IRS 8879 Forms and Templates

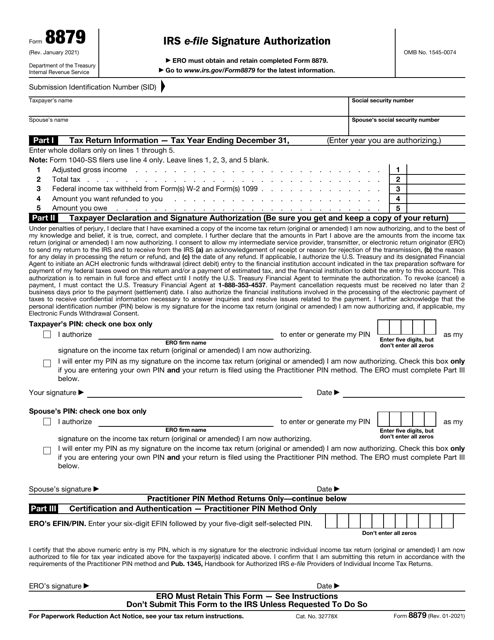

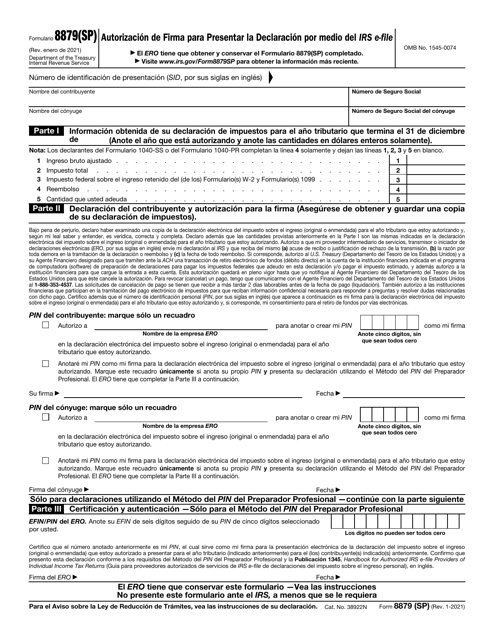

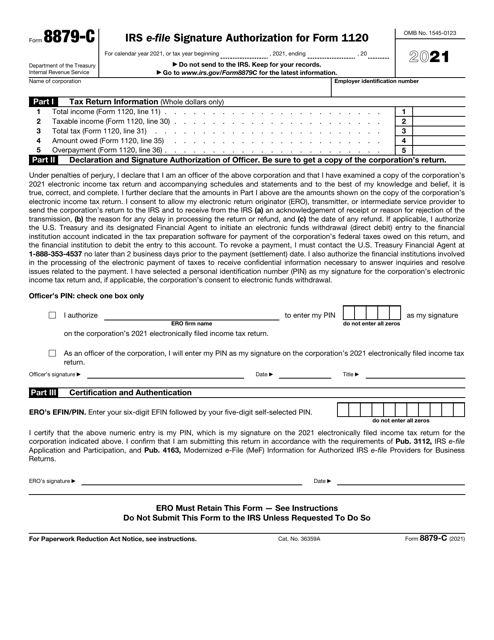

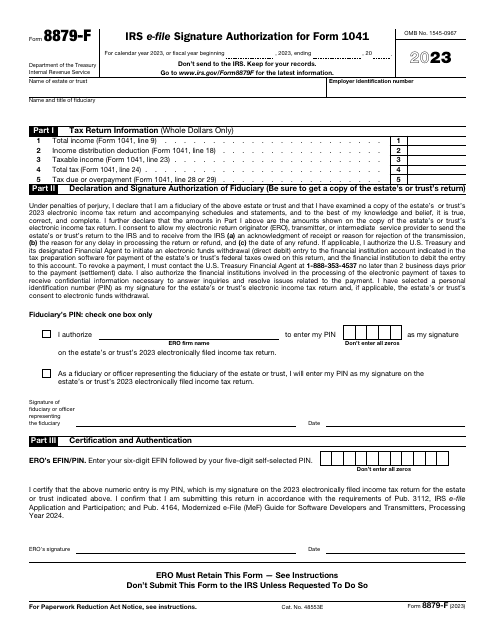

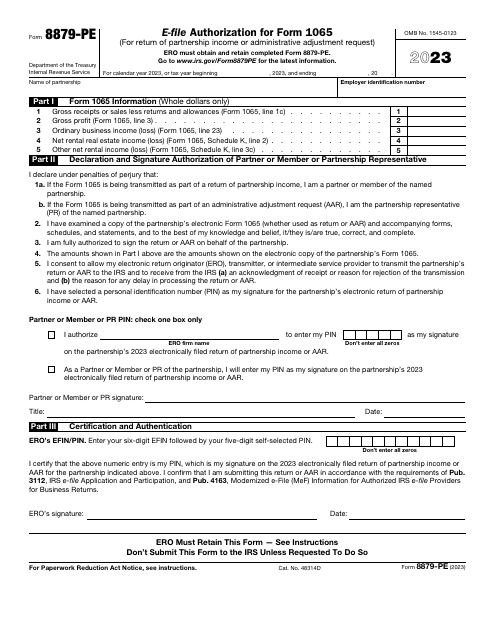

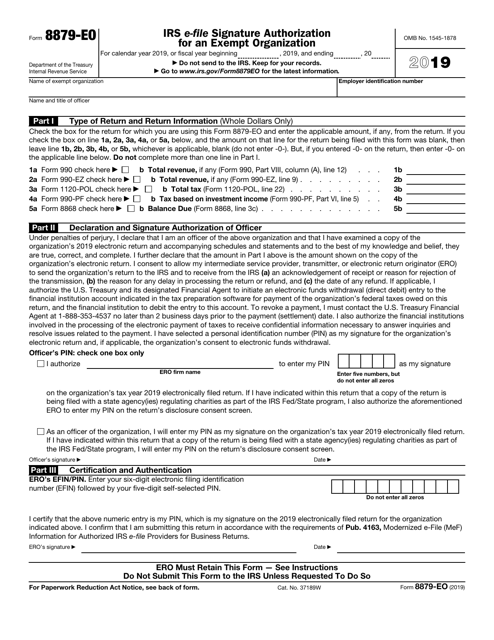

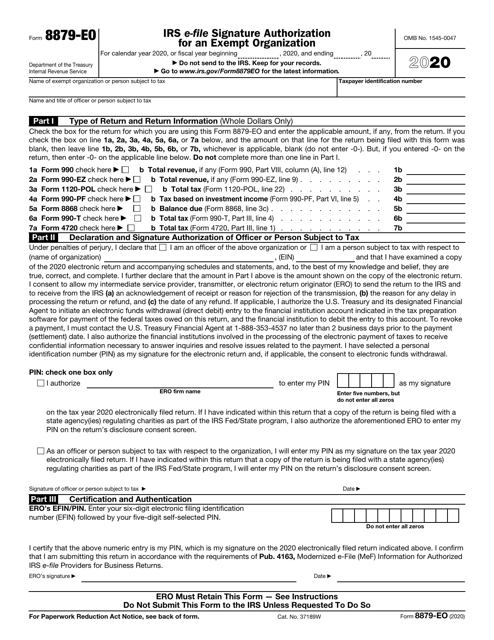

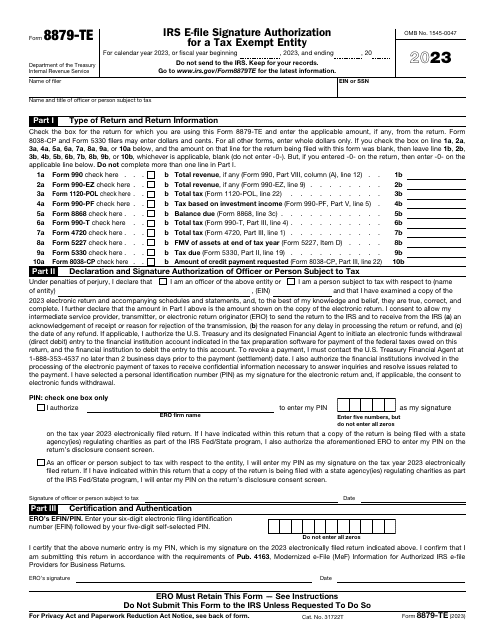

The IRS 8879 Forms are used for e-file signature authorization. They allow taxpayers to authorize their tax preparers to electronically sign and submit their tax returns to the Internal Revenue Service (IRS) on their behalf.

Documents:

37

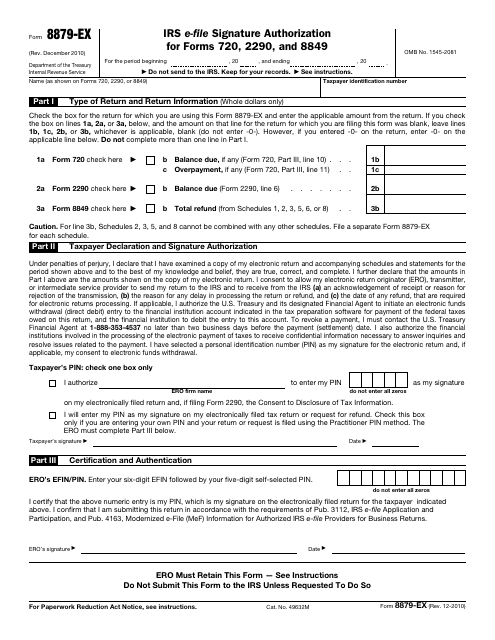

This form is used for IRS e-file signature authorization for Forms 720, 2290, and 8849. It allows taxpayers to authorize the electronic filing of these specific forms with the IRS.

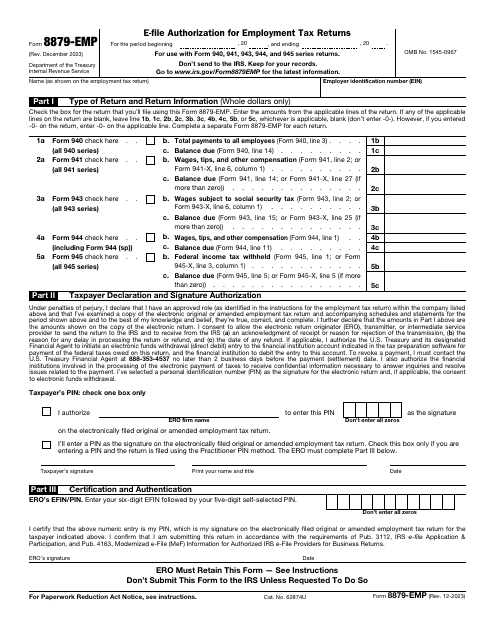

This is a supplementary form taxpayers may sign if they want to confirm their willingness to utilize a personal identification number that will allow them to provide an electronic signature when certifying employment tax returns or asking for a filing extension.

This is an IRS form that allows taxpayers to authorize an electronic return originator to use their e-signature while filing tax returns on behalf of their client.

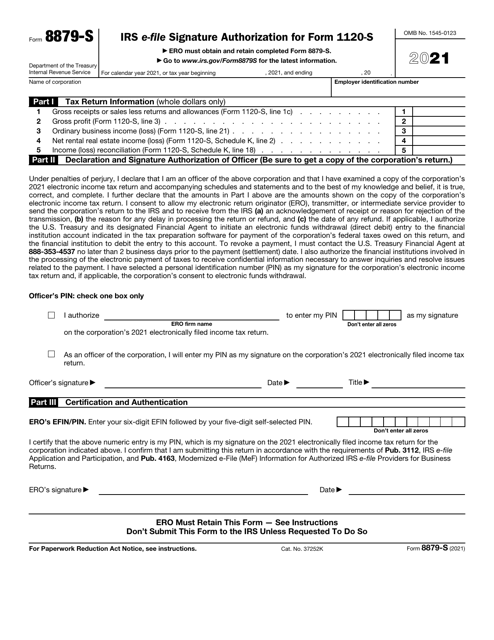

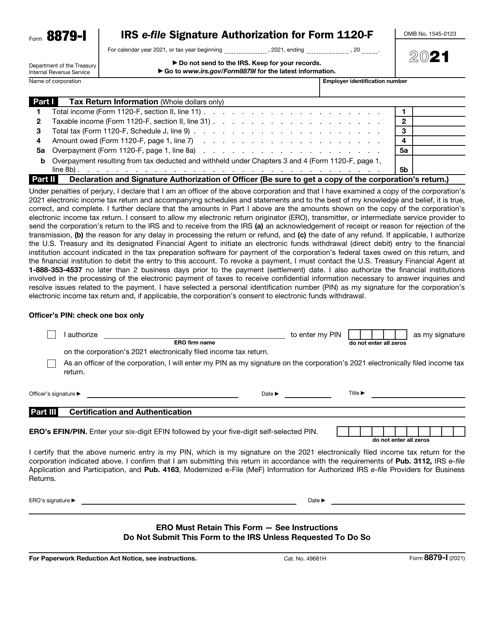

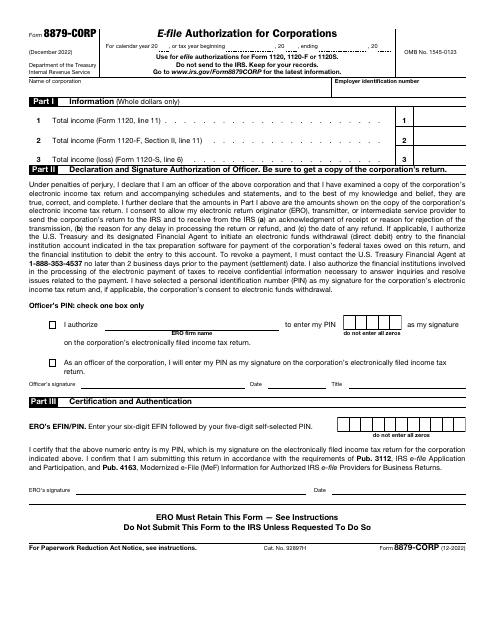

This is a fiscal document corporations use to create personal identification numbers in order to let electronic return originators sign tax returns on their behalf.

This Form is used for authorizing corporations to e-file their tax returns with the IRS.

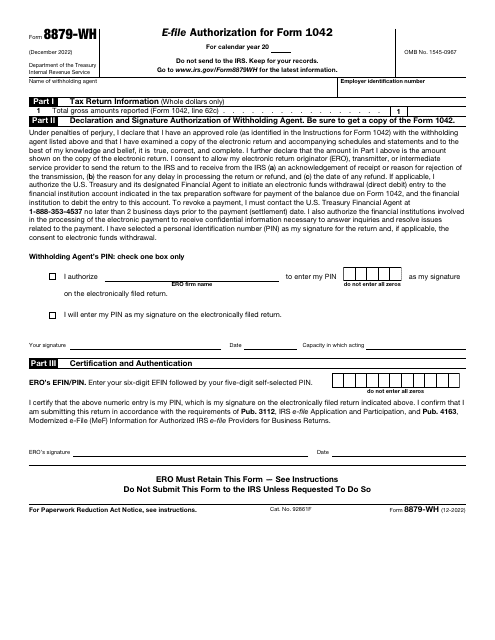

This form is used for authorizing electronic filing for Form 1042 to the IRS.