Property Tax Appeal Form Templates

Documents:

19

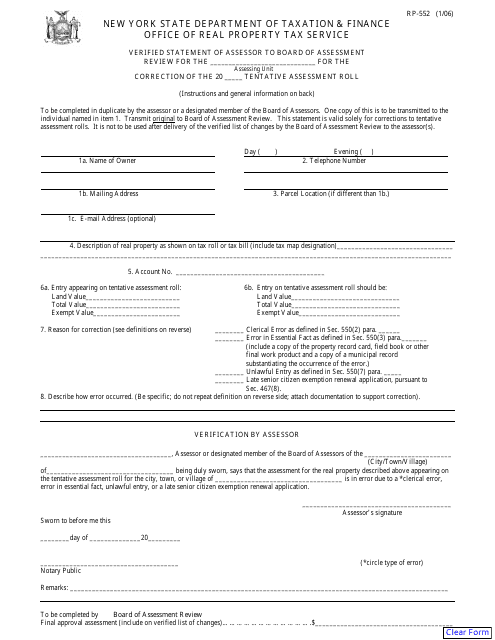

This form is used for the verified statement of the assessor to the Board of Assessment Review in New York. It is to provide accurate and verifiable information regarding assessments.

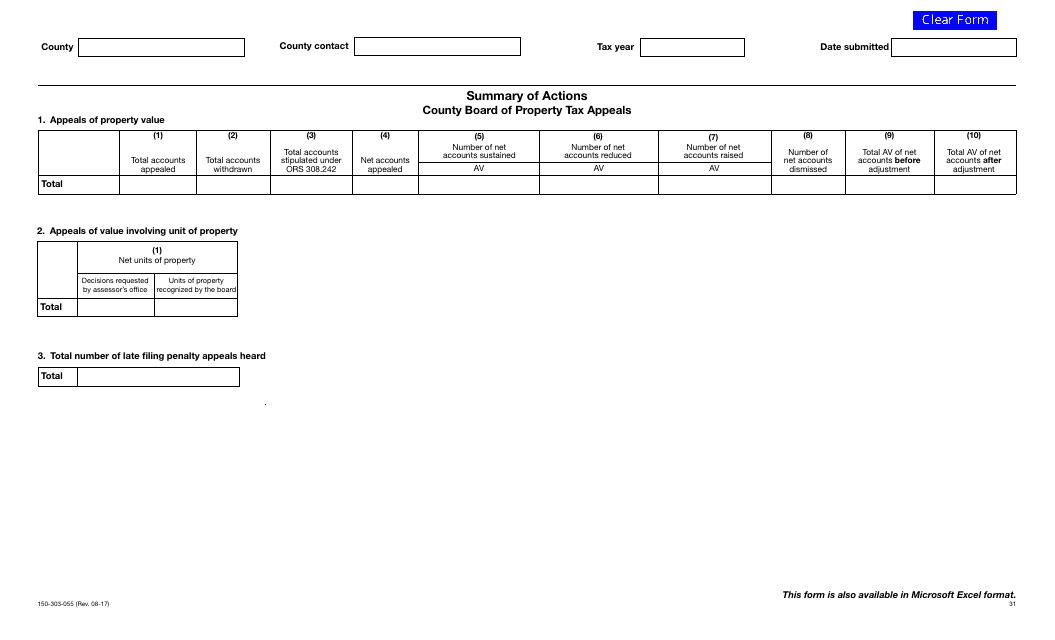

This form is used for submitting a summary of actions for the County Board of Property Tax Appeals in Oregon.

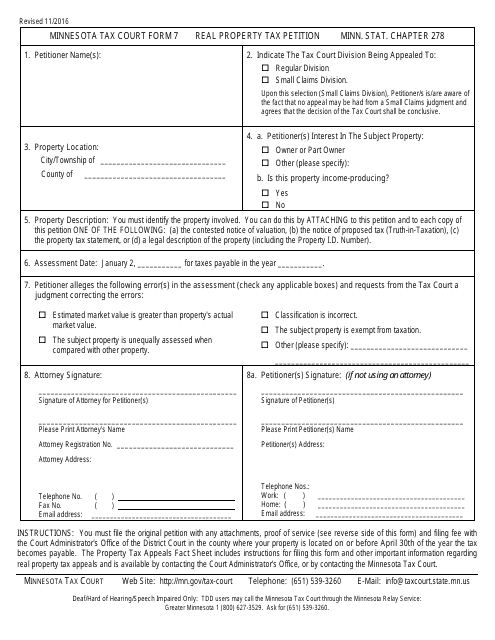

This form is used for petitioning a real property tax assessment in the state of Minnesota.

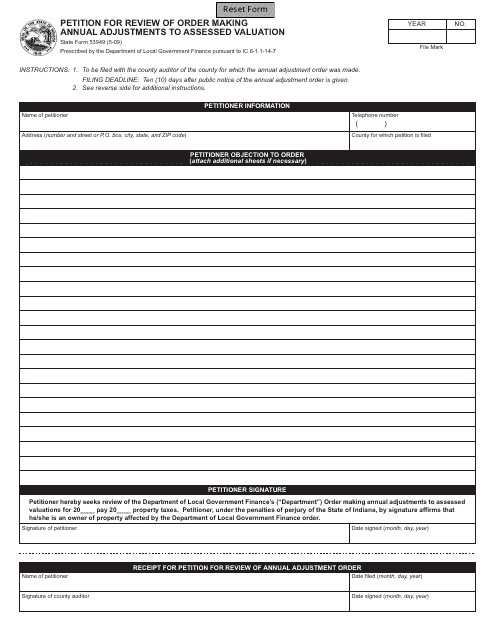

This form is used for filing a petition to review an order that makes annual adjustments to the assessed valuation of property in the state of Indiana.

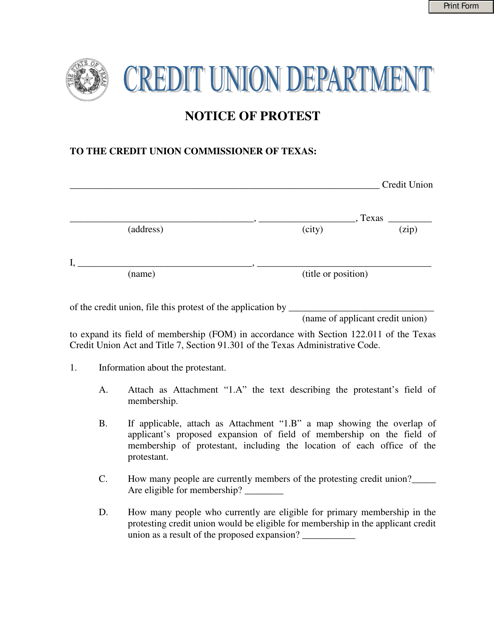

This document is used to file a formal protest in the state of Texas.

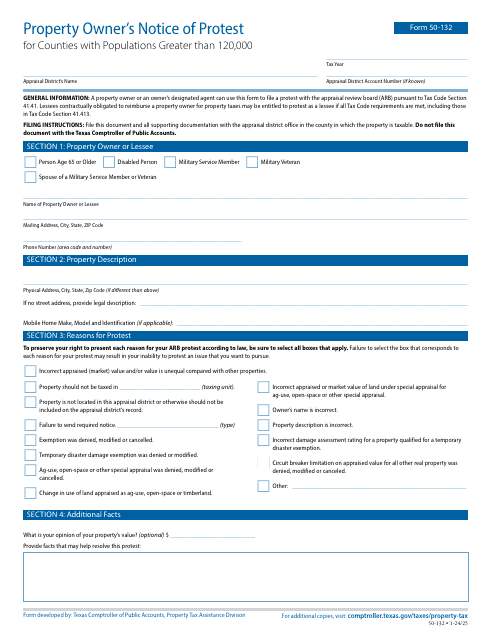

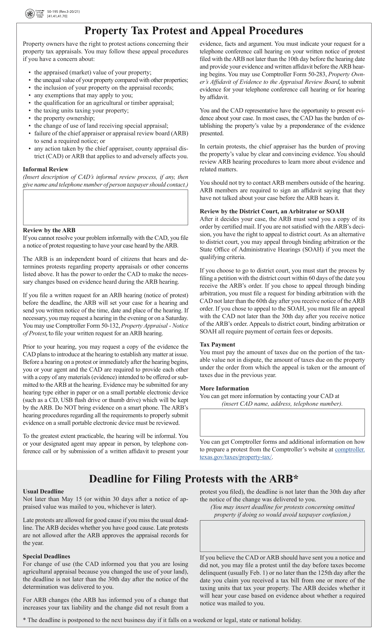

This form is used for property owners in Texas to protest or appeal their property tax assessment. It provides information and procedures for contesting the assessed value of the property.

This Form is used for applying for a tax abatement on real property in Washington, D.C.

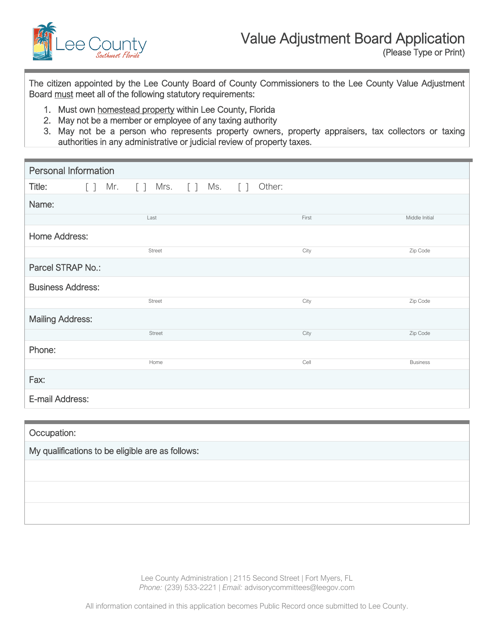

This document is for applying to the Value Adjustment Board in Lee County, Florida.

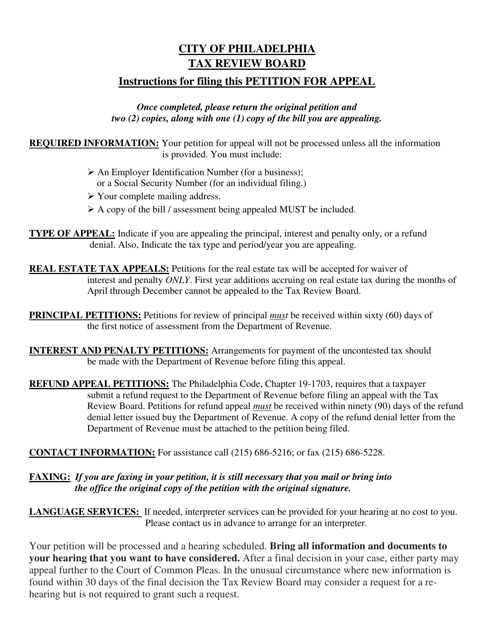

This document is for individuals in Philadelphia, Pennsylvania who wish to appeal a tax assessment made by the Tax Review Board. It provides instructions on how to complete a petition for appeal to challenge the assessment.

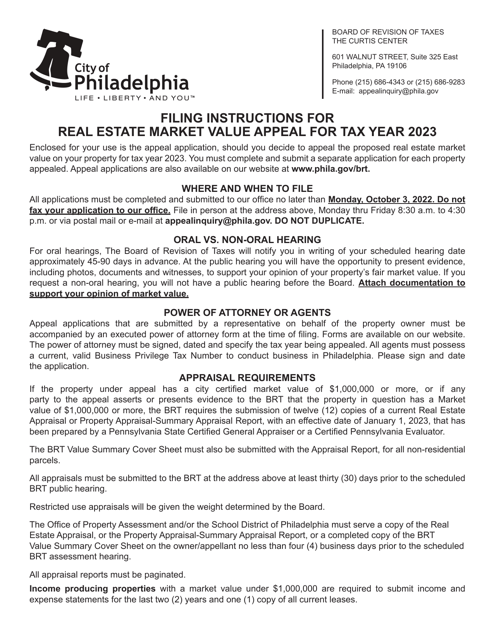

This document is for appealing the market value of real estate in Philadelphia, Pennsylvania. It provides a process for challenging the assessed value of a property in order to potentially lower property taxes.

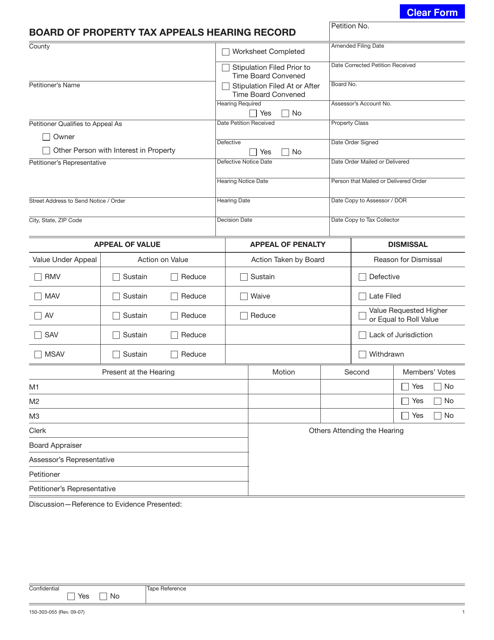

This document is used for recording the proceedings of a Board of Property Tax Appeals hearing in Oregon.

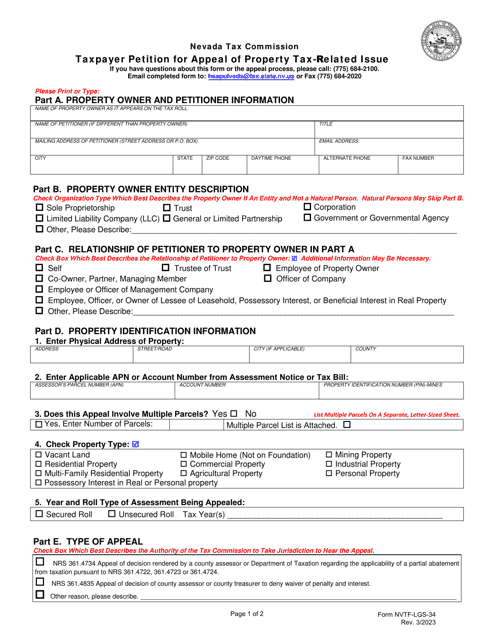

This form is used for taxpayers in Nevada to file a petition to appeal property tax-related issues. It allows taxpayers to seek resolution if they believe their property tax assessment is incorrect or unfair.