Fill and Sign Oklahoma Legal Forms

Documents:

4386

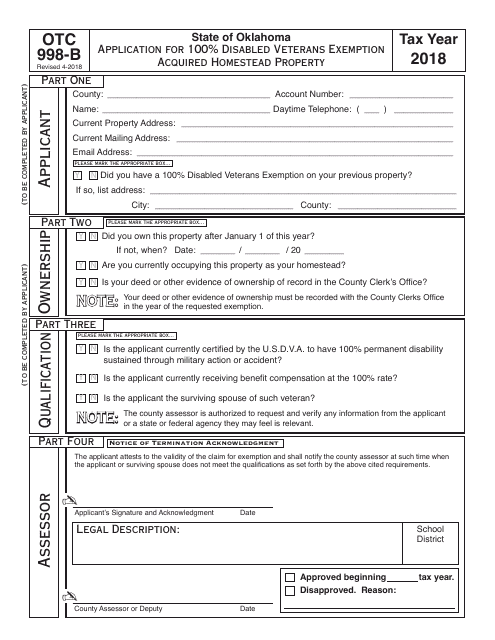

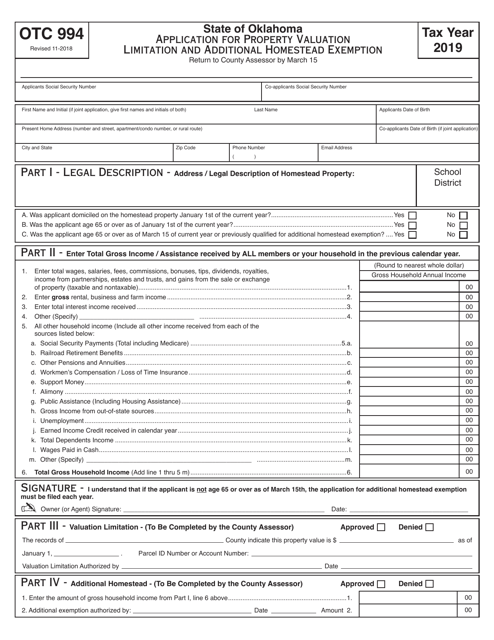

This Form is used for applying for the 100% Disabled Veterans Exemption for acquired homestead property in Oklahoma.

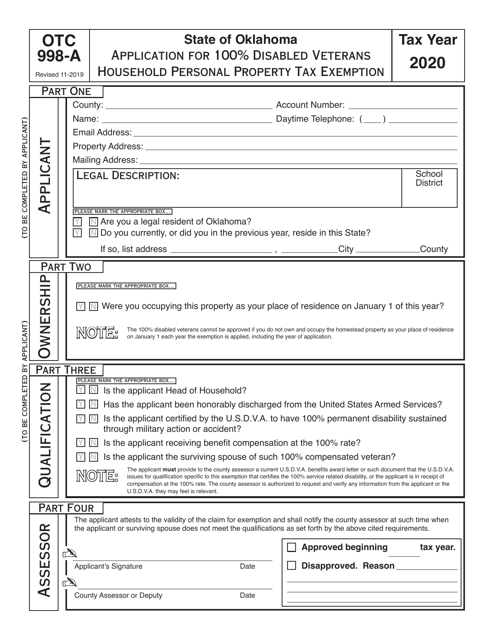

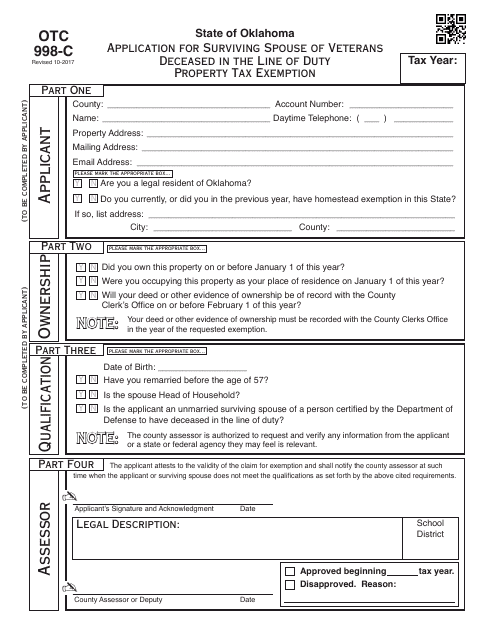

This form is used for applying for a property tax exemption in Oklahoma for surviving spouses of veterans who died in the line of duty.

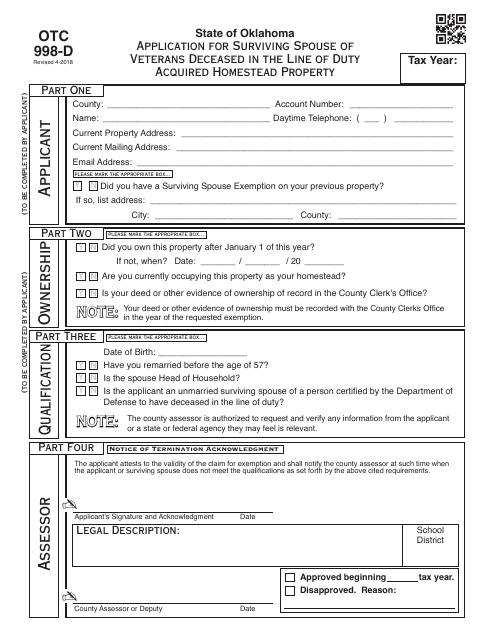

This form is used for applying for the OTC998-D program in Oklahoma, which provides property tax exemptions for surviving spouses of veterans who acquired homestead property.

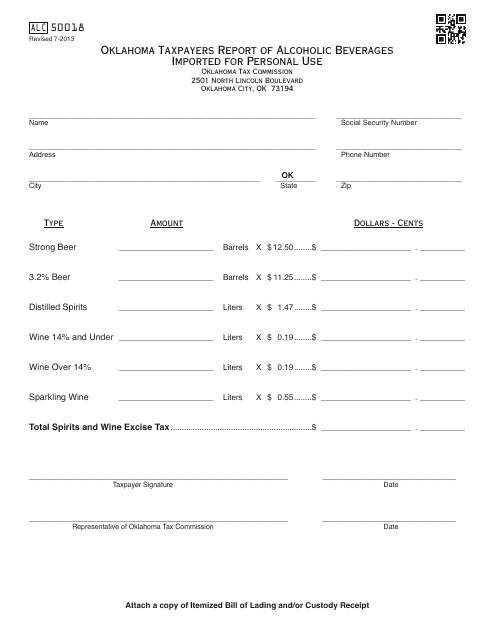

This form is used for Oklahoma taxpayers to report the importation of alcoholic beverages for personal use in the state.

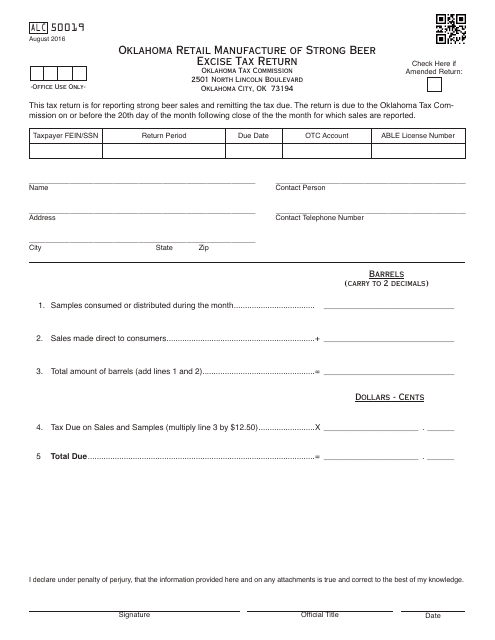

This Form is used for filing the Oklahoma Retail Manufacture of Strong Beer Excise Tax Return in Oklahoma. It is used by retail manufacturers of strong beer to report and pay the excise tax.

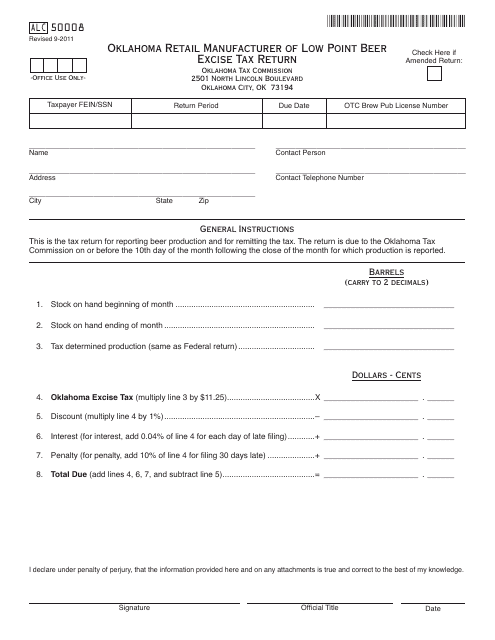

This form is used for Oklahoma retailers who manufacture and sell low point beer to report and pay the excise tax.

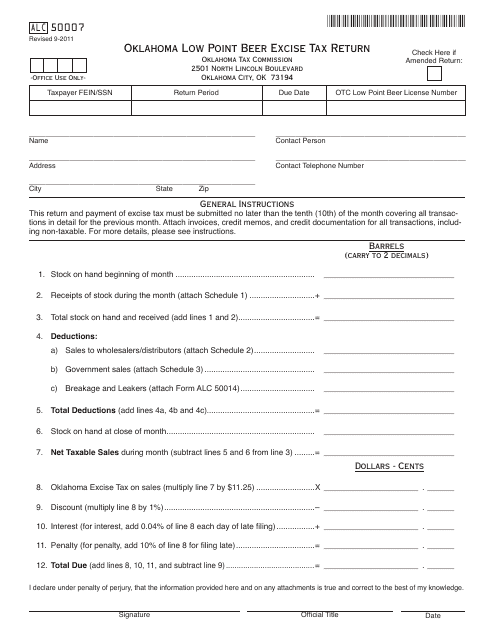

This form is used for filing the Oklahoma Low Point Beer Excise Tax Return for businesses selling low point beer in Oklahoma.

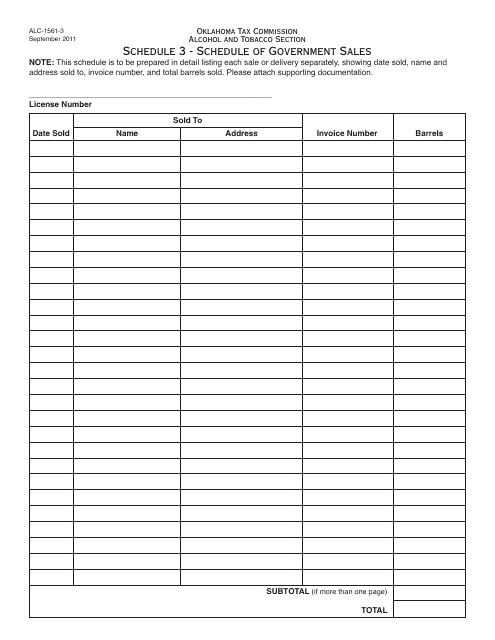

This document is used for reporting government sales in Oklahoma. It is a schedule that provides information about the sales made by governmental entities in the state.

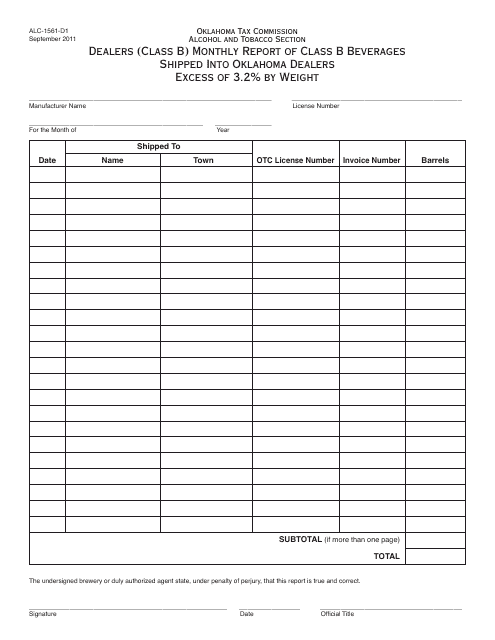

This form is used for dealers to report monthly shipments of Class B beverages exceeding 3.2% by weight into Oklahoma.

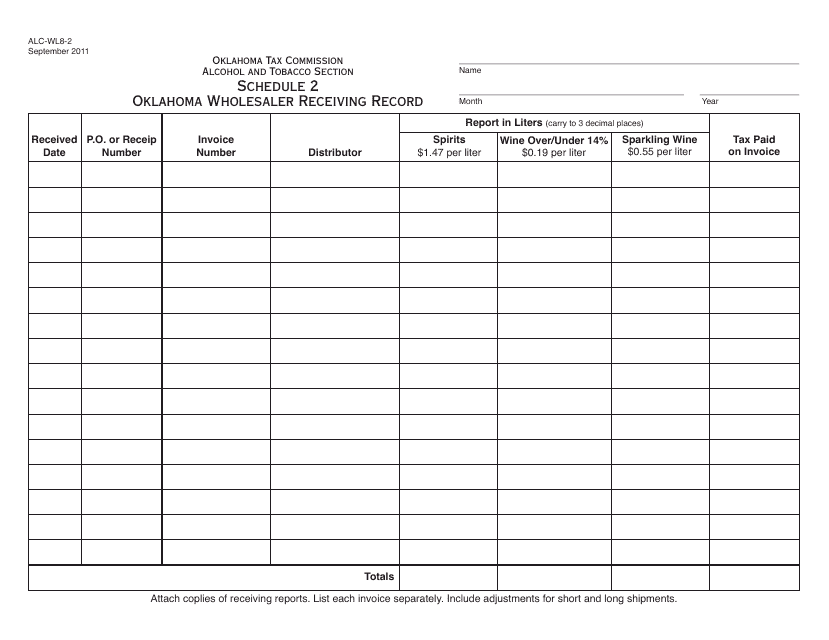

This document is used for recording the receiving of goods by wholesalers in Oklahoma.

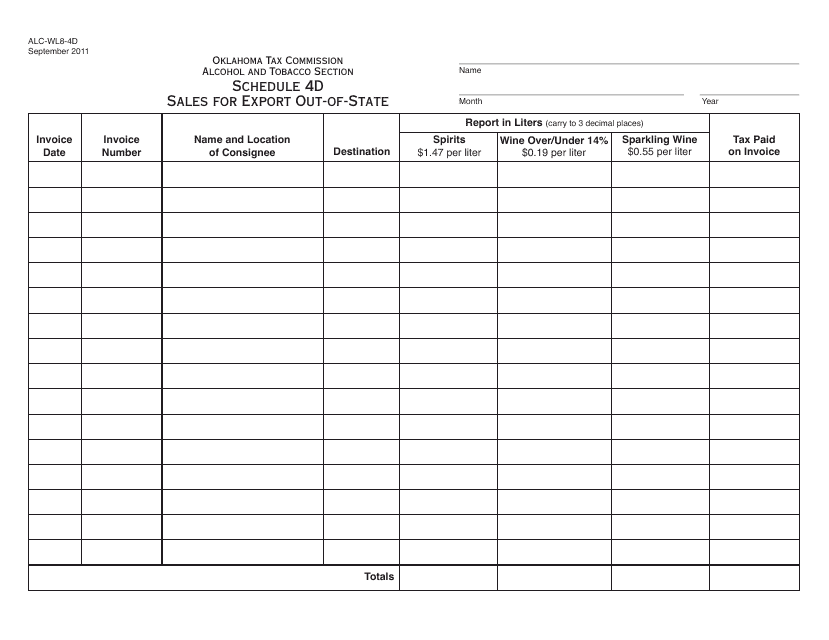

This Form is used for reporting sales of goods for export out-of-state in Oklahoma.

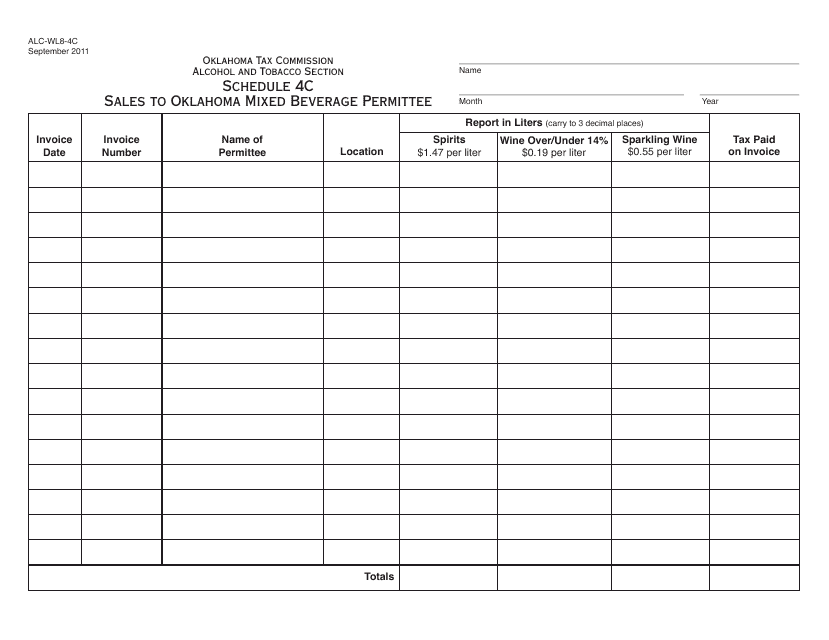

This document is used for reporting sales to Oklahoma mixed beverage permittees in Oklahoma.

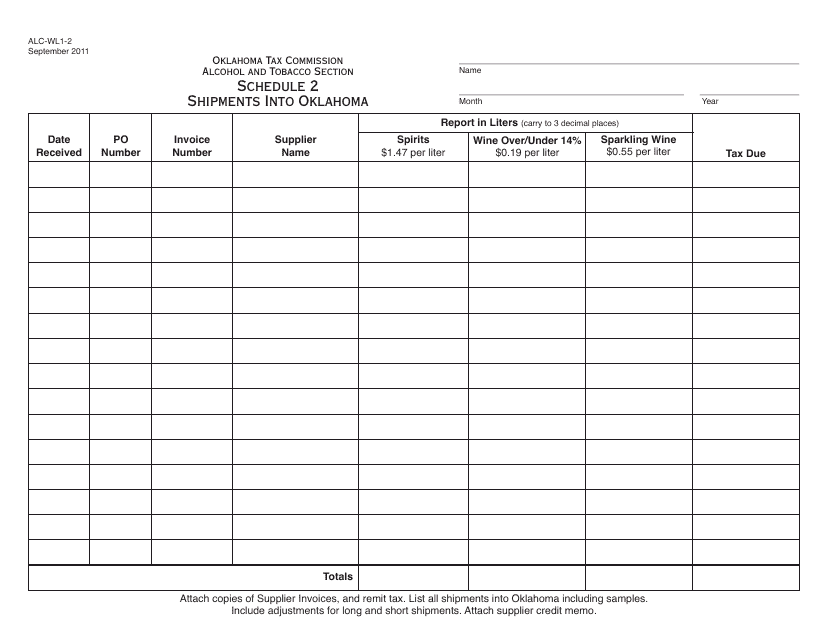

This form is used for scheduling shipments into Oklahoma.

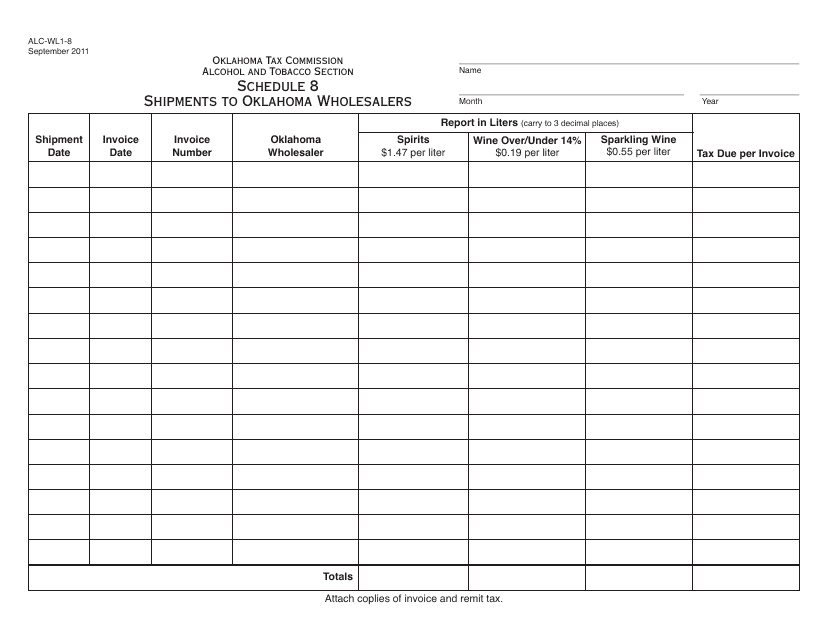

This Form is used for reporting shipments of goods to wholesalers in Oklahoma.

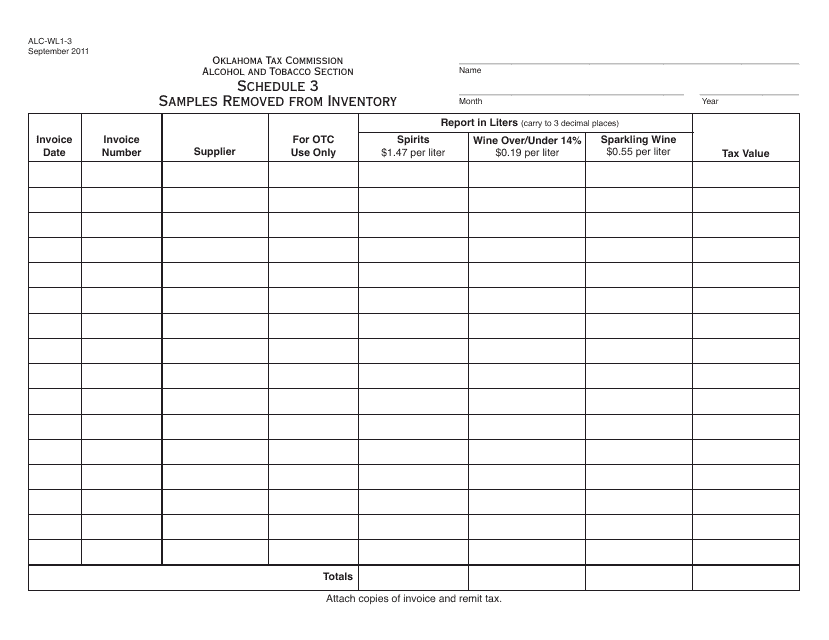

This Form is used for reporting the removal of samples from inventory in Oklahoma.

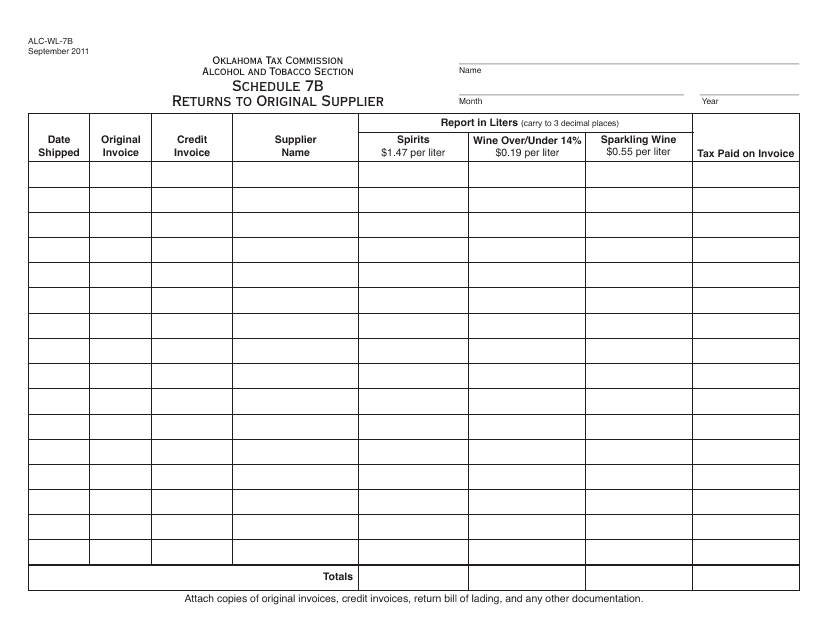

This Form is used for returning items to the original supplier in Oklahoma.

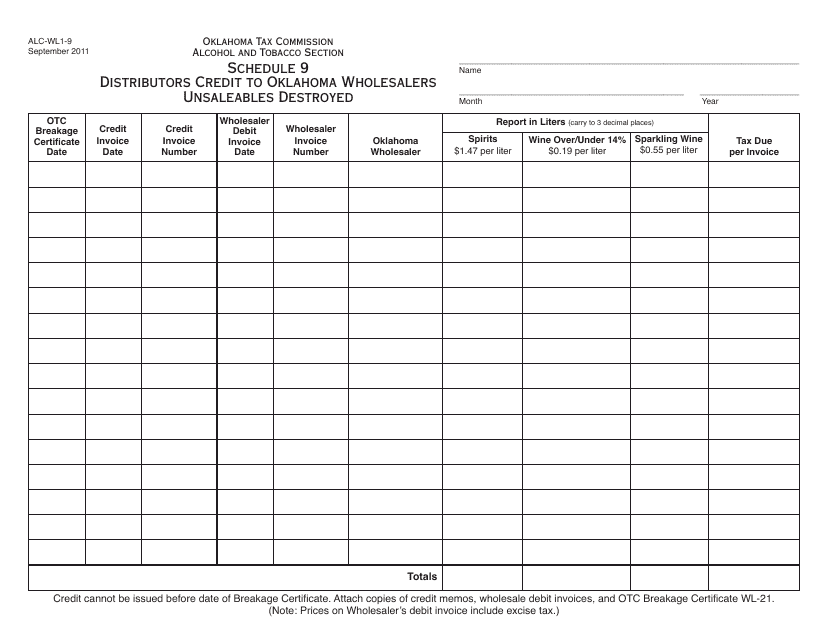

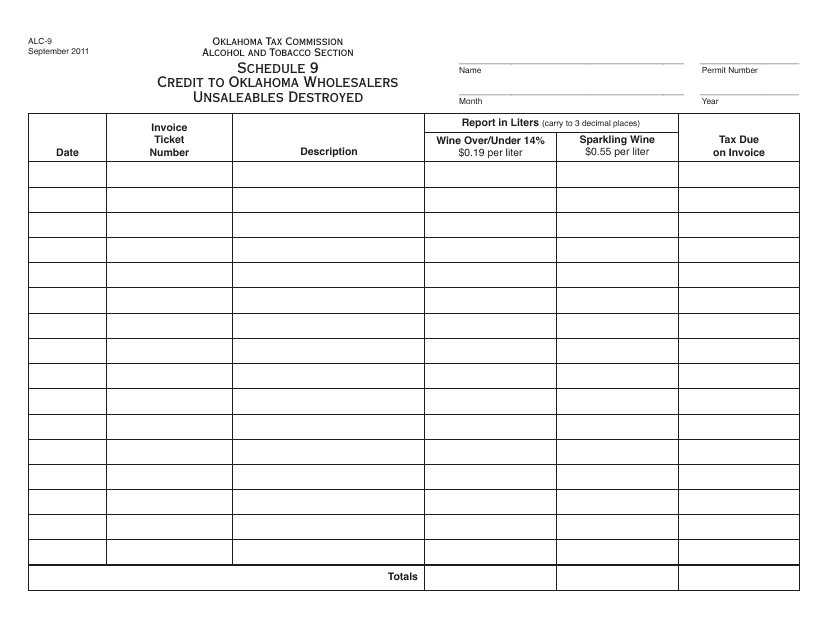

This type of document is a schedule to report distributors' credits for unsaleable products destroyed by wholesalers in Oklahoma.

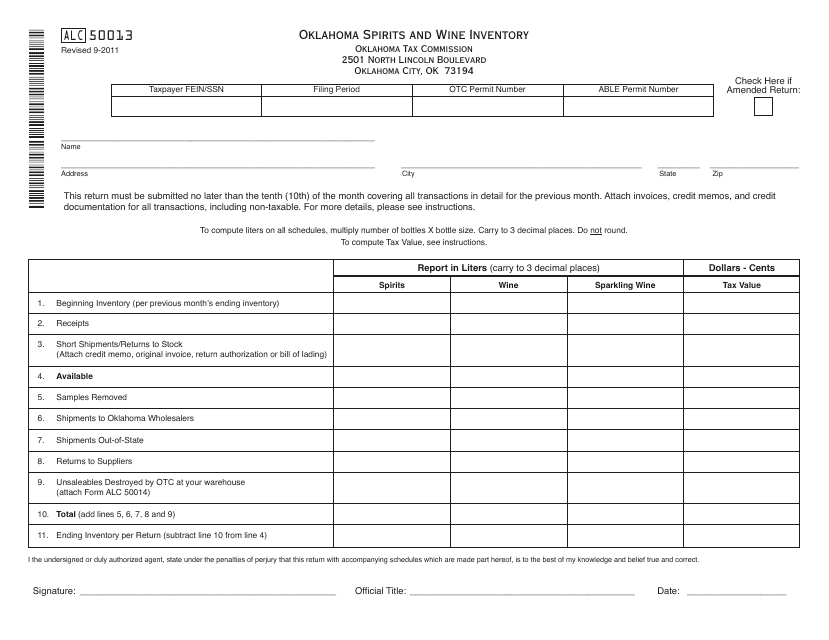

This form is used for inventory management of spirits and wine in Oklahoma, specifically for over-the-counter (OTC) sales.

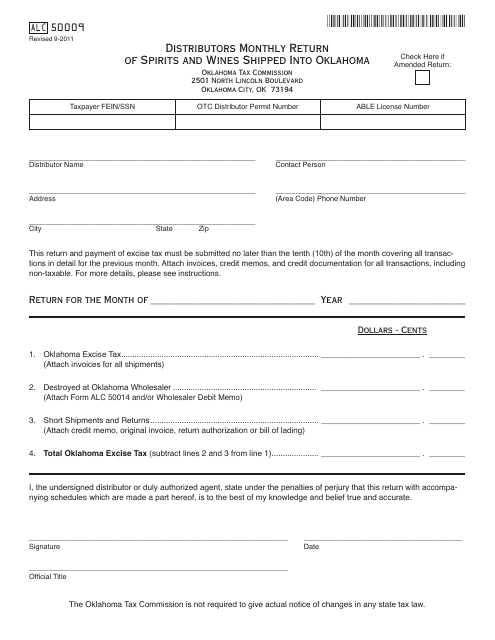

This Form is used for Oklahoma distributors to report and track the monthly shipment of spirits and wines into the state.

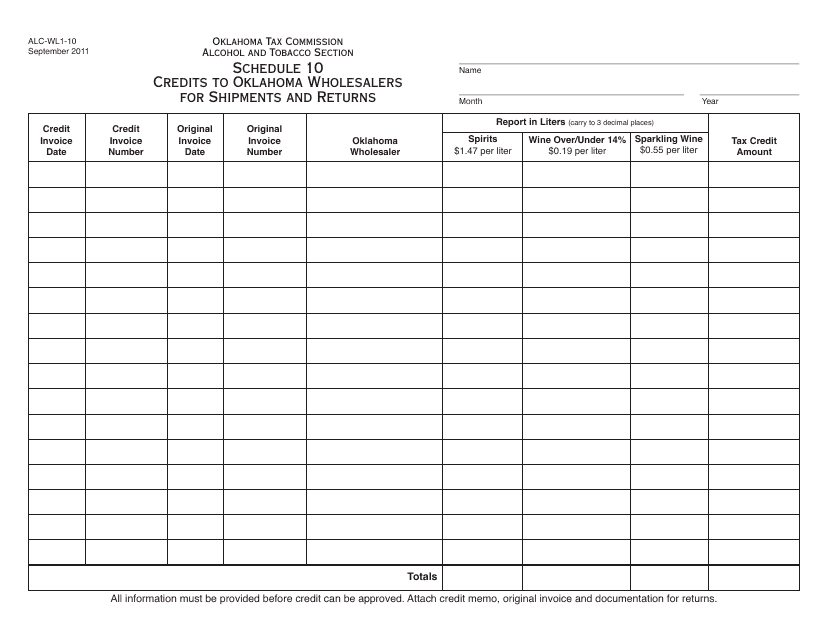

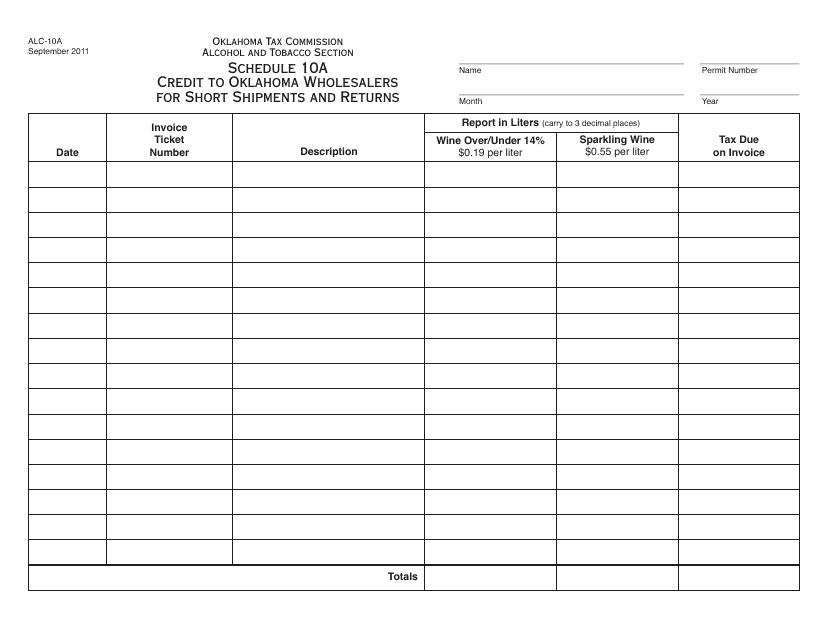

OTC Form ALC-WL1-10 Schedule 10 Credits to Oklahoma Wholesalers for Shipments and Returns - Oklahoma

This form is used for crediting Oklahoma wholesalers for shipments and returns of goods.

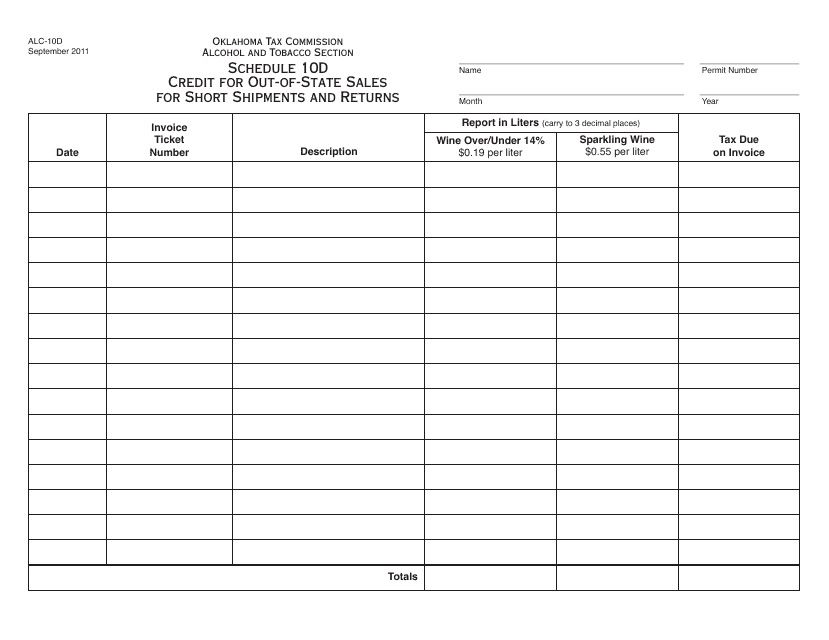

This type of document, Form ALC-10D Schedule 10D, is used in Oklahoma to claim a credit for out-of-state sales for short shipments and returns.

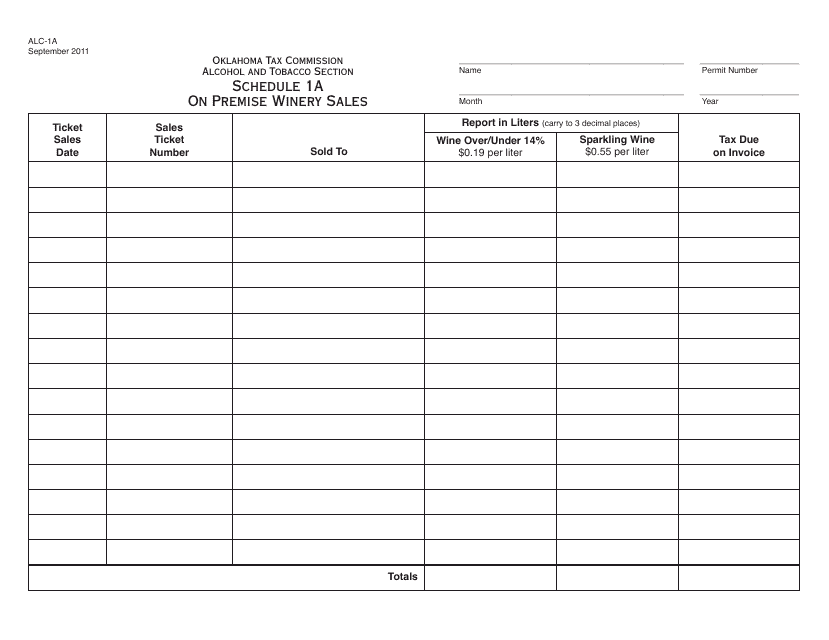

This form is used for reporting on-premise winery sales in Oklahoma.

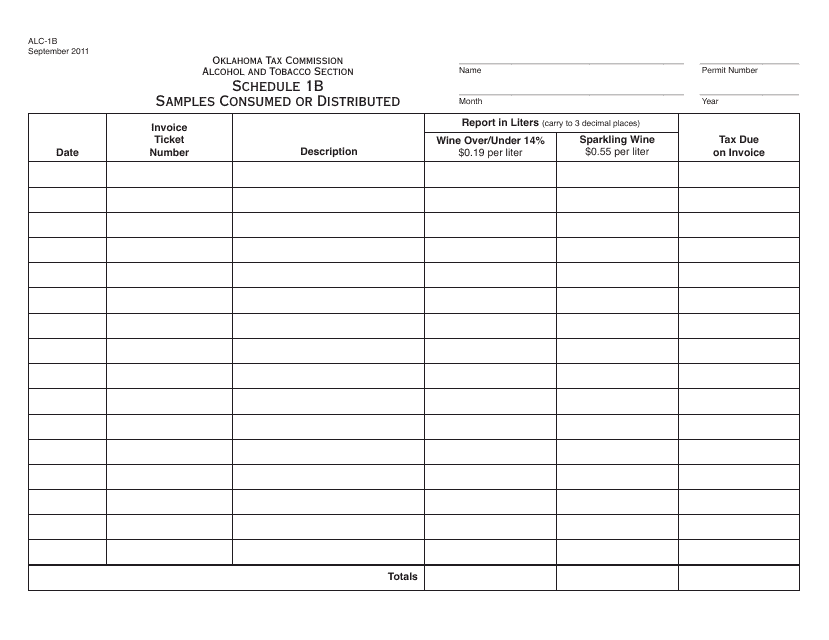

This document is used for reporting samples consumed or distributed in Oklahoma.

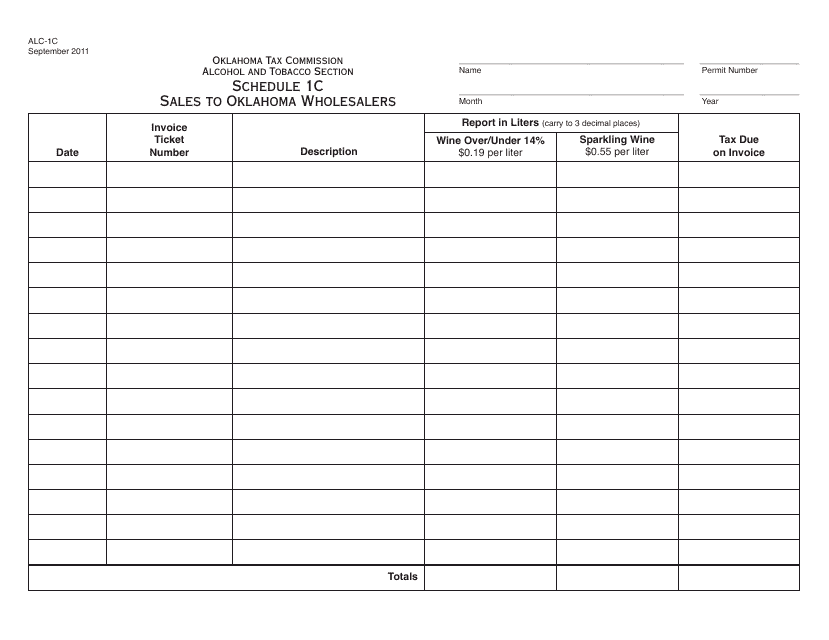

This form is used for reporting sales to wholesalers in Oklahoma. It is specifically designed for use in Oklahoma and is part of the OTC Form ALC-1C.

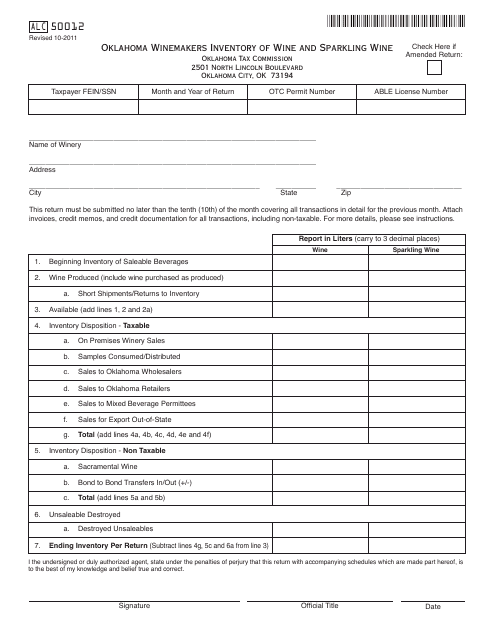

This Form is used for Oklahoma winemakers to report their inventory of wine and sparkling wine.

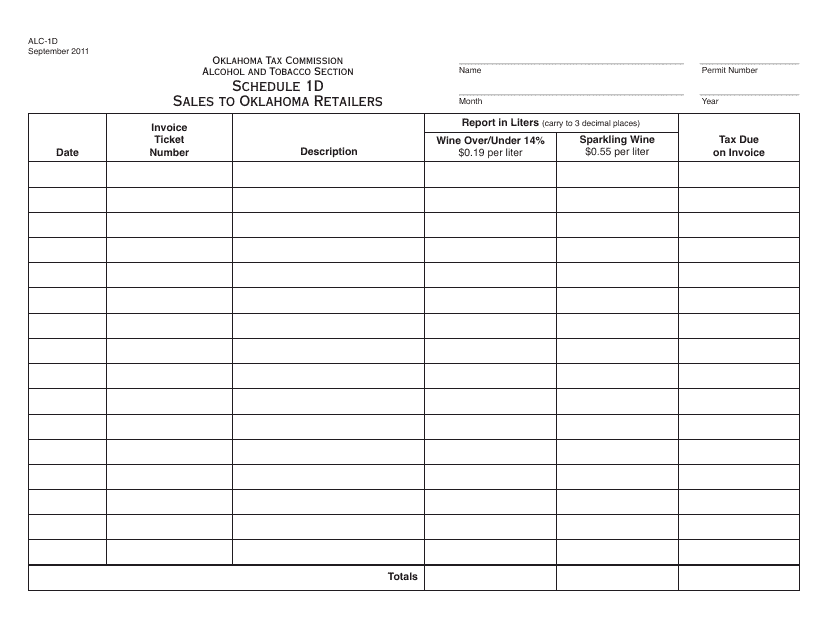

This form is used for reporting sales to Oklahoma retailers in the state of Oklahoma. It is specifically for over-the-counter sales and is known as Form ALC-1D Schedule 1D.

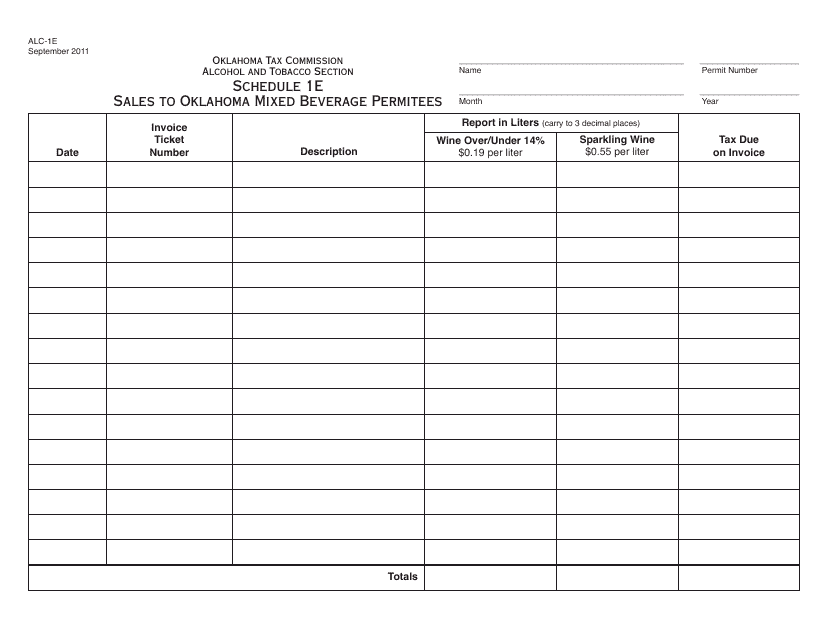

This form is used for reporting sales to Oklahoma Mixed Beverage Permittees in Oklahoma.

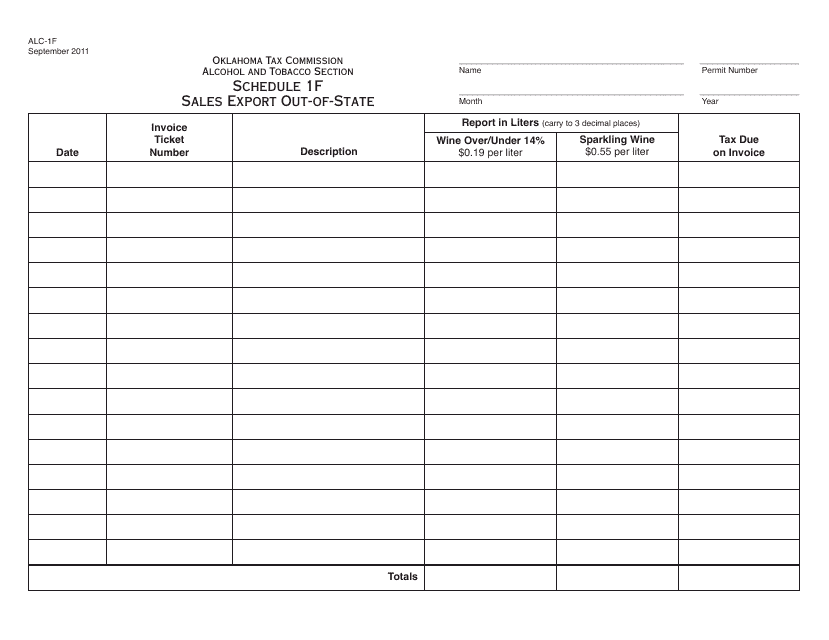

This Form is used for reporting sales exports out-of-state in Oklahoma.

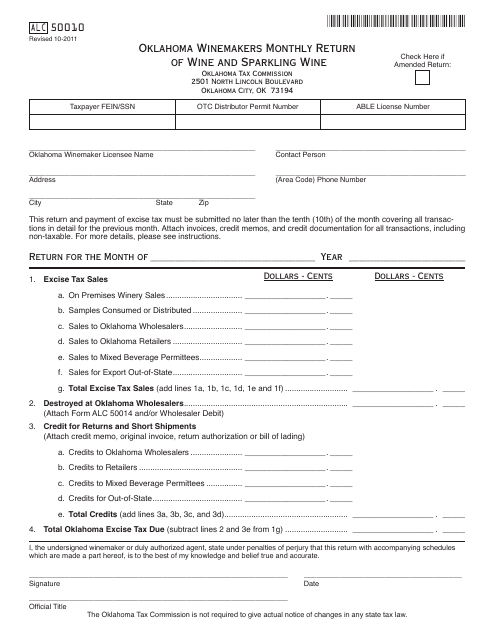

This form is used by winemakers in Oklahoma to report their monthly sales of wine and sparkling wine.

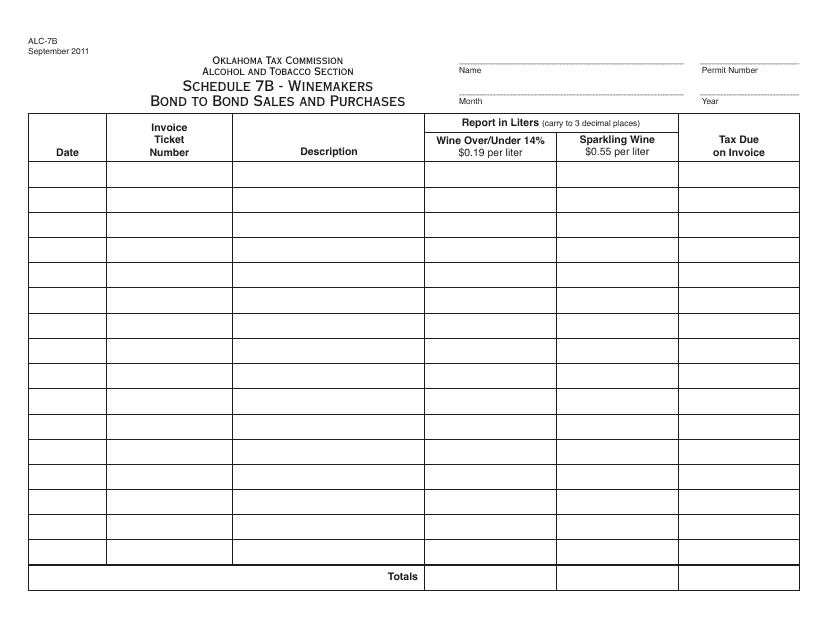

This document is used for reporting and recording the bond sales and purchases of winemakers in Oklahoma.

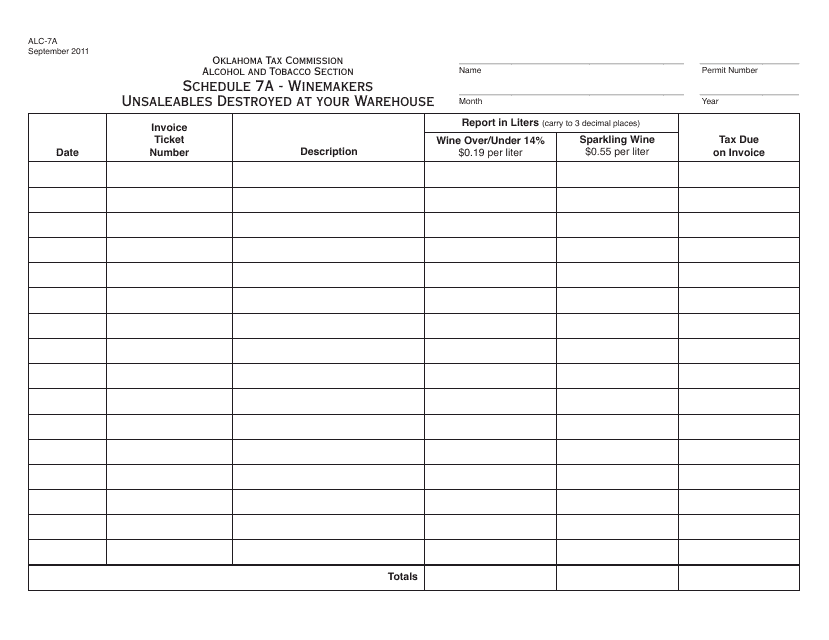

This form is used for reporting the unsaleable wines that have been destroyed at your warehouse in Oklahoma.

This form is used for documenting the credit given to Oklahoma wholesalers for destroyed unsaleable products.

This form is used for providing credit to Oklahoma wholesalers in cases of short shipments and returns. It is specifically for wholesale transactions that take place in Oklahoma.

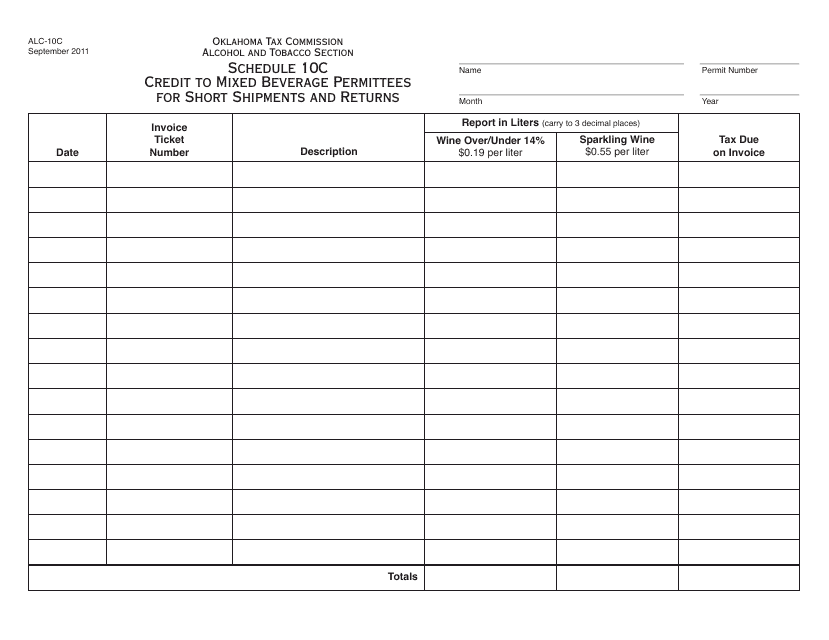

This Form is used for claiming credit to mixed beverage permittees in Oklahoma for short shipments and returns.

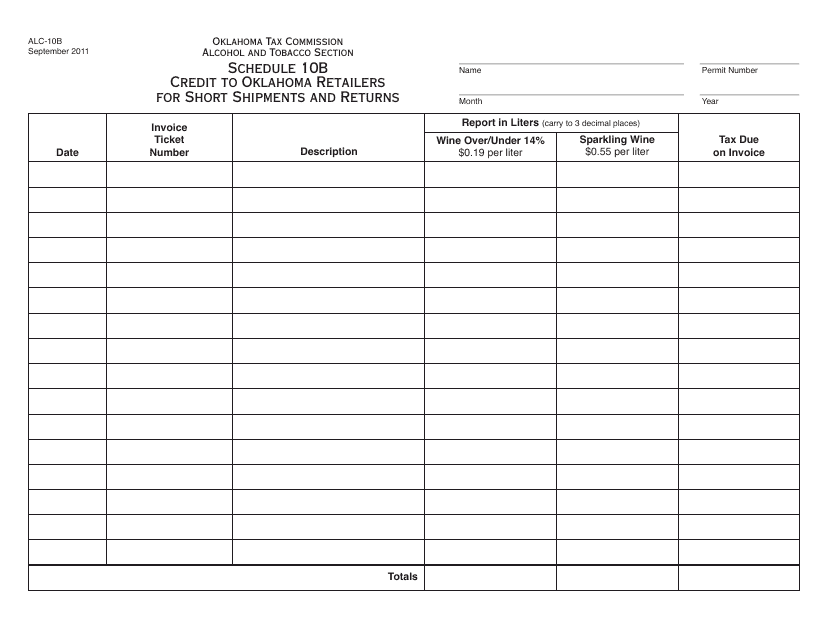

This Form is used for crediting Oklahoma retailers for short shipments and returns.