U.S. Department of Labor - Employment & Training Administration Forms

The U.S. Department of Labor - Employment & Training Administration is responsible for overseeing employment and training programs and policies in the United States. They aim to help workers acquire the necessary skills and resources to find and maintain employment, and also provide support for employers in recruiting and retaining a skilled workforce.

Documents:

28

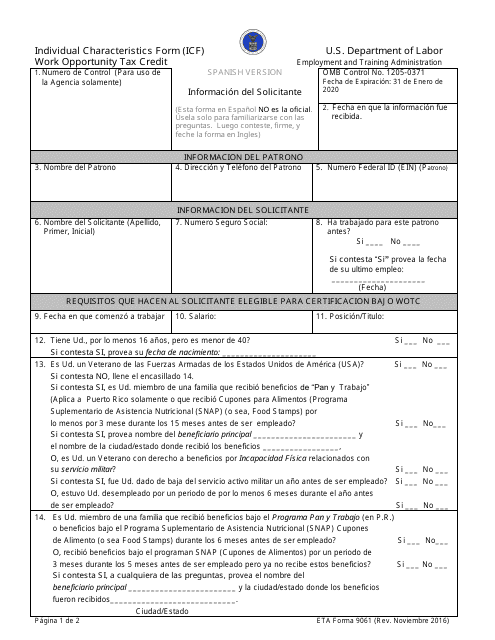

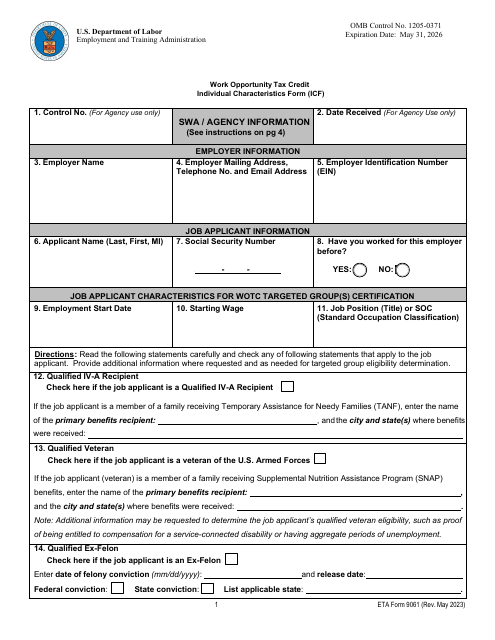

This Form is used for gathering individual characteristics necessary for claiming the Work Opportunity Tax Credit in Spanish-speaking contexts.

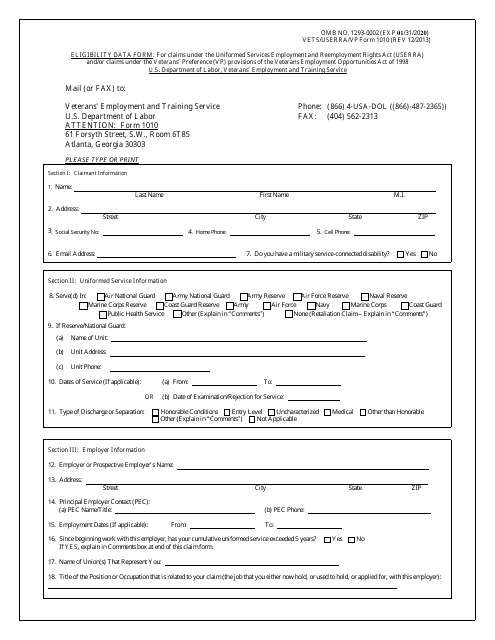

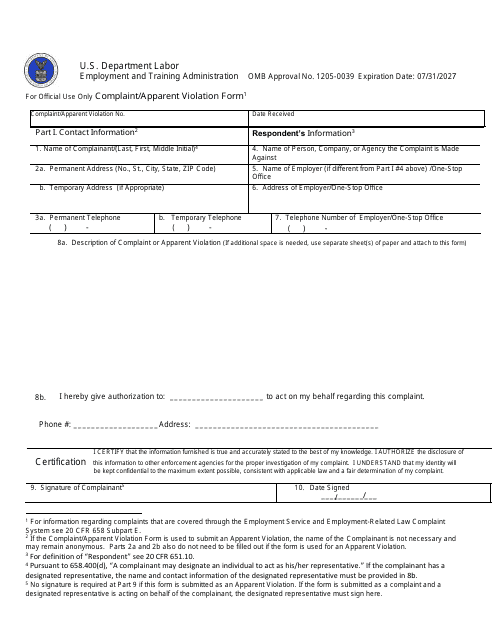

This Form is used for providing eligibility data for ETA programs and services.

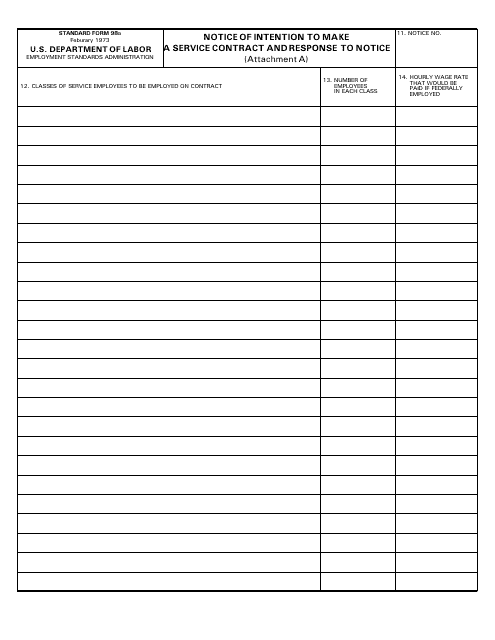

This document is used for notifying the intention to create a service contract and providing a response to the notice.

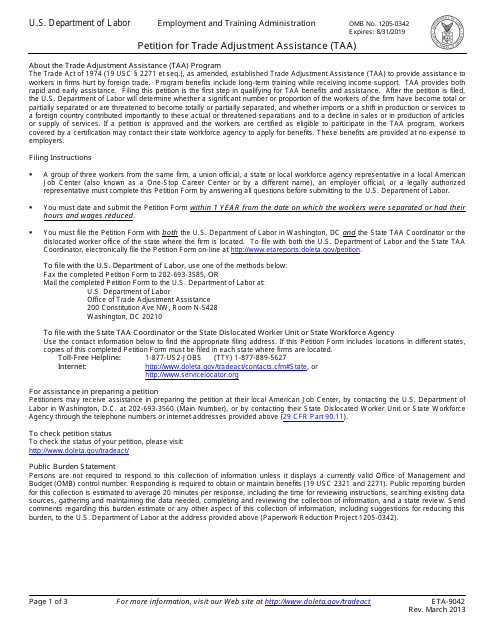

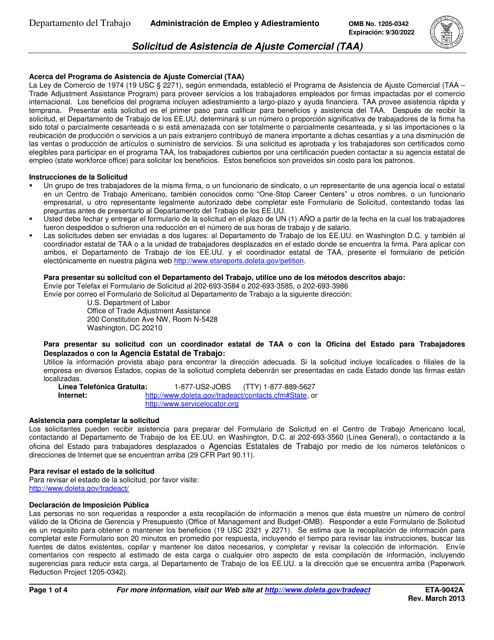

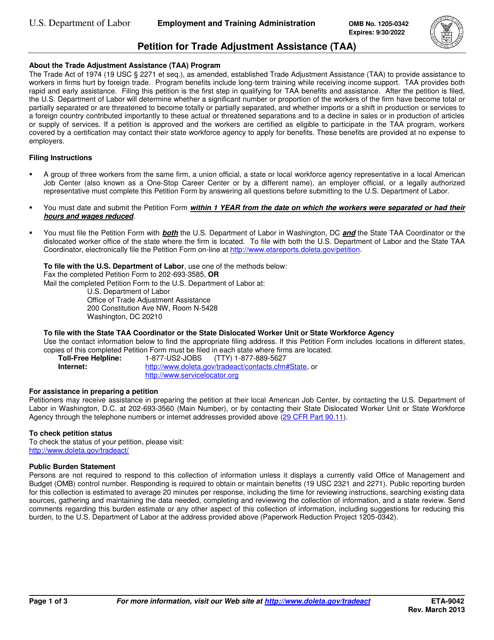

This Form is used for petitioning for Trade Adjustment Assistance (TAA).

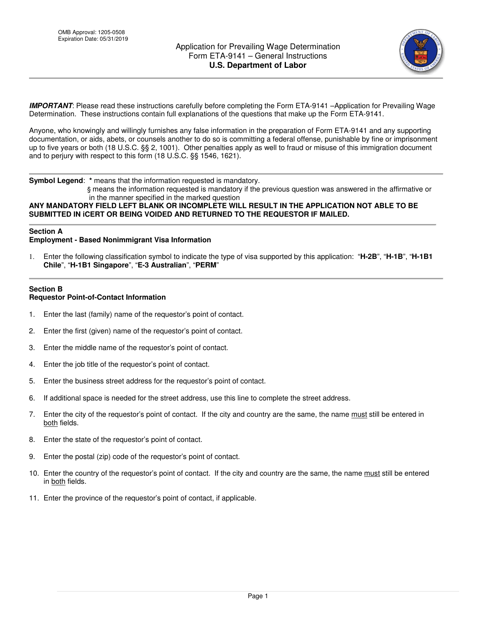

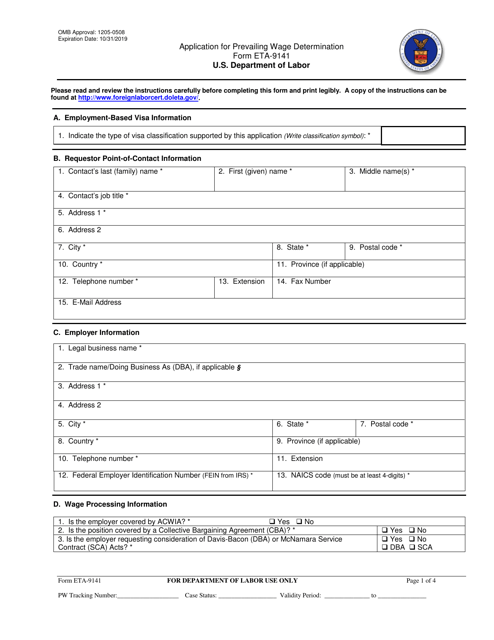

This Form is used for submitting an Application for Prevailing Wage Determination. It provides detailed instructions on how to fill out the form and submit it for review.

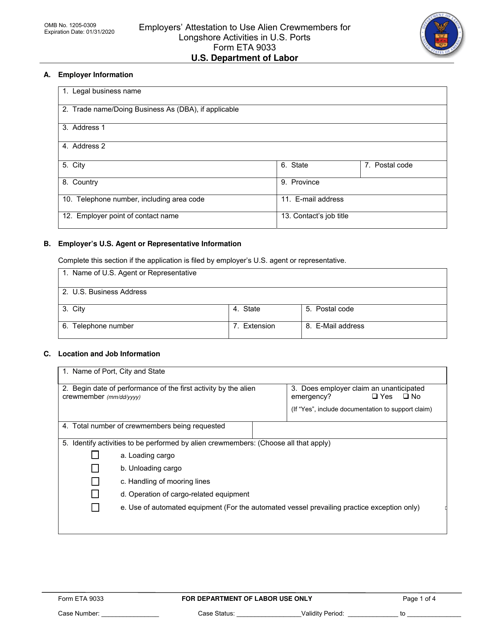

This form is used for employers to affirm that they will hire foreign crewmembers for longshore activities in U.S. ports.

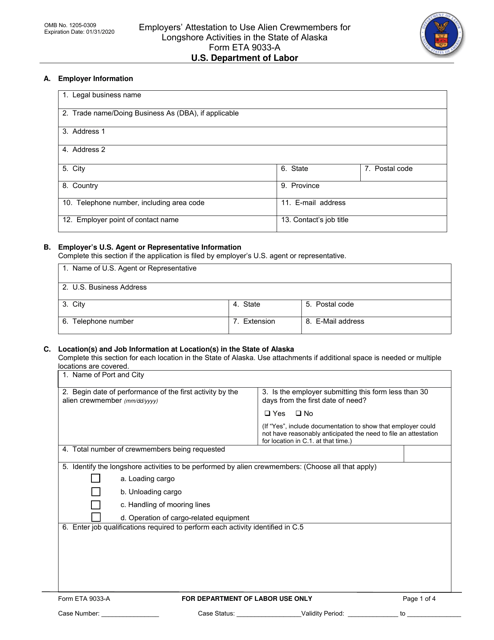

This Form is used for employers in Alaska to attest their use of alien crewmembers for longshore activities. It is required for compliance with immigration regulations.

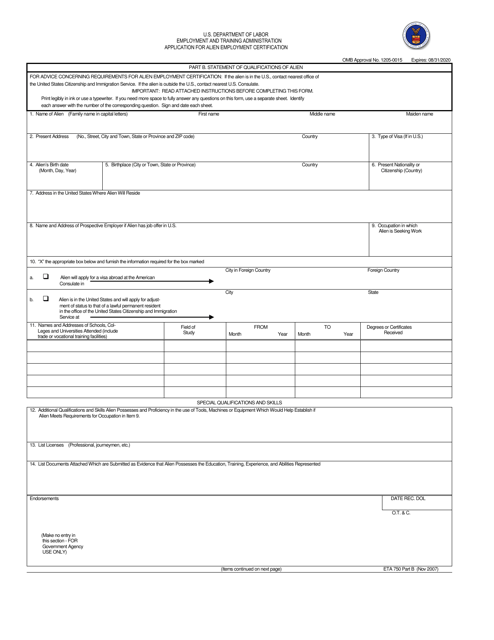

This Form is used for providing the qualifications and skills of an alien when applying for an ETA Form 750.

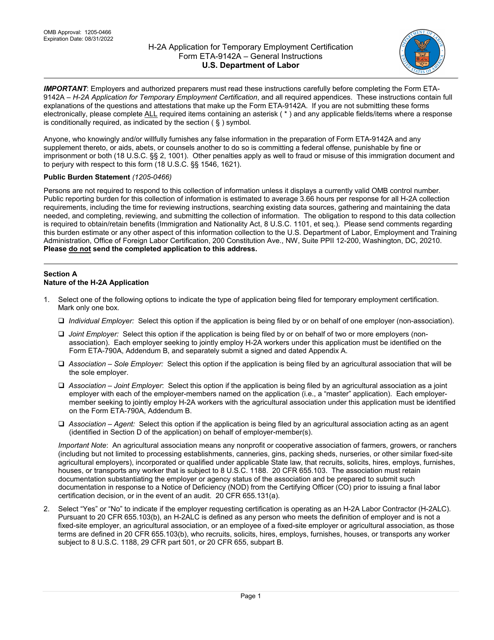

This Form is used for applying for temporary employment certification under the H-2A program. It provides instructions for completing the ETA-9142A application form.

This Form is used for filing a petition for Trade Adjustment Assistance (TAA).

This form is used for applying for a prevailing wage determination. It helps employers determine the appropriate wage to pay their employees based on the prevailing wages in a specific occupation and area.

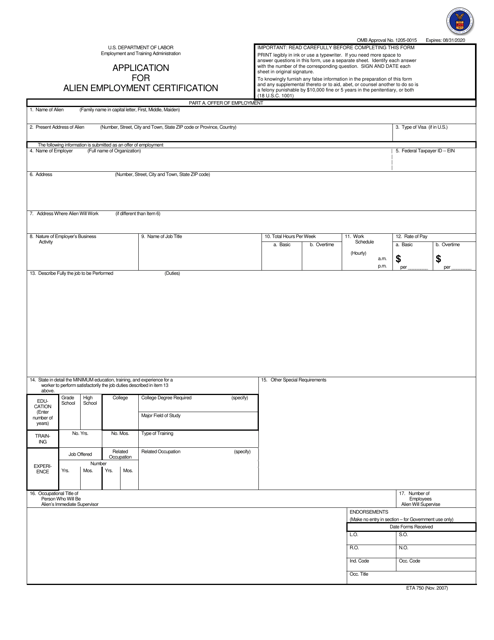

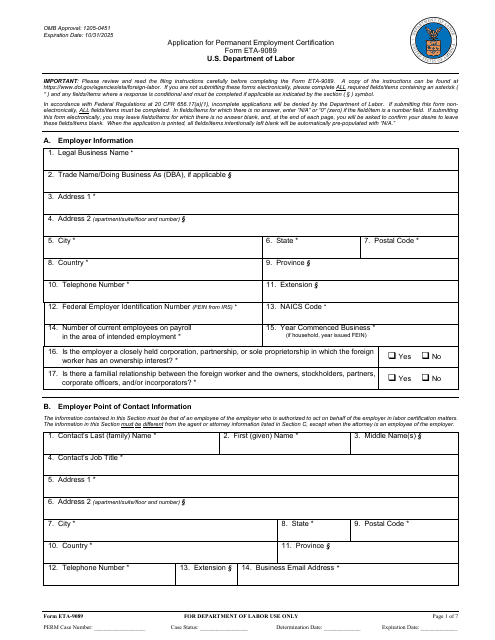

This form is used for applying for alien employment certification.

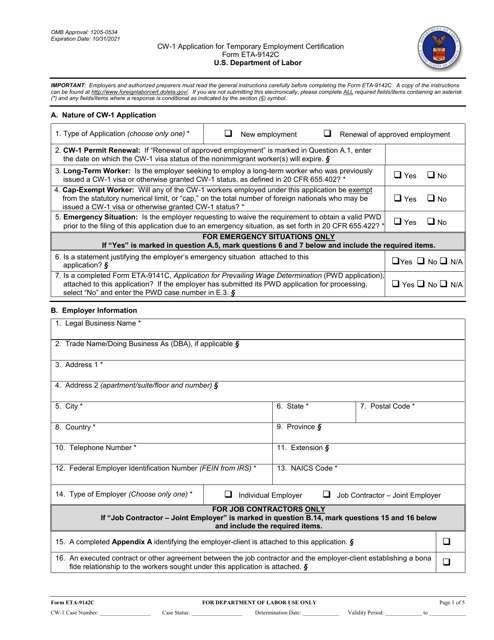

This form is used for applying for temporary employment certification under the CW-1 visa category.

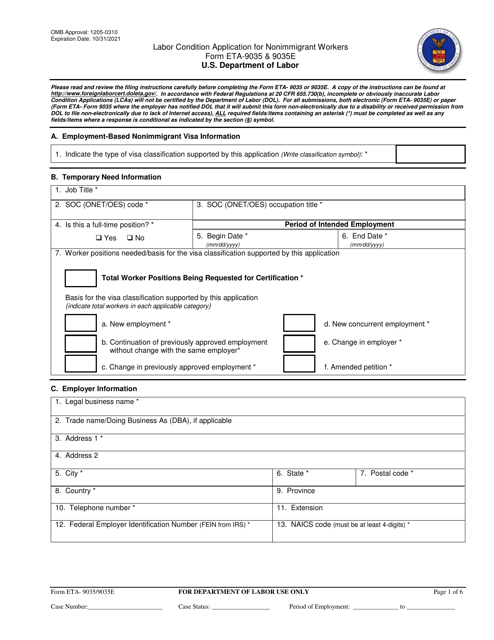

This form is used for employers to submit a Labor Condition Application (LCA) for nonimmigrant workers in the United States. The LCA verifies that the employer will provide fair wages and working conditions to foreign workers.

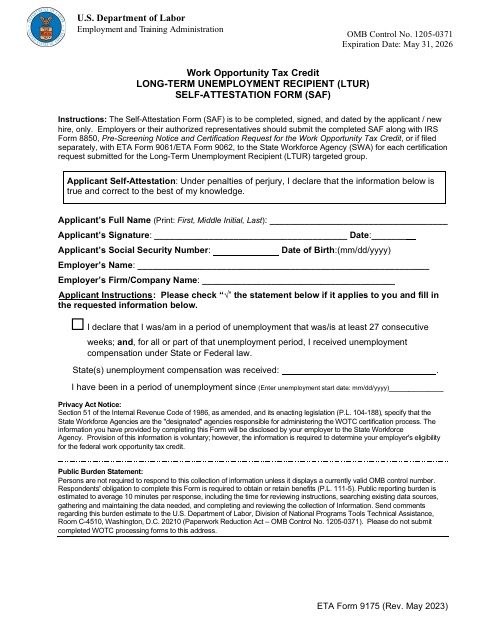

This document is a guide for employers on how to take advantage of the Work Opportunity Tax Credit. It provides information on eligibility requirements, how to apply, and the benefits of participating in the program.

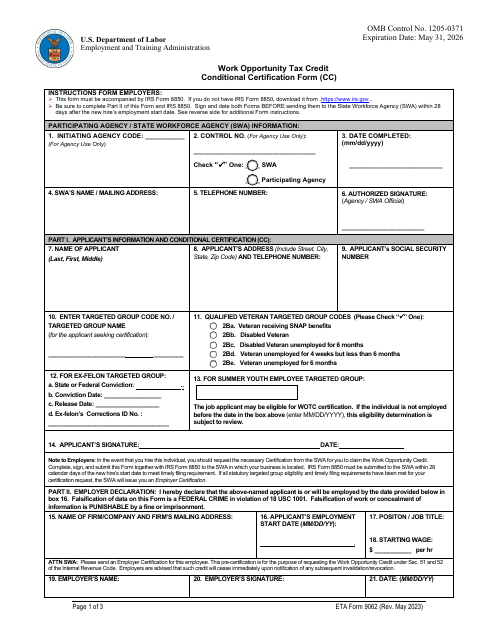

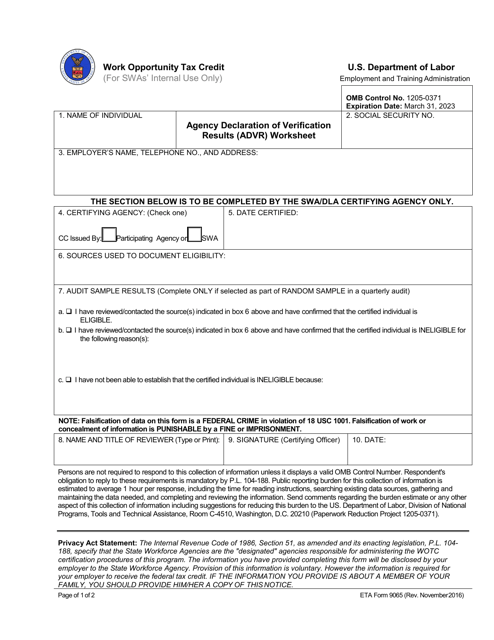

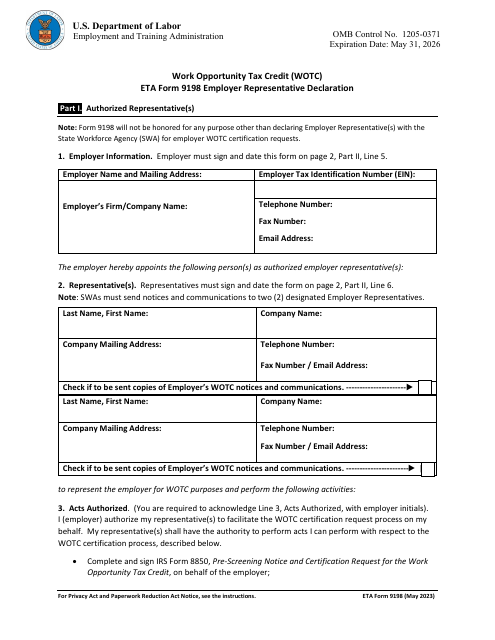

This document is used for the WOTC (Work Opportunity Tax Credit) Agency to declare the verification results through the ADVr (Agency Declaration of Verification Results) worksheet.

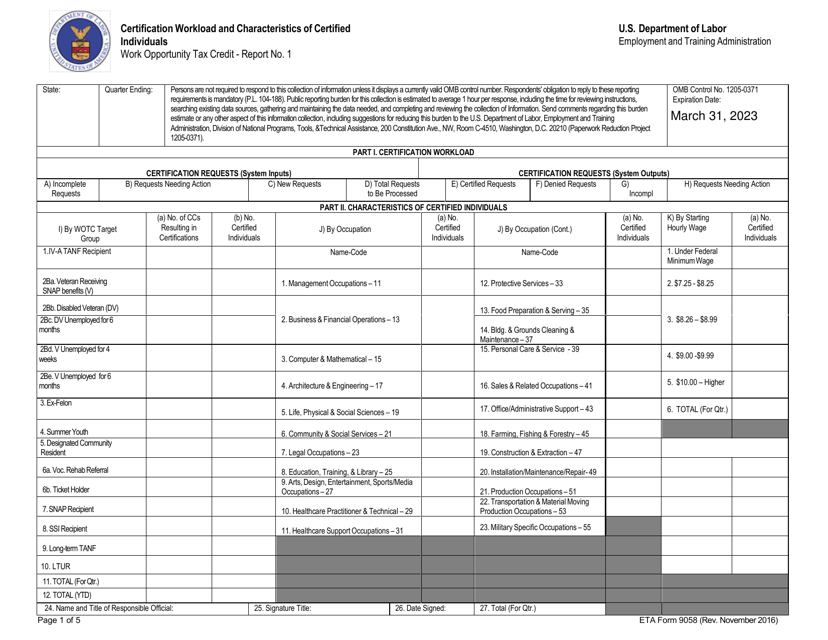

This form is used for reporting the workload and characteristics of certified individuals in the Work Opportunity Tax Credit (WOTC) program.

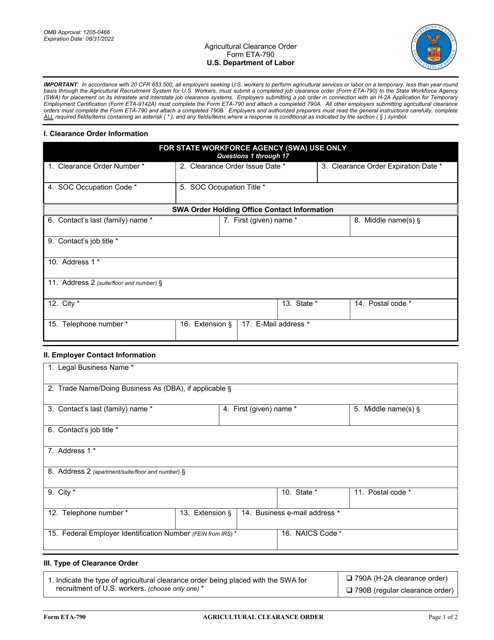

This form is used for requesting an agricultural clearance order in the United States. It is typically used by individuals or businesses involved in the import/export of agricultural products to ensure compliance with relevant regulations and inspections.