Fill and Sign Oklahoma Legal Forms

Documents:

4386

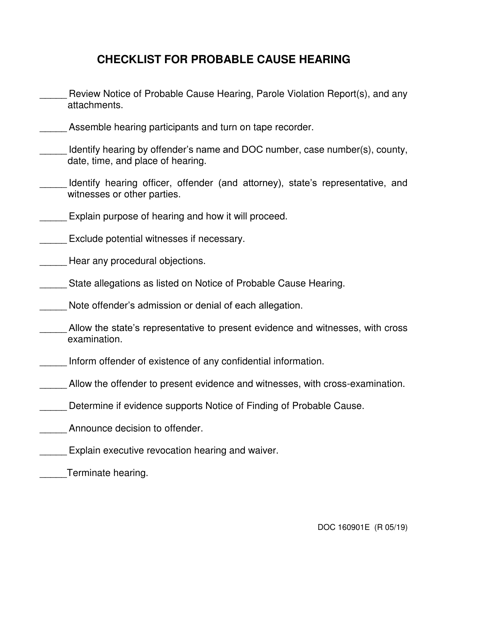

This form is used for completing a checklist required for a probable cause hearing in Oklahoma.

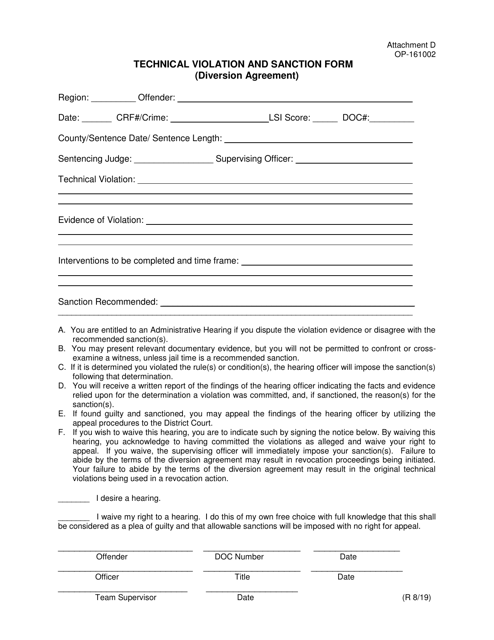

This document is used for reporting technical violations and imposing sanctions as part of a diversion agreement in Oklahoma.

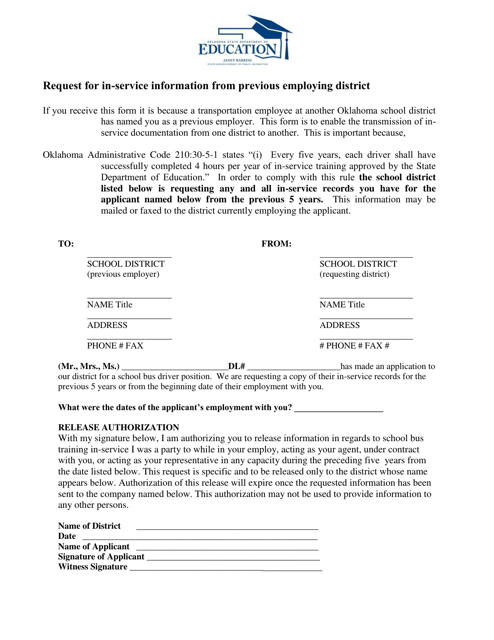

This document is for requesting in-service information from a previous employing district in Oklahoma.

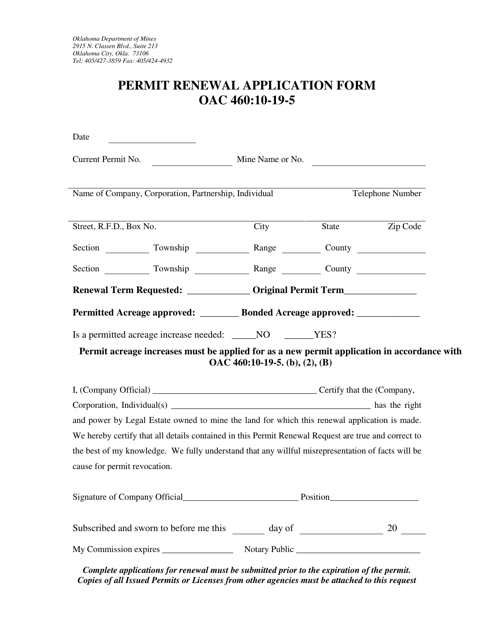

This form is used for renewing a permit in the state of Oklahoma. It is necessary to complete this form in order to continue legally operating under the permit.

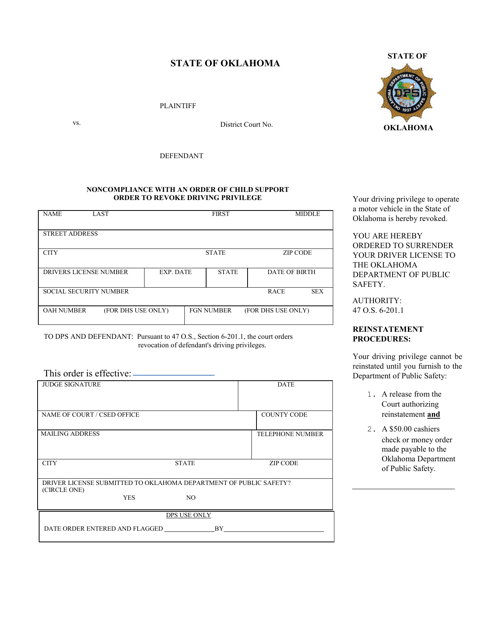

This document is for individuals who are in noncompliance with a child support order in Oklahoma and may result in the revocation of their driving privilege.

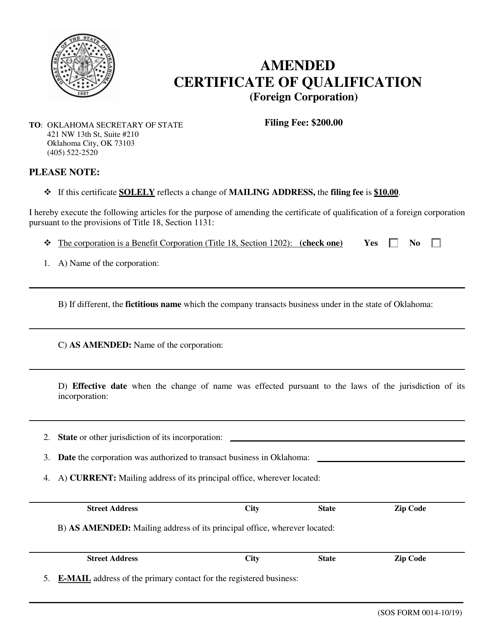

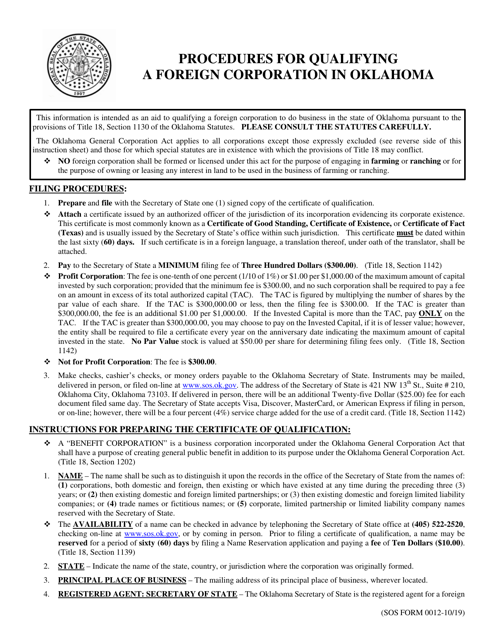

This form is used for amending the Certificate of Qualification for a foreign corporation in Oklahoma.

This document is for a foreign corporation to apply for a Certificate of Qualification in Oklahoma. It is used to demonstrate that the corporation meets the necessary requirements to do business in the state.

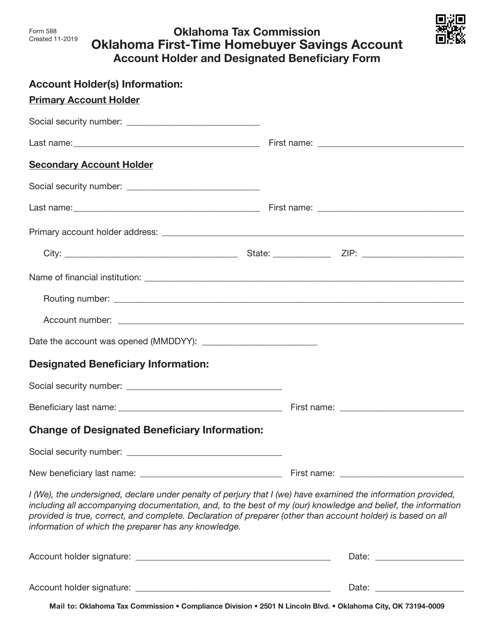

This form is used for opening a First-Time Homebuyer Savings Account in Oklahoma. It is for both the account holder and the designated beneficiary.

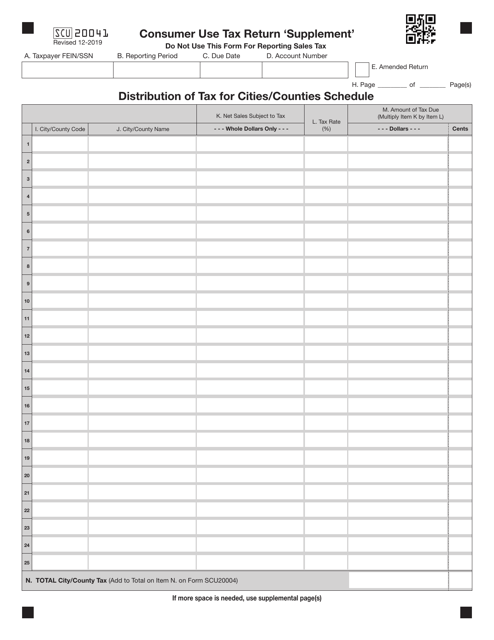

This Form is used as a supplement to the Consumer Use Tax Return in Oklahoma. It helps consumers report and pay their use tax obligations.

This form is used for filing Oklahoma Vendor Use Tax Return for returns filed after July 1, 2017.

This Form is used for filing lodging tax returns in Oklahoma for the period after July 1, 2017.

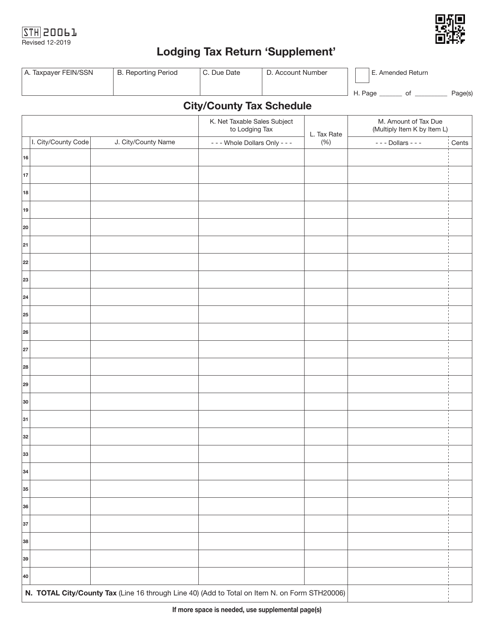

This form is used as a supplemental document for the Lodging Tax Return in Oklahoma. It is used to provide additional information related to the tax return filing.

This Form is used for reporting and submitting the Tire Recycling Fee in the state of Oklahoma.

This form is used for reporting and calculating the tire recycling fee owed by businesses or individuals in the state of Oklahoma.

This form is used for filing sales tax returns in Oklahoma for transactions that occurred before July 1, 2017.

This form is used for reporting prepaid wireless fees for periods before January 1, 2017 in Oklahoma.

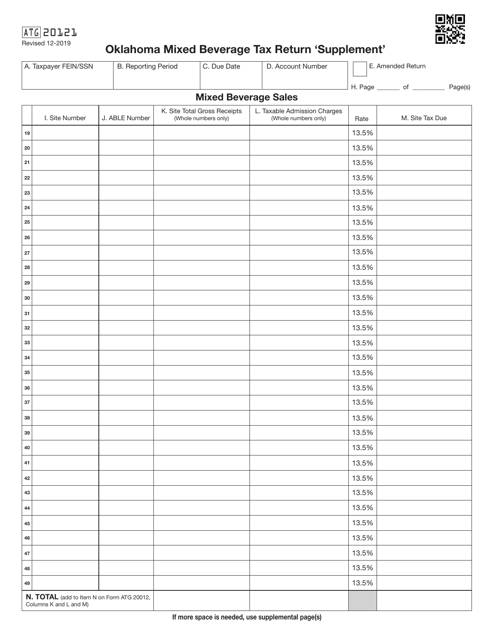

This form is used as a supplement to the Oklahoma Mixed Beverage Tax Return.

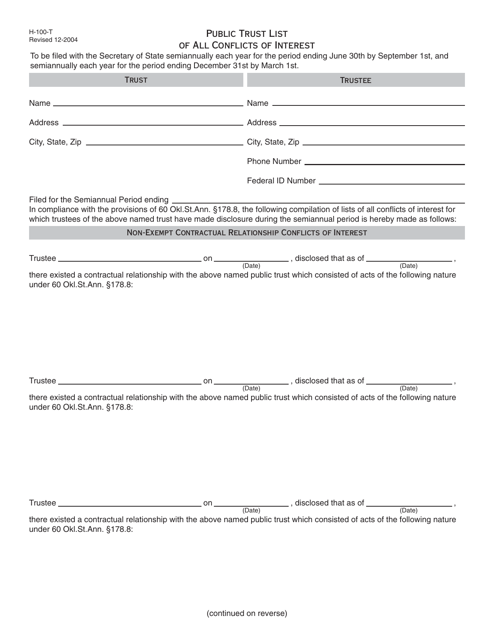

This form is used for disclosing conflicts of interest in the public trust in Oklahoma.

This form is used for filing casual sales tax returns for Oklahoma oil and gas operators before July 1, 2017.

This form is used for Oklahoma oil and gas operators to report and file their casual sales tax returns after July 1, 2017.