Personal Tax Form Templates

Documents:

32

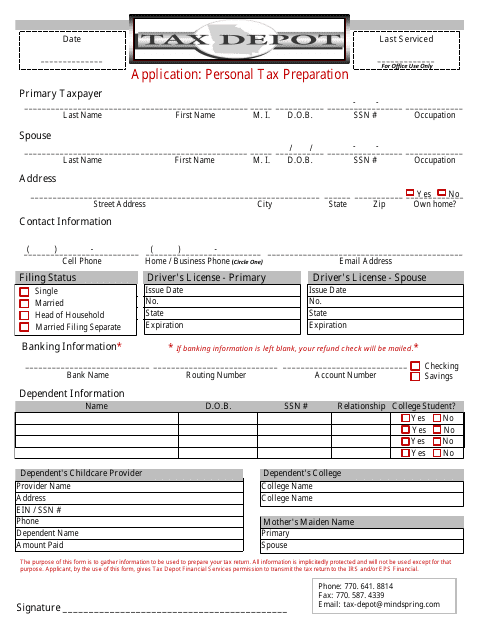

This Form is used for applying for a personal tax preparation application through Tax Depot.

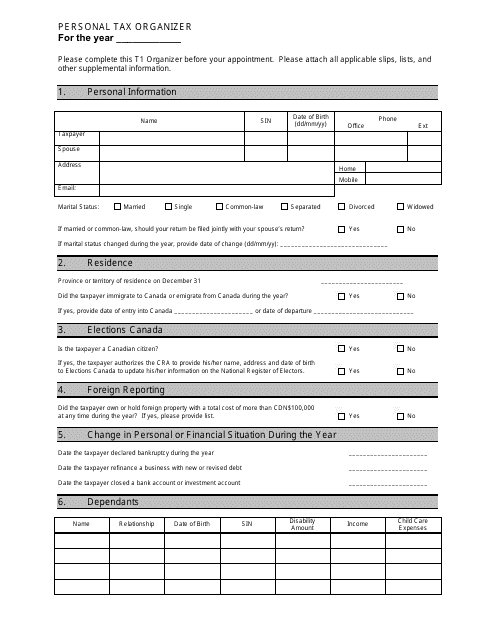

This document is a template that helps individuals organize their personal tax information for filing taxes. It provides sections to record income, expenses, deductions, and other relevant details. Using this template can help simplify the tax filing process.

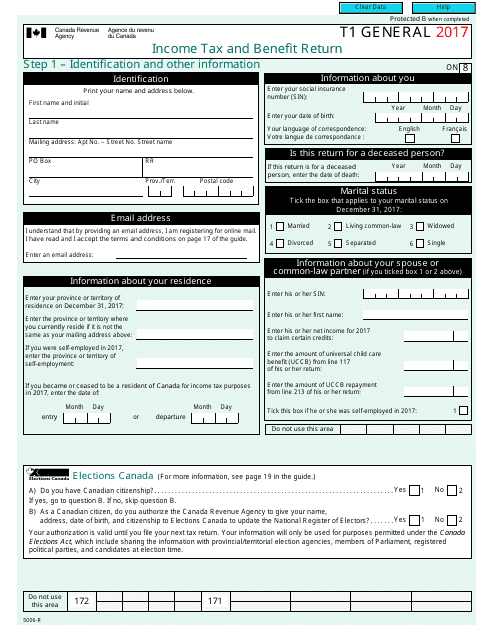

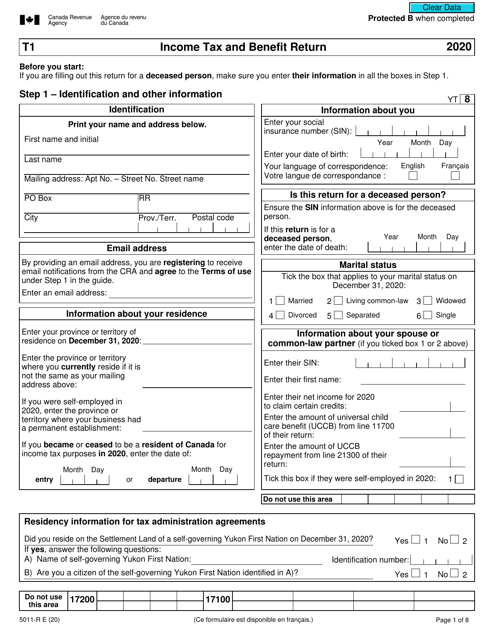

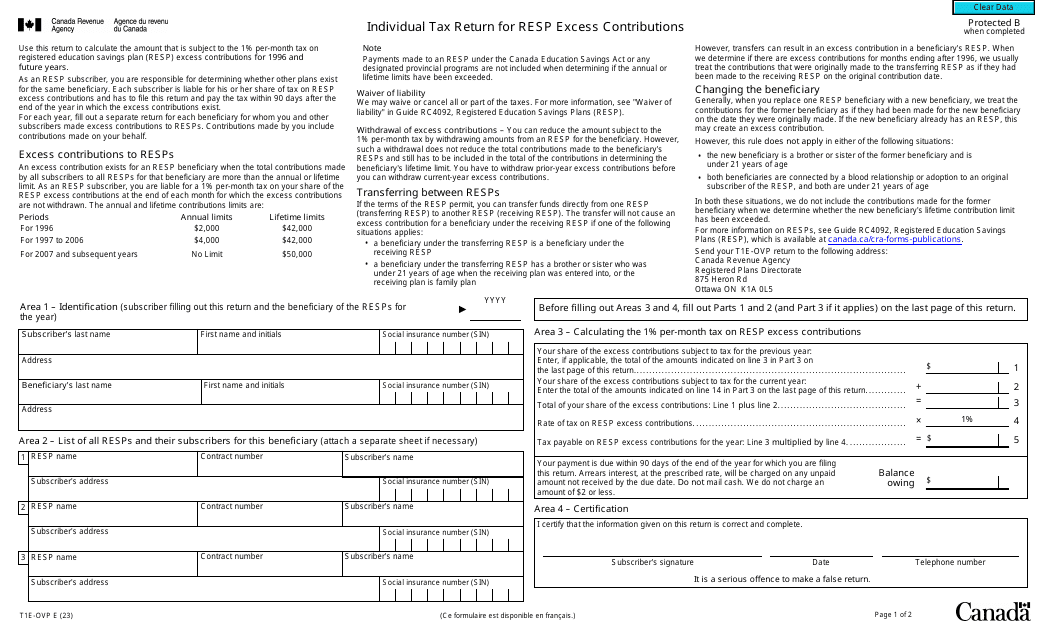

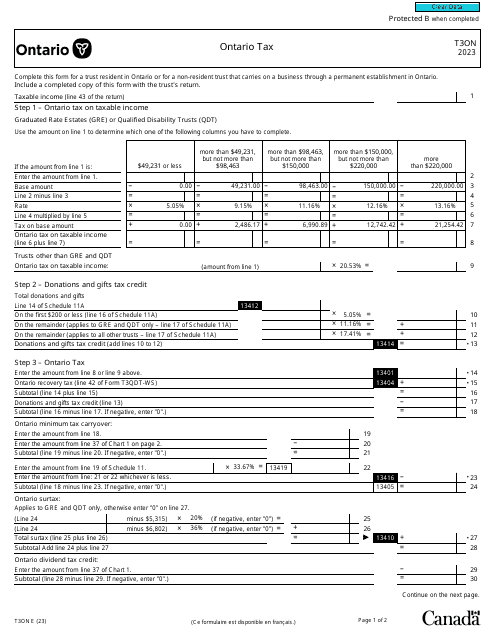

Canadian residents may use this official statement to report their income tax and list all sources of their personal income.

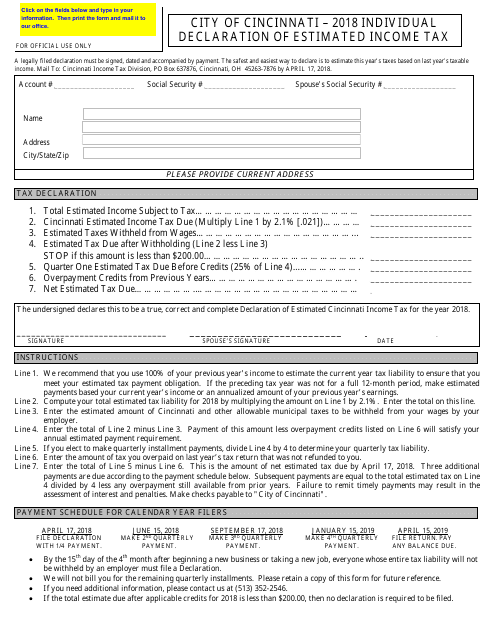

This document is used for individuals to declare their estimated income tax in the City of Cincinnati, Ohio. It is used to estimate and pay the amount of income tax owed to the city throughout the year.

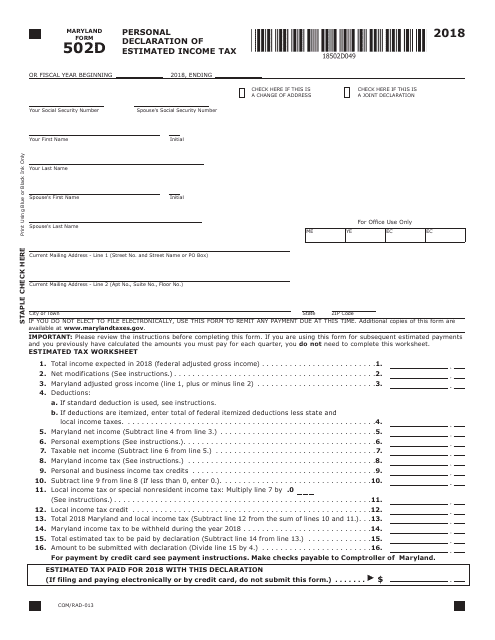

This form is used for residents of Maryland to declare their estimated income tax for the year. It allows individuals to calculate and submit their projected income tax liability to the state.

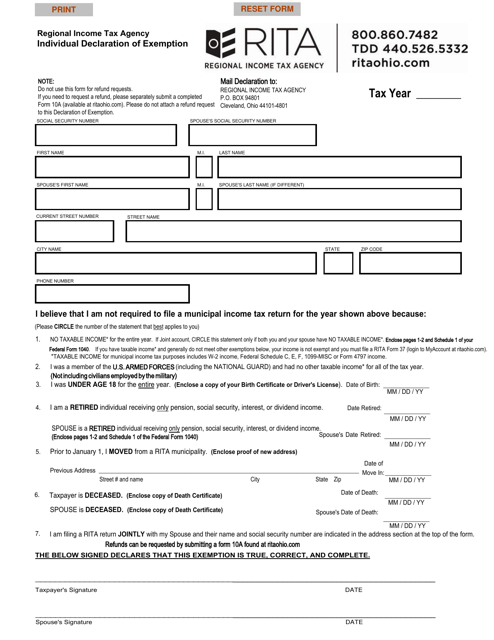

This document is used for individuals in Ohio to declare their exemption from certain taxes or fees. It allows individuals to claim exemptions for specific reasons such as religious beliefs or certain types of income.

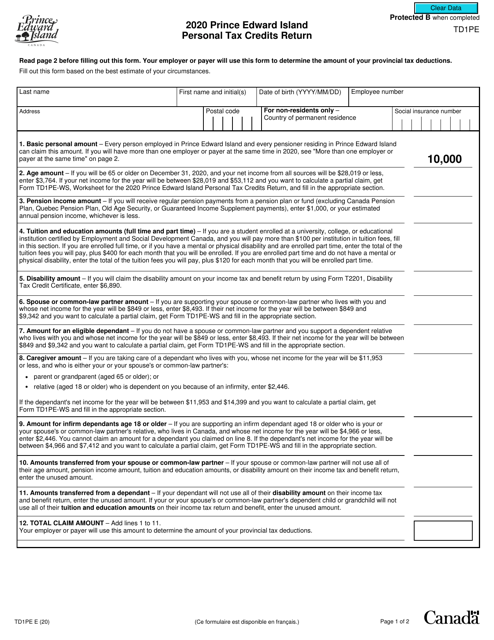

This Form is used for claiming personal tax credits in Prince Edward Island, Canada. It helps individuals calculate the amount of tax they can reduce from their income.

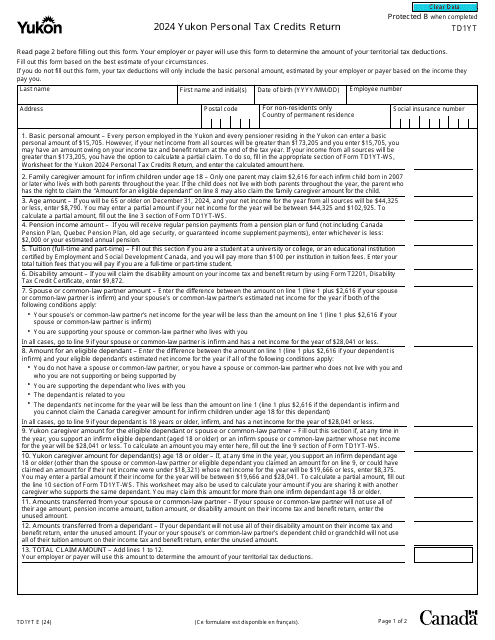

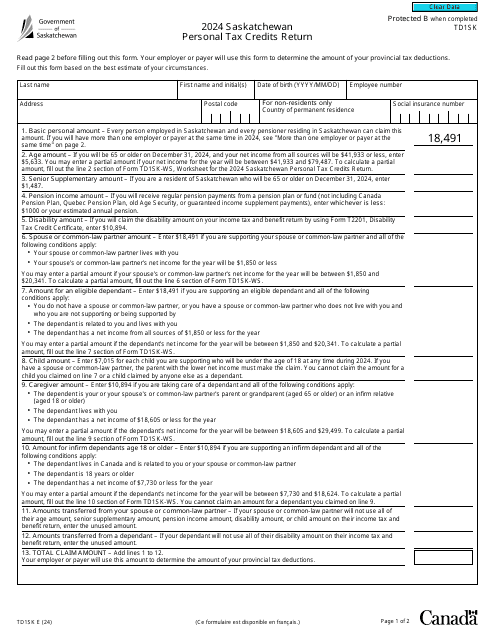

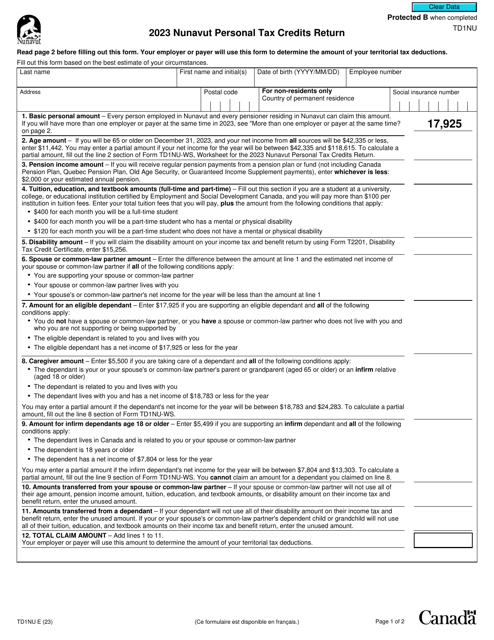

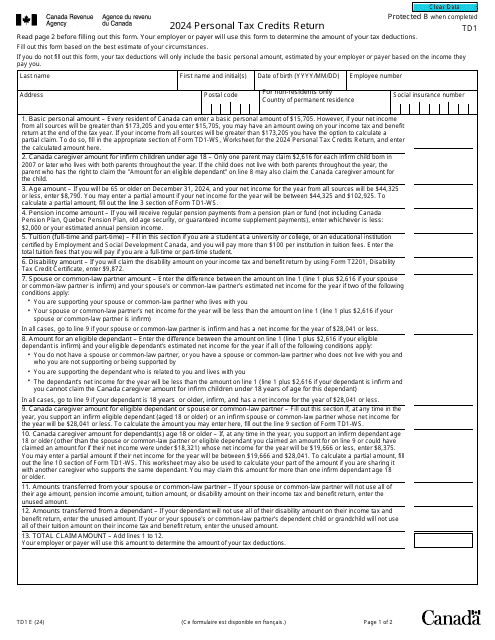

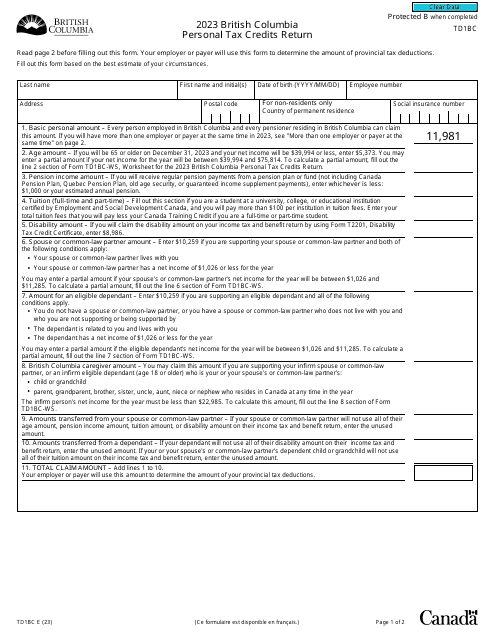

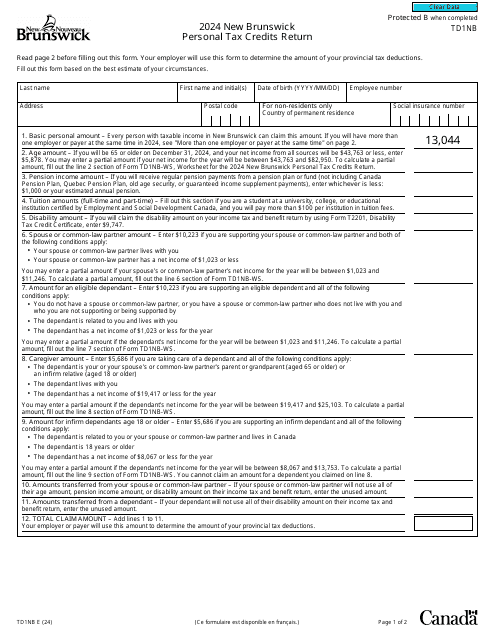

The purpose of this document is to provide a taxpayer's employer with all of the necessary information so that they will be able to determine the number of tax deductions for the Canadian taxpayer.

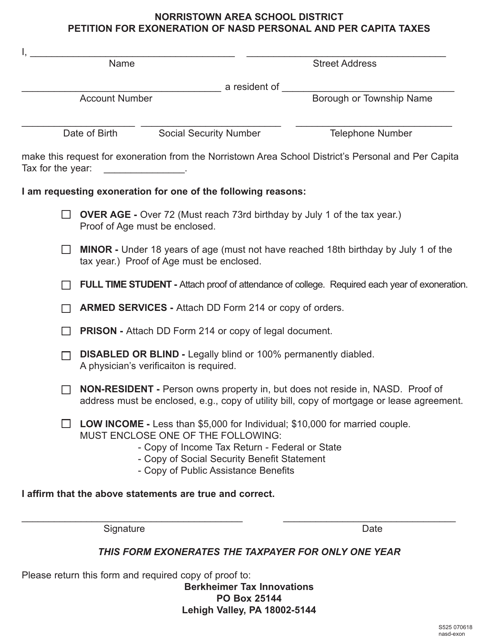

This form is used for petitioning for the exoneration of NASD personal and per capita taxes in the Norristown Area School District, Pennsylvania.

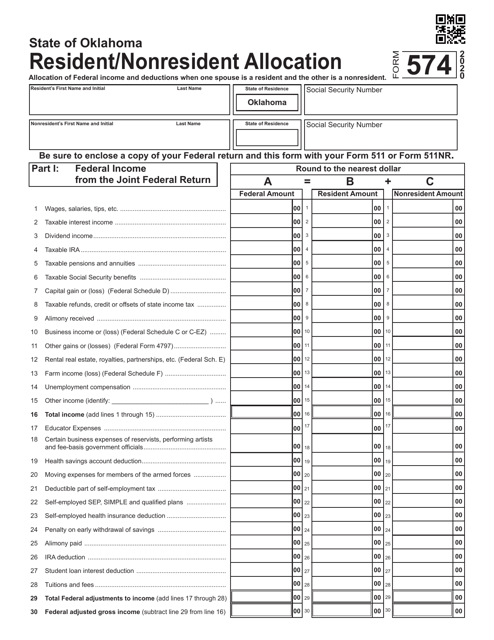

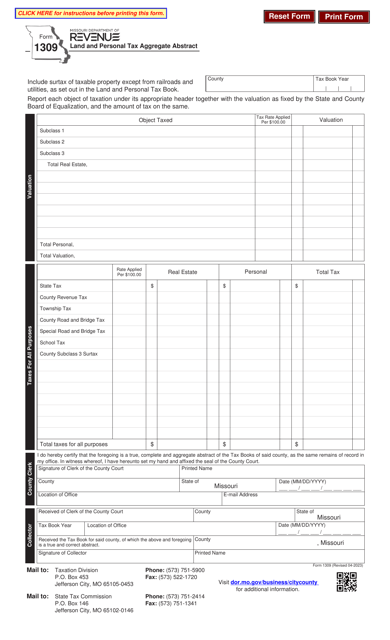

This form is used for aggregating land and personal tax information in the state of Missouri.

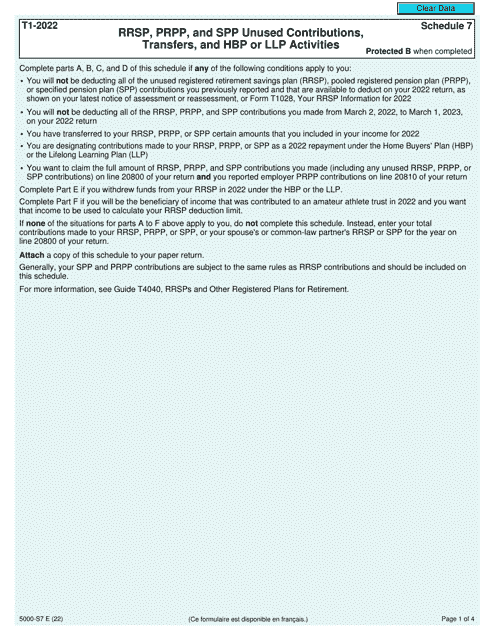

This form is used for reporting unused contributions, transfers, and activities related to RRSP, PRPP, and SPP in Canada.

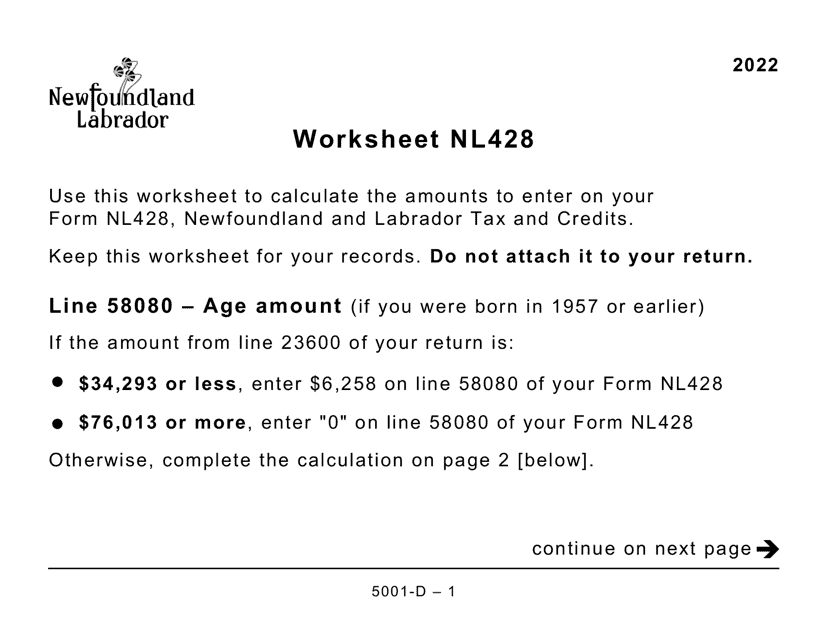

This Form is used for completing the Worksheet NL428 for residents of Newfoundland and Labrador in Canada. It is designed in large print format to assist those with visual impairments.