Payroll Authorization Form Templates

Documents:

13

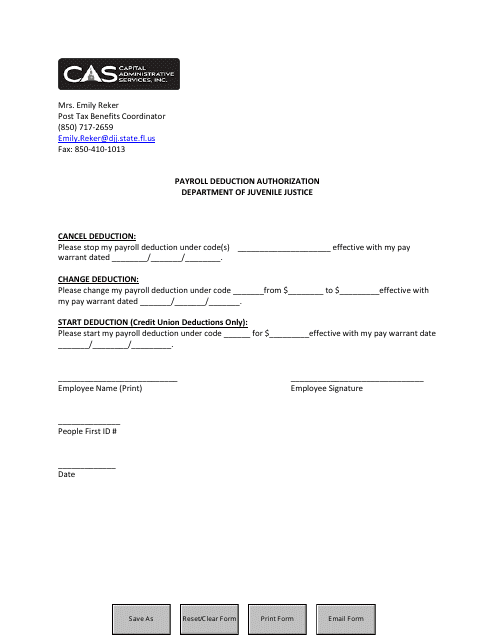

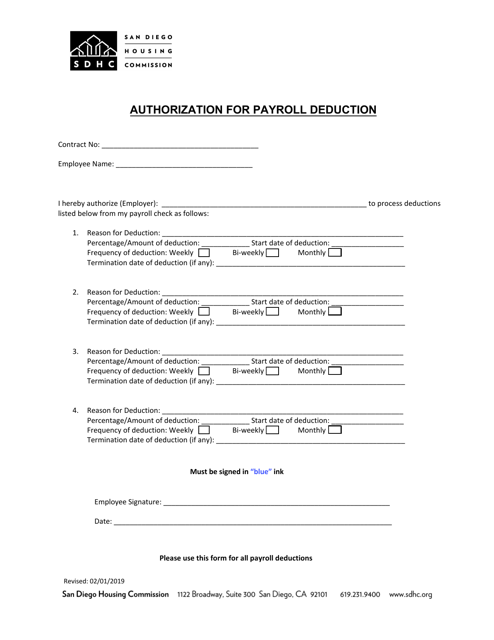

This form is used for authorizing payroll deductions in the state of Florida. It allows employees to specify the amount of money to be deducted from their paycheck for various purposes such as retirement contributions, insurance premiums, or charitable donations.

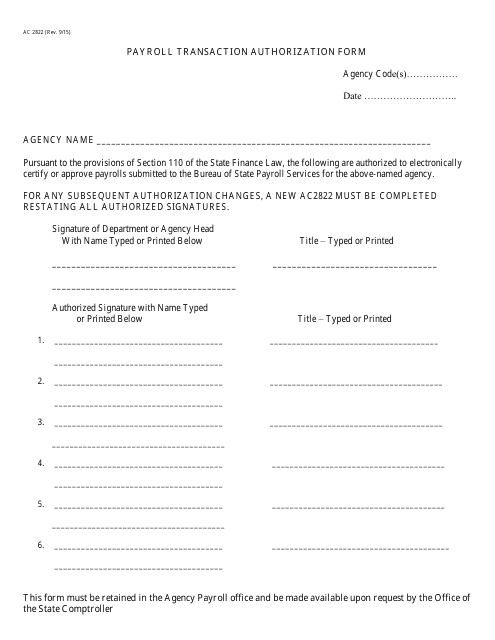

This form is used for authorizing and recording payroll transactions in New York. It ensures that employees are properly compensated and that payroll records are accurate.

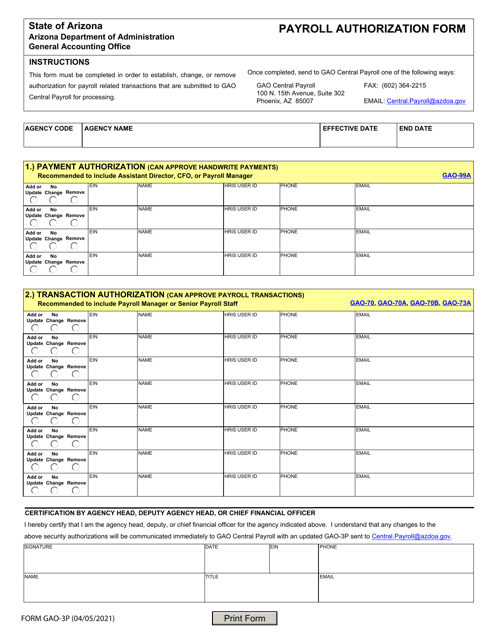

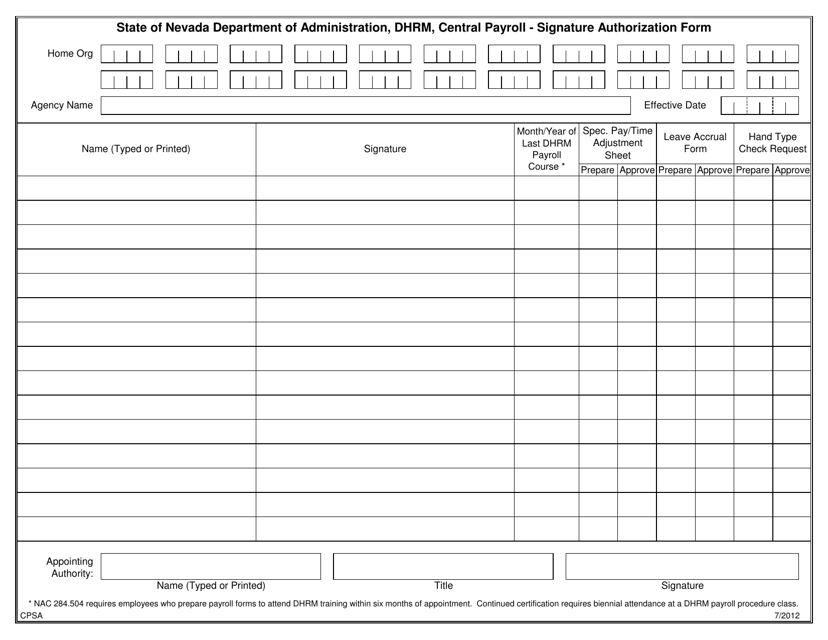

This form is used for obtaining authorization signatures for Central Payroll in Nevada.

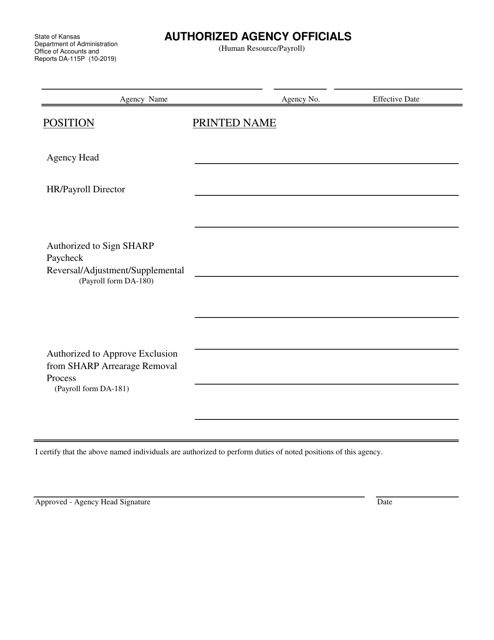

This Form is used for authorized signatures on payroll documents in the state of Kansas.

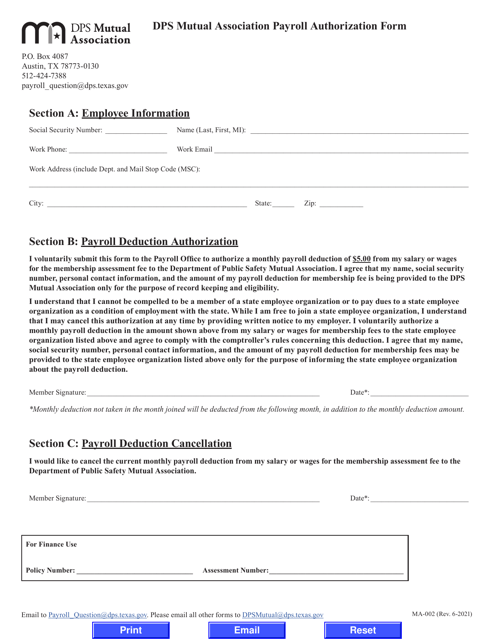

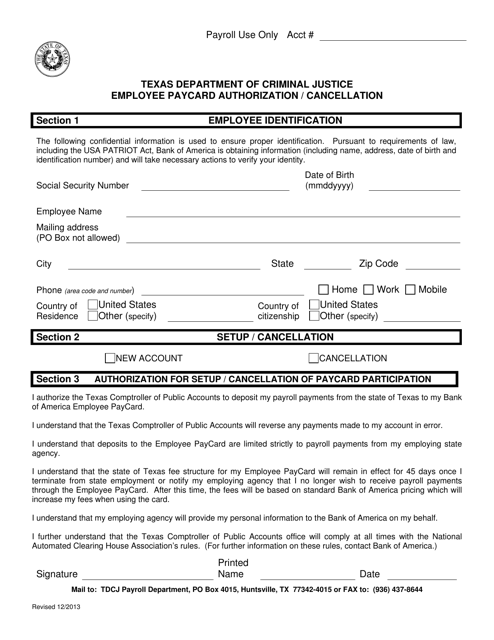

This form is used for authorizing or canceling employee paycards in the state of Texas.

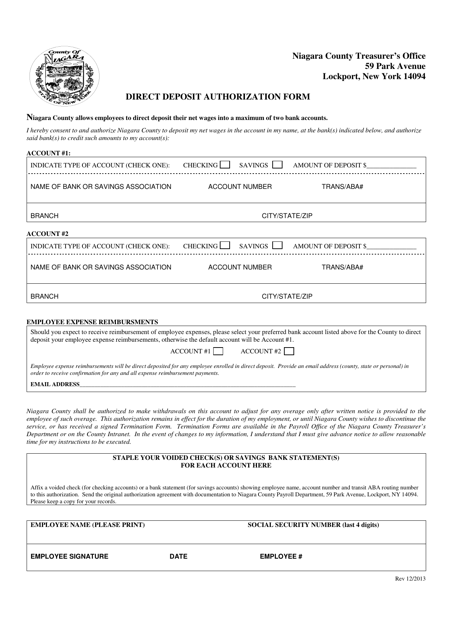

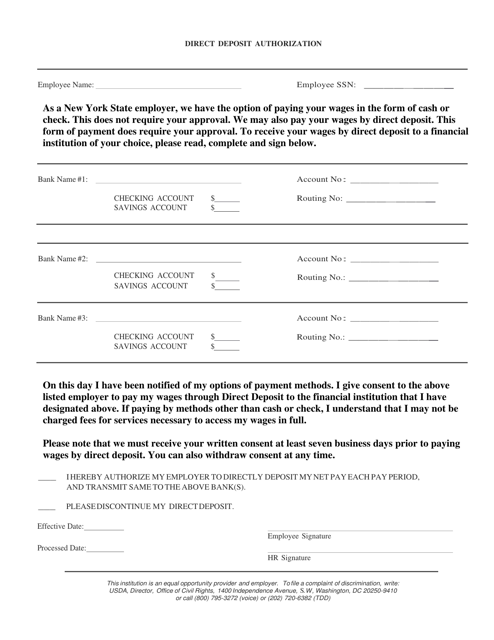

This form is used for authorizing direct deposit of funds in Niagara County, New York. It allows individuals to provide their banking information to receive payments electronically instead of by paper check.

This Form is used for authorizing direct deposit of an employee's salary and wages by the Town of Clayton, New York.

This document is used by employees of the City of San Diego, California to authorize payroll deductions for various purposes such as taxes, retirement contributions, or other authorized deductions.

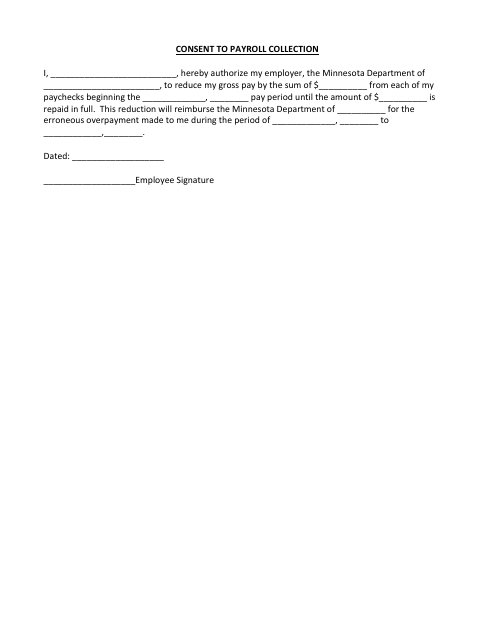

This document is used for obtaining consent from employees in Minnesota to collect and process their payroll information. It ensures that the employer has the necessary authorization to deduct and manage employee wages.