Mississippi Tax Forms and Templates

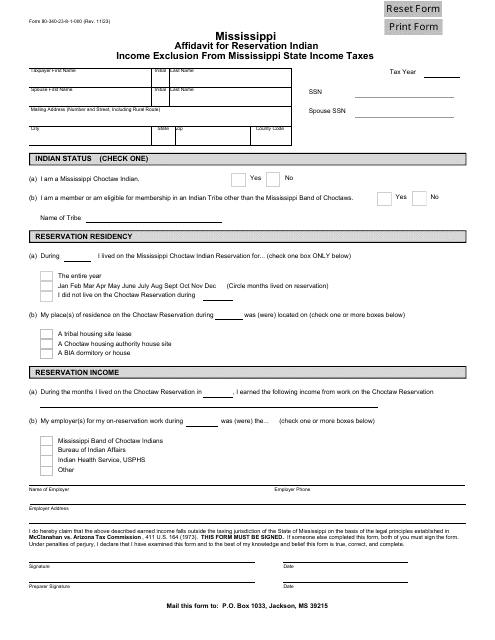

Mississippi Tax Forms are used for reporting and paying state income taxes in the state of Mississippi. These forms help individuals, businesses, and fiduciaries to accurately report their income, deductions, and credits, and calculate the amount of state tax they owe or the refund they are entitled to.

Documents:

24

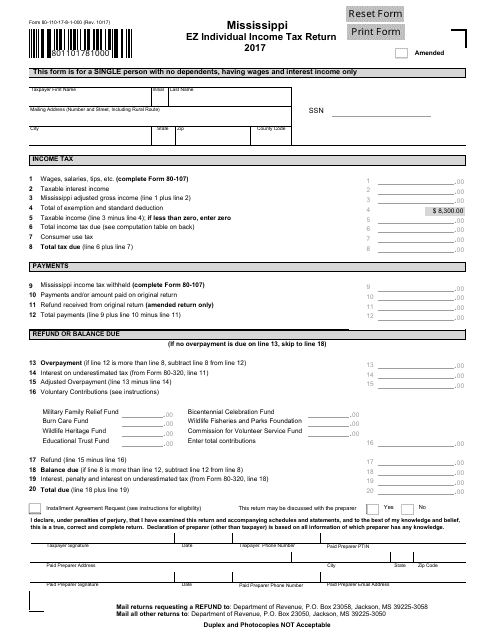

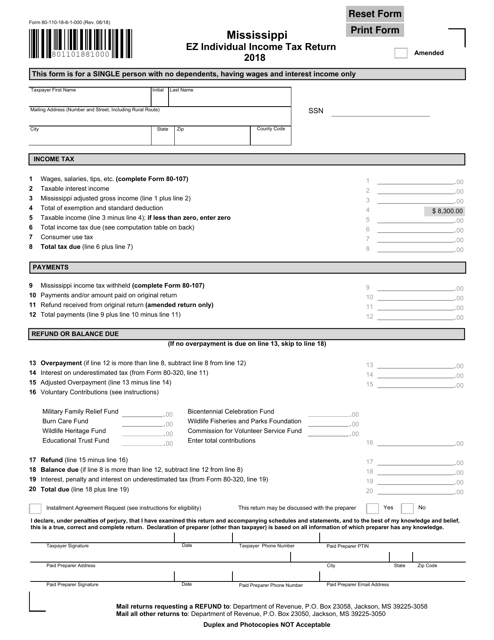

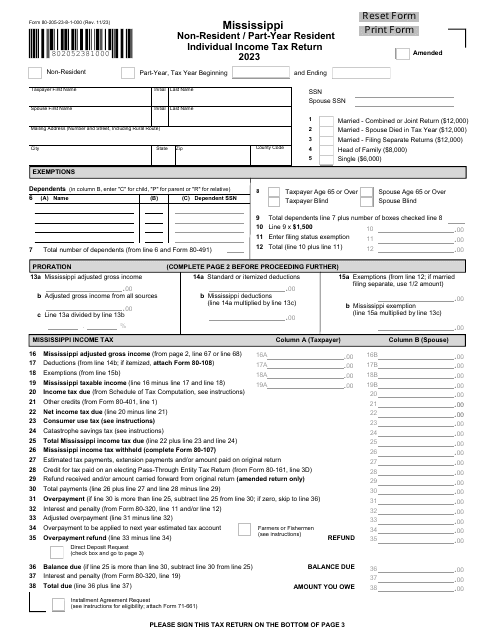

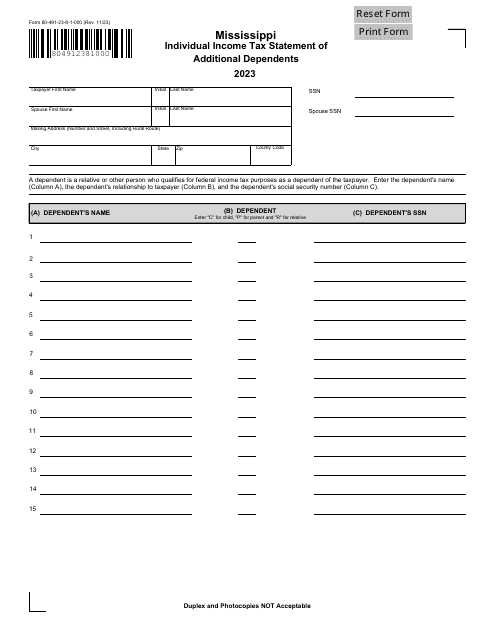

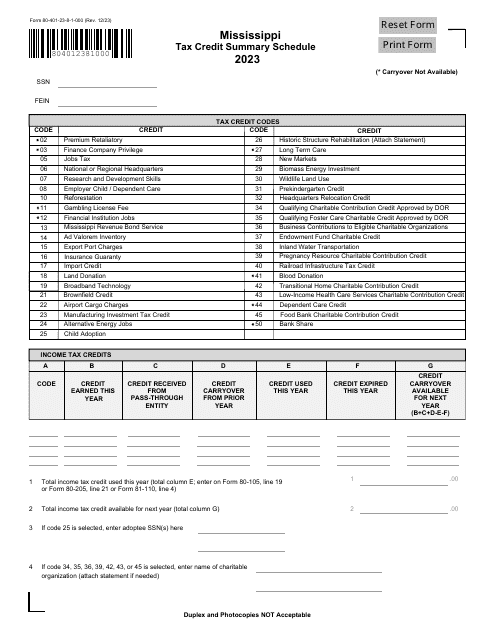

This Form is used for filing an individual income tax return in the state of Mississippi.

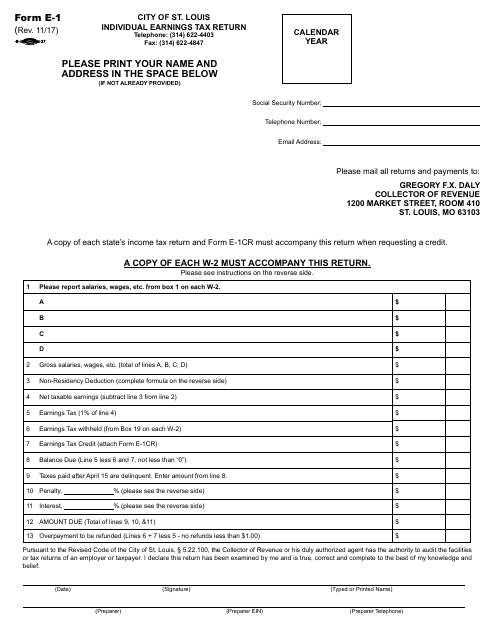

This document is for individuals in the City of St. Louis, Missouri, to file their earnings tax return.

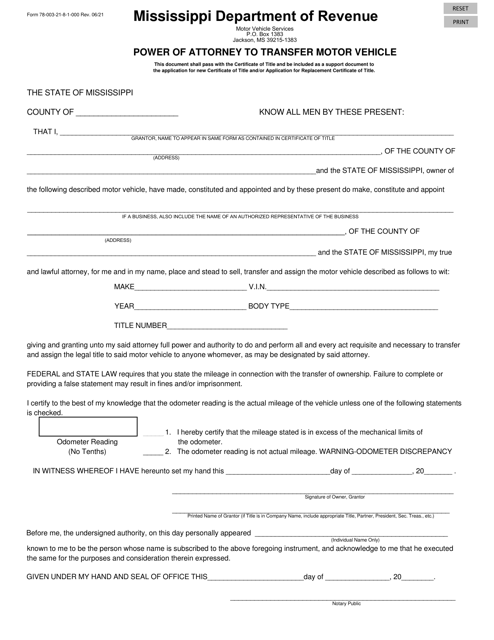

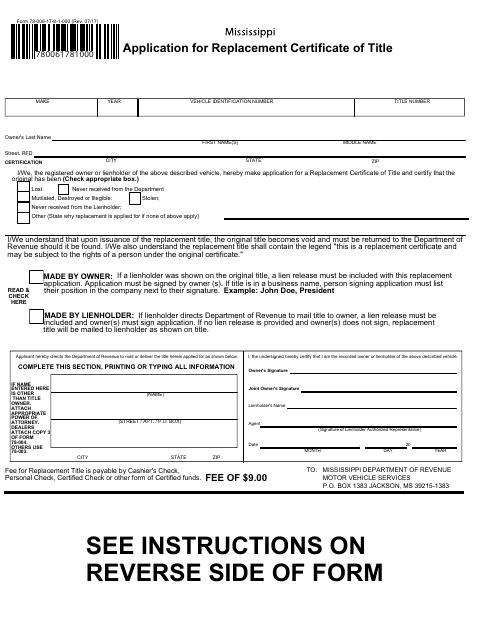

This form is used for applying for a replacement certificate of title in the state of Mississippi.

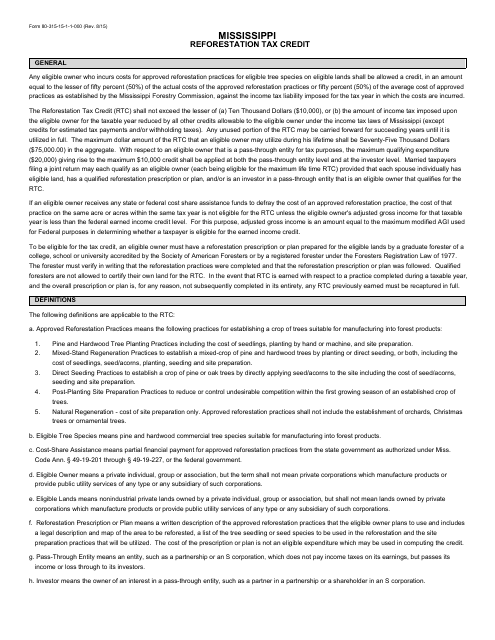

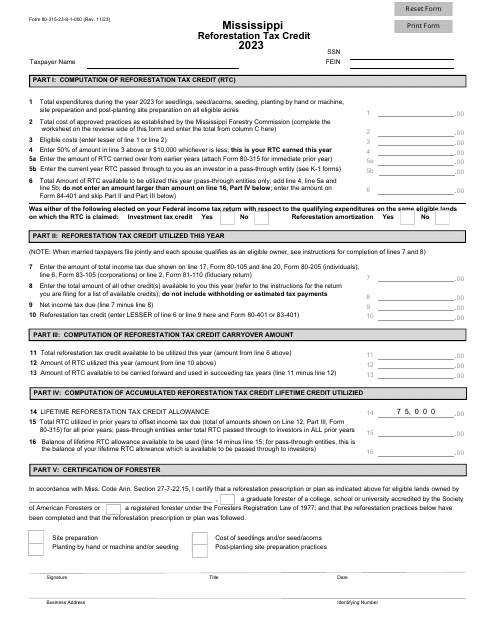

This Form is used for claiming the Mississippi Reforestation Tax Credit. It provides instructions for individuals or businesses in Mississippi who are eligible for this tax credit.

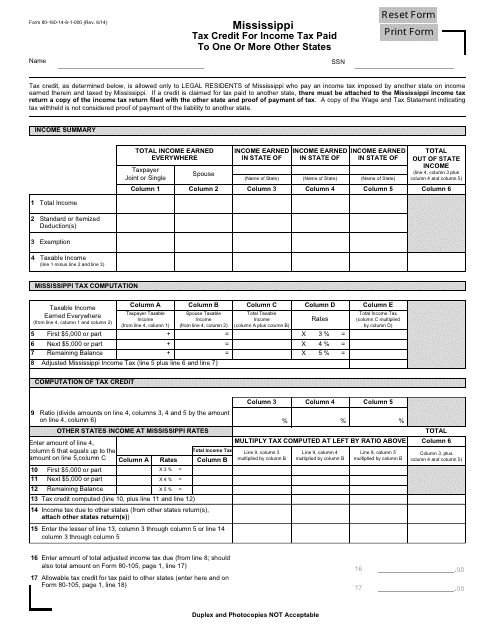

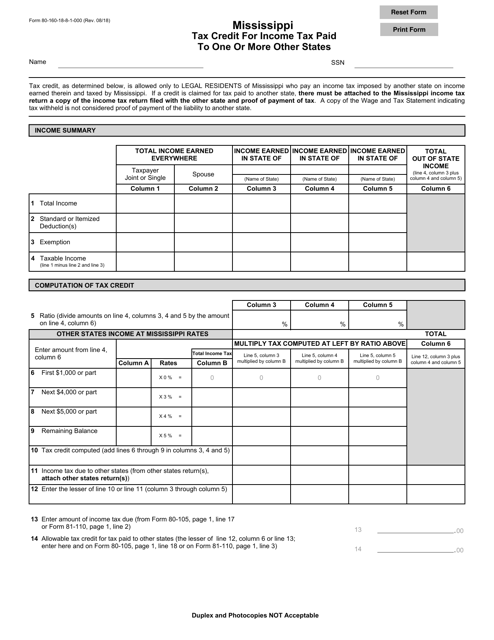

This Form is used for claiming a tax credit in Mississippi for income tax paid to other states.

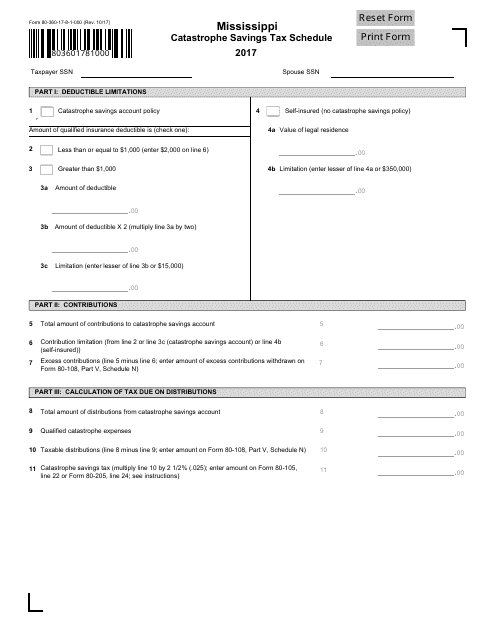

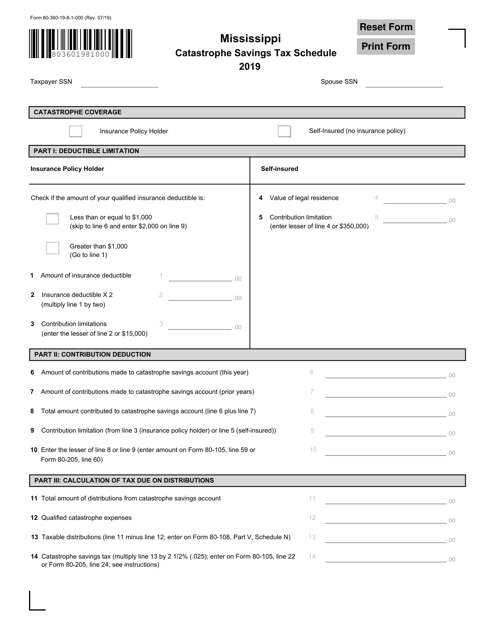

This form is used for reporting and filing taxes related to catastrophe savings in the state of Mississippi.

This form is used for reporting supplemental prime contractor tax in Mississippi.

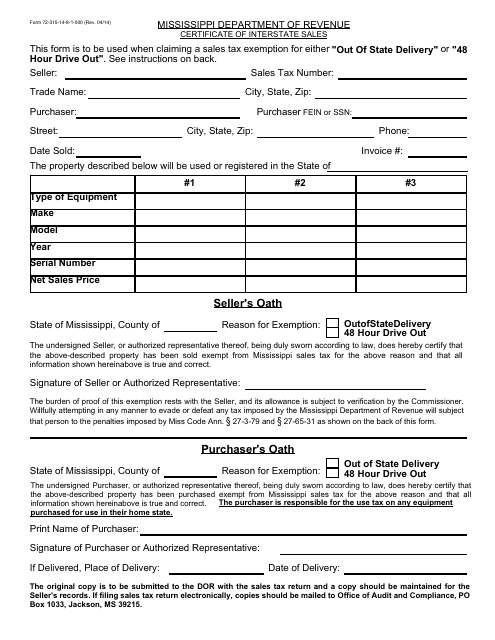

This Form is used for reporting interstate sales made in Mississippi. It is a certificate that provides documentation for sales tax purposes.

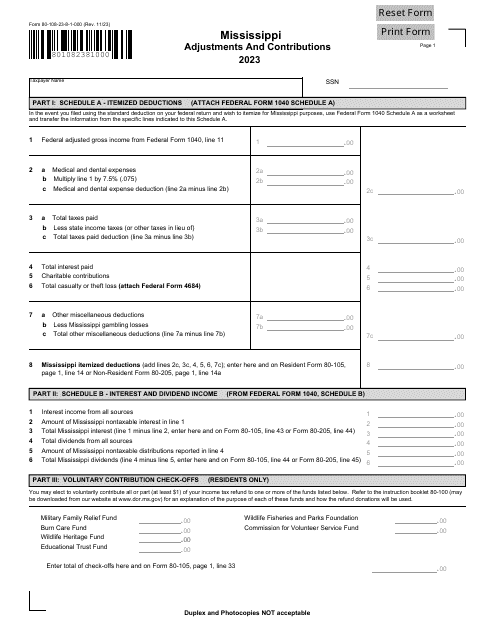

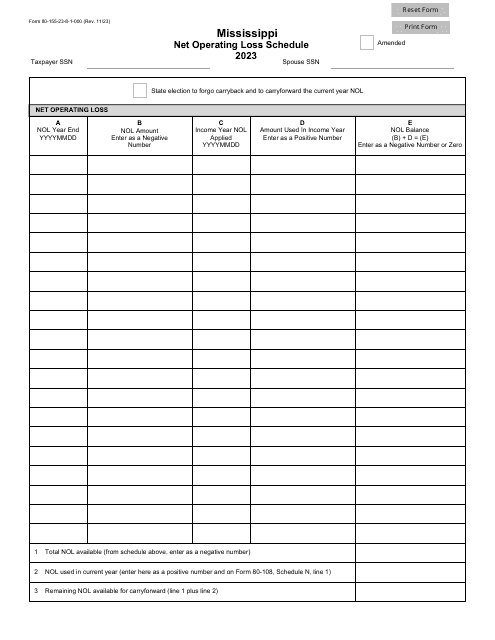

This form is used for filing your individual income tax return in the state of Mississippi.

This document is used for claiming a tax credit for income tax paid to other states when filing taxes in Mississippi.

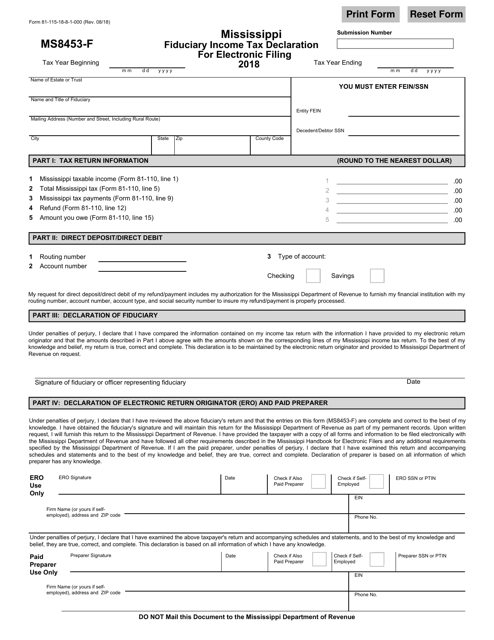

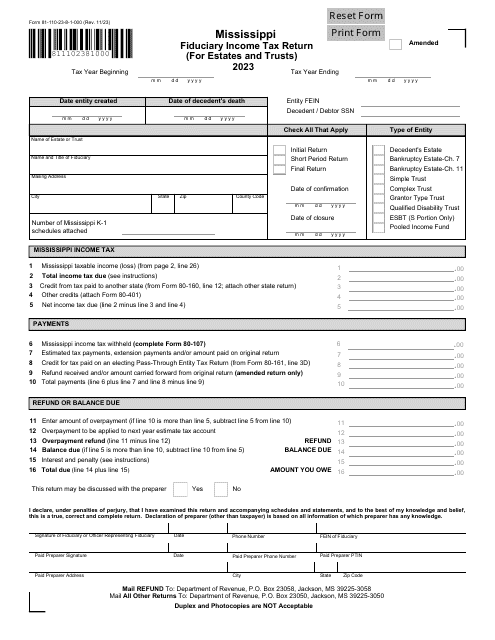

This Form is used for filing the fiduciary income tax declaration electronically in the state of Mississippi. It is also known as form 81-115-18-8-1-000 (MS8453-F).

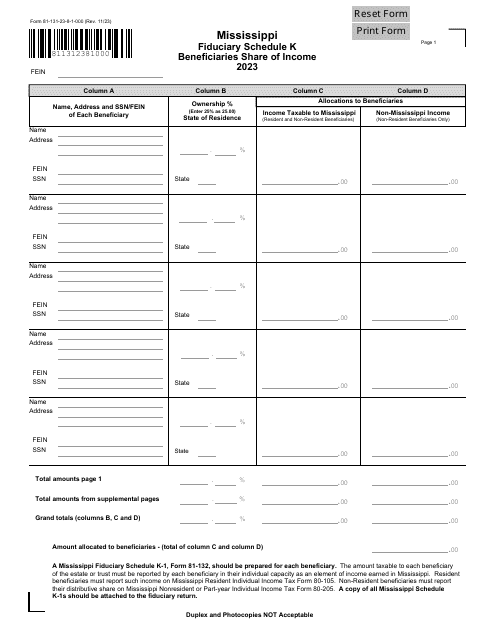

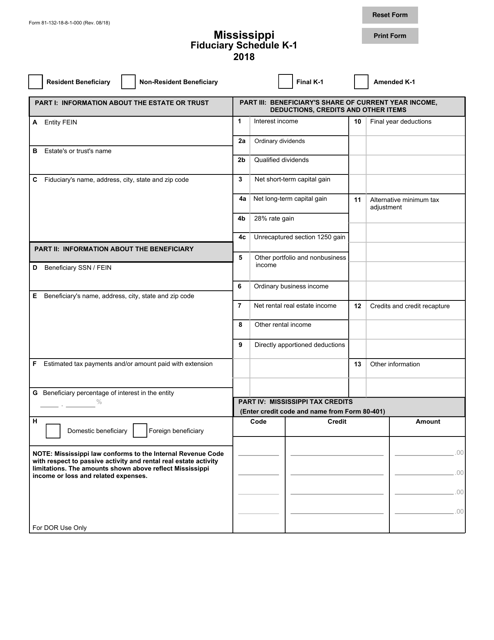

This form is used for reporting the income of a beneficiary in Mississippi, whether they are a resident or non-resident.