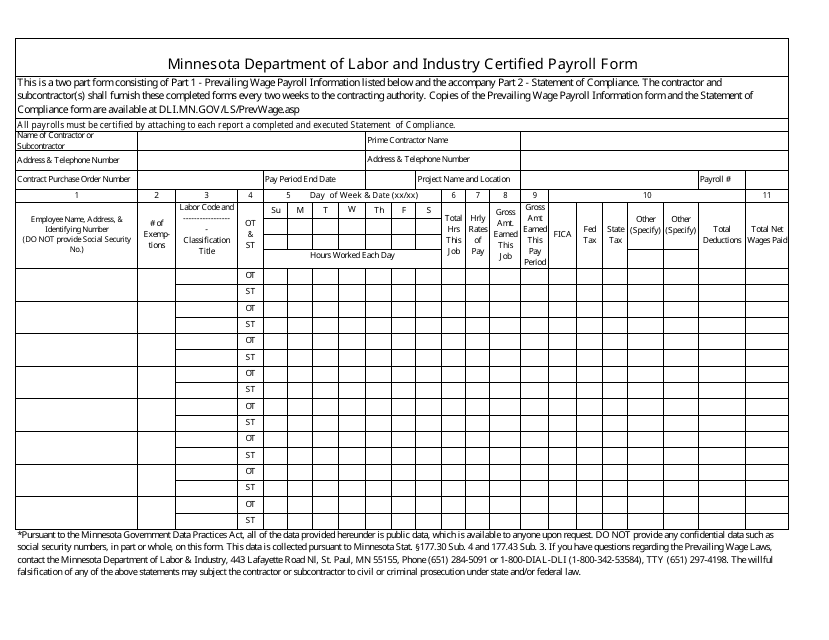

This Form is used for certified payroll reporting in the state of Minnesota. It helps ensure that contractors and subcontractors on public works projects comply with prevailing wage laws.