Tax Exempt Form Templates

Documents:

1303

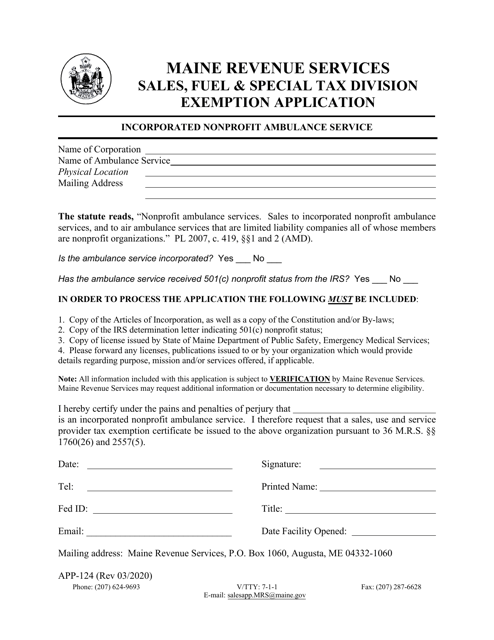

This form is used for applying for an exemption for an incorporated nonprofit ambulance service in the state of Maine.

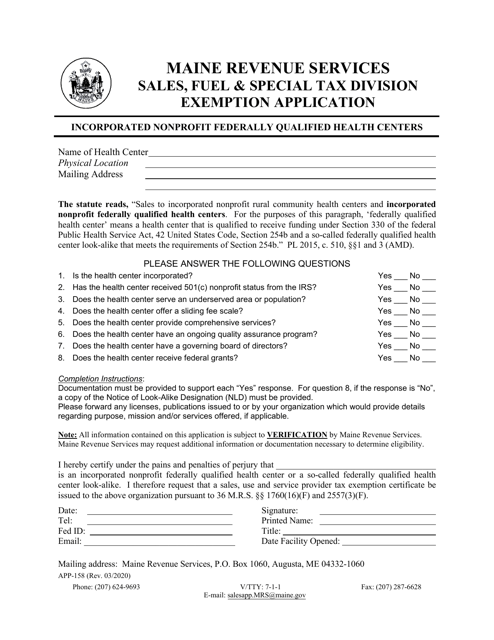

Form APP-158 Incorporated Nonprofit Federally Qualified Health Centers Exemption Application - Maine

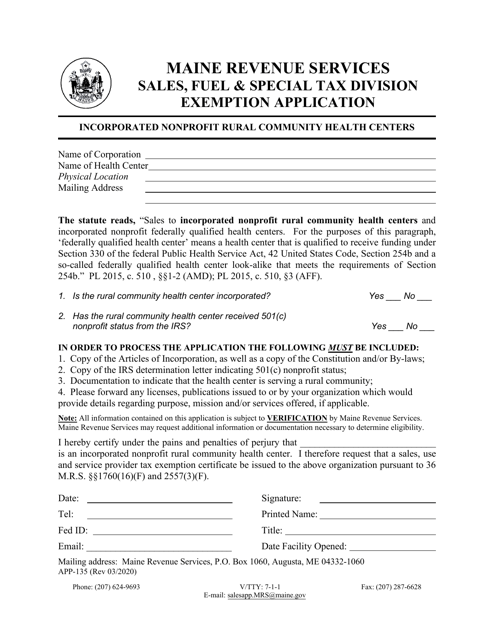

This form is used for applying for a tax exemption for incorporated nonprofit rural community health centers in the state of Maine.

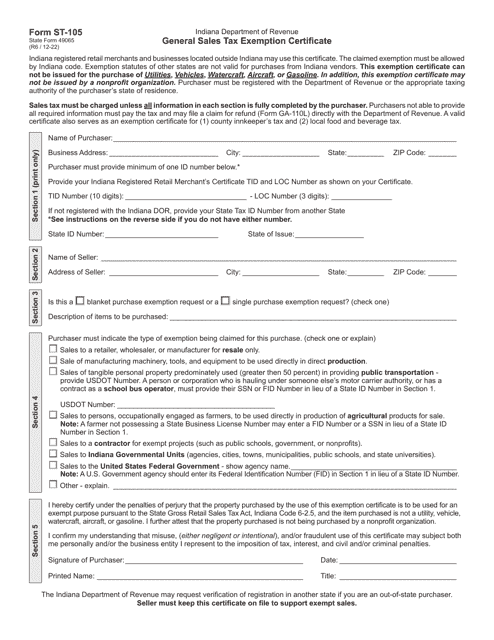

This form is used for claiming a general sales tax exemption in the state of Indiana. It is also known as State Form 49065.

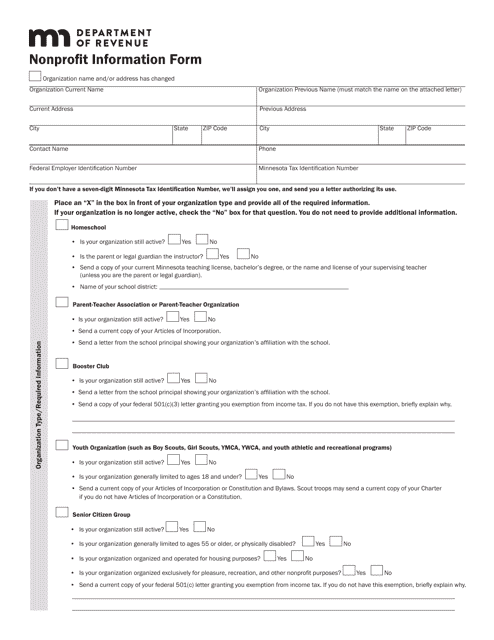

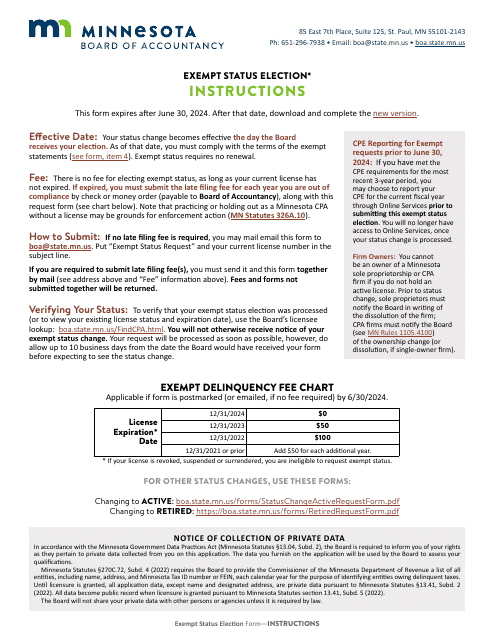

This form is used for collecting information about nonprofit organizations in the state of Minnesota. It is a required document for nonprofits to provide relevant information to the authorities.

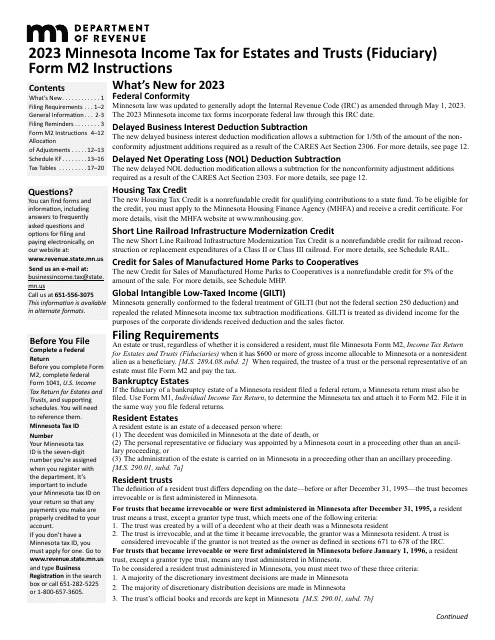

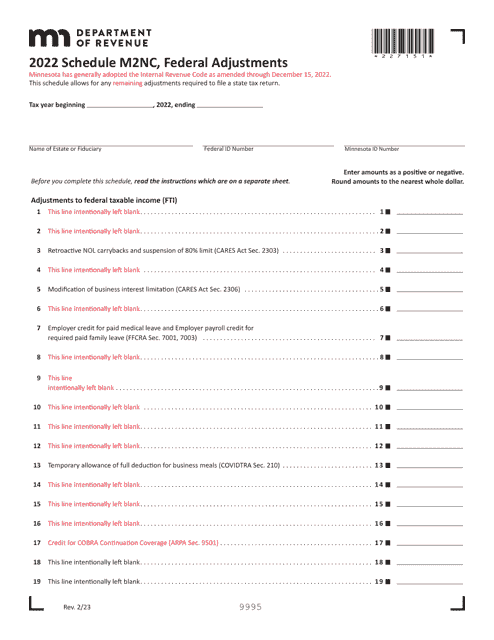

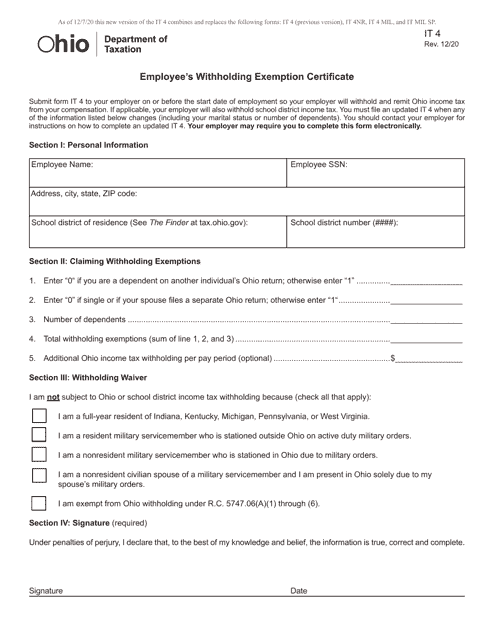

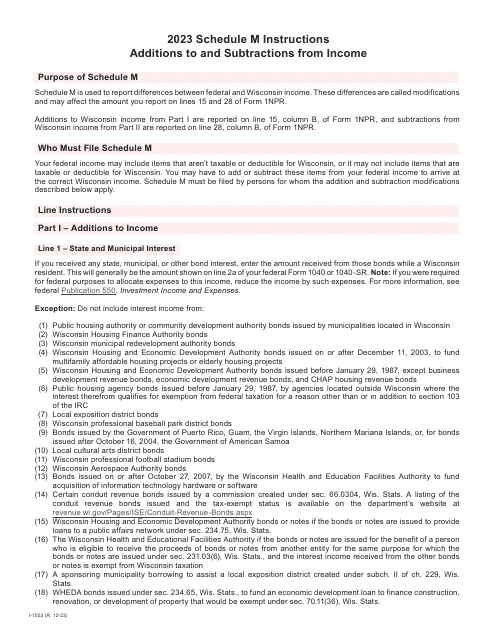

This document is used for reporting federal adjustments on your Minnesota state tax return. It helps ensure that you are accurately reporting your income and deductions for state tax purposes.

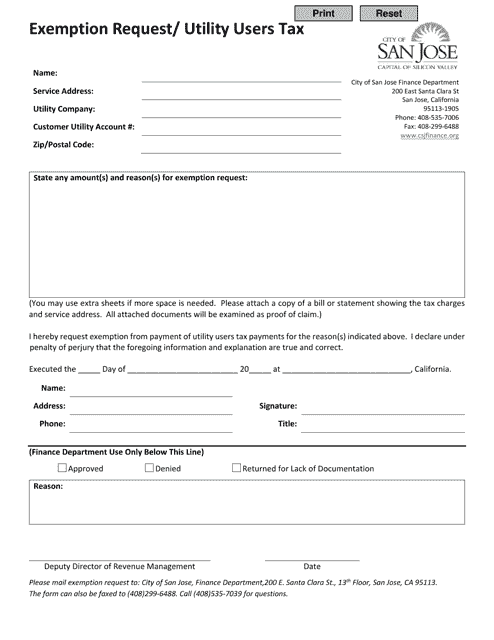

This document is an exemption request form for the Utility Users Tax in the City of San Jose, California. It is used to request exemption from paying the tax for utility usage.

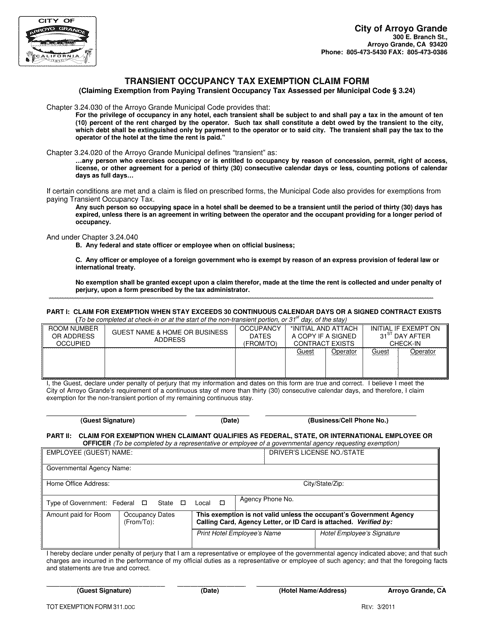

This form is used for claiming a tax exemption on transient occupancy in the City of Arroyo Grande, California.

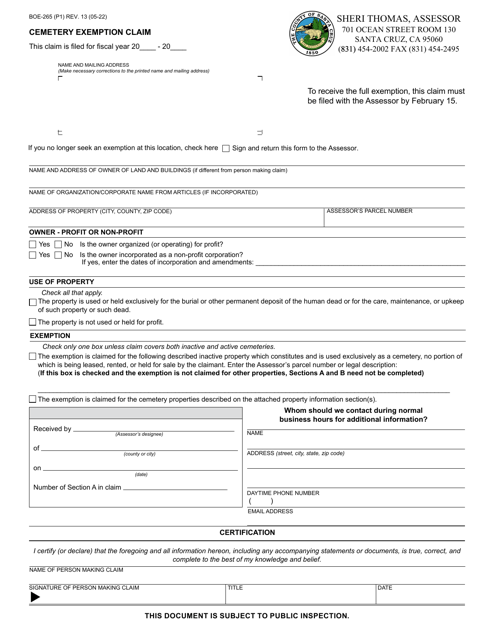

This form is used for claiming an exemption for cemetery properties in Santa Cruz County, California.

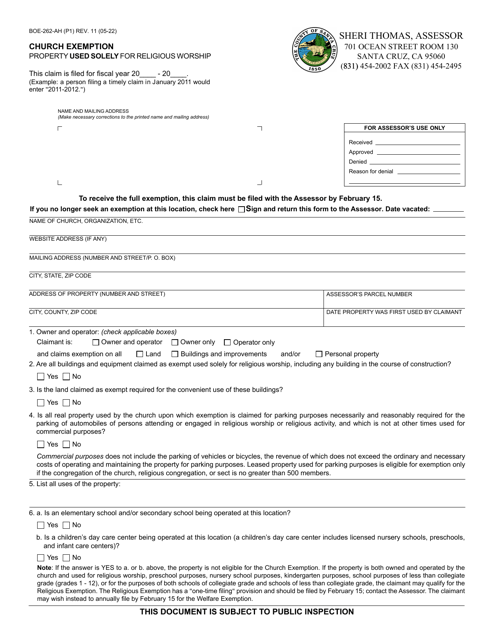

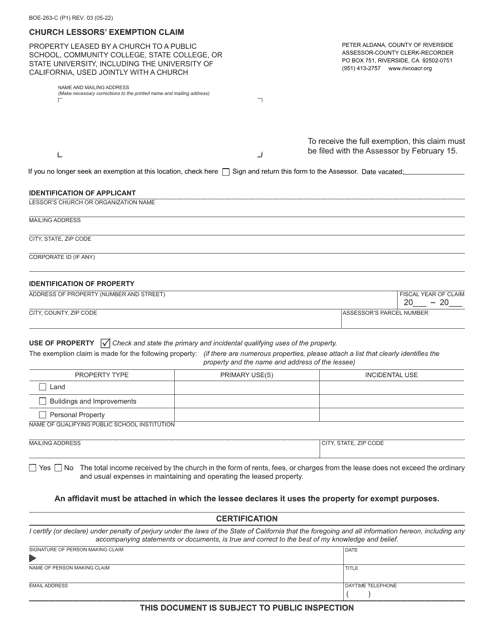

This Form is used for applying for a church exemption in Santa Cruz County, California.

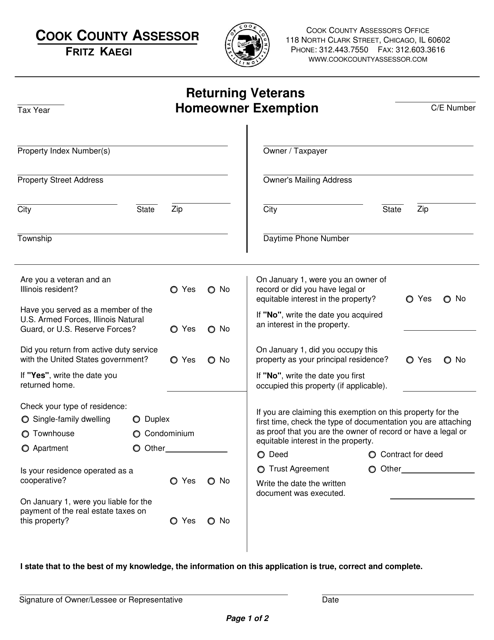

This document is used for claiming a tax exemption for returning veterans who own a home in Cook County, Illinois.

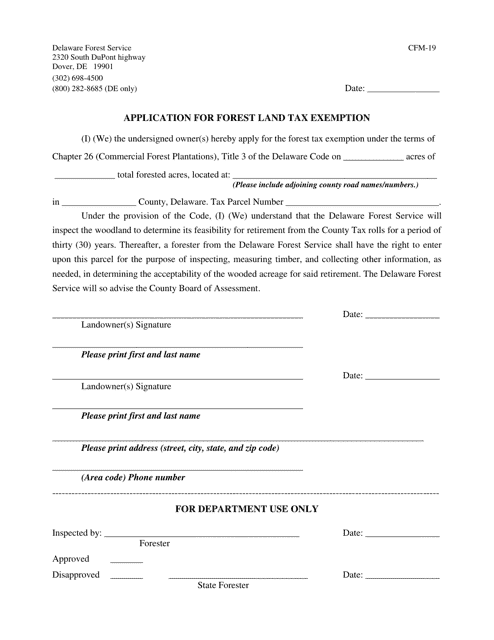

This Form is used for applying for a tax exemption on forest land in Delaware.

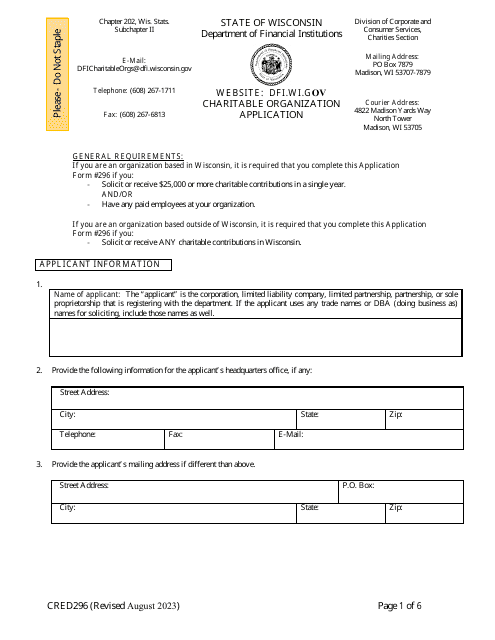

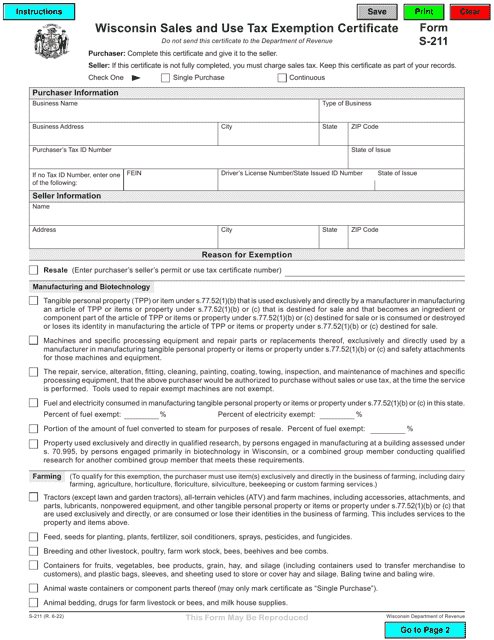

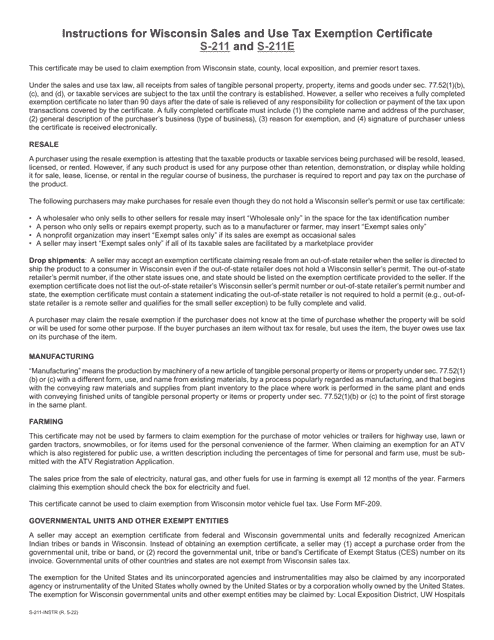

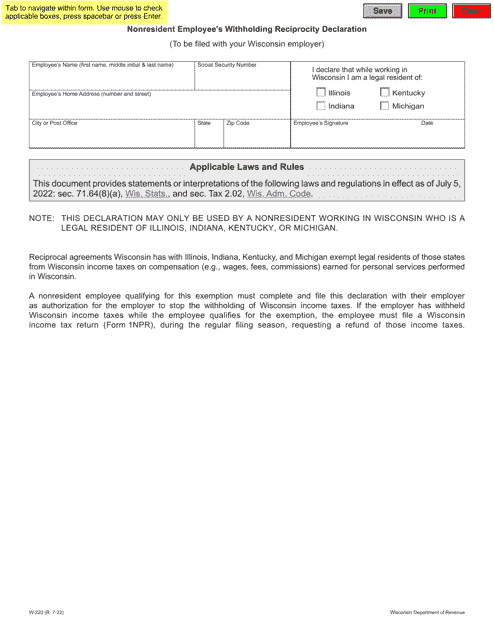

This Form is used for applying for Sales and Use Tax Exemption Certificate in Wisconsin.

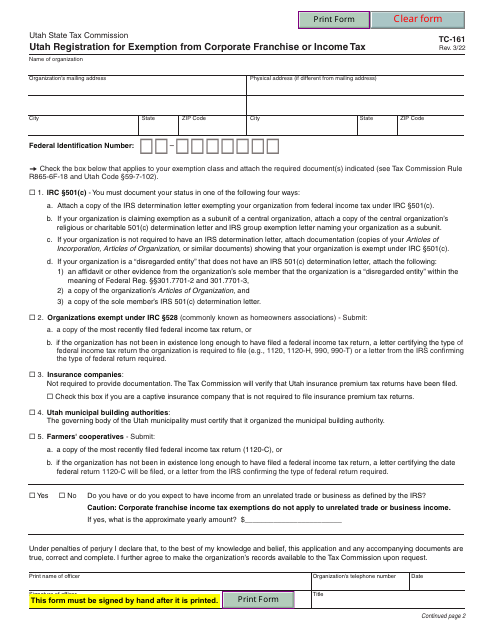

This form is used for registering for an exemption from corporate franchise or income tax in Utah.

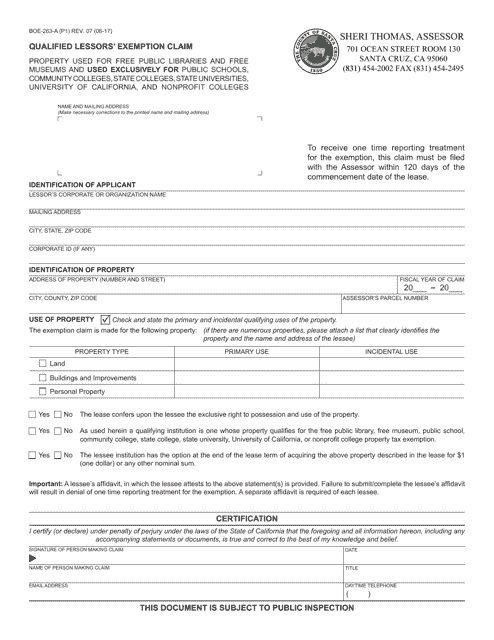

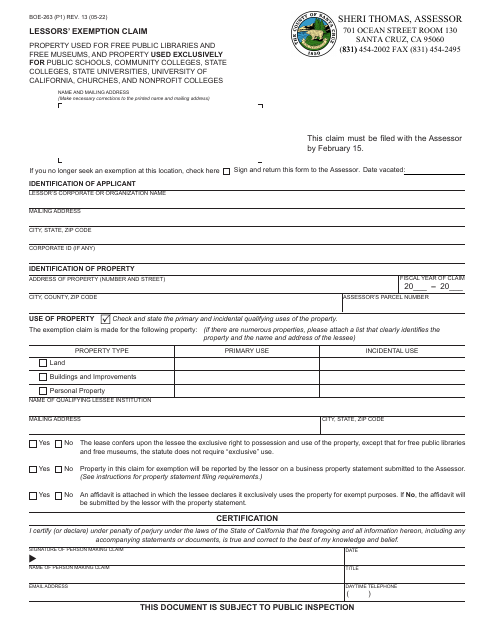

This form is used for qualified lessors in Santa Cruz County, California to claim an exemption. It is specific to property tax regulations.

This form is used for land or property owners in Santa Cruz County, California who want to apply for a tax exemption relating to leased or rented properties, as per regulations laid down by the County's Board of Equalization.

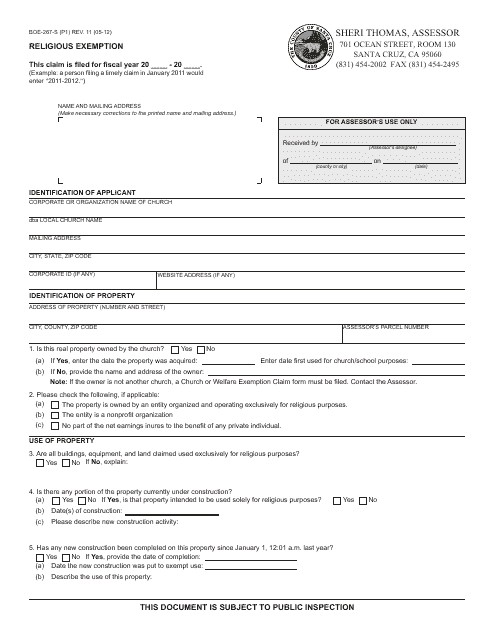

This form is used for applying for a religious exemption in Santa Cruz County, California.