Signature Authority Form Templates

Documents:

104

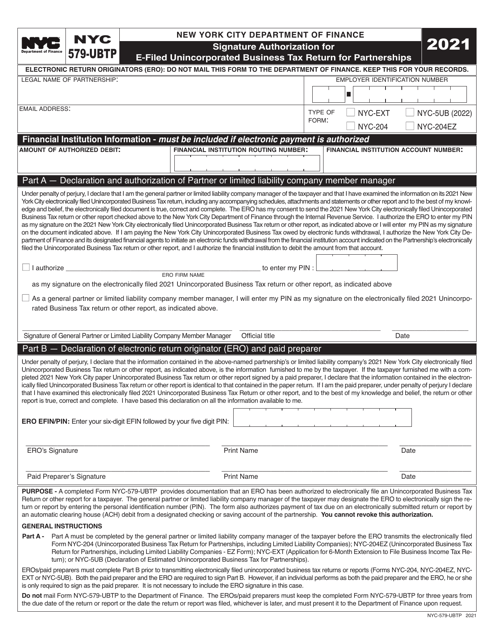

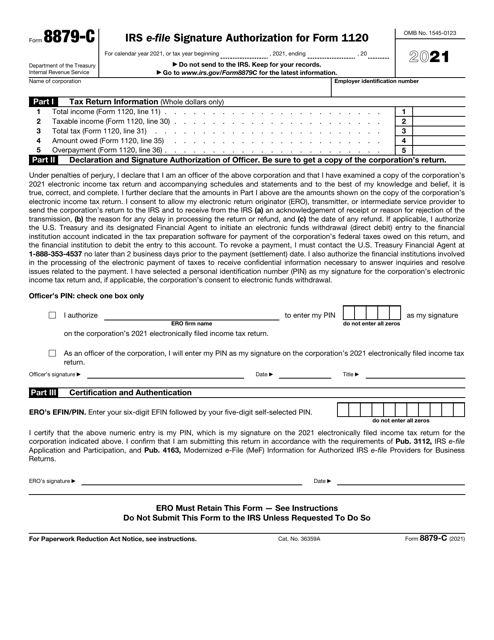

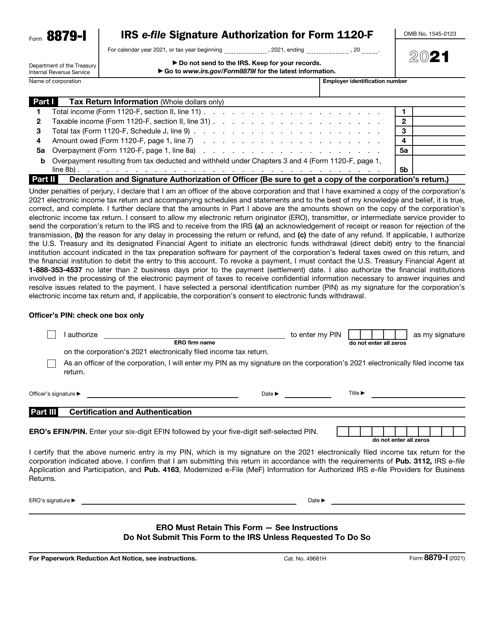

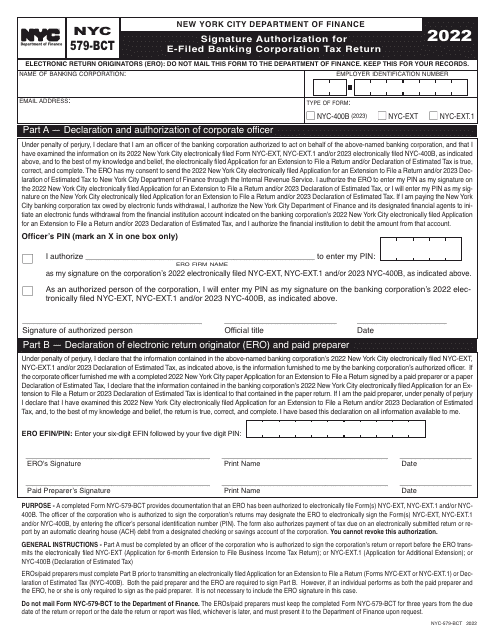

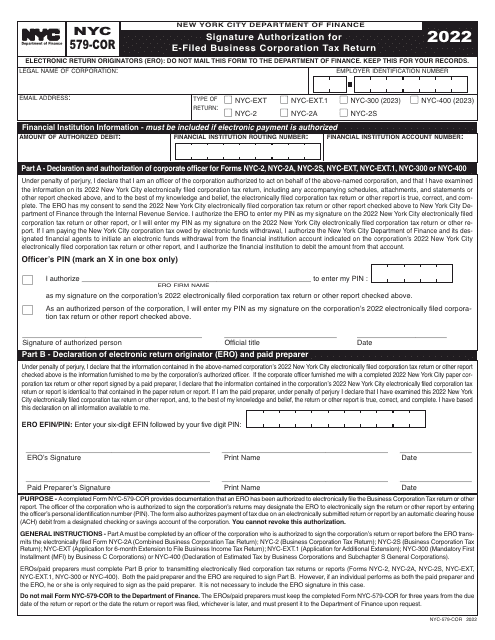

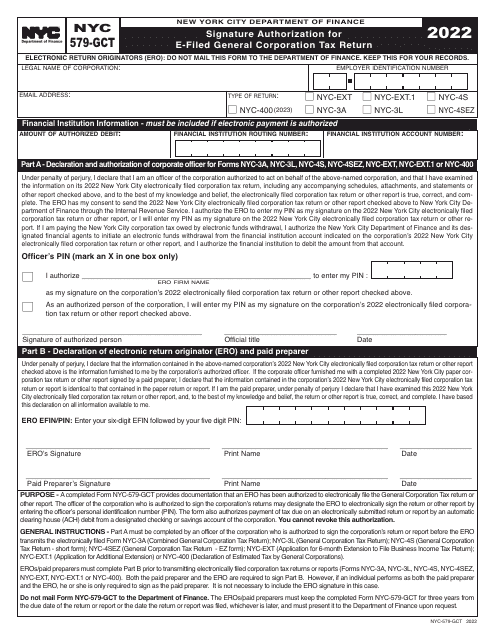

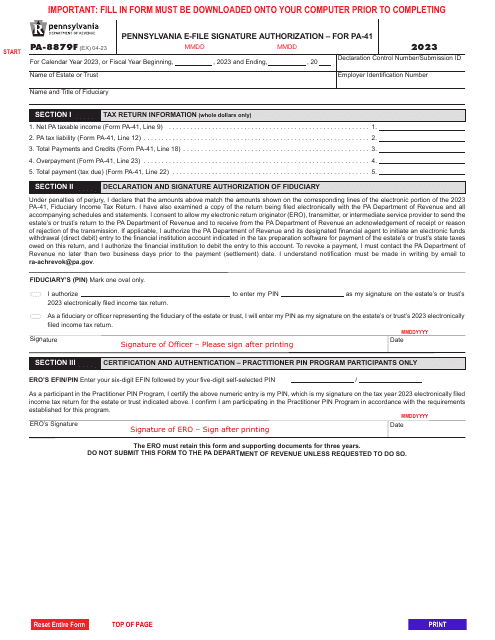

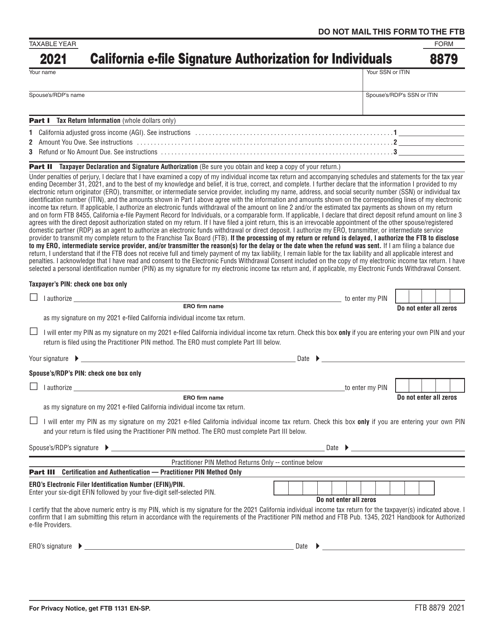

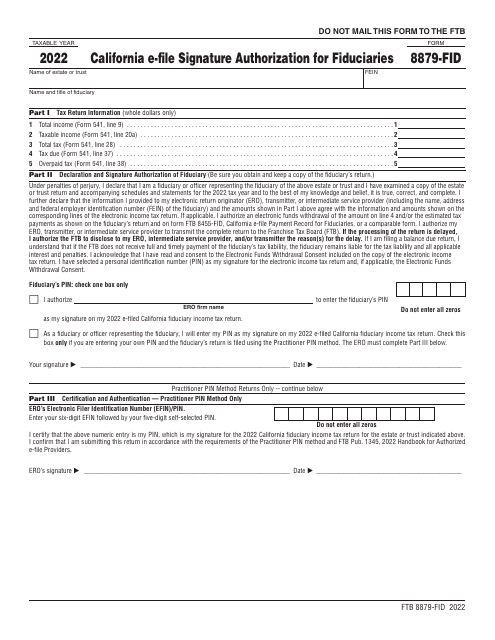

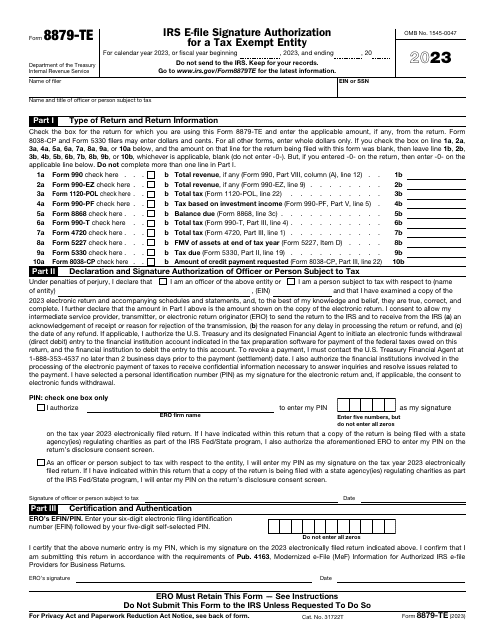

This is a fiscal document corporations use to create personal identification numbers in order to let electronic return originators sign tax returns on their behalf.

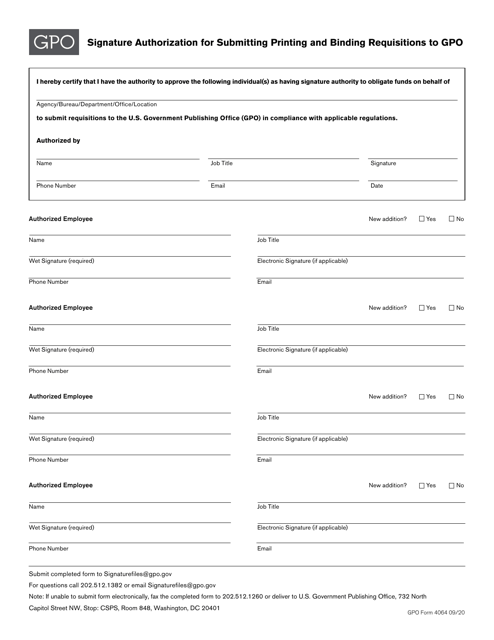

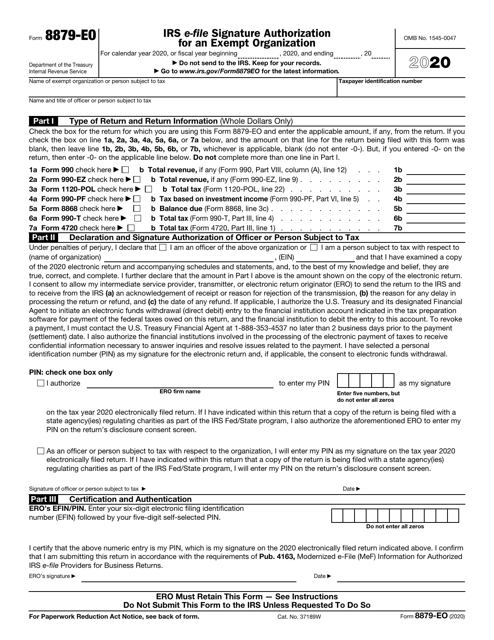

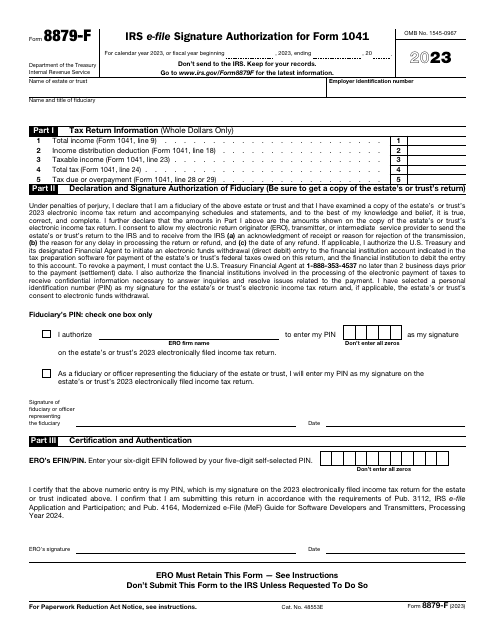

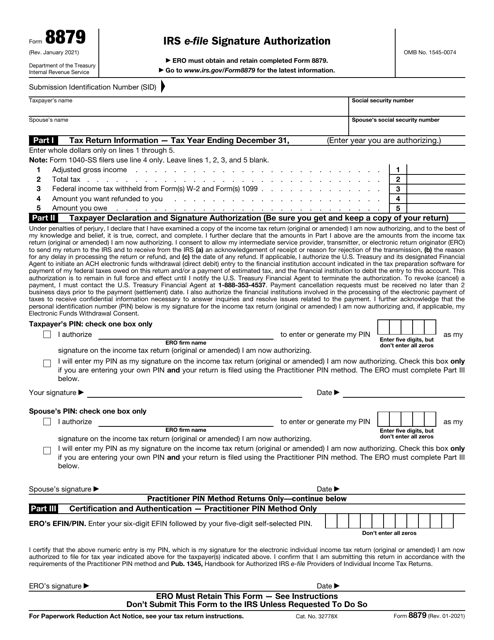

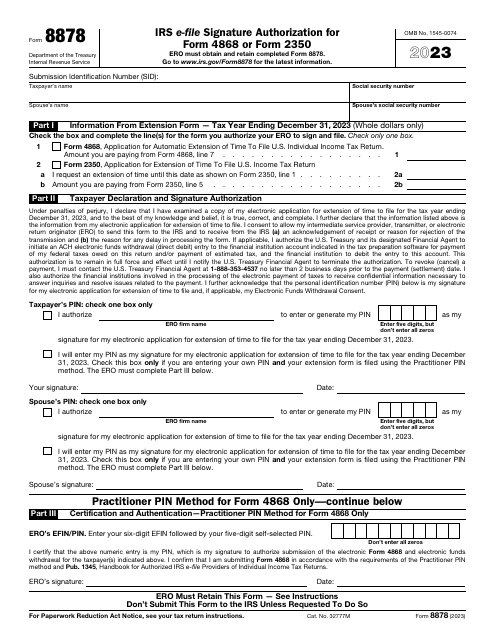

This is an IRS form that allows taxpayers to authorize an electronic return originator to use their e-signature while filing tax returns on behalf of their client.

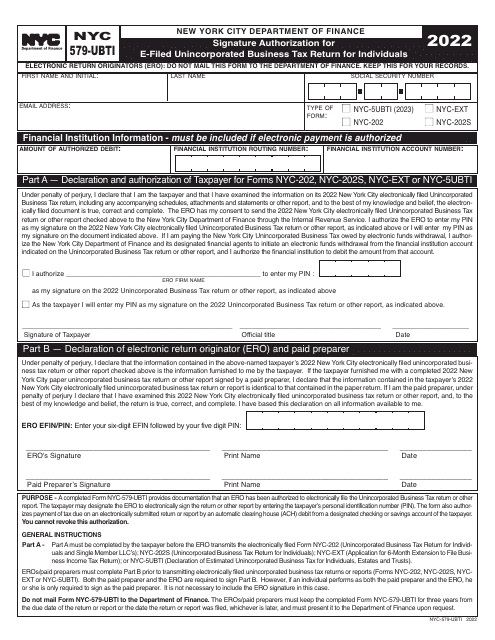

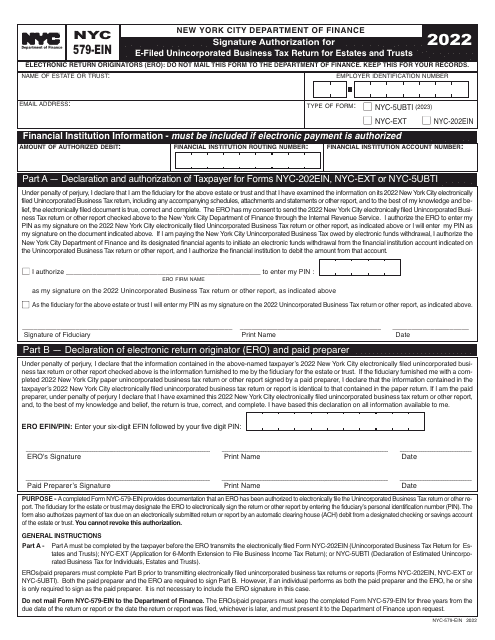

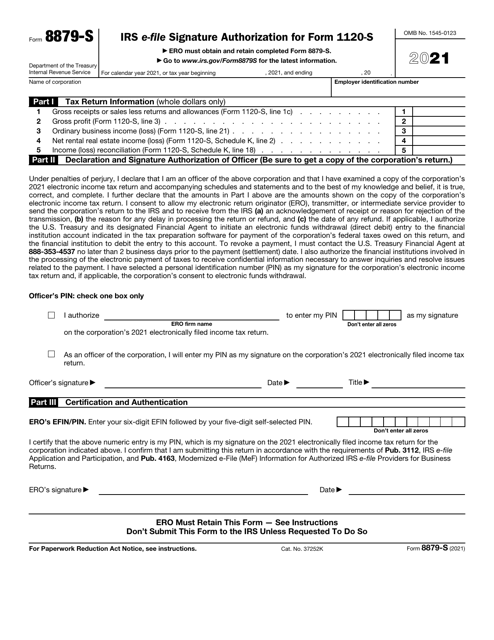

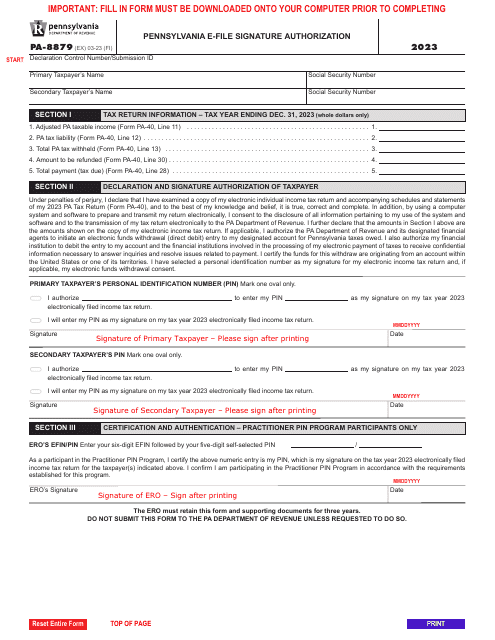

This is a form designed for taxpayers that want to grant an electronic return originator the right to use a unique identification number when filing tax documentation on behalf of the person that hired them.

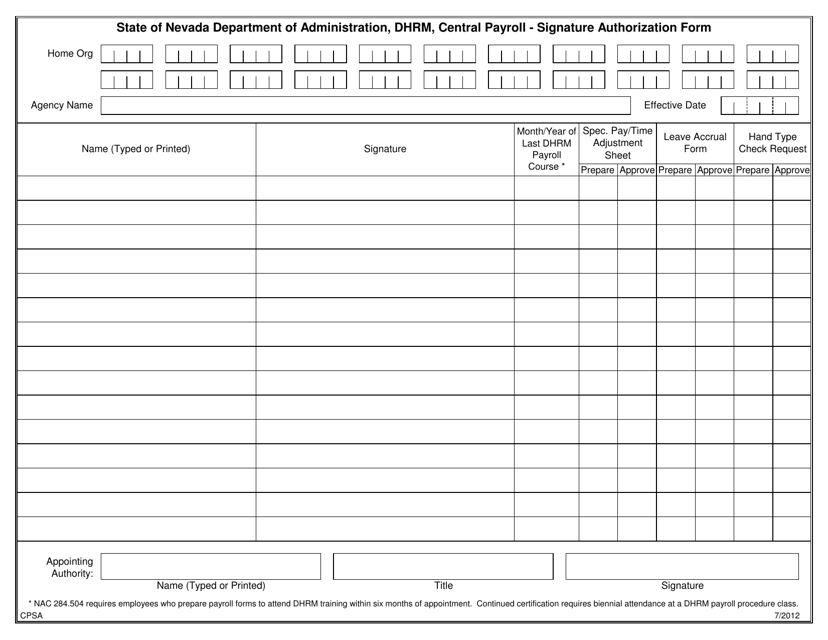

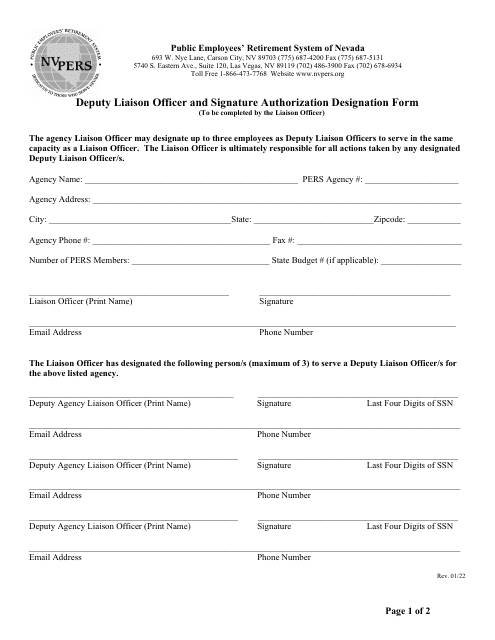

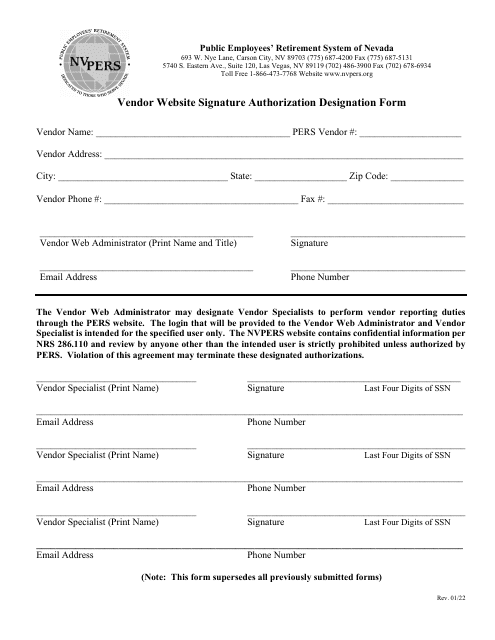

This form is used for obtaining authorization signatures for Central Payroll in Nevada.

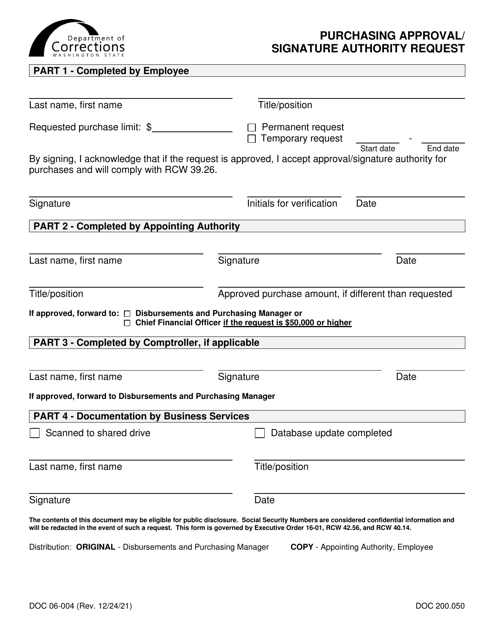

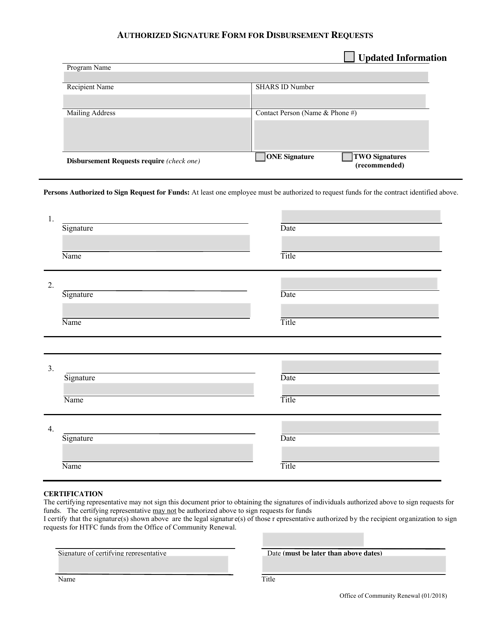

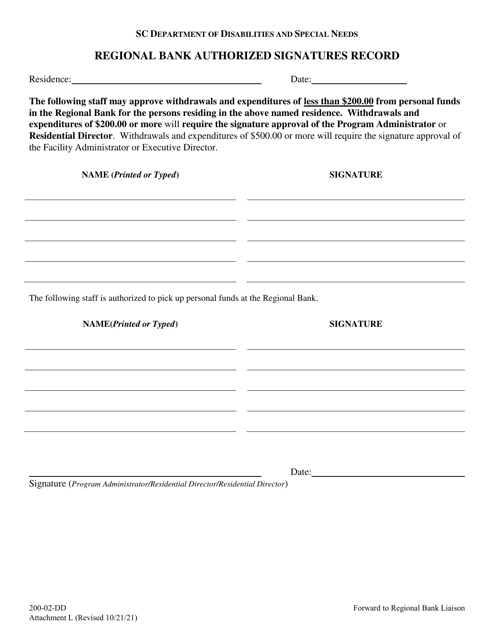

This document is used for requesting disbursement and requires an authorized signature. It pertains specifically to the state of New York.

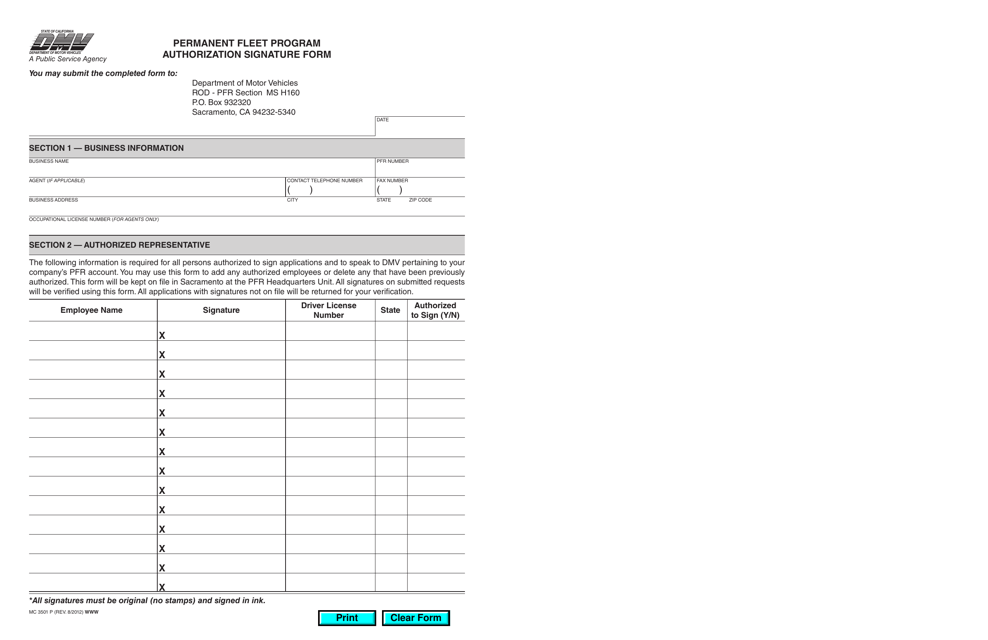

This form is used for obtaining authorization signatures for the Permanent Fleet Program in California.

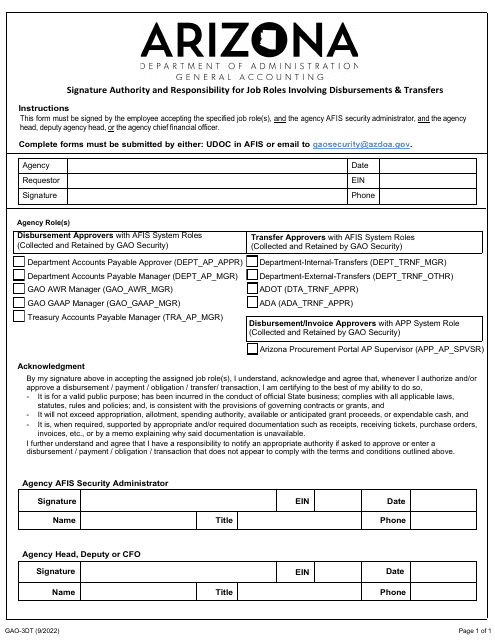

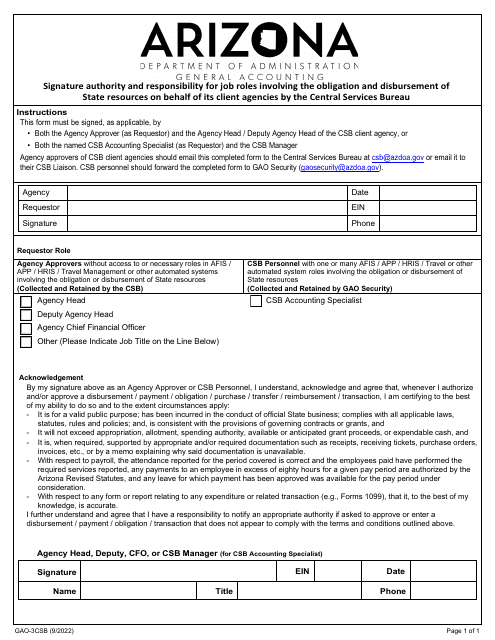

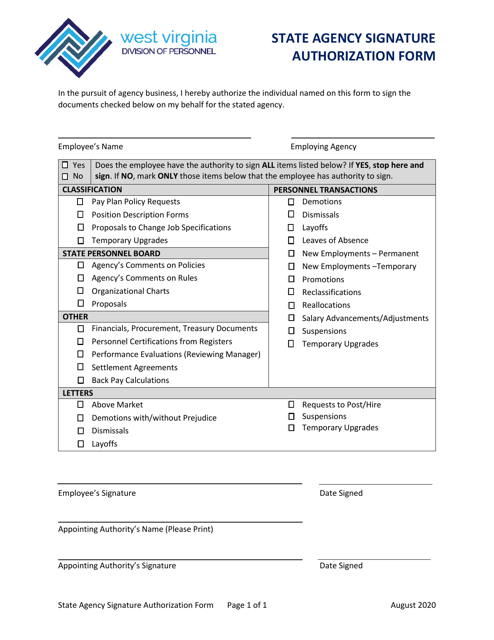

This document is used for authorizing signatures on behalf of a state agency in West Virginia.

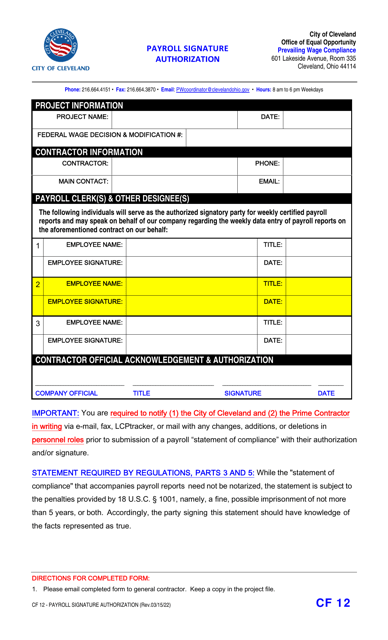

This form is used for authorizing payroll signatures for employees working in the City of Cleveland, Ohio.