Fill and Sign Gift Aid Forms

A Gift Aid Form is a type of document released by the United Kingdom HM Revenue & Customs that is supposed to be used when a charity wants to increase the contribution they receive by 25 pence for each incoming £1. The purpose of the document is to collect information about the contribution and the parties involved with it.

Alternate Names:

- Charity Gift Aid Declaration;

- HMRC Gift Aid Form.

What Is a Charity Gift Aid Declaration?

The form is supposed to be completed and signed by the contributor and returned to the receiver of the donation. They must keep these documents for six years after they have claimed the gift aid. The contributor must be an individual and the receiver must be recognized as a charity organization or as a community amateur sports club (CASC) for tax purposes.

There are two types of Gift Aid Forms. Despite the fact that their contents are quite similar they are supposed to be used in different situations. The choice of which document to use will depend on whether the giving party would like to Gift Aid one contribution or several of them.

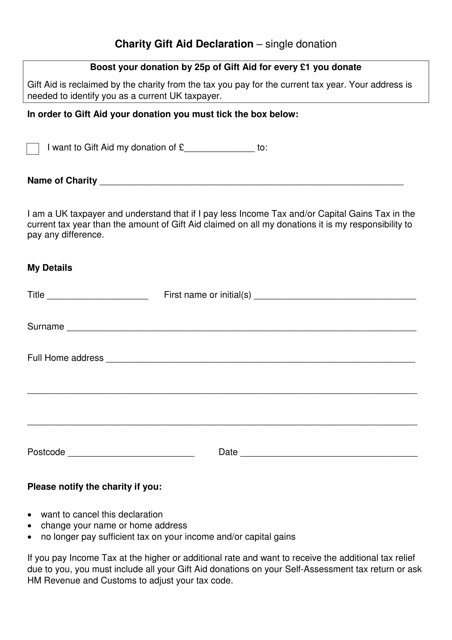

- Charity Gift Aid Declaration – Single Donation. This kind of Gift Aid Declaration is supposed to be used when the contributor agrees to Gift Aid a single donation they have made to the receiver designated in the declaration.

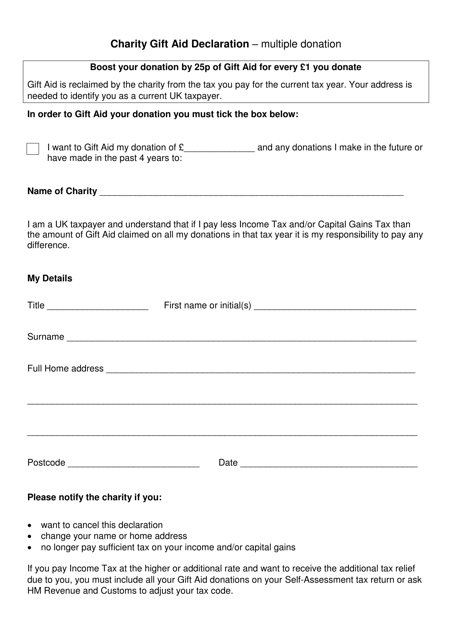

- Charity Gift Aid Declaration – Multiple Donation. Contributors can use this form if they want to Gift Aid the donation they have made and all of their future donations to this receiver. The form can also be used if the contributor wishes to Gift Aid the donation they have made during the last several years to this receiver.

How to Fill in a Gift Aid Form?

A Charity Gift Aid Declaration is presented in a form of a letter where the contributor is supposed to fill in several gaps and check applicable boxes. Its content can be vaguely divided into a few parts, namely:

- Consent to Gift Aid . In the first part of the document, the contributor must tick the box near the statement where it is stated that they intend to Gift Aid their donation. If it is a declaration for multiple contributions then the statement also includes information that the donor agrees to Gift Aid all of their further donations or donation they have made from the last four years. Contributors must also fill in the gap where they indicate the amount of money they have gifted.

- Charity Details . Here, the contributor must state the information about the charity where they have made a donation. Nevertheless, they are not required to gather any extensive data - stating the name of the charity will be sufficient.

- Information About the Donor. Contributors are supposed to use this section of the form to provide their personal information. It includes their title, name, home address, and postcode. In addition, the contributor must date the declaration to validate that its content is current.

- Guidelines. From this part of the declaration, the contributor will learn that they should inform the charity if they want to cancel their declaration if their name or address has been changed, or if they no longer pay sufficient Income Tax or Capital Gain Tax.

Not what you need? Check out these related forms:

Form R40, Claim for Repayment of Tax Deducted From Savings and Investments;

(div)

Form P53, Claiming Back Tax Paid on a Lump Sum.

(div)

Documents:

2

This Form is used for making a single donation to a charity in the United Kingdom and declaring to gift aid the donation.

This document is used for multiple donations in the United Kingdom to declare Gift Aid and maximize the value of charitable contributions.